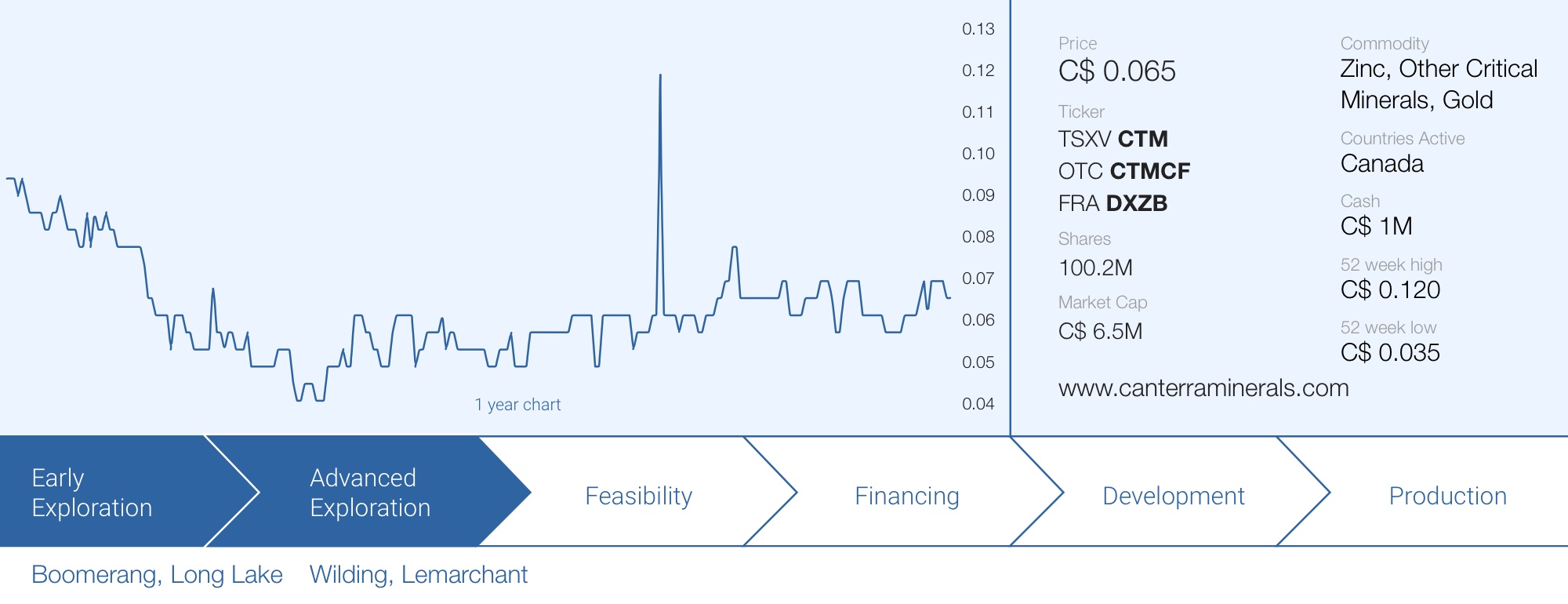

Canterra Minerals (CTM.V) has been somewhat dormant in the past eighteen months as CEO Chris Pennimpede had to take a leave of absence for health reasons. While an interim CEO and President was appointed, Canterra Minerals continued to work on the gold assets in Newfoundland without really generating a massive breakthrough on the assets. Such is the tough life of an exploration stage company.

