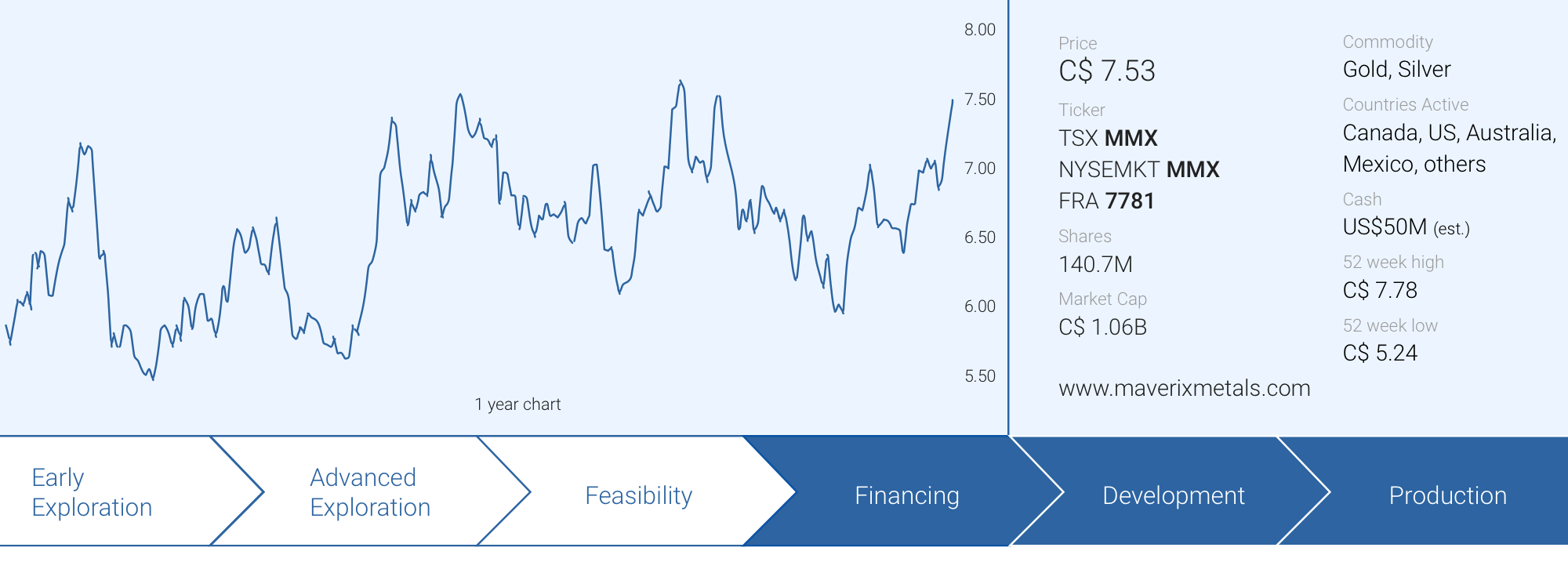

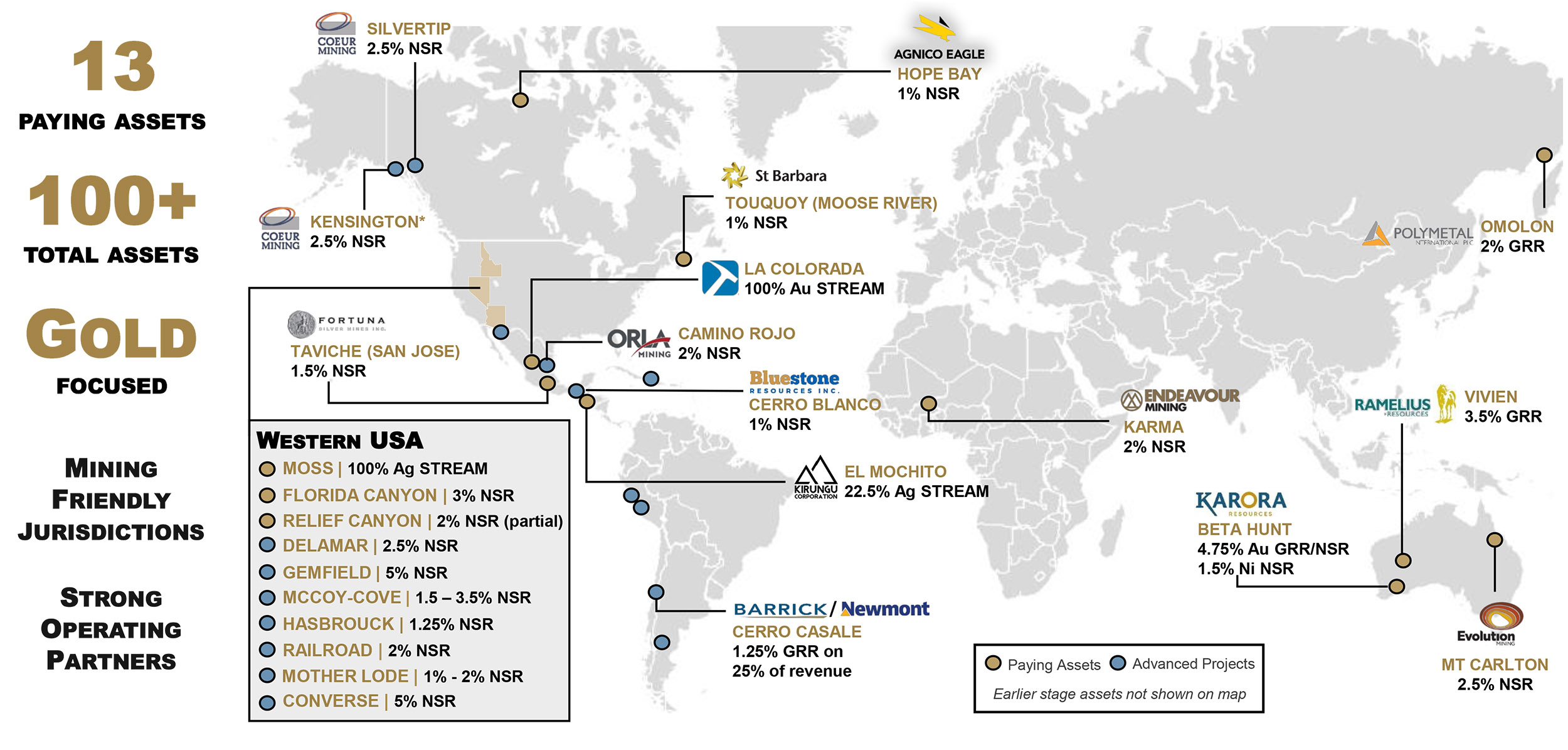

Just a few years after having acquired Pan American Silver’s (PAAS, PAA.TO) portfolio of royalties and streams, Maverix Metals (MMX, MMX.TO) has already established itself as one of the main royalty and streaming companies in Canada. Its dedicated focus on gold projects and gold assets paid off in 2020 as the company’s robust attributable production profile and the high gold price pushed the cash flow results to new highs.

After December 31st, Maverix collected $50M in cash from the exercise of a buyback of 1.5% of Maverix’s 2.5% NSR royalty (1.0% remaining) on the Hope Bay mine and $7.7M in proceeds from selling Northern Vertex stock. The proceeds (totaling almost $58M) were used to repay the full $32M drawn on the Maverix’s revolving credit facility, resulting in a pro-forma cash position of around $50M, including the anticipated incoming cash flows in Q1 2021.

Despite the COVID measures worldwide, Maverix reported a strong attributable production, resulting in strong cash flows

