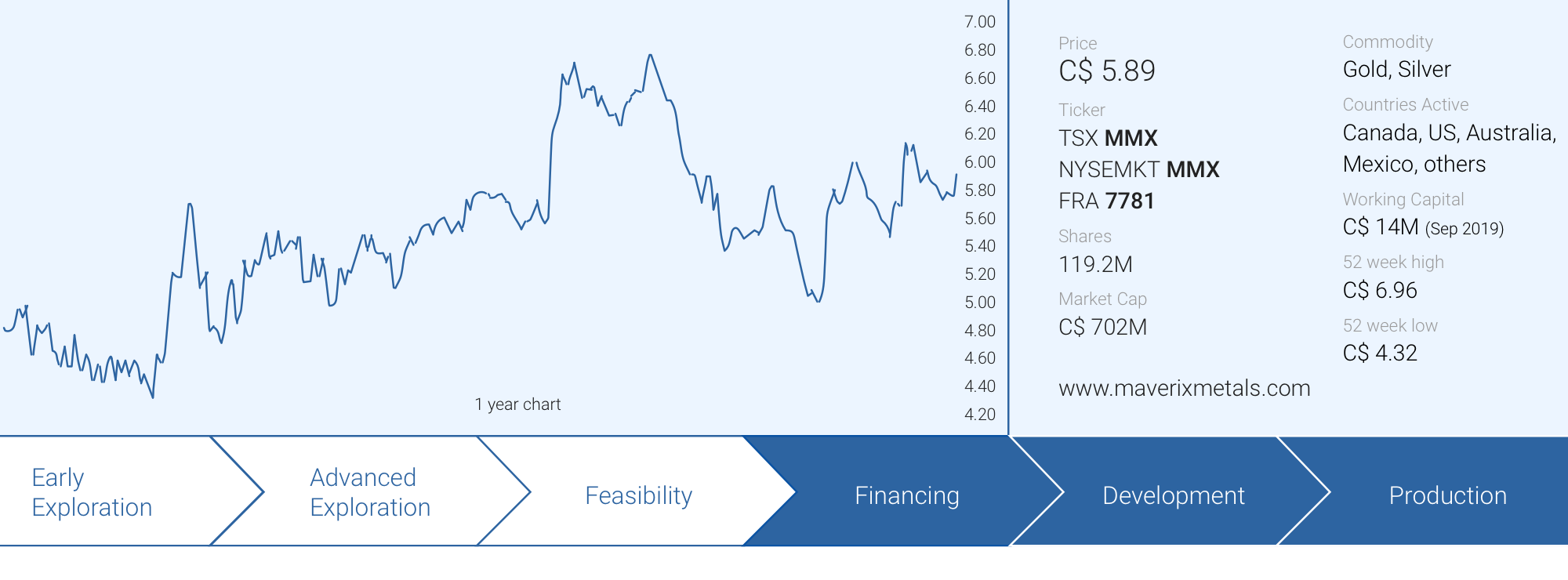

Sometimes companies are ‘silent performers’, and Maverix Metals (MMX.TO, MMX) belongs to that category. As it’s a streaming and royalty company, it doesn’t have to compete for the same amount of speculative investment dollars like junior exploration companies have to do. Instead, Maverix is targeting a whole different audience. An audience that shies away from the riskier semi-binary exploration game and prefers to invest in good cash flowing stories.

Maverix’s production profile is still growing and as such its cash flow results are accelerating (although the company obviously also has to thank the strong gold price for its excellent performance in the third quarter of this year).