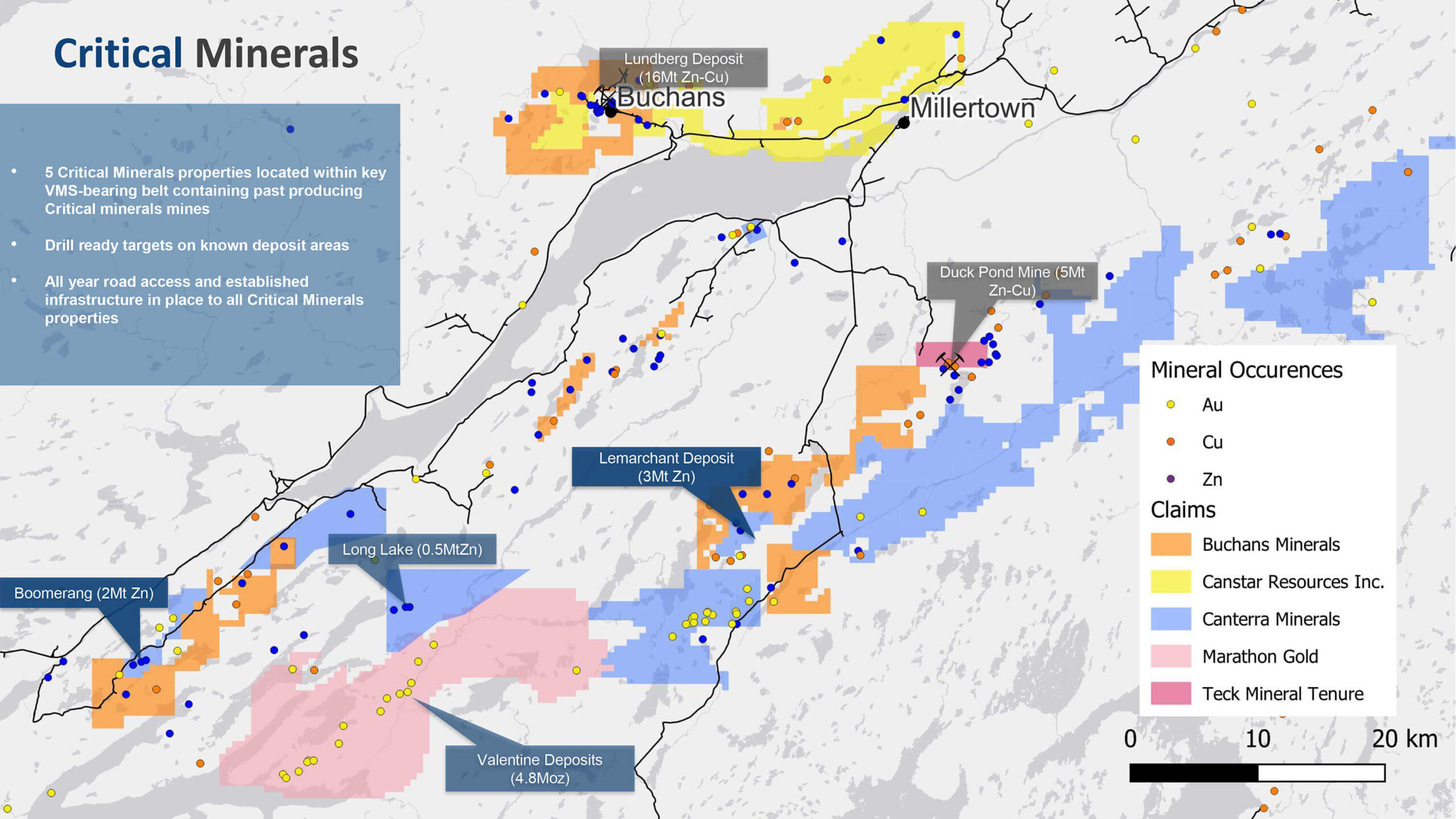

More recently Canterra Minerals started to focus on critical minerals. The company had picked up zinc-heavy assets in 2021 and now appears to be re-focusing on those assets, as Canterra recently also staked claims in the Ring of Fire in Ontario. Plenty of reasons to catch up with CEO Pennimpede who took the reins again in April of this year.

