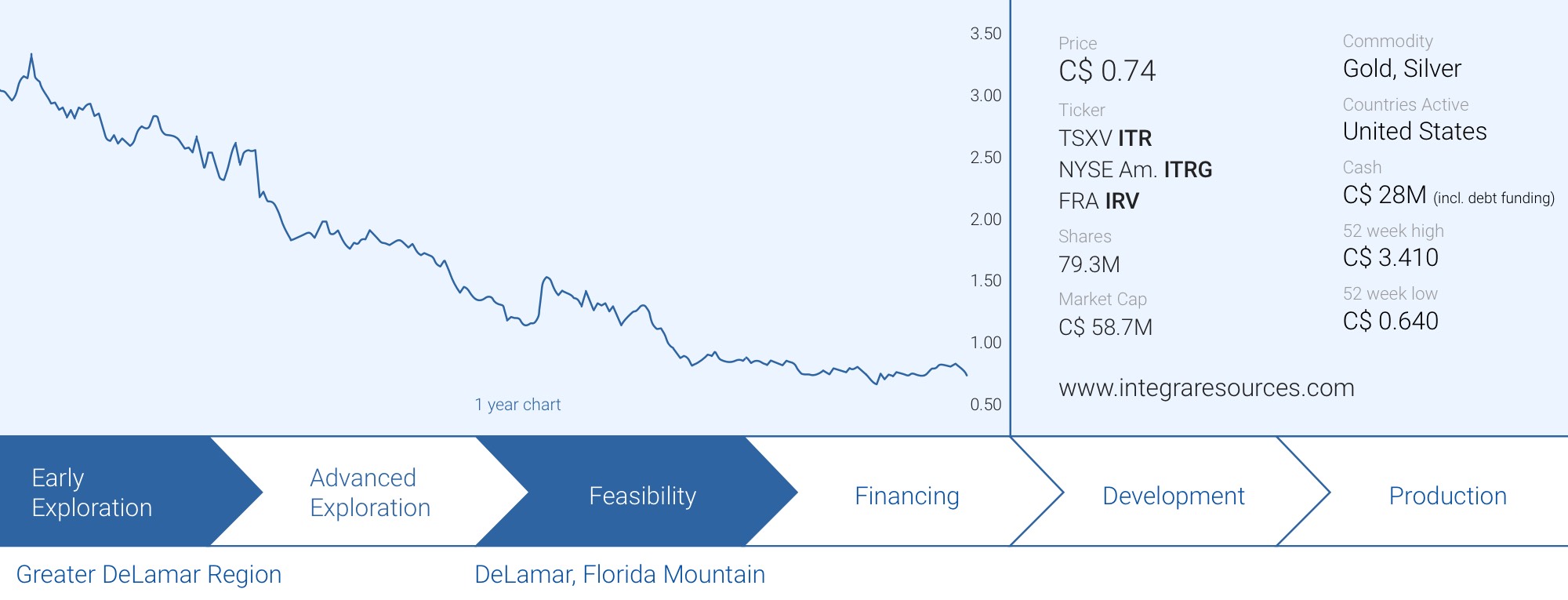

It appears Integra Resources (ITR.V, ITRG) is still in the “inflationary” penalty box for what was initially thought to be a disappointing pre-feasibility study in February of this year. However, reality has now caught up to the mining sector and pretty much every single study that’s currently being published by companies is showing the impact of the inflationary environment.

While you could argue smaller companies are always overly optimizing their studies in an attempt to get noticed by the market, even the larger companies have had to confess serious capex and opex overruns. Ask IAMgold (IAG, IMG.TO) how their Cote Gold Project is doing, as the senior producer had to sell its Rosebel mine in Suriname in an attempt to cover just a portion of the capex increase. And even more recent, OZ Minerals (OZL.AX) in Australia saw a 50% capex increase in the feasibility study on the West Musgrave nickel-copper project. And Skeena’s Eskay Creek before that, and Argonaut Gold’s (AR.TO) Magino project before that one, and so on, and so on…. The situation has become so punishing for so many pre-development companies that we understand that many are trying to delay studies or not release studies at all, in the near term.

Integra Resources was the first but most definitely not the only or last one to incur the impact of inflation on the capital expenditures and the overall economic outcome of a project. But for some reason, the company is still being punished for it.

