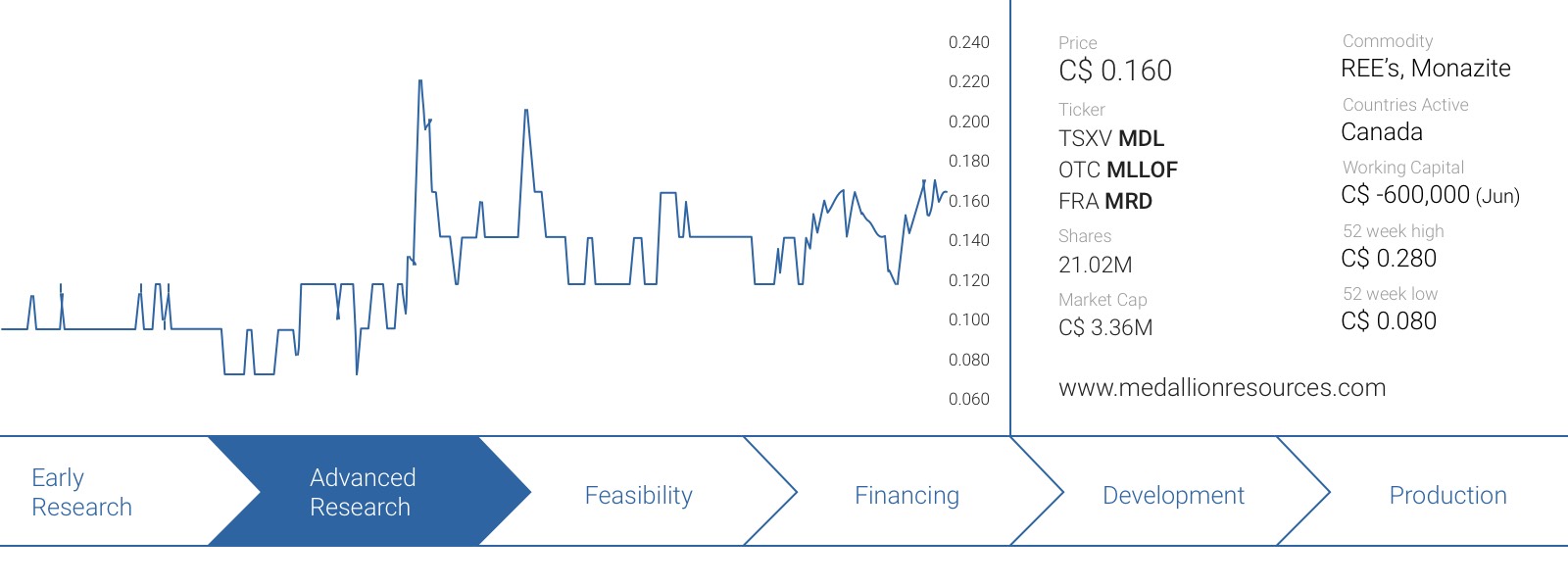

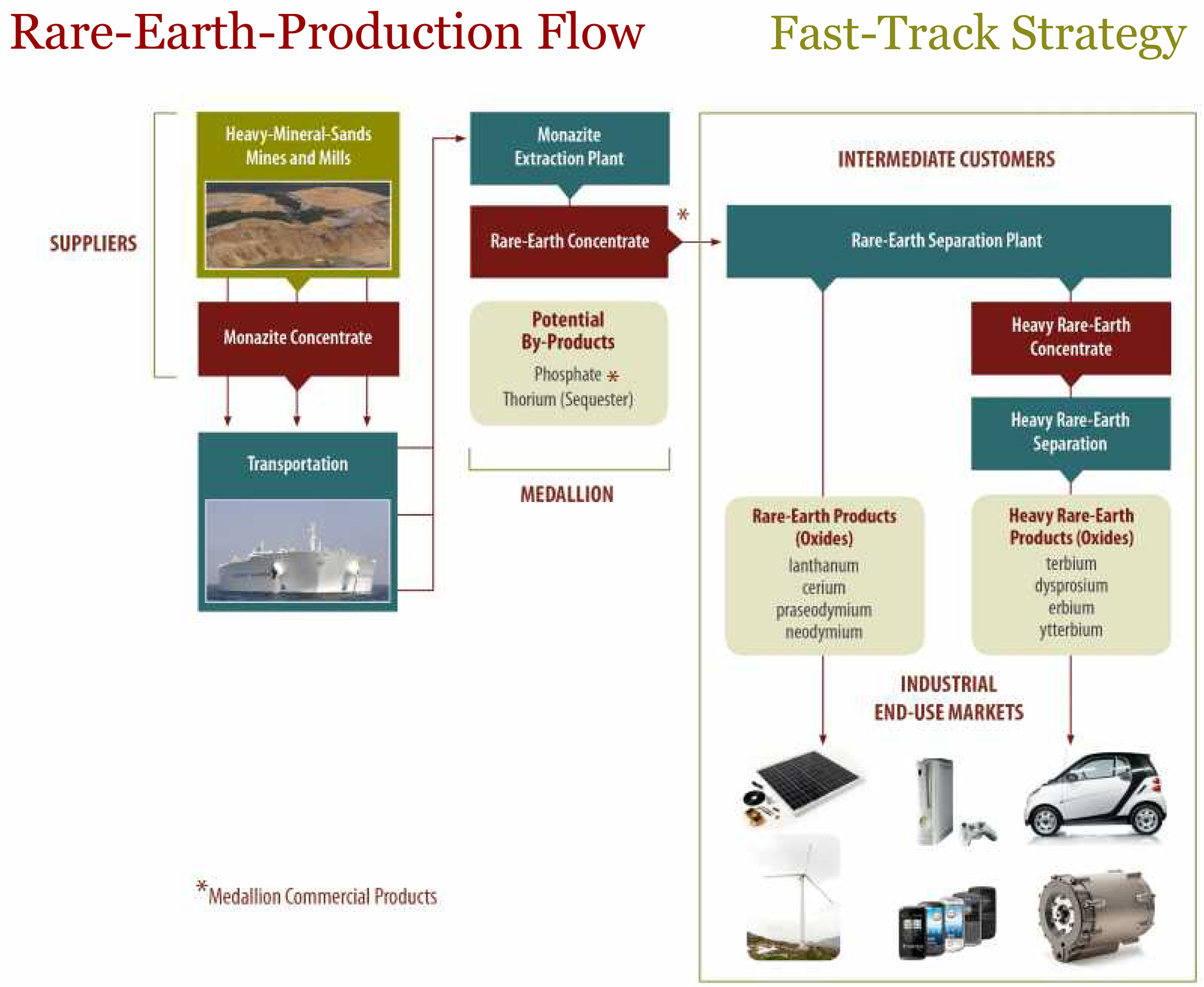

Last year, we were impressed by the Medallion Resources’ (MDL.V) attempts to recover Rare Earth Elements from the mineral monazite. As Monazite is a waste product associated with mineral sands operations, Medallion’s plan presented a win-win situation as mineral sands producers like Iluka Resources (ASX:ILU) , Kenmare (London: KMR) and others could potentially sell their monazite by-product to Medallion and report the revenue as a by-product credit on their income statements.

Last year, we were impressed by the Medallion Resources’ (MDL.V) attempts to recover Rare Earth Elements from the mineral monazite. As Monazite is a waste product associated with mineral sands operations, Medallion’s plan presented a win-win situation as mineral sands producers like Iluka Resources (ASX:ILU) , Kenmare (London: KMR) and others could potentially sell their monazite by-product to Medallion and report the revenue as a by-product credit on their income statements.

Medallion has now developed a flow sheet and is currently raising more cash which should enable the company to complete additional metallurgical test work and conduct some pilot-scale tests to prove the concept. Meanwhile, very recently the demand for neodymium (Nd) and praseodymium (Pr) has really picked up which is translating into substantially higher prices (+50%) for these Rare Earth Elements.

And sector research confirms this is very likely just the beginning…

Medallion Resources is raising more cash to advance its monazite-processing strategy

Medallion is now raising more cash at C$0.16 (post a recent 4:1 share consolidation) to continue to invest in its plans to become a producer of Rare Earth Elements by processing the waste products of mineral sands producers. The unit offering has been priced at C$0.16 and consists of one common share as well as a full share purchase warrant valid for three years, allowing the warrant holder to purchase an additional share at C$0.32 during that period.

