The mining and commodity market has been performing poorly in the past few weeks and months until the gold price suddenly woke up earlier this week, and a recent visit to Vancouver, which undoubtedly is the mining capital of the world, seemed to confirm the (extremely) negative vibes of the current market before the gold price bounced back over the $1300 level.

Fortunately, there’s always light at the end of the tunnel, and exploration stories with excellent drill results are still performing very well as the market seems to be pulling itself up to discoveries and great exploration results. Great Bear Resources (GBR.V) appears to be catering to the market’s needs as the company’s discovery of a high-grade gold system at the Dixie gold project in Ontario’s Red Lake Gold district just keeps on giving. Great Bear has been busy with the (main) Dixie Hinge Zone, but its regional exploration program is paying off as Great Bear announced a new high-grade gold discovery at the Bear-Rimini zone on its extensive land package.

The discovery of the Bear-Rimini zone

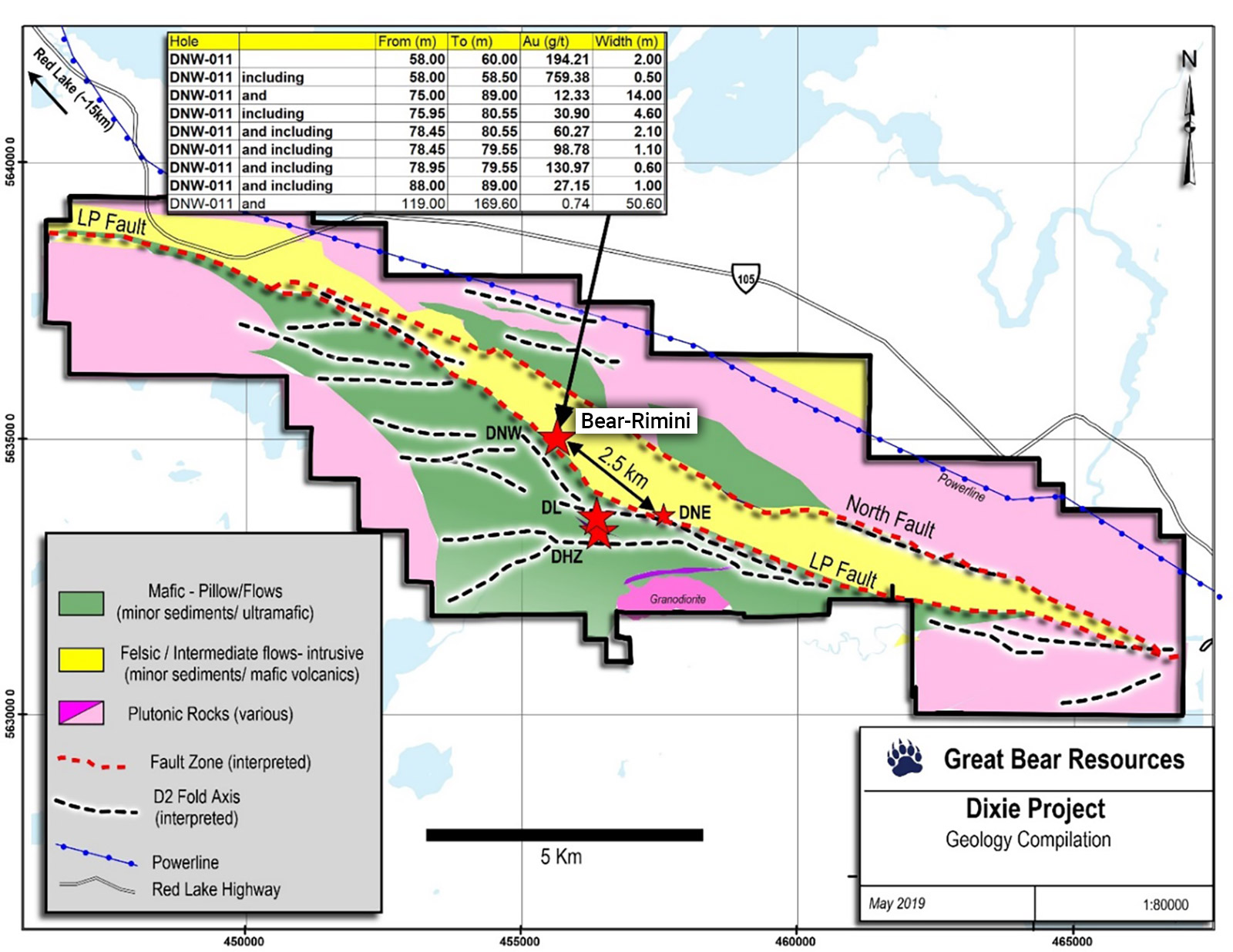

Last week, Great Bear requested a trading halt to provide an important update on its Dixie gold project, where the company announced a new high-grade gold discovery approximately 2.5 kilometers away from the Dixie Hinge Zone, which has been the center of attention during the past year.

Although Great Bear provided the drill results of just one hole, the discovery hole has a very meaningful impact on the perception and the scope of the entire Dixie gold project. In fact, the single discovery hole contained three separate mineralized zones: an ultra high-grade zone relatively close to surface, a wider zone that’s ‘just’ high-grade and a third zone which appears to be a very thick layer of low-grade gold mineralization with an average grade of 0.74 g/t gold.

