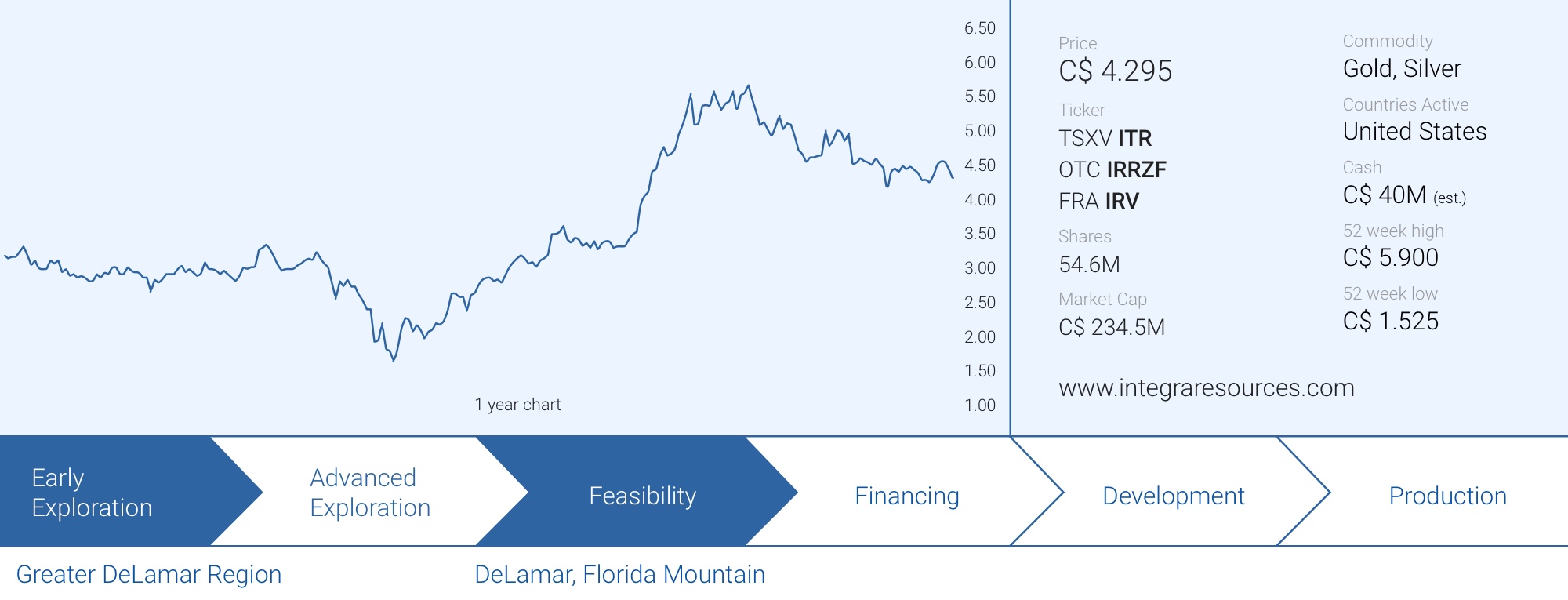

When you combine a good project with a strong exploration team and a robust management team, good things can happen. That’s exactly what Integra Resources (ITR.V, ITRG) is all about. Since acquiring the project from Kinross Gold (KGC, K.TO), Integra has released a multi-million-ounce resource and a PEA which emphasizes how robust the DeLamar project is, even at for instance US$1250 gold which is even lower than the base case scenario used in the PEA.

