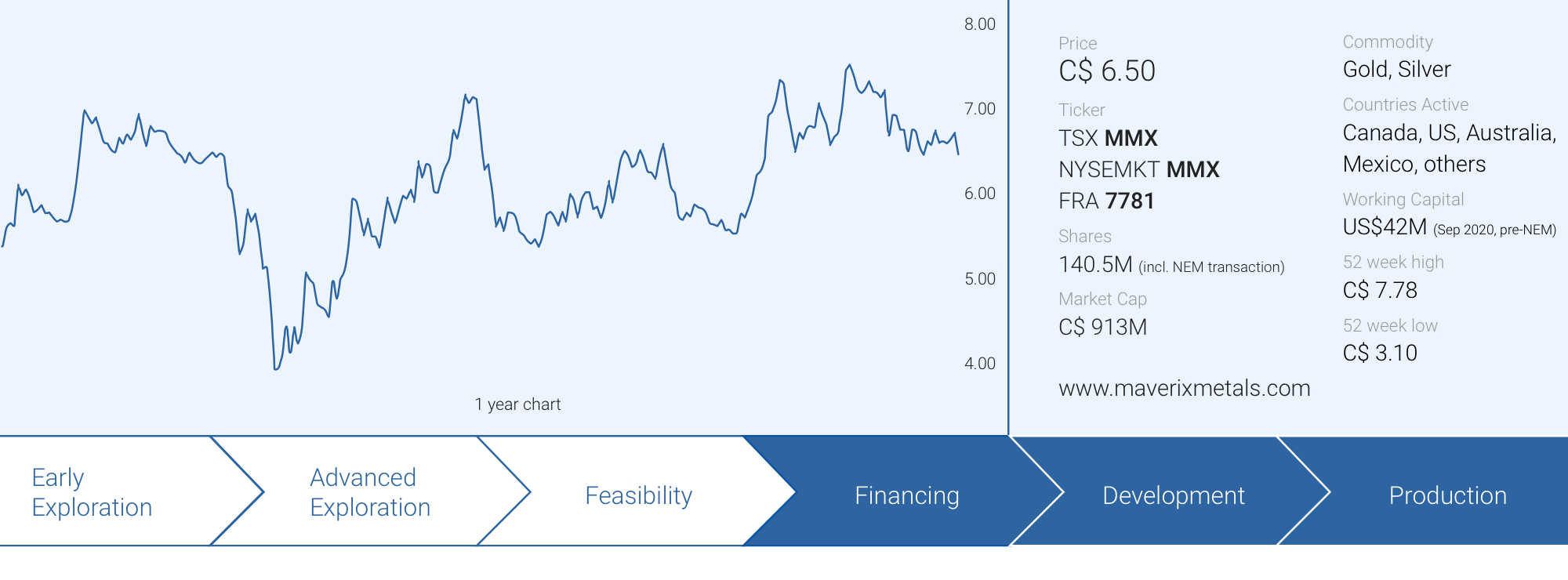

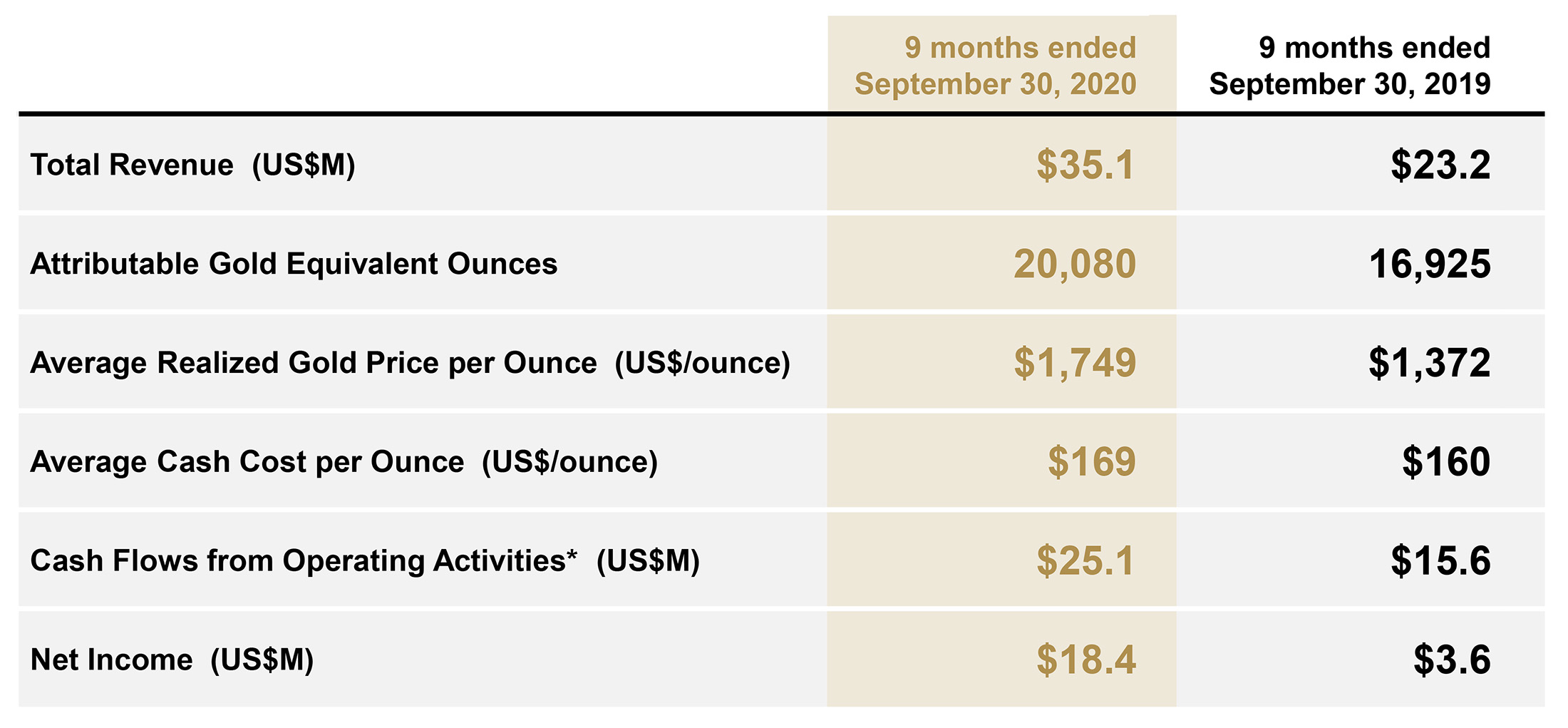

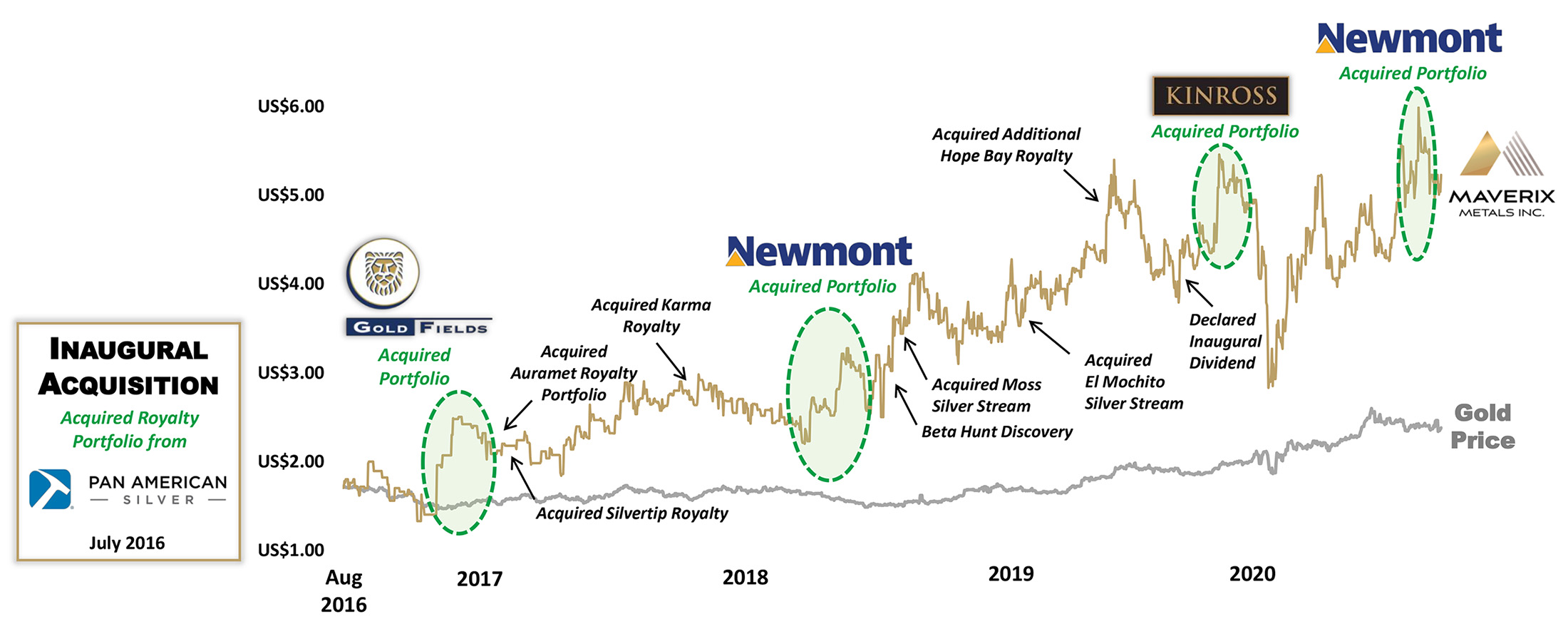

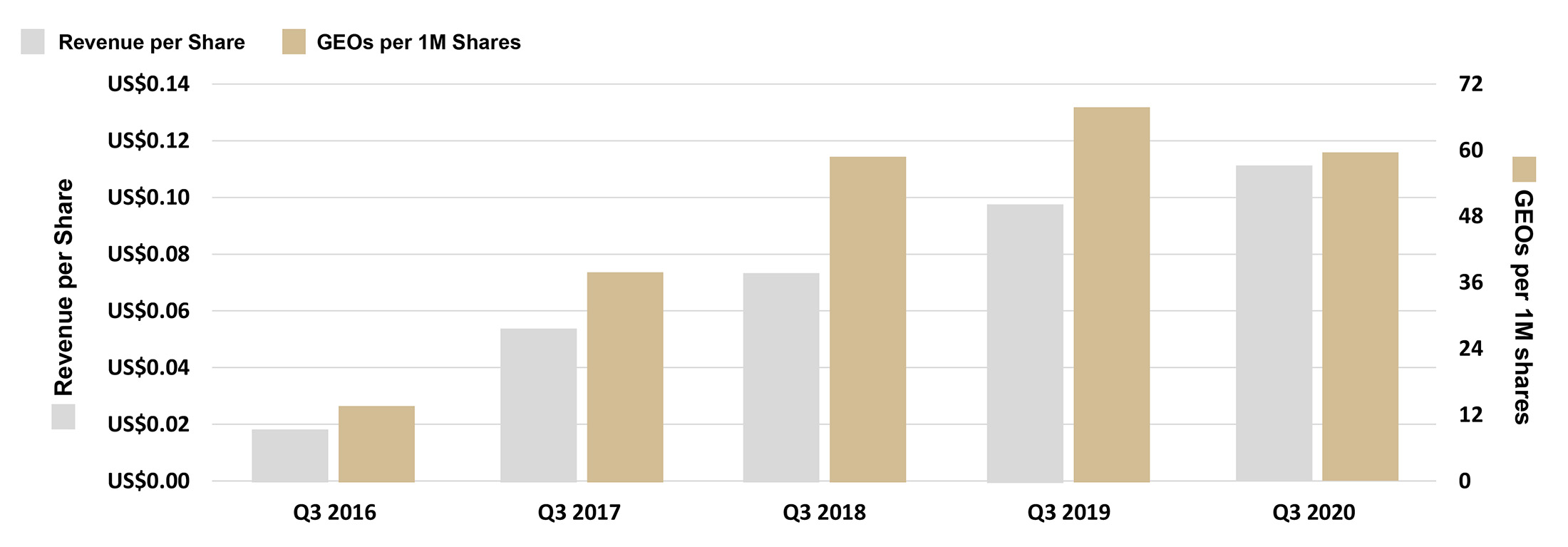

The Q3 reporting season is coming to an end, and most of the companies in the gold and silver sector have handsomely met expectations. Maverix Metals (MMX.TO, MMX) exceeded expectations as the company recorded no less than five records: the record attributable gold-equivalent ounces resulted in a record revenue, record cash flow and record net income, as well as a record-high margin of US$1,710/oz.