And Great Bear played it fair. Rather than announcing 2 meters of 194.2 g/t gold (including 0.5 meters of 759 g/t gold, indicating the remaining 1.5 meters of the interval contains almost 6 g/t gold), Great Bear used the 14 meters containing 12.3 g/t gold as its headline result. Deservedly so, as that’s an interval with a thickness that’s much wider and a grade that’s a bit higher than your average Red Lake intercepts.

What makes the discovery hole even more interesting is the fact that these zones are incredibly close to each other. From the bottom of the 2-meter interval to the start of the 14-meter intercept, there’s only 15 meters in between both zones. So within the first 85 meters from surface, GBR’s new discovery (called Bear-Rimini after the group of local geologists that has been working on the project for Great Bear) hosts two high-grade gold zones with mineable widths.

The very thick zone of low-grade material made us scratch our heads. We spoke with Bob Singh and David Terry, two geological masterminds who are respectively the VP Exploration and an independent director of the company at a Discovery Group-hosted presentation in Vancouver last Wednesday, and Singh confirmed he had been searching for similar types of deposits/mineralized structures all over the world but was unable to find a perfect match. So not only does the discovery hole confirm the mineralization is very wide-spread all over the Dixie project, the hole also encountered what appears to be a rather unique sequence of gold mineralization and we are sure Great Bear’s technical team is dying to figure out the details and interpretation of the Bear-Rimini gold structure.

Discovery Group-hosted presentation in Vancouver last Wednesday

The re-interpretation of the district

The discovery of the high-grade gold at Bear-Rimini appears to fully confirm the exploration theory about the LP Fault which is interpreted to be a major gold mineralization control as it acted as a hydrothermal fluid conduit during the Archean age. Considering there’s approximately one kilometer between the LP fault and the North Fault, Great Bear now thinks this zone could be an area where gold rich fluids accumulated, so there may be much more to be found.