Meanwhile, Integra is looking at all options to increase the value of the DeLamar project. The immediate focus is on expanding the heap leachable resources as that is where the ‘easiest’ upside potential could be generated. While the construction of a mill for the sulphide phase is in limbo at the current gold price, the heap leach facilities are the first phase of the mine project and should/will be built anyway. This means that every year that could be added to the current mine life would add value.

Recent drill results confirm there’s more gold at Florida Mountain and BlackSheep

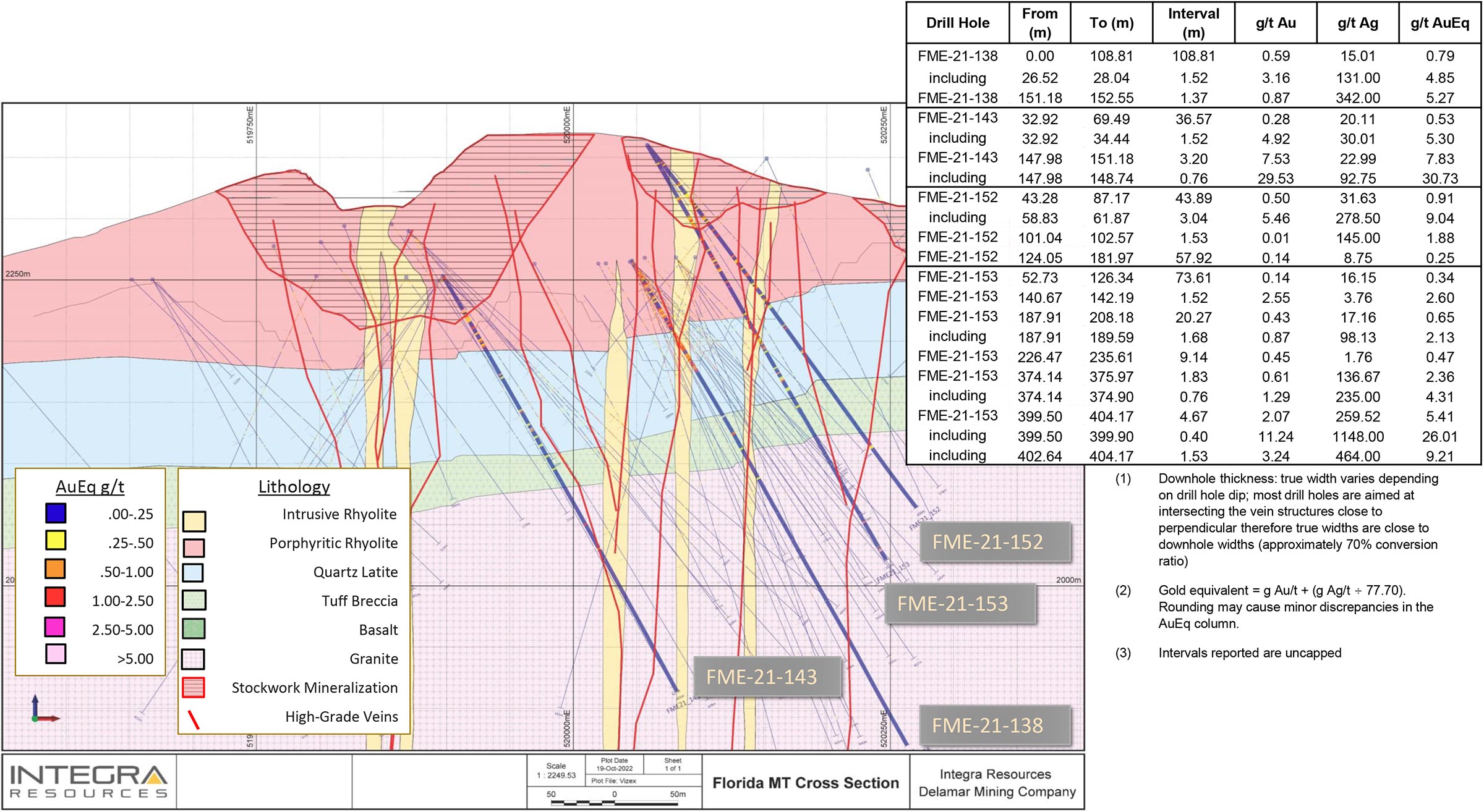

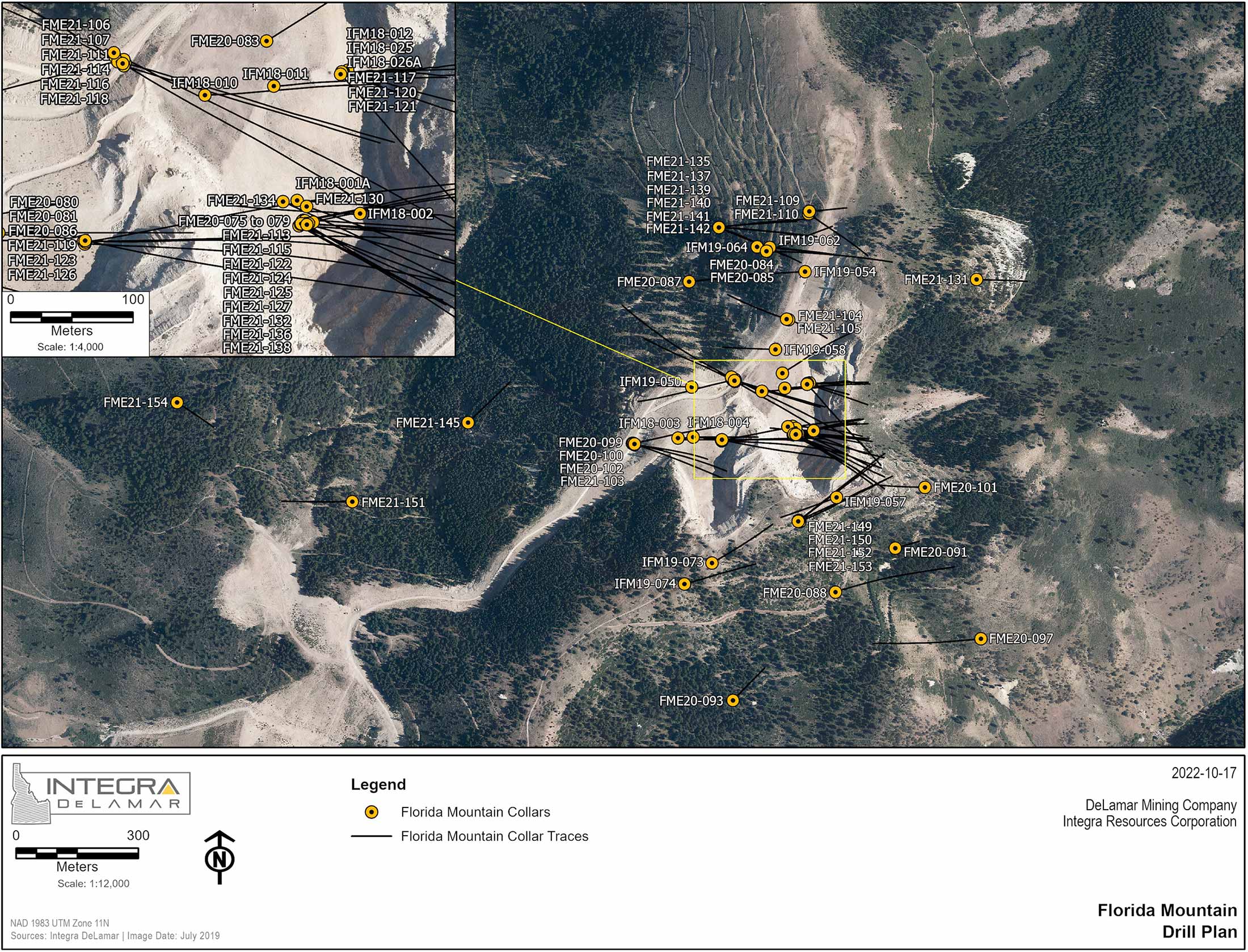

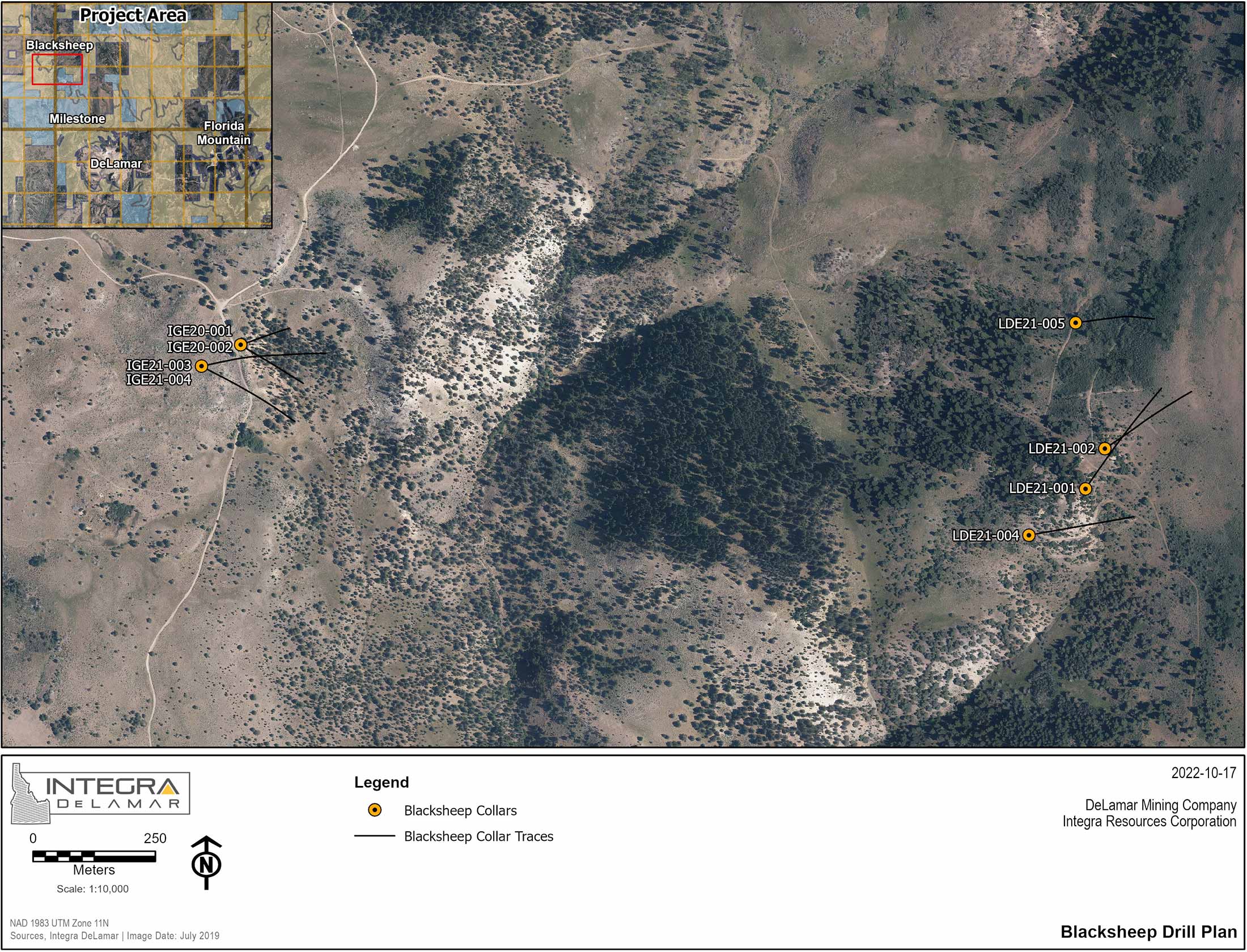

Integra Resources released additional drill results on October 20, publishing drill results from both the more advanced Florida Mountain area as well as the BlackSheep greenfields exploration project.

At Florida Mountain, the company highlighted an interval of almost 109 meters containing 0.59 g/t gold an 15.01 g/t silver for a total gold-equivalent value of 0.79 g/t. This interval contains a higher grade interval of 1.52 meters containing 3.16 g/t gold and 131 g/t silver for a gold-equivalent grade of 4.85 g/t. The most interesting element of this drill interval is the fact the mineralization starts right at surface. A second separate mineralized zone was detected approximately 42.5 meters below the end of the thick lower-grade interval, and yielded 1.37 meters of 0.87 g/t gold and 342 g/t silver. While the company is consistently reporting gold-equivalent grades, this deeper and higher-grade interval clearly is a silver-heavy interval and using the same 77:1 silver:gold ratio, the 0.87 g/t gold has a silver-equivalent grade of 67.7 g/t for a total silver-equivalent grade of almost 410 g/t.

