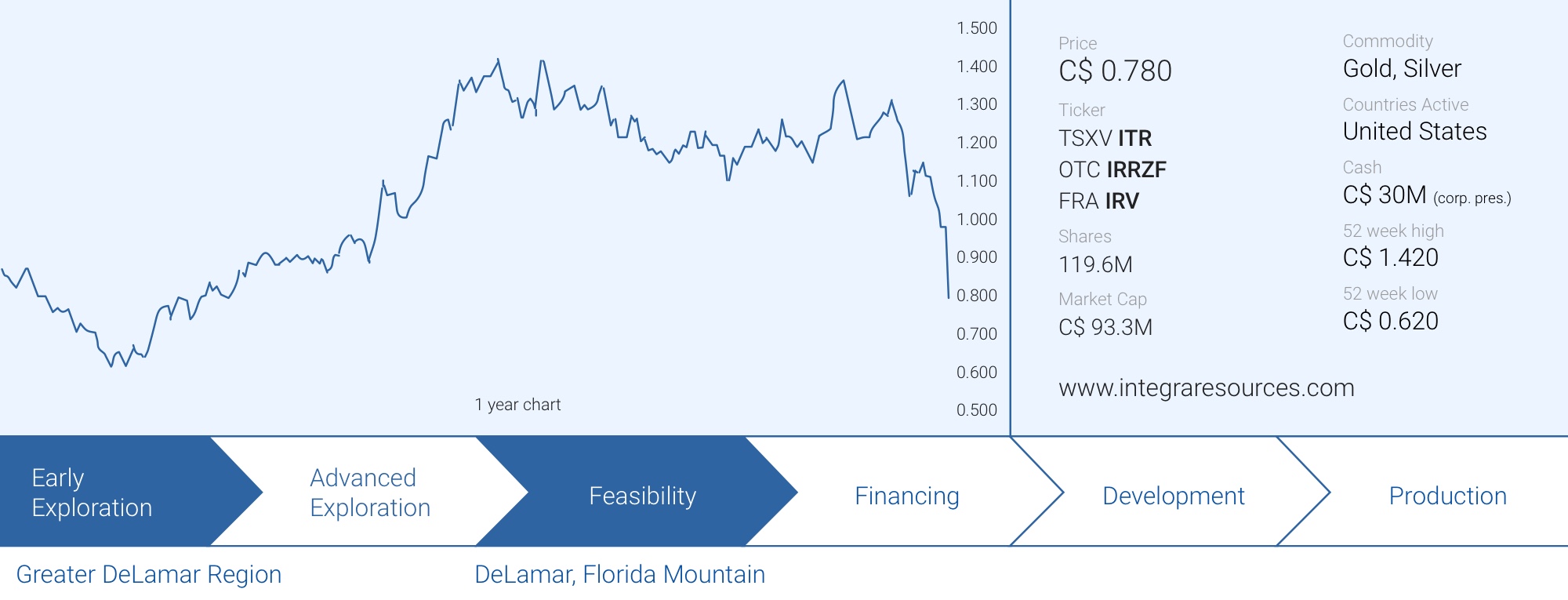

Integra Resources (ITR.V) has been rapidly advancing its DeLamar gold-silver project in Idaho, but the market hasn’t really rewarded the company for doing so. Despite the progress made and the higher gold price, Integra’s share price is currently approximately 40% lower than where it was trading pre-PEA and before the updated resource estimate. Now the stock is also trading 32% below C$1.15/share, the level Integra raised in excess of C$30M in Q4 last year. The drop isn’t related to the company’s operational performance and Integra simply couldn’t escape a sector-wide correction.

The weak share price doesn’t reflect the intrinsic value of the company and its project at all. The team has done everything right but doesn’t get rewarded with a higher share price, and this could be an opportunity as the project is shaping up to be a coveted prize for any mid-tier producer that would like to increase its exposure to a safe mining jurisdiction.

The upcoming exploration plans will provide more clarity on potential resource expansion

Integra is sitting on approximately C$30M in cash and plans to spend it wisely on further advancing its DeLamar gold project in Idaho. A total of (at least) 16,000 meters of exploration drilling will be completed while 7,000 meters will be drilled for additional metallurgical test work to nail down the recovery rates and best ways to process the rock.

