Life hasn’t been easy for base metal exploration companies and in previous articles we discussed how zinc exploration company District Metals (DMX.V) is doing all the right things in Sweden but the company just isn’t gaining any traction.

There are other European zinc exploration companies facing the same issue. Group Eleven Resources (ZNG.V), a company we visited back in 2018, is still actively exploring its Irish tenements but recent encouraging drill results went unnoticed by the market. We caught up with CEO Bart Jaworski to discuss the recent drill results, how they impact the exploration strategy and how he sees the company move forward in the near future.

Interview with CEO Bart Jaworski

Stonepark/PG West

Before discussing your recent drill results, let’s take a step back. The main focus of Group Eleven is on the Stonepark PG West project which is basically straddling the Pallas Green deposit owned by Glencore (GLEN.L). Pallas Green currently contains 45 million tonnes of 8% ZnPb making it one of the largest deposits in Europe and one of the largest undeveloped zinc deposits in the world. Can you remind readers on how the land package was assembled as you originally only started out from scratch?

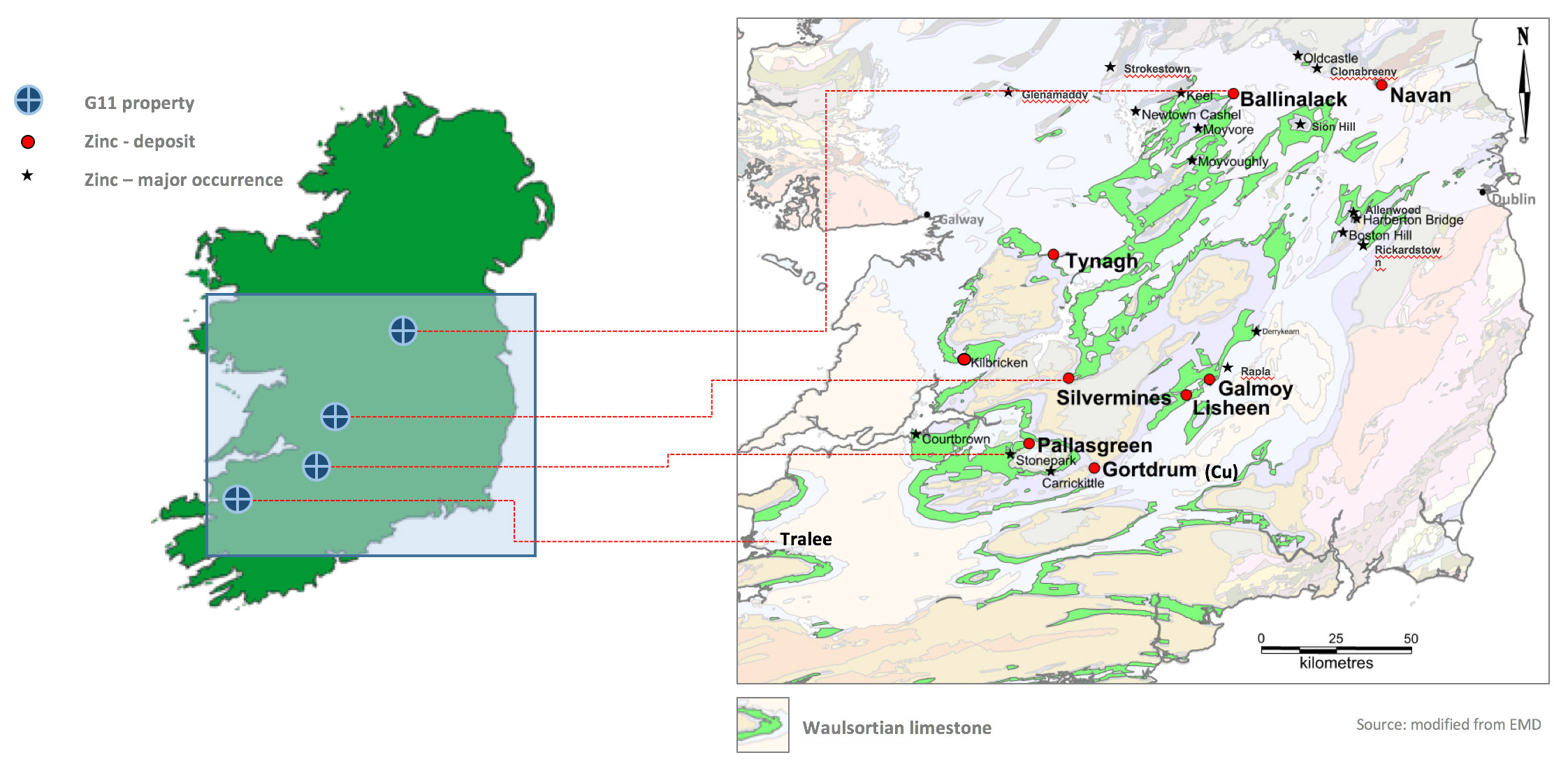

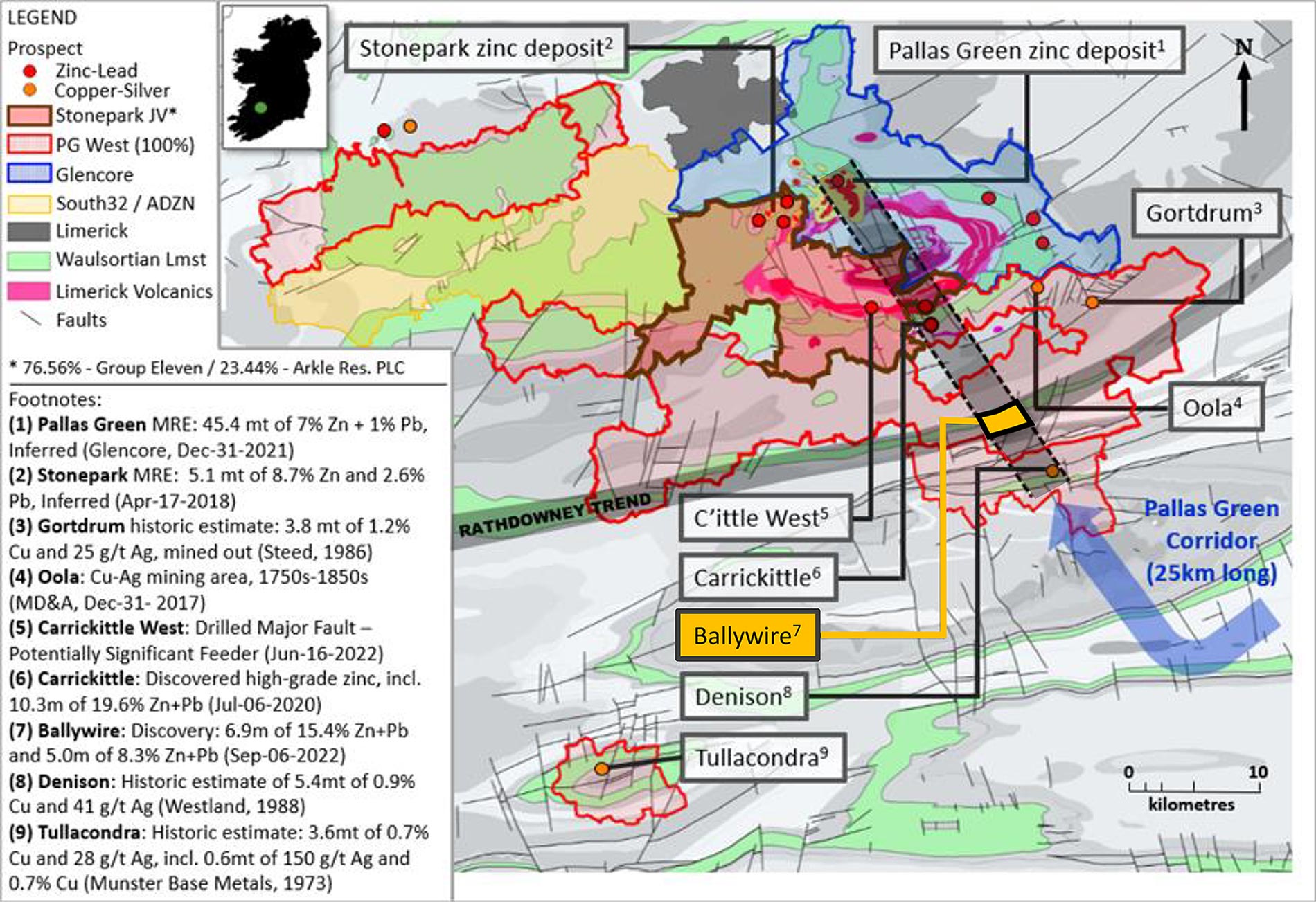

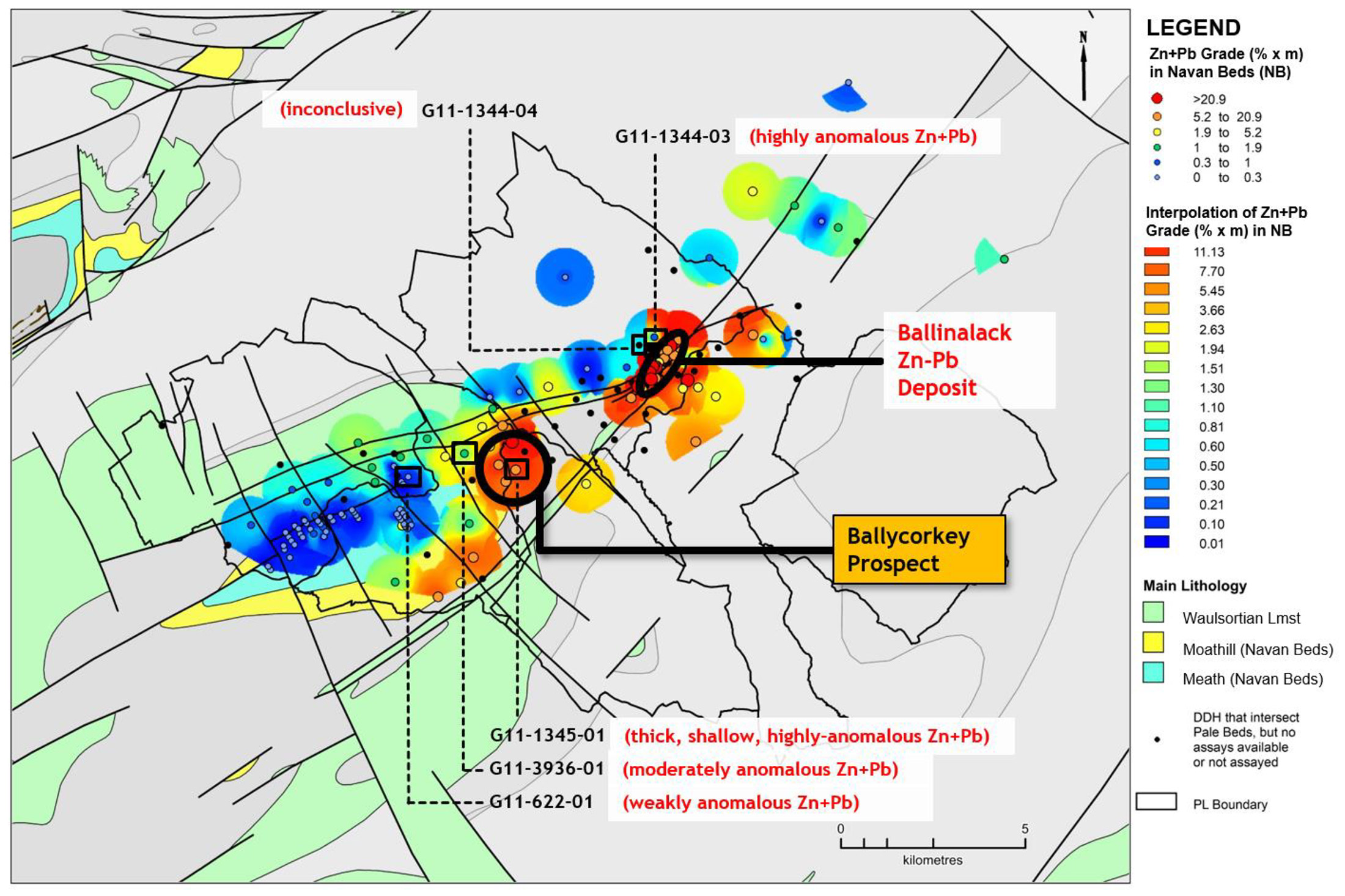

