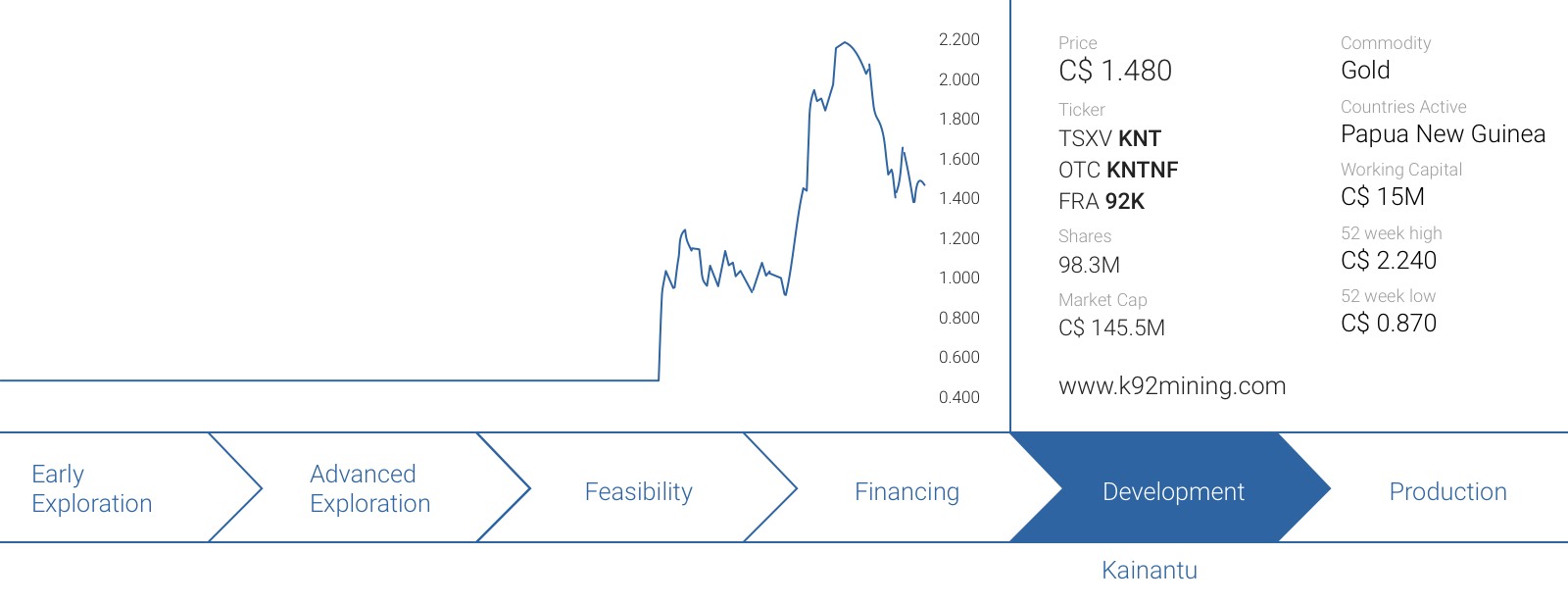

How often does it happen that a company with a valuation of C$75M on the first trading day is able to refurbish an existing mill at an existing mine, to bring everything back into production just three months after that IPO? Not very often, but that’s exactly what K92 Mining (KNT.V) pulled off earlier this year. After having acquired the Kainantu mine from Barrick Gold (ABX, ABX.TO), the company has been able to refurbish the mill and develop a mine plan in just a few weeks time, and K92 Mining should be able to sell increasing quantities of its gold-copper concentrate in the next few weeks and months.

How often does it happen that a company with a valuation of C$75M on the first trading day is able to refurbish an existing mill at an existing mine, to bring everything back into production just three months after that IPO? Not very often, but that’s exactly what K92 Mining (KNT.V) pulled off earlier this year. After having acquired the Kainantu mine from Barrick Gold (ABX, ABX.TO), the company has been able to refurbish the mill and develop a mine plan in just a few weeks time, and K92 Mining should be able to sell increasing quantities of its gold-copper concentrate in the next few weeks and months.

As the ‘moment suprême’ is coming closer, we wanted to find out what we could expect from the mine/company in terms of economics. So we pulled the historical data, blew the dust from our abacus and started calculating.

Everything seems to have gone according to plan

Less than two months after going public, K92 Mining was able to complete the refurbishment of the mill, and the underground mining activities have already started, putting the company on track to ship its first batch of copper-gold concentrate around the end of September.