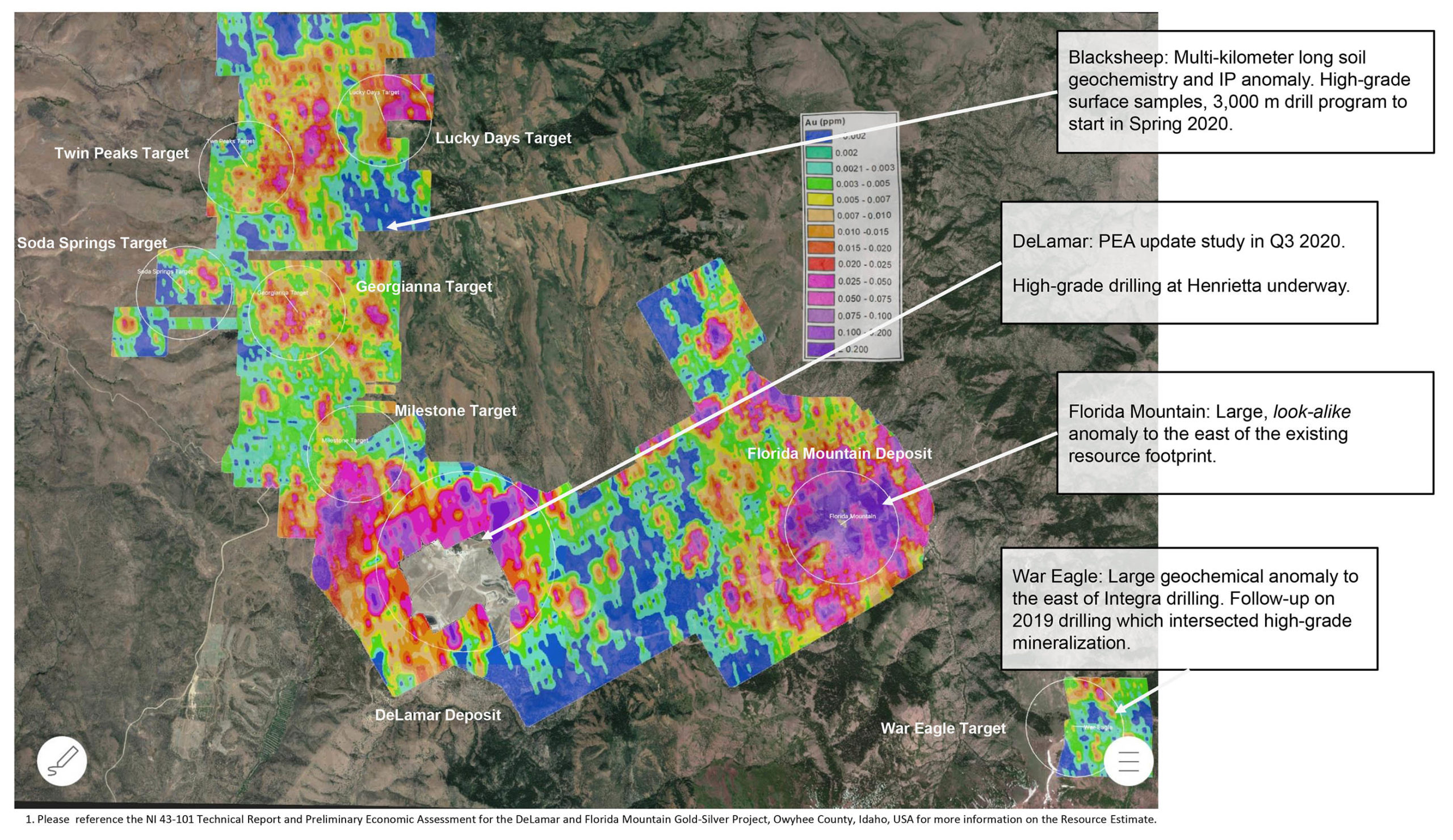

The bulk of the drilling will occur on the Florida Mountain deposit where 7,000 meters will be drilled and of specific interest will be to see the assay results from a newly discovered geochemical anomaly that is directly adjacent to the currently known resource at Florida Mountain. With a total size of 600 by 1400 meters (84 hectares), this zone has the potential to rapidly expand the Florida Mountain Resources (which currently contains 1.07 million ounces gold-equivalent in the M&I categories and an additional 100,000 ounces in the inferred resource category). Given the recent drill holes confirmed the existence of high-grade veins (with 1.52 meters of 40.39 g/t gold and 1.52 meters containing 9.77 g/t gold), Florida Mountain could still deliver positive surprises this year as Integra believes these intercepts could be related to the high-grade veins at depth that have been intersected and have been encountered in historical mining data.