Correct, we started Group Eleven from scratch in 2015. Quickly thereafter, we staked a lot of interesting exploration ground in the country, becoming the No 1 license holder in Ireland and taking advantage of the unusually low levels of issued prospecting licenses at that time. One of our key ground acquisitions was PG West, where we assembled a licence package of around 750km2 adjacent to Teck’s Stonepark Project. In 2017, we successfully negotiated with Teck Resources (TECK) to acquire their (76.56%) stake in the project (along with Teck’s 60% interest in the Ballinalack Project – hosting a historic estimate near Boliden’s (BOL.ST) Tara zinc mine north of Dublin). Having two historic estimates and great blue sky exploration potential allowed us to justifiably proceed to an IPO on the TSX Venture in late 2017.

A couple of years later in 2019, also by virtue of our dominant land position (PG West and Stonepark), we were able to attract our next-door neighbour, Glencore, to become our largest shareholder (which later evolved into them adding a director to our board).

The entire investment thesis is based on an exploration theory you once called ‘Big Think’. Could you elaborate on how that’s evolved over time?

Yes indeed – ‘Big Think’ was essentially large-scale regional exploration and data analysis over our vast ground position, with a view to define the most prospective drill targets. This process started slowly in 2015 and gathered pace from 2018 to 2020. A couple of years ago, we came to the conclusion that PG West and Stonepark were by far the most prospective of our stable of properties. On the back of that, we dropped over half of our ground position, focussing on our core licenses.