A look at the Q3 performance

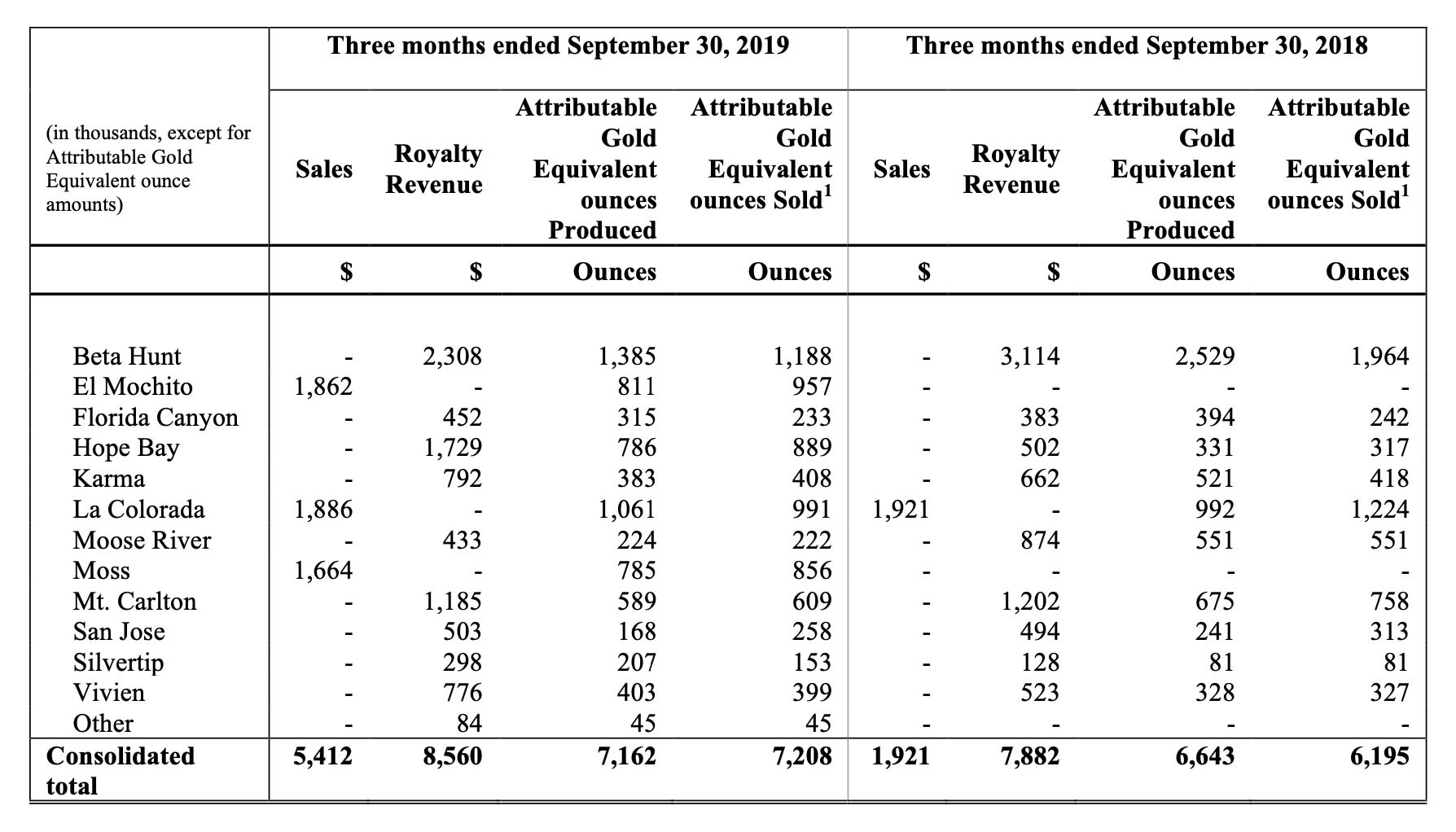

1 – The attributable output

Unlike in the first two quarters of the year, the amount of gold sold (7,208 ounces) was almost equal to the gold production effectively attributable to Maverix (7,162 ounces). We saw a lower attributable gold production from the Beta Hunt mine (which hardly is a surprise considering the ultra high-grade gold discovery in Q3 2018 had a large non-recurring impact on the attributable gold production. Some of the mines (Karma, Florida Canyon, San Jose) reported a lower attributable gold production, but the heavy hitters in the portfolio (Hope Bay and Silvertip) posted triple-digit percentage production increases as the attributable gold production increased by respectively 137% and 156% which helped to mitigate the impact of the mines with a lower attributable production.

Additionally, the new mines Maverix added to the portfolio within the past year are also contributing nicely. The Moss mine added 785 gold-equivalent ounces to the consolidated attributable gold (-equivalent) production profile while the attributable production from the El Mochito mine also had a positive impact on the consolidated results.