And it’s not just on the operating front everything seems to be going well, as K92 was able to raise an additional C$14.5M with some strategic investors, including Ross Beaty, which is boosting the company’s cash position as several investors also already exercised warrants, priced at C$0.50. This means that since the company went public, K92 Mining saw a total cash inflow of almost C$19M. and with an additional 12 million warrants that are in-the-money at C$0.50 and 10 million warrants that are in the money at C$0.75, KNT could expect more cash rolling in over the next 14 months.

Does this mean the further development of the mine is risk-free? No, Even though everything seems to be going very smooth, every mine in a start-up mode will eventually run into some teething problems which are part of the game. In K92’s case, we will keep an eye on the mining dilution and the recovery rates for the copper and the gold, and on the mining front, the continuity of the higher grade zones will be very important to ensure a stable and reliable amount of ore is fed to the mill. And that’s exactly why it’s important to emphasize K92’s experienced management team with Ian Stalker as CEO, John Lewins as COO and Graham Wheelock as a director. Combined, these three men have almost 10 decades of experience under their belt, and that will be very useful to work out those teething problems.

Using Barrick’s production cost to develop an economic model

As K92 Mining hasn’t published a feasibility study or scoping study to determine the viability of the Kainantu mine, we have to use the available historical data to develop an economic model. That’s fine, but it also means our calculations should be considered to be back of the envelope calculations based on our assumptions.

Fortunately, K92 was able to recover the cost summary of Barrick’s operation and even though Barrick obviously wasn’t running the mine and mill at the maximal achievable efficiency, it does provide us with a good starting point if we take the potential improvements into consideration. First of all, Barrick Gold was mining the deposit using shrink stope mining techniques whilst the company’s consultants argued the long hole mining method might be more efficient. Unfortunately, Barrick had to shut down the mine after only 6 months of operating and before it could implement any of the recommended improvements, but we will use some of the recommendations in our own economic model.

Barrick’s production cost per tonne of ore was $217, but if we would simply apply the cost savings of long hole mining versus shrink stope mining, this would already drop to $190/t, and then we aren’t even including any other potential cost savings (whether or not those would be associated with the mill expansion, see later). Using a recovery rate of 91% for the gold (which is below the historical recovery rates in 2007 which reached the mid-nineties) and 80% for the copper, the recoverable copper value is approximately 0.24% Cu per tonne of rock, resulting in roughly 5 pounds of copper per tonne of processed ore. Assuming a copper price of $2.25/lbs and a ‘payability’ of 85%, the gold produced at Irumafimpa will result in a by-product revenue of approximately $10/t, reducing the production cost net of by-product credits to $180/t.

If we would now assume a head grade of 10 g/t at Irumafimpa (which takes an additional 15-20% dilution into account) versus the average in-situ grade of 11+ g/t), K92 will need to process approximately 3.5 tonnes of rock to produce one ounce of gold. This results in a production cost of $620/oz (before taxes, royalties and sustaining & exploration capital expenditures), and a total gold production of in excess of 55,000 ounces per year. As there might be a certain variation in grade, we summarized everything in the following table.

[table caption=”” colalign=”left|left|left|left|left”]

Average head grade (g/t);Recovery Rate;Tonnes needed to produce 1 ounce gold;Production cost per ounce of gold net of by-product credits, assuming $180/t;Total gold production at 200,000 tonnes per annum

5;91%;6.84;$1230;29,000

6;91%;5.70;$1030;35,000

7;91%;4.88;$880;41,000

8;91%;4.28;$770;46,500

9;91%;3.80;$685;52,500

10;91%;3.42;$620;58,500

11;91%;3.11;$560;64,000

[/table]

As you notice, grade control will be quite important to determine the economics at the Kainantu mine, but as Barrick was able to feed the mill with ore grading in excess of 7 g/t, we aren’t particularly worried about this considering grade control was one of Barrick’s weaker points.

What are the next steps?