Sitting down with CEO Chris Pennimpede

Newfoundland

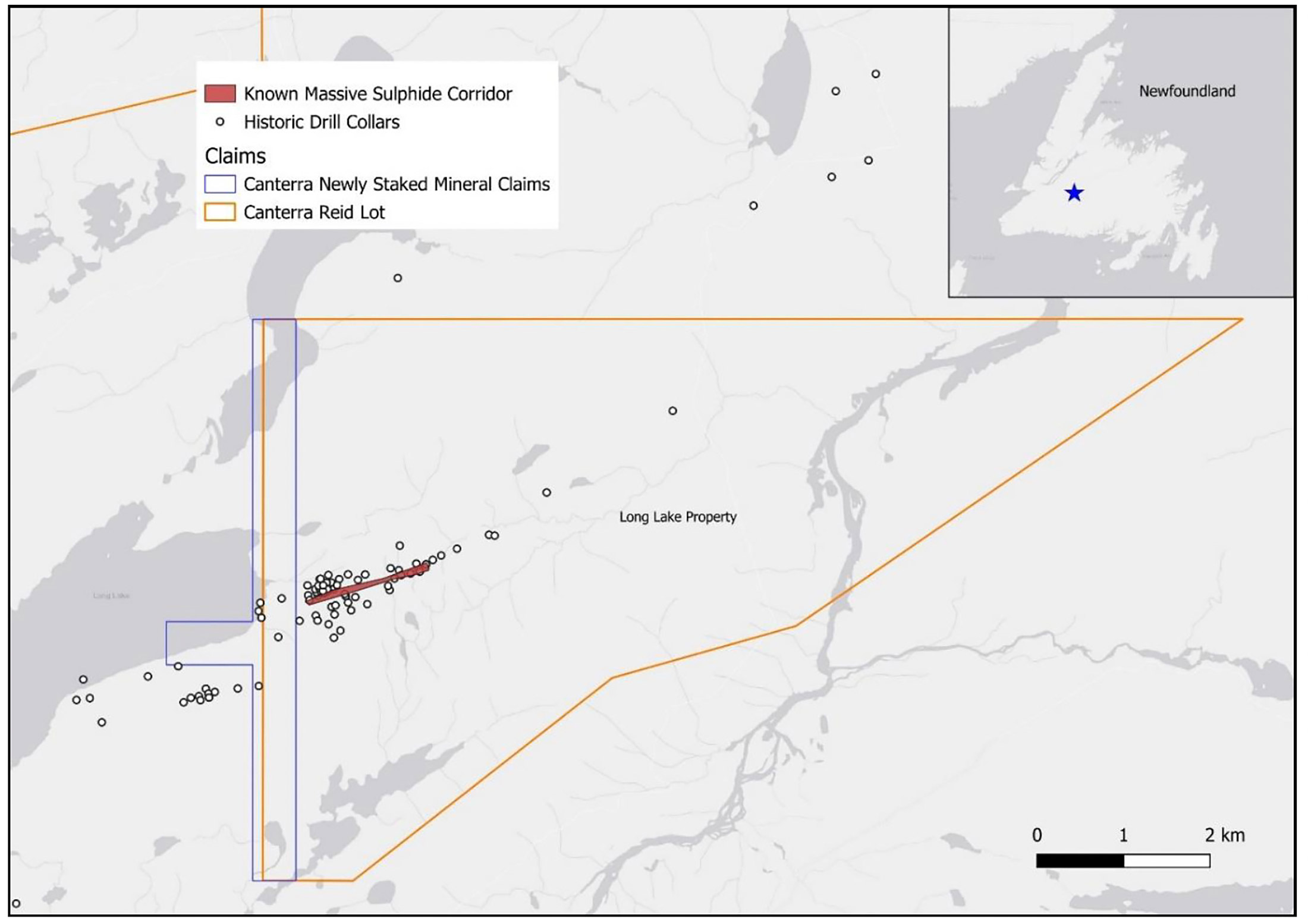

Let’s zoom in on your recent staking activities in Newfoundland. In June, you announced you expanded the size of the Long Lake project in Newfoundland. These claims now include the strike extension of the massive sulphide mineralization and allows you to lock in the areas that have been drilled before. Was this decision made just to ‘be safe’ or are some of the chargeability and gravity anomalies on those newly acquired claims?

