Callinex Mines (CNX.V) has added several projects to its pipeline this year, as the company is betting big on securing a spot in the supply chain on the zinc market. So far, these efforts have definitely paid off as zinc is very likely the best-performing metal this year.

This doesn’t mean Callinex has forgotten where its roots are, and the company continued to explore on its land package in the Flin Flon Belt in Manitoba where it hoped to discover a large, high-grade poly-metallic VMS deposit at their Pine Bay Project which had previously been subject to similar exploration efforts by majors Placer Dome and Inmet. Interestingly, this project is located within walking distance of HudBay Mineral’s (HBM.TO, HBM) 777 processing plant and includes a permitted mining lease.

Today’s drill result appears to be proof of concept towards discovering a significant deposit

The ongoing attempts on the Pine Bay project were a little bit hit and miss and after what the market perceived to be a slightly disappointing update last week when a hole to test an off-hole geophysical target appeared to be weakly mineralized. While Callinex remains very encouraged about the exploration potential in this area, we expressed our hope the deepened Placer Dome drill hole would intersect higher grade mineralization.

Earlier this summer, Callinex decided it would make a lot of sense to deepen an existing hole that was drilled by mining giant Placer Dome several decades ago. According to the company’s technical team, it was quite likely Placer Dome stopped before reaching the ‘sweet spot’. Fortunate for Callinex and its shareholders, today’s drill results have confirmed Callinex’ theory as the Placer drill hole ended just a few meters from what could very well be the discovery of a new base metal deposit with substantial precious metals credits.

We feel bad for the Placer Dome geologists as they were unbelievably close to discovering the high-grade mineralization that would have undoubtedly made them reconsider about giving up the project. But one’s misfortune is someone else’s opportunity!

Callinex deepened the hole by just 38 meters, but these 38 meters were sufficient as the drill bit intersected 10.3 meters of 13.05% Zinc-Equivalent (consisting of 6% zinc, 0.71% copper, 1.78 g/t gold, 0.35% lead and almost 2 ounces of silver per tonne of rock), including an ultra-high grade interval of 4.2 meters containing 20.78% zinc-equivalent (of which 11.82% is ‘pure’ zinc and also includes 0.70% copper, 2.43 g/t gold, 0.73% lead and 73.77 g/t silver).

We pulled up HudBay’s MD&A, and compared Callinex’ discovery hole grade with the average grade of the ore processed by HudBay Minerals in the first half of this year.

[table caption=”” colalign=”left|left|left”]

;777 mine;Pine Bay Discovery Hole

Zinc;2.76%;6.00%

Copper;1.57%;0.71%

Gold;1.36 g/t;1.78 g/t

Silver;17.44 g/t;60.39 g/t

Lead;N/A;0.35%

Rock Value per tonne (USD);200;279

Rock Value per tonne (CAD);260;363

[/table]

Note, we used the following metal prices (Zn $1.02/lbs, Pb $0.90/lbs, Cu $2.11/lbs, Au $1250/oz, Ag $17.25/oz) and assumed a 100% recovery of all metals. The recoverable value per tonne will obviously be lower.

What does this mean? Putting things in perspective

First of all, it’s always great when the drill bit confirms your geological model and expectations, especially when the target is a large, high-grade system. We are particularly impressed with the average grade of the mineralized zone. An average zinc-equivalent grade of 13% is excellent and as the true width of the mineralization will be pretty close to the reported width, this interval is thicker than the average width of the mineralization at the 777 mine and the average grade is also higher. The 777 mine has reported net profit close to $2 billion since commercial production began in 2004, so this says a lot about the potential economics of a new high-grade discovery. An additional advantage of the discovery hole seems to be the consistency of the mineralization, because even if you would exclude the 4.2 meters of high-grade mineralization, the remainder of the mineralized hole still contains in excess of 6% ZnEq.

The high-grade interval of 4.2 meters at 20%+ Zinc-Equivalent is absolutely stunning as this equates to a rock value of C$625 per tonne, especially significant given HudBay’s 777 mining and processing costs are reported to be just C$51 (!) per tonne. As we understand it’s not always easy to ‘understand’ how good a base metal interval is, converting the zinc-equivalent grade into a gold-equivalent grade might be helpful here. If we would use Friday’s closing prices in our calculation, the gold-equivalent grade would be almost 7 g/t over the entire 10.3 meters, with an ultra high-grade interval of 11.26 g/t in those first 4.2 meters.

