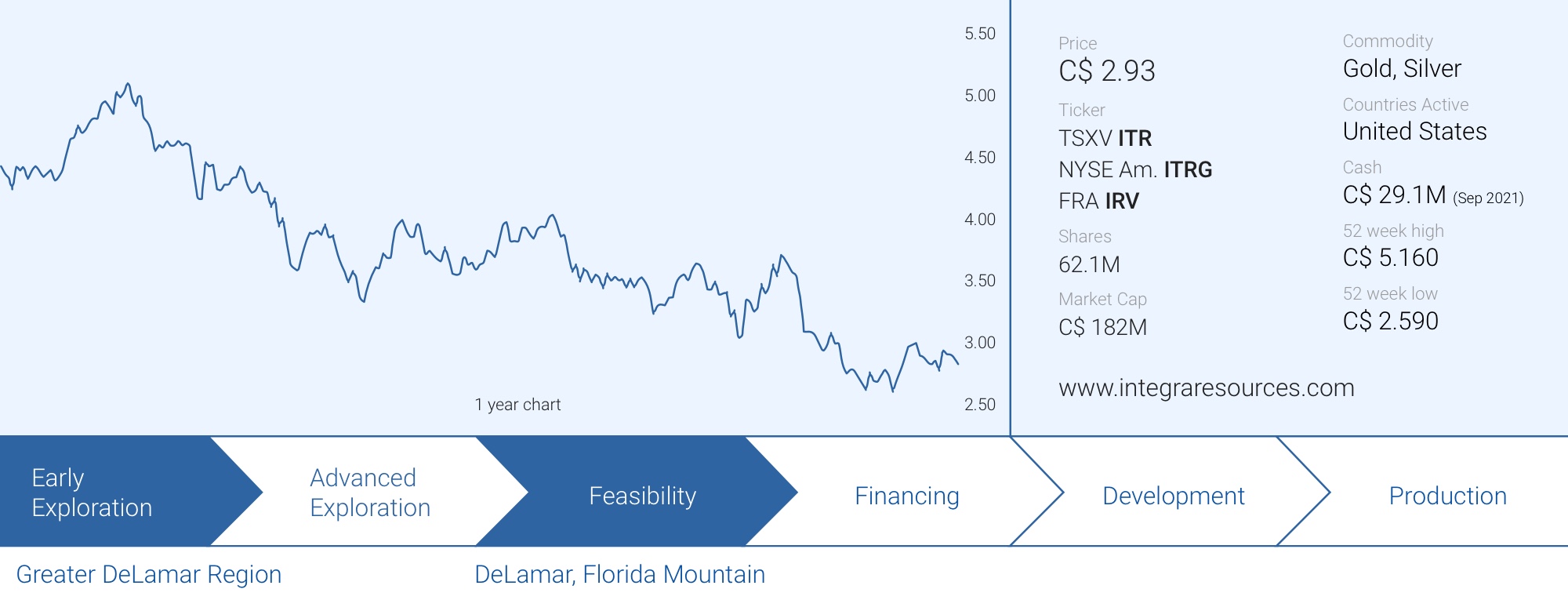

Integra Resources (ITR.V, ITRG) has a luxury problem. The greater DeLamar project region continues to yield excellent exploration results and that means economic studies are almost immediately outdated (for the better) upon publication.

It looks like this will again be the case with the company’s pre-feasibility study which should be released later this month. That study will already be a substantial improvement (i.e. – Increased throughputs at the heap leach pad and mill which expected to result in a 50% or greater increase in the gold equivalent production profile over a longer time-frame relative to the 2019 PEA which showed 124,000 oz AuEq per year over 10 years). Recent drill results from the Sullivan Gulch property indicate the expected economics of the project can be boosted right away. Perhaps we should look at the November PFS as some sort of interim-PFS as we expect Integra could release an updated study by the summer of next year should the potential of the Sullivan Gulch area be confirmed.

