A few weeks ago, we were talking to the portfolio manager of a ‘generalist’ high-net-worth individual who only sporadically dabbles into mining. Despite having a clear focus on mainstream investments, he also wanted to have some low-risk exposure to the gold sector and we learned his core positions in mining consisted of investments in royalty and streaming companies.

The underlying reason for that decision was because A) operational and geopolitical risks are diversified amongst numerous mines and operators, B) royalty and streaming companies are not required to contribute to the underlying operator’s sustaining capital expenditures, but are entitled to the benefits of these expenditures and C) in times where the underlying operator may not be profitable, a royalty/streaming company will still be making money as its returns are based on the mine’s top line performance (metal output and market prices) rather than the bottom line. Royalty and streaming companies are exposed to long term economics of a mine, insofar as the operator and the mine have to stay in production. Three great reasons for a generalist investor to consider royalty companies to be the cornerstone of a mining segment in its portfolio.

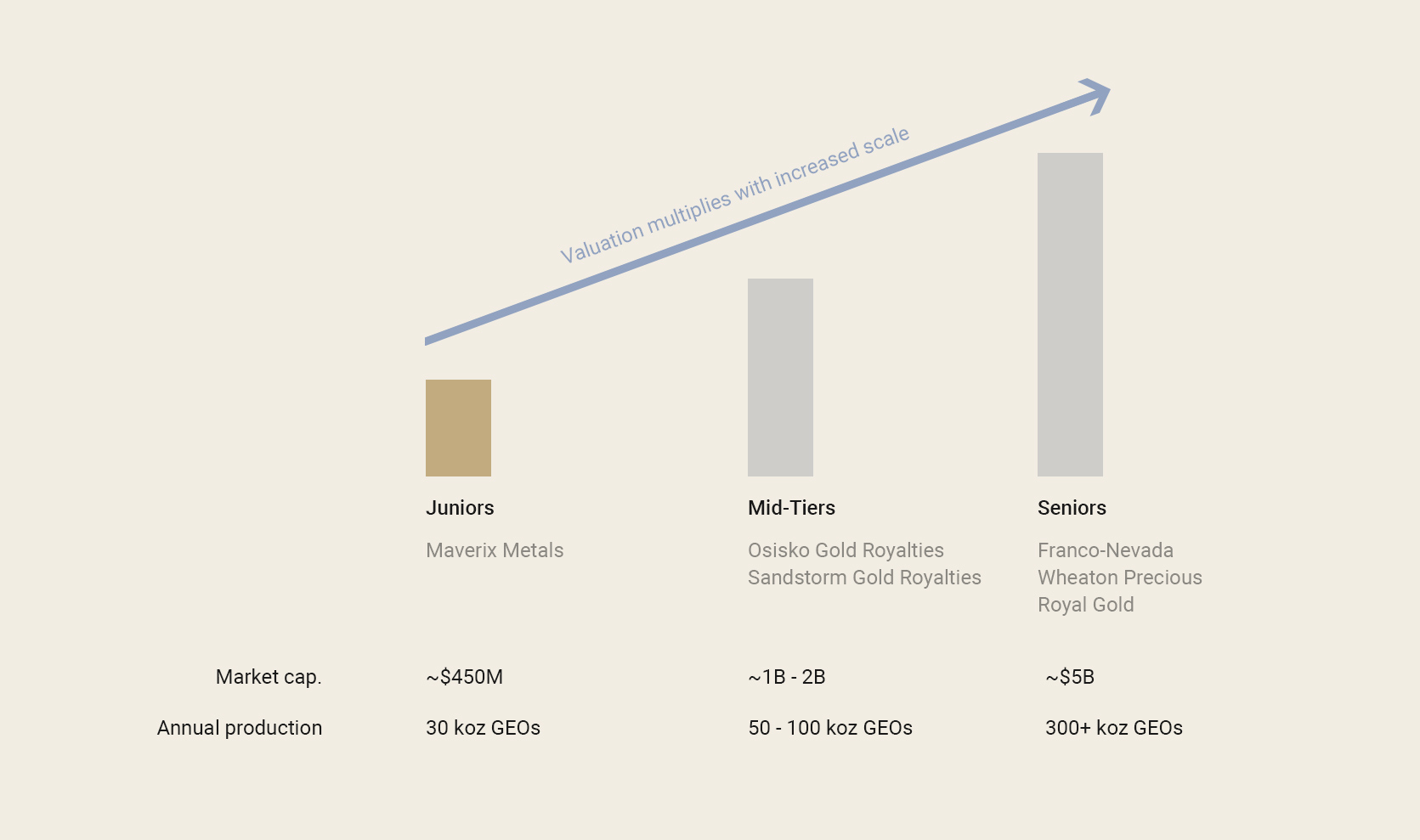

For a long time, the royalty and streaming sector was dominated by a few large companies like Franco-Nevada (FNV, FNV.TO), Wheaton Precious Metals (WPM, WPM.TO) and Royal Gold (RGLD), followed by Osisko Gold Royalties (OR, OR.TO). The problem with Franco, Wheaton and Royal is that they seem to have become a victim of their own success as it’s tough for them to find new investments that are big enough to move the needle on their share price and attributable production rates. The result: their share prices are just treading water.

