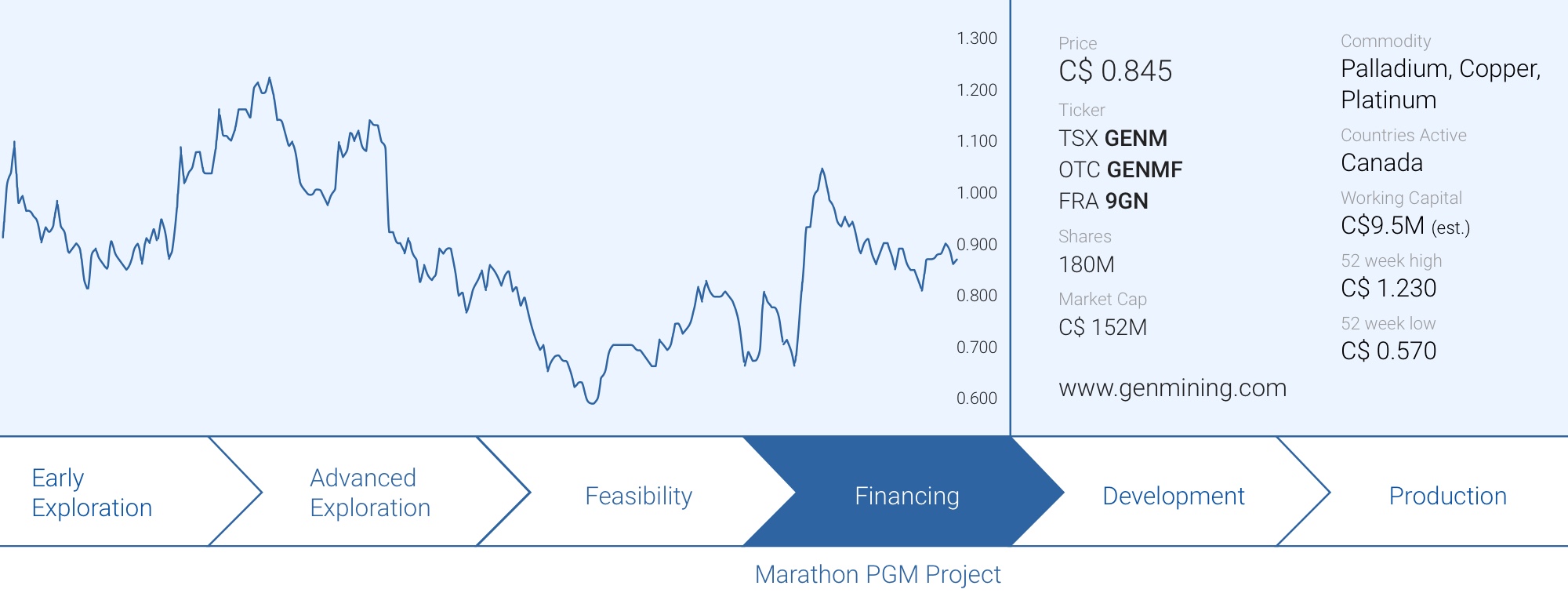

Generation Mining (GENM.TO) is looking forward to what could be a very busy 2022. The company recently completed the acquisition of the stake in the flagship Generation PGM project it didn’t own yet from Sibanye-Stillwater. The completion of that transaction should now enable Generation Mining to execute the C$240M streaming deal with Wheaton Precious Metals (WPM, WPM.TO) while working towards completing the permitting process.

Meanwhile, Generation Mining’s capital structure is now warrant-free. The remaining 9M+ warrants that were still outstanding as of the most recently available financial statements have now been exercised and Generation Mining’s cash position has increased again to almost C$10M despite having spent millions on detailed engineering, permitting and drilling in the past six months. With an additional C$40M cheque from Wheaton Precious Metals underway as soon as both parties execute the gold and platinum streaming deal.

The warrant overhang is no more

We believe one of the reasons why the share price has been held back was the warrant overhang. As of the end of September, there were 9.15 million warrants still outstanding of which 8.5 million warrants had an exercise price of C$0.75 with the remaining 675,000 (finders) warrants having an exercise price of C$0.52. Both series of warrants expired on February 13th.

In a recent update, Generation Mining has now confirmed it has received approximately C$7.4M in proceeds from warrant exercises and this has now boosted the cash position to approximately C$9.5M. The total share count has increased to just under 180M shares with Eric Sprott owning 16.4 million shares for a stake of approximately 9.1% in Generation Mining.

The cash position will likely soon be boosted by the first cheque from Wheaton Precious Metals (WPM, WPM.TO) as part of the C$240M gold and platinum streaming agreement on the Marathon PGM project. We extensively covered that streaming agreement in a previous report and Wheaton will make an initial C$40M available upon completing the streaming agreement. One of the reasons why the deal hasn’t been executed yet was because Generation Mining first needed to obtain full ownership of the project. That step was completed at the end of January when Sibanye-Stillwater (SBSW) became the company’s largest shareholder. After including the recent ‘dilution’ from the warrant exercises, the 32.8M shares owned by Sibanye-Stillwater represent a stake of 18.2%.