Putting the recent Sullivan Gulch drill results into perspective

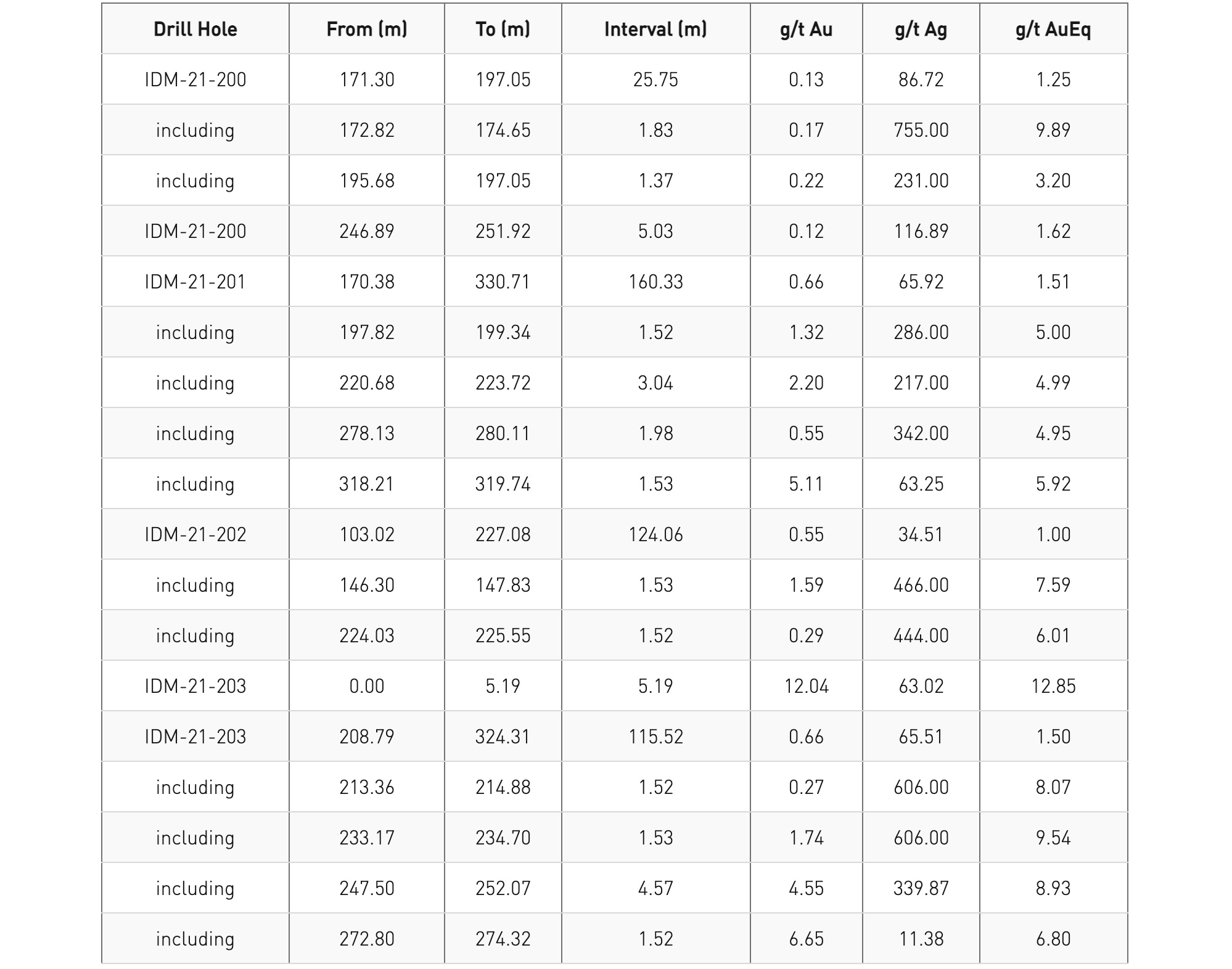

In October, Integra released the assay results from four holes that were completed on the Sullivan Gulch zone of the DeLamar deposit as part of a metallurgical drill program on the project.

The encountered mineralization has now expanded the footprint of Sullivan Gulch to a strike length of 1,000 meters, with a width of 200 meters and a depth of 350 meters. This could prove to be important as Sullivan Gulch could be an attractive satellite deposit that could be mined to fill the mill (and that will be important as especially in holes 201 and 202 a large portion (about 60% and 45%) were attributable to the silver. And the recovery rates for silver are only decent when processed in a mill.