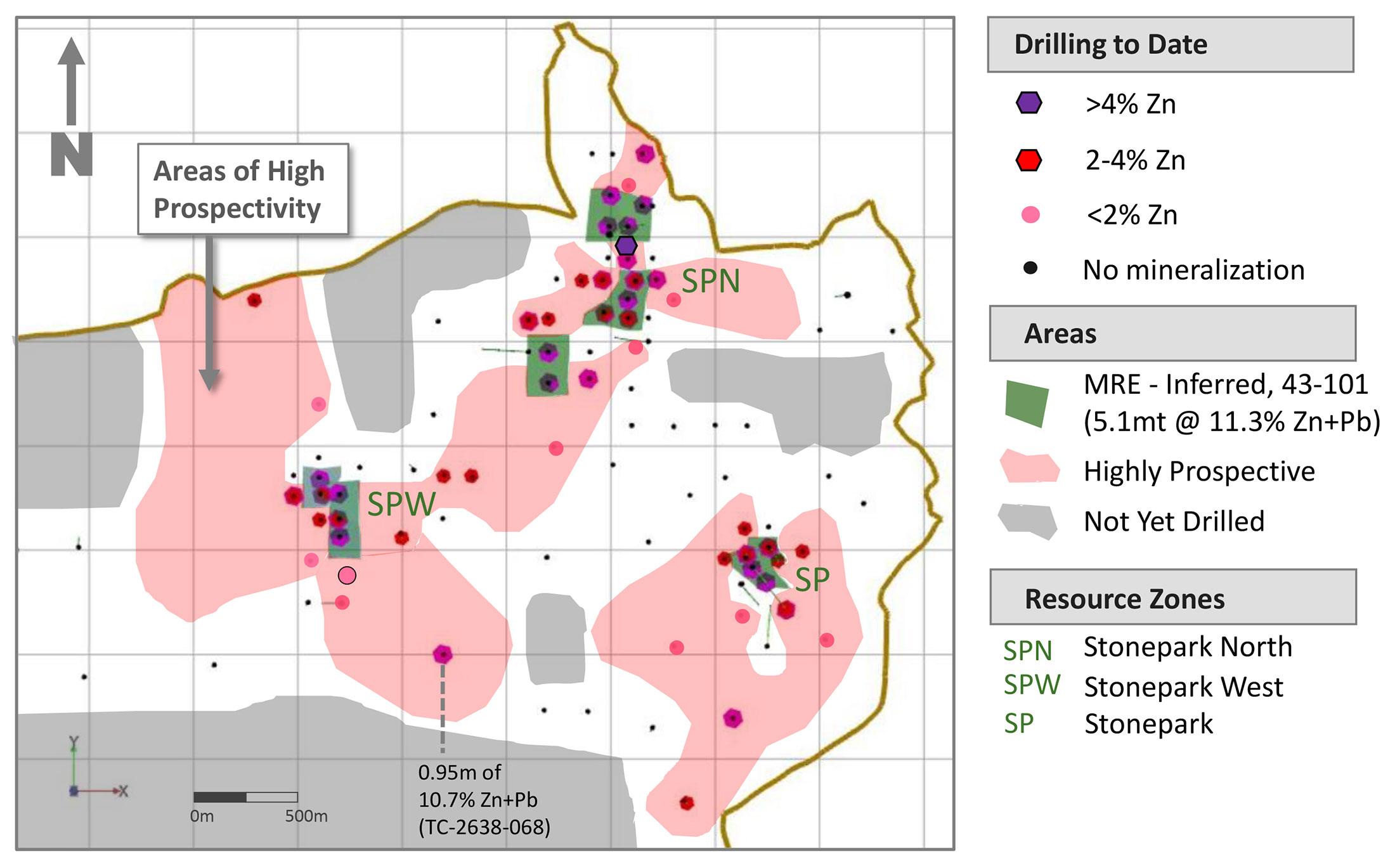

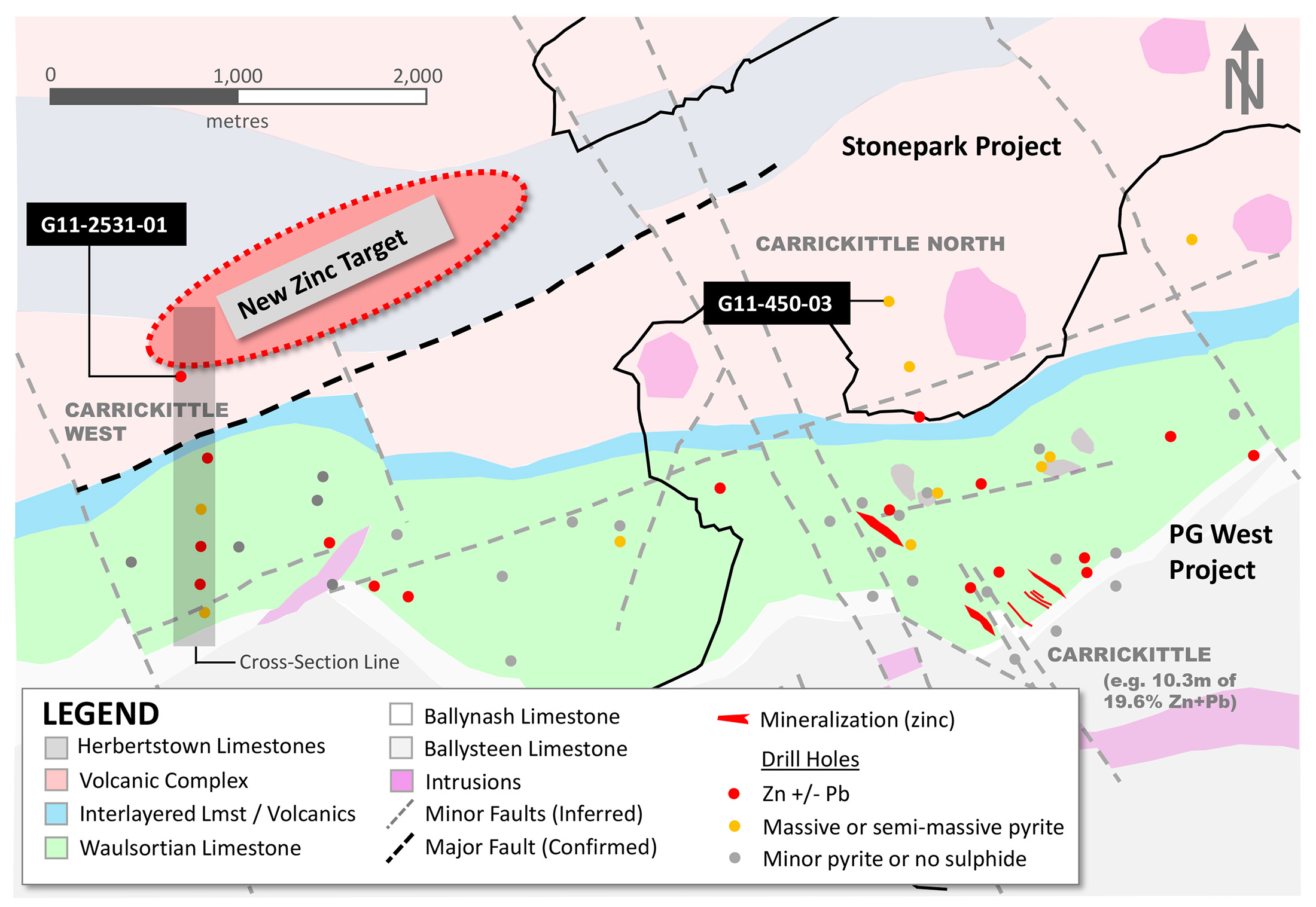

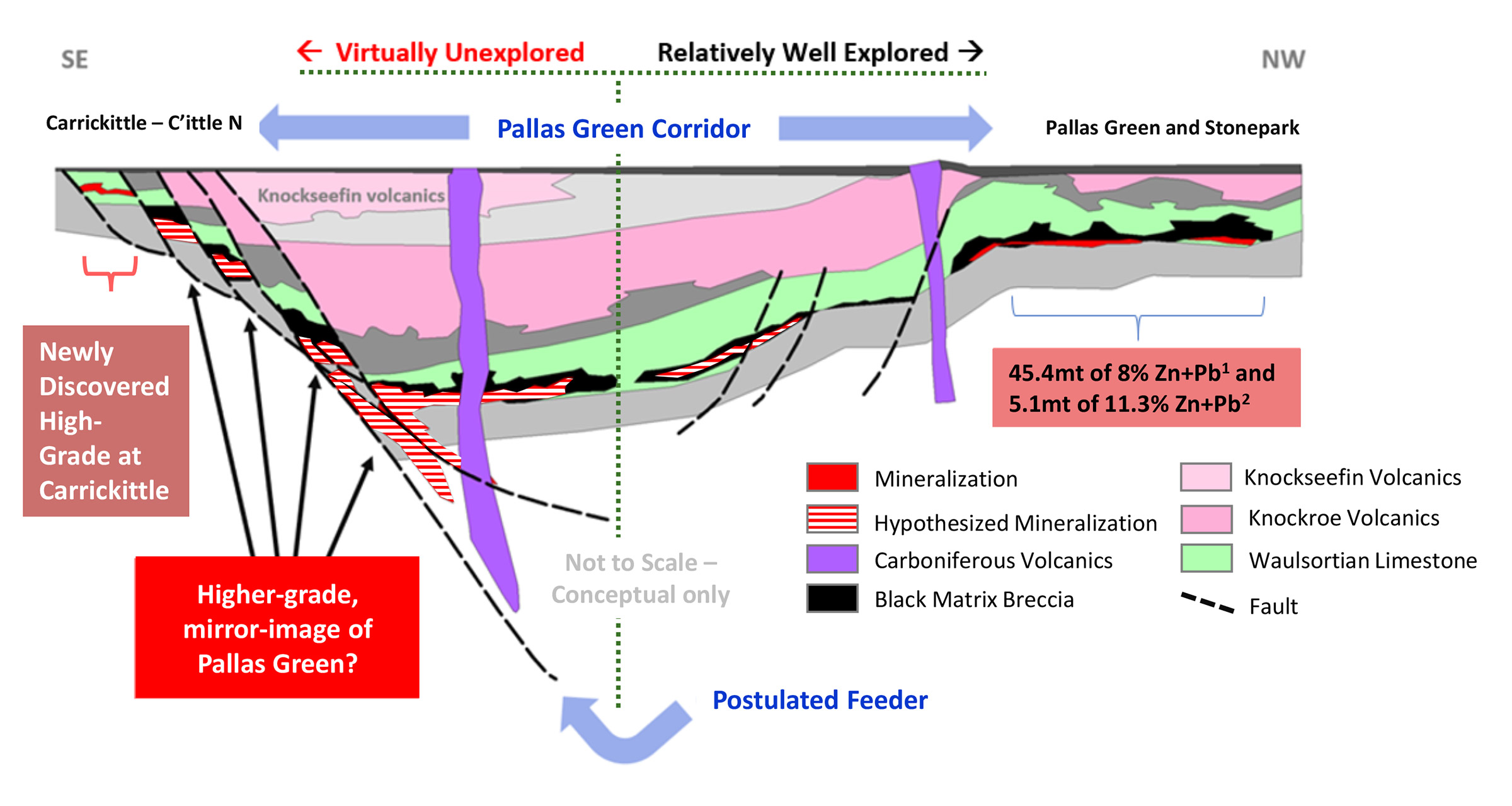

Since mid-2020, we’ve been very much drill-focussed and largely zeroed in on PG West / Stonepark, specifically on the emerging Pallas Green Corridor, which stretches from Glencore’s Pallas Green zinc deposit to our Carrickittle prospect, our recent Ballywire Zn-Pb-Ag discovery and finally to our historic Cu-Ag prospect called Denison (hosting a historic resource estimate).

At this stage, Group Eleven has two key value-drivers: (1) the Ballywire discovery (announced Sept 6, 2022) and (2) our Carrickittle West prospect where we definitively drilled through the first major fault identified in the Limerick Volcanic Complex, possibly representing a mineralizing feeder to the known prospects in the area (Pallas Green, Stonepark, Carrickittle, etc; see our news release dated June 16, 2022).

How was a small company like Group Eleven able to pick up all the land? Were you the first company to work on the exploration theory and has it simply been missed by other geologists? Or does Glencore already have its plate full with the 45 million tonnes at Pallas Green?