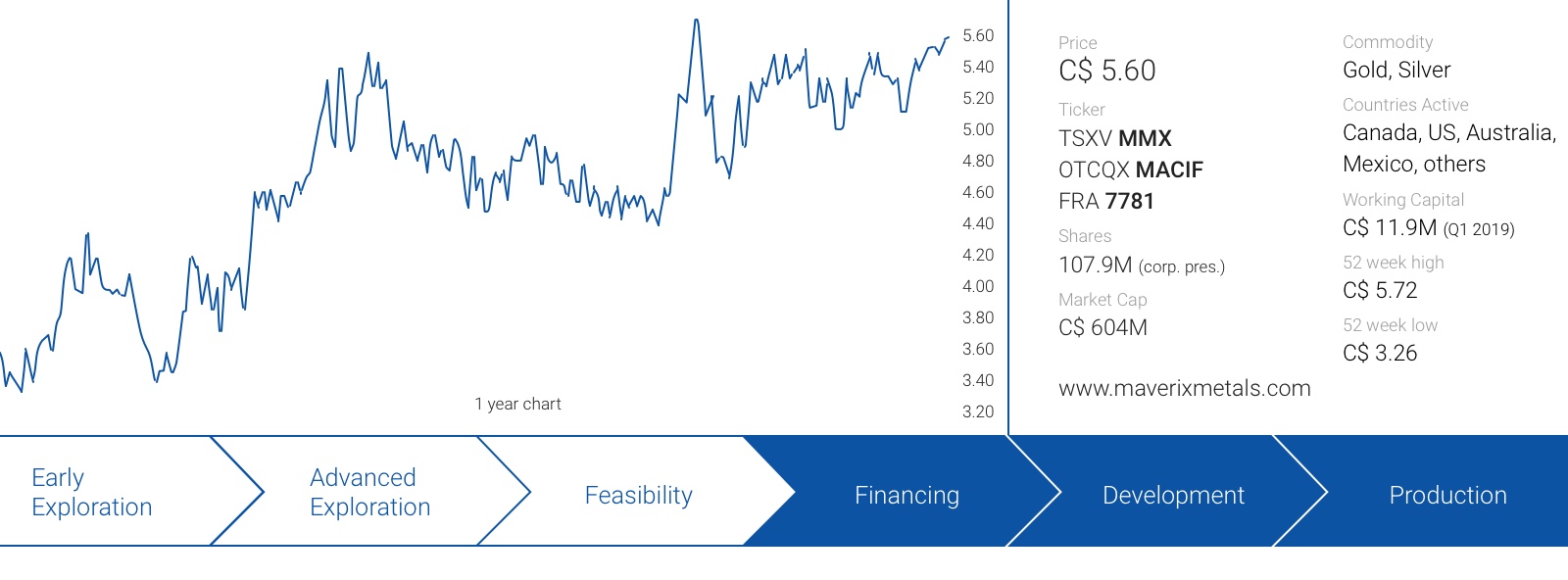

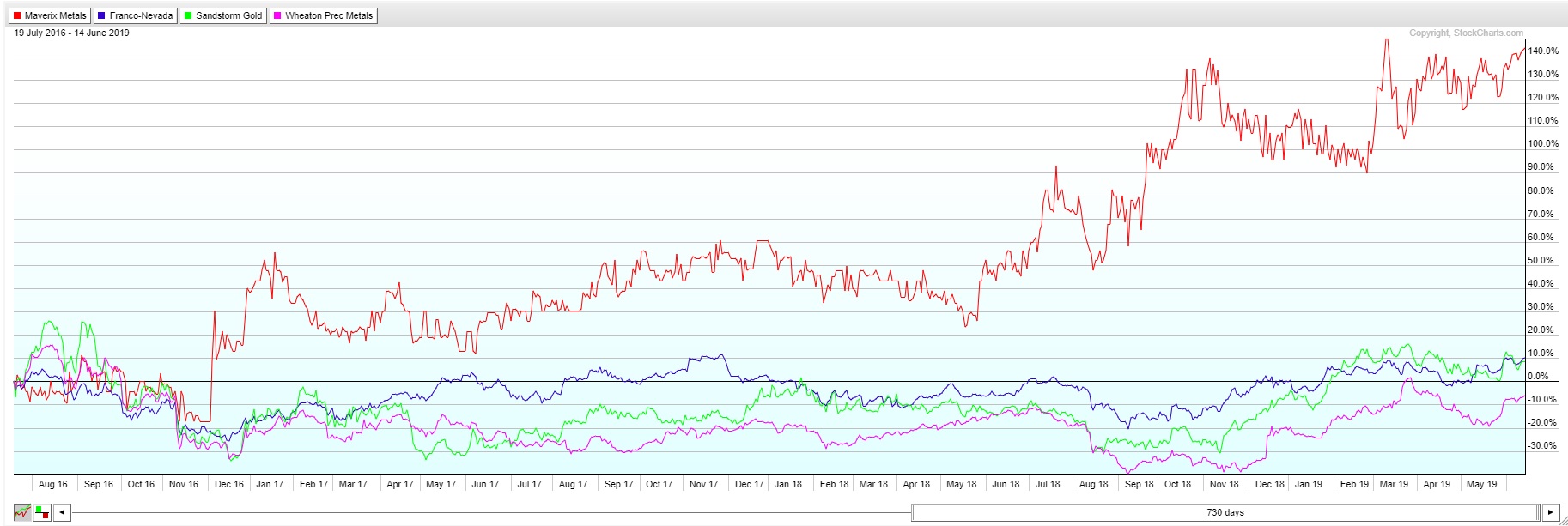

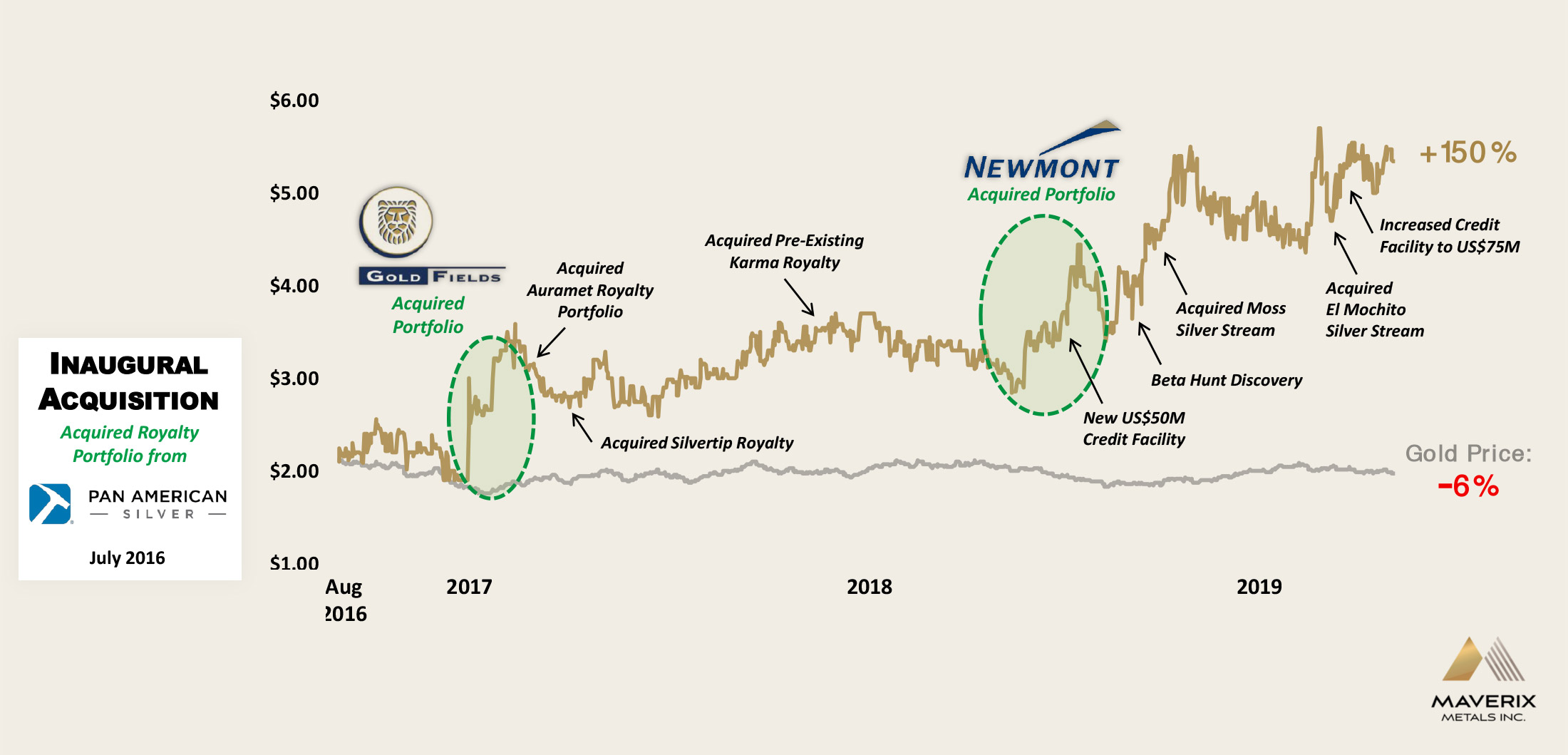

This actually created the perfect circumstances for Maverix Metals (MMX.V) which was able to complete a reverse takeover of MacMillan Minerals Inc. and simultaneously purchase a portfolio of 13 royalties and streams from Pan American Silver (PAAS, PAA.TO) in mid-2016. As a much smaller royalty company, Maverix was able to pursue the aggressive growth the bigger players were lacking. While the gold price (and the share price of its competitors) barely moved over the past three years since Maverix started trading in July 2016, Maverix’s share price has more than doubled since the closing bell after its first day of trading.

And after talking to Chairman Geoff Burns and CEO Dan O’Flaherty, seeing Maverix’s recent deals and its publicly announced plan to list in the US, we feel the best is yet to come and this US$450M/C$600M market cap company could relatively quickly evolve into a mid-tier royalty and streaming company.

The business model of royalty/streaming companies is straightforward

Although we are pretty certain most investors in the precious metals sector know what a royalty and streaming company does, we will explain the basic principles again.

Royalty companies purchase royalties on mining projects, which essentially means they are making a one-time lump sum payment (sometimes tied to the project owner reaching certain milestones) in return for a certain percentage of the life of mine revenue once the project is up and running. This model has gained in popularity over the past decade or so as Franco-Nevada has paved the way for other royalty companies to follow in its footsteps. And a royalty deal benefits both parties involved.

First of all, the seller of a royalty gets a nice amount of cash up front. This could for instance help the owner of the project to complete its economic studies or it could even be part of a construction funding package. As the equity markets for mining companies remain very volatile, selling a royalty could be a very welcome component of a financing structure, instead of the dilution that comes with selling equity at lower than optimum prices. And of course, not all royalties are newly created, as there could be royalties on a project as part of a previous transaction.

