We have been keeping an eye on Brixton Metals (BBB.V) for several years now as the company was advancing its high-grade Thorn project in British Columbia. Unfortunately it looked like much more (expensive) exploration would have been needed to make the project viable, and the market didn’t really like that. Brixton Metals’ share price sank to unprecedented levels in 2015 when the market capitalization dropped to just a few million dollars.

But it looks like the company has emerged from the global precious metals crisis as a stronger entity. Not only did it survive, it was also able to hold onto the ownership of the Thorn project whilst it also acquired the past producer Langis silver-cobalt project where the ‘old timers’ have left some high-grade ore behind.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

Perhaps the most interesting acquisition to fill the Brixton pipeline was Hog Heaven mine project in Montana. Not only did Brixton acquire this project just a few months ago, it also seems to be the main focus right now. In this initial report, we will have a closer look at the company’s four main projects.

The recently acquired Hog Heaven silver-gold-copper project

In June, Brixton announced it was acquiring the Hog Heaven silver project in Montana from Pan American Silver (PAAS, PAA.TO). Brixton had to issue almost 2.7 million shares to Pan American (with a deemed price of C$0.37 per share for a total equivalent of C$1M) and granted Pan American a 3% Net Smelter Royalty.

This seemed to be a pretty good deal for Brixton. Not only was it able to avoid an upfront cash payment, Pan American now has a vested interest in seeing Brixton succeed as a company as the 2.7 million shares represent a position of 5% (after the recent private placement).

So what did Brixton get for these 2.7 million shares?

Hog Heaven is a past producing silver mine in Montana, and although the currently available information is still limited, Brixton’s acquisition includes a historical non-NI-43-101 resource containing just over 10 million tonnes at an average grade of just a little bit over 4 ounces of silver and 0.68 grams of gold per tonne of rock for a total silver content of 47.3 million ounces, and a gold resource of approximately 226,000 ounces.

As said, the company is still combing through all the historic data which was included in the transaction, but we had a chance to catch up with CEO Gary Thompson in Vancouver. It was really interesting to learn that although the historic resource estimate only contained silver and gold, it’s actually very likely the Hog Heaven project also contains an interesting base metals like copper and zinc credits too.

