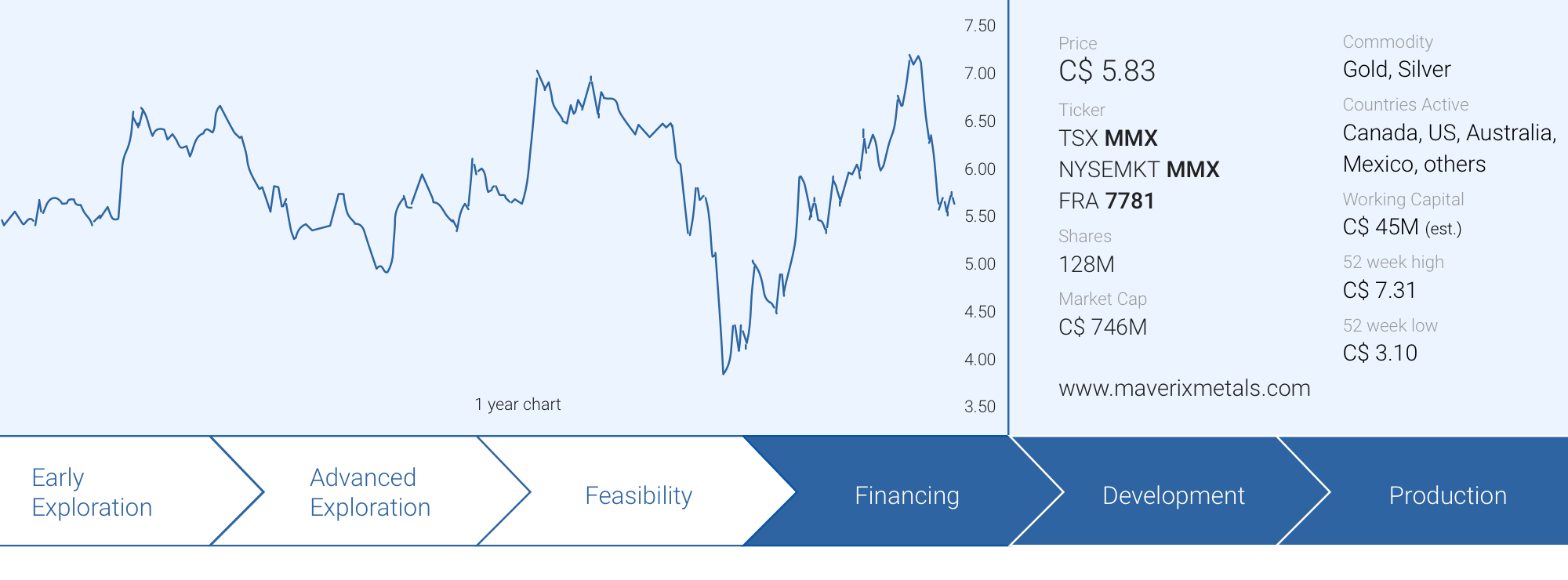

Maverix Metals (MMX.TO, MMX) has recovered well from its 18 month low in March and its share price has more than doubled since, now trading at in excess of C$5.50/share. The initial COVID-19 scare has waned as most of the mines Maverix is exposed to have remained operational. Additionally, the majority of its assets provide exposure to the gold price and with a gold price exceeding US$1700/oz, Maverix is realizing operating margins that are higher than ever before.

The attributable gold-equivalent production in Q1 was impacted by COVID-19 related issues but the high gold price allowed Maverix to continue to generate a strong operating cash flow. Meanwhile, the net debt was reduced and there is a chance the prospective new owner of the Hope Bay mine, Shandong Gold, will exercise the repayment clause on a 1.5% NSR which would add US$50M to the treasury.

Maverix Metals also received US$15.6M in proceeds from the 8.25M warrants exercised by Pan American Silver (PAAS, PAA.TO). This, in combination with the incoming cash flow in the current quarter, will further improve the liquidity profile and lower the net debt.