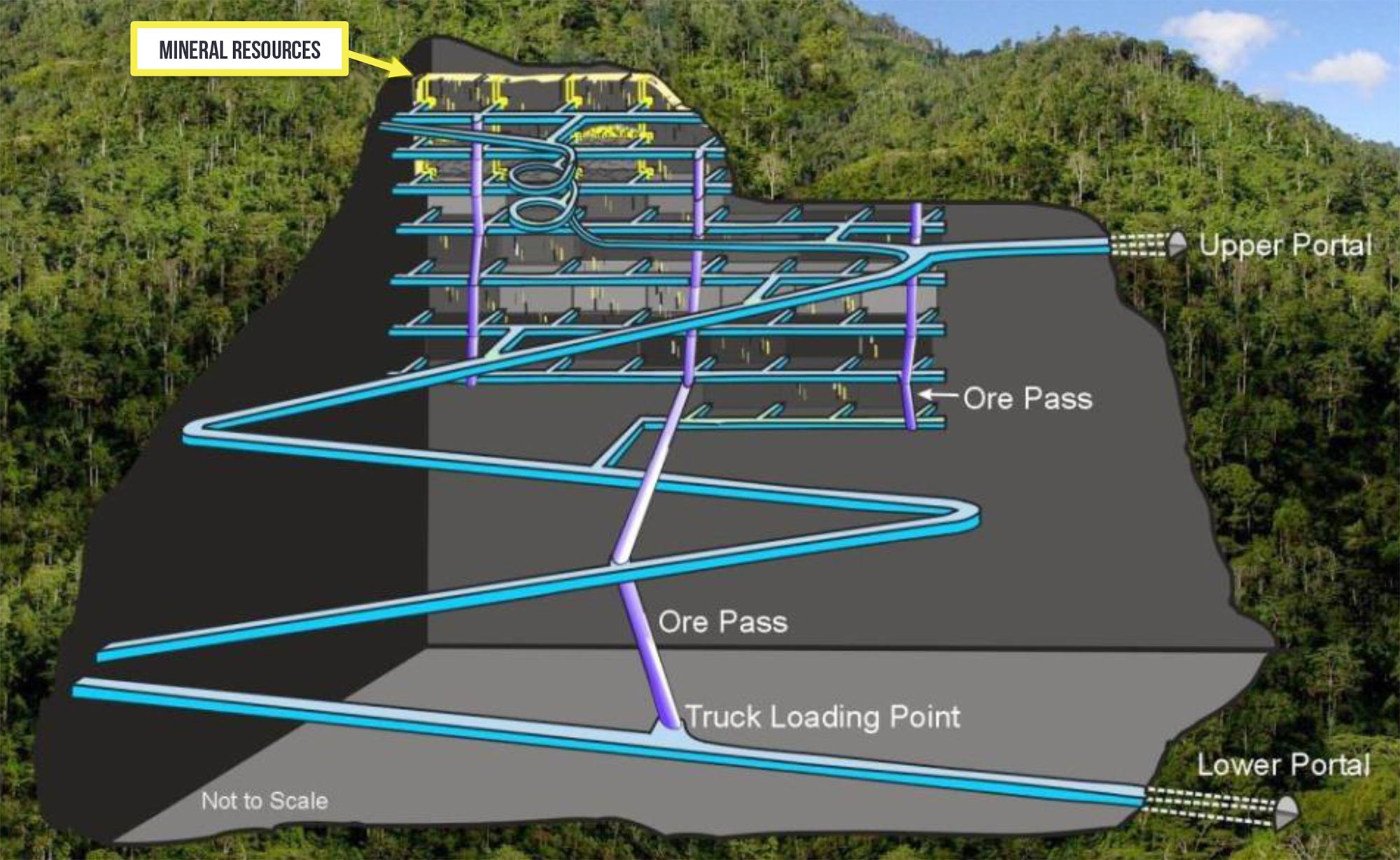

K92 has big plans for the Kainantu mine and even though the property originally came with a mill with a capacity of approximately 600 tonnes per day (200,000 tonnes per year), the company already engaged Mincore to investigate the possibility to double the mill capacity to 400,000 tonnes per year. We didn’t expect this to be a difficult task, but the main question mark was obviously related to the capital expenditures related to the expansion (which shouldn’t be too capital-intensive based on a capex per tonne of processing capacity-basis), and the associated potential economies of scale.

The main reason for K92 to immediately increase the processing capacity is obviously to unlock additional economies of scale on the processing front. Back in the days, Barrick’s cost summary estimated the total processing, G&A and site management cost to be approximately $102/t which was approximately half of the total operating expense

Whilst we don’t expect any meaningful decrease in the processing expense per tonne whether it’s a 200,000 tpa plant or a 400,000 tpa plant, it’s pretty obvious the potential to cut costs on the G&A and site management front is immense. You won’t suddenly need additional mill and site managers and even though K92 Mining will very likely have to add some employees to make sure the expanded mill continues to run very smooth, we wouldn’t be surprised to see the G&A costs fall by 40% and the site management costs by 30%. This would reduce the total operating cost by $27/t and save the company quite a bit of cash on an annual basis.