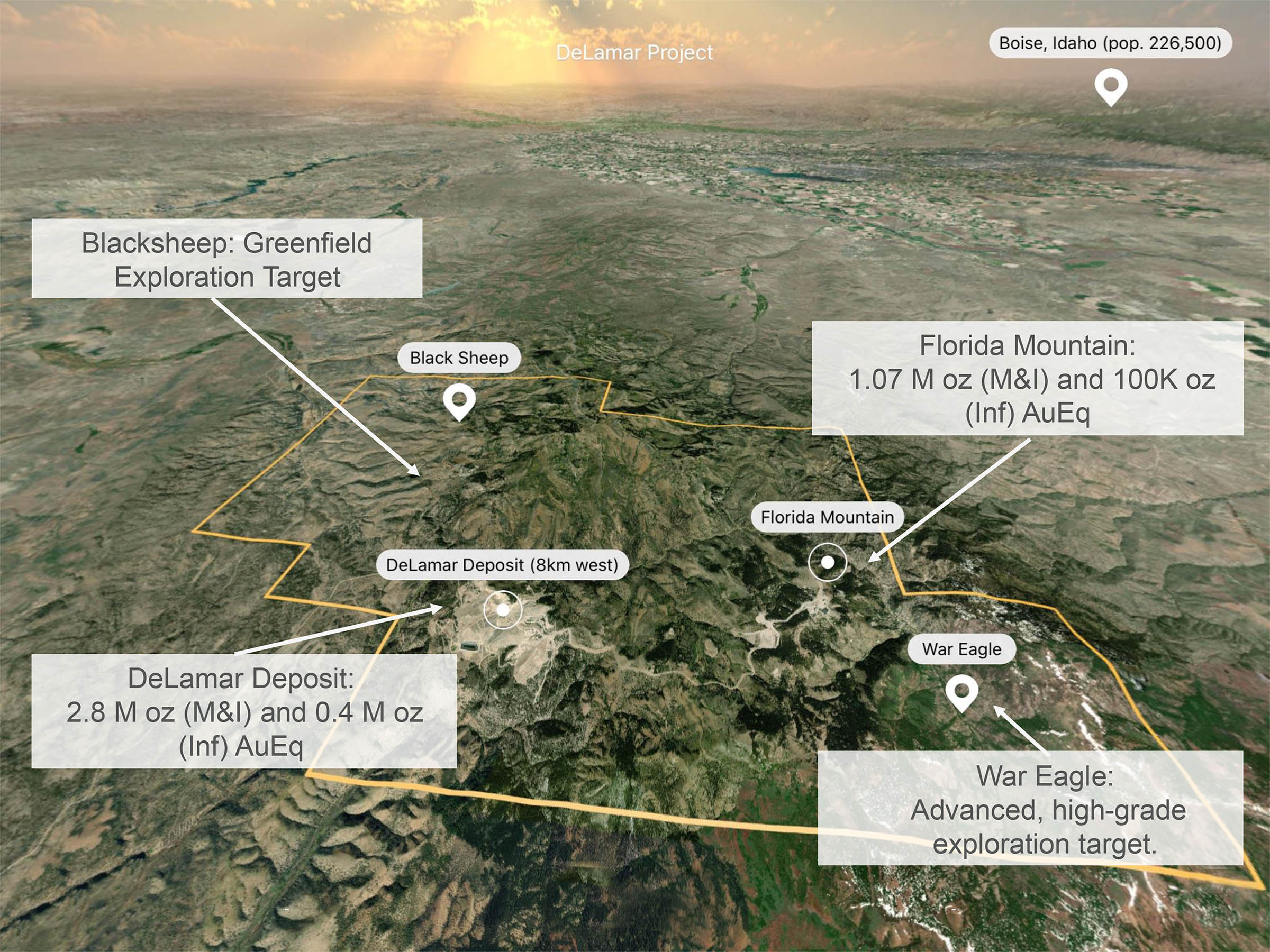

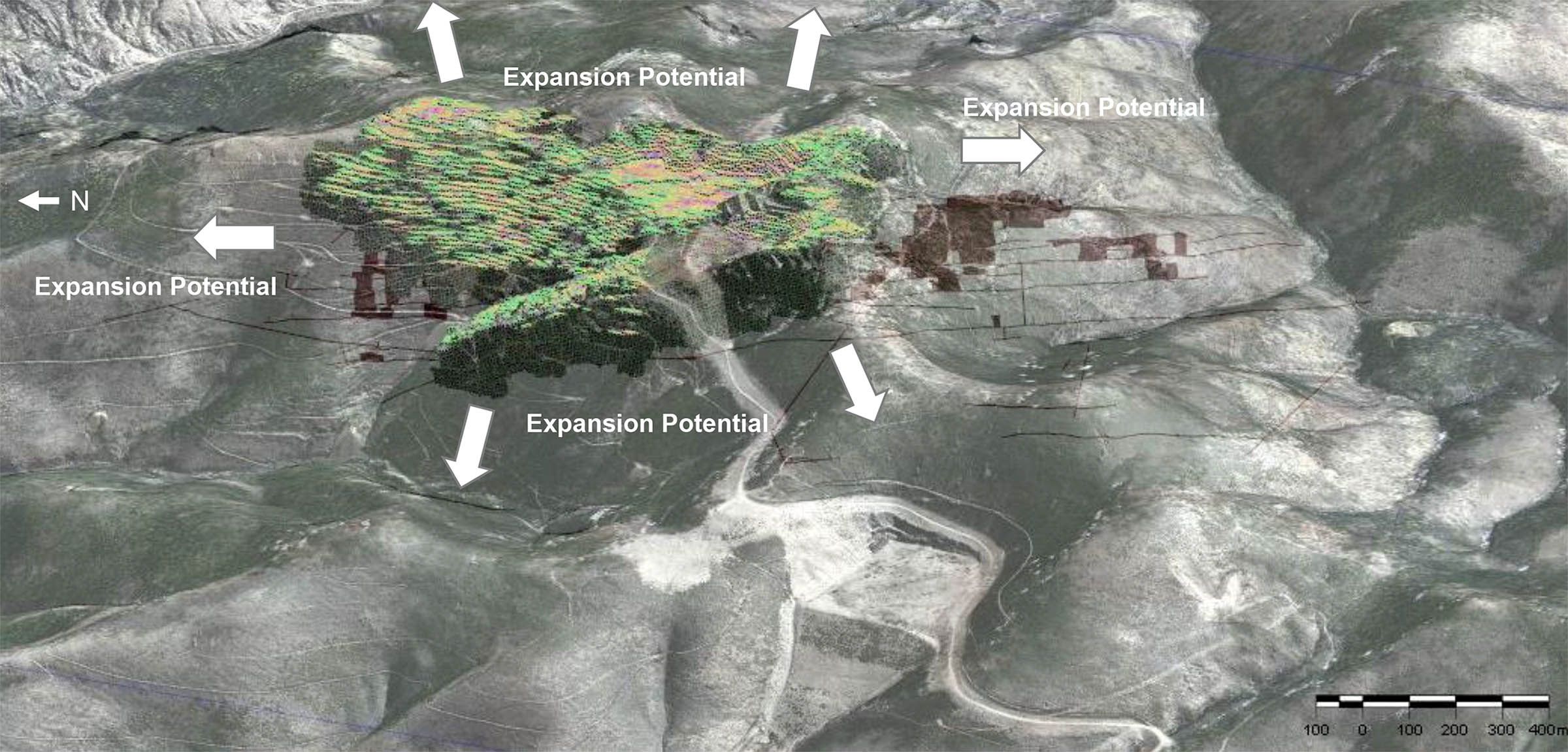

Turns out, the initial resource and PEA were just the start and the assay results from the drill programs conducted over the past 12-18 months seem to indicate there is plenty of upside potential left. Integra has been zooming in on the high-grade vein structures at Florida Mountain which have the potential to quickly add ounces allowing Integra to re-think (read: expand) its sulphide milling plans while regional exploration targets in the immediate vicinity could add heap-leachable oxide and transitional mineralization as well. The 2020 drill program is still in full swing and this will result in a resource update in H1 2021 and a detailed pre-feasibility study by the end of 2021.

With about C$40M in cash in the bank (our estimate), an upcoming resource update which will probably contain in excess of 5 million ounces gold-equivalent (again, our estimate) and the current gold price staying close to the $2000/oz mark, the stars may be aligning for Integra Resources.