While hole FE-21-138 was the best hole, there were plenty of other interesting holes, and we are mainly interested in the gold and silver mineralization occurring close to surface. While the narrow but high grade results are great, it doesn’t look like the market will reward Integra for it anyway. High grade, narrow vein mining is a tough game with Pure Gold Mining (PGM.V) one of the most recent victims. Companies are sticking to lower-cost, lower risk open pit mining and heap leaching for now, and for a reason. What could potentially be very helpful for the company is the mineralization encountered in the upper 100 meter layer of the Florida Mountain deposit as that’s generally the area the oxide and transitional mineralization can be found, and it’s those two types of mineralization that will likely be amenable to heap leaching.

Keeping that in mind, hole 21-140 could potentially be interesting with three distinct zones of mineralization with almost 15 meters of 0.28 g/t AuEq (on the lower end of the spectrum but potentially still viable as that rock would have to be moved anyway to reach the deeper and higher-grade mineralization) followed by 32.6 meters of 0.32 g/t AuE and almost 69 meters of 0.44 g/t AuEq.

We see a similar trend in holes 21-141 and 21-142 with in both cases 69 meters of respectively 0.42 g/t AuEq and 0.30 g/t AuEq as results. While none of these results are jaw-dropping on a grade basis, it does add and confirm the presence of oxide-hosted ounces and will add value to the heap leach scenario.

The company also released the assay results from the BlackSheep target. This target is a little bit a different beast as the oxidized mineralization doesn’t run as deep as at Florida Mountain. On average, the upper 40 meter of the mineralization at BlackSheep are characterized by oxidized and mixed oxide material. This could also potentially be leachable, but Integra will need to complete additional met work on the material before knowing for sure. The highlights of the BlackSheep results can be found in the table below.

None of these holes, with the exception of a portion of hole FME-21-138 drilled at Florida Mountain, was drilled in an area that is part of the current resource at DeLamar, so pretty much every single hole adds value. Either in tonnes or ounces, or in gathering more geological data on how the gold and silver mineralization ‘behaves’.

A new drill program will focus on the ‘low-hanging oxide fruit’