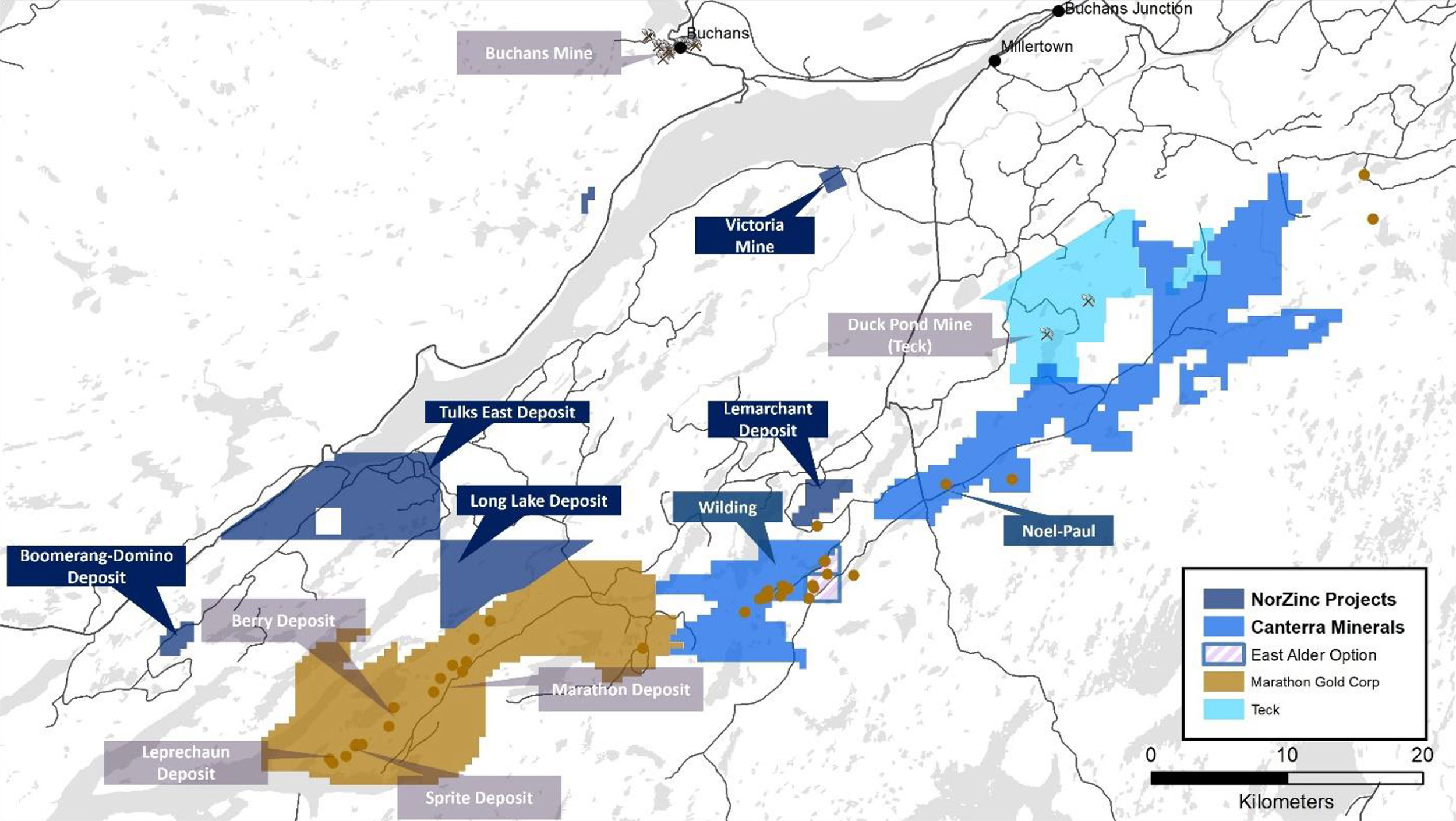

It was both actually. We spent the last two years digesting all the data we acquired in the Norzinc transaction. Out of that, Long Lake looks to be one of the projects that has substantial exploration upside. It was drilled in the minimum amount to rush it into resources so that it could be amalgamated with all the other resource base projects Norzinc had with the idea that you could operate a central mining operation and truck orefrom all of these deposits.

So, we discovered a gravity anomaly in that data that we only partially had covered in the ground we acquired, and Norzinc had dropped a portion of the Long Lake project, which contained some of the drill holes along strike the deposit that made sense to take back in. Interestingly, the gravity anomaly is cut off because the survey didn’t cover the entire property block and so the anomaly probably continues into what we think could be the other limb of the prospective stratigraphy that could host another massive sulfide deposit. So will aim to infill the gravity to confirm our ideas by the end of the year.

Looking at the map, there still appear to be plenty of drill holes drilled in close proximity to the expanded land package. Is that an area you’d like to go after or is it of little importance to you right now?

In the future, if we are successful in expanding mineralization at Long Lake then that would give us reason to do so. But for now, the priority is to prove that Long Lake can be bigger than the initial resource estimate.

Long Lake Property

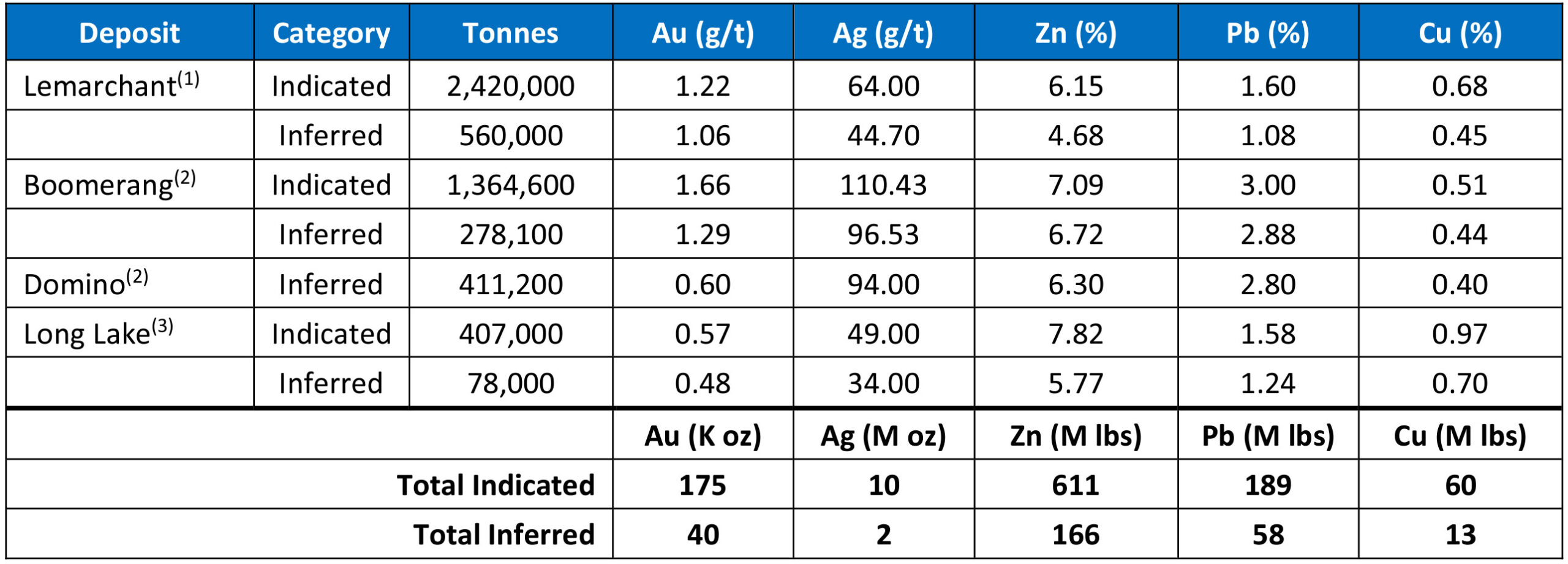

Long Lake was originally acquired as part of a larger acquisition from Norzinc. Investors may already have forgotten this (as that acquisition happened almost two years ago), but you already have an indicated resource containing 611 million pounds of zinc and 189 million pounds of lead in the indicated category with an additional 166 million pounds of zinc and 58 million pounds of lead in the inferred resource category (see below). So the focus on critical minerals isn’t just a ‘new’ idea, is it?