It is relatively inexpensive to pick-up prospecting licenses in Ireland. However, it took a lot of effort to work through our large ground position and find the most prospective areas. Yes indeed – the Pallas Green Corridor was a concept first developed by Group Eleven. We are the first to connect the dots and actively explore this concept. The Ballywire discovery and the potential feeder at Carrickittle West are starting to show what this corridor might be capable of. Regarding Glencore, I cannot speak for them. The fact is that Glencore is the largest shareholder of Group Eleven and recently (August 2020) appointed a director to our board.

Or is Glencore just using the ‘big boy’ strategy by letting the small junior exploration company drill-test its theory? If you confirm your theory anyone, including Glencore likely wouldn’t mind paying a higher price for a de-risked project (if it meets its criteria further down the road).

Group Eleven retains full control of all budgeting and exploration work and Glencore does not have any veto rights regarding approval of projects and/or budgets. In other words, we are developing our own theories and strategies on exploration, albeit, we’re always open to any ideas which may come from the Glencore side. In general, I believe majors prefer to buy something they can sink their teeth into, even if it means paying more, as opposed to saving money by paying for something not yet established.

As a small exploration company, you obviously can’t poke a few dozen holes and you really need to focus on the high-priority drill targets. Could you perhaps elaborate on how your drill targeting works? What work do you do before deciding to drill a specific spot?

Our exploration team generates the idea based on thorough data compilation and analysis. I work closely with the exploration team to hone and choose our final targets. Once the program is detailed, we take it to the board for discussion and final approvals. As you say – we can’t drill everything we’d like because of capital constraints. This is why its important to filter everything, balancing corporate discovery needs with the need to first understand the regional geology of an area. Regulatory spending requirements and of course community/logistics optimization are also key considerations.