A streaming deal is slightly different from a royalty agreement as it generally requires an ongoing payment per ounce of gold and silver delivered to the streaming company.

A good real-life example of a stream transaction involving Maverix Metals would be its recent deal with Ascendant Resources (ASND.TO), which operates the El Mochito mine in Honduras. Maverix recently entered into an agreement with Ascendant whereby the latter committed to sell 22.5% of its silver production to Maverix Metals in return for an upfront cash payment of US$7.5M (approximately C$10M) and an ongoing payment per ounce of silver equal to 25% of the spot price for silver. Subject to certain conditions, Maverix may also acquire an additional 17.5% of the silver production by contributing an additional US$7.5M in cash.

You may wonder why Ascendant was crazy enough to sell an estimated 165,000 ounces of silver per year (this is 22.5% of the expected payable silver output) for an ongoing payment of US$3.75/oz, and thus leaving approximately US$2M per year on the table (the difference between selling the 165,000 ounces at $15/oz or $3.75/oz).

The answer is pretty simple. Ascendant currently has a market capitalization of less than C$30M and raising C$10M on the equity markets would have had a disastrous impact on Ascendant’s share structure. So for ASND it’s an easy move to decide to sell a silver stream as the cost of capital of the silver stream is lower than the cost of equity, especially because the silver is a by-product credit of the zinc mine, and using a part of the expected silver production in a streaming deal shouldn’t have a major impact on the economics of the mine. The US$7.5M cash payment from Maverix provides a very welcome cash inflow for Ascendant as it continues putting its financing package together to expand the mine and cut the production costs to less than a dollar per produced pound of zinc-equivalent.

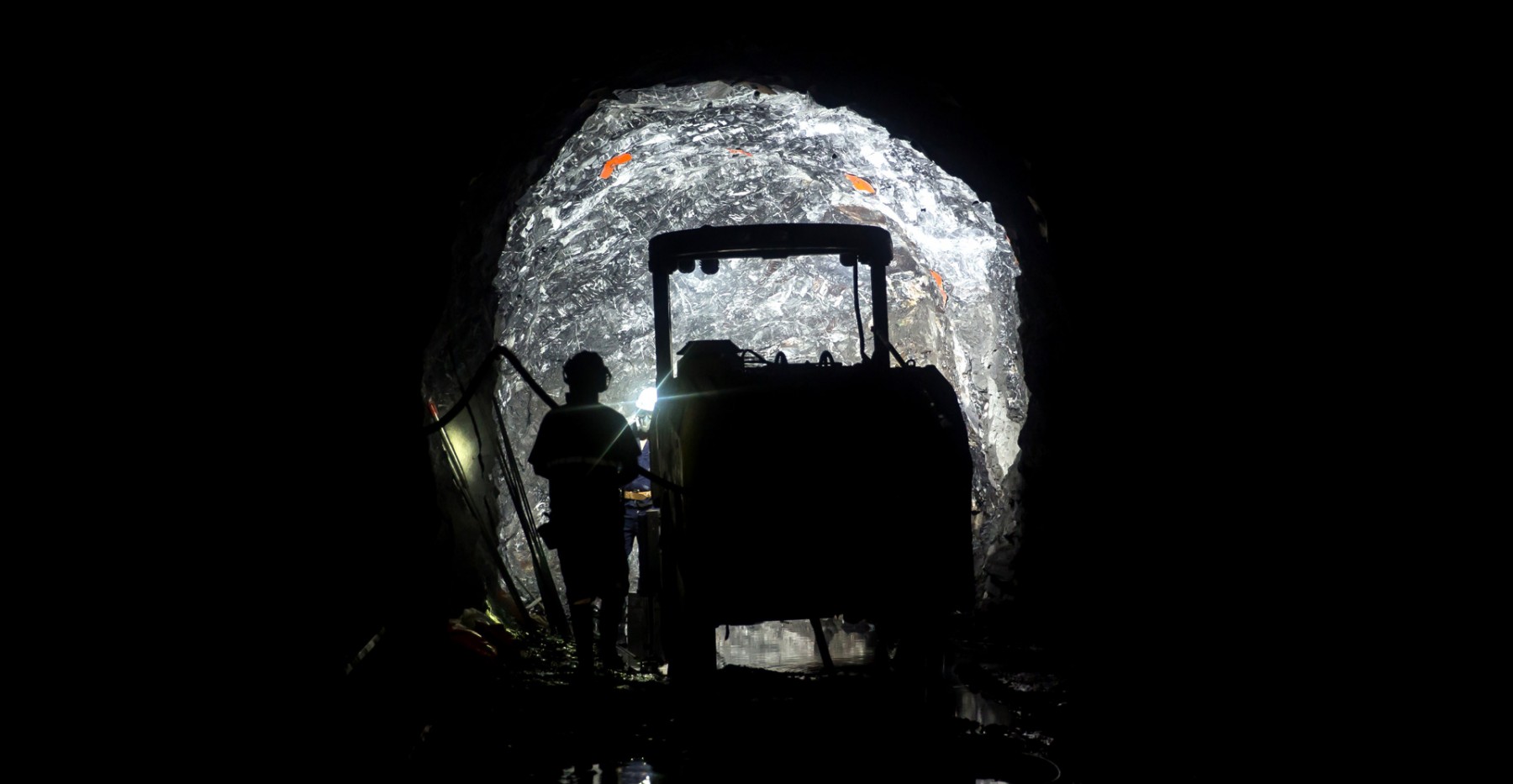

El Mochito Mine operated by Ascendant Resources

So, the benefit for the seller of the stream (Ascendant) is very clear. It simply is the cheapest capital available. But the benefit for Maverix Metals is also clear. The company will be able to purchase 165,000 ounces of silver per year (the expected output in the next three years at the El Mochito mine) at an ongoing payment of $3.75 per ounce, and this doesn’t include the remaining 22.5% of life of mine silver production Maverix is entitled to.