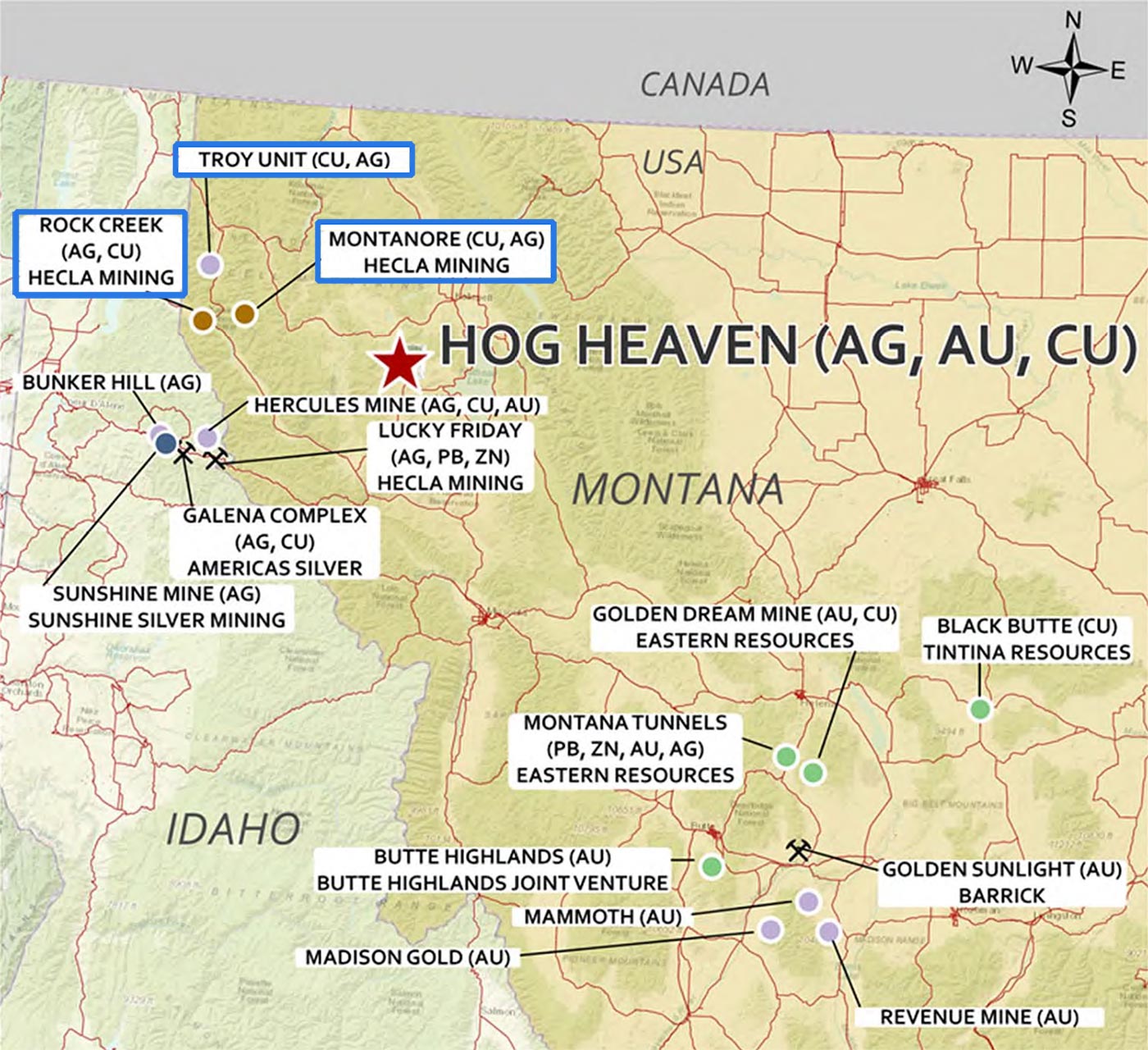

That shouldn’t really have come as a surprise as you might remember we were closely following Revett Minerals (RVM) a few years ago, before it was acquired by Hecla Mining (HL). Revett Minerals operated the Troy copper-silver mine and was permitting the very large Rock Creek copper-silver project. As you can see on the next image, Hog Heaven is located on a trend which hosts both Revett’s copper-silver projects, as well as the Montanore project (also owned by Hecla Mining).

As Hecla Mining also is one of Brixton’s main shareholders, we are pretty certain they are keeping an eye on Brixton’s progress at Hog Heaven as another copper-silver (and gold) project in the same area should appeal to them.

The existing resources are all located at the Thorn project

Until 2016, Brixton was entirely focusing on the Thorn project, which is located in British Columbia approximately 90 kilometers east from Juneau in Alaska. The southern claim boundary is only 60 km to tide water. The Thorn property was discovered in 1959 by Kennco geologists and later a dozen or so operators worked it but was only subject to a very limited amount of drilling (less than 6,500 meters on a combined basis between 1959 and 2010, when Brixton acquired the project from Rimfire Minerals/Kiska Metals).

Brixton didn’t waste any time and immediately started a 5,700 meter drill program in 2011. The second to last hole from the 2011 drill program hit a gang buster hole of 95m of 900 g/t silver equivalent which included 9m of 2984 g/t silver, 3 g/t Au. Brixton then added 12,000 meters of drilling from 2011 to 2016 whilst it also executed a substantial mapping and sampling program (taking more than 4,000 samples) and geophysics.

