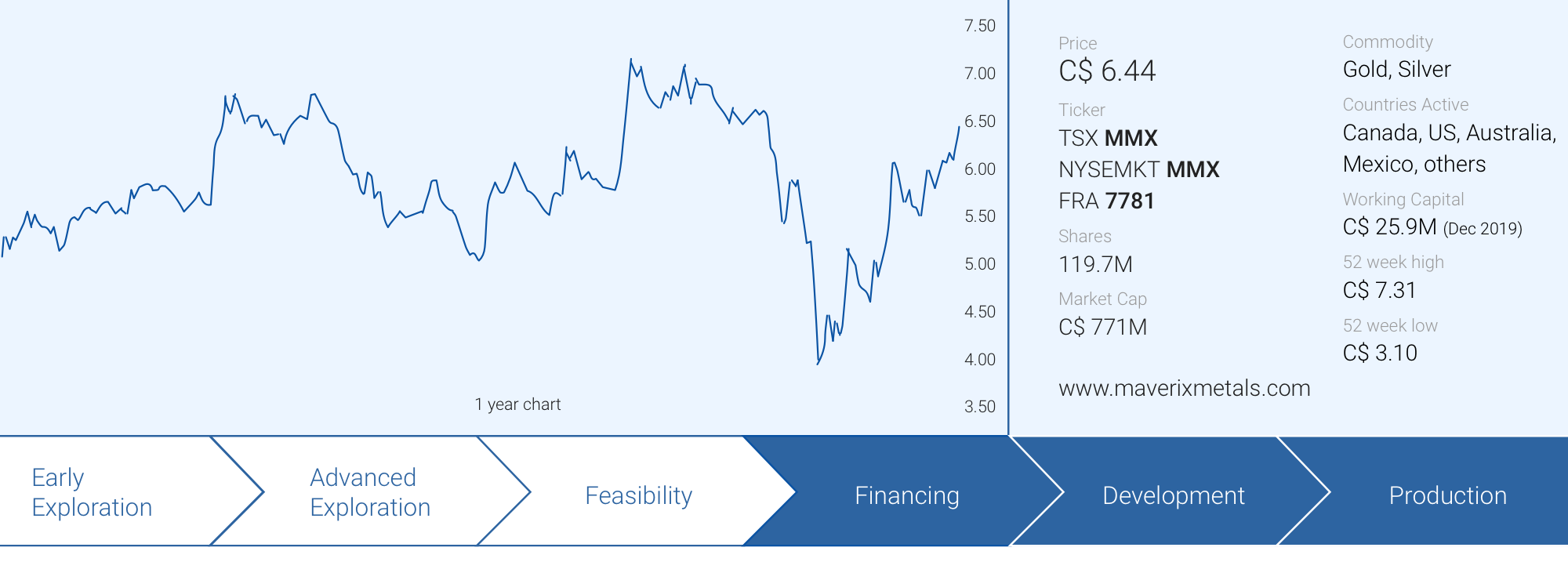

Although the gold price remained relatively stable, even royalty and streaming companies were hurt by the recent flight into liquid assets and Maverix Metals Inc. (MMX.TO, MMX) saw its share price fall by 50% in just three weeks in March.

The situation has now somewhat returned towards normalization as buyers stepped up to the plate as the low of C$3.10 this year resulted in Maverix’s market capitalization dropping to just over C$370M or US$265M. The share price has now regained all the lost ground and is currently trading at C$6.44 per share, for a market capitalization of C$771M.

We obviously shouldn’t be blind to the challenges the mining sector is facing these days as several mines have been shut down or are producing at a reduced rate and this uncertainty forced Maverix to withdraw its full-year gold equivalent ounce (‘GEO’) guidance. A pity, as 2020 was shaping up to be a year of additional growth with expected attributable GEOs of 27,000-30,000. We will have to wait for the COVID-19 dust to settle before Maverix will have a better idea of where its production may end up this year, but remember two things: 1) the gold and silver isn’t ‘lost’, it remains in the ground and its production and sale will simply be delayed, and 2) unlike producers, there are no meaningful ongoing costs to Maverix for delayed production or sales.