The cash flow is pouring in

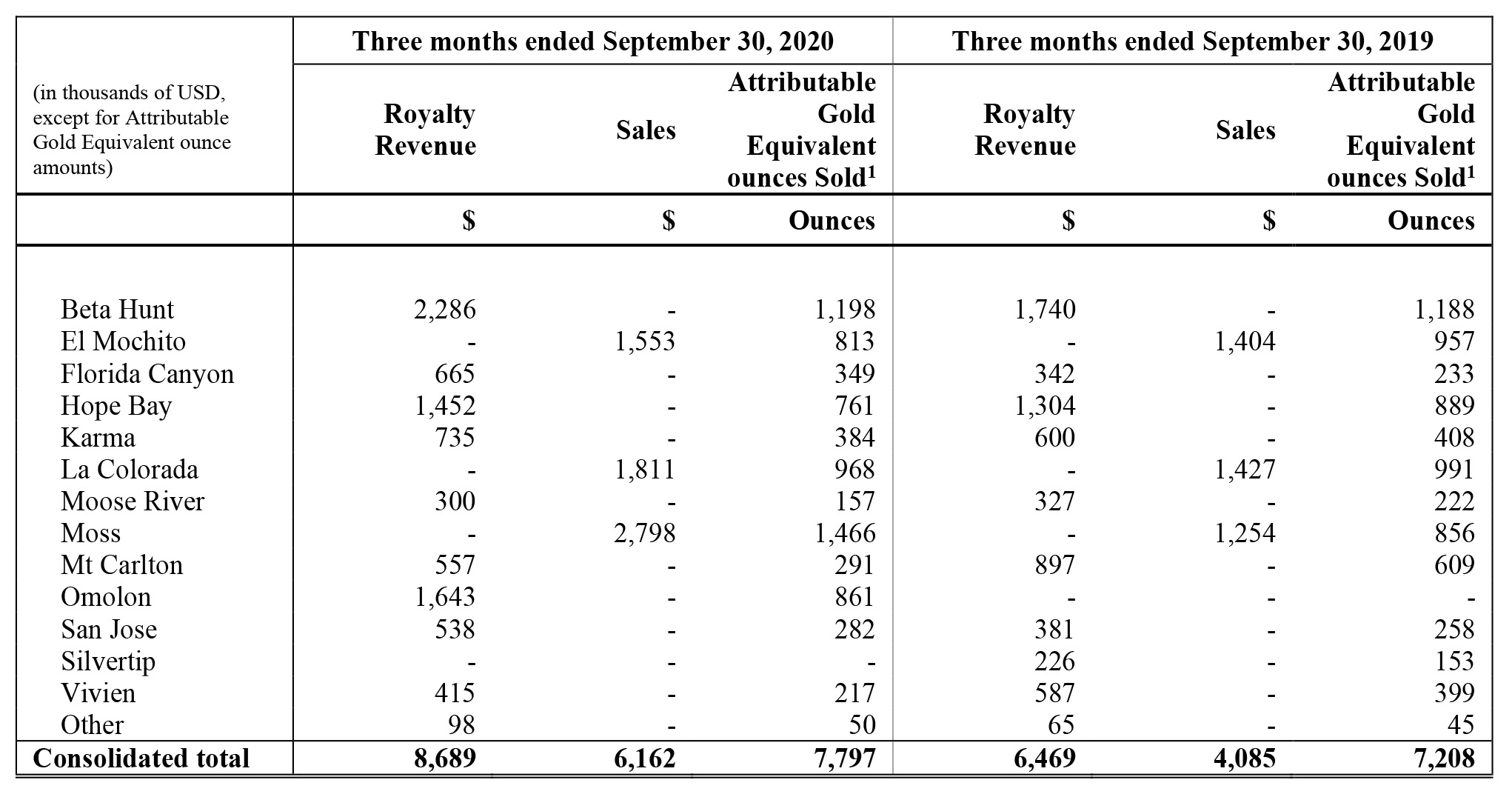

During the quarter, Maverix was entitled to a total of 7,797 gold-equivalent ounces sold by the underlying operators of the mine. The main contributor remained the Beta Hunt mine where the attributable production of 1,198 ounces represents just over 15% of the total attributable production. The Moss gold mine in Arizona is also gaining momentum and the attributable production of 1,466 ounces is approximately 71% higher than in the same period in 2019.

