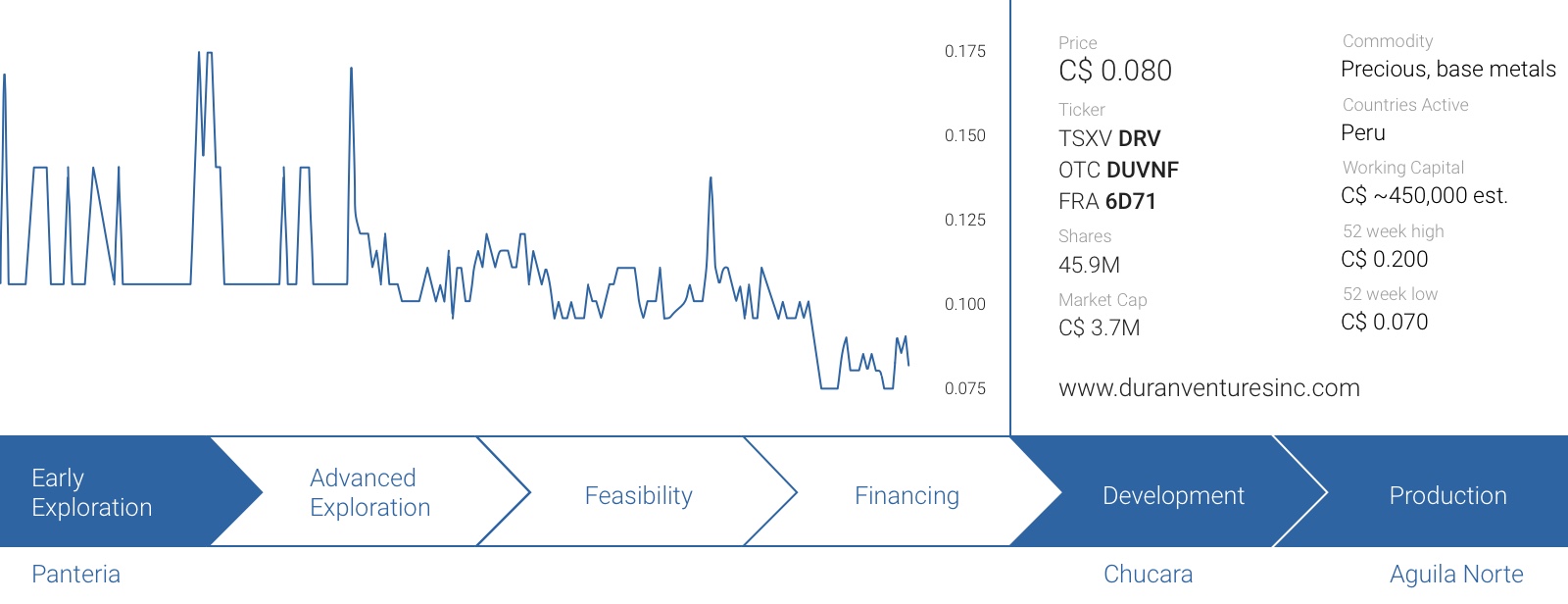

Duran Ventures (DRV.V) has released its Management Discussion & Analysis report associated with the filing of its Q3 financial results, and now officially owns 80% of the Aguila Norte processing plant in Northern Peru. The 80% stake has already been transferred, and the corresponding interest in the land claims will be transferred once full permits are issued which should be early in the first quarter of 2017.

The construction of the plant has now been completed (at a cost of just over C$2M), and the commissioning phase has now started. This will very likely take a few months, which is very common for a new start-up.

Locking in mineral delivery contracts – Chucara will remain a key supplier

Mineral purchases have commenced, and the purchased materials will be processed later in the commissioning phase. Duran will obviously use cheaper and lower grade ore to commission the mill and Duran is currently doing its due diligence on additional sources of mineral to make sure it has a decent-sized stockpile to ensure the mill can operate continuously.

As a reminder, Duran Ventures also entered into a mineral assignment agreement to both extract and process the high grade material from the 675 hectare Chucara property in Northern Peru, just 50 kilometers to the southeast of the Lagunas Norte mine, owned and operated by Barrick Gold (ABX.TO, ABX).

