The demand for lithium is skyrocketing, but the commodity isn’t rare at all. In fact, lithium projects can be found all over the world, but only a few of them will ever be developed into a producing lithium mine. For that reason, we have been avoiding the so-called hard-rock lithium mines as those tend to be much more capital intensive than for instance brine operations (it’s more expensive to build and operate a hard rock lithium mine rather than the low-cost evaporation process). Canada Lithium tried it a few years ago, but went bankrupt.

But in between hard rock and brine lithium projects, there is some sort of middle ground. In Nevada, Cypress Development (CYP.V) is aiming to develop a sedimentary-hosted lithium project into a full-fledged lithium mine. It’s some sort of a ‘hybrid’ operation as the nature of the deposit actually combines a (higher grade) hard rock operation with the economic advantages of a lower-cost production method. The Preliminary Economic Assessment on the project indicates the operating cost will be relatively low thanks to having hectorite-free clay as a host rock which makes it less capital intensive than other non-brine lithium projects. That, as well as a substantially higher lithium price compared to the market conditions when Canada Lithium failed, give Cypress Development a good shot at further advancing this project.

About the project

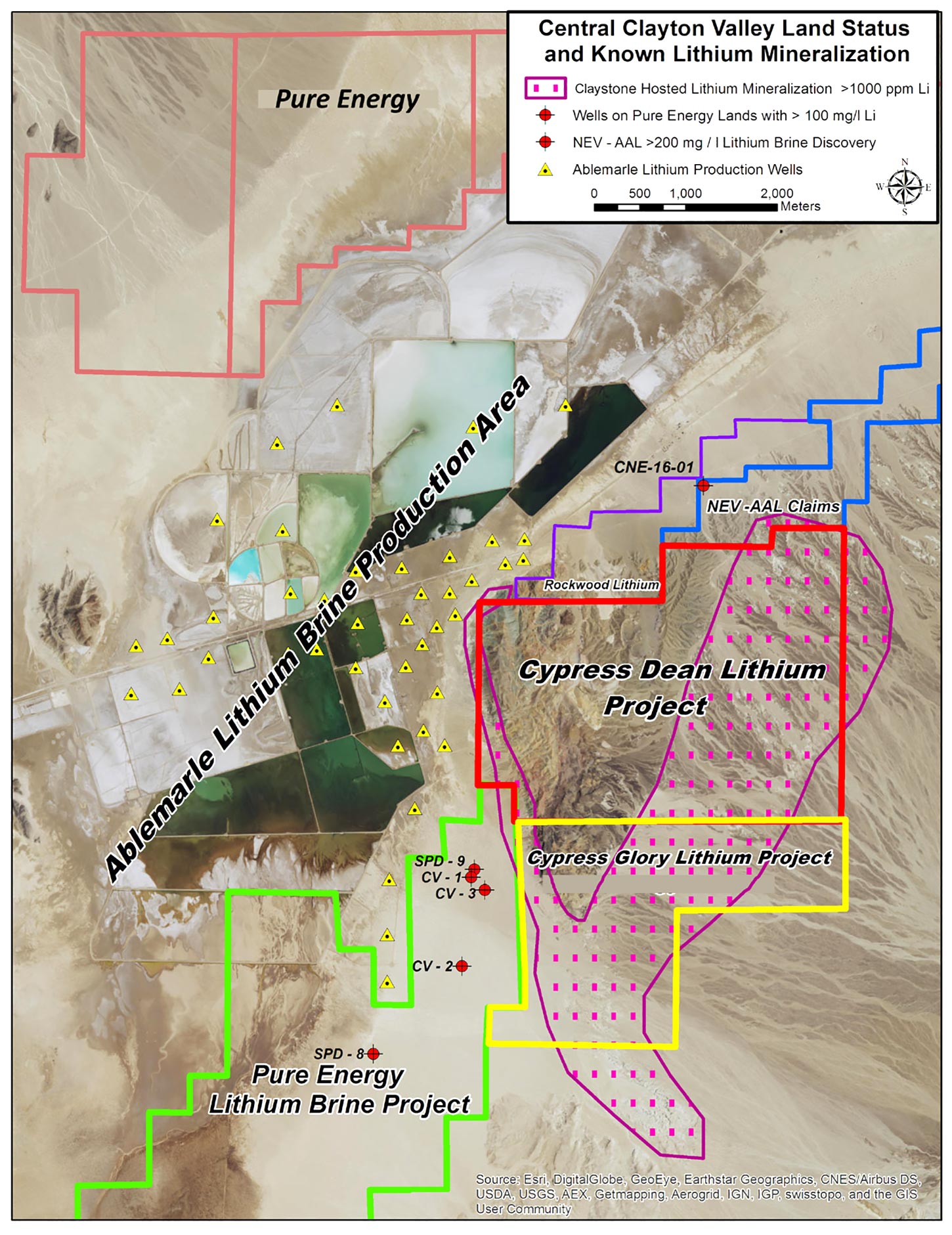

The Clayton Valley lithium project consists of 139 placer mining claims and 178 overlapping lode mining claims for a total surface area of 4,780 acres (approximately 1935 hectares or 19 square kilometers), just 60 kilometers southwest of Tonopah, which acts as a regional center for the mining industry in Nevada.