This also indicates the encountered grade certainly appears to be economic. According to our calculations, the rock value of the 10.3 meter interval is C$363, so even if you’d use a low recovery rate of 70%, the average recoverable value from one tonne of ore would be C$254. This does indicate this zone would have very attractive operating margins, even if the production and processing cost would increase on a per-tonne basis. Note, our generalized recovery rate is extremely conservative, as HudBay’s recovery rates are substantially higher:

[table caption=”Projected Recoveries” colalign=”left|left|left”]

Metal;777 Mine Recovery%;777 North Expansion Recovery%

Gold;72.5;57.0

Silver;64.0;45.0

Copper;93.0;85.0

Zinc;85.2;85.0

[/table]

Source: 777 mine technical report

The value of the by-product credits is approximately C$187/t, so even if we would apply a recovery rate of 70%, the value of the by-products per tonne of rock should still be in excess of C$130/t. This will cover all operating expenses and allow a negative cash cost (after by-product credits) for the zinc output.

What’s next?

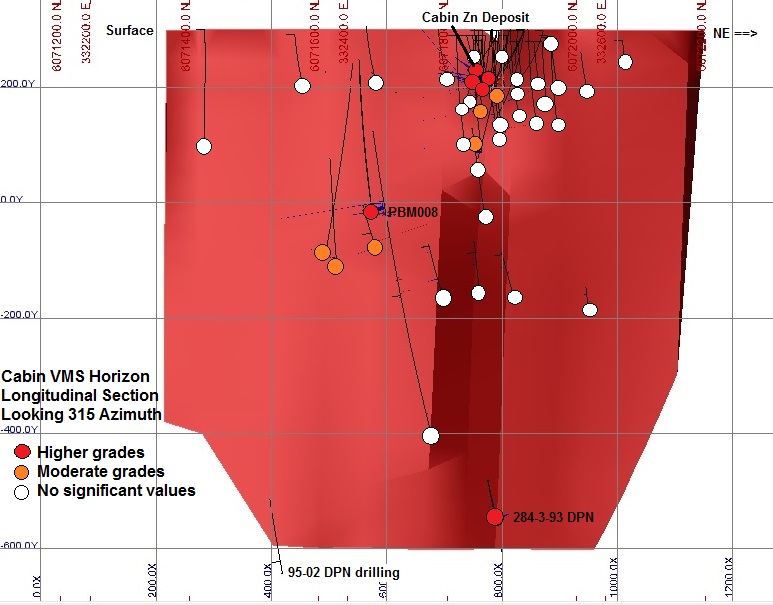

Whether or not a deposit could be economic doesn’t only depend on the average grade but also on the total size of the mineralized envelope. One high-grade hole is a great start but we agree talking about economics is still very premature at this stage until Callinex has been able to define the limits of the mineralization; however, it’s important to know what your potential target is as follow-up drilling is conducted. The 777 Mine has exceeded 20 million tonnes and when Placer Dome explored the project they had a 30 million tonne target when they drilled the hole that Callinex ultimately intersected the new zone with.