The first quarter: lower attributable production but a higher gold price

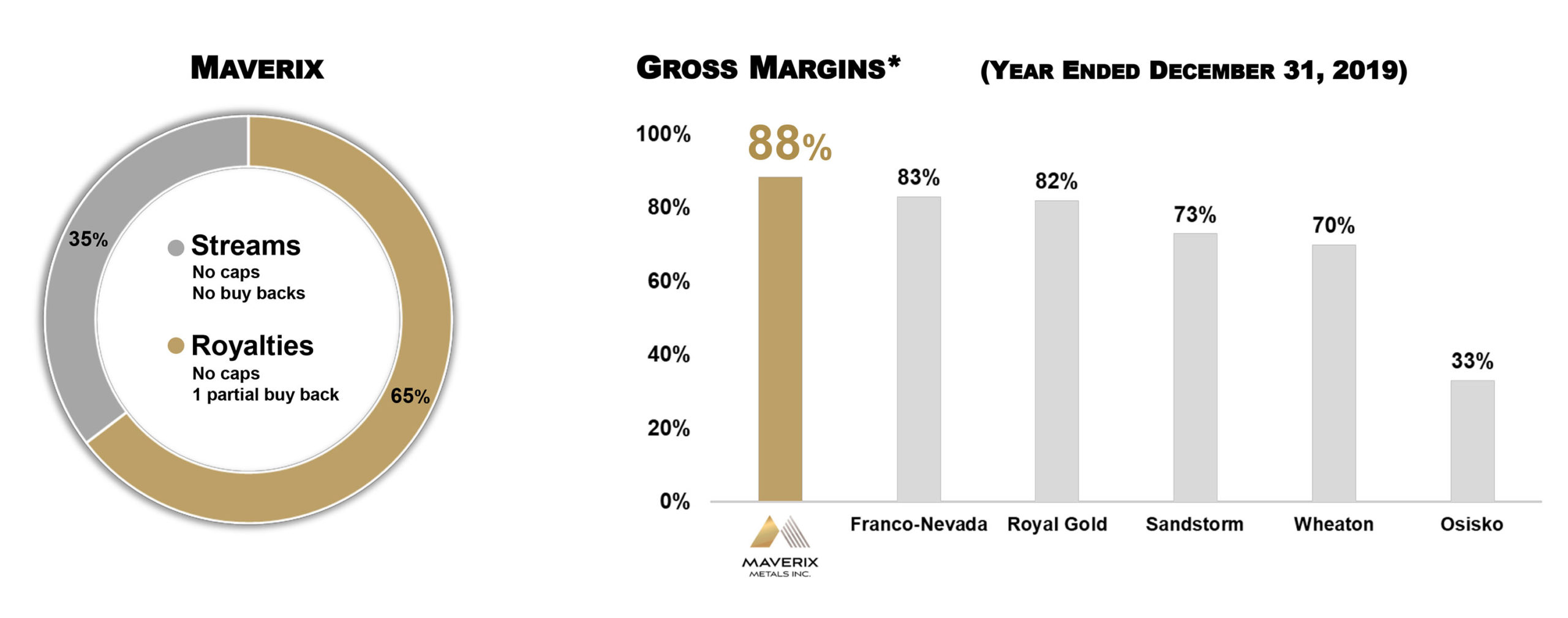

In the first quarter of the year, Maverix reported 5,871 attributable gold-equivalent ounces (‘GEOs’), sold at an average gold price of US$1582/oz. As the ongoing payments for these ounces remain low at US$167/oz (most of Maverix’s assets are royalties where no additional payment is required, only the streaming assets require Maverix to make ongoing (low) payments), the company generated a cash operating margin exceeding US$1,400/oz.

