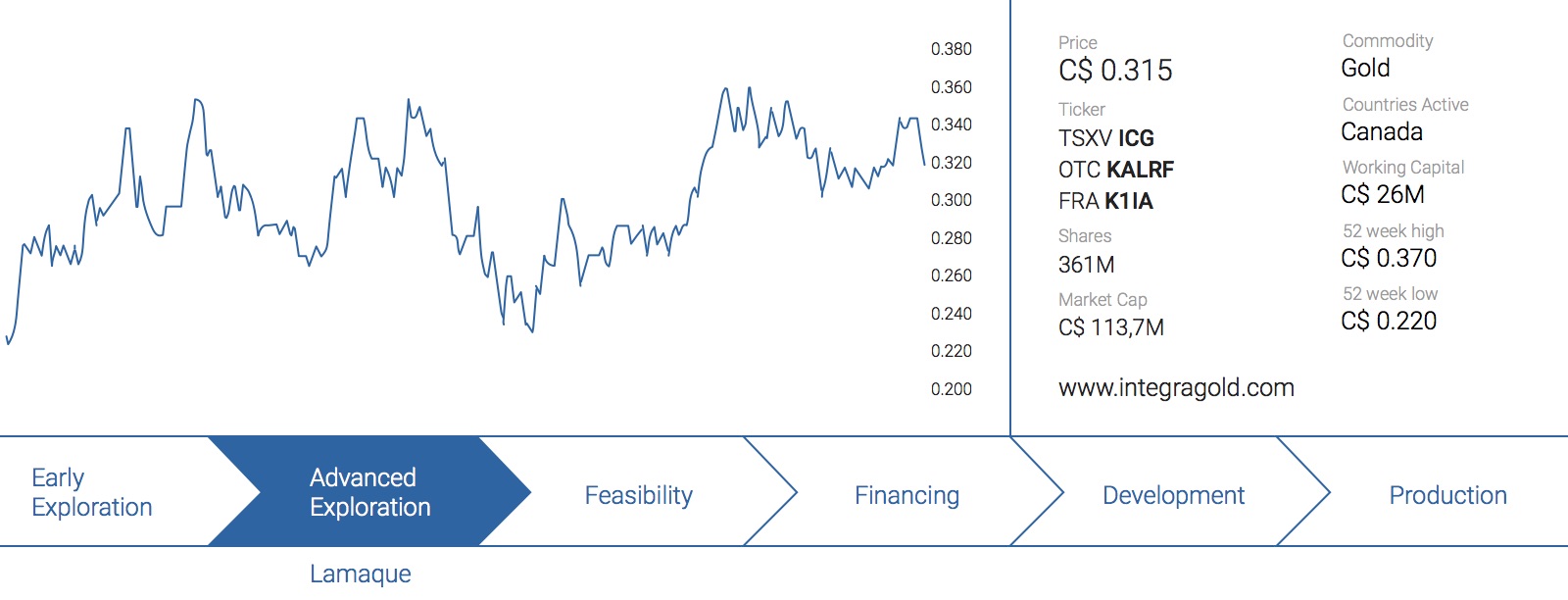

Integra Gold (ICG.V) has been one of the better performing companies we have been covering here at Caesars, and since we initially discussed the company and visited the project, the share price has roughly doubled. Meanwhile, Integra hasn’t had any problems at all to raise cash. In fact, it had to increase the size of several private placements and was able to attract Eldorado Gold (ELD.TO, EGO) as a strategic investor in the process. The stars are aligning for Integra Gold, and we wouldn’t be surprised to see the company being bought out before the end of this year.

View PDFFor our new readers; a brief history of the Lamaque Gold Project

Integra Gold’s predecessor, Kalahari Mining, consolidated the full ownership of the Lamaque project in 2009 right when the mining sector was pulling itself together to come out of one of the worst market corrections in decades. With CEO Stephen de Jong at the helm of the company since the summer of 2012, Integra continued to focus on the Lamaque project, which has been the company’s flagship since Kalahari Mining was formed.