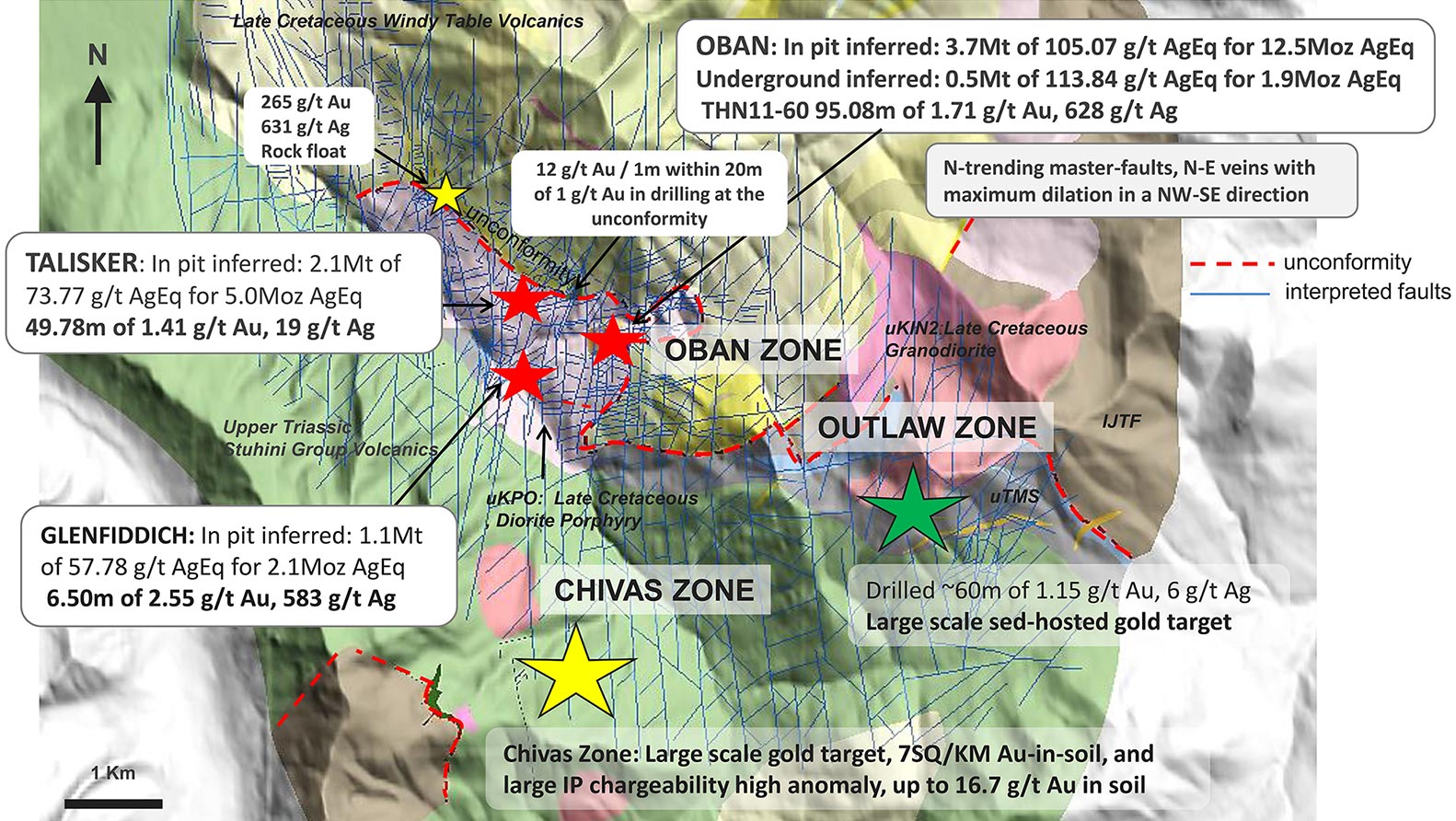

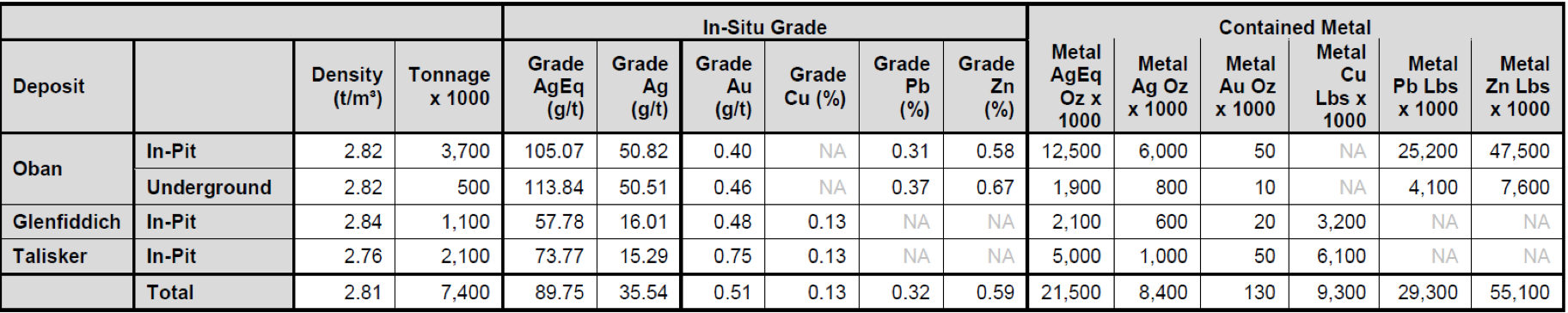

The Thorn project has been ‘divided’ into five high-priority zones: Oban, Outlaw, Talisker, Glenfiddich and Chivas (it’s pretty clear what these zones were named after). Three of these zones (Oban, Glenfiddich and Talisker) had sufficient amounts of drilling to initiate a maiden resource calculation, which was completed in December 2014. As you can see in the next image, the total resource came in at approximately 21.5 million ounces silver-equivalent, of which 8.4 million ounces were pure silver.