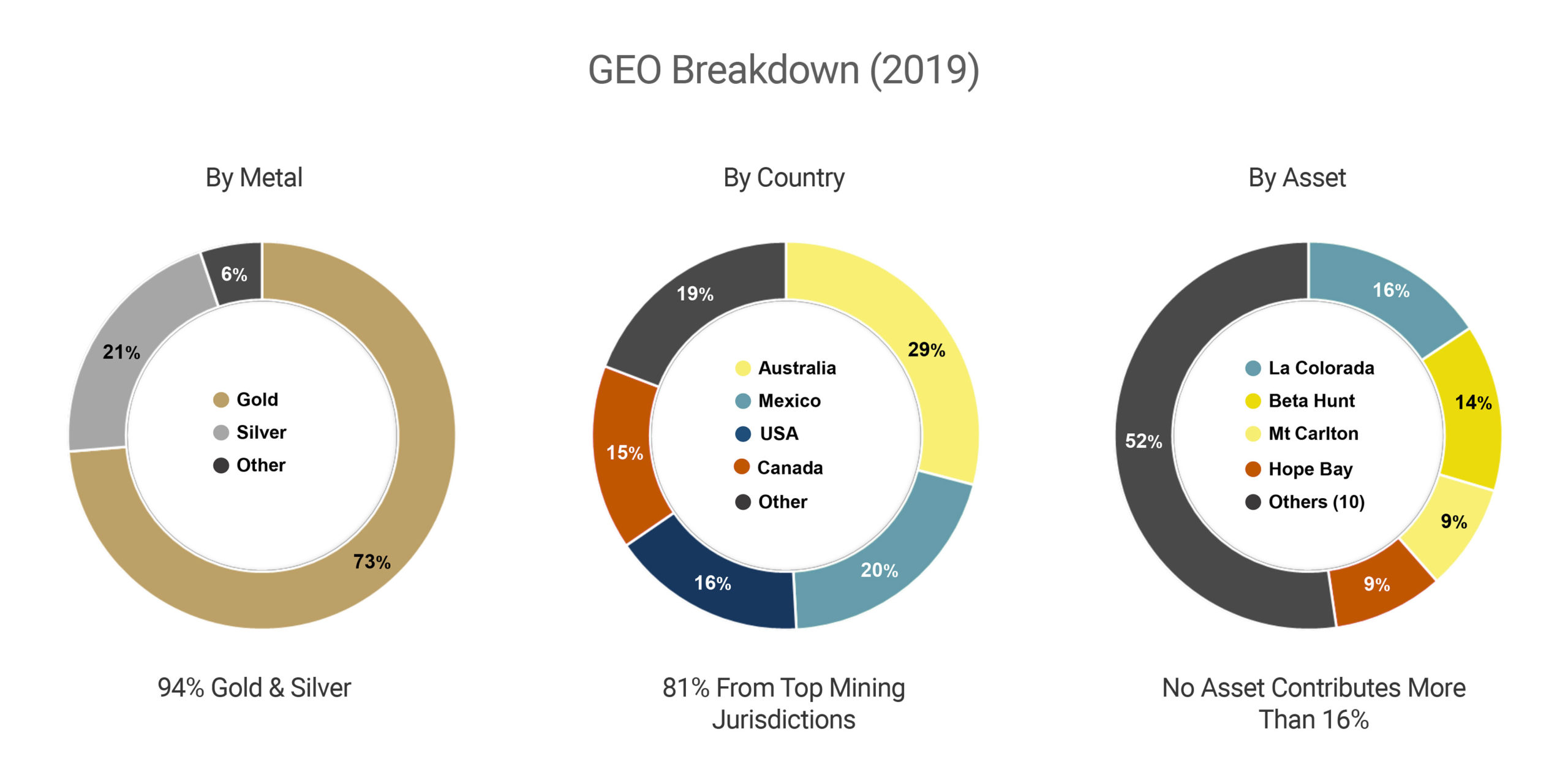

It’s also important to emphasize that withdrawing the guidance doesn’t mean things are alarmingly bad at Maverix: most of the mines remain fully operational and continue to contribute cash flow to the Maverix treasury. We should see a relatively strong incoming cash flow in the Q1 results (which will be published halfway through May) as it was ‘business as usual’ in January and February while temporary closures only occurred towards the end of March. Also keep in mind that the current strong gold price will act as a hedge to the lower attributable gold output: selling 25,000 ounces into a $1,700 gold environment will actually work out better for Maverix than selling for instance 28,000 ounces in a $1,400 gold environment. Also keep in mind that Maverix generated roughly three quarters of its 2019 revenue from gold sales, as such, its exposure to gold producing assets in the current price environment should put the company in an enviable position.