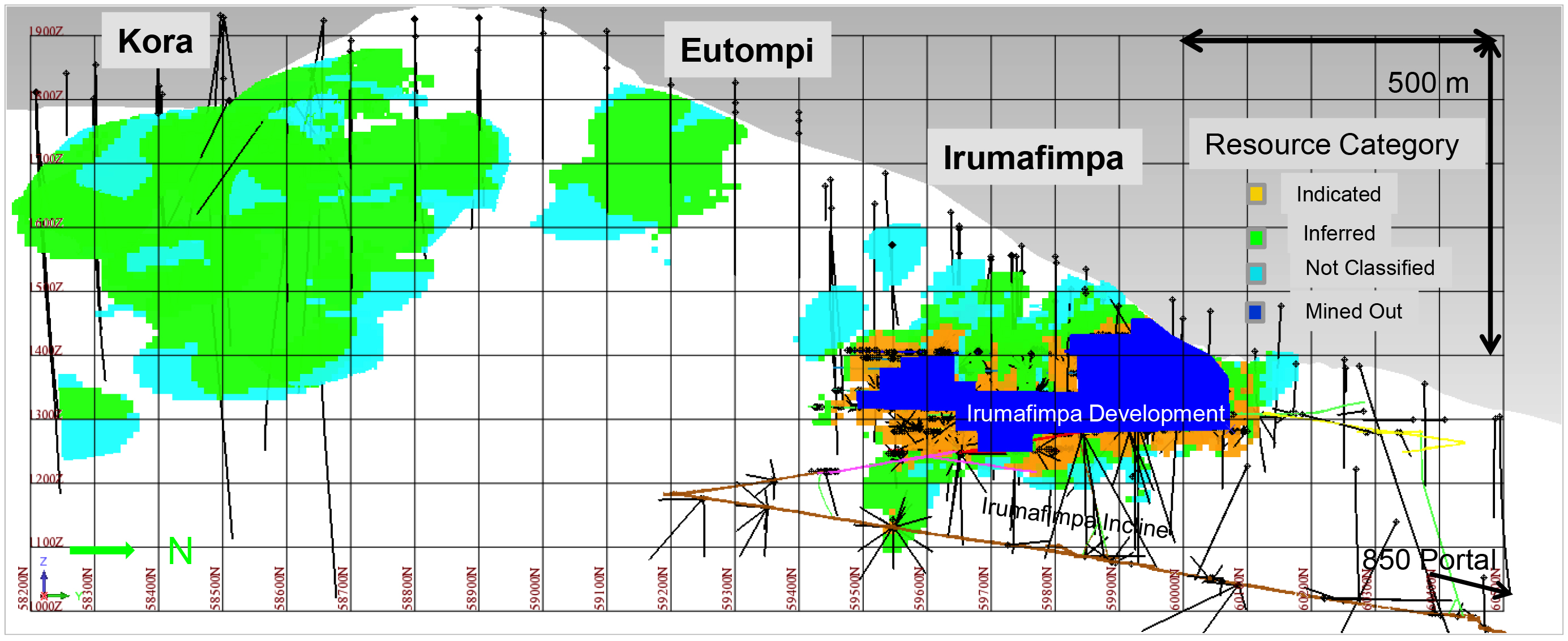

Another question obviously is where the additional 200,000 tonnes per year of mill feed will come from, and that’s why the company seems to be very keen to develop the Kora deposit as fast as possible. Another Australian consultant has been engaged to complete a scoping study on the development of Kora, and it’s our belief this will be the ‘real’ moneymaker for the company.

Not only is the average grade at Kora roughly in line with the average grade at Irumafimpa and the vein significantly wider, the gold-equivalent grade at Kora contains more copper, which means that even if the average gold-equivalent output would remain stable, the total amount of pure gold in the copper-gold concentrate will be lower. But so will the cash costs, as the copper and silver sales will be booked as a by-product revenue, driving down the production cost per ounce of gold.

On top of that, the revenue will also be higher, as the Kora zone is not subject to the gold pre-payment deal with Cartesian (which will receive 18,000-20,000 ounces of gold from Irumafimpa during the first 36 months of the mine life), and Cartesian will only be entitled to a 0.25% NSR (which could be repurchased) on the revenues from the Kora zone. So, it does make a lot of sense for K92 Mining to develop the Kora zone to maximize its revenue and cash flow.

Conclusion

K92 Mining has been in fast-track modus since the company was created, and this should result in the company shipping its first copper-gold concentrate by the end of September. It will be very interesting to see how the company’s production costs per tonne compare with the cost per tonne experienced by Barrick Gold but we have no doubt at all a focused company like K92 will run a much leaner operation than a mastodon like Barrick.

It will be very interesting to see how fast the company can develop the Kora deposit, and what kind of drill results it will be able to pull out of the ground at the Judd vein system which is running parallel to the currently known mineralized zones. After raising all of the capital required to re-start the mine privately and prior to going public and subsequently bringing in another $19 million since being a public entity, K92 Mining is very well capitalized and won’t have to tap the equity markets anytime soon.

Disclosure: K92 Mining is a sponsoring company, we hold a long position. Please read the disclaimer

Pingback: K92 fast tracking Kora deposit in PNG – South Pacific Metals