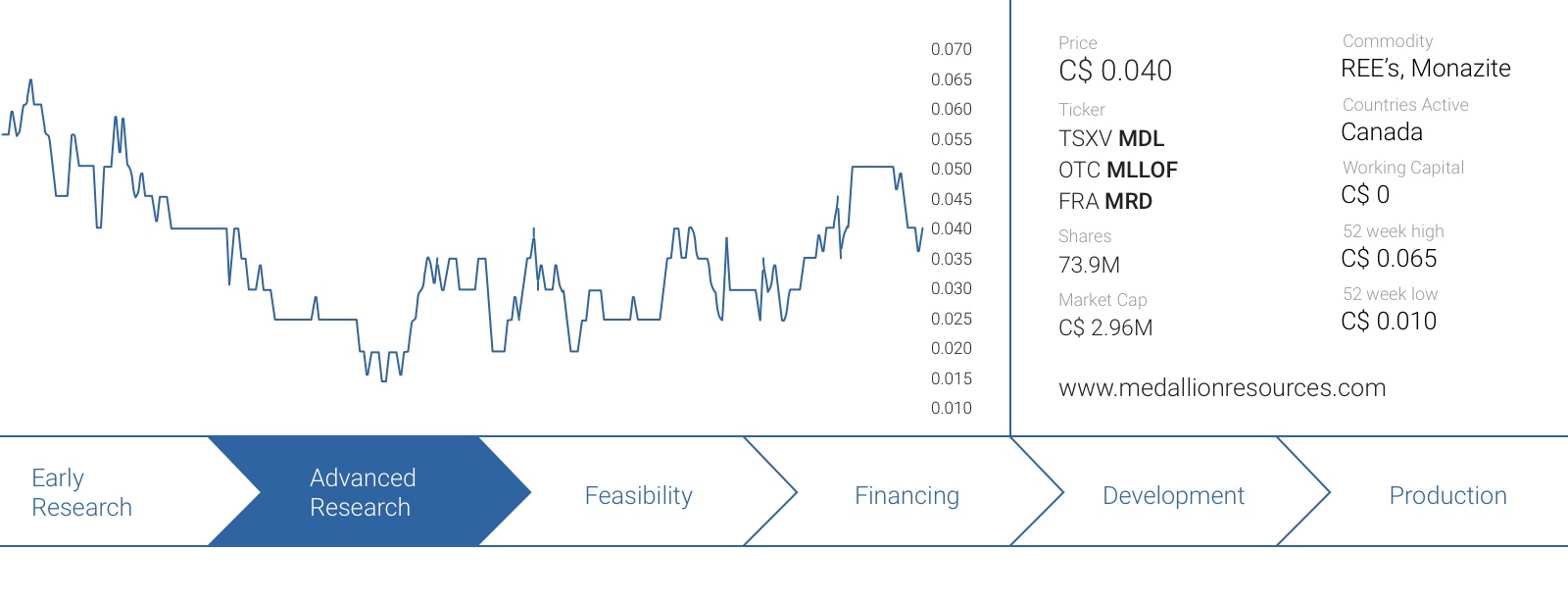

Late last year, we introduced you to Medallion Resources (MDL.V) and explained how the company is planning to produce REE’s it will recover from monazite, a waste product of certain mineral sands (MinSand) operations.

The market seems to be starting to understand Medallion’s business model and prospects, as the share price is currently trading 33% higher compared to the C$0.03 when we released our first report. In that report, we promised you to try to build an economic model to find out how much this company could be worth, and in this report we will explain the different parts of Medallion’s production chain and determine a fair value for Medallion Resources.