2019 ended on a strong note – thanks to the gold price

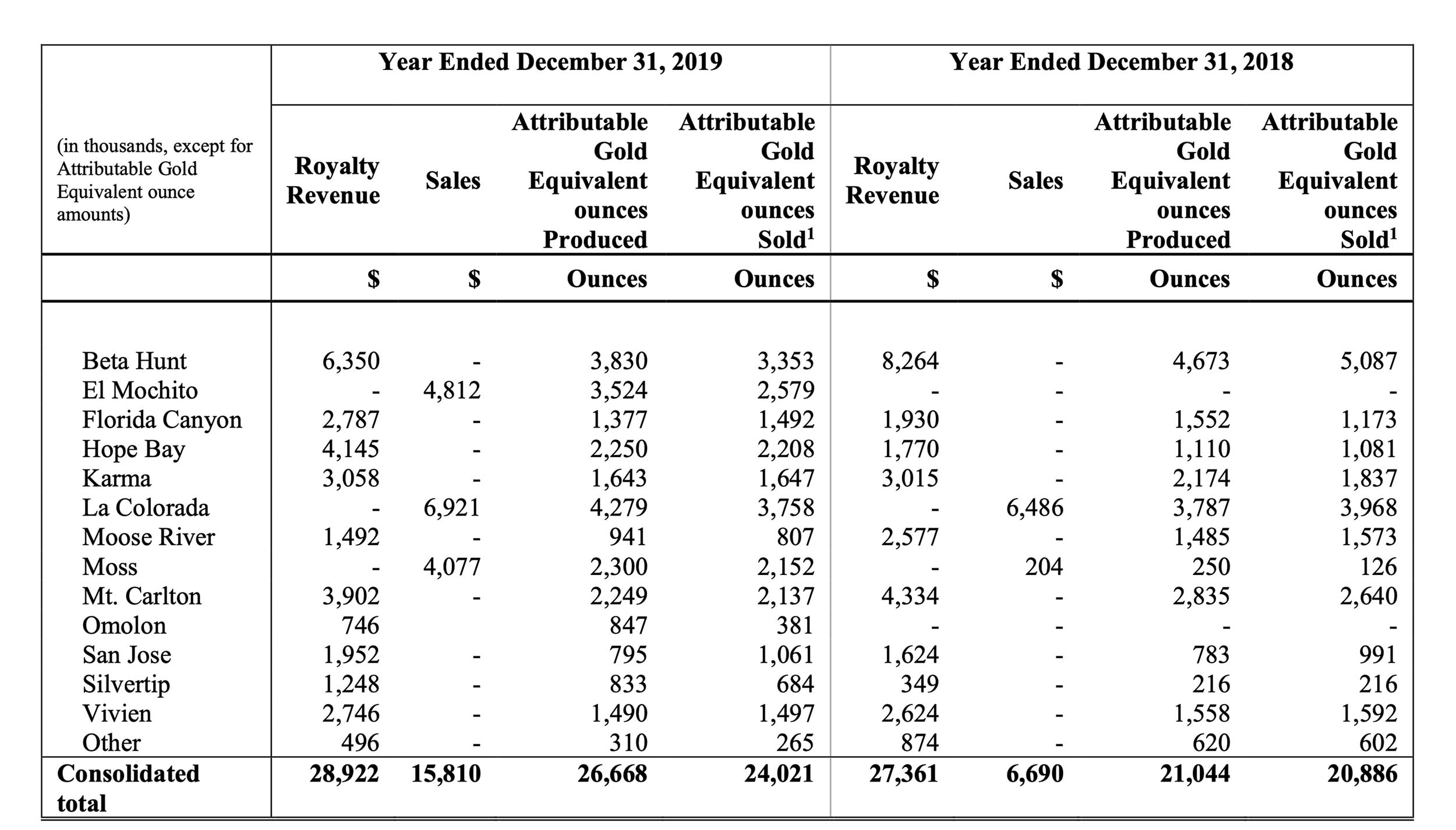

In 2019, Maverix generated a total revenue of C$44.7M, which resulted in a gross profit of C$22M, an increase of approximately 67% compared to the gross profit in 2018. Unfortunately, the bottom line of Maverix’s income statement showed a net loss of C$10.2M or around 9 cents per share, but this net loss was caused by a C$18.9M impairment charge incurred as a result of the initiation of restructuring proceedings by Lydian International from whom Maverix is entitled to receive certain quarterly royalty payments once production starts.

The net loss does not mean Maverix generated negative operating cash flow. An impairment charge is a non-cash expense and should be seen as a ‘sunk cost’: the Lydian investment was part of a greater royalty portfolio acquisition a while ago (in 2018 when Maverix acquired the royalty portfolio from Newmont Mining (NEM, NEM.TO) and there is no additional cash outflow associated with the impairment charge.

It makes more sense to look at the cash flow statements provided, and Maverix generated a positive operating cash flow of C$27.7M, which included a C$3.7M investment in the working capital, but excluded C$2.8M in financing costs and interest payments made to increase borrowing capacity from US$50M to US$120M and on the amount drawn down from its revolving credit facility. An additional C$96.6M was deployed to purchase new assets and this was funded by cash flow from existing royalties and streams and an additional C$75M drawn from Maverix’s revolving credit facility.