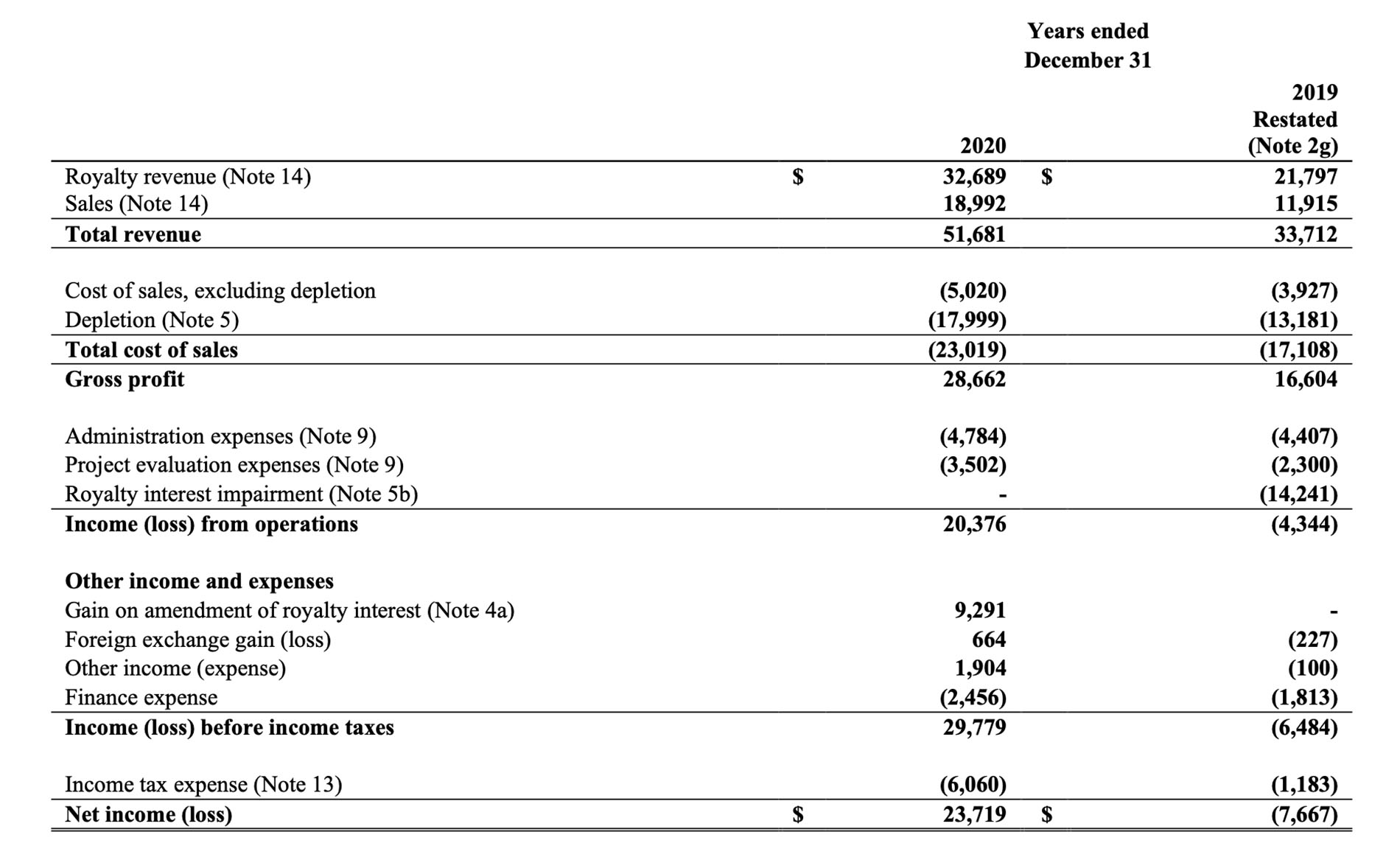

2020 was a record year for Maverix as the company confirmed a record attributable gold-equivalent output (28,916 GEOs sold), resulting in record revenue of $51.7M thanks to strong results from Maverix’s growing royalty portfolio and the high average gold price of approximately $1,787 per ounce. Consequently, Q4 2020 was the best quarter in the history of Maverix.