The recent annual report of Norilsk Mining contained interesting tidbits on palladium

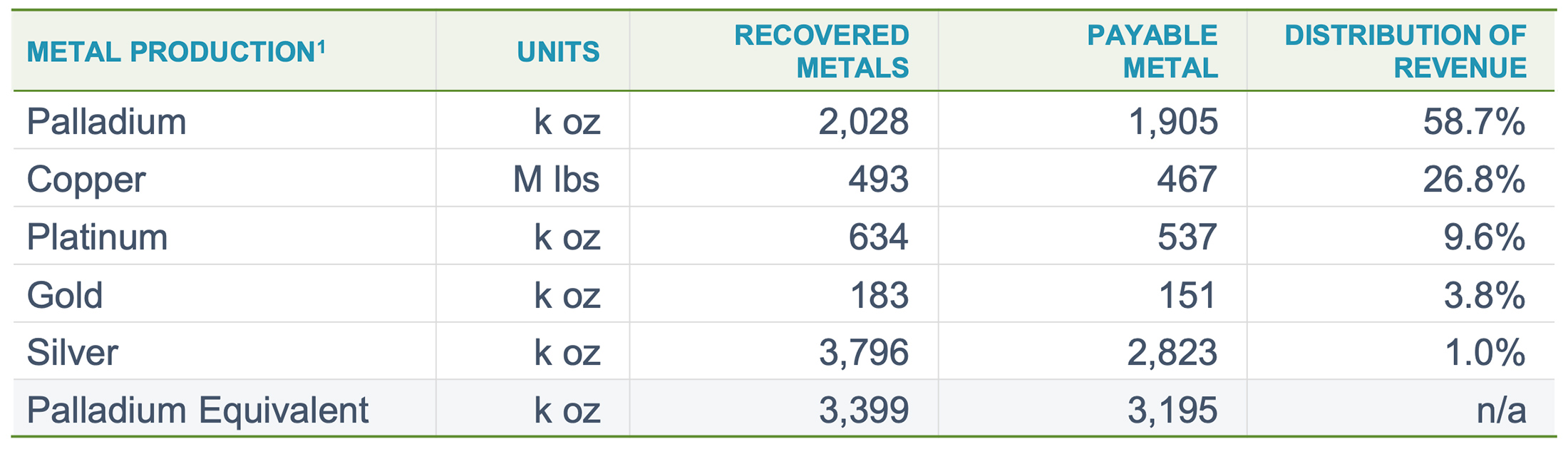

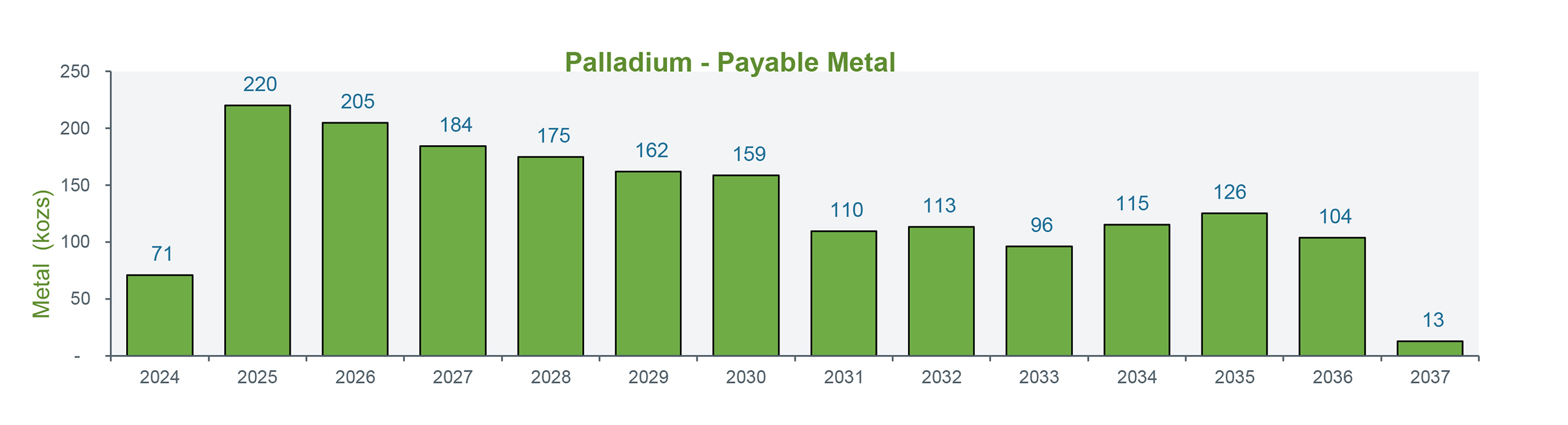

The Generation PGM project predominantly is a palladium project. Based on the feasibility study which was completed in 2021, almost 60% of the total revenue will come from the palladium component of the production mix. Using a palladium price of $1730/oz, 58.7% of the revenue will come from the 1.9 million ounces recoverable and payable palladium.