The drill bit continues to deliver

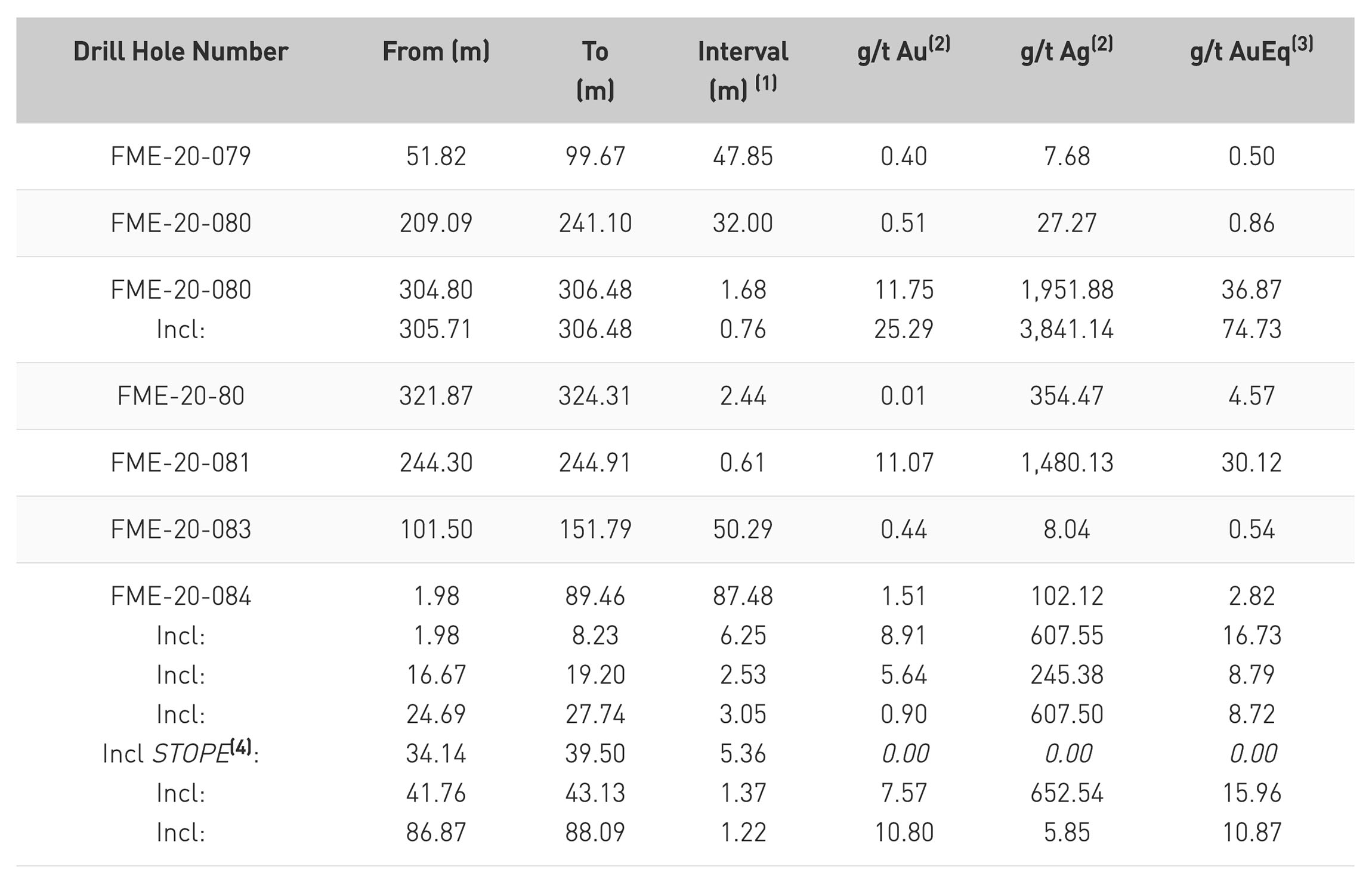

Integra released assay results from an additional five holes that were drilled on the Florida Mountain area of the DeLamar, the results of which you can find below.

Integra’s three drill rig program continues to deliver high-grade gold and silver results at Florida Mountain where Integra has been focusing on the high-grade vein structures (with a more specific focus on step-out drilling beyond the current resource boundaries). However, in order to reach some of those zones, Integra needs to drill through previously detected mineralization and the consequence is something we would call ‘accidental infill drilling’. Although not a priority, some holes trying to hit new mineralization will act as an infill hole for previously known mineralization as well. A total of 7,000 meters of drilling has been earmarked for exploration at Florida Mountain and the five holes above represent approximately 1/5th of that drill program. The results are pretty consistent with the exploration theory there as the lower grade thicker zones closer to surface are underlain by narrow, steeply dipping but high-grade veins. The company’s exploration team has now modeled seven of those high-grade vein structures which appear to occur as plunging shoots. In fact, hole 84 is an excellent testament to the exploration theory as that specific hole successfully intercepted several of the shoots modelled by the Integra geologists.

It’s perhaps a bit disappointing to see the lukewarm reaction of the market to these excellent drill results and perhaps investors have already been spoiled with high-grade drill results this year. Back in July, for instance, Integra reported multiple high-grade intervals at Florida Mountain with 1.5 meters containing almost 73 g/t gold and almost 11 meters of 6.8 g/t gold (and 7.65 g/t gold-equivalent) as eye-catchers.

The company had four specific targets for its 2020 drill program and two of those targets were zooming in on Florida Mountain where the two-pronged approach was focusing on drill-testing the down-dip extensions of high-grade and almost vertically plunging shoots while expanding the oxide footprint at Florida Mountain was also high on the list.