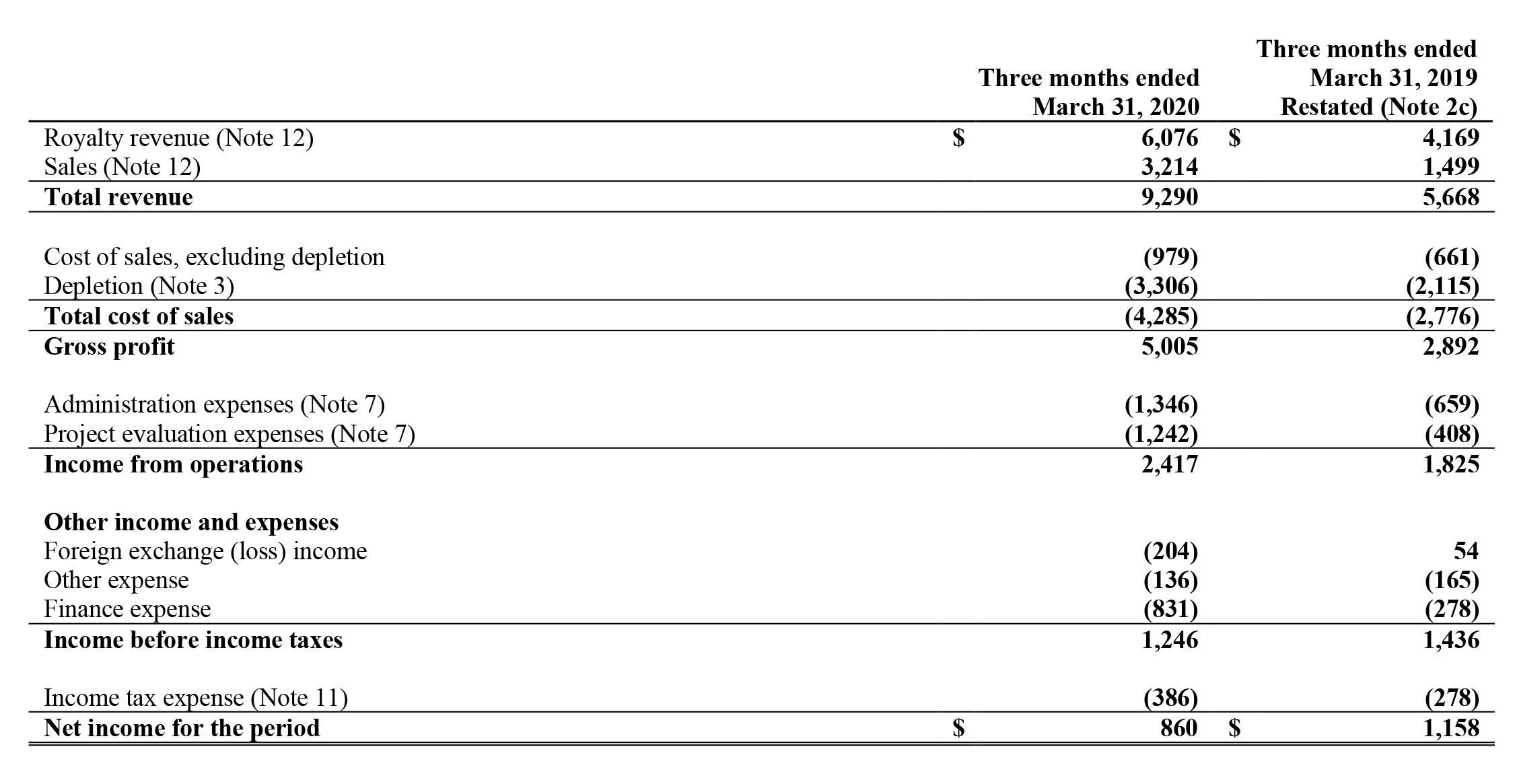

Maverix generated total revenue of US$9.3M and this resulted in US$2.4M income from operations, an increase of almost US$0.6M or 32% compared to the first quarter of last year despite having spent three times as much on project evaluation expenses. Unfortunately, the net income decreased mainly due to a forex loss and the higher interest expenses (as Maverix drew down cash from its credit facility to fund new acquisitions and as a precaution related to COVID-19). The bottom line showed a net income of US$860,000 after taking into consideration almost US$0.4M in taxes.