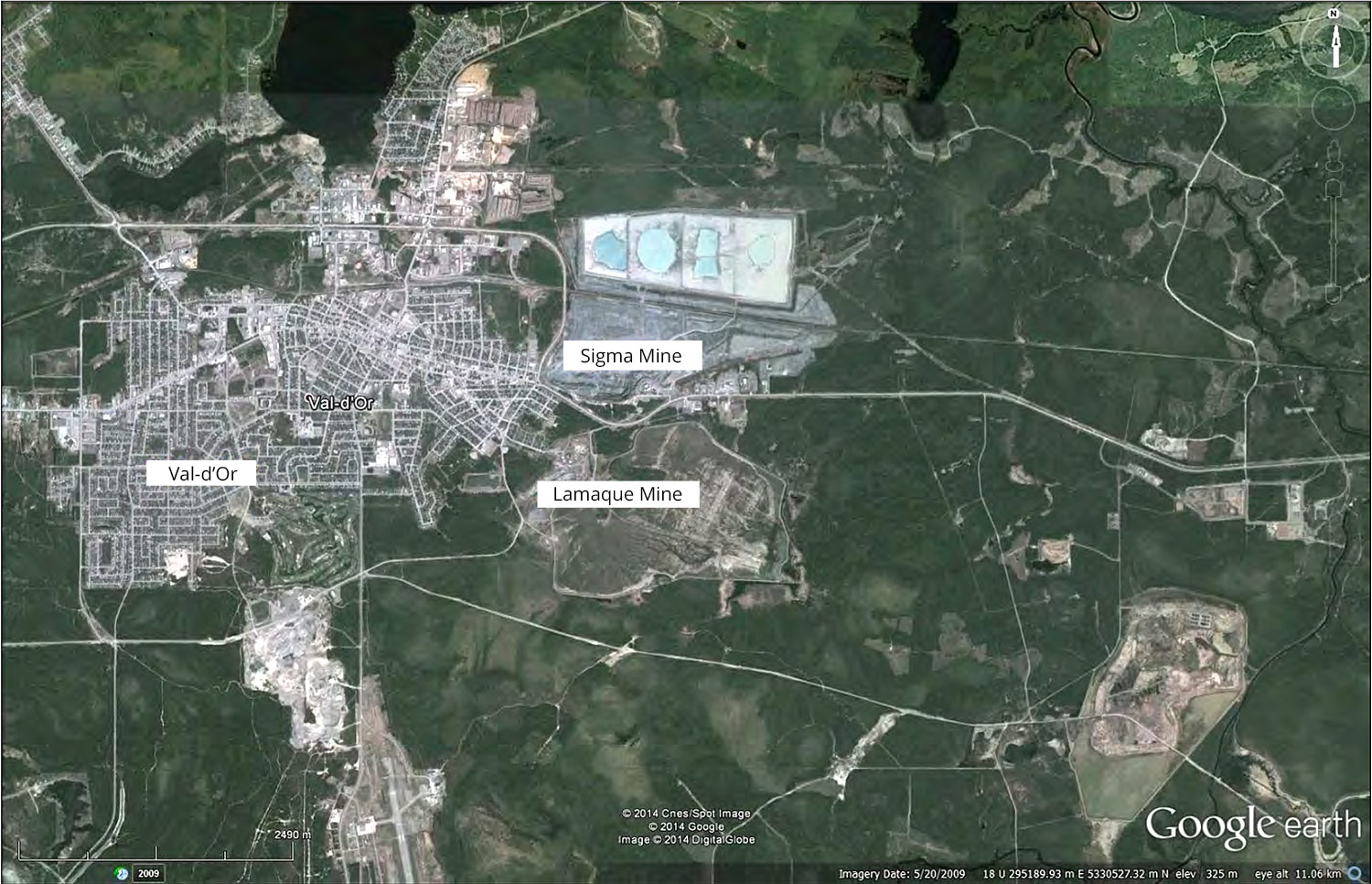

This allowed the company to release a first Preliminary Economic Assessment in Q1 last year, but that economic study was referred back to the drawing board as Integra announced a strategic transaction that might very well be described as a ‘coup’. Right across the road in Val D’Or was the Sigma-Lamaque mine, operated by Century Mining and Placer Dome. Unfortunately for Century, the company went bankrupt due to a difficult gold market and, in hindsight, a relatively weak mine plan and the mine as well as the 2,200 tonnes per day processing plant were placed on care and maintenance.

This was a once in a lifetime opportunity for Integra Gold and the company acquired the mining and milling assets for cents on the dollar from the bank that took possession of Century’s assets. The total consideration of the mine and mill was just C$7.55M with the majority of the acquisition price to be settled in new shares of Integra Gold. This created some sort of share overhang, but Integra has dealt with this, and the seller of the assets currently no longer holds any more shares it could dump on the market. Integra’s team has found a ‘new’ home for all of the shares it issued as part of this deal and the stock is currently held by strong hands in Europe (London) and the USA.