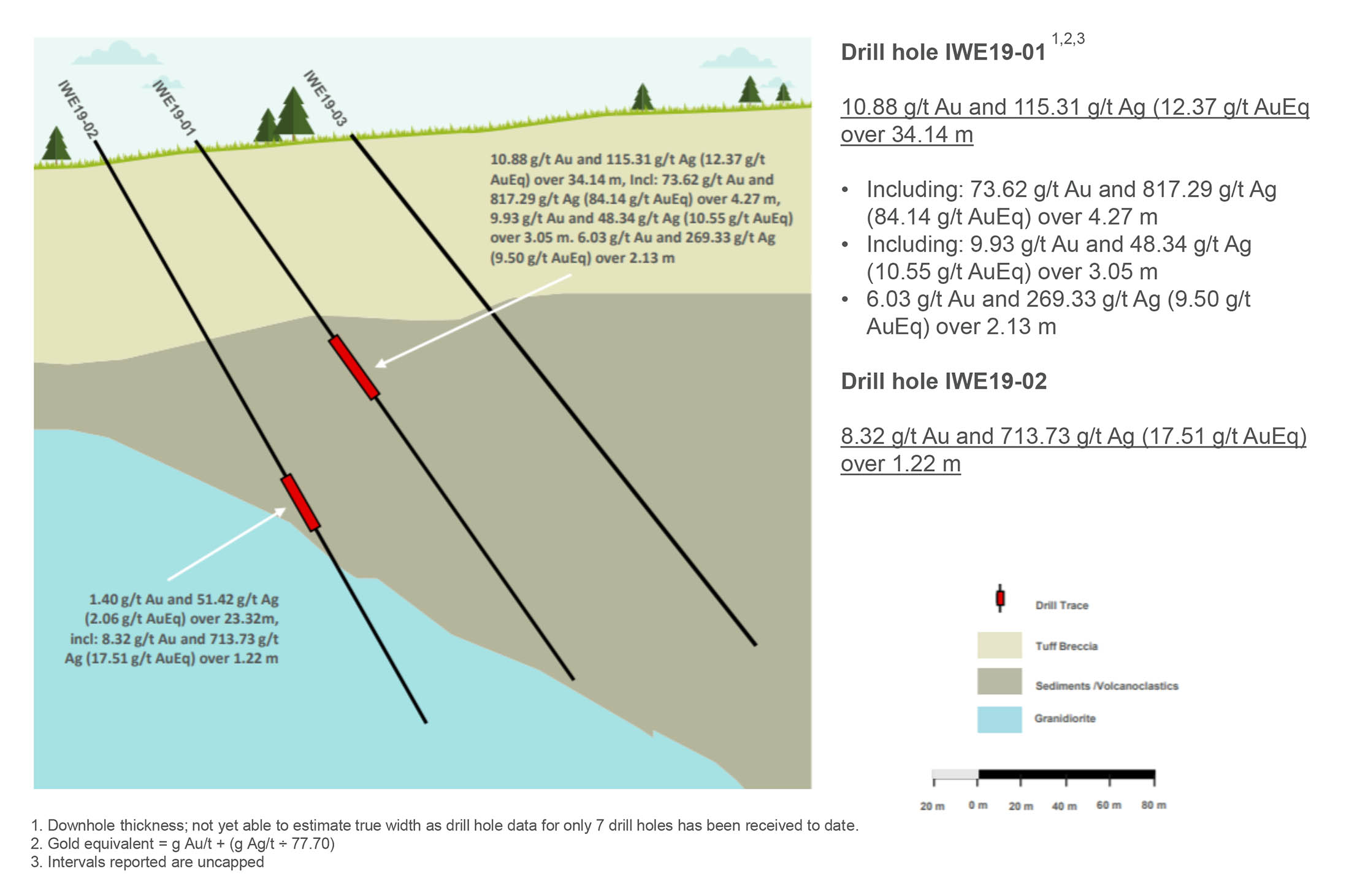

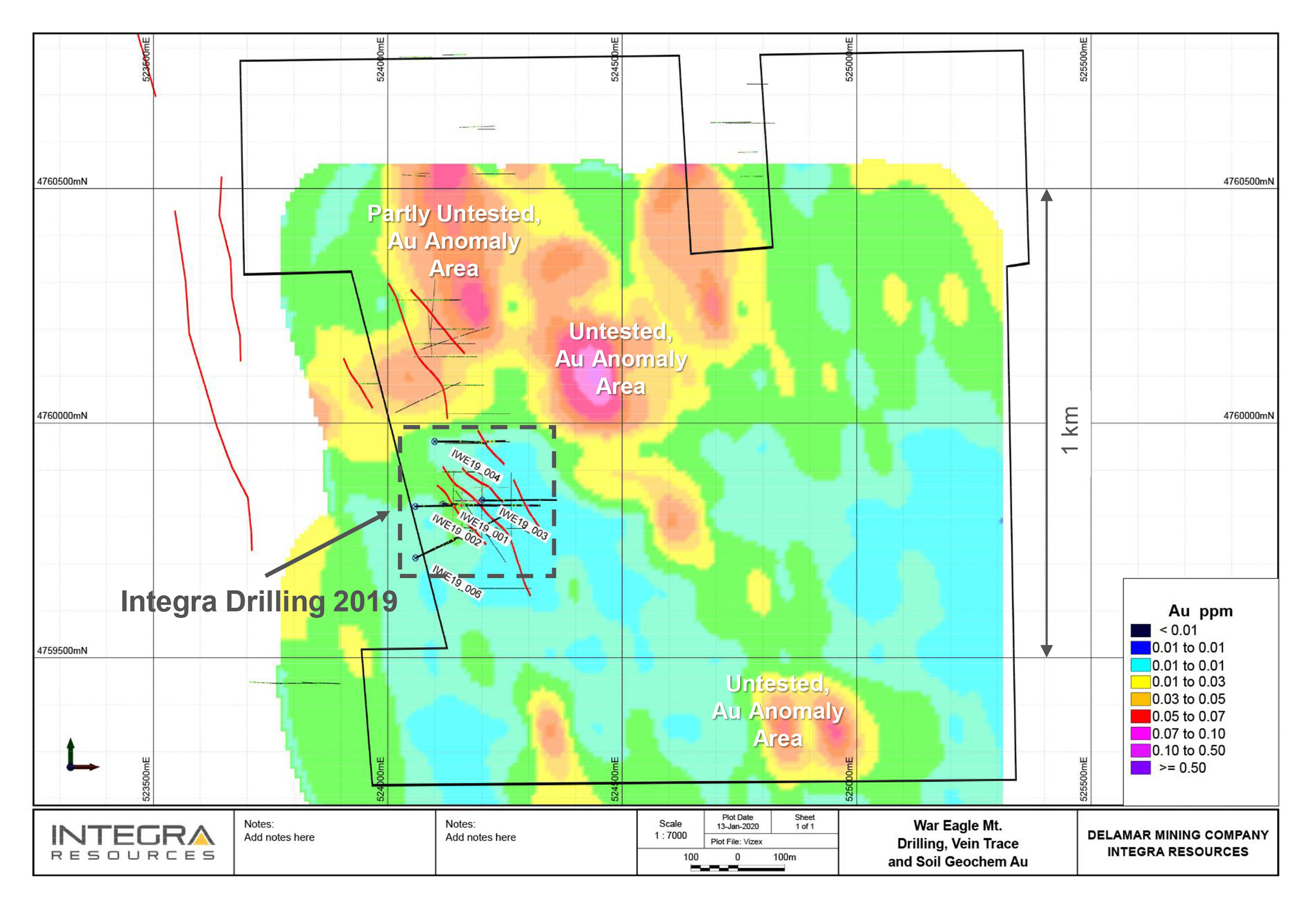

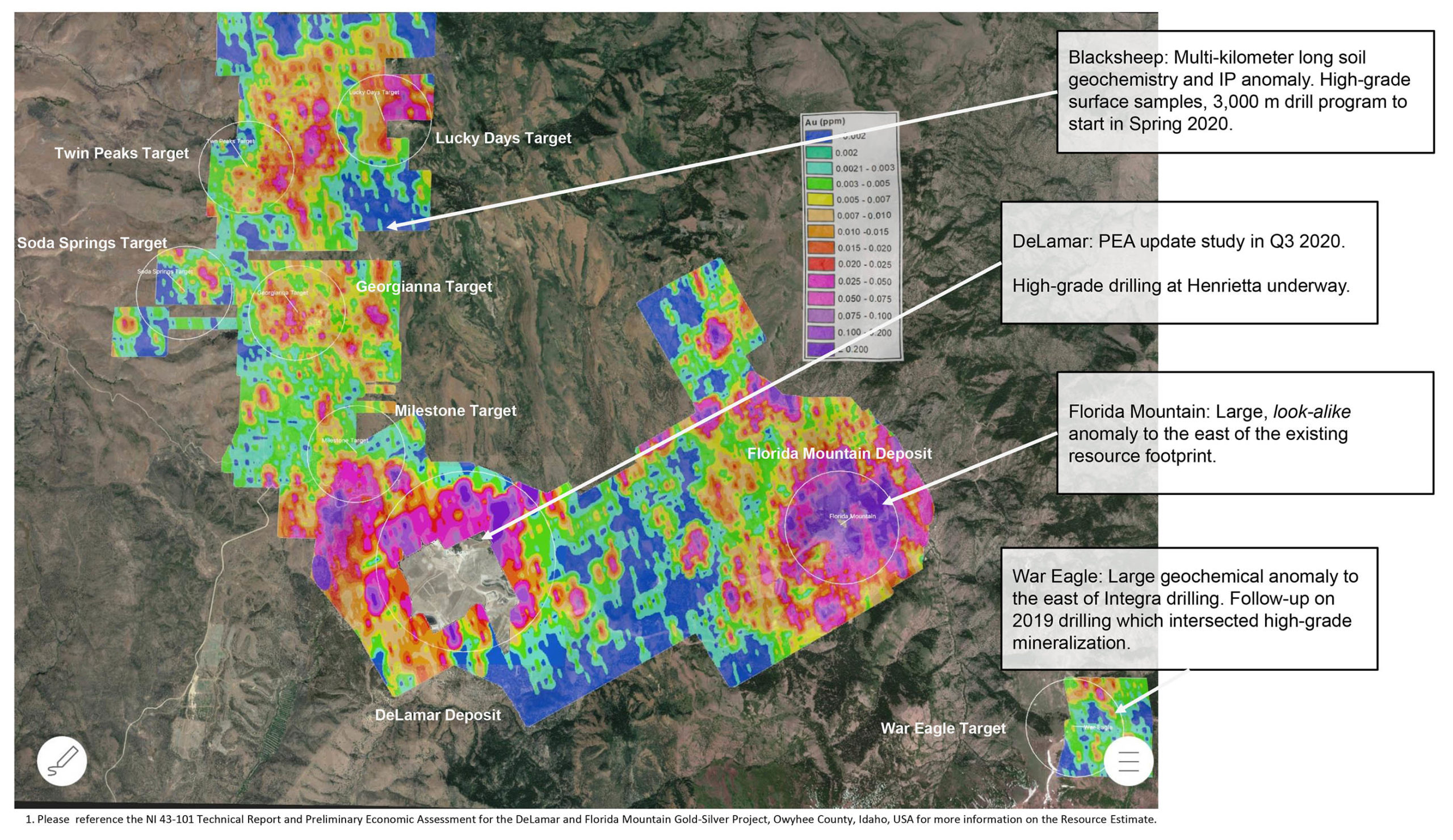

Of course, Florida Mountain is just one of the areas Integra Resources is drilling this year. Right now, two rigs are drilling at Florida Mountain and a third rig is working on the War Eagle zone focusing on the high-grade areas while perhaps doing some work towards the east of the high-grade vein system where Integra’s previous exploration efforts have outlined a large geochemical anomaly. The War Eagle area is the third high-priority target of this year’s drill program.