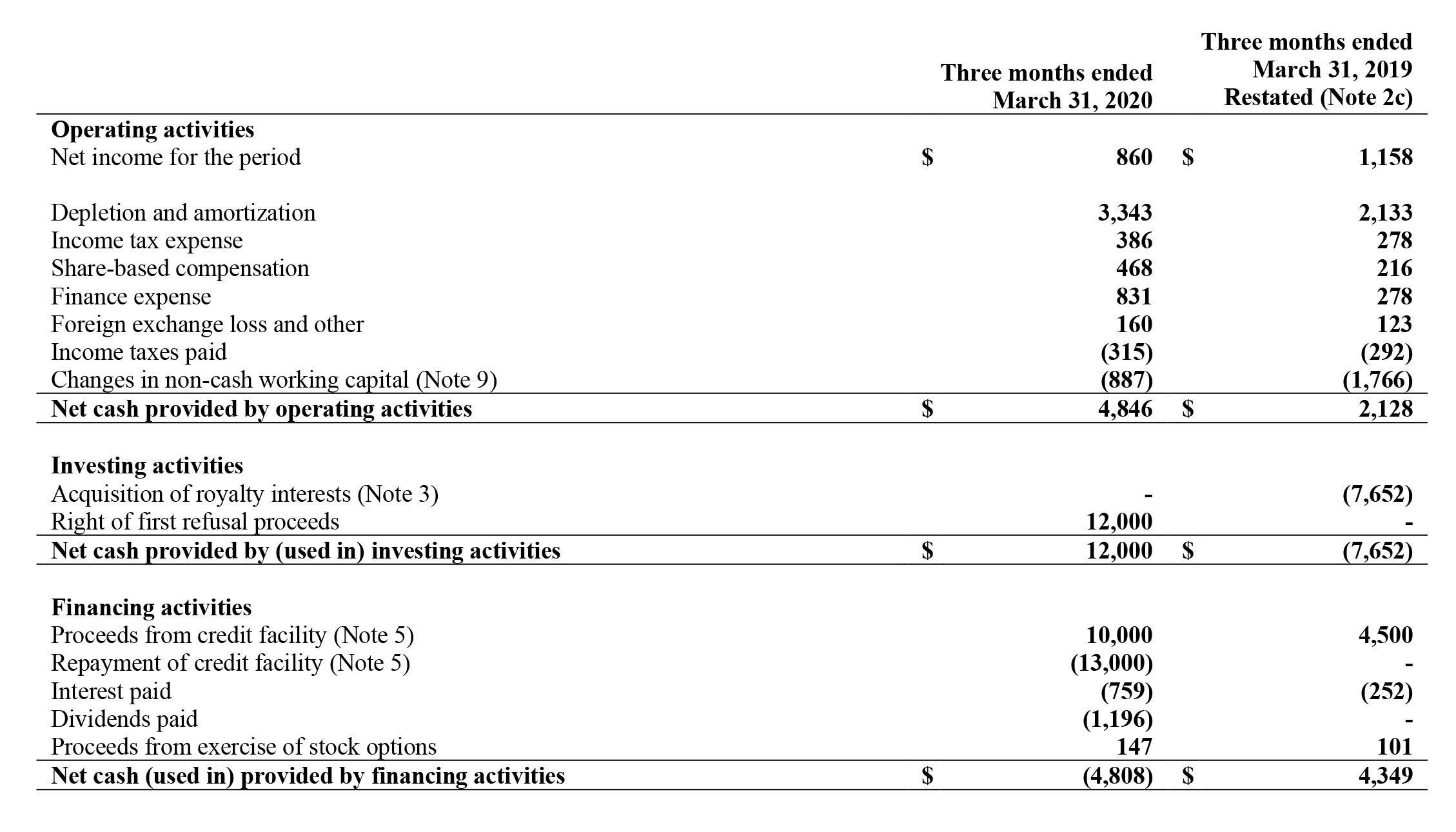

The operating cash flow generated by Maverix in Q1 was US$4.85M, but this doesn’t yet include the US$0.8M in interest payments, however, it does already take a US$0.9M investment in the working capital into account. Looking at the balance sheet, the working capital changes were related to Maverix reducing its payables.

This means the operating cash flow adjusted for working capital changes and including financial charges was approximately US$5M in Q1 2020 compared to US$3.9M in Q1 2019.

And of course, Maverix once again declared a dividend. The US$0.01 per share will be paid out on July 15th to the shareholders of record at the closing bell on June 30th. The ex-dividend date wasn’t published but we can reasonably expect the company to trade ex-dividend on June 28 or 29.