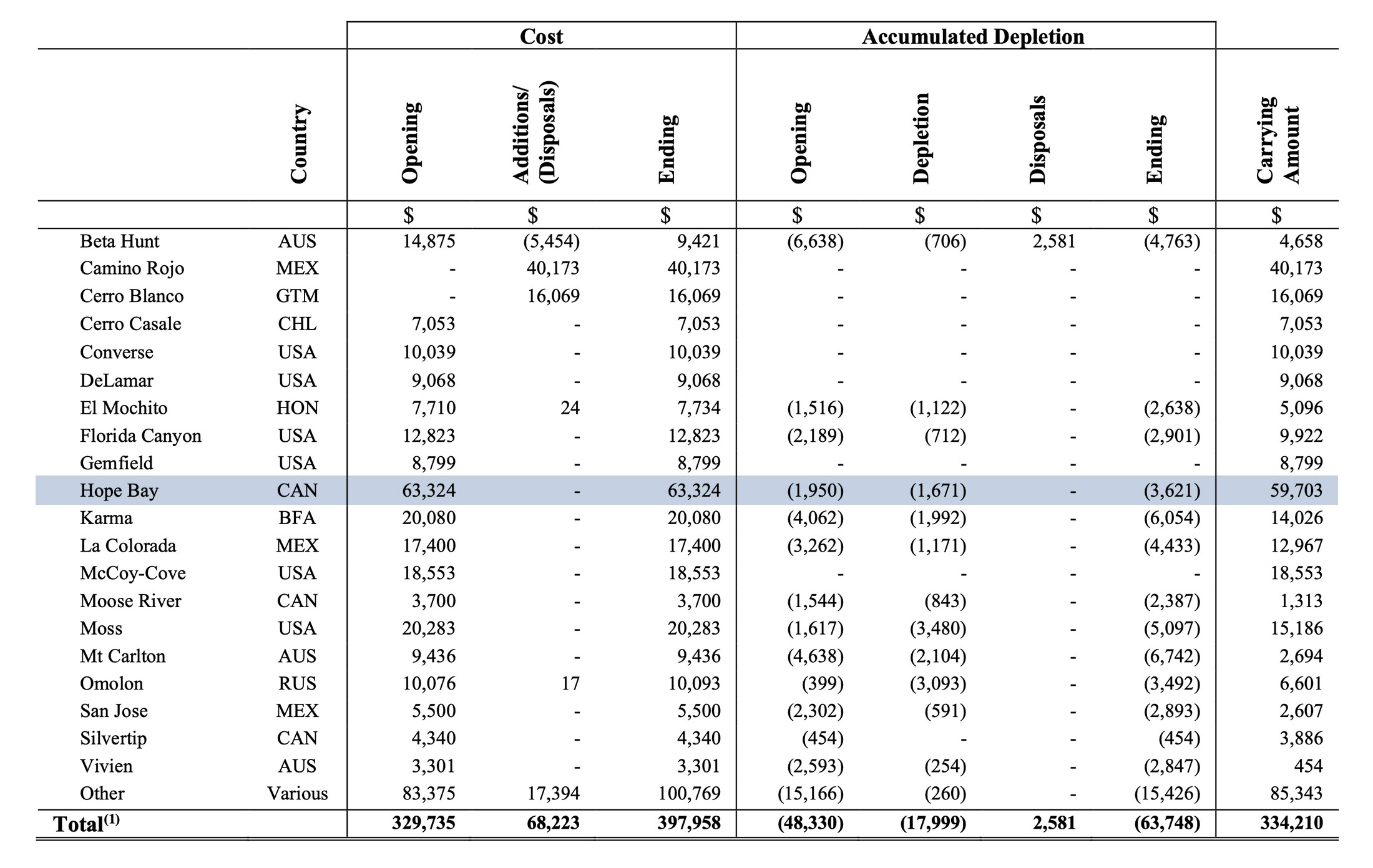

The total revenue increased by more than 50% to $51.7M and as the company’s operating expenses remained virtually unchanged, the company was able to convert the higher revenue into a positive net income. Whereas the depletion (non-cash) increased by 36%, the increase was less than the 50% increase in total revenue and the additional margin flows directly into the bottom line.

In 2020, the net income (after recording a $6.1M tax expense) was approximately $23.7M for an EPS of $0.19. It should be noted, the $6.1M tax expense included approximately $3.1M related to the one-time gain on the Beta Hunt royalty amendment during the year. Keep in mind the EPS is based on the average share count of 126.7M shares, about 10% below the current share count of just over 140 million shares.