It is important to keep an eye on the palladium market and it’s always worth reading the comments from both Norilsk Nickel and Sibanye-Stillwater on this topic.

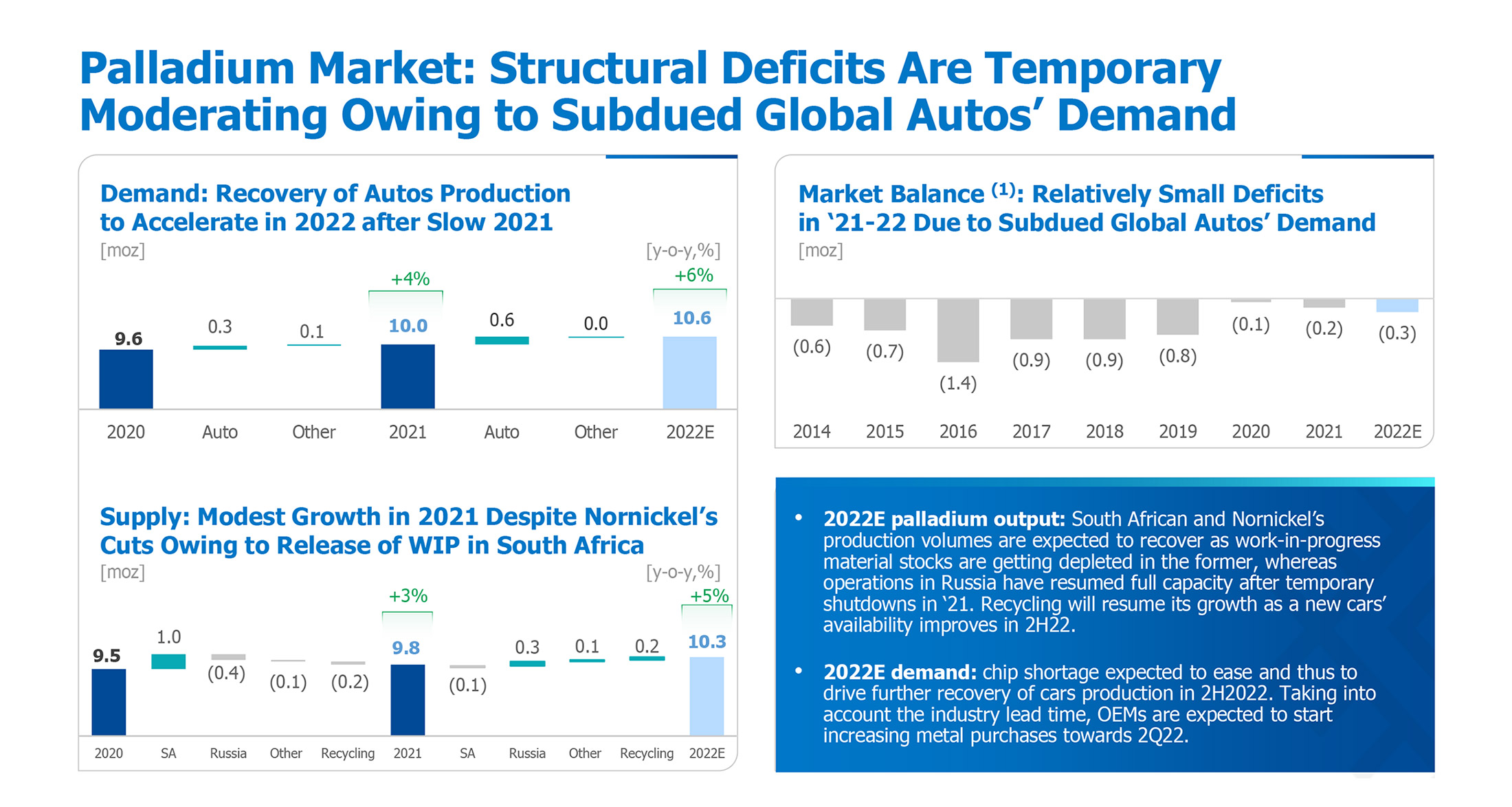

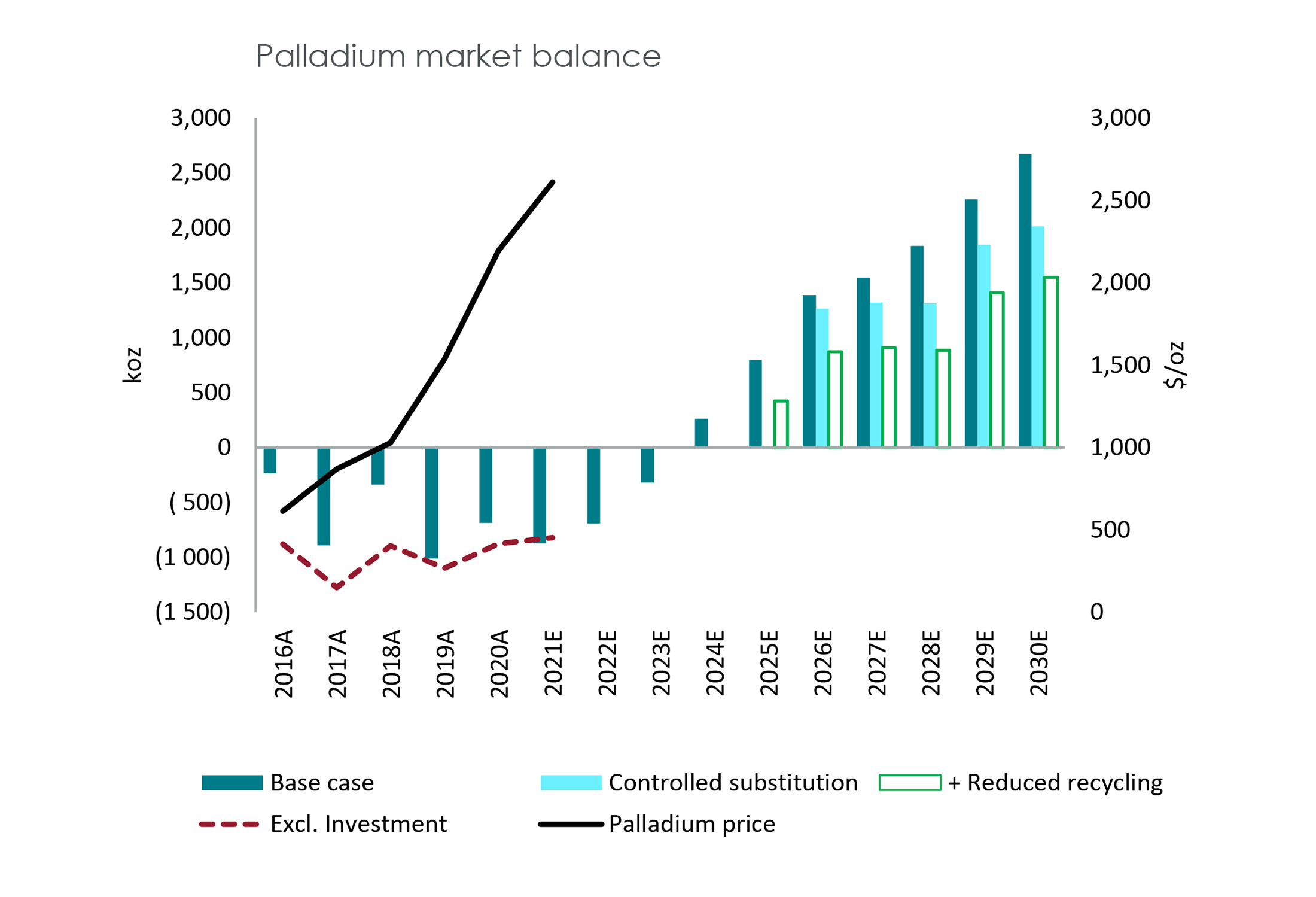

According to Norilsk’s update, the palladium demand increased by 4% to approximately 10 million ounces in 2021 on the back of higher demand from the automotive sectors. That’s a little bit surprising as the automotive sector is still plagued by delays due to supply chain disruptions. According to Norilsk, the recovery of the car industry is now only expected in the second half of this year or in 2023.

Meanwhile, the palladium supply continued to increase to 9.8 million ounces so the palladium market was almost in equilibrium. The palladium production from Norilsk decreased in 2021 due to the production issues but apparently the South African producers jumped in the gap and boosted their output. The palladium deficit was 0.2 million ounces in 2021 and Norilsk expects the deficit to increase to 0.3 million ounces in the current year as the supply chain issues in the car industry should start to resolve themselves. This should result in a 7% increase in the palladium demand while the supply will only increase by roughly 5%, mainly thanks to Norilsk’s own mines returning to a full year of normalized production.

Long story short: Norilsk is expecting a demand of 10.6 million ounces and a production of 10.3 million ounces of palladium in 2022.

