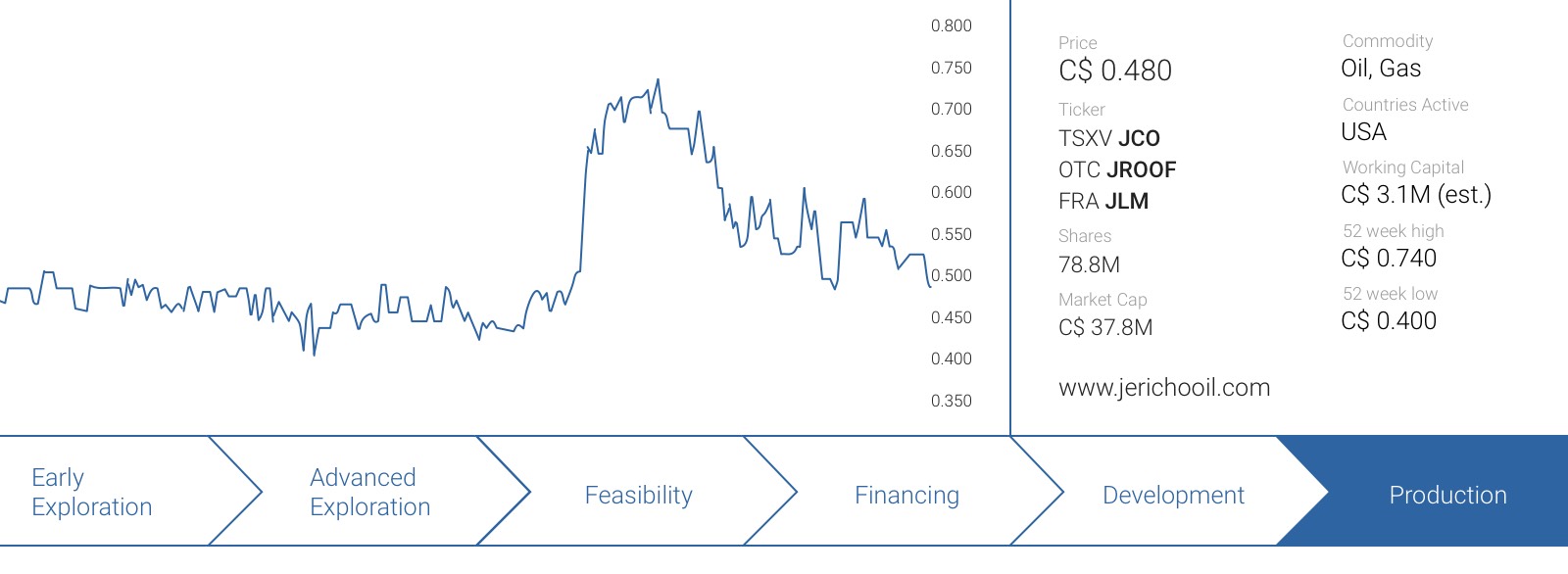

Jericho Oil (JCO.V) is still working towards becoming a mid-tier oil producer in the United States. Whilst the company is very likely still pursuing an acquisition, it’s also developing its own exploration and development plans to unlock the full potential of the oil projects it has already acquired (in joint venture with a family office).

The updated reserve report confirms our investment thesis

If there was one update from Jericho Oil we were really looking forward to, it was the company’s reserve report which was supposed to provide an update on the oil reserves and future cash flow estimates based on the situation at the end of December 2016.

It took Jericho a bit longer than expected, but the company finally released this long-awaited update in the first week of May, and fortunately we weren’t disappointed with the final result.

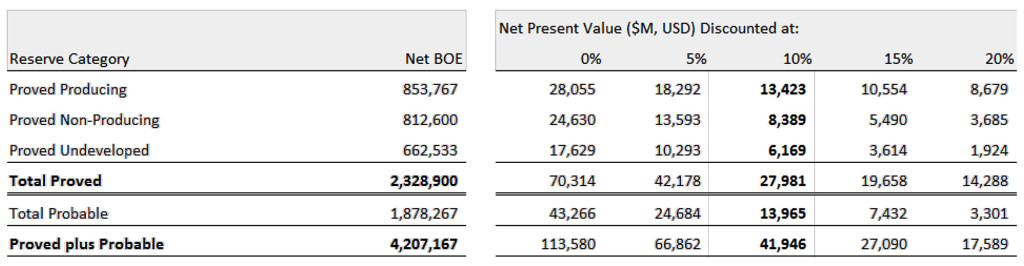

Jericho Oil saw its proved reserves increase by 77% to 2.3 million barrels, whilst the 4.2 million barrels of oil-equivalent in the proved and probable reserves (‘2P’) almost tripled compared to the end of 2015. One of the most important metrics to define a company’s efficiency rate in finding, developing and including new reserves is to calculate the reserve replacement ratio, which basically looks at the total reserve addition compared to the amount of barrels that has been produced in the preceding year.