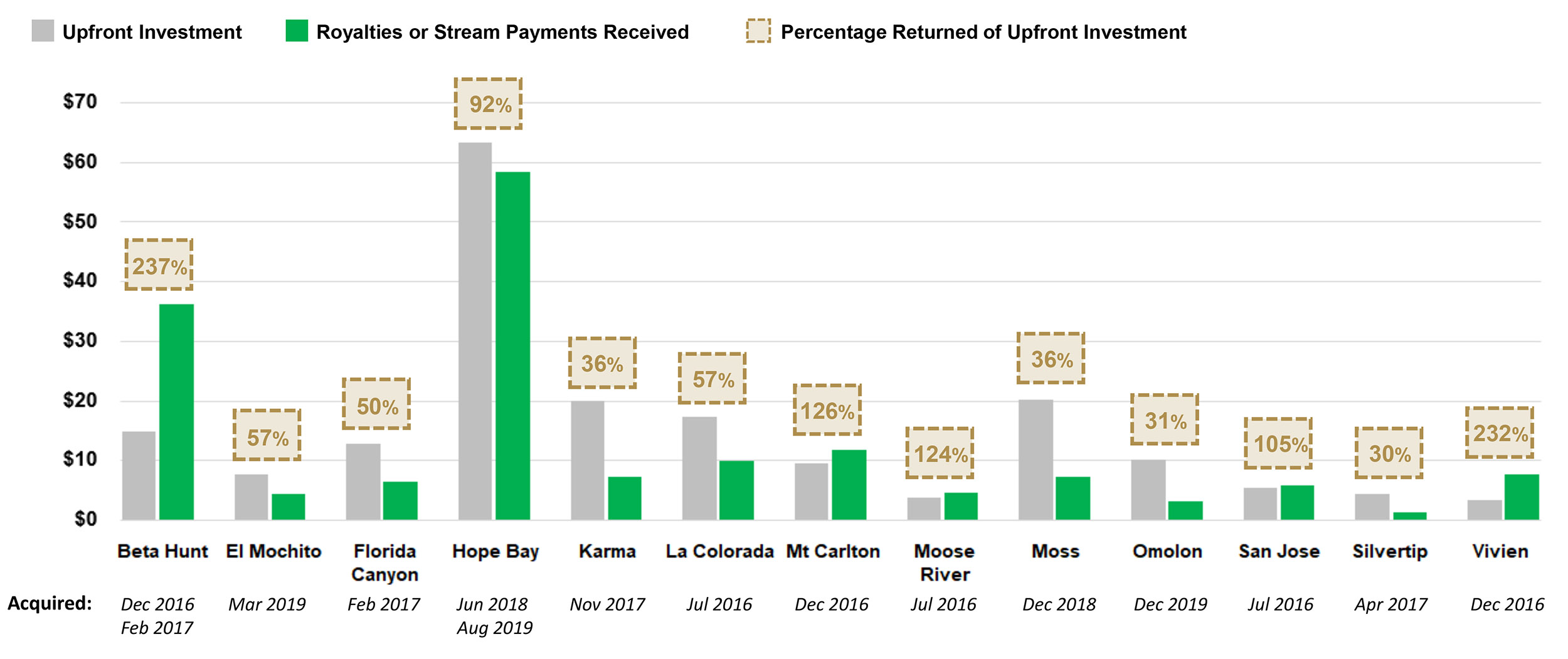

As Maverix has barely any operating expenses (most of its assets are royalties and the ongoing payments for the streaming agreements are relatively low), the non-cash depletion expenses are reducing the taxable income and the net income. But as the royalty and streaming business is based on sunk costs (as Maverix pays a sizeable lump sum upfront), these depletion charges are useful to reduce the taxable income, but are ‘hiding’ the strong cash flows.