A good start, but more work will need to be done to increase the size and grades. All of the zones remain open for expansion on strike and at depth. There certainly some really good intercepts, so perhaps with some optimization and more drilling the company could unlock the potential here.

It will be a bit tougher to develop the project due to the lack of existing infrastructure (although the northern part of BC seems to be unlocked now as the Golden Triangle is gaining a lot of traction lately) and the lack of a readily available work force (flying them in and out will be expensive). But it’s definitely not a ‘Mission Impossible’ as more infrastructure is being put in place in the Golden Triangle and an increasing number of companies are working in the region.

The Thorn project might benefit from this as well, further down the road. Contrary to some other projects in BC, Thorn isn’t ‘too’ remote, as it’s actually not too far away from Juneau, Alaska and only 60km to tide water. The nearest road is the Golden Bear Mine road about 50km away.

That’s why Brixton took a step back and started to look at the bigger picture again in 2016.

During the 2016 summer exploration season, the company drilled five holes at the Outlaw zone and four holes at Aberlour for a total of 1,645 meters. We were very interested in the Outlaw zone, as that seems to be the zone which remained wide open for the expansion of a gold-rich sediment host mineralized system. This was confirmed with really intriguing drill intercepts such as 18 meters containing 1.61 g/t gold and 12.31 g/t silver (125 g/t AgEq using $1250 gold and $17 silver) starting from surface, followed by 13 meters at 1.73 g/t gold and 7.25 g/t silver for a silver-equivalent grade of 135 g/t (also starting from surface) and some deeper intervals such as 59 meters at 1.15 g/t gold and 5.5 g/t silver. However only 450m (at 150m spaced holes) of the 5km trend at the Outlaw zones has been drill tested which means approximately 85% of the trend remains untested.