Considering the current silver price is approximately $15/oz, Maverix will make a margin of approximately $11.25 per ounce delivered by Ascendant. $11.25 multiplied by 165,000 ounces results in an incoming annual cash flow of $1.8M. And considering Maverix paid just US$7.5M for the silver stream, the payback period is just 4.5 years.

And that’s where it gets interesting for Maverix Metals.

El Mochito contains approximately 7.5 million tonnes of rock in the measured and indicated resources and an additional 5 Million tonnes in the inferred resource category (note, this resource estimate is about a year old, so there very likely will be some depletion to the tune of the 800-900,000 tonnes that have been mined since the publication of the resource estimate).

If we would assume a part of the inferred resources would effectively be converted into M&I resources and subsequently be included in the mine plan and if we would assume 8 million tonnes of the 12.5 million tonnes across all categories (the NI43-101 rules obviously prohibit Ascendant Resources to throw Measured, Indicated and Inferred resources on one pile) would be processed, the remaining mine life at El Mochito would be around 10 years (excluding the impact of the expansion plans which could shorten the mine life but increase the annual production).

So Maverix purchased the stream based on a payback period of 4.5 years, while it reasonably expects the mine to be open for approximately 10 plus years. The mine has been operating for over 70 years, and previous operators have always been able to replenish the resources and bring the additional tonnes into a mine plan.

Conclusion: this streaming agreement makes sense for both Ascendant and Maverix. The deal obviously wasn’t risk free as Maverix will remain subject to Ascendant’s production decisions (the mine could for instance be put on care and maintenance should the zinc price collapse), but Maverix also benefits from exploration upside (more tonnes = more silver = more deliveries to Maverix Metals) and pricing upside (should the silver price increase to $20/oz, the operating margin would increase to $15/oz from the aforementioned $11.25/oz, and the payback period would decrease to a little over 3 years).

This real-life example probably explains very well why royalty or streaming deals could be a win-win for both parties involved. Maverix is able to invest its cash while generating positive returns and for Ascendant it just was the cheapest form of capital that was available to advance their expansion project at El Mochito. Win-win.

The brief history of Maverix Metals and its competitive advantage

As mentioned in the introduction, Maverix is a relatively new company as it only started trading on July 11th, 2016. Less than three years ago.

Bigger isn’t always better and smaller companies tend to be more agile than larger competitors, while the decision-making process involves fewer layers of management. That’s very likely one of the main reasons why Maverix Metals has substantially outperformed its larger peers. The chart below compares the performance of Maverix’s share price since the first trading day (so excluding the pro-forma valuation the moment the reverse takeover occurred) with Franco Nevada, Wheaton Precious Metals and Sandstorm Gold. We used the Canadian listings for all four companies to exclude the impact of FX changes to ensure we are comparing apples to apples:

While most mature streaming and royalty companies had difficulties to post a positive performance over the past 700 odd trading days, the performance of Maverix since its very first trading day is impressive.

And this didn’t happen by accident or luck, but by acquiring new royalties (and 3 major royalty portfolios) which subsequently created a solid platform to pursue additional transactions.