In fact, this also confirms the purchase of the El Mochito silver stream was a good idea. The 811 attributable gold-equivalent ounces represent approximately 70,000 ounces of silver (using the current gold:silver ratio of 85). Considering Maverix agreed to pay 25% of the spot silver price (currently $4.45/oz based on a silver price of $17.8/oz), it is currently generating just over $12.5 in cash flow per ounce of silver sold at El Mochito. Multiplying this with the 70,000 attributable ounces produced in Q3 results in Maverix generating approximately US$850,000-875,000 in pre-tax cash flow from this asset. And considering Maverix paid just US$7.5M for the silver stream, the return on investment on this stream purchase appears to be exceptionally high. A testament to the Maverix management team that identified this opportunity.

Maverix has confirmed its full-year outlook at 22,500-24,500 gold-equivalent ounces. Considering the total attributable production in the first nine months of the year was almost 15,900 ounces and Q3 saw an attributable production of almost 7,200 ounces, we would expect Maverix to meet the higher end of the full-year guidance. This should also pave the way to aim for an attributable gold production of close to 30,000 gold-equivalent ounces in FY 2020. But this is, of course, our own speculation as Maverix Metals hasn’t yet provided an official production guidance for 2020.

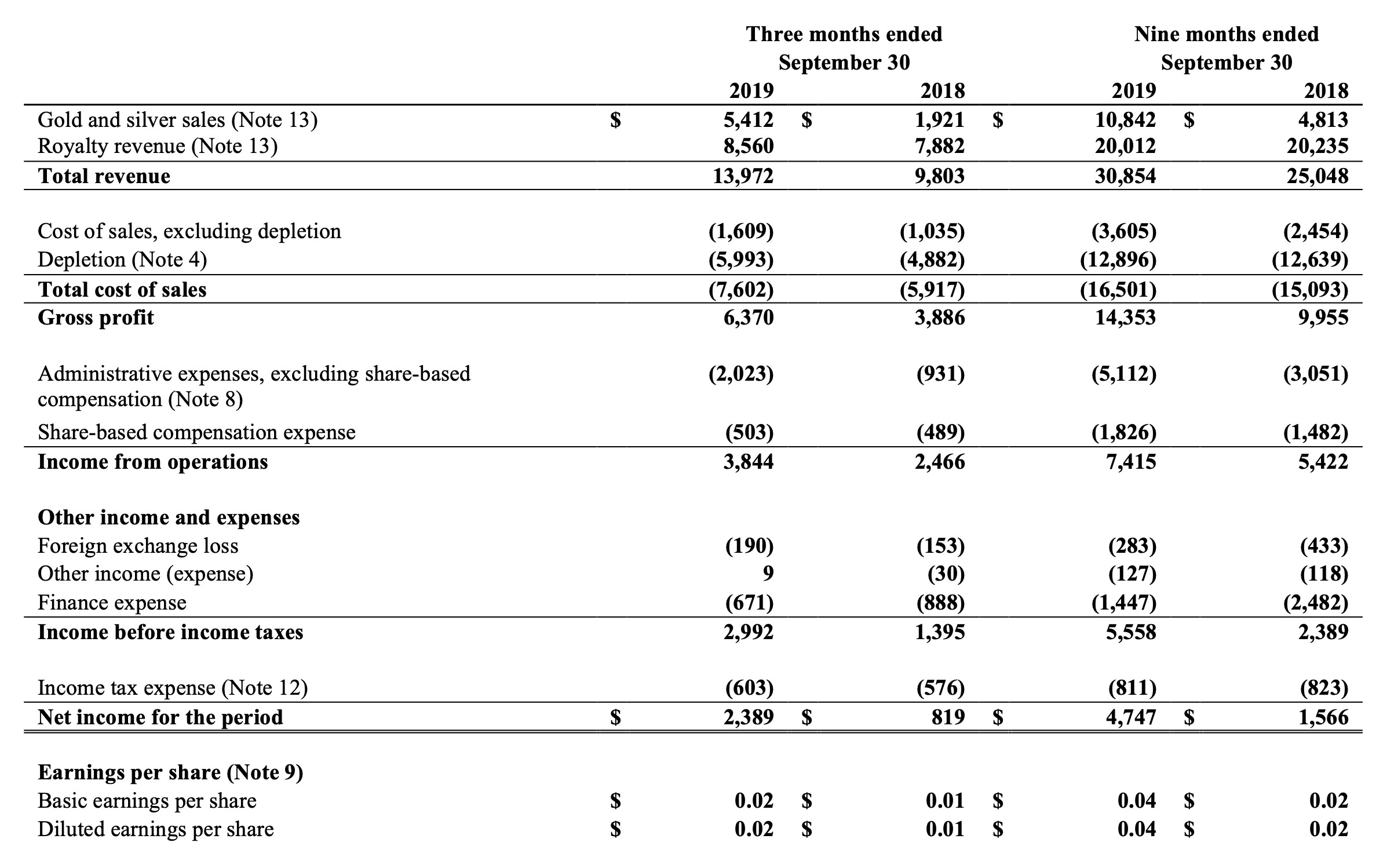

2 – The financial results

Considering the amount of gold sold was in line with the effective attributable production also means that the third quarter provides us with an excellent insight into the normalized financial performance of Maverix.

The total revenue in the third quarter of 2019 came in at almost C$14M which resulted in a gross profit of C$6.4M and an operating income of C$3.8M. This emphasizes the strong performance in the third quarter as the operating income was higher in Q3 than in Q1 and Q2 combined despite another increase in administrative expenses (to C$2M compared to C$3.1M in H1). The bottom line of the income statement shows a net income of C$2.4M or two cents per share.

Considering a large part of the operating expenses consist of non-cash expenses (for instance the C$6M depletion expense and C$0.5M share-based payments), one can reasonably expect the free cash flow result of Maverix to be substantially higher than the reported income.