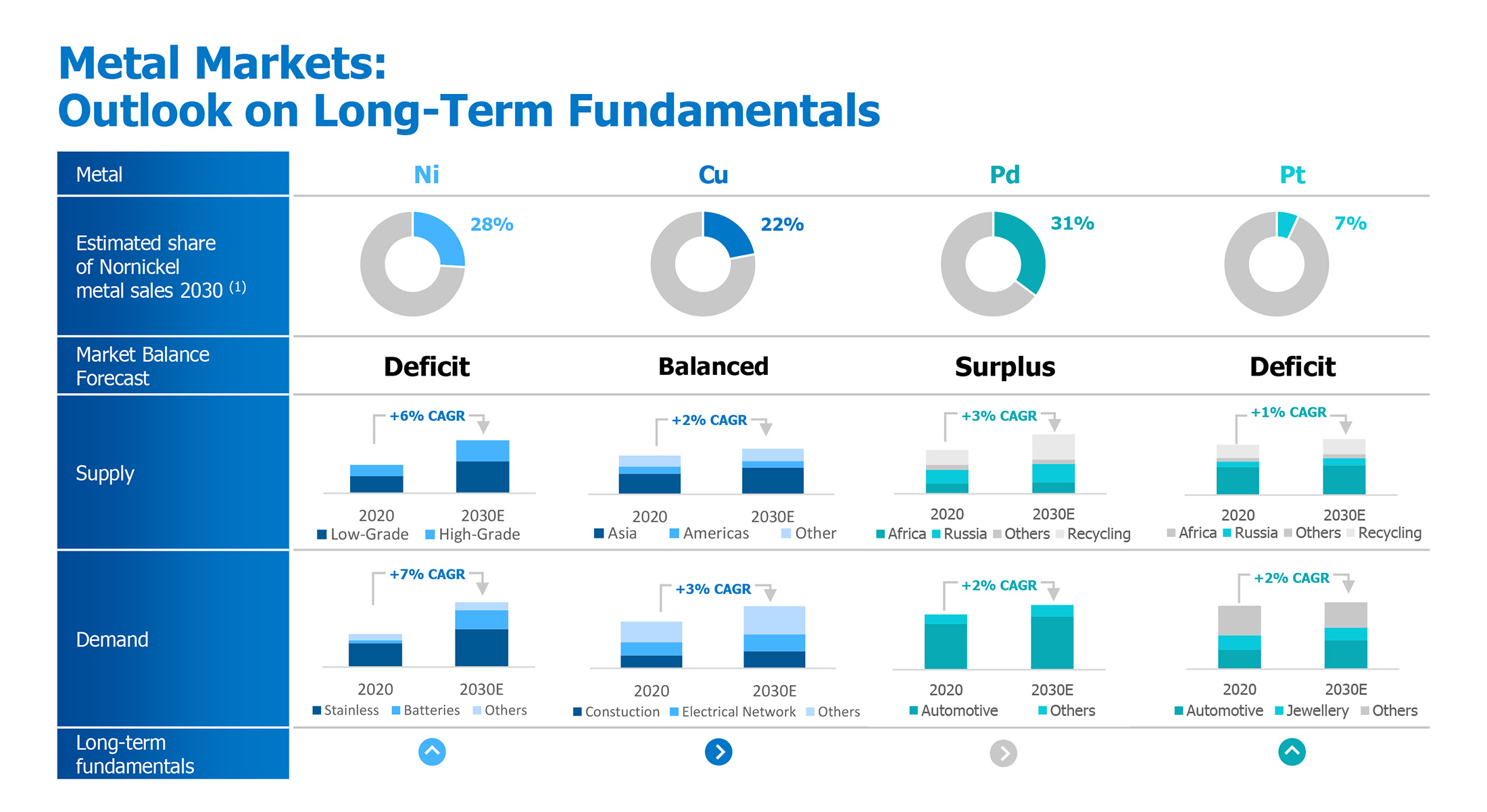

This would mean the palladium market has been in a deficit for the past decade. That being said, the longer-term outlook of Norilsk Nickel is a little bit more bearish. The company expects the demand to increase by approximately 2% per year between 2020 and 2030 while the supply will increase at a CAGR of 3%.

Using the 2020 numbers with a production of 9.5 million ounces of palladium and a demand of 9.6 million ounces, the demand will increase to 11.7 million ounces by 2030 while the anticipated supply will increase to 12.7 million ounces. That would indeed mean there would be a supply surplus of about 1 million ounces per year by 2030.

Of course, that is assuming all palladium projects go ahead and that appears to be unlikely. Especially in South Africa where it’s far from certain the existing mines are able to keep the output up. Additionally, the anticipated supply increase includes the ‘expected’ production increases in the world. This includes the almost 0.2 million ounces of palladium per year in the first few years of the Generation PGM mine life.

So it remains to be seen how much of that 30% increase in the palladium output will actually happen this decade.

Sibanye-Stillwater is even more pessimistic as it expects the palladium market to move into an even more substantial supply surplus. But the same comment can be made here. How many of the ‘planned’ new palladium output will actually materialize in the next few years, especially now the higher inflation seems to be hitting mining projects left and right.

We will obviously have to keep an eye on the supply and demand in the palladium sector, and Norilsk Nickel will play an important role as it currently produces in excess of 25% of the world supply. And keep in mind that even if the palladium market moves towards a supply surplus, Generation Mining has based its economics on a palladium price 25% below the current spot price so there already is some margin of safety built-in.