Some of the rock at Sullivan Gulch appears to be refractory which means additional steps may be required to figure out the most optimal way to process this type of rock. There are a few processes out there that would allow Integra to include this material in future studies. The drill holes from Sullivan Gulch were for metallurgical purposes so we can assume they are looking at the available processing options which could allow this target to be included in future economic studies…

Should the refractory rock indeed be amenable for processing, the DeLamar project could change dramatically as suddenly tens of millions of tonnes at Sullivan Gulch would ‘come into play’.

In any case, the thick mineralized intervals at Sullivan Gulch (albeit a bit deeper than we would have liked) are increasing the scope of the DeLamar project where regional exploration successes continue to add tonnes and ounces to a resource. While refractory gold is indeed a complicating factor, there are several options to successfully recover gold from the host rock.

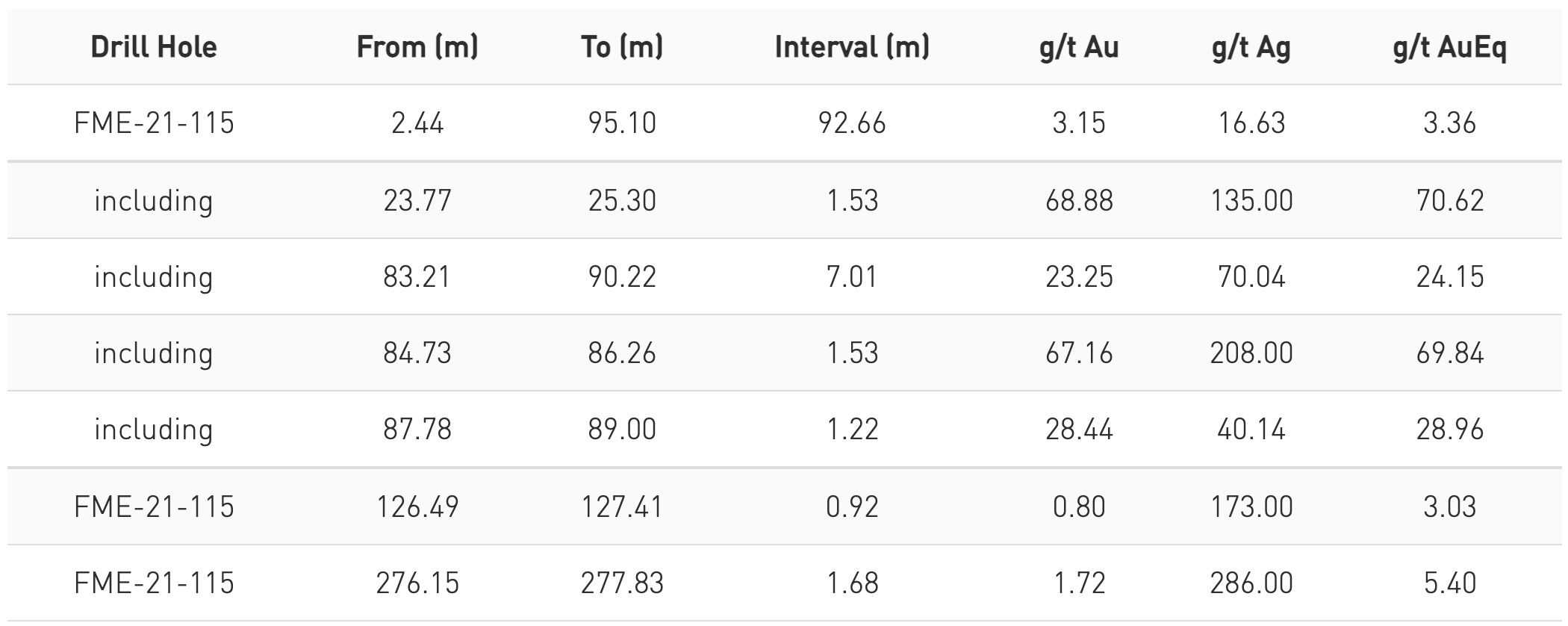

In another exploration update released last week, Integra released additional assay results from the Florida Mountain deposit with 92.66 meters almost starting at surface and containing 3.36 g/t gold-equivalent as mouth watering result. The headline result is great but the grade is carried by just 8.5 meters: the 1.53 meters of 70.62 g/t AuEq and the 7.01 meters containing 24.15 g/t AuEq. Excluding these two intervals from the wider 92.66 meters would result in a residual value of just around 0.40 g/t gold-equivalent over a length of around 84 meters. And that’s fine. Florida Mountain is generally carried by narrow but high-grade intervals, and this new hole is no exception.

