Freeman Gold (FMAN.C) has now released the final assay results of its 7,000 meter 2020 drill program which was focusing on twinning some historical holes while completing some infill drilling. This will allow the company to use the historical drill data to put a maiden NI43-101 compliant resource estimate together at Lemhi, expected later this quarter. That initial estimate will be the basis for further growth as Freeman still has an exploration target of 1.5 million heap leachable ounces in mind.

2021 will be busy for Freeman Gold. Not only may we expect the company to publish a resource estimate, but we will also see more assay results from the 2021 drill program while the core from the diamond drill holes will be used to further finetune the metallurgical test work at Lemhi to optimize the recovery rates. The combination of all elements should culminate in a PEA or PFS in 2022 and the decision on starting out with a PEA or skip that step and immediately publish a PFS will depend on the percentage of the upcoming resource in M&I category versus the inferred category.

Recent drilling confirms the widespread mineralization at Lemhi

Freeman had to exercise a lot of patience with the lab it has been using for its exploration program on the Lemhi oxide gold project in Idaho. It took a while for the assay results to come in but fortunately, the delays do not indicate any issues with the project or the drill program as the recently released intervals confirm the existence of thick zones of gold mineralization at Lemhi and basically validate the 70,000 meters of historical drilling in 380 holes on the project.