The balance sheet can handle future acquisitions

As of the end of the first quarter, Maverix had US$16.8M in cash on the balance sheet (with an additional US$6.9M in receivables) and US$66M in gross debt as part of its credit facility, resulting in a net debt of US$49.2M or approximately C$70M. Maverix drew down an additional US$10M after the end of Q1 to further boost its liquidity to protect its balance sheet during these uncertain times, but this obviously has no impact on the net debt.

The credit facility was confirmed at US$120M last year and after drawing down US$76M (including the US$10M drawdown after the end of Q1), Maverix will be able to draw down an additional US$44M from this facility. This, in combination with the US$26M in cash means Maverix has access to approximately US$70M (almost C$100M) in liquidity – excluding the incoming cash flow this quarter.

TMAC Resources will be acquired by Shandong Gold – what does this mean for the Maverix-owned NSR?

The Hope Bay mine in Nunavut, operated by TMAC Resources (TMR.TO), was the second-highest contributor to Maverix’s royalty revenue in the first quarter of the year. The 2.75% NSR on the property resulted in 762 GEOs for total revenue of US$1.2M.

Maverix originally owned a 1% NSR on Hope Bay but supported TMAC by acquiring an additional 1.5% NSR (with a 0.25% ‘bonus’ added until the royalty is registered against the property) in August 2019 for US$40M. This additional royalty purchase contains a repurchase clause allowing TMAC Resources to buy back 1.5% of the Net Smelter Royalty. In normal circumstances, we wouldn’t have expected any changes to this royalty (TMAC Resources was only allowed to repurchase 0.5% for US$15M and was only allowed to do so after June 30, 2021), but the agreement also contained a repurchase clause in case a ‘change of control’ event occurred.

If such an event were to happen, the entire additional royalty (1.5%) could be repurchased for US$50M by the new owners.

Now the question is, what is Shandong Gold planning to do? If Shandong Gold expects the gold price to remain strong, it may make sense for them to repurchase the 1.5% NSR as the one-time US$50M payment could easily be recouped over the remaining mine life. However, any repurchase decision could be based on A) the expected production profile of the mine and B) Shandong’s view of the exploration potential. The bigger the potential to add more ounces, the more inclined Shandong will be to repurchase the royalty. Shandong must make the decision by the closing of the transaction.

The most important aspect of the proposed acquisition by Shandong is that it will likely double production at the mine. TMAC does not have the financial resources to execute the pre-feasibility study plan to expand throughput from 2,000 tpd to 4,000 tpd, but Shandong does. The expansion would cost US$500M and increase gold production from ~125,000 oz/yr to ~250,000 oz/yr, which would greatly enhance the value of Maverix’s royalty.

Should Shandong effectively repurchase the 1.5% NSR, Maverix will lose some revenue, but given Maverix’s 1% NSR, a completed expansion would largely make Maverix whole. Additionally, the US$50M cash payment to Maverix would basically wipe out the net debt position on the balance sheet and allow Maverix to chase larger fish in the royalty & streaming pond. Selling the royalty for US$50M a year after paying just US$40M will result in a Return on Investment of approximately 30% (including the gold sales during the additional royalty ownership).

Conclusion

Maverix saw its Q1 operating cash flow increase by approximately 130% compared to the first quarter of last year but the COVID-19 pandemic is clearly playing a (minor) role. Fortunately, the gold price is still cooperating as the price of the yellow metal continues to trade above $1700/oz and this will continue to boost the operating cash flow. As most of the mines Maverix has an interest in remained open in Q2, odds are the higher gold price will almost fully mitigate the impact of the lower attributable production.

Additionally, in the press release announcing the sale of TMAC Resources to Shandong Gold, the chairman of Shandong went on record pointing out the ‘generational potential’ of the [Hope Bay] camp’, and this strengthens our belief Shandong will try to repurchase the 1.5% NSR on the Hope Bay mine. Should Shandong effectively do so, Maverix will convert the existing net debt position into a net cash position and the bolstered balance sheet will allow it to pursue more transactions.

Disclosure: The author holds a long position in Maverix Metals Inc. Maverix Metals Inc. is a sponsor of the website.