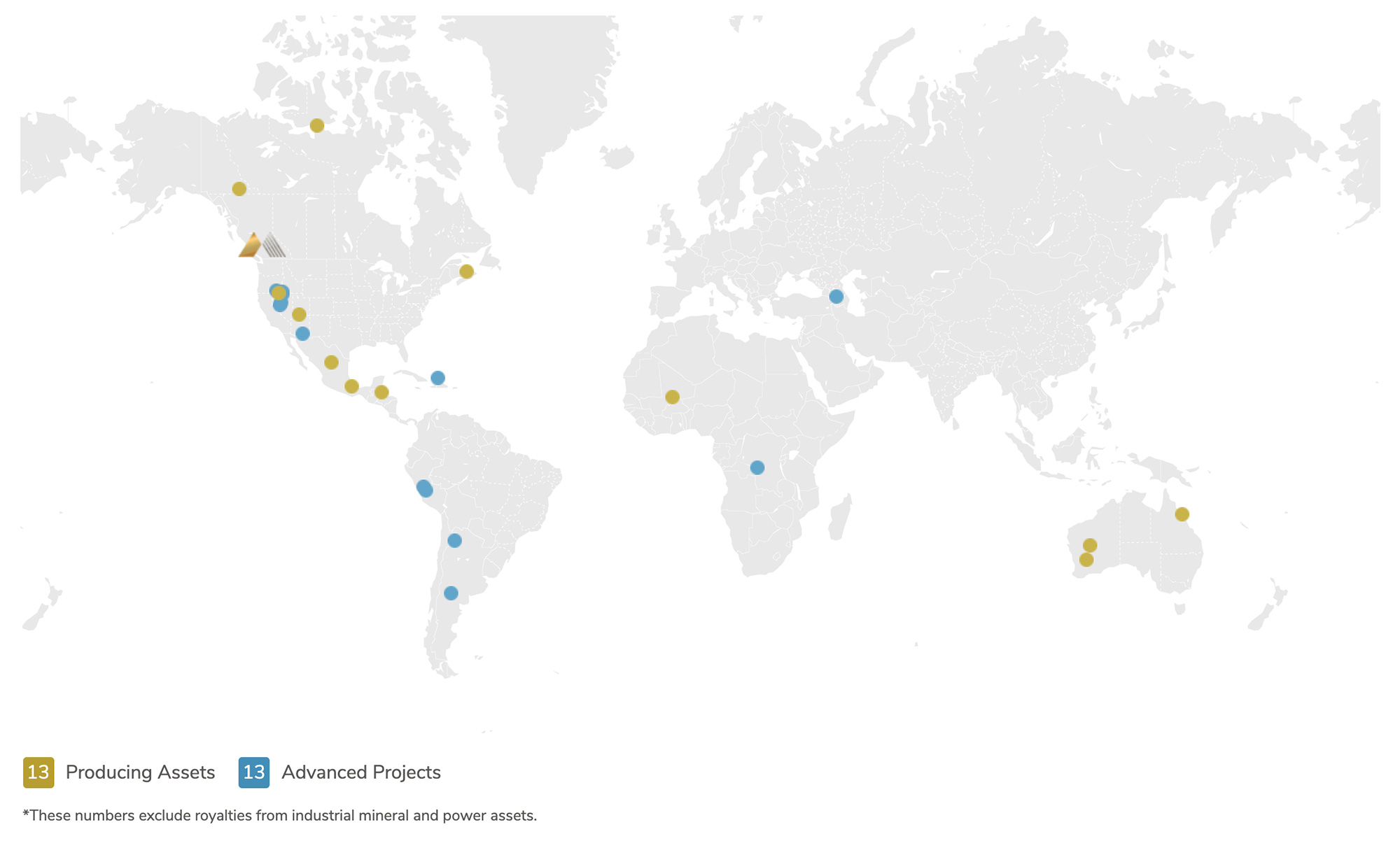

Maverix has acquired a number of additional “bolt on” royalties since they started trading, but the major boosts in its portfolio were all caused by substantial acquisitions. Thanks to the excellent reputation both Burns and O’Flaherty enjoy in the mining sector, a lot of doors were opened and strategic deals with large and well-respected counter parties (Newmont Mining, Pan American Silver, Gold Fields,…) were the result. And if Maverix meets its guidance of 22,500-24,500 gold equivalent ounces for 2019, their attributable AuEq output will have doubled over the last two years (coming from 12,000 ounces in FY 2017).

The aggressive growth is spectacular, but there also is a downside. As Maverix was able to acquire these royalty portfolios by making payments in both cash and stock (again, it says a lot about the credibility of Maverix’s business plan and key people if you see that these large companies were willing to take Maverix stock in lieu of cash), Gold Fields, Newmont Mining and Pan American Silver ended up with a combined ownership of approximately 70% of Maverix Metals. Gold Fields recently sold its stake to other institutional investors, so we currently consider the shares to have ended up in strong hands.

On the one hand, it’s great to have one large producer as a reference shareholder, having three of them probably is the best vote of confidence you can get. Each of these three major shareholders also have future ROFO’s where they must give notice to and grant Maverix an opportunity to make an offer to acquire any future royalty or stream they contemplate granting in the future. Additionally, Pan American currently holds two seats on Maverix’s Board of Directors, while Newmont holds one, which brings another layer of experience and knowledge to Maverix’s Board.

On the other hand, it also creates liquidity issues. Maverix Metals has the perception of mainly being a ‘story for institutionals’ due to its anchor investors and lack of free float. The three large companies owned 70% right before Gold Fields sold its stake, Chairman Burns owns 5.7% while CEO O’Flaherty owns an additional 2.9% of Maverix Metals.

Other board members control an additional 2% (rounded) while Resolute Funds owns ~15% (as they were one of the purchasers of the Gold Fields block), and both Tocqueville Asset Management and US Global Investors own Maverix shares as well. This means five institutions and management & insiders control a large percentage of the stock. Throw in the fact most existing shareholders are extremely pleased with the performance of Maverix so far (which reduces their willingness to sell), and Maverix’s main issue right now is the lack of liquidity which acts as a potential deterrent for other investors.

The total trading volume in the past 5 trading days was approximately 336,000 shares (in Canada), which represents a dollar volume of C$1.8M, which is quite low for a company with a market capitalization of around C$600M. So if there’s something Maverix still needs to work on, it’s spreading the message and getting more retail investors interested in the stock as that’s what ultimately drives the volume, making the stock more ‘investable’ for other parties.

A quick look at some of Maverix’s most important royalties and streams

Considering Maverix Metals has multiple royalties and streams on producing (and non-producing) mines, it would take us too long to discuss them all in great detail. We will limit ourselves to highlighting just a few, but you can find a detailed (and up-to-date!) description of the producing mines on Maverix’s ‘assets’ pages.

La Colorada, Mexico

One of the original streams that was created when Maverix Metals acquired the portfolio from Pan American was the gold stream on the prolific La Colorada mine in Mexico. Maverix is entitled to purchase 100% of La Colorada’s by-product gold production at a fixed cost of $650/oz.