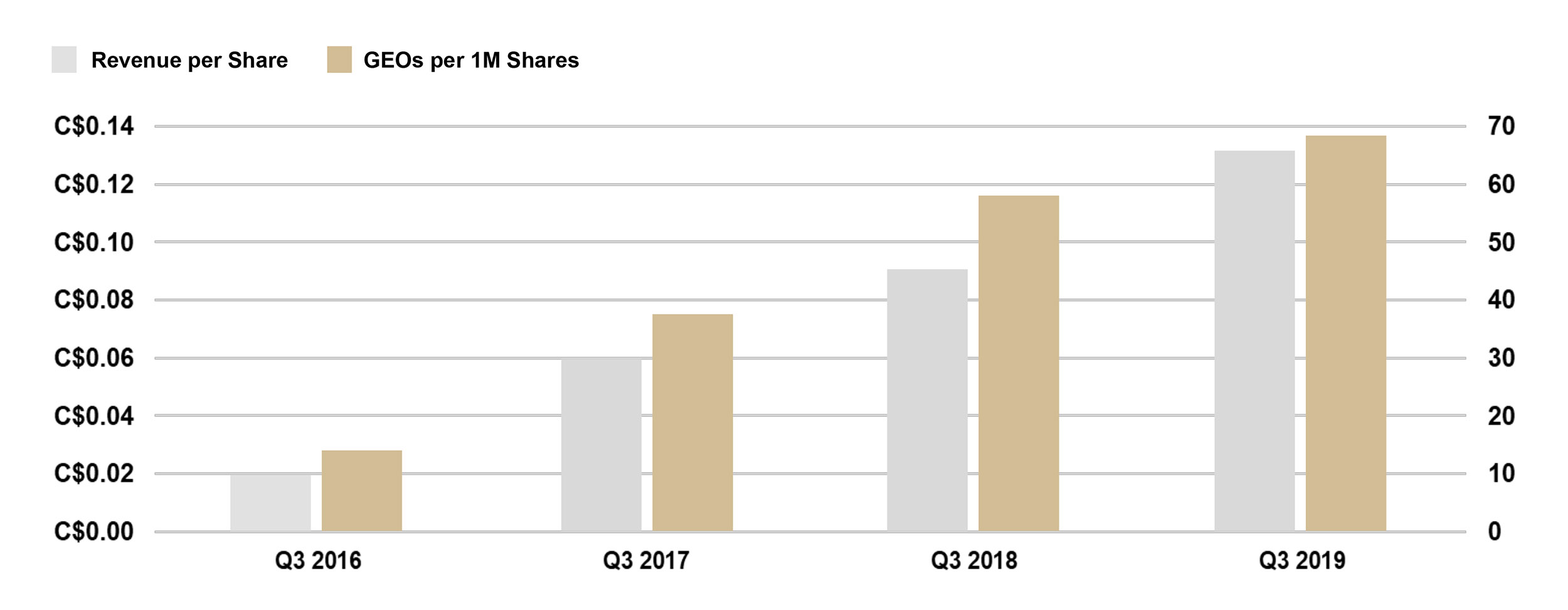

In the first three quarters of 2019, Maverix generated an adjusted operating cash flow (defined as reported operating cash flow excluding working capital changes, but including financing costs and interest payments) of C$18.8M, but the full year results show a remarkable increase to C$28.5M (C$9.75M net operating cash flow in Q4), almost 50% higher than the three preceding quarters combined. This improved performance is related to the higher gold price (in Canadian Dollars) and the higher attributable production of 7,817 gold-equivalent ounces (‘GEOs’) in Q4 compared to an average of 6,284 GEOs in the first three quarters of the year.

This bodes well for 2020, as Maverix has an excellent platform to continue its growth. Unfortunately, it is possible that the impact of COVID-19 on Maverix’s operating partners and underlying investments may have an impact on Maverix’s 2020 performance.

Though 2020 may be a lost year due to mine closures and uncertainty related to COVID-19, Maverix is uniquely positioned to weather the storm of COVID-19.

The Mexican situation

A few weeks ago, the Mexican government deemed mining operations to be non-essential and the mines in the country have wound down their operations to comply with the new Executive Order issued by the Ministry of Health. Several companies are very likely still lobbying for mining projects to be classified as an essential service, but shareholders should mentally prepare for a couple months without any relevant production as the Executive Order was recently extended to May 30th, 2020, with the potential for an earlier start up on May 18th in areas with low or no cases of COVID-19. It will also likely be a slower month in June as production is ramped up again – if the Executive Order isn’t further extended beyond May 30th.