In Jericho’s case, the proved reserves increased by 1289% of the production rate, which indeed means the company has added thirteen times more barrels to the proved reserve category compared to its annual production. That’s an exceptional result and although a part of this could be explained by the relatively low production rate of the company, it also is a testament to Jericho’s field teams which have been successful in unlocking value for the company and its shareholders.

With a total of 4.2 million barrels oil-equivalent in the reserve statement (of which approximately 75% effectively is crude oil), Jericho shareholders effectively own approximately one barrel in the ground for every 19 shares you own. And let’s be clear, the total reserve increase in 2016 was just the beginning, and we expect Jericho to continue to add barrels to its reserves.

A reserve statement also provides us with more insight of the value of the barrels. North American companies are required to report on a PV10 value, which basically is the sum of the anticipated pre-tax cash flows after applying a 10% discount rate. Fortunately Jericho is a Canadian reporting company which means it’s allowed to use (reasonable) forward prices rather than having to use the average prices of the 12 previous months (which really torpedoes the PV10 values of American companies).

Fortunately Sproule has used relatively acceptable oil prices to base its calculations on, and an average WTI price of $55/barrel in 2017, $65 in 2018 and $70 in 2019 might be optimistic, but certainly not unrealistic. Also, keep in mind the further away the higher oil prices are, the lower the impact of a ‘pure’ higher oil price as the cash flows will be discounted anyway.

Talking about these discounted cash flows, the PV10 value is approximately US$42M, but we always like to use our own interpretation and models instead of just copying a PV10 value.

For the proved and producing reserves, we are perfectly happy to use a 5% discount rate. After all, these wells are already in production, the operational and development risks are low and as these wells will provide the output and revenue in the next few years, the timing risks are also very manageable.

We will use a 10% discount rate for the proved non-producing and proved undeveloped reserves, and a 15% discount rate for the probable reserves as these are the ‘least certain’ to be developed.

Adding all these numbers, we end up with a total PV10 value of US$40.3M. After deducting the net debt of approximately $1.3M, the NAV of Jericho Oil’s share in the oil projects has a value of US$39M, or almost exactly 50 cents per share. US Dollar-cents, which means the Canadian Dollar equivalent is approximately C$0.65-0.67 per share. This definitely confirms Jericho Oil isn’t expensive at all based on its current assets.

East West Bancorp has increased the company’s borrowing base

Jericho really has ticked a lot of boxes in 2016, and not only did it increase its total oil reserves ànd the PV10 values, it was also able to attract East West Bancorp (EWBC) as its lender. That by itself already was a huge achievement because we shouldn’t forget Jericho Oil had a market capitalization of less than C$30M back then.

The total size of the facility has been negotiated up to $30M, of which a first tranche of US$10M has been made available by East West. However, EWBC subsequently decided to increase the borrowing base to US$12M (on the partnership level, rather than the Jericho Oil level), which is a 20% increase and an important ‘thumbs up’ from its main financier.

Also keep in mind the higher borrowing base was announced ten days before the reserve report and updated PV10’s were published, so we would expect EWBC to be even more confident in Jericho’s prospects right now and additional increases in the borrowing base seem pretty likely. And with an interest rate of Prime + 0.75%, Jericho’s debt is actually pretty cheap considering it still is a small company.

Still chasing a large acquisition

Jericho has always been a ‘build through acquisition’ type of company, and we don’t expect the business strategy to change. Even though the worst seems to be behind us in the oil sector, Jericho is still kicking the tyres of some assets as it’s trying to get its hands on a producing oil field which would immediately catapult it into a much higher league.

Whilst the corporate guys are trying to work something out on the M&A front, Jericho Oil isn’t just sitting on its hands. And under the impulse of newly-hired Dennis Webb, Jericho has been evaluating the possibilities to increase the value of certain assets by re-stimulating the existing wells. The company’s acquisition of the Enervest assets includes 62 horizontal wellbores, and quite a few of those weren’t producing at the time of the acquisition. We expect to see more updates from this front in due course, and we would highly recommend you to read the CEO’s annual letter to the Jericho Oil shareholders here.

Conclusion

Jericho Oil is still working towards becoming a mid-tier oil producer through either M&A or organic production growth. Shareholders should be very happy their share price is now fully backed by the company’s PV10, and even if we would apply our stricter model (which discounts the probable reserves by 15% rather than 10%), the company’s NAV/share is higher than the current market cap.

With a (pure) production cost of less than 20 dollar per barrel and some really smart people in the field, Jericho Oil has plenty of time to assess its options.

Disclosure: Jericho Oil is a sponsoring company, we have a long position. Please read the disclaimer