A brief recap of Medallion’s business model

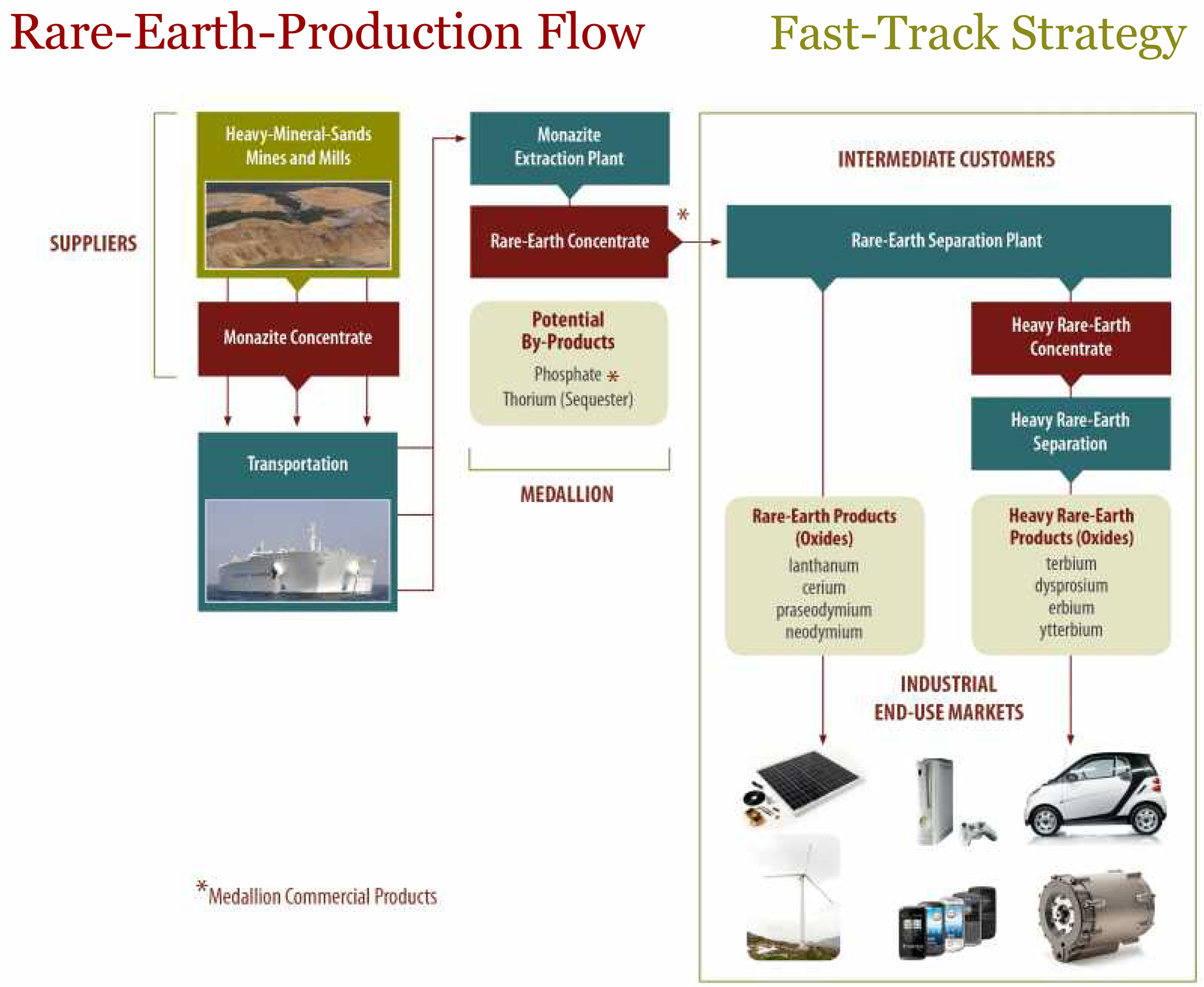

Medallion Resources is not your average resource company. The company has no intention at all to build and operate its own mines, but would rather like to position itself as a mineral processor in the REE-sector.

We dare to say the huge majority of the non-Chinese REE-mines are treading water at best, consider being cash flow negative a ‘normal scenario’ whilst so many other REE-hopefuls are about to throw the towel.

As a services provider, the market should also look at Medallion differently, as the operating risks will be tremendously lower. Medallion won’t have to deal with labour unions, changing mining laws nor any other risks associated with a mining project. Nor will it have to construct any infrastructure. The processing facility will be located in a safe first-world country which reduces the risks. It will also make it easier for us to try to establish a NPV for the company’s operations as the majority of Medallion’s revenue and operating costs will correlated to each other. Should the REE prices go down, Medallion will pay less for its feed stock. In case the REE prices are increasing again, Medallion will have to pay more for its feed stock but will see its operating margin expand.

The different steps of the value creation chain

1. Buying the Monazite

As Medallion aims to be just a ‘processor’ of monazite, it won’t operate nor own its own mines where the monazite could be sourced from. Instead, the company will rely on third parties that produce monazite as a by-product. They will supply the monazite (which contains approximately 50 to 60% REE’s). The purchase cost of the monazite obviously depends on the final negotiations with a potential monazite provider, but after discussing the business model with CEO Don Lay, we think Medallion will be able to purchase the monazite by paying approximately 10-15% of the REE value in the monazite sand.

So why would anyone with monazite sand even be considering selling it at just 10-15% of the in situ value?

The answer to this question is quite easy, but consists of different steps. First of all, the monazite provider(s) are mineral sands companies, focusing on the production of the titanium minerals rutile and ilmenite as well as zircon. That’s their main business, and they couldn’t care less about REE-containing monazite sands that are associated with their operations. Bluntly stated, all monazite sand that has been dug out as part of a mineral sands operation is being seen as a superfluous waste and is basically being discarded or ‘stockpiled’.