Duran expects to receive 1,000 tonnes of mineral per month from Chucara by the end of Q1 next year, increasing to 1,500 tonnes per month before July. At 1,500 tonnes per month, Chucara could provide a sufficient amount of material to fill 50% of the plant capacity at Aguila Norte. And this would be huge, considering the average grade of the Chucara rock is jaw-dropping high. Duran took 23 samples of a mineral shipment earlier this year, and the average grade of the rock was 0.48 ounces of gold/ton, 12.73 ounces of silver per ton of rock, as well as 5.98% zinc and 5.79% lead.

Just to give you an idea of how valuable this type of rock is, the rock value per tonne (on an in-situ basis, so without taking recovery rates into consideration) is approximately US$1042/tonne and is pretty much the equivalent of 28.8 g/t gold using $1125 gold, $16 silver, $1.25 zinc and $1.05 lead for the gold-equivalent calculation. So, the Chucara mineral is very valuable rock, and it would be really difficult to make a loss on this. Of course, this was a collection of 23 random sample from mineral sacks ready for transport, and this doesn’t guarantee the average grade of the 1,500 tonnes per month will be this high (there’s no official resource estimate at Chucara), but it does give you an idea about the potential of the Chucara project.

The Chucara deal is a win-win-win deal between Duran Ventures (securing mill feed), the owner of the concession (more transparency) and the small-scale miners (better and reliable payments and payment terms). Duran will invest just US$100,000 in new (modern) equipment to increase the efficiency of the mining operations at Chucara, and once this has been completed, DRV is pretty much off to the races.

The profits from processing the mineral coming from Chucara will be shared in a 50/50 profit sharing agreement with the owner of the land claim, after deducting the extraction expenses, the transportation expenses to the Aguila Norte mill as well as a fixed processing fee. This basically means Duran Ventures will be able to recoup ALL of its operating expenses before having to pay a single dollar to the concession owner. This really limits the company’s financial risks, and this 50/50 profit sharing agreement is a very fair deal for both sides.

Duran has applied for and has been granted several new concessions hosting potential high grade ore located within trucking distance to the Aguila Norte plant. The company’s geologists are currently reviewing the data collected during 2016 and news on these new concessions is expected in the new year.

Expanding the throughput of the plant

Duran has received all necessary permits to operate up to 100 tonnes per day, but the company confirms it’s in a ‘well-advanced stage’ to receive full permits and licenses allowing it to expand the Aguila Norte plant to a much higher capacity. This shouldn’t be a problem at all, as Duran Ventures has been taking this into account when it designed the current 100 tonnes per day plant.

According to Duran, the plant layout and initial ground preparations allow the company to easily increase the capacity of the processing plant to 350 tonnes per day, whilst it’s also possible to add a CIP (‘Carbon in Pulp’) gold leaching circuit.

The current capacity of the tailings area is estimated to be sufficient for the next 3.5 years of operating the mill at 100 tonnes per day, but due to the favorable topology, Duran thinks it shouldn’t be a problem at all to take advantage of the mountainous area. Expanding the capacity of the tailings area to in excess of 20 years is a very realistic assumption here, and very likely was one of the main reasons why Duran Ventures chose to build the plant at exactly that spot.

Conclusion

Duran Ventures is in the final straight line towards the finish line, and we’re looking forward to see the confirmation of the start of commercial production at Aguila Norte. Being transparent will be one of the key points Duran will have to focus on, as the Peruvian processing sector has encountered its fair share of bad luck.

Whilst the focus will obviously be on successfully locking in access to high-grade ore (wherein the Chucara property will play a very important role), we will also be looking forward to hear about the exploration plans First Quantum Minerals (FM.TO) might have for the Panteria exploration project where it’s earning an 80% stake.

2017 will be the year of the truth for Duran Ventures, and if the management’s expectations to generate almost US$1.5M per quarter in EBITDA are even remotely correct, Duran will be ready for a re-rating by the market.

Disclosure: Duran Ventures Inc. is a sponsoring company, we have a long position.