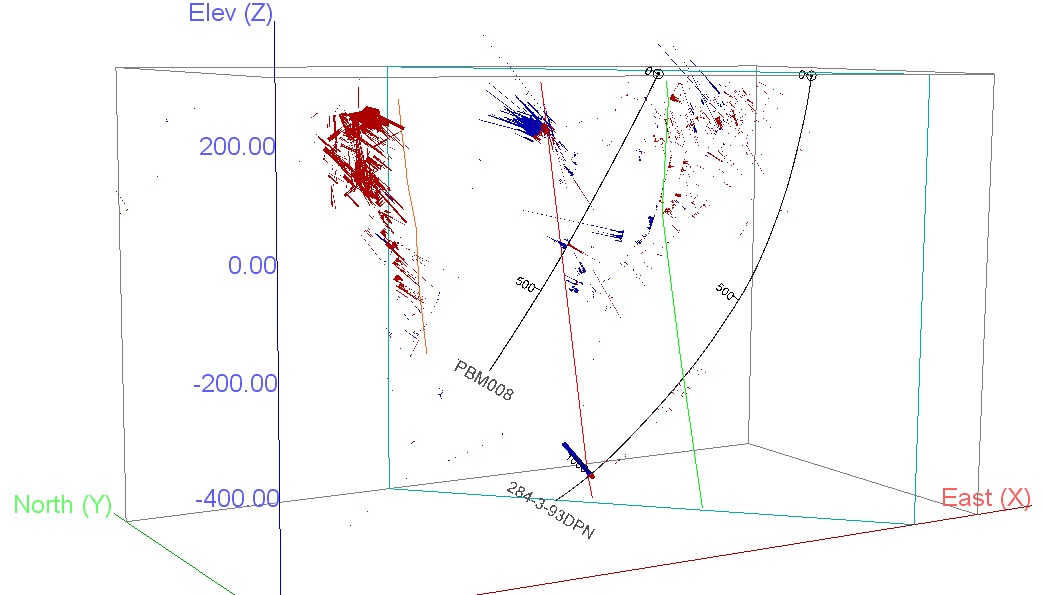

Furthermore, Callinex’ reported geophysical target (700 X 1100 meters) is also in the vicinity of 30 million tonnes if the width they intersected is representative of the total size of the target.

We are expecting to see the assay results from a second re-interpreted hole previously drilled by Inmet (based on data provided by Placer Dome) within 45 days and potentially sooner. This hole has been drilled approximately 400 meters to the south of the current discovery hole, and exactly because this is a huge distance for a step-out hole we aren’t putting a bottle of champagne in the fridge just yet as it would be very surprising to see similar results in this second hole. The hole was initially drilled to follow-up on the extension of another separate mineralized zone. Callinex’s ongoing re-interpretation of the data will very likely improve

Also keep in mind Placer Dome wasn’t a small company and couldn’t care less about small deposits. The company had a very clear mandate to look for VMS deposits with a total size of 30 million tonnes, and they wouldn’t have spent great efforts at Pine Bay if it didn’t think there was something in that size range lying underneath the surface. Placer was initially drawn to the area based on a very large alteration system and series of smaller deposits that could be associated with a much larger deposit.

Interestingly, new geophysical data from Callinex’ recently completed hole is suggesting a large target along the strike towards the south exactly where Placer Dome and Inmet had attempted to drill, but both fell short of the target area.

HudBay will be watching closely

As mentioned before, HudBay Minerals is operating the 777 mine and processing plant just a few kilometers away from this discovery hole. What’s really interesting is the fact the 777 mine will run out of ore within the next few years, and HudBay has already publicly acknowledged it has been unable to find more ore to keep the processing plant running. An additional bonus is the fact the discovery was made on a part of the Pine Bay project that is covered by a mining lease!

Not only will HudBay have to shut the mill down by the end of this decade, it will also have to cover roughly C$100-125M in decommissioning expenditures (our own estimate based on the total decommissioning liabilities on HudBay’s balance sheet). So if the company could extend the mine life of the greater Flin Flon area, it could push back the decommission expenses by several years.

But let it be clear, if Callinex is indeed able to aim for a 20-30 million tonne deposit at Pine Bay, its options don’t remain limited to doing a deal with HudBay. Size does matter and the more tonnes Callinex can define, the more likely it is to consider Pine Bay to be a standalone operation and could interest many more suitors to try to sign a strategic deal.

Conclusion

There are a few things you need to remember from Callinex’ discovery hole. First of all, the mineralization is very similar (or even better) than what HudBay Minerals is currently mining at its nearby 777 mine (which will run out of ore by 2020). This mine was one of the most profitable base metal projects in North America, generating several billions of dollars in operating and free cash flow in the past few decades.

One hole is a good start, and we expect Callinex Mines to follow up on these results in an upcoming winter program after all data will have been carefully reviewed to make sure the company creates the biggest possible bang for its buck (as these deep holes aren’t really cheap). With in excess of C$4M in the treasury (the working capital position was C$5.2M (C$0.08/share) as of at the end of June) and backed by main shareholder RCF, Callinex is in an excellent position to continue to create shareholder value by letting the drill bit continue to speak for itself.

Disclosure: Callinex Mines is a sponsoring company, we have a long position. Please read the disclaimer

this bitch is gonna be another lumina copper 20+ per share