Maverix has two paying assets in Mexico. It owns the right to purchase 100% of the gold produced at Pan American Silver’s (PAAS, PAA.TO) La Colorada mine for a fixed payment of $650/oz. According to Pan American’s original guidance, La Colorada was expected to produce 4,000-5,000 ounces of gold in 2020, so assuming about 1.5 months of lost production (no relevant production in April and half the normal run-rate in May) would result in a contribution decrease of 500-625 ounces of gold and a monetary impact of around US$0.5-0.6M. Negligible.

The San Jose mine operated by Fortuna Silver Mines (FSM, FVM.TO) also contributed just 1,061 GEOs (for C$2.0M in revenue) in 2019 from the 1.5% NSR on the Taviche Oeste land package. This NSR had a book value of just C$4.2M as of the end of December last year, so although the suspension of incoming cash flows for the next few weeks will certainly be felt by Maverix, the impact on the company’s bottom line will be relatively minor.

The Silvertip Mine (Coeur Mining)

Earlier this year and completely unrelated to COVID-19, Coeur Mining (CDE) announced it was putting its Silvertip polymetallic mine on care and maintenance. Coeur cited the weak market prices for zinc and lead concentrates. In addition, Coeur plans to initiate an exploration program and evaluate a potential expansion of the mine.

Maverix owns a 2.5% Net Smelter Royalty on the Silvertip mine which contributed 833 GEOs in 2019 and just 216 GEOs in 2018, so even a prolonged shutdown of the mine shouldn’t be a huge issue for Maverix as the gold-equivalent output represented less than 4% of the total gold-equivalent output of Maverix.

Maverix retains balance sheet flexibility

At the end of December and after completing the acquisition of the Kinross Gold (KGC, K.TO) royalty portfolio, Maverix had C$6.3M in cash and had an undrawn capacity of US$51 on its available credit facility.