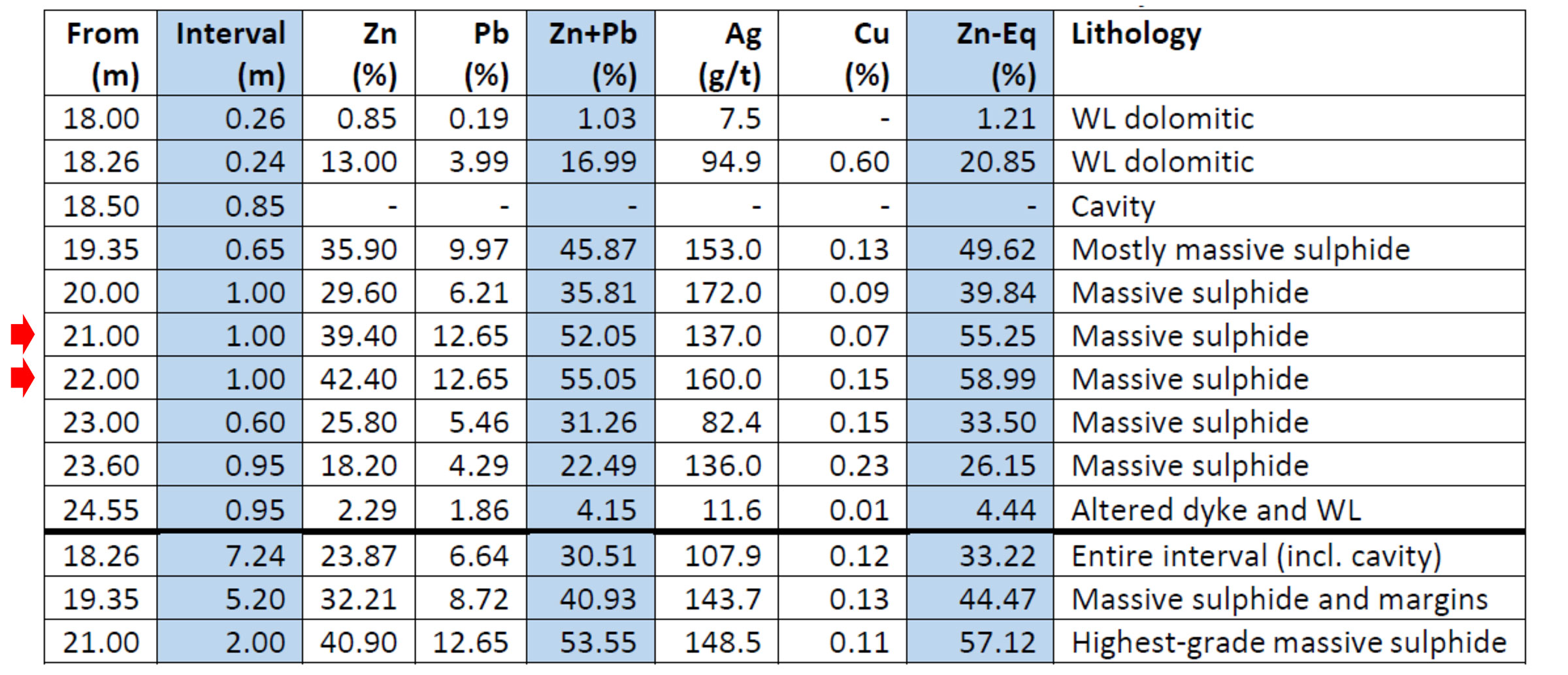

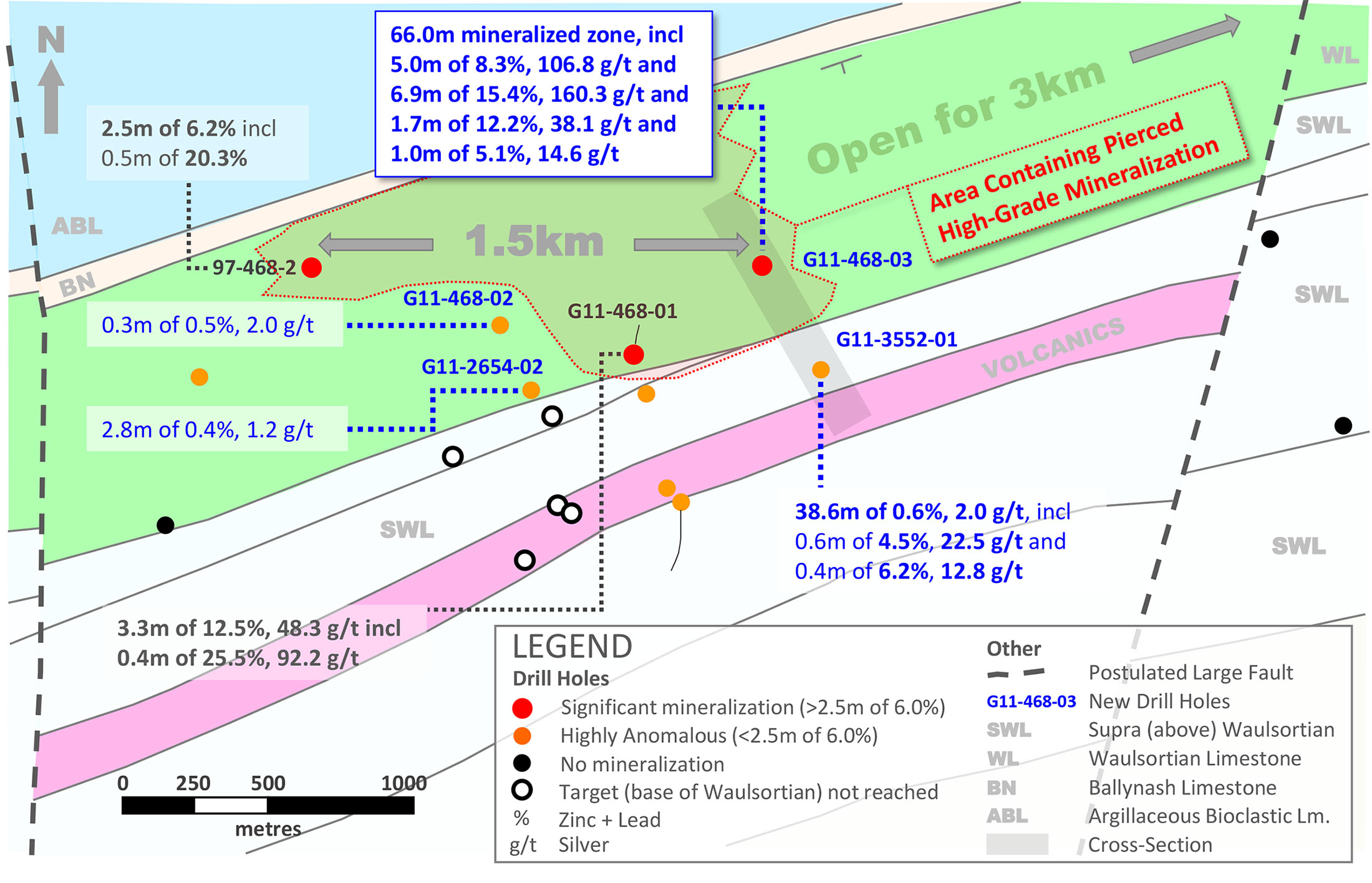

The exploration program paid off. You announced the assay results from hole G11-468-03 which contained several distinct zones of zinc-lead mineralization with for instance 5 meters of 8.3% ZnPb and 3.5 ounces of silver per tonne followed by 6.85 meters of 15.4% ZnPb and 5 ounces of silver per tonne. This was a successful hole, but did it also meet your expectations?

Yes, it surpassed our expectations because we hadn’t seen anything as robust anywhere at Ballywire to date. We ended up intersecting a 66m package of mineralization with several stellar intercepts, the best of which was 2.05m of 40.8% Zn+Pb and 385 g/t Ag.

This hole was drilled approximately 410 meters away from hole G11-468-01 which contained 3.3 meters of 12.5% ZnPb and approximately 1.5 ounces of silver per tonne. That’s quite ‘far’ away. How do you approach this now? You recently announced you will be drilling five additional holes, but how did you decide on where exactly you would drill those holes? And what are you trying to achieve with the five new holes?

If you include a historic hole drilled in 1997 (2.5m of 6.2% Zn+Pb, including 0.5m of 20.3% Zn+Pb), we now have an area stretching 1.5km along strike which hosts only strongly mineralized holes (three of them in total, with no other drilling done yet). The strongest of the three holes is G11-468-03, as you mention above. The next step is to drill five holes as concentrically as possible around this discovery hole, stepping out 100m to 250m. The exact location of each hole is dictated by local logistical considerations. The aim here is to determine the extent and direction/shape of the mineralized system.

In addition to the above, there is a swath of ground 3km to the east along strike from our discovery hole which has yet to be drilled (i.e. its wide open / completely untested). The above five follow-up holes will hopefully shed some light on whether mineralization continues into this 3km area. In all, we have over 4km of prospective strike length to play for here.