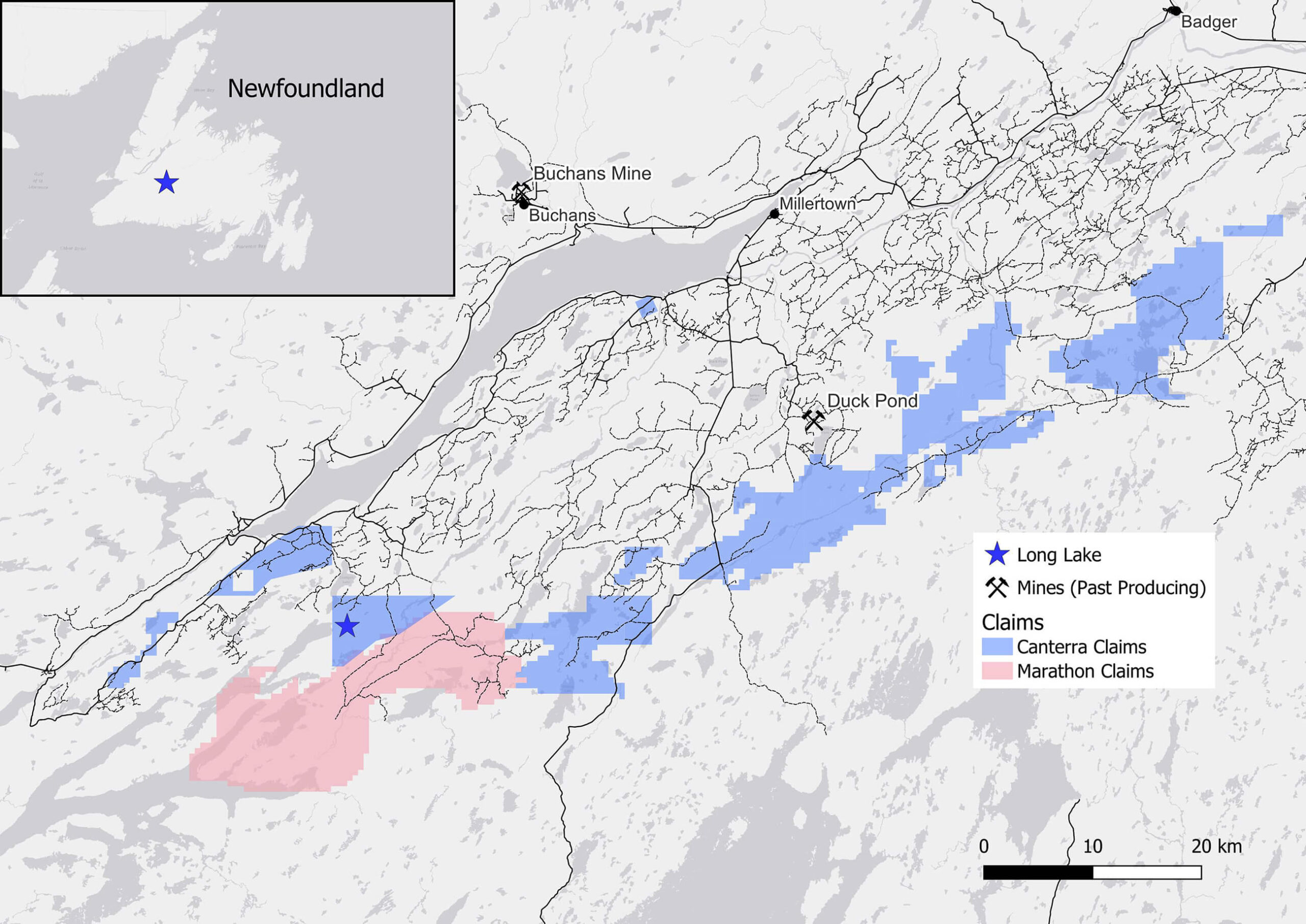

Correct. When we acquired the gold assets next to Marathon Gold’s (MOZ.TO) Valentine Lake project in the end of 2020 we got to work straightaway on trying to find the next Marathon-like discovery on our side of the shear zone. Because of the hype around all gold explorers on the island of Newfoundland in 2021 our market cap appreciated substantially like many of our peers. We knew that exploration on our gold projects was early-stage and therefore required high risk exploration drill holes. We started shopping around for more advanced projects to offset that risk. We found the Norzinc-owned deposits and were able to leverage our market cap to get them for a really good valuation just as the base metals trade was taking off. Unfortunately, the drill holes on the gold side failed to deliver a Marathon like discovery: there was smoke but no fire. And at the same time investor interest in explorers dropped off.