The DeLamar deposit will only see a limited amount of drilling as the current plans include just 1,500 meters to be completed with a specific focus on the high-grade and silver-heavy Henrietta target. Henrietta won’t be the sole focus of the DeLamar drill program as the drill rig may be redirected to help out with the metallurgical drill program at DeLamar where the bulk of the drilling will take place as Integra wants to get a better understanding of the sulphide zones (Called ‘unoxidized’ rock by the company) to support an expanded plan to mill the sulphide rock as the silver recovery rate would more than double and the gold recovery rate would be boosted by a double-digit percentage. The Company expects that the expanded mill scenario would significantly boost the potential production profile which is 124k oz AuEq over 10 years according to the PEA.

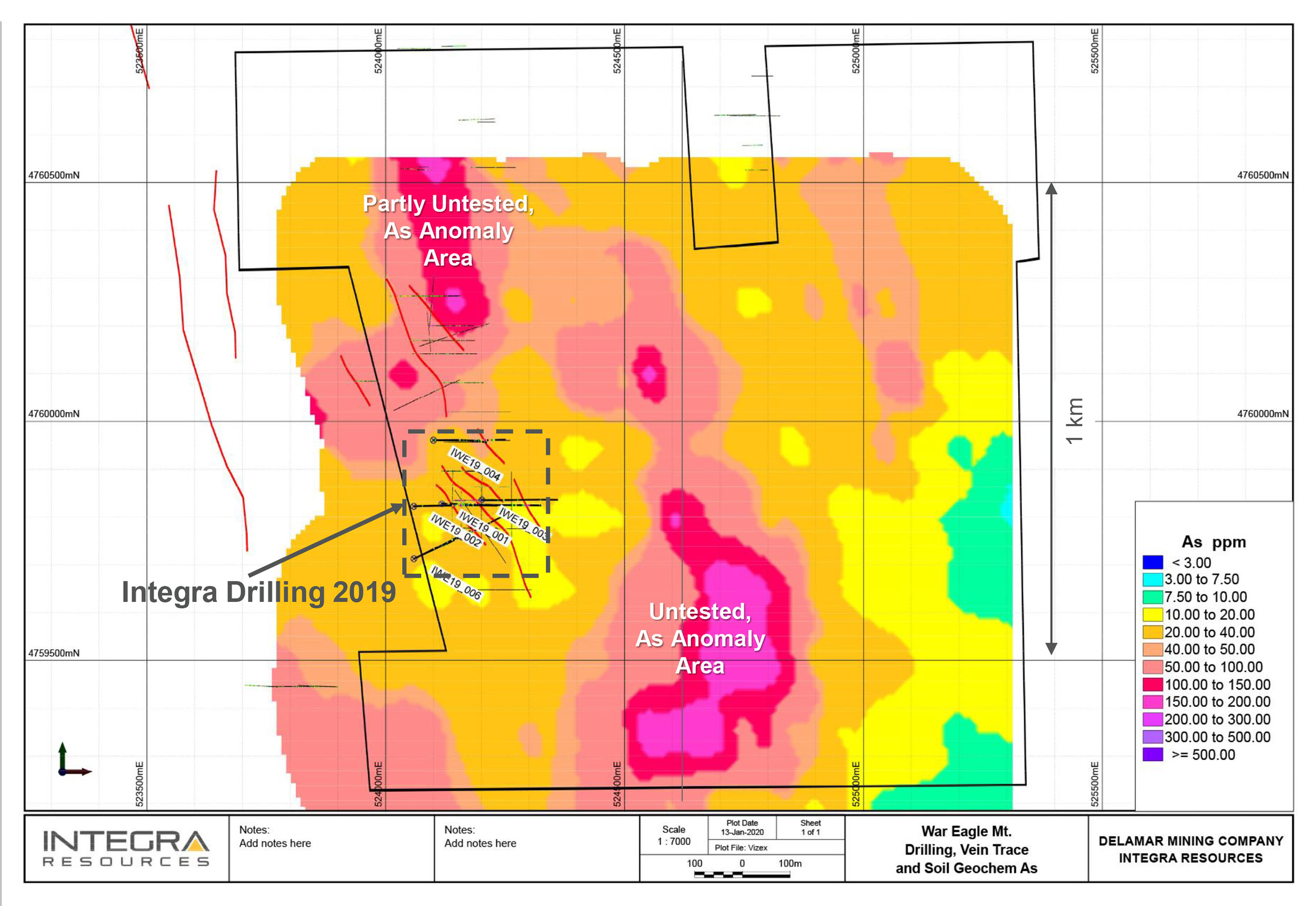

5,000 meters will be drilled at War Eagle, the deposit located just a handful kilometers away from Florida Mountain. Integra will be chasing higher grade ore shoots at War Eagle (which was one of the highest-grade mines about a century ago). Integra will zoom in on some of those shoots and subsequently try to follow those veins towards potential high-grade veins that ‘created’ those shoots. There is also a large geochemical anomaly to the east of the drill holes completed by Integra which has not been tested.