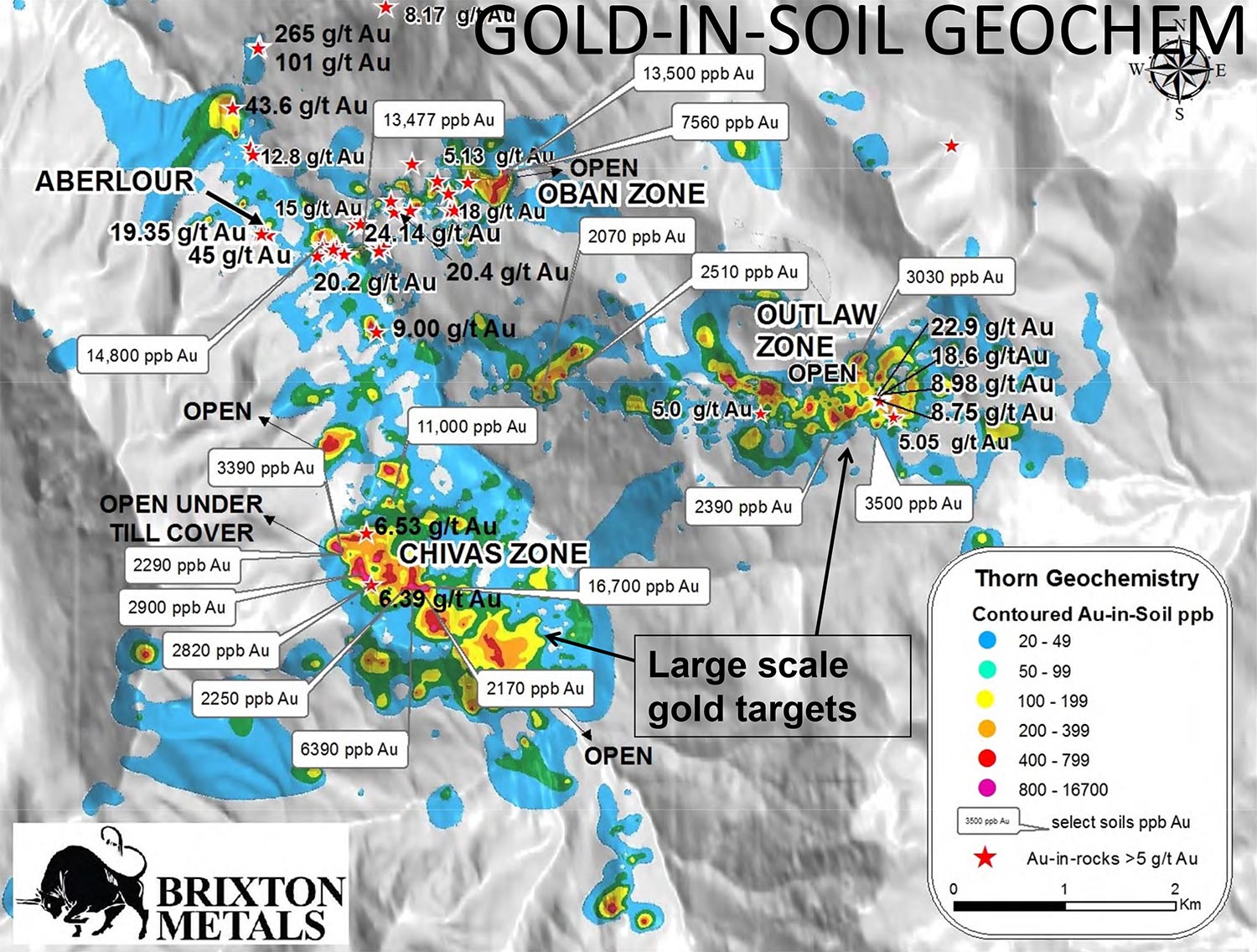

It’s still nothing to get extremely excited about at the current metal prices (in terms of near-term development), but this really emphasizes the exploration potential at Thorn as Brixton also discovered higher-grade mineralization at Aberlour, which seems to be a gold-rich system. Keep in mind Chivas was only discovered in 2014 based on 12 soil samples (up to 11 g/t Au) and no exploration was done in 2015 due to the weak markets, it’s still early days for the Chivas zone which now hosts a 7 square kilometer gold-in-soil anomaly and IP Chargeability anomaly defined during 2016. The Chivas Zone has a northwest-southeast trend as you can see on the next image: Drilling at the Chivas zone in 2017 hit 17.26m of 2.62 g/t AuEq within a broader zone of 52m of 0.87 g/t AuEq. Also, 6.45m of 4.86 g/t AuEq with 18m of 1.83 g/t AuEq.

Revisiting what made Agnico Eagle big: the silver-cobalt camp

A first step to gain exposure to other projects than Thorn was the acquisition of the past-producing Langis mine and Hudson Bay mines in eastern Ontario’s (Cobalt Camp). Not only is this part of one of the most prolific silver districts in the world (where Agnico Eagle Mines actually evolved into a senior producer), the exploration expenses will also be much lower compared to Northern British Columbia.

And Brixton had a good vision, as Langis-HudsonBay wasn’t just a silver project, but a silver-cobalt project. The Langis mine produced in excess of 10 million ounces of silver and almost 360,000 pounds of cobalt and the Hudson Bay mine produce 6.4 million ounces of silver at a grade of 123 ounces of silver per tonne and 185,570 pounds of cobalt from 52,000 tons. Whilst the silver grade was obviously much higher than the cobalt grade, cobalt was just a by-product for the silver-focused small-scale miners. Times have changed and cobalt is now one of the most sought-after metals in the world, so Brixton has an opportunity to take advantage of this renewed focus on Cobalt as well, especially as the assay results from a dump sampling program showed double-digit percent cobalt grades. Note; these grades aren’t representative for the expected average grade at Langis (and Hudson Bay), and should only be seen as illustration of why the silver-rush occurred there.

Brixton Metals is still putting all historical data together but it’s clear the total cobalt production has been underestimated as the data seems to be confirming that as soon as the previous owners discovered a cobalt-rich vein, they went the other way as the high-grade silver veins were what they were really after.

We are hoping Brixton will indeed be able to drill an additional few thousand meters on the property (see later), as we think Langis and Hudson Bay could be quite valuable once Brixton gets a better understanding of the structures and hits more bonanza grades silver and cobalt.