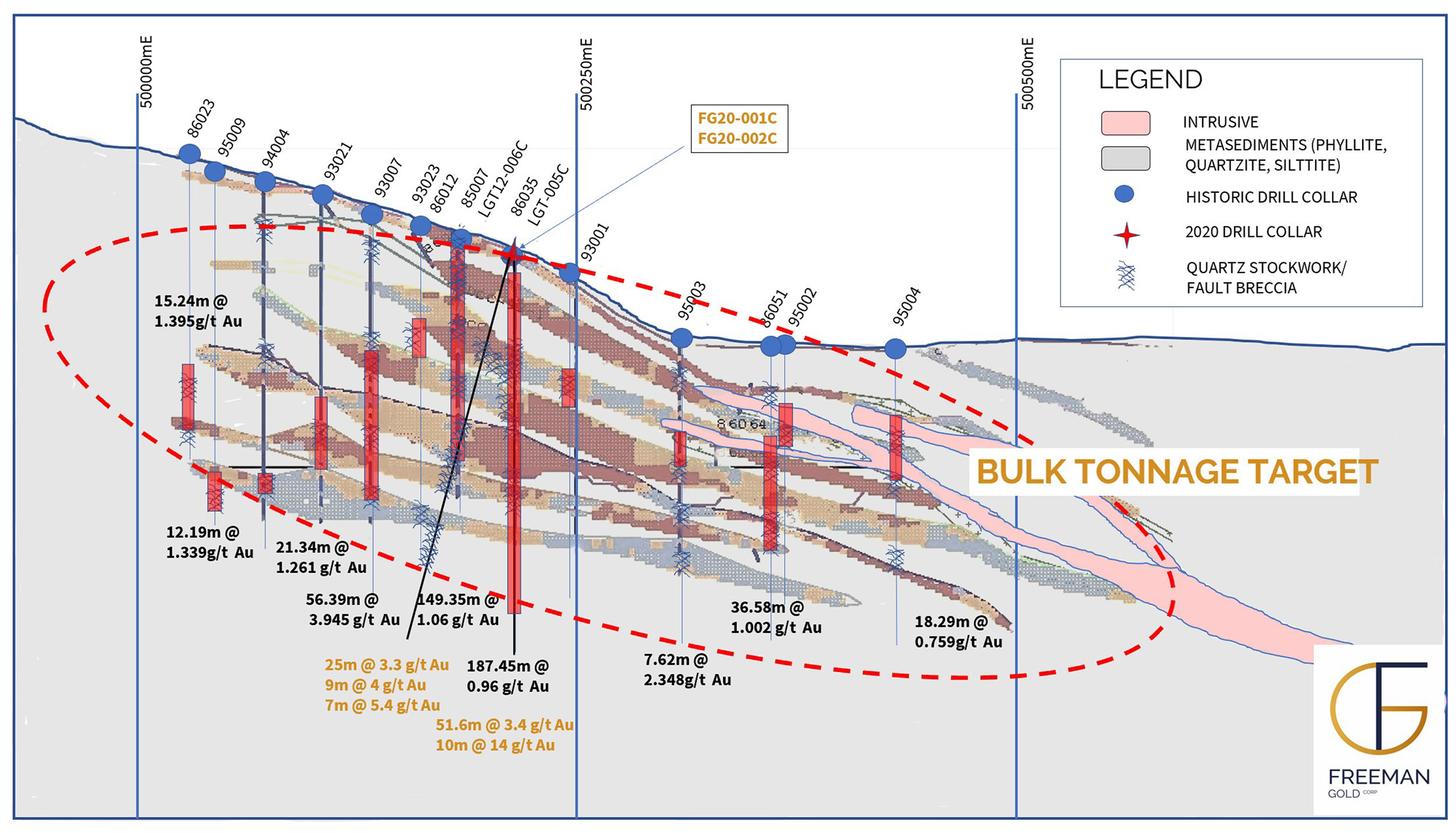

The most recent exploration update also contained the highest gram-meter interval encountered at Lemhi: 2.5 g/t over 151 meters is an excellent result and even after filtering out the high-grade interval of 8.7 meters containing 25 g/t gold, the remaining 142.3 meters in the hole had a residual value of approximately 1.12 g/t. And that’s high for a heap leach oxide gold project. The data from the 2020 drill holes also confirmed the structure of the gold mineralization at Lemhi: there are stacked high-grade gold zones with lower grade zones in between.

This update came pretty fast after an earlier exploration update in March, which included a headline result of 174 meters containing 0.9 g/t gold almost starting at surface including some higher-grade intervals like 7.1 meters of 3.8 g/t gold and 18.5 meters of 3.9 g/t gold. While those two intervals obviously push up the average grade of the entire 174.2 meters, the smearing is pretty limited as the 149 meters outside these two high-grade intervals still have an average grade of approximately 0.39 g/t gold. Much lower, but still above cutoff grades for these types of deposits.