Considering La Colorada will produce between 4,100 and 4,800 ounces of gold this year, the La Colorada stream should result in an incoming cash flow of US$2.5-3M and represents approximately 20% of the expected full-year gold-equivalent production. As this is one of Pan American’s most profitable silver mines (the cash cost per produced ounce of silver was just over US$2/oz in FY 2018) and with 8.6 million tonnes in the reserve estimate, the total mine life based on the reserves is approximately 13 years.

There recently was some excitement about La Colorada when Pan American Silver’s 2018 exploration program intersected thick intervals of high-grade skarn mineralization. Unfortunately, there were no gold values reported (as the mineralization consisted of a silver-copper-lead-zinc combination), so the jury’s out on whether this new skarn discovery will contribute any value to Maverix Metals at all. So for now, let’s just focus on the remaining 13 year mine life contributing around 4,500 ounces of gold per year to Maverix Metals.

Hope Bay, Canada

Maverix Metals owns a 1% Net Smelter Return Royalty on the Hope Bay project in Nunavut. TMAC Resources initially struggled to reach positive cash flow on the project, but this turnaround story is (finally) gaining traction. After producing just 44,000 ounces of gold in the first half of 2018, the output increased by 50% to 67,000 ounces in the second half of 2018.

Despite a weak Q4 2018, TMAC started 2019 very strong as it continues to increase its recovery rate towards the planned 90%, while the average daily throughput of 1,610 tonnes is just 80% of the 2,000 tpd nameplate capacity. Despite this additional room for improvement, TMAC already produced 40,000 ounces in the first quarter and remains comfortably on track to meet its full-year production guidance of 160,000-180,000 ounces of gold.

As a side note, the average grade of in excess of 10 g/t that was processed in Q1 is substantially higher than the average grade of 6.8 g/t so the higher throughput and recovery rate will be necessary to continue to meet TMAC’s guidance this year.

But for 2019, Maverix Metals can look forward to its 1% NSR on 170,000 ounces of gold (the mid-point of the official guidance) to generate north of US$2M in cash flow.

Karma, Burkina Faso

The Karma project in Burkina Faso was originally advanced and developed by True Gold Mining (TGM.V), one of the companies from Mark O’Dea’s Oxygen Capital stable. Right when True Gold recovered its first gold from Karma (even before the project was in commercial production), True Gold was acquired by Endeavour Mining (EDV.TO) which probably is the best Africa-focused mining company in the world (now Randgold Resources has been acquired by Barrick Gold).

When True Gold initiated its development plans for Karma, the initial mine life was just 8.5 years, but it was clear there was plenty of additional upside by adding to the resources while converting existing resources into mineable reserves.

As of the end of last year, the total resource at Karma contained approximately 3.4 million ounces (oxide, transition and sulphide) and at a current production rate of in excess of 100,000 ounces of gold per year, we are pretty certain the mine will be up and running for longer than the initially eyed 8.5 years. Endeavour Mining also plans to conduct a 27,000 meter drill program to find more oxide zones to continue to keep the leaching activities going, but considering the majority of the 3.4 million ounces are hosted in sulphide, Endeavour will have to figure out if it wants to build a CIL plant to process the sulphide mineralization.

Maverix Metals acquired a 2% Net Smelter Return Royalty on Endeavour’s 90% stake in Karma (which results in an ‘effective’ 1.8% NSR on the total gold production) for US$20M. Endeavour expects to produce 105,000-115,000 ounces of gold this year, and the midpoint of this guidance (110,000 ounces) would indicate an attributable 1,980 ounces of gold for Maverix, for a net cash flow of US$2.5M per year.

Beta Hunt, Australia

And finally, given the recent excitement around the Beta Hunt mine owned and operated by RNC Minerals (RNX.TO), it’s perhaps interesting to note Maverix Metals has a 6% gross revenue royalty and a 1.5% Net Smelter Royalty on all the gold coming out of Beta Hunt (on top of the 1.5% NSR on the nickel production). RNC Minerals aims to have an updated resource out any day now, and will very likely develop a new mine plan to maximize the production and cash flows from the ultra high-grade veins. A total of 987 ounces of gold has been recovered from 238 kg of vein rocks, indicating the total recoverable gold value per metric tonne was in excess of 4,000 ounces, and that’s literally unheard of. And for the record, the 987 recovered ounces should result in RNC Minerals writing Maverix a cheque to the tune of up to C$125,000.

Again, this is just a limited selection of Maverix’s royalty and streaming portfolio which solely consists of high-quality assets. The ‘assets’ pages on Maverix’s website provides excellent background information on every cash flowing royalty in its portfolio, and we encourage you to have a look there.

From ‘a few royalties’ to ‘building a company’: the next steps

Maverix Metals has doubled its attributable gold-equivalent production rate but this is just the beginning for this company. The equity markets for mining companies are still closed for companies that are aiming to raise a meaningful amount of cash. This presents an excellent opportunity for Maverix to selectively use its balance sheet to acquire additional streams and royalties by providing financing to mining companies that is otherwise unavailable.

The larger streaming companies won’t care too much about a small royalty deal or stream as that won’t move the needle for them, but that’s exactly what Maverix’s bread and butter is.

Maverix Metals reported its financial results of the first quarter of this year last month, and as expected, the company continued to increase its attributable production and revenue as Maverix is still expanding its asset portfolio.