So, as those companies consider it to be 100% waste (and have no intention to get into the REE business by processing the monazite on site) and someone comes along and offers you 15% of the REE value of the monazite sands, why wouldn’t you take it? It’s like found money! And yes, 15% of the face value sounds low, but even at the current low REE prices (and using the average distribution of REE in monazite from another mining operation that we deem to be representative for Medallion’s purposes) it would make a lot of sense. Have a look at the next table:

[table caption=”” colalign=”left|left|left|left|left”]

Rare Earth Element;% distribution;Price/kg;Contributed value per kg REE con

Lanthanum;28%;$1.80;$0.50

Cerium;42%;$1.70;$0.71

Praseodymium;6%;$48;$2.88

Neodymium;19%;$40.5;$7.70

Samarium;2.9%;$1.95;$0.06

Europium;0.05%;$85;$0.04

Gadolinium;0.9%;$16;$0.14

Terbium;0.1%;$370;$0.37

Dysprosium;0.2%;$210;$0.42

Erbium;0.1%;$85;$0.09

Yttrium;0.75%;$4;$0.03

;100%;;$12.94

[/table]

So we would expect Medallion to pay approximately $1.95/kg of REE contained in the monazite. Assuming a distribution rate of 52.5% (which is on the lower side of the world’s average), selling one tonne of monazite could result in a mineral sands company pocketing $1,000/tonne. So should Medallion purchase 10,000 tonnes of monazite per year, that MinSands company could add $10M in revenue to its annual income statement. A true win-win situation. (Keep in mind the final REE distribution will be slightly different from the percentages we used, but we’re confident the margin of error will be less than 10%).

2. Transporting the material

Once the monazite has been acquired at the mine gate, it will have to be shipped from Australia/Africa/South-East Asia to Medallion’s processing plant. The easiest solution would be to just send the monazite per ship to the port of Vancouver (assuming Medallion’s first plant would be located in Canada), where after it could be railed to the location of the plant. Keep in mind this location is still unknown as it will depend on a variety of factors. We would guess Saskatchewan would be a pretty good fit for Medallion as there’s plenty of expertise there to deal with the thorium and slight traces of uranium in the monazite.

As the shipping costs for bulk goods is reaching multi-year and even multi-decade lows, the cost to ship the monazite to the port of Vancouver will be minimal. We got our hands on a recent price deck for bulk materials and the freight rate for iron ore from Western Australia to China, for instance was approximately $3.2/t (yes, just 3.2 dollars per tonne) in January of this year.

Vancouver is indeed further, but even if we would triple the shipping cost to Vancouver to $10/t and add an additional $20/t as economic cyclical compensation as well as taking into consideration a smaller vessel will be used (which has a higher operating cost per tonne), the shipping cost will be roughly $50/t.

The rail cost will also be pretty cheap. The general quotes range from $0.03-0.05/t/km. Assuming a railing distance of 2,000 kilometers, the cost to rail the monazite will be approximately US$80/t (using the mid-point of the transportation cost). Long story short, we anticipate the cost per tonne to get the monazite from the mine gate to a processing facility in the middle of Canada to be $130/t. And just to remain cautious, let’s include all the handling and a big fat contingency allowance and round the transportation + handling cost up to $250/t.

This basically means the transportation cost will be $0.25 per kilogram of monazite, and approximately $0.48 per kilo of contained REE. Again, let’s add an additional layer of safety and round this up to $0.40 per transported kilo of monazite.

3. Processing the monazite

Once the monazite arrives on site, the processing phase can start. Based on the preliminary indications of Medallion’s management team, the processing cost per kilogram of monazite will be approximately $3.5 (and this should cover everything, from reagents to overhead expenses).

Putting the costs of these three steps together allows us to have a pretty decent overview of how much it would cost Medallion to purchase and process its monazite. $1.95 + $0.40 + $3.5 = $5.85/kg. Adding a 10% contingency on top of everything, and we expect Medallion’s total cost to be approximately $6.50/kg.

4. And at what price could Medallion sell its concentrate?

We have established the purchase price and processing cost, but let’s now briefly discuss and tackle the other side of the equation. The final buyer of the concentrate (which will very likely be a solvent extraction operator) will also apply a discount to cover its own processing costs. The market consensus is generally taking a 25-30% discount into consideration, and as we’re trying to build a conservative economic model here, we think using a 35% discount is quite appropriate as we want to build a conservative model.

Applying this 35% discount to the basket price of $12.94/kg, we are estimating the current fair value of Medallion’s concentrate to be $8.41/kg, resulting in an operating margin of $1.9/kg.