It’s important to note the restructuring of the Beta Hunt royalty was completed in September 2020, but with an effective date of July 1st. As such, we should not see a huge QoQ swing in the attributable gold-equivalent production from the Australian mine in the fourth quarter.

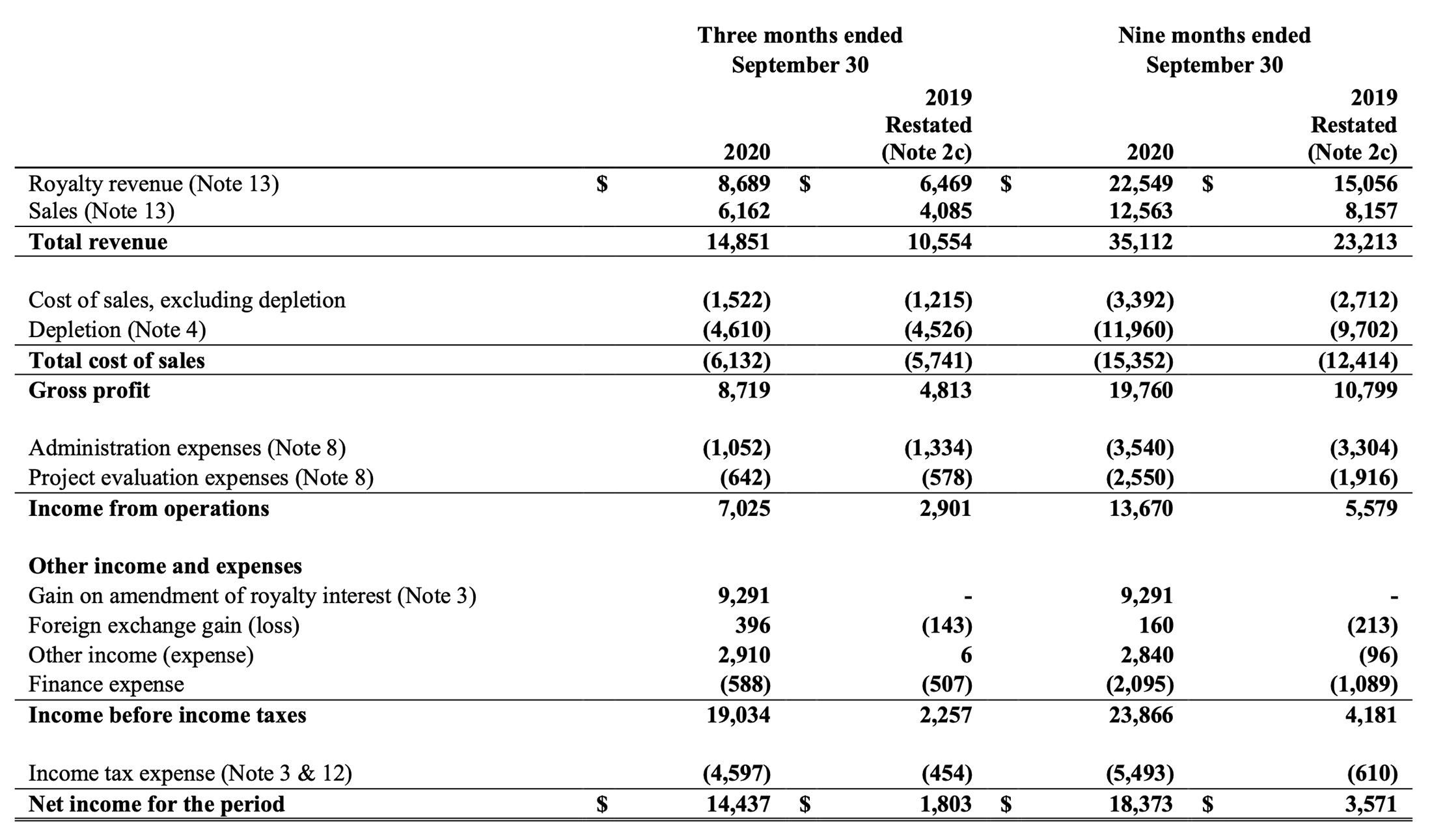

A record attributable output and a record-high gold price obviously results in a record revenue. In the third quarter, Maverix recorded revenue of US$14.9M, which resulted in income from operations of just over US$7M. As the majority of Maverix’s overhead expenses are fixed, the higher attributable revenue has an immediate spillover effect to the income from operations.