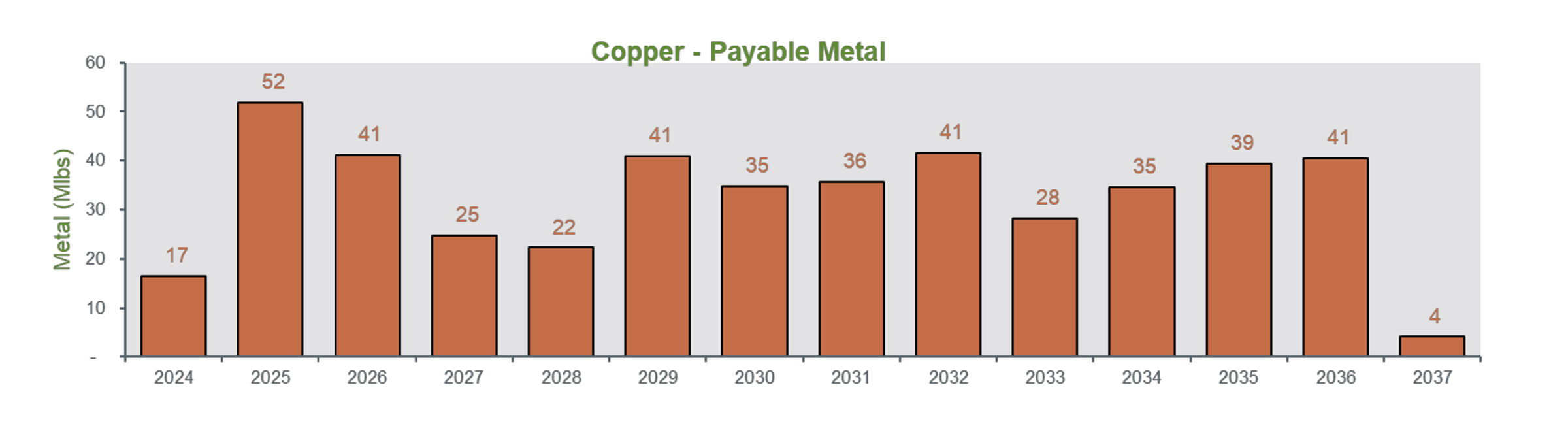

And while Generation PGM still very much is a palladium project, let’s not forget about the copper. If the copper price continues to increase on the back of the greenification, it will become a more important metal in the product mix. Should the copper price increase by an additional 50% in the next decade or so, it would actually catch up to the palladium revenue and both metals would have equal value. Copper could for sure be an interesting wild card in the production mix and at a certain point it would become a co-product rather than a by-product credit.

The potential capex inflation doesn’t worry us too much

We can’t deny we are in an inflationary environment and the ‘real’ capex of Generation PGM will much more likely come in higher than anticipated rather than below budget. This also means Generation Mining will have to keep a close tab on how the capex evolves, but this doesn’t have to be a net negative.

After all, the inflationary aspect mainly comes from the increases in raw material and labor. While there’s nothing to be done about higher labor expenses, the higher raw material prices actually have a net positive contribution to the project’s NPV.

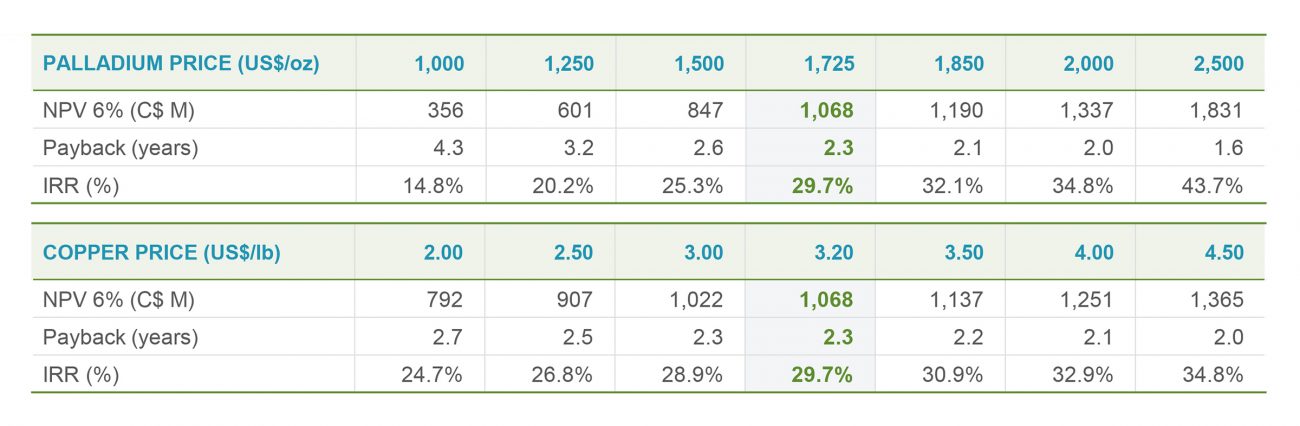

The company’s feasibility study contains an excellent sensitivity analysis and if we would single out the palladium and copper price sensitivity, we see that if we would apply slightly higher metal prices, the capital intensity of the project likely wouldn’t move much.