Long Lake, Central Newfoundland

This meant that we never got a chance to market these critical minerals projects, but to be honest it took a full year and then some to digest the 2 TB of data that came with the projects.

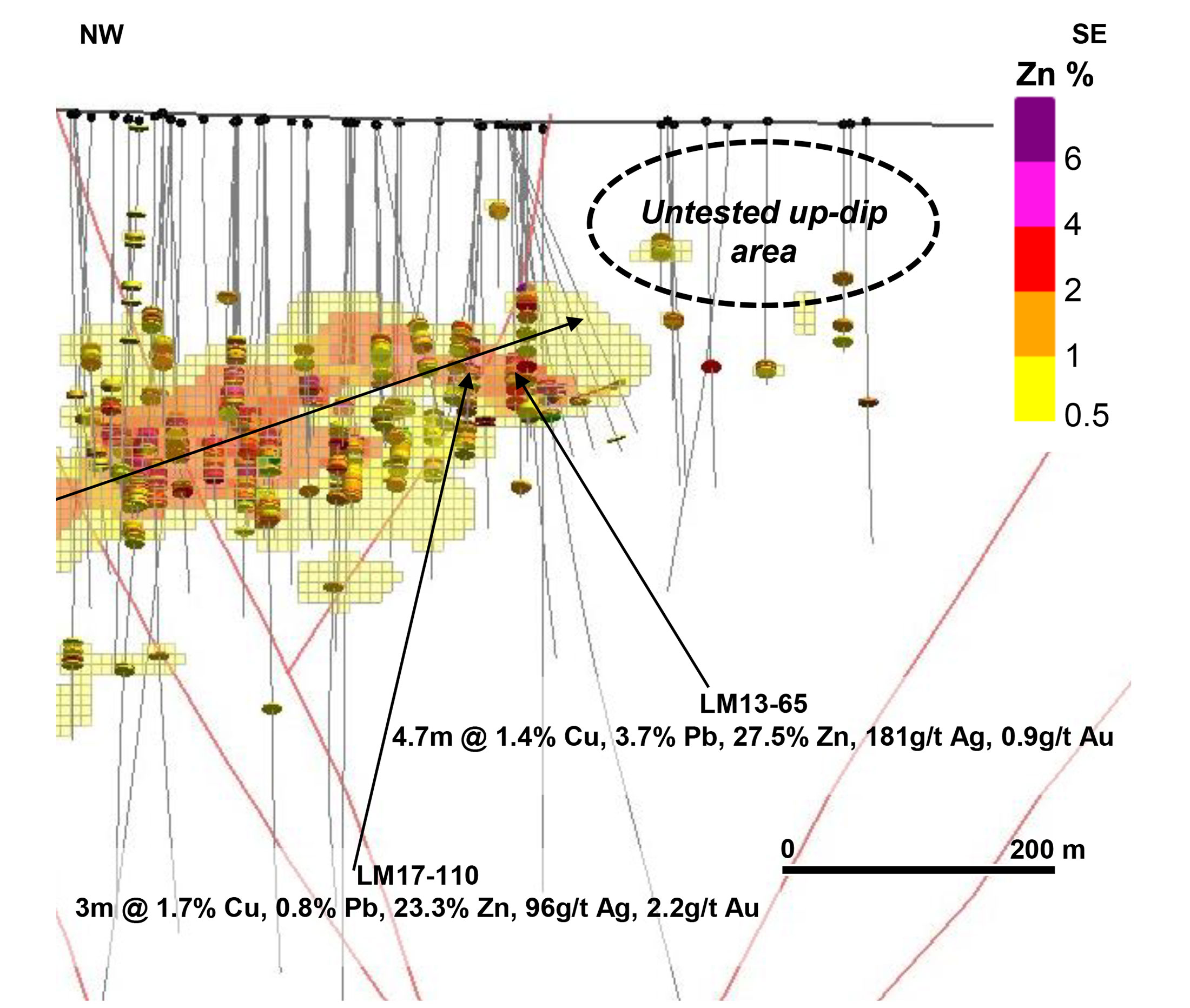

So, the focus now is to drill high-grade zinc equivalent at Lemarchant and Boomerang as well as some exploratory holes at Long Lake. We know we can hit massivesulphide here and hopefully we will encounter the same very high grade results previous operators intersected. That should get the market’s attention as I don’t believe that any value has been ascribed to these resource assets in our current valuation (our market capitalization is just C$6M right now).

If you look at Western Alaska Minerals (WAM.V) or Fireweed Metals( FWZ.V), high- grade combined metals still captures investor interest.

As an explorer, I look for deposits that could potentially be viable. The commodity doesn’t matter because make it big enough and rich enough in grade and there will be a market for that deposit to be mined.