As we explained in our site visit report on Allegiant Gold (AUAU.V), the existing infrastructure in and around Tonopah is a major benefit for all mining projects in the region. The Clayton Valley project is no exception as approximately half of the distance to get to the project is on highway 95, a well-maintained road of vital importance to the district. After leaving the highway, the project can be reached through a gravel road, and even those gravel roads in Nevada are very well maintained and a pickup could comfortably cruise at 80 km/h.

The project is also immediately adjacent to the Silver Peak lithium mine, currently operated by Albemarle (ALB) after its acquisition of Rockwood Holdings. Silver Peak is a classical evaporation-based lithium mine clearly visible on satellite images:

After acquiring the property, Cypress Development immediately initiated a drill program and the company completed approximately 1,900 meters of NQ core drilling in 23 holes. This initial drill program confirmed the widespread presence of the ash-rich mudstone which hosts the lithium zones. Although the drill holes were widely spaced (and the project will require an infill drill program before a feasibility-stage mine plan could be developed), the average grade and thickness of the lithium bearing zones appeared to be very consistent, and this allowed the company to rapidly advance Clayton Valley to the PEA level.

The results of the PEA were announced in September and the full technical report was filed in October. This allowed us to gain a better insight in the technical approach of the project, and convinced us that a clay-hosted lithium project could indeed be viable.

The PEA indicates this lithium claystone project is viable

We admit that when Cypress Development acquired the property, we had our doubts. But upon reading the technical report with the Preliminary Economic Analysis, we now do understand why the project has a chance of being developed into the next domestic lithium mine in the US.

First of all, the average grade of the current resource is pretty good. The company is using a base case scenario with a cutoff grade of 300 ppm lithium, but even if you’d increase the threshold to 600 ppm, you’d only lose 3% of the lithium content in the indicated resource category and about 5% in the inferred category while the grade increases by 2-3%. That’s important as the acid consumption in the preliminary met tests indicated a slightly higher consumption than the assumptions used in the calculation of the cutoff grade.

Granted, there is some variation depending on the layer, but the fluctuations are quite benign and when this deposit gets mined, the miners will be able to establish visual confirmation of the zones they are excavating at that point:

The very shallow gravel cover is a second advantage of Cypress Development over ‘real’ hard rock operations. There is almost no strip ratio (0.1:1), so Cypress basically just needs a few excavators and trucks to haul the mudstone to the hopper.

A third advantage is the fact the lithium is contained in mudstone as its host rock. You don’t need expensive crushing equipment, as these sandstone-type deposits are pretty easy to prepare for the final lithium extraction process. Rather than trucking the lithium-bearing mudstone to a plant, the trucks will deliver it to a hopper which will be built on-site. After dumping the rock in the hopper, it would be sent (on a conveyor belt) to a repulping system which will create a slurry out of the mudstone by adding water. The slurry will then be sent to the final extraction plant using a pipeline. This is by far the most efficient and cheapest method to keep the operating expenses low, as you’re saving on buying and operating a boatload of trucks.

These three key elements are a huge advantage for Cypress as especially the crushing and trucking part of the opex are playing an important role in other non-brine lithium development plans around the world.

Once the slurry gets delivered to the processing plant, Cypress will just follow the conventional method to produce lithium carbonate. The incoming slurry will be leached with sulphuric acid in a temperature-controlled environment (70-90 degrees Celsius) where after two stages of impurity removal have been added to the flow sheet before ending up with the final product: Lithium Carbonate with a purity of 99.5%. The total expected recovery rate from the pit to the end product is 81.5%, which is pretty good for a mudstone hosted lithium deposit.

Playing with numbers

The initial capex of the project is US$482M, and this appears to be relatively high for what essentially is an easy excavating operation. However, the $482M includes in excess of $76M in contingency (20%) and almost $24M in working capital to bridge the period between incurring the production expenses and the incoming revenue flow. The direct capex is just $382M, and this includes an acid plant which will produce 2,000 tonnes of sulphuric acid per day. Cypress provides a 3-page list of the capex element in the PEA, and we encourage you to have a look at the technical report (which you should do anyway before making investment decisions in the mining sector).

The initial capex is high but developing the mine (and plant) is only capital intensive before the initial production. The sustaining capex has been estimated at US$120M for a period of 40 years, which works out to be just US$3M per year (or US$125 per tonne of lithium carbonate).