Subsequent to the end of the quarter, Maverix paid a US$0.01 dividend in January (impact: US$1.2M) and received US$12M from Agnico Eagle Mines (AEM, AEM.TO) which exercised its right of first refusal on the 2% NSR royalty on the Hammond Reef gold project that was part of the Kinross royalty portfolio acquisition. Given the average USD/CAD exchange rate in January, we expect Maverix to have added C$14M in cash to its bank account, while the incoming cash flow from operating activities in the first two months of the year will also have boosted the cash position.

As 2019 was an acquisition-heavy year, Maverix was able to increase the size of its revolving credit facility as its expanded asset portfolio increased the borrowing base of said facility. Maverix is now allowed to borrow US$120M, which is the equivalent of approximately C$168M using an USD/CAD exchange rate of 1.40.

We will have to wait for the Q1 results to have an exact number, but we estimate Maverix has approximately C$100M available for acquisitions (to be confirmed when the Q1 results come out later this month). This ensures the company’s flexibility to act fast on potential opportunities that might present themselves in this market.

Case Study: the El Mochito mine and the continuous cash need of small companies

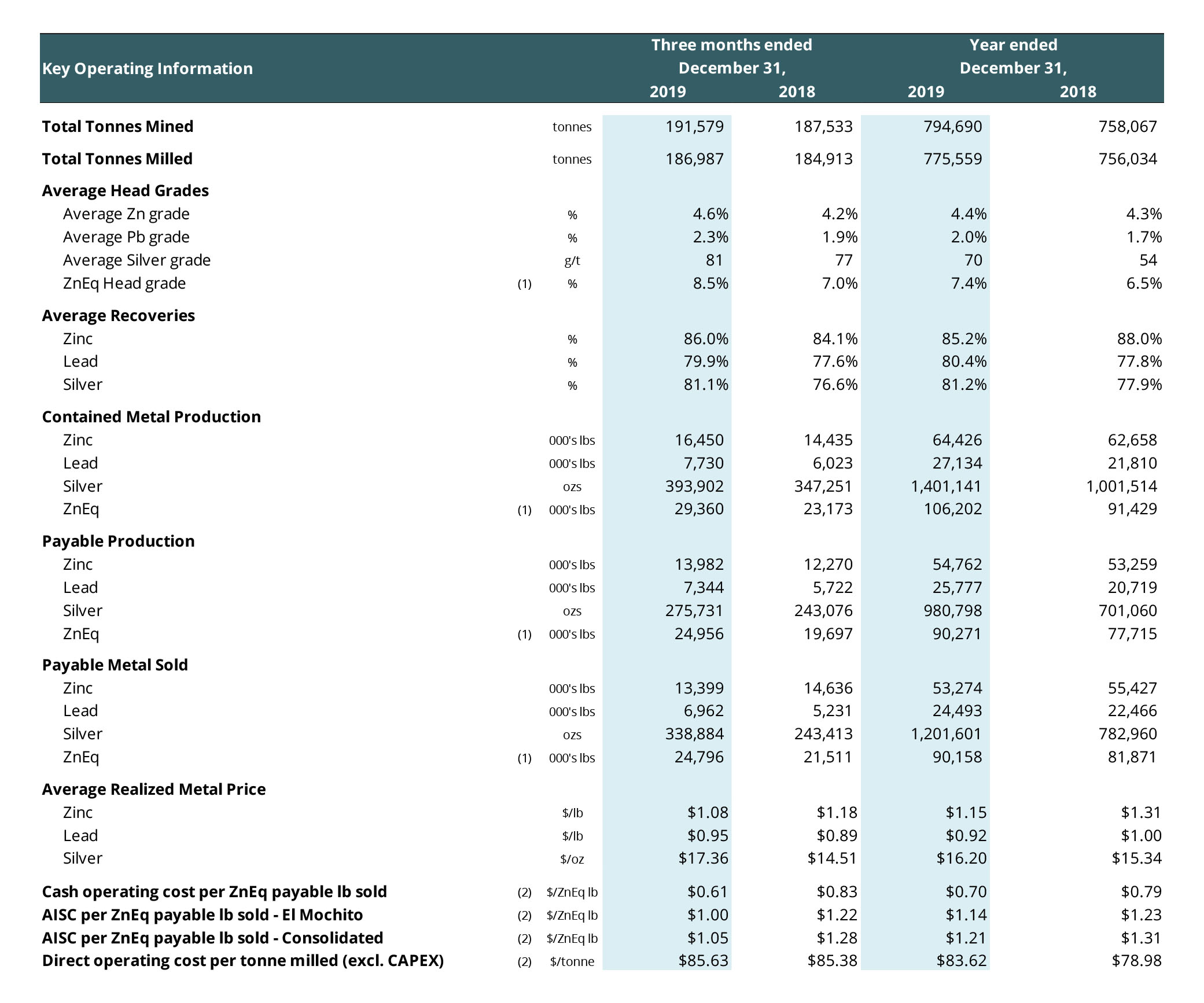

The El Mochito mine operated by Ascendant Resources (ASND.TO) will have a bigger impact on the Maverix attributable production and cash flows. Maverix is entitled to purchase 22.5% of the silver production at 25% of the spot price. Given the current low silver price the ‘damage’ will be limited and on top of that, it will be interesting to see what happens on the silver markets if the Mexican silver output will indeed fall back to almost zero ounces. The country produces on average close to 200 million ounces of silver per year so ‘losing’ 1.5 months of production will remove 25 million ounces of physical silver from the market.

In FY 2019, the El Mochito mine produced 1.4 million ounces of silver, but not all of these ounces will be payable. In the first nine months of 2019, about 70% of the produced silver was qualified as payable silver, and we can reasonably expect the El Mochito mine to have produced 1Moz of payable silver in 2019.

Assuming the production remains unchanged in 2020, Maverix will be able to purchase 225,000 ounces of silver at $3.75/oz (assuming a silver price of $15/oz), resulting in an attributable cash flow of US$2.5M per year. Not bad for a stream whose initial investment cost to Maverix was just US$7.5M.