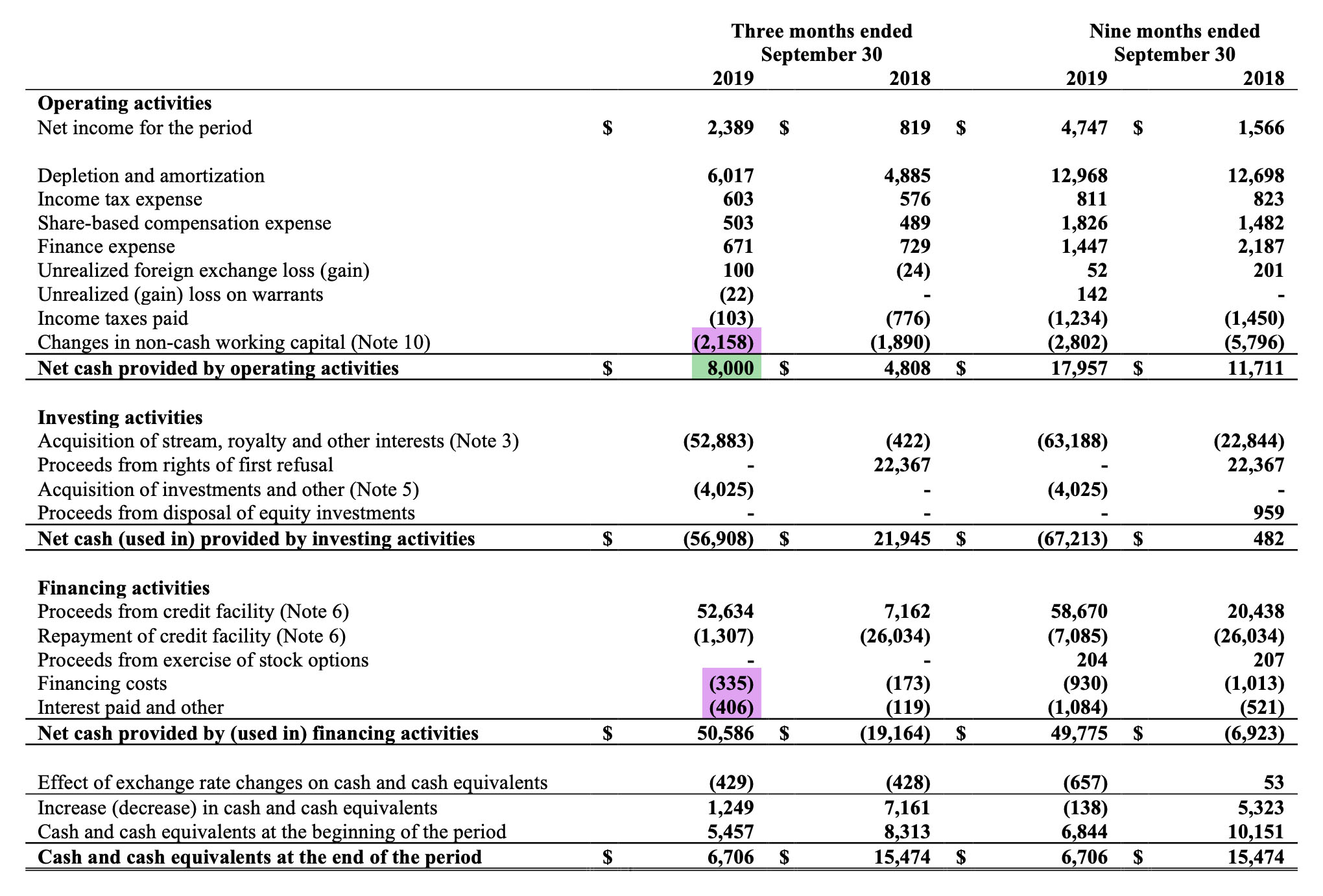

The reported operating cash flow was exactly C$8M in the third quarter, but this also included a C$2.16M working capital adjustment for the timing differential of accruing royalty revenue during the quarter, but receiving the royalty revenue after the quarter-end and excluded C$740,000 in interest and financing expenses that were payable in Q3. So on a normalized basis (excluding the working capital changes but including the finance expenses), Maverix generated C$9.4M in operating cash flow.

On an annualized basis, based on Q3 2019, Maverix’s operating cash flow could easily reach C$35-38M (at the current gold price). This cash will be used for new acquisitions of streams and royalties, and to repay the cash drawn down from the credit facility as well as payment of the recently announced dividend.

The increased credit facility ensures flexibility to act on new opportunities

During the third quarter, Maverix completed the purchase of an additional 1.5% Net Smelter Royalty on the Hope Bay mine, owned and operated by TMAC Resources (TMR.TO) for C$53M in cash. An additional 0.25% NSR will be payable until TMAC meets certain conditions, but TMAC will also have the right to repurchase the 1.5% NSR for US$50M in cash in case of a change of control event announced prior to June 30, 2021, while it also retains the option to repurchase 0.5% of the NSR for US$15M in cash after June 30, 2021.

To fund this transaction, Maverix withdrew cash from its credit facility which was subsequently upsized. The new US$120M (approximately C$160M) credit facility is provided by a consortium of three Canadian banks (CIBC, National Bank and Scotiabank) and has a very reasonable cost of just LIBOR +2 to +3% while there is a standby fee of 0.45-0.675% per year on the unused portion of the credit line. The definitive percentages depend on the leverage ratio on the balance sheet. The lower the ratio, the cheaper the credit facility.