Thanks to the very low strip ratio, the total operating cost per tonne of rock remains very low: Cypress’ independent consultants have guesstimated the production cost to be just US$17.5/t, and 85% of the cost is situated on the processing plant level:

Taking all these parameters into consideration, the after-tax NPV ranges from US$773M to US$1.97B depending on the discount rate used and based on a LCE price of $13,000/t. We have summarized the results in the table here below:

The $13,000/t is pretty close to the current price of lithium carbonate, but we would also like to stress-test the project. Fortunately the PEA includes a sensitivity analysis, and according to the independent consultant there’s a US$263M decrease of the NPV8% for every 10% decrease of the lithium carbonate price. Using a lithium price of US$9,100/t (-30% versus the price used in the PEA and -25% versus the current market price) would still result in an after-tax NPV8% of approximately US$600M. The IRR would obviously collapse, but even at an LCE price of $9,000/t the project would remain viable and a candidate to be developed.

The next step: confirming the metallurgical assumptions

The results of the PEA are positive, but let’s not forget what the ‘P’ stands for: ‘Preliminary’. You should realize you could expect to see some changes before the project gets to a pre-feasibility study.

This initial study focusing on the economics of a potential mining operation also included a substantial section on the metallurgical test work, and we were very interested in seeing the findings. The met work performed by SGS and AMICS confirmed the clay deposit is practically hectorite-free as the host material appears to be illite, and that’s the main reason why this project could actually work.

After the usual crushing and grinding (which will require very little energy as the illite easily breaks up in smaller parts), the claystone will be leached in a high temperature environment, using sulfuric acid. After several test-runs on sub-surface mineralization, SGS determined an acidic solution of 10% H2SO4 yielded the best recovery rate at 83.5%. Other solutions (based on 5% H2SO4) would also work, but yielded recovery rates in the mid-70’s. The conclusion of the met work was simple: the lithium from the Clayton Valley project could be recovered from the claystone at a recovery rate of in excess of 80% by using a high-temperature leach environment (50-80°C) and the normal atmospheric pressure. The acid consumption (125 kg/t) is relatively high, and this very likely will be one of the things Cypress Development will be working on in the next round of metallurgical studies.

The first attempt to define a good flow sheet was successful, but these preliminary findings will have to be confirmed and could perhaps even be slightly improved (by for instance increasing the recovery rate and/or reducing the acid consumption). The importance of the upcoming metallurgical test work should not be underestimated as it will increase the credibility of the economics.

The technical report contains 21 pages about the metallurgical test work, and we encourage you to read up on it.