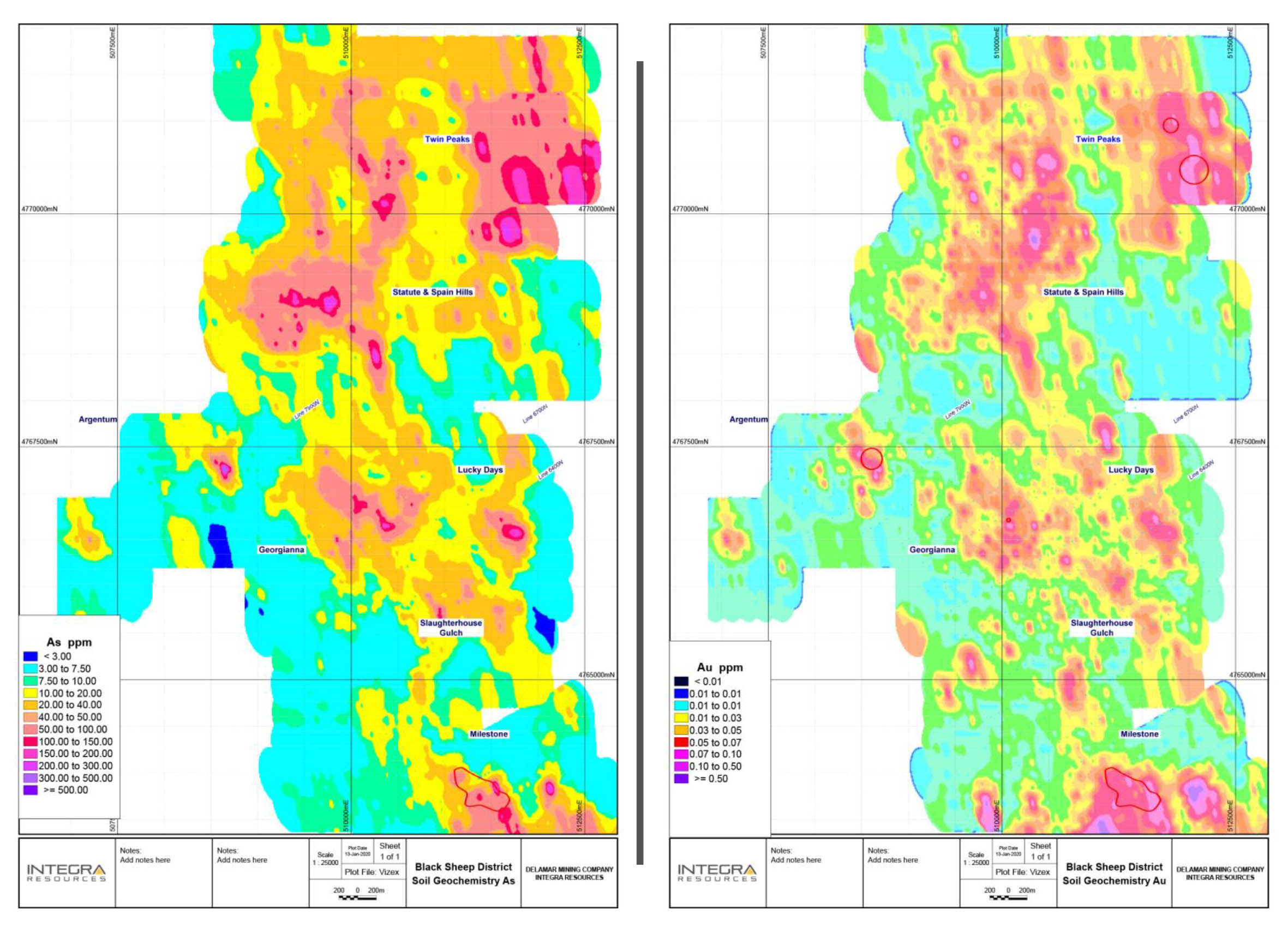

The remainder of the drill program will be conducted in the Blacksheep area, where Integra is planning to complete 3,000 meters of drilling on the several high priority exploration targets in a 25 square kilometer area. These high exploration targets were defined through geochemical soil anomalies as well as IP surveys, and Integra seems to be keen on putting a few holes into the Georgiana, Statue, Twin Peaks and Spain Hills areas.

As the vast majority (almost 90%) of the existing resource is already part of the measured and indicated resource categories, Integra’s exploration plans contain very little infill drilling as the first phases of the exploration campaign at DeLamar. This year’s exploration program will be solely focusing on resource expansion as Integra is aiming to push the total gold-equivalent resource above 5 million ounces and possibly getting close to the 6 million ounce mark which should once again increase the inbound interest from corporates. The drill program is also aimed at delineating a high-grade resource that would potentially displace some of the lower-grade material going through the mill. Increased grade at the mill has the potential to create serious torque at the Project.

The updated PEA will include more sulphide mineralization

Although the original PEA, which was published in September 2019, did contain a milling scenario, Integra wanted to conduct more metallurgical test work before adding additional sulphide tonnes to the mine plan.

Now Integra Resources is working on a new PEA to incorporate the large sulphide component at DeLamar. This updated PEA will be presented as an alternative option to the previous PEA. The 2019 is robust and profitable and provides a path forward that Integra Resources could potentially finance and build. The second PEA will probably include a larger mill and capex; however, this option has the potential to significantly increase the production profile, making it appealing to larger operators.

As the updated PEA is only expected to be published in September, there still are a lot of moving factors and over the next few months, we will probably get a better idea of what the company is focusing on.