Using a palladium price of $1850 for instance, which is less than 10% higher than the base case scenario and still a 20% discount to the current spot price of palladium, adds C$122M to the NPV6%. Using a copper price of $4.00 would add almost C$200M to the NPV.

These two elements alone would add in excess of C$300M to the NPV (on a combined basis). So even if the capex would increase by C$200M (and note, this is an arbitrary number and definitely not a guidance), the after-tax NPV6% of the project would still be higher than in the base case scenario. So while a capex increase would obviously be unwelcome, a raw materials price induced inflation could actually have a net benefit to this project. And we shouldn’t worry too much about financing the initial capex either. The C$240M coming in from Wheaton Precious Metals will cover a big chunk of the anticipated equity portion of the capex while Generation Mining could consider selling additional streams as only 22% of the platinum and none of the silver (2.8 million ounces) and copper (467 million pounds) is subject to a streaming agreement. So that could be a viable option to explore although we would expect Generation Mining to try to keep the copper exposure untouched.

And finally, permitting is and remains key and the recent updates from the company regarding the community benefits agreements with two local First Nations are very encouraging as the project will need their blessing to move through the permitting process.

Generation has also signed a MOA with the Biigtigon Nishnaabeg with GENM committing to work with BN to create job opportunities and to partner with the community to create a win-win situation. Additionally, some of the contracting jobs at the Generation PGM project will be awarded to BN as part of the MOA, which is a component of the Community Benefit Agreement.

Generation also signed a Consultation and Process Agreement with the Metis Nation of Ontario. This agreement sets out the principles for the relationship between the company and MNO and should result in a Community Benefits Agreement.

Conclusion

Generation Mining is in an excellent spot right now. While most palladium producers seem to expect additional palladium supply to hit the market, Generation Mining’s Generation PGM project could be one of the first new projects coming online and that could be a deterrent for other projects where a construction decision will have to be made towards the end of the decade.

While we understand the case for a supply surplus, we think the more important feature for this decade is the anticipated palladium demand increase from 10 million ounces to 11.7 million ounces. This means that the world needs 1.7 million additional ounces of palladium per year by the end of this decade. And as the average production rate of Generation PGM is expected to be just 165,000 ounces per year in the 2028-2030 time frame, the world would basically need 10 new ‘Generation PGMs‘ to come online to cover the anticipated supply increase.