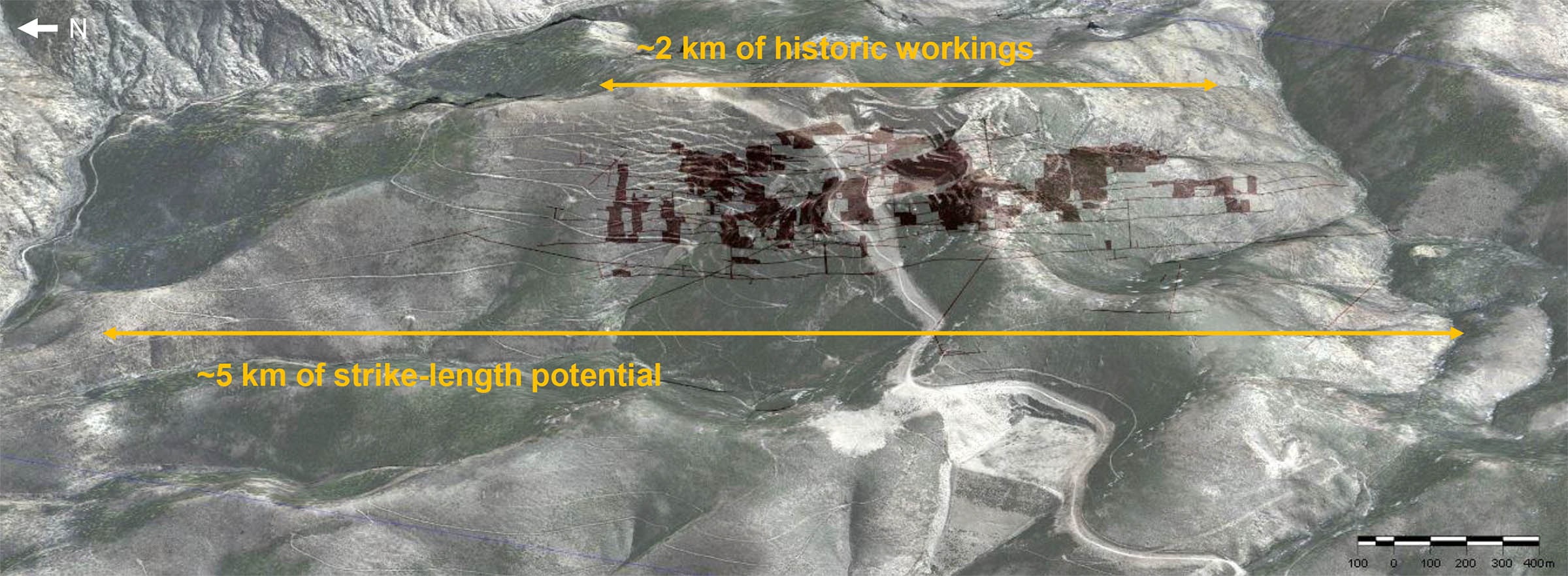

War Eagle is a household name in the US mining industry as this specific mine in Idaho was one of the highest grade gold mines in the western US around the 1900s and recent drilling by Integra (in 2019) confirmed there still are high-grade veins left to be explored and – hopefully, to be mined one day. This year’s drill program is expected to do more work on tracing the high-grade feeder veins and perhaps include certain zones of War Eagle in the resource update.

While War Eagle exploration efforts are perhaps a bit overshadowed by what Integra has been able to accomplish at Florida Mountain, but we shouldn’t underestimate the impact War Eagle could potentially have on the mine plan. Should Integra be able to outline a mineable resource/reserve at War Eagle, this could be an important component to avoid a bottleneck when it comes to mining the sulphide areas in the greater DeLamar region. It could be an option to mine both the Florida Mountain and War Eagle high-grade zones simultaneously to ensure a consistent mill feed (and access to two separate high-grade gold areas could also underpin a higher mill throughput).

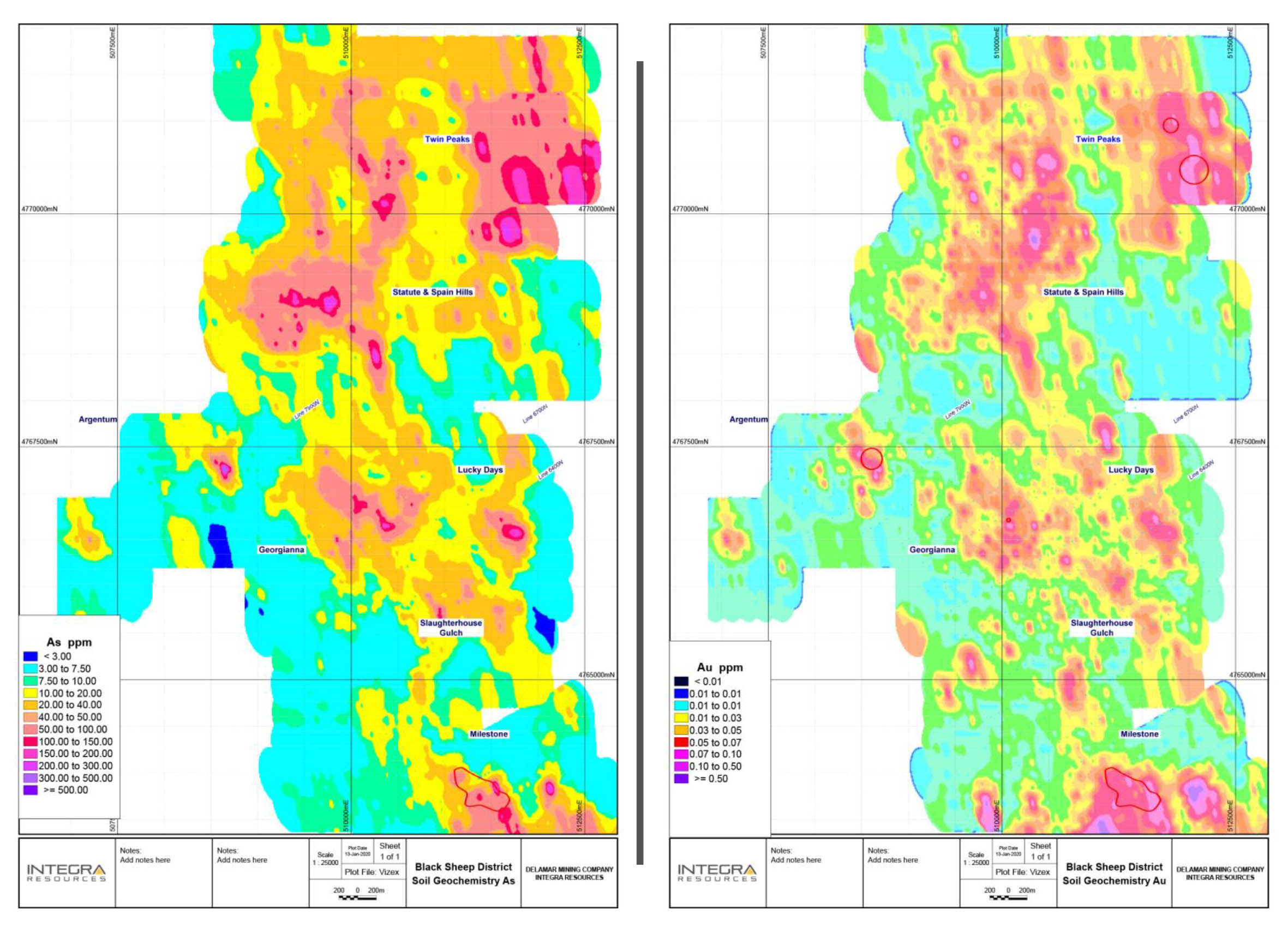

The fourth prong of this year’s drill program will be regional exploration, with the Black Sheep area becoming increasingly important. About 3,000 meters of this year’s drill program were earmarked for the black sheep area where the company has detected numerous low-sulphidation epithermal targets within a 25 square kilometer area. Additionally, as several geochemical and geophysical signatures are similar to the Florida Mountain and DeLamar deposits.