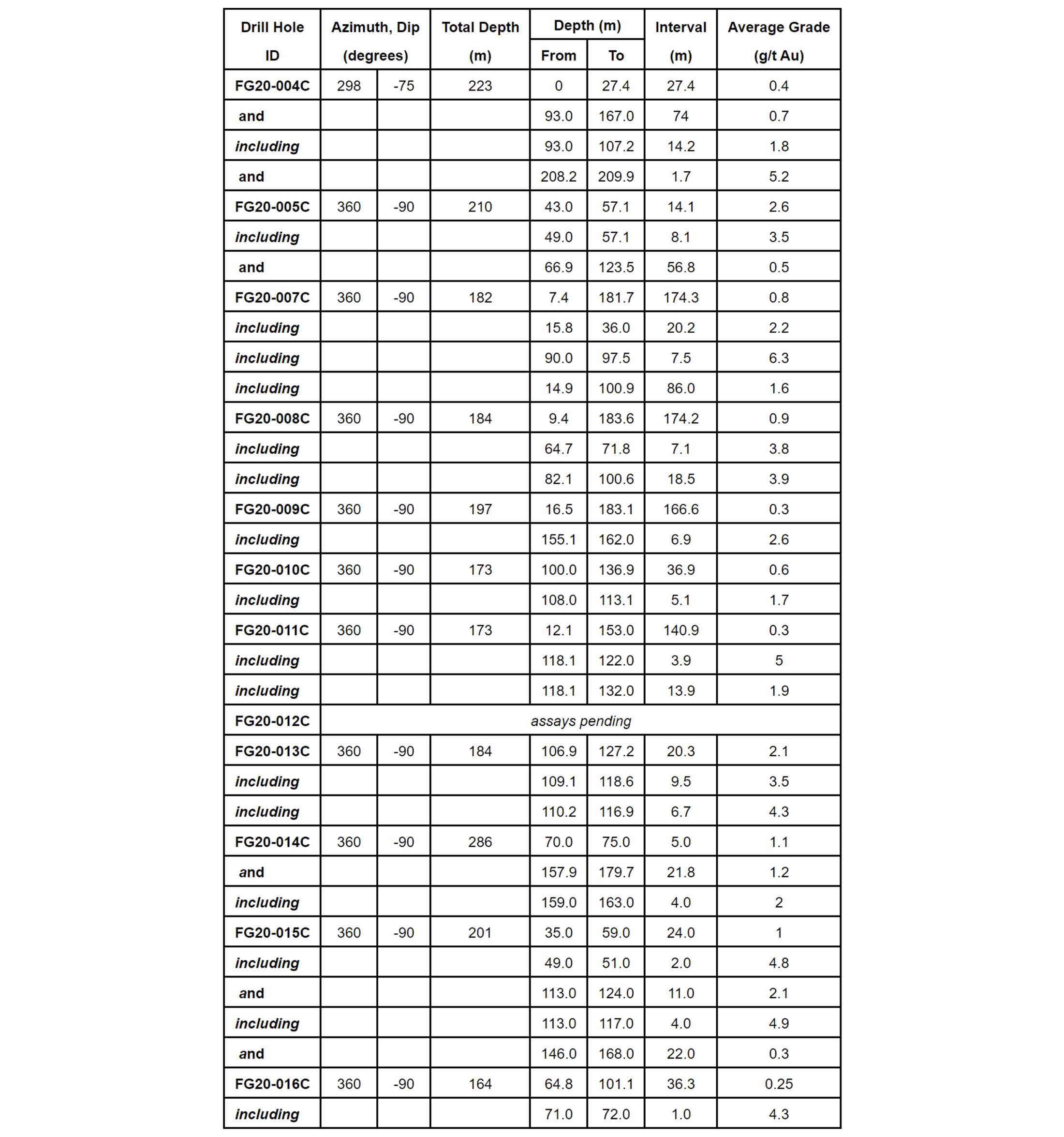

The company reported on the assay results of eleven holes and you can find the entire breakdown on the image below.

Now the assay results of all 2020 drill holes have been received, Freeman will be able to refine its 2021 work program which will include drilling, metallurgical test work and a maiden resource estimate.

Where to go from here?

The drill results will now be compiled into a resource estimate, which will be the first-ever NI43-101 compliant resource estimate for the Lemhi gold project. While the company seems to be quite confident in ending up with 1.5-2 million ounces of gold, the first resource estimate will likely come in quite a bit lower. Although the company is not allowed to publish an exploration target, Freeman seems to be aiming at 0.8-1.2 million ounces of gold at an average grade of 1g/t using a conceptual pit outline with a low cutoff grade.

This seems to be reasonable considering the historical resource estimates, and at this point we would use the lower end (800,000 ounces) as base case scenario, the Lemhi project would already show great promise.

After all, the historical metallurgical test work has indicated above-average leach kinetics for the gold mineralization in the oxide layers. Bottle roll testing programs resulted in a recovery rate of about 95% while the heap leach recovery rates came in at 70-90%, depending on the crushing size. If we would use the midpoint of the average recovery rate of the heap leach recoveries (80%) and assuming the average grade of the project would indeed come in at around 1 g/t gold, the recoverable rock value per tonne at that grade and an 80% recovery rate would be approximately $40/t (using a gold price of $1600/oz). Considering the operating costs for a heap leach operation with a very low strip ratio should be quite low (perhaps even less than $10/t, but that remains to be confirmed depending on the final strip ratio and leach kinetics).

As Freeman Gold has been drilling core holes, it has plenty of material available to conduct more detailed metallurgical tests this year. Keep in mind the recovery rates mentioned above are based on historical test work and hopefully Freeman Gold can squeeze a few additional percent out of the rock. Additionally, while heap leach may be the preferred way to go, we also expect Freeman Gold to also investigate a vat leach scenario. This would likely be more expensive than a heap leach operation but offers two advantages. First of all, the recovery rates may be higher (and potentially exceed 90%) which means a trade-off study (does the higher amount of recovered gold justify the higher initial capex) may decide on how to proceed with Lemhi. An additional benefit would be the permitting phase: we would expect a vat leach operation to have fewer permitting hoops to jump through compared to a heap leach operation. At this point, the company should keep all its options open.