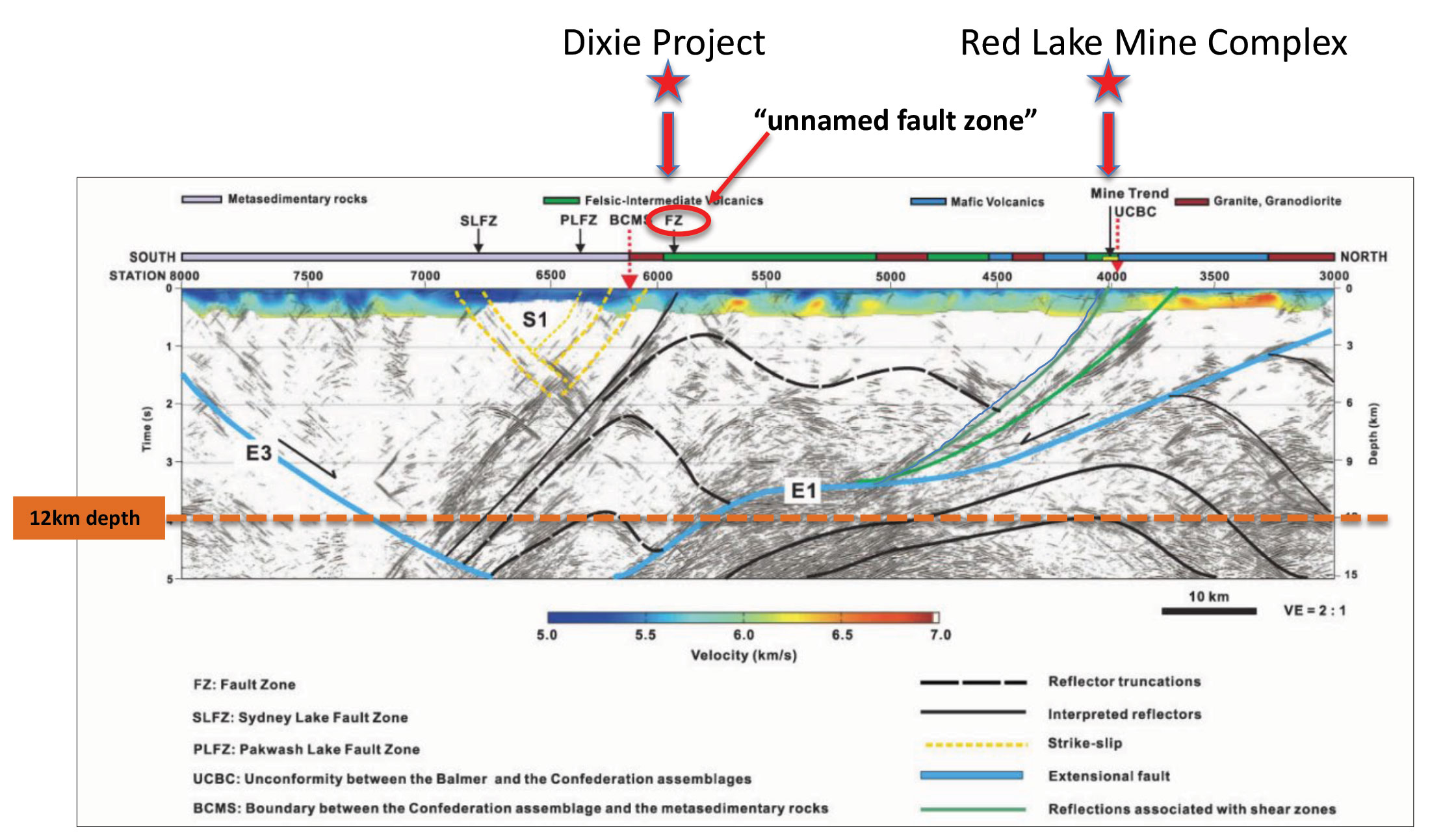

And one of the images included in GBR’s press release showed the similarities between the fault structures that host the Red Lake mine complex and the LP Fault which appears to be controlling the gold mineralization at Dixie.

We already know the LP fault is expected to reach a depth of about 14 kilometers, but the Bear-Rimini discovery now also provides insight on the potential strike length of the LP Fault. All 15 drill holes that have been drilled along the LP fault over a distance of 2.5 kilometers have intersected anomalous or moderate gold grades. Most of these holes were drilled by previous operators and they didn’t fully realize what they could be sitting on as approximately 80% of these historical holes have never been split and assayed, so Great Bear will now embark on a large re-logging and re-assaying campaign to figure out if the previous operators might have missed something during their own drill campaigns.

