Inca One Gold (IO.V) has just completed an equity raise of in excess of C$6M which allows the company to boost its working capital and perhaps even more important, to restructure its balance sheet.

Inca One Gold (IO.V) has just completed an equity raise of in excess of C$6M which allows the company to boost its working capital and perhaps even more important, to restructure its balance sheet.

The company entered into an agreement with its lenders to convert a substantial part of its debt in new equity, and this puts the company in a much stronger position to ramp the Chala One facility back up to 100 tonnes per day and to explore further growth initiatives. We had a chat with CEO Ed Kelly and discussed the recapitalization of the company and the near-term and longer-term plans for the future!

The Recapitalization

You recently closed a private placement, raising a total of C$6.3M. In earlier conversations, you said raising C$4M would get you back on track, and any amount above would add more flexibility. You have now raised substantially more as there was a very strong demand for the placement which is obviously a great vote of confidence from the financial markets. Do you have any specific plans for the ‘additional’ C$2.3M?

It’s indeed great to see the demand for our financing was substantially higher than the amount we initially intended to raise. The additional funds will be used to pay down debt, as per the various debt settlement agreements – this will improve our financial position further.

The substantial equity raise allowed you to reshuffle your debt obligations. Can you elaborate on how the existing debt was restructured, and what the remaining gross debt is? What is the current share count after taking the conversion from debt to equity as well as the final tranche of the private placement into account?

The remaining debt on our balance sheet will be approximately C$3M, down substantially from our prior debt levels which totalled in excess of $14M CAD.

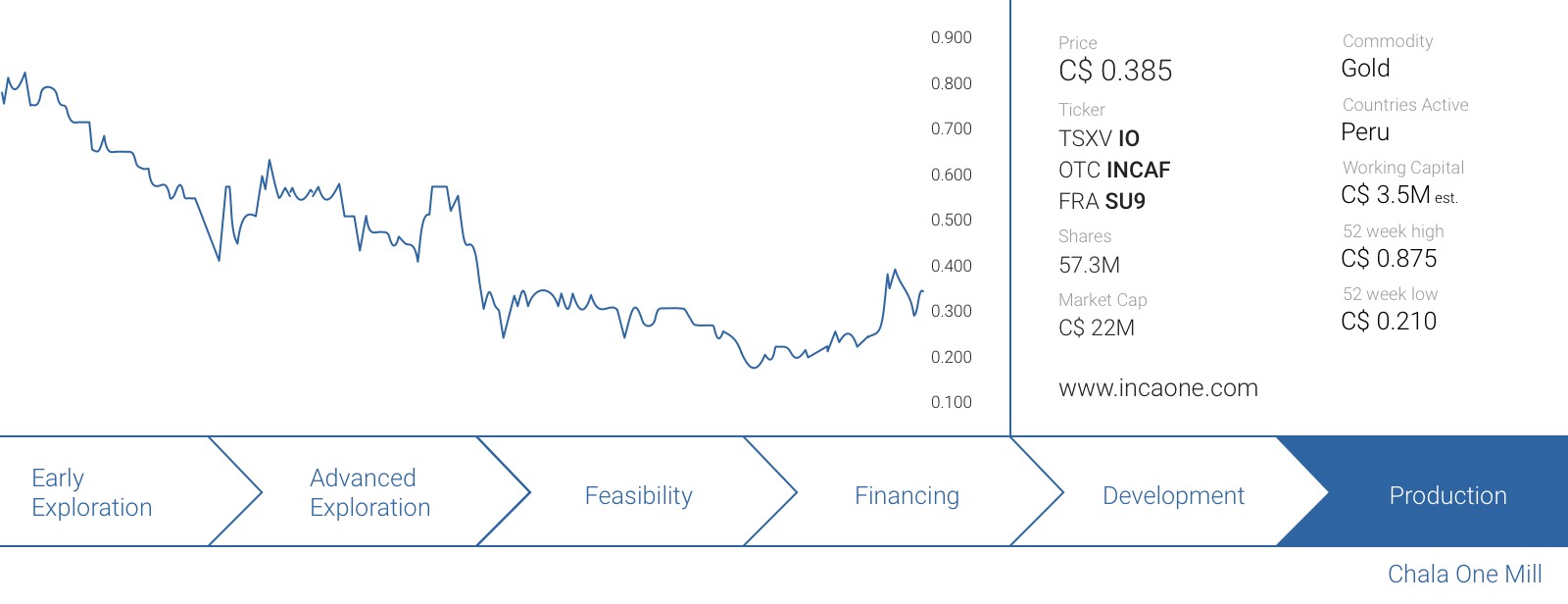

Our current share count is 57,332,153 shares outstanding, and this gives us a market capitalization of approximately C$19 million.

Inca One also appointed Bruce Bragagnolo as its chairman, and our readers will obviously remember him from being a key factor in the evolution of Timmins Gold (TMM.TO). What will be his role at Inca One Gold ?

Bruce’s role as Chairman will be to hold our board and management team accountable and ensure they remain on track to meet company milestones. Furthermore, he is a seasoned public market figure and brings further credibility and business acumen to our board, so we are glad to have him on board!

Did any strategic parties take a position in the current private placement?

The placement participants were varied and diverse, including a number of private equity funds and family office funds in Europe and Canada, as well as high net worth individuals and a number of accredited investors from across Europe, Canada and the United States.

We continue to have a diversified shareholder base on both continents, and this confirms our plans to become a main player in the Peruvian gold processing space appealing to a wide range of retail and institutional investors.

Operational

An important previous issue was the lack of capital to purchase ore to keep the mill running at 100 tonnes per day caused by the IGV withholding of approximately $3 million CAD. These funds were tied up for over one year within the Peruvian Government until recently. With the current recapitalization and substantial cash inflow, we would expect ore purchases to pick up again. Are you already deploying the capital on ore purchases? What’s the current approximate ore intake?

Yes, our ramp up has begun and ore buying activities have picked up substantially and we have begun increasing production and stockpiling even more material. We are buying all the ore we can get our hands on that meets our minimum requirements in terms of grade.

Our mill is currently processing approximately 60 tonnes per day but this can change in either way as we are still early in the ramp up phase.

Before the summer you were operating at approximately 30 tonnes per day, so it’s great to hear you have already doubled your production rate! When do you expect to be back at 100 tonnes per day?

We would obviously like to be at 100 tonnes per day as soon as possible and from an operation standpoint we could be there tomorrow.

However, our main goal is to achieve positive cash flow, and maximize operating capacity at all production levels. We continue to focus on margins and recovery throughout this ramp up.

‘Quality over quantity’ is definitely a valid statement here.

In the past 12-18 months you were trying to be one of the consolidators in the Peruvian toll milling space, but both deals fell through upon doing more Due Diligence. Is consolidation something you’d be willing to consider again?

Yes, if and when the time and opportunity is presents itself, it could definitely be examined further. We are an ambitious company, but everything must fit the bill, and that’s why we have a very thorough due diligence process when we’re looking at opportunities

Conclusion

Inca One Gold’s C$6.3M cash injection was a very good move as the company has now been able to clean up its balance sheet and ramp the production rate back up to 100 tonnes per day. 2017 will be a very important year for Inca One wherein it reaches its nameplate capacity and generates a positive free cash flow.

Inca One Gold is a sponsor of this website, we hold a long position. Please read the disclaimer