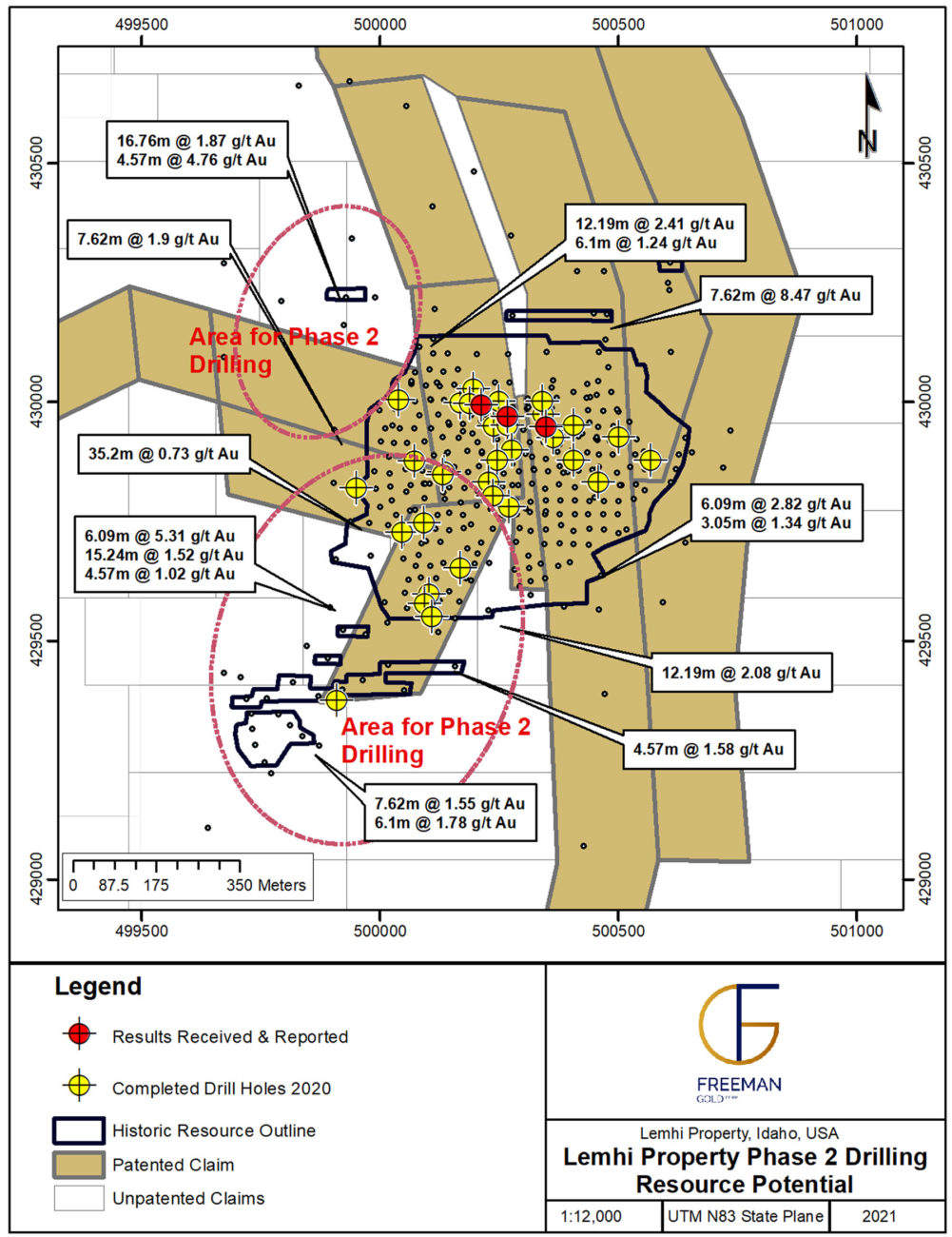

The third catalyst for this year will be the continued exploration efforts. While the 7,000-meter drill program in 2020 was predominantly focusing on twinning some historical holes and completing a round of infill drilling which will allow Freeman Gold to use historical drill data in its upcoming maiden resource estimate. This first resource will only be the starting point for the Lemhi project as this year’s drill program will be focusing on resource expansion.

According to CEO Randall, there will be a few step-out holes towards the west of the currently known mineralized envelope and we expect to see some low-hanging fruit which could further enhance the economics of the initial resource at Lemhi. And additional ounces couldn’t just be found by going west, but also at depth as the current mineralized zone remains open along strike and at depth.