As of the end of September, Maverix had drawn down C$67.5M from the credit line which means it had approximately C$92.5M available on the credit facility. Combined with the almost C$7M in cash on the balance sheet, Maverix’s access to liquidity totaled almost C$100M at the end of Q3. This was subsequently used to make the cash payment to Kinross Gold (see later).

The first dividend will be paid in January 2020

The company had been mulling over initiating a dividend policy for the past few quarters, and the board of directors has now approved a first quarterly dividend.

Maverix will pay US$0.01 per share on January 15th, 2020 to the shareholders of record as of the end of the business day of December 31st, 2019. This means the shares will very likely start trading ex-dividend on either December 29th or December 30th (1 or 2 days ahead of the record date). Although the initial dividend will be payable in US Dollars, Maverix remains a Canadian company and the Canadian dividend withholding taxes will apply. The standard withholding rate for non-resident investors is 25% but most countries have treaties in place to reduce this percentage to 15%. Additionally, foreign investors will obviously still also have to pay the relevant dividend taxes in their country of domicile.

The initial dividend yield will be just below 1% (based on the current USD/CAD exchange rate and the current share price of Maverix) so the dividend is relatively symbolic. An additional positive side effect is that it would allow portfolio managers that are required to own dividend-paying stocks to also consider an investment in Maverix when it starts its dividend payments.

A new president

Maverix also recently expanded its team as the company announced the appointment of Ryan McIntyre as the new president of the company.

Mr. McIntyre joins Maverix from Tocqueville Asset Management where he was a co-portfolio manager of the Gold Strategy fund as well as the Tocqueville Gold Fund. As Tocqueville is (and has been) a major shareholder in Maverix, Mr. McIntyre should already have a detailed knowledge of the assets in the Maverix portfolio so he should be ready to dive right in.