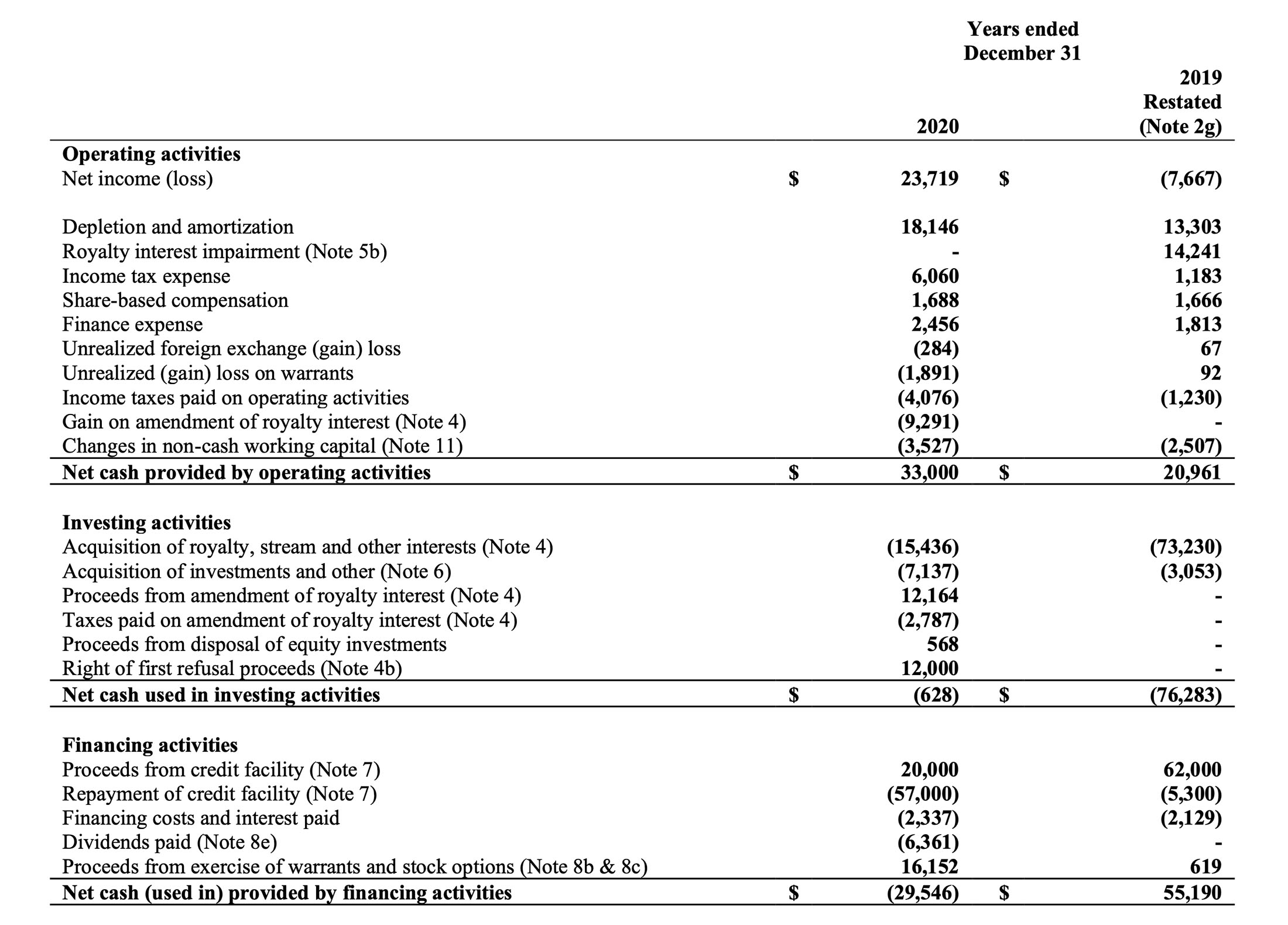

In Maverix’s case, the operating cash flow in 2020 was almost exactly $33M. This included a $3.5M cash outflow related to working capital changes but didn’t take the $2.3M in (cash) finance expenses into account. After taking these two adjustments into consideration, the adjusted operating cash flow was approximately $34.2M.

Not Shandong Gold but Agnico Eagle purchased TMAC Resources: a good deal for Maverix

After the Canadian government blocked the sale of TMAC Resources (TMR.TO) to Shandong Gold, Agnico Eagle Mines (AEM, AEM.TO) stepped up the plate and offered the TMAC shareholders a cash buyout of C$2.20 per share, clearly a superior offer to the C$1.75/share Shandong was offering before the gold price started to move up. A win-win solution for everyone involved: TMAC shareholders got a decent buyout and Agnico Eagle can use its extensive expertise operating in the Arctic conditions at Hope Bay.

But there’s a third winner. Agnico immediately notified Maverix it would be wiring $50M to buy back the 1.5% additional NSR Maverix had acquired on Hope Bay in 2019 for $40M. As part of the agreement to purchase the additional NSR, a change of control at TMAC would allow the buyer of TMAC to buyback the royalty. The sale of the 1.5% NSR has now been completed, and Maverix retains a 1% NSR on Hope Bay, which is not subject to any further reduction.

This is an excellent deal for Maverix. First of all, the entire 2.5% NSR had a book value of $59.7M, less than 20% higher than the $50M it received for selling just 60% of the royalty.

This means the book value as of December 31st implies a value of $23.88M per 1% NSR, and the book value of the 1.5% NSR that was sold back to Agnico has an implied book value of just under $36M. This emphasizes the sale of the royalty is a net positive to Maverix as it was able to sell it at almost 40% above its book value. On top of that, with the well-capitalized and experienced group now taking the reigns of the mine, the Hope Bay mine is now in good hands and we are convinced the remaining 1% NSR will continue to send cash to Maverix in the future. After acquiring the Hope Bay mine, Agnico disclosed that it believes that Hope Bay has the potential to be a 250,000 to 300,000 ounce per year operation and that it will continue to evaluate optimal mining and milling strategies for future production.