But as mentioned above, we expect the mine life and NPV to increase, but depending on when the mill will be built, the initial capex will increase as well. This means the IRR will very likely come in lower as well (obviously assuming an unchanged gold price compared to the first PEA).

And this will result in Integra being able to cater to two potential types of suitors. Senior producers will be looking at the total amount of ounces that could be recovered and the mine life (and the updated PEA will cater to that scenario) while smaller (mid-tier) producers may want to focus on higher rates of return and higher operating margins rather than optimizing the mine plan for a maximized production.

Again, time will tell how much the new scenario will differ from the ‘old’ scenario and once we see a few more details over the next few months we will develop our own back of the envelope calculations to figure out what we can expect. But once the new PEA is completed, Integra has two options to move forward with DeLamar: a low-capex smaller operation, and a higher capex larger mine.

Integra Resources is fully cashed up after taking advantage of a financing window

Every non-revenue company needs to tap the capital markets to fund its exploration and development plans. After the PEA was published, Integra Resources was able to close a substantial bought deal of C$25.3M on the back of a strategic investment made by Coeur Mining (CDE) to the tune of C$6.6M.

The cash was raised at a fixed price of C$1.15 per share and did not contain a warrant which means the entire Integra Resources capital structure remains warrant-free. There are 10.9 million options outstanding which means there’s room for about 1 million additional options, but that’s about it. The 7.37 million options that were circulating before the capital raise had an average exercise price of C$0.96 while the most recent batch of options (3.56M options, to be precise) were priced at C$1.15 which was the level the most recent financing was completed at.