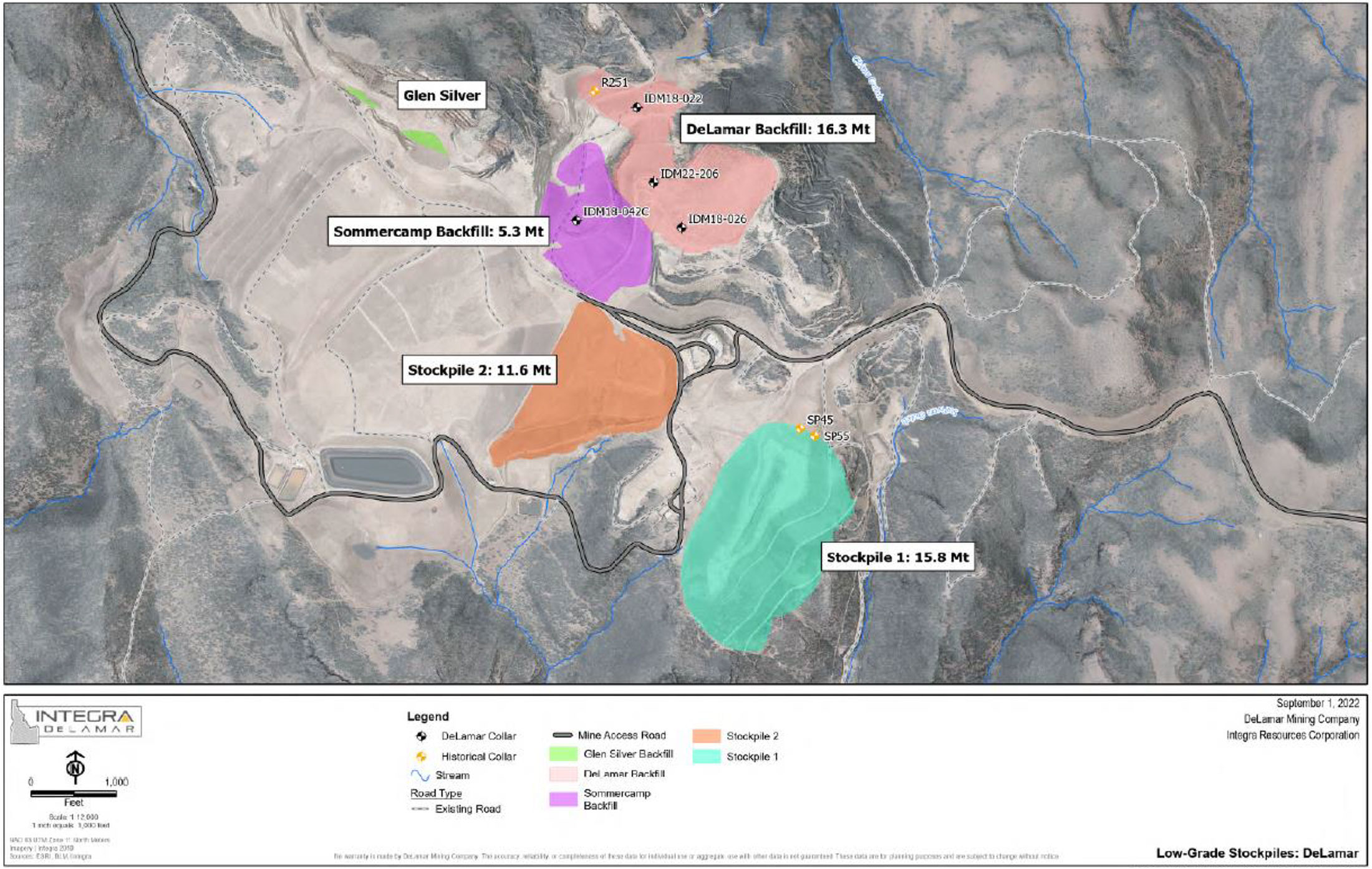

Additionally, Integra has started another substantial (11,000 meter) drill program at DeLamar using a sonic drill rig. This should be a relatively low-cost program to test the roughly 60 million tonnes of low-grade material that’s currently present on the property. These 60 million tonnes consist of a blend of historical low-grade stockpiles consisting of material below the historical mill cut-off of 0.86 g/t AuEq) and oxide mineralized material used as backfill for historical pits. This is a low-risk approach to further extend the mine life of the heap leach phase of the project beyond the initial 8.5-9 year mine life there.

This approach is low-risk because it is widely known there are plenty of tonnes lying around as Kinross Gold (K.TO, KGC), the previous owner of DeLamar drilled twelve holes into the Eastern End of Dump Pile 1 and these twelve holes averaged 0.31 g/t gold and 24 g/t silver (for a gold-equivalent grade of 0.61 g/t using a 80:1 silver:gold ratio). While that is lower than the anticipated average gold grade of 0.40 g/t gold in the heap leach scenario, the silver grades (17.3 g/t) in the current mine plan are lower which results in pretty much the same 0.61 g/t AuEq grade.

We know the heap-leach recovery rate for silver is worse than for gold, so we wanted to compare these typical grades on a post-recovery basis. Applying the same recovery rates of roughly 71% for the gold and 40% for the silver (the average recovery rates used in the pre-feasibility study based on the average of the DeLamar and Florida Mountain recoveries), the net recoverable AuEq grade of the twelve holes drilled by Kinross on the low grade stockpile would be 0.34 g/t AuEq compared to 0.37 g/t AuEq in the heap leach scenario. While the current 11,000 meter drill program will have to confirm the grade and grade variability of the stockpiles and dumps, the net recoverable grade appears to be very much in line with the grades used in the current mine plan. And considering this would be just a large earth-moving exercise (and no blasting will be required considering these are historic stockpiles), that small grade difference should not have a major impact on the economics and/or the viability of the project.

And as we explained in a previous report, even if only 30 million tonnes could be added to the current mine plan, the net gold-equivalent production will increase by 325,000 ounces at a comparable AISC of just over $800/oz on a gold-equivalent basis (treating both precious metals as co-products).

While the exploration team will be busy adding tonnes and ounces to the resources and hopefully to the mine plan in a later stage, Integra Resources continues to work on its baseline studies which are now over 80% complete. This means the company remains on track to submit its Mine Plan of Operations to the Bureau of Land Management in late 2023.

Conclusion

It looks like Integra is still being punished for publishing a realistic, inflation-impacted pre-feasibility study back in February. In the past eight months since that study was released, pretty much every other aspiring producer out there had to revise studies, or delay them outright, due to the impact of inflation on the cost of energy, labor and construction materials. Integra was just unlucky to be the first one to publish a study with updated inputs, and it appears to be unfair to still have to deal with the fallout as the headwinds are not Integra-specific, but an issue every company has to deal with on a worldwide basis.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website.