As Integra notes, these higher grade results seem to confirm the continuity of the higher grade veins which could be very useful further down the road. Judging the language of the November 4th press release, Integra is now more explicitly hinting at an underground development scenario at Florida Mountain, so we expect it to be something the company will for sure have a closer look at.

The pre-feasibility study will be released imminently

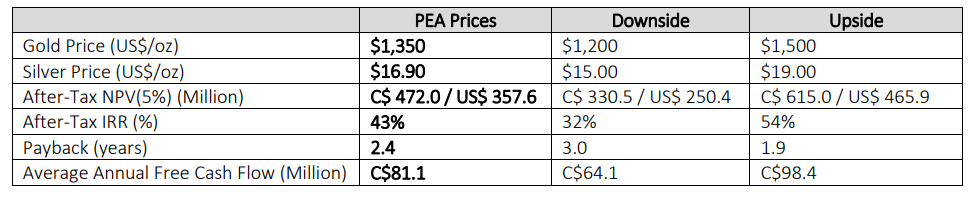

Perhaps a brief recap of the 2019 Preliminary Economic Assessment could be useful although that study is completely outdated. DeLamar is now for sure bigger and also appears to be better, so we should only look back at the PEA to establish some sort of baseline. A hurdle the company should easily jump over, both on the NPV as well as the IRR front.

As you may remember, the PEA used a heap leach scenario with 27,000 tonnes per day complemented by a 2,000 tonnes per day processing plant. Only 1.24 million ounces of gold and 46 million ounces of silver actually made it into the mine plan. That’s just 1.82 million ounces gold-equivalent of the 3.9 million ounces gold-equivalent in the measured and indicated resource and the half million ounces gold-equivalent in the inferred resource. According to the PEA, the total production profile was limited to just 1.03 million ounces of gold and 16.6 million ounces of silver on a payable basis.

Despite this, the after-tax NPV5% at $1500 gold and $19 silver was estimated at C$615M with an after-tax IRR north of 50%. Using $1650 gold would likely boost the after-tax NPV5% to in excess of C$725M while the IRR would exceed 60%.

Needless to say there was a lot of blue sky potential in the PEA as even including just half of the gold-equivalent ounces from the resource in the mine plan would boost the production profile by more than 30%. And we expect the total resources to increase due to the exploration success enjoyed by Integra Resources in the past few years.

We expect the pre-feasibility to be better. There should be more ounces included in the mine plan and as more tonnes of the transition and sulphide zones will make it into the mine plan, we expect the mill throughput to increase compared to the rather low 2,000 tonnes per day in the PEA. Integra mentioned an anticipated throughput of 8,000-10,000 tonnes per day and that indeed seems to be a logical next step.

In an update released early October, Integra confirmed it is now looking at a 32-35,000 tpd heap leach scenario with a 8-10,000 tonnes per day million scenario which will allow the company to include (tens of) millions of tonnes in the DeLamar resource that were previously withheld from the mine plan designed in the PEA. Additionally, putting more tonnes through a mill will dramatically boost the silver production as the recovery rate of silver in a heap leach scenario is a pathetic low double digit percentage (34%) which would be boosted towards 80% if the rock would be processed in a mill. Recovering more silver will boost the production profile expressed in gold-equivalent ounces, while the expanded milling scenario should obviously also boost the production of pure gold. This should pave the way to produce in excess of 175,000 ounces gold-equivalent in the first 10 years of the mine life.

The initial and sustaining capital expenditures will increase. Not just because of the bigger scope of the project, but a lot of time has passed since 2019 and as inflation has started to roar its ugly head there will for sure be some inflationary aspects that will push opex and capex higher. Although we expect the bulk of the inflationary impact to impact the economics whe, Integra prepares a feasibility study.

Integra raised more cash

As of the end of June, the Integra balance sheet still contained almost C$20M in cash, but the working capital position had decreased to just over C$12M at that point. Rather than waiting for the market to continue to bet against Integra, knowing very well a non-revenue company will have to tap the equity markets to keep on working, Integra executed a bought deal financing in September, right on time to boost the cash and working capital position before the end of the third quarter.