Another royalty portfolio acquisition while adding Kinross as a strategic shareholder

Maverix also had more important news as the company announced it acquired a portfolio of 25 royalties from Kinross Gold (KGC, K.TO). This acquisition effectively expands Maverix’s royalty & stream portfolio to 105 assets of which 14 will be generating cash flow.

Some of the royalties in the portfolio are on well-known projects like the 2.5% Net Revenue Royalty on the Kensington mine in Alaska, owned and operated by Coeur Mining (CDE) and the 1.5% NSR on the Monument Bay project owned by Yamana Gold (AUY, YRI.TO). According to the Yamana website, Monument Bay contains 1.8 million ounces of gold in the indicated resource category at an average grade of 1.52 g/t and an additional 1.78 million ounces in the inferred resource category at an average grade of 1.32 g/t so it definitely is a sizable project.

Another interesting royalty included in the package is the 2.5% NSR on the DeLamar project in Idaho, owned by Integra Resources (ITR.V). The NSR is on the DeLamar deposit (and not on Florida Mountain) so given the currently planned mine sequence according to the PEA, the DeLamar zones will only be mined from year 6 on so any potential income from this NSR probably won’t occur before the end of next decade. But it still is an interesting royalty as Integra has barely scratched the surface at DeLamar and the total potential size (beyond the current total resource estimate of 1.8M ounces gold and 106 million ounces silver remains unknown at this point).

Additionally, the royalty on the Cerro Casale project (1.25% on 25% of the gross revenue) in Chile may also move the needle for Maverix further down the road as this large project is owned by Newmont Goldcorp and Barrick Gold. With in excess of 20 million ounces of gold and over 4 billion pounds of copper in the reserve estimate, both heavyweights of the industry are properly incentivized to try to develop the project. It’s not something that will happen overnight, but it’s one of those royalties that could add a lot of cash flow and value to Maverix further down the road.

And although there is only one currently paying royalty, Maverix emphasizes its longer-term outlook by acquiring royalties on projects that have a good chance of being brought into production. And although most royalties won’t start to generate cash flow until halfway next decade, there will also be an element of ‘instant gratification’ as the acquired royalty portfolio is expected to generate approximately US$3M – US$4M in cash flow in 2020. This means that based on the total purchase price of US$74M, the incoming cash flow yield will already come in at around 5% from next year on.

The acquisition terms also appear to be very reasonable. Maverix has paid US$25M in cash and issued 11.2 million shares to Kinross, which will make the latter a relatively large strategic shareholder with a 9.4% stake in Maverix. A good deal, as Maverix doesn’t have to draw down too much cash from its existing credit facility while it adds another cornerstone shareholder to its shareholder register.

Conclusion

Maverix is one of those ‘silent performers’ that does what it promises to do. This year’s attributable gold-equivalent production will probably come in at the higher end of the official guidance of 22,500-24,500 ounces, and for next year we are aiming for a gold-equivalent production of 26,000-29,000 ounces (note: these are our own expectations. Maverix has not yet provided official guidance).

And with the new dividend policy in place, Maverix will also be able to tap into a different crowd: investors looking for some exposure to the precious metals sector, but who require a (small) dividend. This year’s attributable production will be approximately twice as high as the 2017 gold-equivalent output, and we expect 2020 to be another year of additional growth.

The closing of the royalty portfolio purchase of Kinross Gold was completed about 10 days ago so the contribution to the Q4 results will be negligible (and possibly even negative as Maverix will undoubtedly have incurred some legal and banking fees during Q4) but should be a clear positive for next year. Based on Maverix’s preliminary guidance, the Kinross portfolio should add in excess of C$5M (assuming the current USD/CAD exchange rate remains stable) to the operating cash flow profile in 2020, and this will be a clearly noticeable improvement.

Maverix is continuing to position itself as one of the fastest-growing royalty companies out there and the Kinross portfolio acquisition is just another step in Maverix’s business plan to grow its cash flow base, increase its NAV per share and expand the depth and optionality of its royalty and stream portfolio.

Disclosure: The author holds a long position in Maverix Metals Inc. Maverix Metals Inc. is a sponsor of the website.