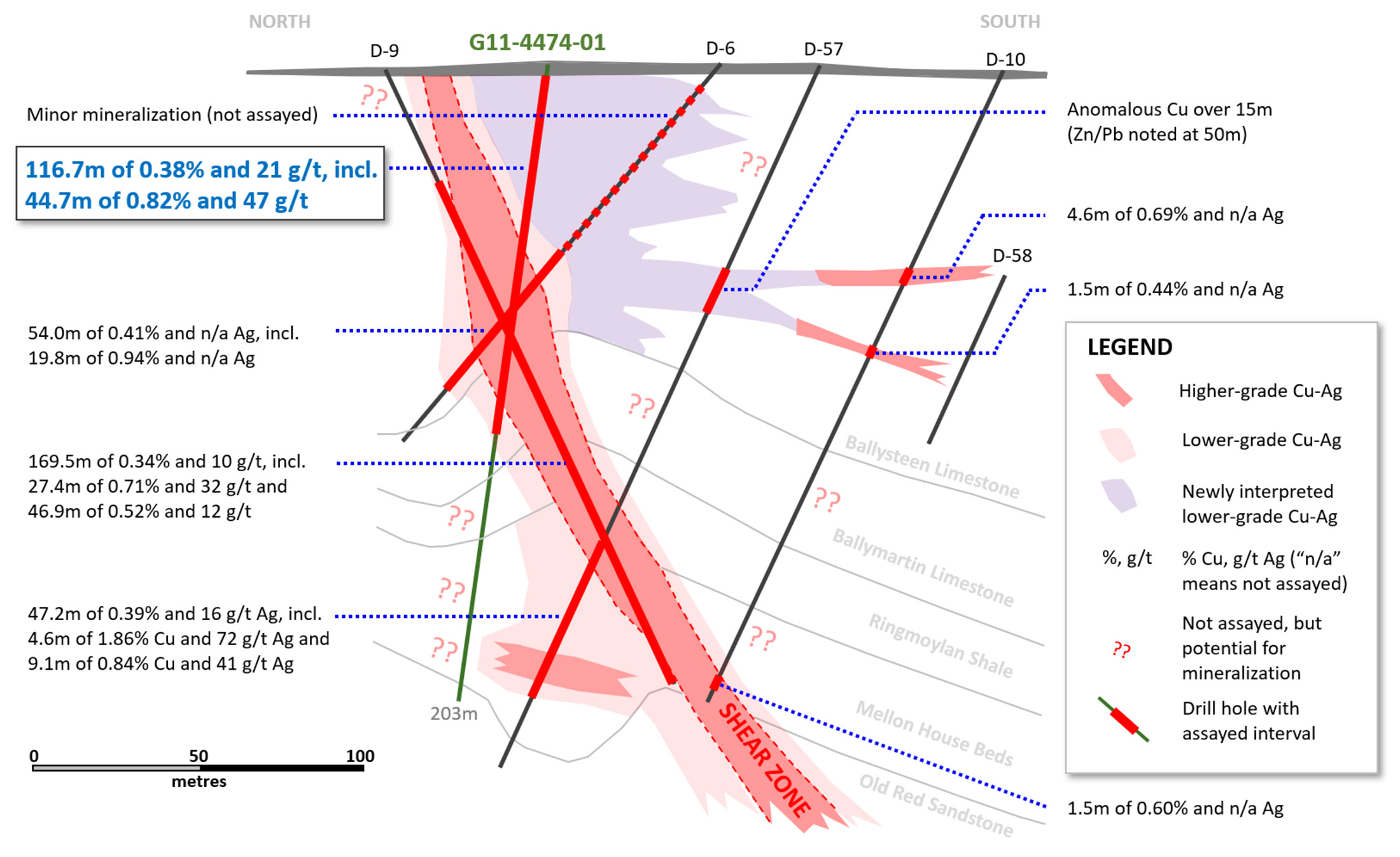

At Carrickittle West you are planning to complete one very deep hole (700-1,100 meters). What’s the purpose of this hole?

This next hole will test an area where we believe a large fault (possible feeder drilled recently and announced on June 16, 2022) cuts through the base of the Waulsortian Limestone (the target horizon). This area is very prospective and the analog for the type of mineralization we’re hoping to find here is Glencore’s Pallas Green and/or Boliden’s Navan (Tara) systems (i.e. very large deposit type).

Ever since Pallas Green was discovered some 20 years ago (in 2002), operators in and around the Limerick Volcanic Complex (which host Glencore’s Pallas Green deposit and our Stonepark deposit discovered in 2007) have been trying to find the fault structure where all the mineralization is likely to have come from. This fault structure has been elusive and no one has been able to find anything obvious. However, on June 16th this year, we announced that we intersected, very definitively, a large fault structure with at least 150m of throw (movement along the fault structure). This is the type of displacement that we see at faults hosting other zinc deposits in Ireland. Therefore, we suspect we may have finally identified a possible feeder. The only thing to do now, is to drill the area where the fault meets the base of the Waulsortian Limestone.

Are you still doing work on Ballinalack?

Yes our Ballinalack zinc deposit is still a key asset for us and we will continue to progress the project in due course. Our regulatory spending requirements at Ballinalack does not fall due until 2025, so we will use that time to focus on PG West / Stonepark and go back to do some drilling at Ballinalack likely sometime in 2024.

Corporate

What is your current cash/working capital position?

As at our most recent quarter (ending June 30th) we had C$2.6m in cash. Current assets were C$2.7m and current liabilities were C$965k. However, to get a working capital that better illustrates exploration funding potential (as opposed to just financial risk), note that director fees of C$140k are paid out as DSUs; and Exploration Partner Advances of C$338k represent a commitment to complete the Stonepark drilling this year and Ballinalack drilling in future. Therefore, adjusted current liabilities for the above gets you to C$487k, for an adjusted WC of $2.2m.

Cash is incredibly difficult to come by, especially for base metals companies. Although the zinc price is still quite robust at $1.35 per pound, there seems to be a general apathy in the markets and companies with good drill results, like for instance District Metals (DMX.V) don’t seem to be getting any traction or the recognition they deserve. What’s broken in the industry? What will have to change for companies like Group Eleven to get their fair share of the spotlights?

I believe what is broken in the industry right now is a clear idea of what the outlook looks like. There is obviously a lot of uncertainty stemming from the Russian invasion, after-effects of Covid and now inflation with a brewing higher-interest rate environment. Because of these unknowns, the market in large part is going to cash and indiscriminately selling. As always, for some, this will be a great opportunity to buy quality names at a steep discount, knowing the dust will clear eventually.

As for Group Eleven, the key distinguishing factor will likely be grade. Irish-type zinc deposits typically have high-grades and tend to produce clean, highly-sought after concentrates. Being on the door-step of European smelters and having the in-country infrastructure is also key. Our stellar grades reported recently at the Ballywire discovery of up to 52% Zn+Pb and silver up to 632 g/t, bode well for hopefully finding a large and high-grade mineralizing system. Time will tell and I suspect a lot more people will be listening if we start demonstrating continuity of high-grade on this next round of drilling at Ballywire.

Any parting thoughts?

Offshore wind power in Ireland – watch this space. (See my discussion with Andrew Johns on this and other green energy implications to the zinc demand outlook, starting at 22mins).

Zinc batteries, solar farms and offshore wind power are going to have a significant impact on zinc demand over the foreseeable future. Ireland specifically is poised to become the largest offshore wind energy producer in Europe. This means green-hydrogen and the distinct possibility of green energy fuelling the next generation of zinc mines in Ireland.

Conclusion

This isn’t an easy time to be an exploration stage company and just like so many other companies, Group Eleven Resources isn’t just getting any traction or share price appreciation on the back of very interesting drill results. Not only did recently drilled holes confirm the presence of high-grade zinc-lead mineralization in the backyard of a Glencore-owned project, it is also very important to note that these drill results are confirming the company’s exploration theory.

The only thing Group Eleven (and by extension, all other exploration companies) can do is to further advance their projects while keeping an eye on the treasury to avoid seeing the market starting to speculate against the company. At a price of just over $1.35 per pound, the zinc price remains strong. Meanwhile, Ireland remains an excellent mining jurisdiction so Group Eleven has a lot of elements going for it but in the current market, everything is an uphill battle.

Disclosure: The author has a small long position in Group Eleven Resources. Please read the disclaimer.