The Hinge zone keeps on giving as well

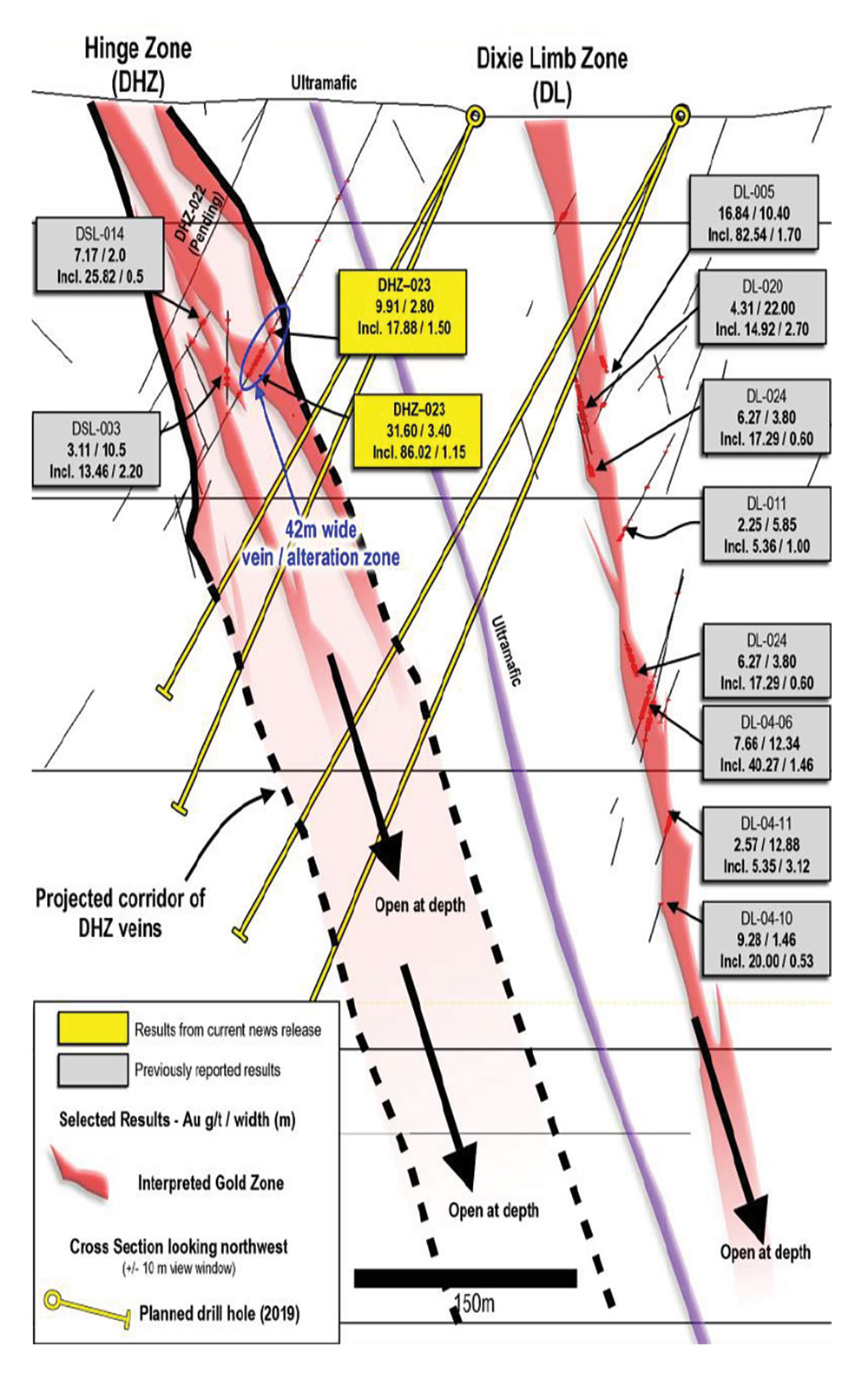

With all the excitement surrounding this new discovery on the Dixie gold project, one would almost forget the Dixie Hinge Zone. It’s where it all started, and the zone continues to yield excellent exploration results as Great Bear’s hit ratio remains exceptionally high.