The current downturn on the metals markets and a financing window that has now been closed could force junior producers to turn to royalty and streaming companies to raise money. And that’s why the current balance sheet flexibility Maverix has is so important. The company does have the fire power to act on opportunities, and it will be able to act fast when suitable investment options come knocking on its door.

A few additional words about El Mochito: Ascendant was in a bad shape (financially) and likely would have needed more cash to improve its balance sheet as the company remained operating and free cash flow negative in 2019. You may have noticed Ascendant Resources entered into an agreement with Kirungu Corp. (a private company with Ascendant’s COO as a mutual officer) to sell the El Mochito mine to Kirungu for a symbolic US$1M.

Although the Ascendant press release doesn’t mention this, Maverix’s management confirmed the silver stream on the mine in Honduras will remain in effect. Kirungu Corp will have to continue to honor the contract to deliver 22.5% of the silver production to Maverix at 25% of the spot price and El Mochito will continue to be an important contributor to the Maverix cash flows.

Conclusion

Given the unique business model of royalty and streaming companies with low (if any) ongoing payments per delivered ounce of gold/silver, we aren’t worried about Maverix at all. The company is well diversified and should remain cash flow positive this year which will gradually reduce its net debt. Any impact of COVID-19 on the mines in which Maverix has invested will not cause the gold (and silver) to disappear from the ground, it will simply be mined at a later date. It should also be noted that Maverix has over 90 non-paying assets and the higher gold price has made those much more valuable.

Keep in mind Maverix also has about C$100M available under its existing credit facility so in case any good investment opportunities are popping up, the Maverix team will be able to act fast to take advantage of the situation.

In 2019, approximately 75% of the revenue generated by Maverix Metals came from gold sales and this high percentage exposure to gold should have a positive impact on mitigating the impact of (temporary) mine closures this year. Yes, it is likely less GEOs will be produced, but it looks like Maverix is set to achieve a higher average price per ounce that will be sold this year. Withdrawing the 2020 production guidance was a logical step as no one really knows how and when this pandemic will end, but based on what we know and see today MMX actually has a good shot at keeping the cash flows unchanged on a lower attributable production. This will allow it to strengthen its balance sheet while building up liquidity in anticipation of signing new deals.

Disclosure: The author holds a long position in Maverix Metals Inc. Maverix Metals Inc. is a sponsor of the website.