Drilling at Black Sheep has not started yet but will be drilled by perhaps two rigs which will be repositioned after completing the Florida Mountain drill campaign. We expect Integra to prioritize the Lucky Days and Georgiana targets where the combination of an Induced Polarization survey and a surface sampling program have provided the company with some good drill targets. Once the rigs move over to the Black Sheep area, we expect to see a more detailed drill plan from Integra.

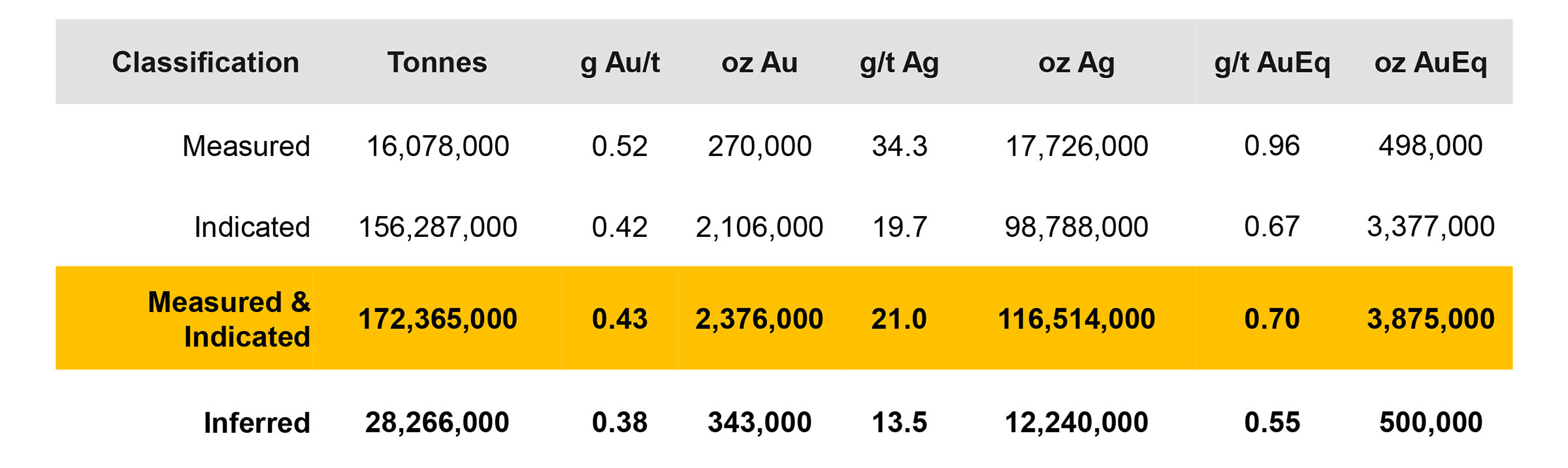

And just as a reminder, the consolidated resources at the DeLamar project right now contain about 4.4 million ounces gold-equivalent, of which about 2.7 million ounces are gold and the remainder of the equivalent resource is related to the 129 million ounces of silver (116.5Moz in the measured and indicated categories and 12.2M ounces in the inferred resource category).

The strong drill results from the recent drill programs are very encouraging, and we’d be very surprised if the next resource would come in lower than 5 million ounces gold-equivalent (without changing the cutoff grade for the resource estimate).

Integra filled up the gas tank – a good decision

Integra closed a bought deal financing in September whereby the company issued 6.785M shares (this was a straight share financing, no warrants were issued) at US$3.40 to raise US$23.1M. After deducting the underwriters commission, Integra will add roughly US$22M or almost C$29M to its treasury. As the company still had a working capital position of in excess of C$20M as of the end of Q2, the company will very likely end Q3 2020 with a working capital exceeding C$40M, putting Integra in an excellent shape.

We received a mixed bag of reactions from some readers. Generally speaking, we are in favor of the capital raise. Although one person commented ‘it feels like the company thinks it’s unable to generate additional interest before needing to raise more money’, it’s not always that simple for a non-revenue generating company. Financing windows can open and close on short notice and although Integra has never had it really difficult to raise money in the past few years the company has been around, the adage ‘take the money when it’s offered at reasonable term’ is also very valid for Integra, and we think the company made the right call by raising the money when it did. The market now knows the company is fully funded to the completion of the pre-feasibility study.

The recently completed placement was conducted at US$3.40 which is was just over C$4.50/share. Adjusted for the reverse split, the previous raise in December 2019 was conducted at C$2.875/share so the recent capital raise was conducted at a level more than 50% higher than the previous round.

And let’s also not forget the advantage of having ‘peace of mind’. The market knows very well the Integra team is pursuing an accelerated exploration and development strategy and the worst decision a management can make is having the treasury run on fumes as that could result in the market starting to ‘bet’ against a company, being fully aware a financing is in the works.