The recent deals further strengthen the balance sheet

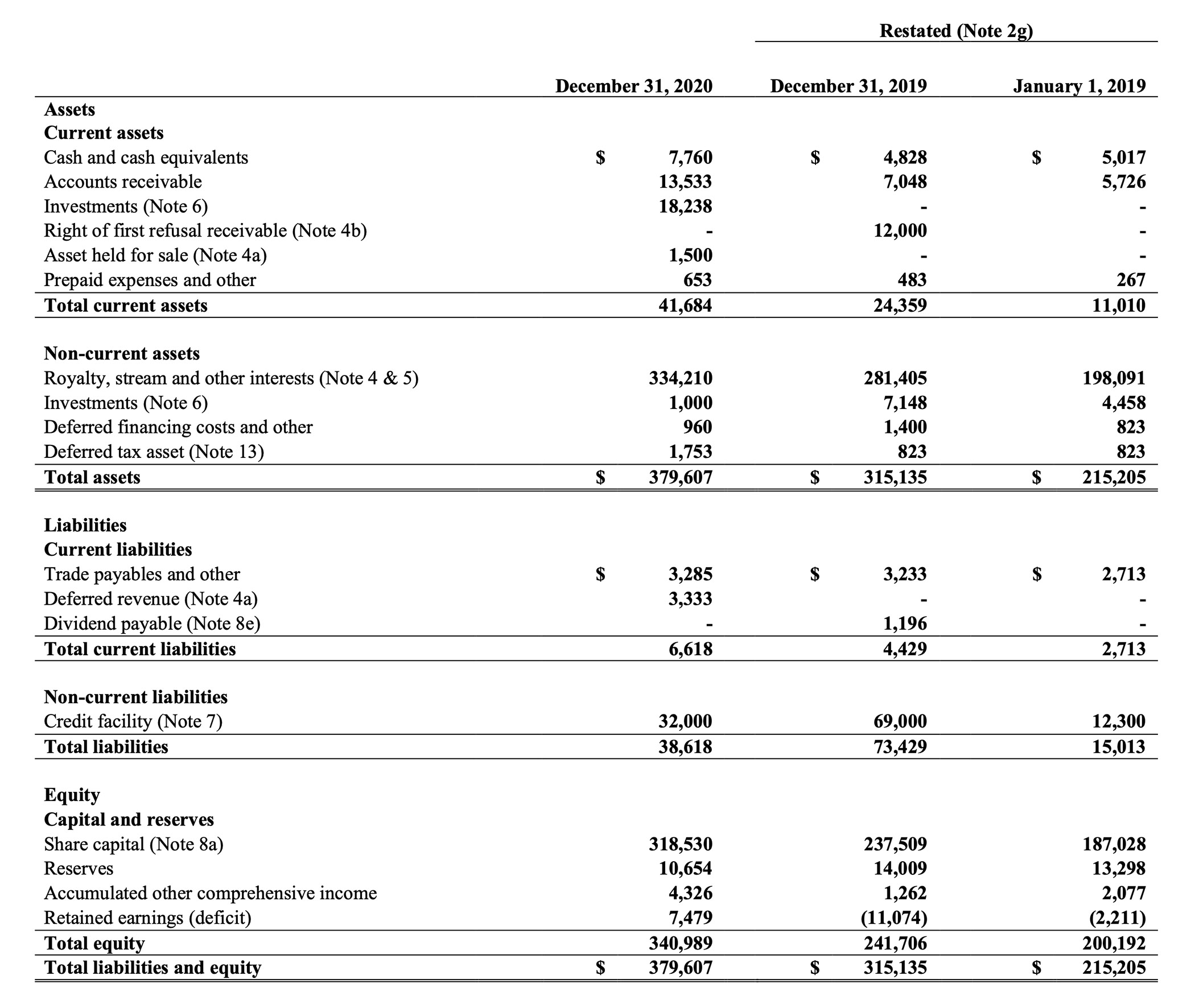

While the full-year financial statements provide an excellent snapshot of the balance sheet as of the end of December, keep in mind the most important developments happened after December 31st and as such aren’t shown on the balance sheet yet.

On December 31st, the balance sheet contained almost $7.8M in cash while there was approximately $32M in debt related to the credit facility, resulting in a net debt of just over $24M. A very clean balance sheet.

After December 31st, two transactions were completed. As mentioned earlier in this article, Agnico Eagle completed the acquisition of TMAC Resources and completed the $50M cash payment to Maverix Metals. The $50M is obviously not shown yet on the December 31st financials. Nor is the $7.7M in proceeds from the sale of Northern Vertex Resources (NEE.V) shares as part of its agreement to support the merger of Northern Vertex with Eclipse Gold to create a stronger Arizona/Nevada-focused precious metals company. And obviously, Maverix’s silver stream (100% of the silver production for an ongoing payment of 20% of the silver price) remains unchanged.

This means a total of $57.7M in cash has hit the balance sheet after the end of the year, and we will only see the balance sheet improvement when Maverix files its Q1 results. The company already disclosed it repaid the entire $32M of outstanding debt which means Maverix currently has the entire $120M credit facility at its disposal for potential acquisitions. We consider repaying the debt a good move as this will save the company a few million dollars in interest expenses (the total recorded interest related cash outflow in 2020 was just over $2.3M).

The Camino Rojo project should start contributing this year, balancing out the sale of the 1.5% Hope Bay NSR