The share structure and cash resources

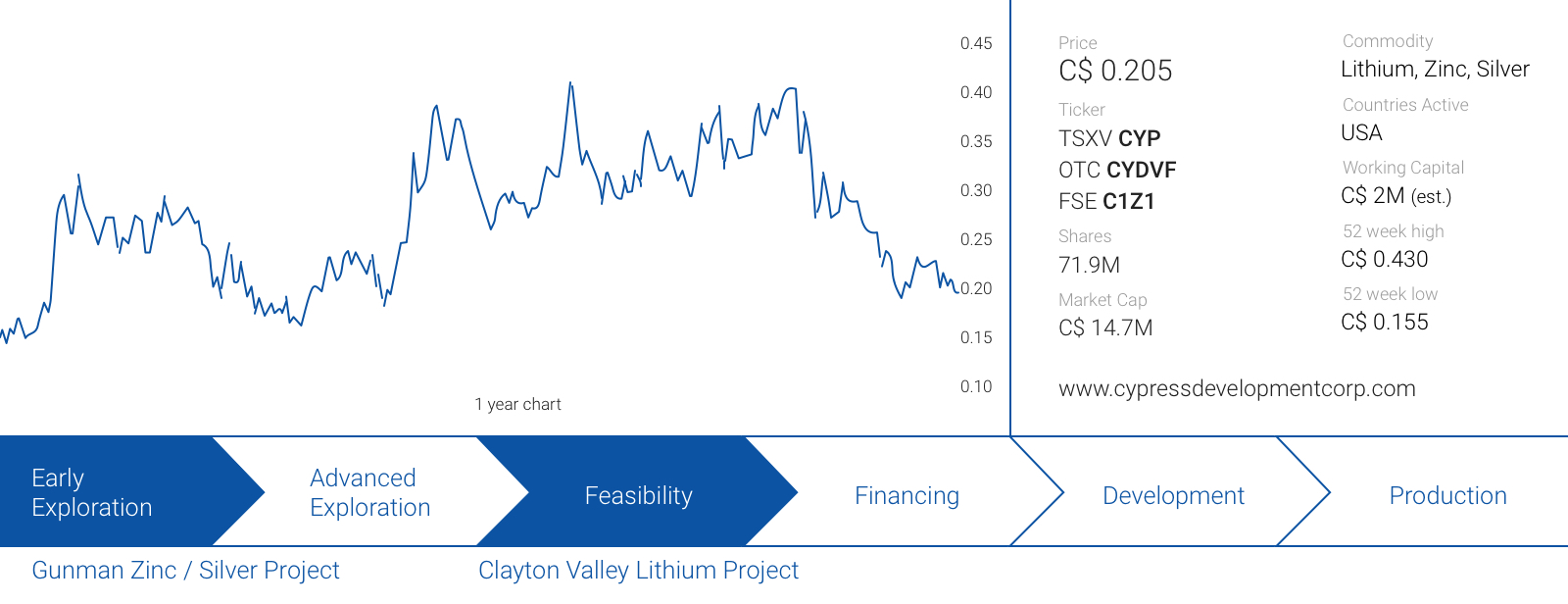

Cypress Development had 62.4 million shares outstanding, but recently closed an upsized and oversubscribed private placement. When all was said and done, Cypress issued 9 million units for a total of C$2.01M, bringing the share count to 71.9M. Every unit consisted of one common share in Cypress Development and one full warrant allowing the warrant holder to purchase an additional share of Cypress at C$0.33 for a period of 3 years.

As of the end of June, Cypress Development had a working capital position of almost C$800,000. As the company obviously had to spend some money on completing the Preliminary Economic Assessment, the recently announced private placement shouldn’t have come as a surprise. After raising the C$1.96M (net, after fees), the company’s working capital position should be pretty robust again, and allow it to complete its metallurgical test work to further fine-tune the process to recover the lithium from the mudstone.

The only issue with the capital structure is the warrant and stock option overhang. These warrants and options were mainly issued when Cypress’ share price was trading much lower, and that’s why the 13.4M outstanding warrants and 4.52M options are priced at C$0.124 and C$0.12 respectively. We expect to see a slightly warrant count when Cypress Development provides the updated results for Q3, as we expect some of the warrants have been exercised.

And if that would be the case, that’s fine: it means the warrants are being exercised in an orderly fashion and the market doesn’t get hit by relentless selling caused by these exercises. Approximately 12.3 million warrants, as well as 585,000 stock options will expire in 2019. If (read: when) they will all be exercised, Cypress Development will take an additional C$1.65M to the bank, while the share count will increase to approximately 85M shares, giving the company a market capitalization of less than C$20M based on the C$0.22 placement price.

The people

Bill Willoughby – Director, CEO

Bill Willoughby, PhD, PE serves as a Director and Chief Executive Officer of Cypress Development Corp. Dr. Willoughby is a mining engineer with 38 years of experience in all aspects of natural resources development. Since 2014, he has been principal and owner of consulting firm Willoughby & Associates, PLLC. Prior to that, he was President and COO of International Enexco Ltd., which was acquired by Denison Mines in 2014. He previously held various positions with Teck (Cominco). Dr. Willoughby has been a Professional Engineer since 1985 and received his Doctorate in Mining Engineering & Metallurgy from the University of Idaho in 1989.

Jim Pettit – Director, CFO

Jim Pettit serves as a Director and acting Chief Financial Officer of Cypress Development Corp. Mr. Pettit is currently serving on the board of directors of five publicly traded companies and offers over 25 years of experience within the industry specializing in finance, corporate governance, executive management and compliance. Jim was previously Chairman and C.E.O. of Bayfield Ventures Corp. which was bought by New Gold Inc. in January 2015.

Donald Huston – Chairman, President

Don Huston serves as Chairman of the Board and President of Cypress Development Corp. Mr. Huston has been associated with the mineral exploration industry for over 30 years and has extensive experience as a financier and in-field manager of numerous mineral exploration projects in North America. He was born and raised in Red Lake, Ontario and spent 15 years as a geophysical contractor with C.D. Huston & Sons Ltd. as mineral exploration consultants in northern Ontario, Manitoba and Saskatchewan. Mr. Huston serves as a director of four Canadian public resource companies.

Conclusion

Cypress Development isn’t a new story, and although the very first round of drilling confirmed the company appeared to be sitting on a large lithium resource, we wanted to see the PEA before taking a stance. The PEA appears to be excellent, and even at a lithium carbonate price of US$9,000/t, the project remains viable.

Surprisingly, the market didn’t really reward Cypress for the positive outcome of the PEA, and we think this is due to a certain reluctance to accept the final results of the PEA. We expect the upcoming metallurgical test work to remove a lot of those uncertainties as Cypress will provide more details on the assumed recovery rates and the efficiency to effectively recover the lithium from the clayish mudstone.

Disclosure: Cypress Development is a sponsor of this website. The author has a long position in Cypress Development.