5. Removing the Cerium would boost the sales price

In our previous report, we briefly touched the subject of removing the cerium from the concentrate before sending it off to a solvent extraction operator. This could happen through a simple precipitation step in the production process. We are currently in discussions with Medallion’s management team to find more about the potential removal of the cerium, and in a next report we hope to provide a rigorous overview of how Medallion plans to remove the cerium from the concentrate to enhance the value of said concentrate.

Removing the cerium would reduce the ratio of one of the lower-priced REE’s from the concentrate which will boost the average grade of the elements with a much higher sales price. As it will very likely be cheaper to remove the cerium and sell it to a different customer than just leaving it in and being penalized by the buyer of the concentrate, we think Medallion will thoroughly investigate this possibility.

What would be the Net Present Value of a monazite processing facility running at 10,000 tpy?

In this sub-title we will now finally build our economic model. In a first phase we will try to establish a NPV based on a throughput of 10,000 tonnes of monazite per year, which would result in a TREO production rate of approximately 4,700 tonnes per year, based on a 90% recovery rate. In our calculations we will ignore the potential phosphate by-product for now (and consider any potential phosphate sales as icing on the cake).

We expect a plant of that size to have an initial capex of US$20M (and we think this is quite a conservative estimate). We are anticipating an effective tax rate of 40% (most analysts in Canada use 30%) and will use a discount rate of 10%, which is a mark-up of approximately 8.3% compared to the 10 year T-Note of the USA).

As Medallion is a services provider or processor, it can theoretically continue to produce until eternity (unlike mining operations which have to deal with orebodies that are per definition limited), so instead of a normal NPV calculation with a limited timeframe, we would feel comfortable using a calculation for perpetual cash flows.

A. Keeping the throughput rate stable

The annual post-tax cash flow based on the current assumptions would be approximately US$7.1M per year, resulting in an after-tax NPV10% of US$34M (assuming a $20M capex and a $0.25M annual sustaining capex for basic maintenance on the plant). If one would apply a 15% price increase on the value of the REE basket, the operating margin would increase from $1.9/kg to approximately $3.5/kg and if you’d insert this number in the equation, the after-tax NPV10% would increase to $75M.

B. Budgeting a 50% capacity increase in Y5

However, we aren’t anticipating the REE prices to remain at the current depressed levels for an extended period of time. We have also built a model based on the REE prices remaining at the current level for the next 5 years and have budgeted a 20% price increase from Y6 on. We are also taking a 50% expansion into account in the fifth year of the company’s operations. This will increase the output from 4,700 tonnes of TREO to 7,000 tonnes per year. We are keeping the operating cost stable even though there should be some economies of scale associated with the capacity increase. We are budgeting $10M in Y5 to fund the capacity increase.

This means we will have to break up the NPV calculation in two parts. A first part is to calculate the after-tax NPV for the first five years of the ‘operating’ life, followed by a calculation of the NPV of perpetual cash flows, re-discounted towards the fair value at the moment of the construction start.

Step 1

[table caption=”” colalign=”left|left|left|left|left”]

After-tax cash flow;Discount rate (10%);NPV 10%

-20.000.000;;-20.000.000

5.400.000;1,00;5.400.000

5.400.000;1,10;4.909.091

5.400.000;1,21;4.462.810

5.400.000;1,33;4.057.100

-4.600.000;1,46;-3.141.862

;;-4.312.861

[/table]

Step 2 would see the operating margin increase from $1.9/kg in the base case scenario to $3.6/kg using a 20% higher REE price (and this does take a 20% price escalation for the transportation costs into consideration as well).

Using this increased operating margin and a 7,000 tpa TREO production rate, the average after-tax cash flow is approximately $14.7M per year (after almost tripling the sustaining capex to US$0.7M per year). The NPV10% of these perpetual cash flows is US$147M, but we obviously have to discount this number as this value will only kick in from year 6 of the operations. The re-discounted value of the perpetual cash flows is US$91M, and if you’d throw in the -$4.3M in net present value of the first 5 years of the mine life, the total fair value of an expanded monazite-processing plant would be US$87M (C$120M).

Conclusion

Medallion’s plans could unlock quite a bit of shareholder value, as our NPV calculations indicate the company’s business model definitely has a chance to be successful, even at the current low price environment in the REE sector.

Of course, Medallion still has a lot of work to do and we expect the company to go back to the market within the next few months to raise the funds that will allow Medallion to continue its metallurgical test work at the pilot plant scale. Once the pilot plant will confirm the expectations, Medallion could really start to look at where it intends to build its plant and locking in supply and offtake agreements for its incoming monazite and outgoing Rare Earth concentrate.

Keep an eye on Medallion because if the economic model gets confirmed, the payoff could be huge.

Disclosure: Medallion Resources is a sponsoring company, we hold a long position.