Additionally, Maverix recorded a US$9.3M gain on the restructuring of the Beta Hunt royalty. Hardly a surprise as we already discussed this in a previous report. This gain on the restructuring of the Beta Hunt royalty obviously is a non-recurring item, just like the US$2.9M ‘other income’. This ‘other income’ is related to the increase in value of the warrants Maverix holds in other mining companies. The combination of the strong operating results and the non-recurring elements caused Maverix to report a US$14.4M net income, which is approximately 11 cents per share (based on the average weighted share count in Q3).

The cash flow statement also clearly shows how important the third quarter was for Maverix. Adjusted for the gain on the Beta Hunt restructuring and the warrant income, the reported operating cash flow was US$13.8M. However, we noticed Maverix only paid US$1.6M in taxes (versus the US$4.6M due in Q3 2020) while there also was a positive contribution from changes in the working capital. When adjusting for these timing differences in working capital, the operating cash flow was US$10.8M

We still need to deduct almost US$750,000 in financing expenses and this resulted in a net positive ‘core’ cash flow of around US$10M (excluding the additional cash flows generated from the Beta Hunt restructuring).

The balance sheet has gotten stronger

As Maverix didn’t complete any deals during the quarter other than the restructuring of the Beta Hunt royalty, the cash was integrally used to reduce debt. As you may remember, during the initial outbreak of the pandemic, Maverix tapped its lines of credit to cash up, but now the initial panic around the pandemic has subdued and now Maverix is printing cash, the company thought it was opportune to repay a large chunk of the outstanding balance. During Q3, Maverix repaid US$41M of the credit facility, and this should result in lower interest expenses in Q4 (which, in turn, will boost the net cash flows).

As of the end of September, Maverix had in excess of US$28M in cash on the balance sheet and US$35M in debt for a net debt of just under US$7M. As Maverix also had in excess of US$11M in receivables on the balance sheet, as well as almost US$14M in investments, the balance sheet is in an excellent shape.

The acquisition of the Newmont royalty portfolio has now been completed

Maverix continues to build its royalty portfolio and the company has now completed the acquisition of a royalty portfolio from Newmont (NEM.TO, NEM). The portfolio consists of 11 royalties on projects in different stages of the development curve with Orla Mining’s (OLA.TO) Camino Rojo project in Mexico in the construction stage. This project is anticipated to start producing in 2021 with an average output of 97,000 ounces of gold and 511,000 ounces of silver per year. At the current gold and silver price, this 2% NSR has the potential to generate almost US$4M per year in cash flow.

Interestingly, the royalty portfolio also contains an NSR on the Mother Lode project owned and operated by Corvus Gold (KOR.TO, KOR) and this 1%-2% NSR could be very interesting given the recent exploration success enjoyed by Corvus on the land package. However, the NSR will only be applied to a portion of the total package, so it will be in Maverix’s best interest to see Corvus adding ounces on the land where the NSR does apply.

These are just two highlighted projects but we encourage you to read the entire Maverix press release here as the company described the key assets in more detail.

As consideration for the purchase of the portfolio with 11 royalties, Maverix has issued 12 million shares (at a deemed price of US$5/share) and paid US$15M in cash for a total upfront consideration of US$75M. Maverix may have to pay up to an additional US$15M if certain production milestones are met at each of the Mother Lode, Imperial, or Ana Paula projects.

As this deal only closed in October, the cash outflow of US$15M will be recorded in the Q4 report.

Conclusion

While the record-high net income was partially caused by two non-recurring events, the ‘core’ cash flow indicates Maverix Metals had another phenomenal quarter and this allows the company to continue building a pristine balance sheet. The small net debt would have been converted into a net cash position by year’s end, if it wasn’t for the acquisition of the Newmont portfolio. We obviously don’t mind this deal as one of the projects in the royalty portfolio is currently being built while four others are earmarked as development stage projects and we can reasonably expect the first royalty to start contributing in 2021 (the official production start guidance provided by operator Orla Mining) and this will further boost the cash flows. Additionally, it is great to see a top quality company like Newmont increase its shareholding in Maverix from 23% to 30%, which signals its confidence in the company.

Disclosure: The author holds a long position in Maverix Metals Inc. Maverix Metals Inc. is a sponsor of the website. Please read the disclaimer.