You recently visited the Newfoundland projects, what was the purpose of that trip?

The main priority of this trip was to go to Long Lake and Lemarchant to evaluate our planned drill holes. It’s easy enough to plan them in 3D space or in plan view in GIS, but sometimes it helps to see them in the field as there can be unexpected tree growth that you’ll need to account for in preparing a drill pad or the water source might be dry at this point in the year so you’ll need to plan for another water source and so on.

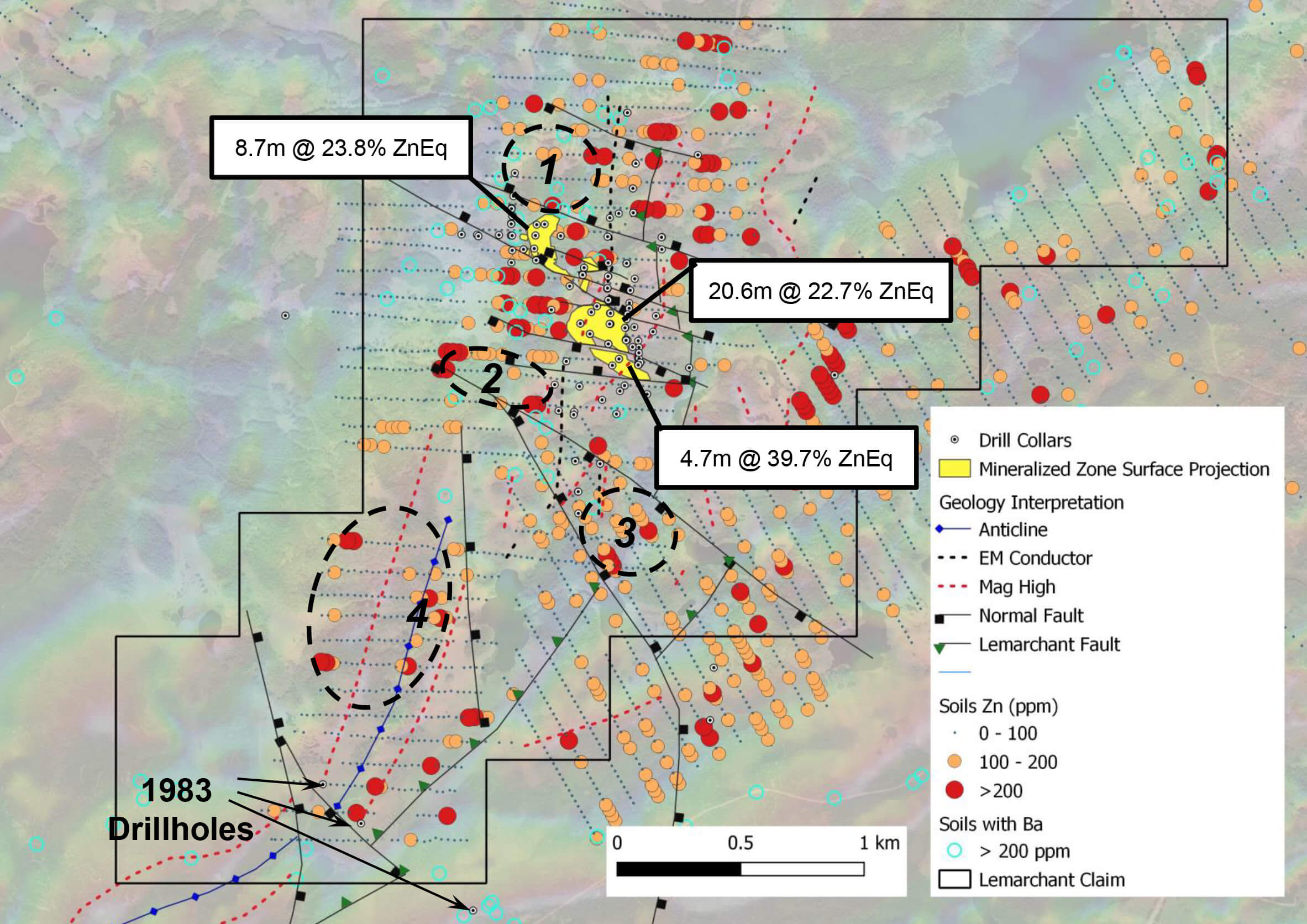

The second priority of this trip was to visit some of the other massive sulfide projects in the belt to compare and contrast. Some of those projects are available for option as we look to expand our presence in this belt. We have the data for most of these projects and so were going through a target ranking exercise and trying to determine which of these projects has the most prospectivity for yielding another Duck Pond size deposit. And that’s really the key here. Of the existing deposits in this belt, the biggest one is our Lemarchant project which is half the size of Teck’s past producing duck Pond mine (5Mt Zn-Cu at an average grade of 15%ZnEq).