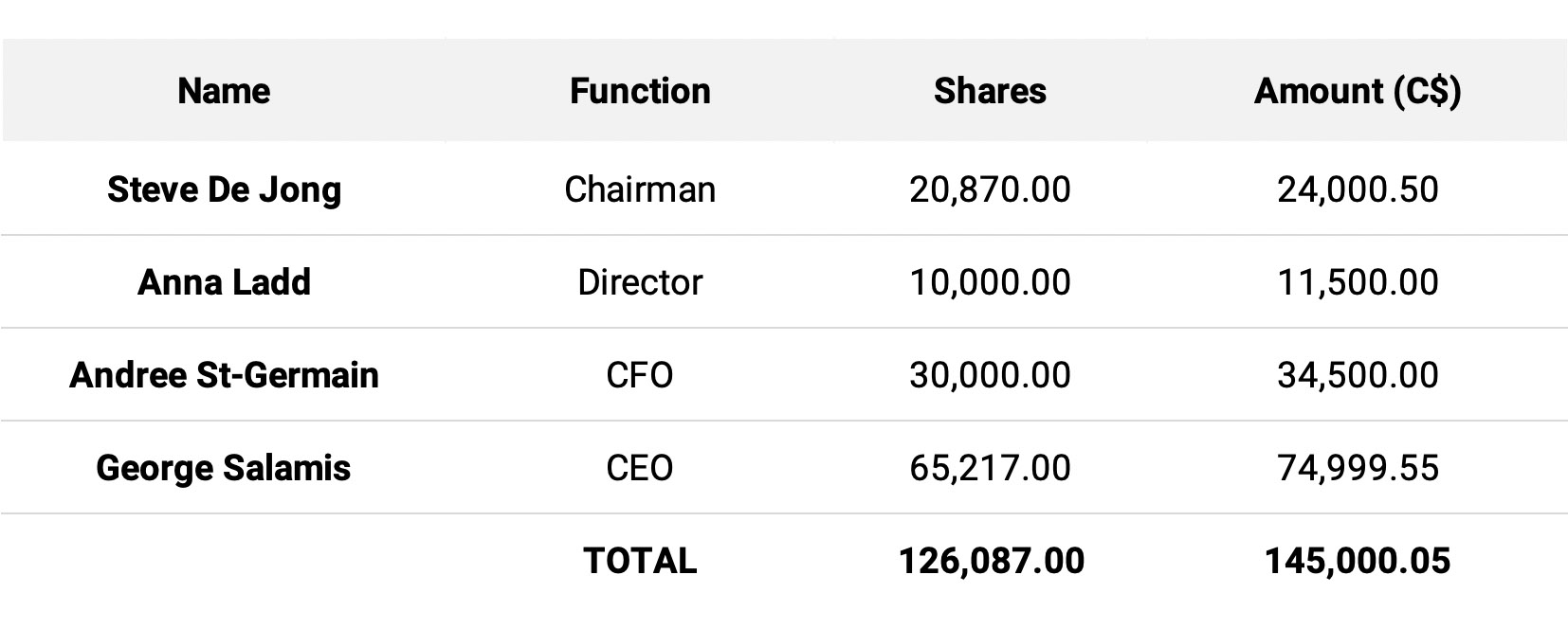

It was also encouraging to see the level of insider participation in the recent C$1.15 financing. We have summarized the insider filings related to the financing below:

And according to recent filings, CFO St-Germain took advantage of the pennystock status of Integra Resources to add 15,600 shares to her position at an average share price of C$0.96. And last Friday, CEO Salamis added 20,000 shares to his position at an average price of C$0.83 (rounded).

Integra will file its year-end financial results in April, but according to the company’s presentation, it still has approximately C$30M in cash on the bank account which puts Integra in a very enviable position as capital remains scarce in the junior exploration space.

Conclusion

We can only imagine the level of frustration in the Integra offices when the company’s share price gets pushed down along with others on weak market days. One would expect a company with a 4.4M ounce gold-equivalent resource would be more resistant against market turmoil but unfortunately Mr. Market doesn’t seem to be making any distinction.

Fortunately, Integra cashed up when it had the opportunity to do so and this means the company is in a comfortable position to complete its 2020 exploration program, complete the new PEA which should show a higher NPV and a higher amount of gold recovered compared to the 1.03 million ounces in the first PEA (and 16.6 million payable ounces of silver). Meanwhile, the budget to further de-risk the technical side of the project remains intact.

Our main fear at the current price levels is that we will wake up one day and see a takeover offer on the table that would perhaps contain a nice premium to the current share price, but still undervalue the flagship project. Ultimately it’s the shareholders that will have to decide on accepting any offer the board of directors deems reasonable and although the majority of the shares are owned by institutional investors, you never know what they might decide to do given the current market circumstances and the flight towards liquidity.

The bottom line is that although Integra’s share price is about 40% lower than where it was trading at in early February, the company and project appear to be in a better shape than ever before.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website.