Province of Québec

The net cash payment that had to be covered by Integra Gold was just C$800,000 a s a private partner stepped up the plate and forked over C$1M in return for a right on the waste rock on the property. The acquisition cost of the assets of Century Mining was just C$6.5M which truly was a bargain considering the replacement value of the processing plant was estimated at approximately C$100M.

The importance of the acquisition became pretty clear when the second PEA was released, as Integra Gold was now able to incorporate the operating cost savings of owning a mill compared to using a toll mill to process the Lamaque-ore. We initially estimated the cost saving to be C$100/oz, and the final economics prove us right as Integra’s most recent PEA indicates the cash cost (before sustaining capital expenditures) fell by C$104 per ounce and the after-tax NPV5% increased by 28% to in excess of C$110M.

The updated resource estimate is in line with our expectations

After an additional 12 months of drilling at the Triangle Zone which has new really become the company’s main focus and priority number one, Integra Gold has released a new resource update on Lamaque South with a special focus on the Triangle Zone. The updated resource estimate has incorporated an additional 39,000 meters (according to the updated technical report) of drilling at Triangle.

This 39,000 meters was sufficient to increase the total resource estimate at Triangle from less than 600,000 ounces of gold to almost 1.2 million ounces. On top of that, the total amount of ounces in the indicated resource category increased by 14% to 503,000 ounces (using a cutoff grade of 5 g/t gold, which makes us feel more comfortable than using a cutoff grade of 3 g/t). So not only did the total amount of ounces double, the amount of ounces in the category with a higher confidence-level increased as well.

Based on a total addition of 586,430 ounces in a 39,100 meter drill program, Integra’s 2015 exploration program at the Triangle zone seems to have been very efficient with the addition of approximately 15 ounces of gold per meter that has been drilled. That’s a pretty good ratio and it will be interesting to see the discovery rate in 2016 (keep in mind a substantial part of the 2016 drill program at Triangle will focus on upgrading the existing inferred resources to the measured and indicated category as well). Additionally, we’re also looking forward to see some drill results from a drill program that will test the continuity of the C-structures from the Triangle zone into the N° 4 plug.

The company’s external consultants have now proposed a total work budget of almost C$32M to advance the project even further. This sounds like a lot of money (and it is), but approximately 2/3rd of the total anticipated budget will be used towards an underground exploration program at the Triangle Zone (which would result in an anticipated revenue of C$4.5M from selling the gold recovered during a bulk sampling program). Also keep in mind the ‘proposed budget’ does not have to be completed this year, and Integra can increase or reduce the development pace. The most important thing to consider here is the fact the company is fully-funded for its planned 100,000 meter drill program in 2016.

Integra has already started to construct an exploration ramp at the Triangle Zone and the construction activities at the portal zone are going as expected. The portal face has been completed and the portal has reached a depth of approximately 20 meters. Additionally, Triangle has now been linked into the power lines and the road across the property which is connecting the Triangle zone to the processing plant has already been completed. As you can see, Integra Gold has been very active in the past few months!

Any updated PEA will at least DOUBLE the NPV of Lamaque. Why?

1. More ounces

The 2015 PEA indeed confirmed the huge cost savings associated with the acquisition of the Sigma-Lamaque and it’s important to keep in mind the 28% increase in the NPV of the project barely takes any additional resources into consideration. The PEA based its NPV and internal rate of return on a mine plan wherein roughly 500,000 ounces gold would be recovered.

Fast forward to today, and with the new technical report, the Lamaque South project now contains in excess of 1.5 million ounces of gold. Of course, we do realize not all of the 1.67 million ounces that are currently on the table will be successfully incorporated in a mine plan as there will always some concessions that will have to be made, but based on the current resource estimate and the updated vision on the project, we would now expect an updated mine plan to recover at least 1.2 million ounces of gold.

Assuming the mine life could be extended from 4.5 years to 11 years, the pre-tax NPV5% would increase by C$275M (after applying an additional discount rate to calculate the value at Year 0). On an after-tax basis and assuming a total all-in tax and royalty pressure of 42% the positive impact of an updated PEA would be anywhere between C$150-175M based on our back of the envelope calculations.