The company (once again) engaged Raymond James to complete a bought deal offering, which was closed within days. Integra issued just under 6.8 million shares at US$2.55 per share for total gross proceeds of approximately US$17.3M and likely around US$16.5M in net proceeds. This means the working capital position was boosted by in excess of C$20M, and we expect the upcoming Q3 financial report to reflect a healthy working capital position.

It’s important to note this once again was a straight share, no-warrant offering and Coeur subscribed for just over 420,000 shares to keep its position in Integra unchanged at approximately 6%.

Some readers asked us if this meant Coeur would be in the running to acquire Integra, we aren’t sure about that. Coeur’s limited cash position and equally limited financial flexibility may make an all-cash offer difficult and as Coeur doesn’t have a Canadian listing, it would only be able to use its shares as currency for a limited amount of shares. But of course, never say never, and we will cross that bridge when we get there. While we believe Integra could very well be a buyout candidate as it advances the DeLamar project, potential acquirers may want to see additional steps to de-risk the project. Permitting will for instance be an important factor to take into consideration.

In any case, the proceeds of the bought deal indicate the company’s cash position should last until next summer and we would expect the company to tap the equity markets again after completing an updated pre-feasibility which should include the potential development of the Sullivan Gulch zone.

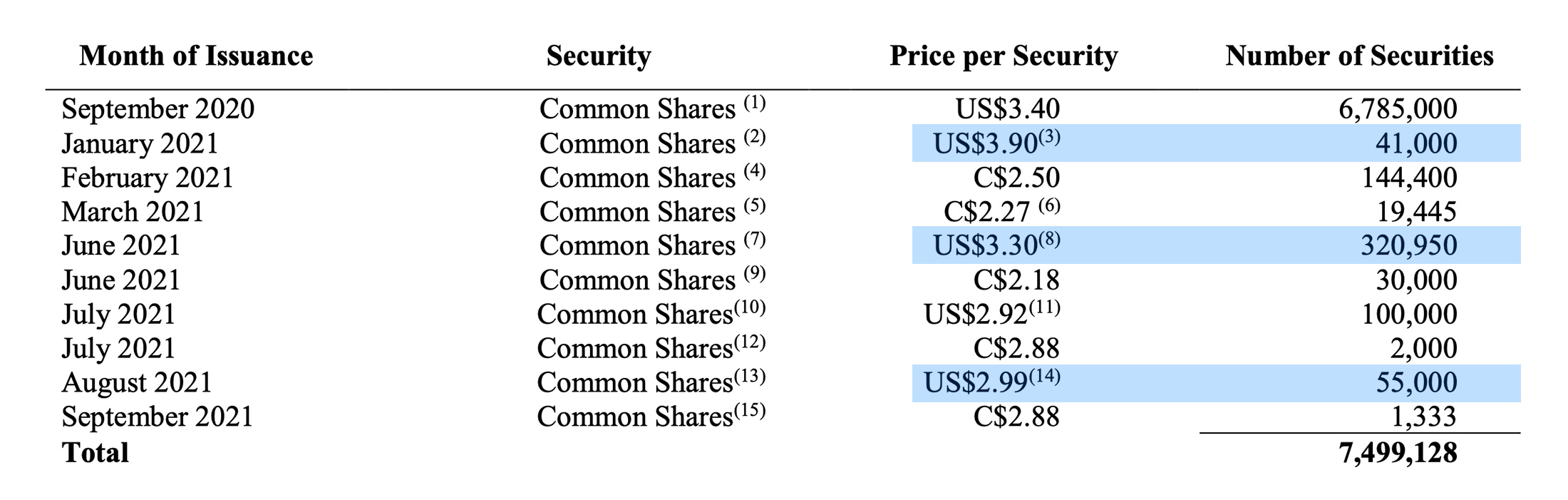

We also noticed the company terminated its ATM program after having issued just over half a million shares for total proceeds of just under US$1.7M. The proceeds from ATM offerings are highlighted below.

Conclusion

It would be wrong to look at Integra using a backward-looking perspective. The 2019 PEA is already outdated and there’s a good chance the November 2021 PFS will be outdated in a few months as well. And that’s positive as it means the project is constantly evolving and expanding and more tonnes and ounces can and will be added to the mine plan.

The upcoming release of the pre-feasibility study will be an important milestone for the company and should grab the market’s attention as we expect strong economics at $1650 gold and $22 silver.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website.