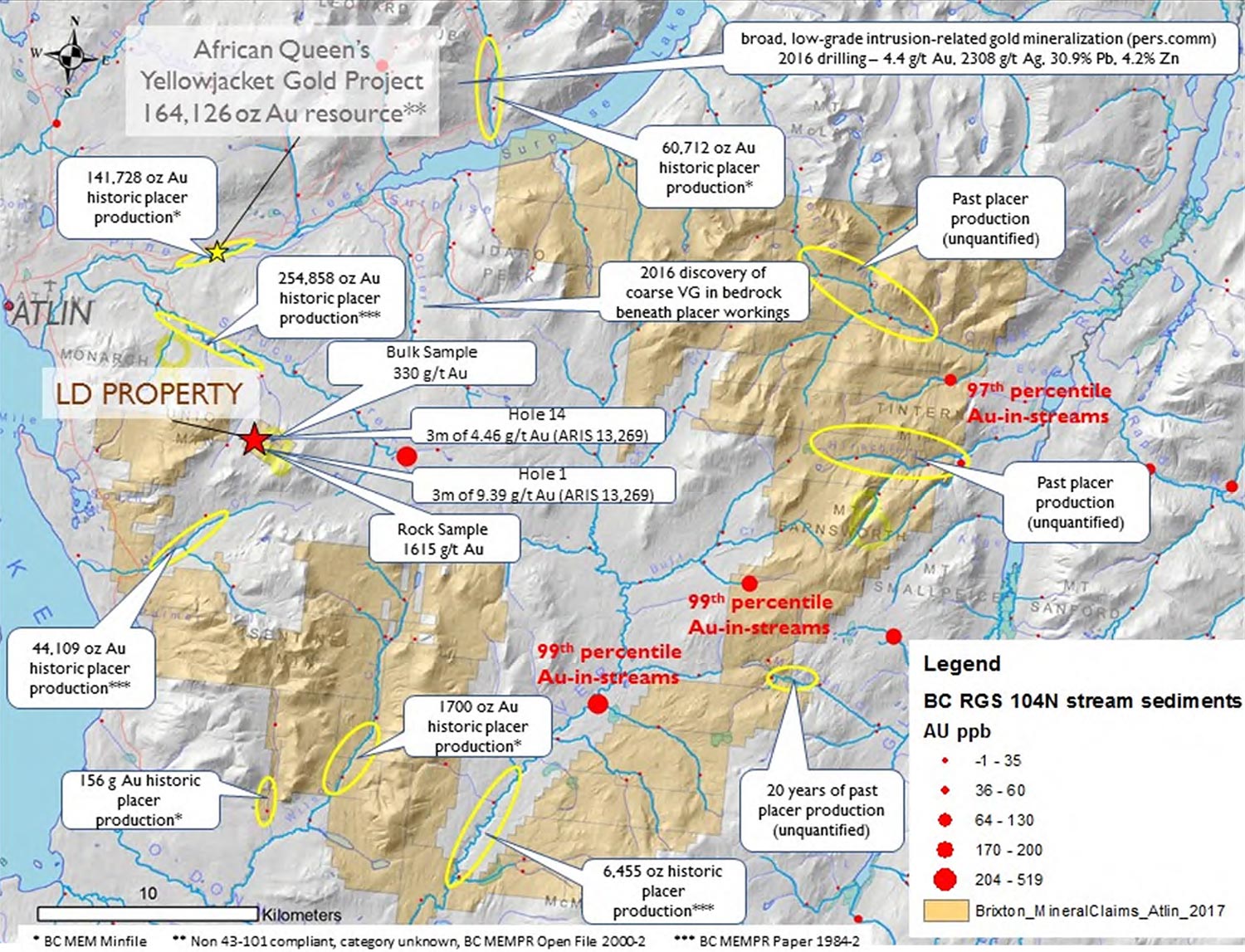

Almost forgotten, but equally important: Atlin

Whilst most of the attention was directed towards the aforementioned three projects, Brixton shareholders shouldn’t forget about the 557 square kilometer Atlin gold project within the 2500 square kilometer Atlin placer camp in British Columbia. This gold camp was the second largest producing camp in British Columbia with a total gold production which is very likely in excess of a million ounces (an ‘official’ production total of 600,000 has been published), but it goes without saying the ‘undeclared’ gold production will increase that amount by a substantial margin. One gold nugget recovered from Spruce Creek was 85 ounces and is the largest ever gold nugget recorded in Canada.