This would be a massive improvement by any standard, and the after-tax NPV5% at Lamaque –keeping all other parameters stable- will more than double. In fact, based on what we now know, we would estimate the total after-tax NPV5% at approximately C$300M.

2. A weaker Canadian Dollar

The mainstream media – even in Canada – do like to point out the gold price has been weak lately. Whilst this is essentially 100% correct when you look at the gold price in US Dollar, the situation looks much better in Canadian Dollar.

In fact, whereas the most recent PEA used a gold price of C$1340/oz as base case scenario, the current spot price of gold in Canadian Dollar is approximately C$1470/oz. Based on an expected total gold production of 1.2 million ounces, the pre-tax undiscounted cash flow of Lamaque South would increase by in excess of C$150M by just using the current spot price of the gold.

The Blue Sky Potential: C-structures and historical evidence of mineralization at depth

Having a resource estimate containing 1.67 million ounces gold using a cutoff grade of 5 g/t (and 2.2 million ounces using a lower cutoff grade of 3 g/t) is already a huge and important improvement compared to the resource estimate where the first mine plan was based on.

However, despite having tripled the total resource estimate, the limits of the mineralization at Lamaque South still haven’t been discovered and Integra Gold has for instance discovered several C-structures in the past 12-18 months. These C-structures could play a very important role in the further development of the project as the C-Structures could be mined at a lower cost per tonne due to the steeply-dipping nature of the zones (the C-structures are dipping at an angle of 55-75 degrees and the majority of the ounces at the Triangle Zone are located within these C-structures).

There also seem to be more C-structures than originally expected as the company’s geologists have now identified a sixth C-structure at the Triangle zone of Lamaque South and as the Triangle Zone remains open in all directions it would be surprising if Integra would NOT find any additional C-structures, pushing the total resources to in excess of 2 million ounces.

Also keep in mind most of the high-grade vein systems and mines in Québec’s greenstone belt see their mineralization continue to a depth of approximately 2,000 meters (with Agnico Eagle’s LaRonde mine reaching a depth of 3,000 meters!). It’s imperative to realize the current exploration program at Lamaque South is exploring at a depth of approximately 600 meters (which is the deepest point of the indicated resource) whilst the historical production at the Lamaque mine reached a depth at 1,100 meters and the Sigma mine has reached a depth of 1,830 meters during its mine life. And there’s no reason (at least no geological or scientific reason) to think the Lamaque South zone would not continue at depth. The current 1.67 million ounce resource estimate could thus very easily be threefolded (assuming the system continues at depth) and suddenly Integra’s preliminary exploration target of 4.2 million ounces definitely seems achievable..

But there’s more to come. Much more.

Even though we already were pretty happy with the updated resource estimate which now contains 1.67 million ounces gold at an average grade of just in excess of 9 g/t, the Lamaque South resource will undoubtedly continue to grow.

According to the accompanying press release, announcing the resource update, in excess of 60,000 meters (of which 17,000 meters at Triangle) have not been incorporated in the resource update and as Integra Gold plans to drill an additional 100,000 meters in 2016, the current resource estimate is already outdated.

As the resources at Lamaque continue to expand, we wouldn’t be surprised if the average daily throughput would ultimately be increased from 1,500 tonnes per day to the 2,200 tonnes per day the Sigma mill is currently capable of handling. We’re not sure an updated PEA would already reflect this possibility but as Integra continues to find more gold it would make a lot of sense to try to optimize the production rate.

Conclusion

We feel sorry for Integra’s consultants because the moment they complete an updated technical report with a new resource estimate, that estimate is already outdated due to Integra’s very aggressive exploration strategy. We expect the company to have completed an additional 80,000 meters of drilling that has not been incorporated in the current resource estimate (of which almost 50,000 meters was drilled outside of Triangle, highlighting Integra’s district-scale land package).

We expect Integra to end the year with approximately C$20M in cash (after receiving an additional inflow of C$2.5M from a flow-through placement that closed right before the end of 2015), and together with the recoverable tax credit from Québec (C$2.75M) and the assumption the 30 million warrants at C$0.30 will be exercised, Integra Gold should be fully funded (or close to be fully funded) for the entire proposed C$32M exploration program to advance the Lamaque project.

Integra Gold is one of those very rare companies that were able to attract cash in a very weak market and seeing Eldorado Gold taking a strategic stake in Integra Gold is a huge vote of confidence.

The author holds a long position in Integra Gold. Integra Gold is a sponsor of the website. Please read the disclaimer