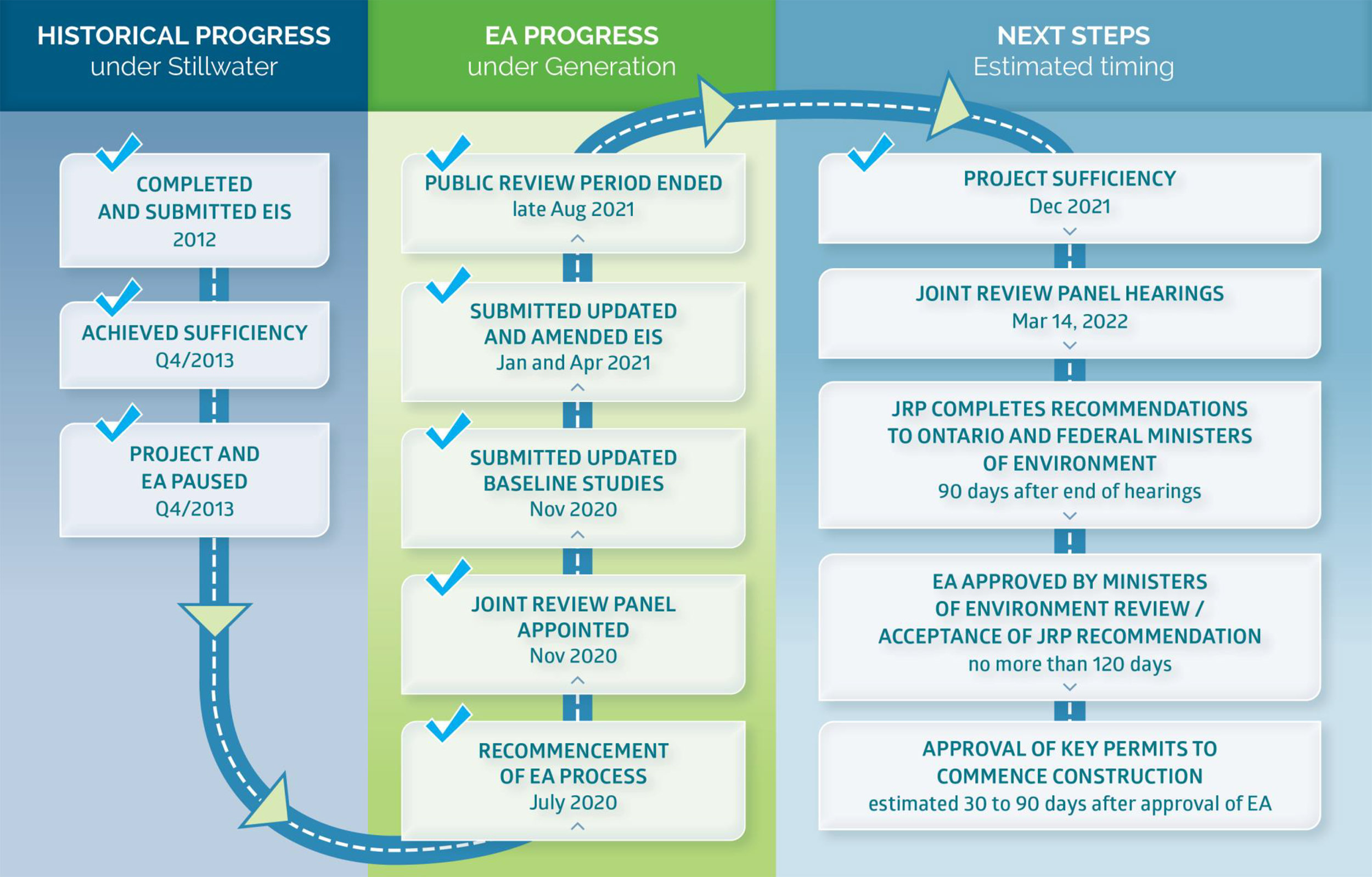

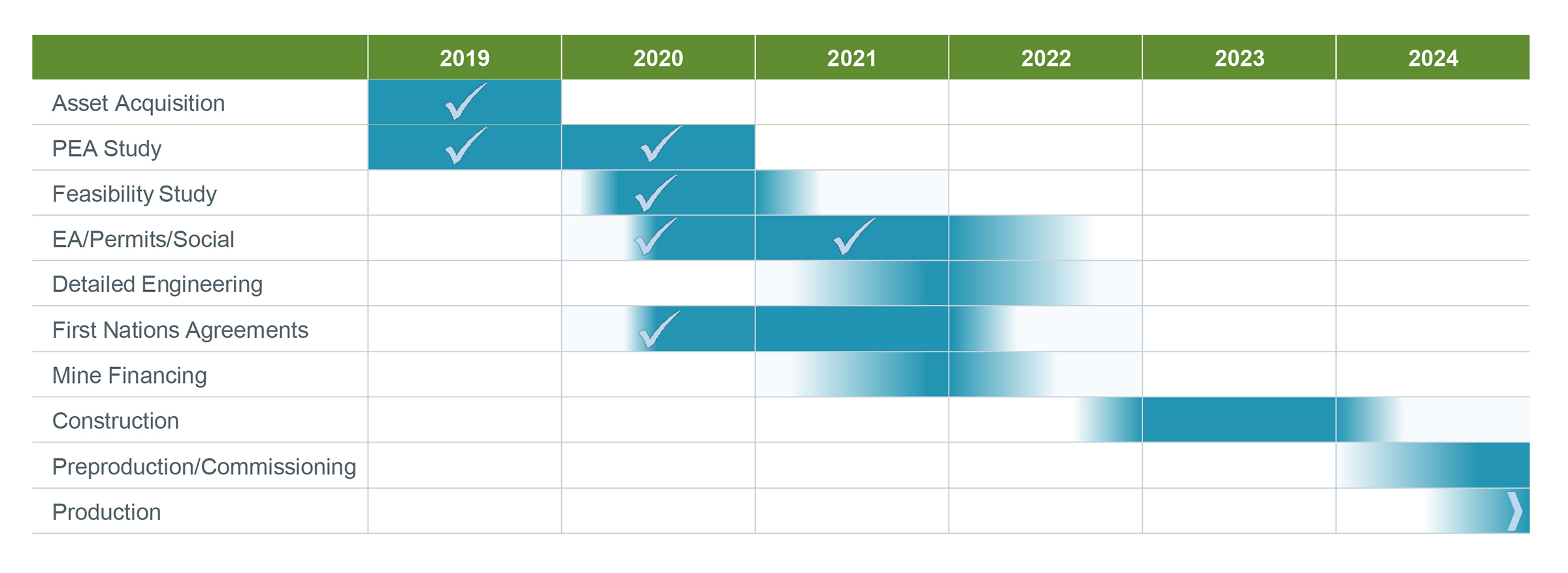

The palladium price will be key. But Generation PGM also has the advantage of being an almost shovel-ready project. Hopefully, the permitting process could be completed by the end of this year as that will be the most important milestone for the company.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. Please read the disclaimer.