In a late April update, Great Bear released the results from seven drill holes, which were all drilled on the so-called Dixie Limb zone (directly north of the Dixie Hinge Zone). All holes intersected gold, but three holes that assayed higher grade gold values offer important insight on the structures that control the gold mineralization as these three holes intersected gold at the predicted plunge. This could make Great Bear’s life much easier going forward as the high-grade gold zones at the Hinge Zone also appear to be predictable based on the plunges.

Upon reviewing the data from previous exploration programs and drill holes, Great Bear’s geologists noted the grades and thicknesses at Dixie Limb appeared to increase along a 100-meter strike length centered on the predicted intersection of the vein and the Dixie Limb.

The three holes that were drilled to test this theory effectively contained high-grade gold mineralization over mineable widths. Shorter intervals like 2.3 meters of 9.29 g/t is typical Red Lake stuff, but there were also some longer intervals (like 5.3 meters containing 9.15 g/t gold) as well as narrower but ultra high-grade zones with 1.5 meters grading 20.12 g/t gold and 0.5 meters at 24.38 g/t gold.

And just one week later, additional assay results from 30 meter and 100 meter step-downs along the projected plunge at the Dixie Hinge zone were published. Both stepdown holes have hit identical styles of high-grade gold mineralization, confirming the potential to find more gold at perhaps a higher average grade at depth.

With 3.7 meters containing 28.37 g/t gold (including 0.5 meters of 200 g/t gold), Great Bear has been very successful in proving the mineralization appears to continue at depth as the mineralization was encountered at a depth of approximately 273 meters. Other holes also contained several high-grade gold intervals, and this only strengthens and confirms Great Bear’s exploration thesis: the ‘corridor of gold veins’ continue at depth.

Hole 39 is now indeed the deepest hole where high-grade gold mineralization was successfully intersected, but this hole very likely is just the prelude of what could be found at lower levels. After all, gold mineralization in the Red Lake camp can easily continue to depths of in excess of 2 kilometers.

With 63% of the holes that have been completed at Dixie Hinge hitting grades of in excess of 15 g/t gold, the hit ratio is phenomenal. And that’s also one of the reasons why Great Bear decided to focus on its Dixie gold project by allowing GoldON Resources (GLD.V) to earn an initial 60% interest in GBR’s West Madsen project, where after it could acquire full ownership of the project.

Terms of the Option AgreementTo earn an initial 60% interest in the West Madsen Property, GoldON must:

(a) incur minimum Exploration Expenditures on the Property, as follows:

(i) $100,000 on or before the first anniversary of the Definitive Agreement;

(ii) a cumulative total of not less than $350,000 on or before the second anniversary; and

(iii) a cumulative total of not less than $750,000 on or before the third anniversary; and(b) pay cash to Great Bear as follows:

(i) $50,000 within 10 days of signing a Definitive Agreement;

(ii) $50,000 on or before the date that is 10 days after the first anniversary; and

(iii) $75,000 on or before the date that is 10 days after the second anniversary; and(c) issue common shares of GoldON to Great Bear as follows:

(i) 250,000 Shares within 10 days of signing the Definitive Agreement;

(ii) 250,000 Shares on or before the date that is 10 days after the first anniversary; and

(iii) 375,000 Shares on or before the date that is 10 days after the second anniversary.In order to earn the remaining 40% interest, for a total of 100% interest, GoldON must:

- incur additional Exploration Expenditures on the Property of at least $750,000 on or before the fourth anniversary of the Definitive Agreement, and

- pay $500,000 cash or issue 500,000 Shares to Great Bear at GoldON’s election on or before the date that is 15 days after the third anniversary of the Definitive Agreement.