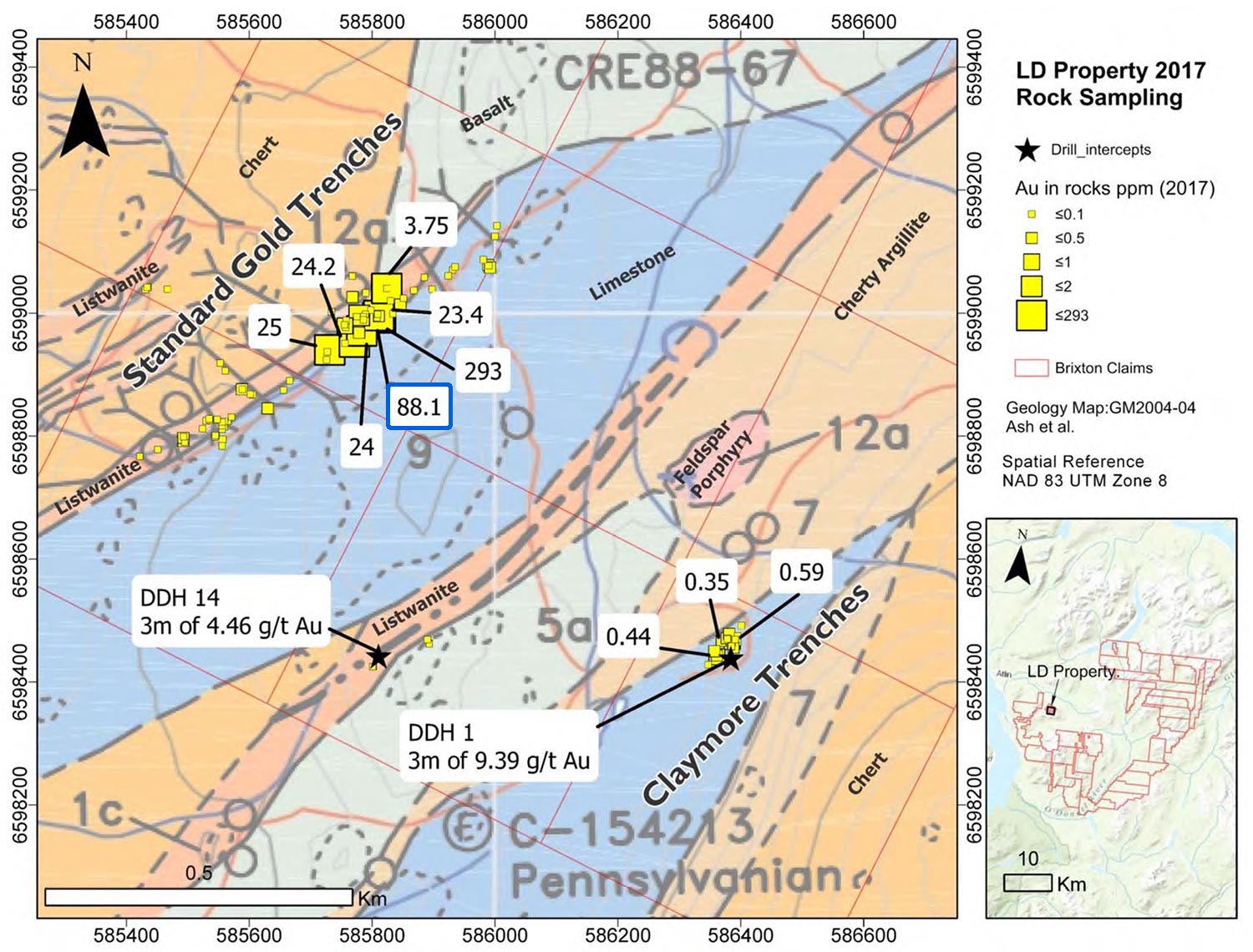

Brixton Metals has recently reported the assay results from a sampling program at Atlin, where the company has taken in excess of 300 samples (rock and soil) and completed a 4,600 kilometer long airborne magnetic survey.

The soil samples showed some very interesting results with 29 samples returning values of in excess of 0.1 g/t with 6 samples showing a double digit gold grade whilst one sample at the LD Showing returned a value of a stunning 293 g/t gold. These are encouraging results and Brixton Metals will continue to work with the Mineral Deposit Research Unit from UBC to get a better understanding of how these gold zones should be interpreted.

The near-term exploration plans

We obviously also discussed Brixton’s exploration plans with CEO Thompson and it’s clear the Hog Heaven project will receive most attention as Brixton has earmarked C$1.2M for a first exploration program. This will include a drill program which will be aiming to do some confirmation drilling and perhaps twinning some of the historical holes as that’s the best way for Brixton to confirm the historical drill data and historical resource estimate.

This doesn’t mean the historical resource will immediately be updated, but it will point Brixton in the direction of how it could maximize the impact of its future exploration programs in 2018, before publishing a NI43-101 compliant resource estimate sometime in 2019. A part of the drill program (in 2018) will probably also test the mineralization at depth, where Brixton plans to test its theory about an existing copper porphyry zone (similar to the mineralization found at Troy, Rock Creek and Montanore). It sounded like Brixton is planning an aggressive exploration program in 2018, and an additional cash infusion will be needed to complete all the exploration activities it would like to do.

At Langis, Brixton will very likely spend half a million dollar on a 3,000-5,000 meter drill program to target the known silver-cobalt structures. As all the energy-related metals (cobalt, vanadium, …), we would hope to see the market starting to pay attention to Langis if/when Brixton hits some decent cobalt mineralization. Fortunately the drill cost per meter is very cheap at Langis, so Brixton could do a lot of ‘damage’ with a relatively small budget.