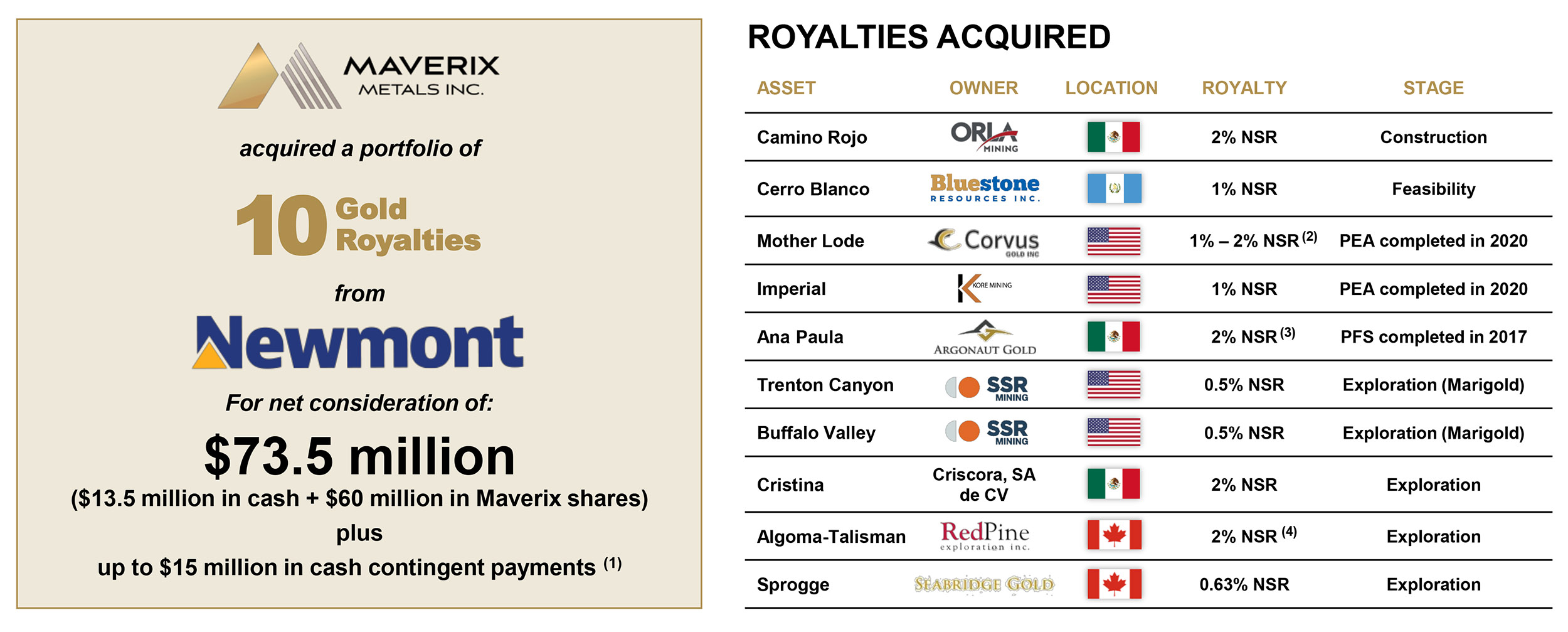

In 2020, Maverix continued to build its royalty portfolio and completed the acquisition of a royalty portfolio from Newmont (NEM.TO, NEM). The portfolio consisted of 10 gold royalties on projects in different stages of the development curve with Orla Mining’s (OLA.TO) Camino Rojo project in Mexico in the construction stage. This project is anticipated to start producing in 2021 with an average output of 94,000 ounces of gold and around half a million ounces of silver per year. At the current gold and silver price, this 2% NSR has the potential to generate approximately $3.5-4M per year in cash flow. In a recent update, Orla Mining confirmed the construction activities at Camino Rojo remained on track, and with an updated feasibility study in hand confirming the economics, it shouldn’t be too long before the Camino Rojo gold project starts sending cheques to Maverix.

Interestingly, the royalty portfolio also contained an NSR on the Mother Lode project owned and operated by Corvus Gold (KOR.TO, KOR) and this 1%-2% NSR could be very interesting given the recent exploration success enjoyed by Corvus on the land package. However, the NSR will only be applied to a portion of the total package, so it will be in Maverix’s best interest to see Corvus adding ounces on the land where the NSR does apply.

These are just two highlighted projects but we encourage you to read the entire Maverix press release here as the company described the key assets in more detail.

As Camino Rojo will only enter the production phase by the end of this year, the official 2021 production guidance of Maverix is pretty much in line with the 2020 performance. Maverix expects 27,000-30,000 attributable gold-equivalent ounces in 2021 (compared with 28,916 GEOs in 2020), so this year will be a flat year, production-wise. And that’s fine, as 2022 will likely be yet another year of growth as the Camino Rojo project will accelerate its output.

Conclusion

Despite all COVID-related disruptions at the mine sites throughout the world, Maverix reported an excellent set of results in 2020. The attributable gold-equivalent production increased by a double-digit percentage and thanks to a strong gold price, 2020 was a record year on almost any level.

2021 will be the year of consolidation. The amount of attributable gold-equivalent ounces will likely be flat this year after Agnico Eagle repurchased a 1.5% NSR on the Hope Bay gold mine, but the company will likely see its production increase again in 2022 when the new Camino Rojo mine will reach commercial production. Additionally, with a very clean balance sheet (with a net cash position that will likely reach roughly $50M as of the end of Q1), Maverix is in a very enviable position as it can immediately act on potential opportunities. Assuming our $45-50M net cash assumption is correct, Maverix has access to about $170M in liquidity ($45M in net cash and the existing $120M undrawn credit facility) to pursue M&A.

Disclosure: The author has a long position in Maverix Metals Inc. Maverix Metals Inc. is a sponsor of the website. Please read the disclaimer.