Great Bear will retain a 2.5% Net Smelter Return royalty after GoldON completes the initial 60% earn-in. GoldON shall have the right to buy back 1% of the Royalty for $500,000 at any time prior to a production decision being made on all or part of the Property.

Great Bear spends the majority of its cash on exploration

As you know, we also like to keep an eye on how companies are actually spending their cash. When running an exploration company, the majority of the funds should go into the ground rather than paying hefty salaries and covering the CEO’s golf club membership.

Fortunately, Great Bear Resources seems to be doing the right thing, and we are happy to see a large part of the total quarterly cash outflow is effectively spent on the Dixie gold project.

Great Bear filed its quarterly financial results last week, so we are able to look at the most recent quarterly overview. In the income statement, Great Bear reported an operating expense of C$1.78M in the first three months of the year, and the majority of this was caused by C$1.23M in share-based compensation expenses. Excluding these, the ‘normalized’ expenses in the first quarter of the year would have been just C$550,000, of which almost half was spent on ‘travel; promotion and shareholder information’. That’s a lot of money, but as the gold zones on the projects keep on growing, Great Bear needs to get the story out to anyone who’s willing to listen to it. We also don’t expect the company to continue to spend an annualized C$1M per year on these elements, but as long as there’s a positive marginal return on investing in travel & promotion, Great Bear should just continue what it’s doing now, as it appears to be very effective now the stock is trading close to its all-time high.

So, despite the relatively high G&A expenses of C$550,000 in the first quarter, Great Bear’s ratio of cash spent on the project versus the total cash outflows remains exceptionally high.

Great Bear doesn’t expense its exploration expenses at Dixie, but capitalizes them which means we won’t see exploration expenses popping up in the income statement. As everything is capitalized, the cash spent on the property is considered to be an ‘investing cash flow’, and the details of these exploration expenditures can be found in the cash flow statement.

With a G&A of C$550,000 and capitalized exploration expenses of C$1.94M, Great Bear spent approximately C$2.5M of its cash in the first quarter of the year. As the exploration expenditures represent 78% of the total amount of cash expenditures, Great Bear definitely has its priorities straight.

And finally, perhaps a word about the C$1.23M in share-based compensation. That’s not because Great Bear’s management is handing out free shares like candy, but is a rather negative consequence of the exceptional performance of Great Bear’s share price in the past year.

The company issued 500,000 options with an exercise price of C$3.72, but due to the high volatility levels in the stock, the Black-Scholes model assigns a theoretical value of C$3.33 to these options. And that’s why the corporate expenses show a C$1.23M expense although the current value of these options is just 37 cents per option (C$4.09 – C$3.72), or C$185,000. There’s no funny business going on, it’s just a volatility-based penalty.

Conclusion

Great Bear is taking all the necessary steps to quickly develop a good understanding of the geological structures at the Dixie gold project. Zooming in on drilling along the D2 fault axis was a good move, and the drill results are paying off big time. And with the discovery of the high-grade Bear-Rimini zone, one could start to wonder what else could be found on the Dixie land package?

As of the end of March, Great Bear had a working capital position of C$11.4M and although Great Bear’s exploration team is now firing on all cylinders, the cash outflow in the current quarter will be mitigated by warrants expiring in July and August, which will very likely bring in another half million dollars or so.

And oh. How would Newmont (Goldcorp) feel now, less than two years after granting Great Bear the right to acquire its 33% stake in Dixie for just C$80,000 in cash…

The author has a long position in Great Bear Resources. Great Bear Resources is a sponsor of this website. Please read the disclaimer