And while it’s completely understandable the company wants to focus on getting the biggest bang for its buck by trying to expand the maiden resource estimate, but we should also keep in mind there will likely be an element of regional exploration in an attempt to discover satellite zones.

The relentless selling pressure could end soon

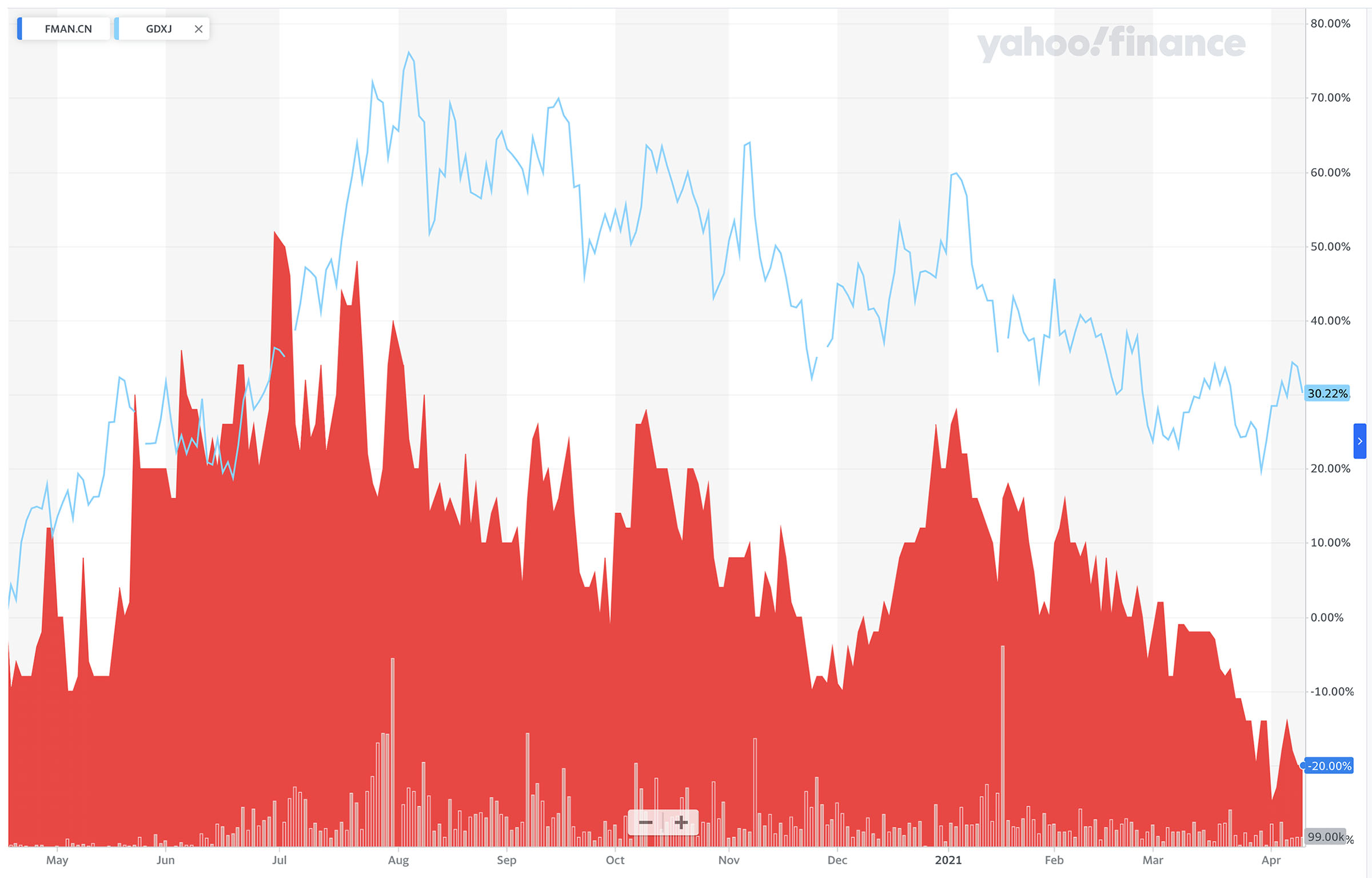

Freeman Gold’s share price has been underperforming the GDXJ for quite a while now. While there will always be underperformers and outperformers, the weak performance of Freeman is likely related to the shares issued to the vendors of the Lemhi gold project.