To make a go of it here in central Newfoundland you have to find another Duck Pond and so we spent some time looking at various other projects and evaluating what they looked like in the field versus what they looked like in the data to give us the best opportunity of making that new discovery.

By the end of the trip, we had solidified the drill hole priorities for fall and I feel very confident in our modelling to grow through drilling the deposit size at Lemarchant and hopefully make a new discovery there.

As the focus on ‘critical minerals’ seems to have taken over, what does this mean for the gold assets? We understand it’s still early days but will the shift to critical minerals be complete by selling the Wilding project or will you retain them albeit on the backburner?

We will continue to pick away at the gold projects as long as it makes sense to do so. We’ve drilled the best targets that we generated and while there was success, with the Elm zone yielding 50 gram-metres and Red Ochre yielding 20 gram-metres over 400 m of strike, neither of those amount to a Marathon like discovery and stepping out further failed to grow those zones in the same width and grades. So, the remaining targets are fully under cover and require a concerted effort to do generative target work to develop a target worth drilling. That will take some time and may not yield a target that warrants drilling. While we wait for a target that’s worth drilling to materialize through our early-stage efforts, the critical minerals resource stage projects will take the focus as we know we can hit grade zinc equivalent there in the next drill program, which should get the markets attention.

Ring of Fire

An interesting move in July, as you announced Canterra staked claims in Ontario’s Ring of Fire district. Can you elaborate on the thinking process ahead of staking these claims? Why the Ring of Fire?

Before Canterra existed as a Newfoundland explorer, it had been a diamond explorer for 20 years. In that time the company had amassed gigantic geophysical data sets across Ontario including the Ring of Fire and in the Northwest Territories. As part of our critical mineral strategy we spent six months digitizing that data and picking out areas that could be perspective for VMS deposits similar to what we have in Newfoundland, but also magmatic nickel deposits that is more what the Ring of fire is known for. We managed to come up with a few targets for staking that happened to be open and nearby the projected road that will one day go to the Eagle Nests deposit owned by Ring of fire metals.

It made sense to act on this target generation and stake the ground while it was open especially given all the recent activity in the region. The plan is to option the project to a junior nickel explorer and package it with a more comprehensive Ring of Fire data set.

Looking at the map, your claims are relatively far away from the large land packages owned by the larger players in the district. How did you stumble on this specific area of 3,000 hectares? The area is also pretty small at just 30 square kilometers. Was it too expensive to stake more, or was this specifically based on a geological interpretation and footprint of the anomalies on the mafic and ultramafic rocks?

We looked at the geological setting of Eagles Nest and other deposits in the region and combined it with the best EM anomalies we had in our data set. We could have staked more, but the EM anomalies and geological setting outside of the area we staked were not compelling enough to warrant the expenditure. 30 km² is plenty to host an Eagle Nest sized deposit. And the plan was to option it from the outset.

Do you have any (immediate) work plans there?

No. It’s available to option and we hope to package it with the rest of the Ring of Fire geophysical database.

General

What’s your current cash position and what kind of runway do you expect to have?

Current cash is C$1M. It gives us runway until next April.

Given the low share price and market cap, may we assume that securing a flow-through financing may be the easiest way for you to raise money?

In my opinion it’s never advisable to go exploring or drilling in companies of our size on hard dollars especially if flow-through is available. Given the recent incentive announced by the federal government to investors an additional 30% tax credit to flow-through investors on flow-through financings for critical minerals projects, I believe the flow-through availability will be attractive to potential investors in CTM. Especially when combined with Newfoundland and Labrador’s commitment to expand the junior exploration assistance grant to basically create or double it to accommodate a whole extra funding path for projects developing or exploring for critical minerals.

Conclusion

While Canterra Minerals hasn’t been very active in the past twelve months after the company didn’t immediately succeed to prove up scale on its gold targets, the renewed focus on critical metals means Pennimpede and his team are hitting the ground running. The VMS deposits in Newfoundland were put on the backburner but the high-grade zinc levels makes the deposits appealing again. The assets contain almost 800 million pounds of zinc (611M pounds in the indicated and 166 million pounds in the inferred resource category). Additionally, there’s about 189 million pounds of lead in the indicated category and 58 million pounds in the inferred category and to top it off, there’s 175,000 ounces of gold and 10 million ounces of silver in the indicated resource category as well.

And reading between the lines, CEO Pennimpede appears quite optimistic about increasing the tonnage and resources on the Long Lake asset which could further boost the consolidated resources. At the very least, Canterra can certainly hit high-grade zinc equivalent in the next drill program which is slated to start in late September. Given the market has slept on these acquisitions, readers could expect a WAM type of gain when they hit massive sulfide. Of course, the proof of the pudding will be in the eating, but we look forward to seeing Canterra doing more work on these assets. We’ll keep close tabs on the company as CEO Pennimpede reorients Canterra towards a critical minerals focus.

Disclosure: Canterra Minerals is not a sponsor of the website. The author has a long position in Canterra Minerals. Please read our disclaimer.