The current cash position should be sufficient for Integra to cover all expected expenses (drilling, overhead, economic studies,…) through the PFS in Q4 2021. Another look at the 2019 PEA

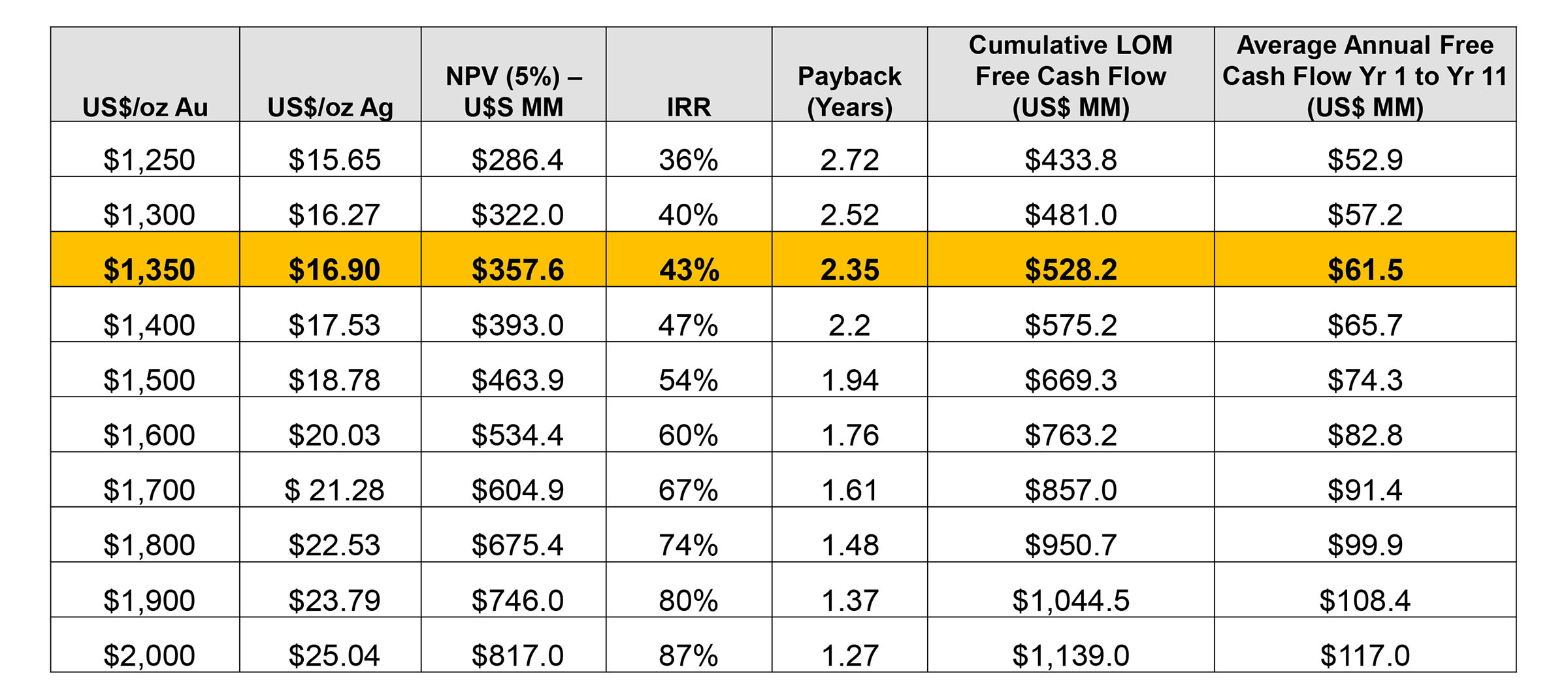

Although a PEA usually is ‘the most optimistic look one can have at a project’, Integra could be one of the few companies delivering a PFS that would actually be better than the PEA. As a reminder, this is what the NPV and IRR looked like of the Preliminary Economic Assessment, published in September 2019. Integra’s corporate presentation contains an excellent sensitivity table showing the impact of a higher gold price on the economics of the project.

At US$1350 gold, the after-tax NPV5% was approximately US$358M in a base case scenario where just around half of the total amount of ounces in the 2018 resource estimate were used.

A lot has changed since then.

We expect Integra to publish an updated resource estimate ahead of the pre-feasibility study. This resource will likely include a higher amount of ounces in both the oxide and sulphide categories (the transitional material seems to be leaching well, so for the time being we’ll consider that part of the oxide resource category). As the confidence level in the sulphide resources is growing, we expect a much higher portion of the sulphide resource to be included in the mine plan.

This will likely go hand in hand with a bigger mill so we are expecting a higher sustaining capex (considering the mill will probably be built using the cash flows of the oxide phase of the mine life) but this should be compensated for by economies of scale and a longer mine life as more sulphide tonnes will be milled. Additionally, the recovery rate for the silver is much higher in a mill compared to a leach pad indicating the by-product revenue will increase, keeping the production cost and all-in sustaining cost per ounce of gold down.

Secondly, we can perhaps also expect some of the newer zones to provide additional feed for the leach pads. We are looking forward to seeing if the DeLamar oxide zone continues to grow and although it may be too early to take potential resources on the Black Sheep zone into consideration, good exploration results could further validate the area as an additional source for oxide mineralization.

And finally, although $1350 was a reasonable gold price last year, Integra could perhaps get away using a higher gold price as base case scenario. Using $1500 gold instead of $1350 would already have added over US$100M to the NPV5% in the 2019 PEA and as we are expecting a longer mine life, using $1500 as base case scenario will very likely push the after-tax NPV5% to in excess of US550M.

The table shown in this sub-section of the report also shows the 2019 PEA has an after-tax NPV5% of US$746M using $1900 gold. We tend to shy away from making bold statements but in Integra’s case the recent drill results tend to make us believe the after-tax NPV5% at $1900 gold will come in above US$1B.

Conclusion

Integra Resources has pretty much everything going for itself as even the gold price is cooperating. We expect to see in excess of 5 million gold-equivalent ounces in the next resource update (H1 2021) and this updated resource will be the basis for a pre-feasibility study which should be ready by the end of next year.

There still are a lot of moving parts and we’ll only be able to figure out how good the 2021 PFS will be after seeing the resource update. In any case, at $1900 gold we will probably see an after-tax NPV5% exceeding US$1B but it obviously wouldn’t be reasonable to use a multi-year high gold price as base case scenario, and we would expect Integra to use $1400-1500 gold (depending on the gold market in 2021) in which case we expect to see an after-tax NPV exceeding US$600M.

The DeLamar project is shaping up like it could be Idaho’s next major gold mine, and we expect the pre-feasibility study in 2021 to confirm the viability of this project, even at a substantially lower gold price than what the yellow metal is trading at these days.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website.