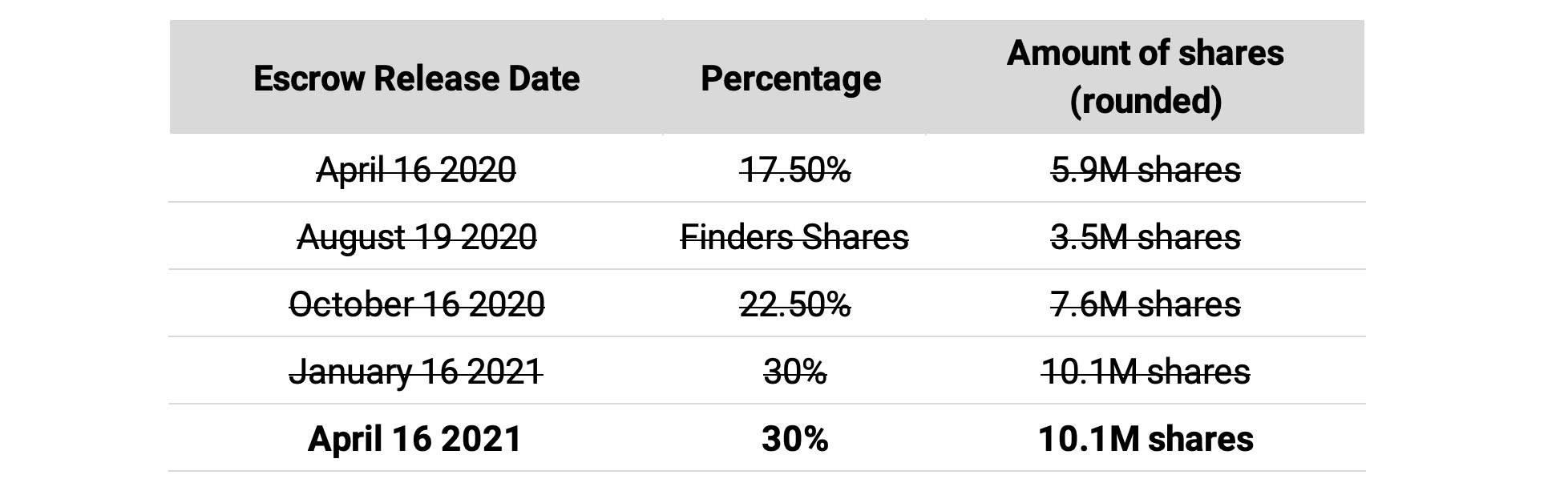

The shares issued as compensation for the acquisition, as well as the 3.5 million finders shares, were released from escrow at regular intervals within a 12-month time frame. As you can see on the image below, the vast majority of the shares (70% of the vendor shares and all of the finders shares) have been released from escrow, and there’s only one batch left. On April 16th, the final block of 10.1 million shares will be released from escrow.

We can reasonably expect the majority of the sales conducted by ‘001-Anonymous’ were related to shares coming out of escrow, and this means we can be cautiously optimistic about the selling pressure once the final block has been dealt with. In a recent call, CEO Will Randall mentioned the company is working on a block trade that could perhaps take care of the majority of the shares that could potentially be sold. Removing the final overhang should have a positive impact on the trading pattern of Freeman Gold.

Conclusion

With the assay results of the 2020 drill program now released, Freeman Gold’s 2021 will contain plenty of catalysts. The first major step will be the publication of a maiden compliant resource estimate where we are hoping to see 800,000 ounces at an average grade of 0.9 g/t (we don’t want to set the bar too high). Subsequently, we will see more drill results from resource expansion drilling (towards the west) and updated metallurgical test results which will help to further de-risk the project.

Freeman’s share price has performed pretty poorly but once the overhang of the final 10.1 million shares being released from escrow will be dealt with, one could expect the stock to be rerated as the company works towards de-risking Lemhi. The combination of positive updates (a resource update, metallurgical test results, additional drill results) and a waning selling pressure should be sufficient to improve the valuation of Freeman which is currently trading at a market cap of just over C$30M.

Disclosure: The author has a long position in Freeman Gold. Freeman Gold is a sponsor of the website.