The company reported a revenue of C$7.5M which is just 10% higher than the same period last year, but that’s mainly due to a delay of the effective sale of some of the ounces: of the 5,264 attributable gold-equivalent ounces, only 4,358 ounces were sold. The shortfall will very likely be sold during the current quarter which should result in a higher-than-expected Q2 revenue and cash flow which should mitigate the impact of the relatively soft first quarter.

Excluding the changes in the working capital position (where the account receivables increased by in excess of C$2M), Maverix’s operating cash flow would have been C$5.2M and after deducting the interest expenses paid on the net amount that has been drawn down from the credit facility, Maverix’s adjusted operating cash flow in the first quarter would have been C$4.9M.

An excellent result considering the attributable production will increase throughout the year as some of the assets Maverix has a royalty or streaming deal on are still ramping up. This results in Maverix maintaining its full-year production guidance of 22,500-24,500 gold-equivalent ounces, and the midpoint of this guidance (23,500 ounces) indicates Maverix will (on average) generate in excess of 6,000 gold-equivalent ounces as attributable production in the next three quarters.

Thanks to the expanded production profile, Maverix’s lenders (CIBC and National Bank) have agreed to upsize its revolving credit facility from US$50M to US$75M which should ensure enough fire power to continue to pursue additional royalty and stream acquisitions. The cost of debt is quite low as well at LIBOR +2-3% (indicating the current cost of debt is approximately 5.75%) with a standby fee of 0.45-0.675% due over the unused portion of the credit facility. This updated credit agreement will expire in 2023. Maverix currently has an available capacity of approximately US$60M on the revolving credit facility.

Maverix Metals recently completed its 2:1 share consolidation (which was approved at the Company’s AGM in mid May) which allows the Company to meet the minimum share price requirements of a US listing. A US listing will provide Maverix with a broader array of retail investors as the Company continues to build its portfolio of precious metal royalty and streams.

Management & Board

Geoff Burns – Chairman

Mr. Burns co-founded Maverix Metals Inc. in 2016. Previously, he served as President and CEO of Pan American Silver Corp. from May 2004 until December 2015, and was also a member of the Company’s Board of Directors. In his 30 plus years in the precious metals mining industry, Mr. Burns has gathered extensive experience throughout North and South America in both mine operations and project development having participated in many mine construction projects from the feasibility study into continuous operation. Throughout his career he has led or been a part of numerous capital market transactions raising in excess of $1.2 billion in equity, debt and convertible debt. During his tenure, Mr. Burns was instrumental in completing a number of key transformational acquisitions for Pan American. Mr. Burns holds a BSc. degree in Geology and an MBA.

Dan O’Flaherty – Director & CEO

Mr. O’Flaherty co-founded Maverix Metals Inc. in 2016. He has over 10 years of investment banking and Executive Officer experience in the mining industry. Mr. O’Flaherty is currently an Executive and Director of Anthem United, and prior to that was an Executive Vice President of Corporate Development at Esperanza Resources. He was a director in the investment banking team of Scotia Capital in Vancouver focused exclusively on the metals and mining sector where he specialized in providing advice to clients on acquisitions, divestitures, mergers, and hostile takeover defenses as well as on equity and debt financings. Mr. O’Flaherty holds a Bachelor of Commerce degree, with honours, from the University of British Columbia.

Matt Fargey – CFO

Mr. Fargey brings additional experience to the Maverix team having previously served as Corporate Controller for another metal streaming and royalty company. In his previous role, Mr. Fargey was involved in financial reporting, tax compliance, public financings, tax structuring and integration of acquisitions, and managing the day-to-day accounting of the company. Prior to becoming a Corporate Controller, he was a Manager in the Audit and Assurance Group at PricewaterhouseCoopers LLP. Mr. Fargey holds Chartered Professional Accountant and Chartered Financial Analyst designations and has a Bachelor of Commerce from the University of Victoria. Doug Ward – VP Technical Services

Mr. Ward has over 25 years of mining experience with a focus on financial and strategic planning. He was the former Director of Business Development at Pan American Silver Corp. and previously the VP Corporate Development of Revett Minerals as well as Manager of Business Development and Senior Financial Analysis of Coeur d’Alene Mines and Technical Analyst for N.M. Rothschild & Sons. He earned his BSc. in Mining Engineering from the Colorado School of Mines and an MBA from the University of Denver.

Brent Bonney – VP Corporate Development

Mr. Bonney was a member of the investment banking group with Scotiabank Global Banking and Markets specializing in the metals and mining sector. While in investment banking, he assisted clients in assessing and executing on various strategic initiatives including mergers and acquisitions, asset divestitures, strategic investments as well as other forms of equity and debt financing. Mr. Bonney holds a Bachelor of Commerce (Honours) in Finance from the University of British Columbia.

Conclusion

Maverix Metals may not be a ‘household name’ in the royalty and streaming sector, but the company is working hard to become a mid-tier gold royalty and streaming company. Due to the smaller size of the company it has a streamlined decision-making process and new transactions still have the ability to significantly move the needle.

The recently doubled production to almost 25,000 ounces gold-equivalent is just the start as Maverix Metals is just coming out of the gate. In the very near future, the company should obtain a full-US listing, while it will also upgrade from the Venture Exchange to a full-TSX listing in Canada.

The author currently has no position in Maverix Metals but intends to go long in the near future. Maverix Metals is a sponsor of this website. Please read the disclaimer