Regarding the Atlin project, no additional expenditures are required to keep the property in good standing until the end of next year. However, the company has designed a C$500,000 sampling & mapping program which could then be followed up by with a 3,000 meter trenching program and C$500,000 to be spent on a 2,000 meter drill program. But as these claims are in good standing for an additional 13 months, Brixton only really needs to start spending money in 2019.

And finally, Brixton most definitely isn’t ‘giving up’ on Thorn at all, and whilst the project likely won’t be the subject of a drill program in the near future, Brixton will send its geologists back in the field in the 2018 exploration season to conduct more alteration mapping, preparing the project for a decision to drill later on (we had the impression Thompson definitely wanted to get some more work done on the Outlaw zone, whilst we also think the Chivas zone could still unveil more high-priority drill targets). It will also be interesting to see Brixton following up on the copper potential at Thorn.

As you can see, Brixton is planning to remain busy over the next 6-12 months, but as always, the (complete) execution of the drill/exploration programs will be correlated to the company’s cash position and ability to raise more cash.

The recent financing has topped up the treasury

Brixton Metals completed a private placement in October, raising C$1.675M (before expenses) by issuing 5.2 million units at C$0.32 per unit. Each unit consists of one common share and half a warrant with each full warrant allowing the warrant owner to acquire an additional share at C$0.48 for a period of 36 months. The share count has now also increased from 43.8 million shares at the end of June to approximately 51.7 million after taking the completion of the acquisition and the recent C$1.675M placement into account.

As Brixton ended June with a working capital position of C$2.35M (and C$2.8M in cash), we think it’s reasonable to expect the company to have a cash position of approximately C$3M right now.

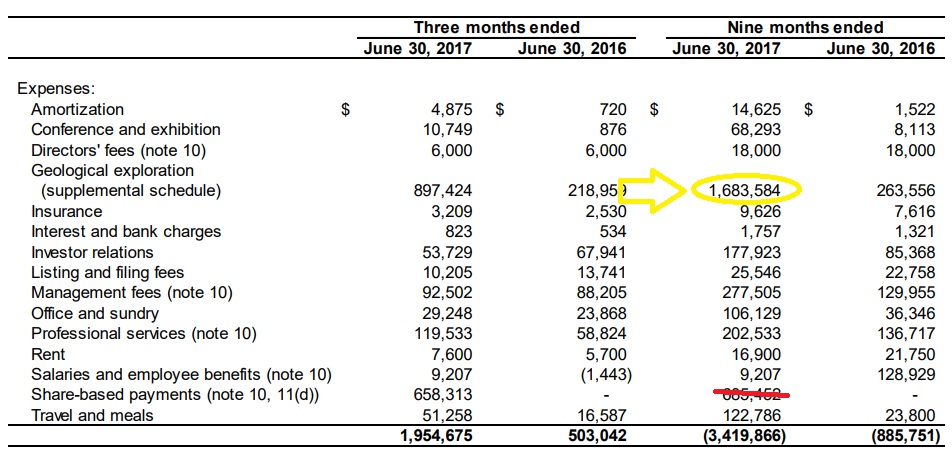

When we were checking Brixton’s recent financial statements, we also noticed the majority of the cash burn is effectively project-related. The total expenses in the first nine months of the year were approximately C$3.42M, of which C$2.73M were cash expenses. As you can see on the next image, almost C$1.7M was spent on the properties meaning in excess of 60% of the cash was invested in advancing and developing the assets. This bodes well for the recently raised C$1.675M as well, as Brixton Metals is running a relatively tight ship with a burn rate of approximately C$1.3M per year.

Conclusion

Whilst Brixton Metals’ Thorn project in British Columbia still is an intriguing project (especially with the discovery of higher grade gold at the Chivas zone), it’s interesting to see Brixton focusing on other properties with year-round exploration potential. Not only will it be cheaper to explore at both Langis and Hog Heaven, the upcoming data-mining results from the Hog Heaven program will keep the company busy during the winter period.

Brixton’s current market capitalization of C$12M doesn’t seem to be justifying the four promising precious metals projects it’s working on, and based on the currently available information virtually every single one of those projects would warrant a valuation of C$10M.

With approximately C$3M cash on the bank account, Brixton Metals is in a good shape to advance its exploration assets, and we’re looking forward to see CEO Gary Thompson and his technical team starting to unlock the value of these projects.

The author has a long position in Brixton Metals. Brixton Metals is a sponsor of the website. Please read the disclaimer

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.