The proceeds of this financing will be used towards further metallurgical test work as well as more in-depth analysis to define the best place to build a monazite processing plant (which will very likely be in Saskatchewan given the province’s experience with radioactive materials and Medallion’s relationship with the Saskatchewan Research Council).

However, there is one thing that we will focus on in the near future and that’s the removal of the cerium from the REE concentrate. This will also be the specific focus of this report as we would like to show how important the removal of the cerium could be for the company’s economic prospects.

The REE prices are (finally!) picking up again!

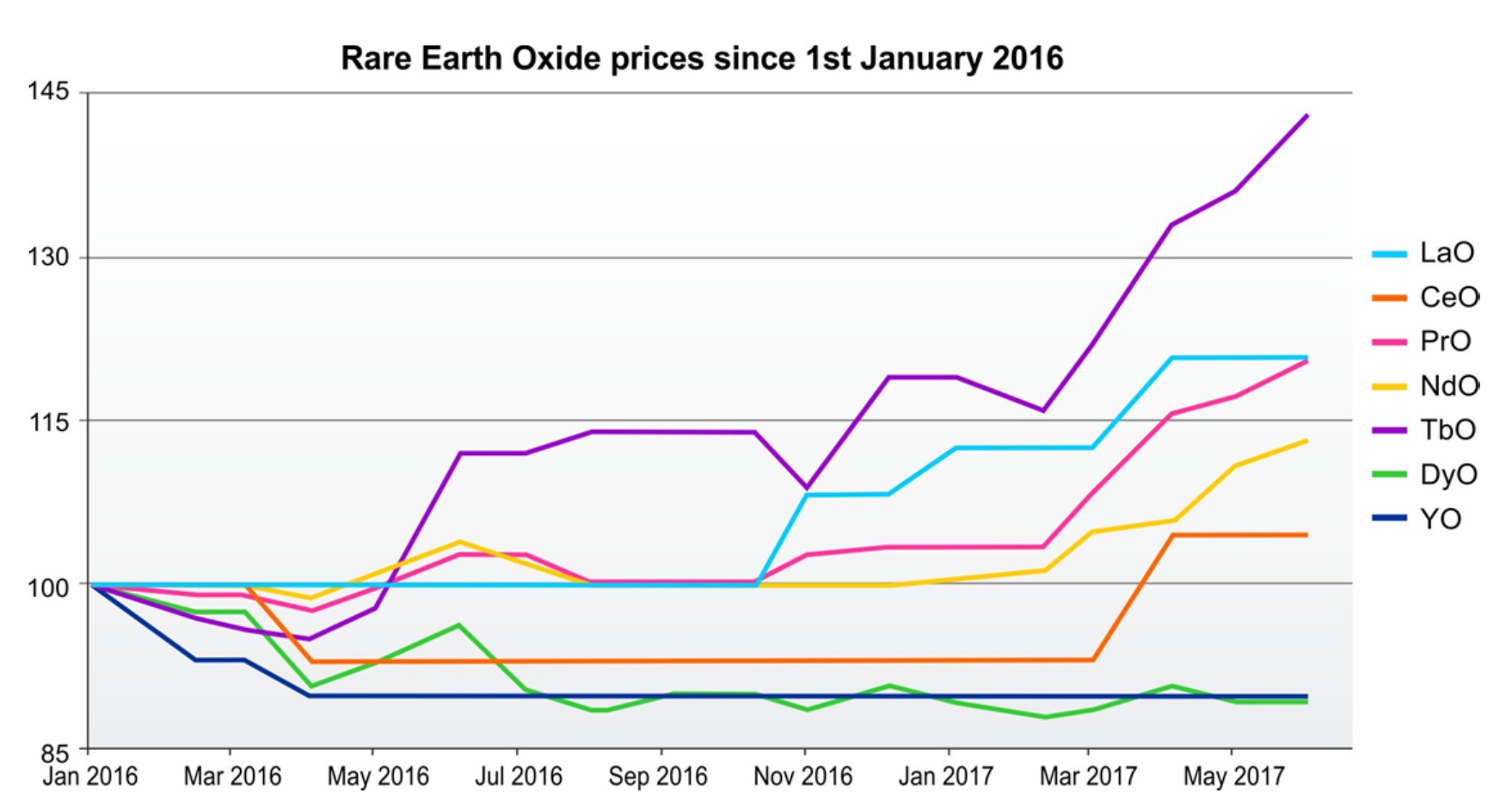

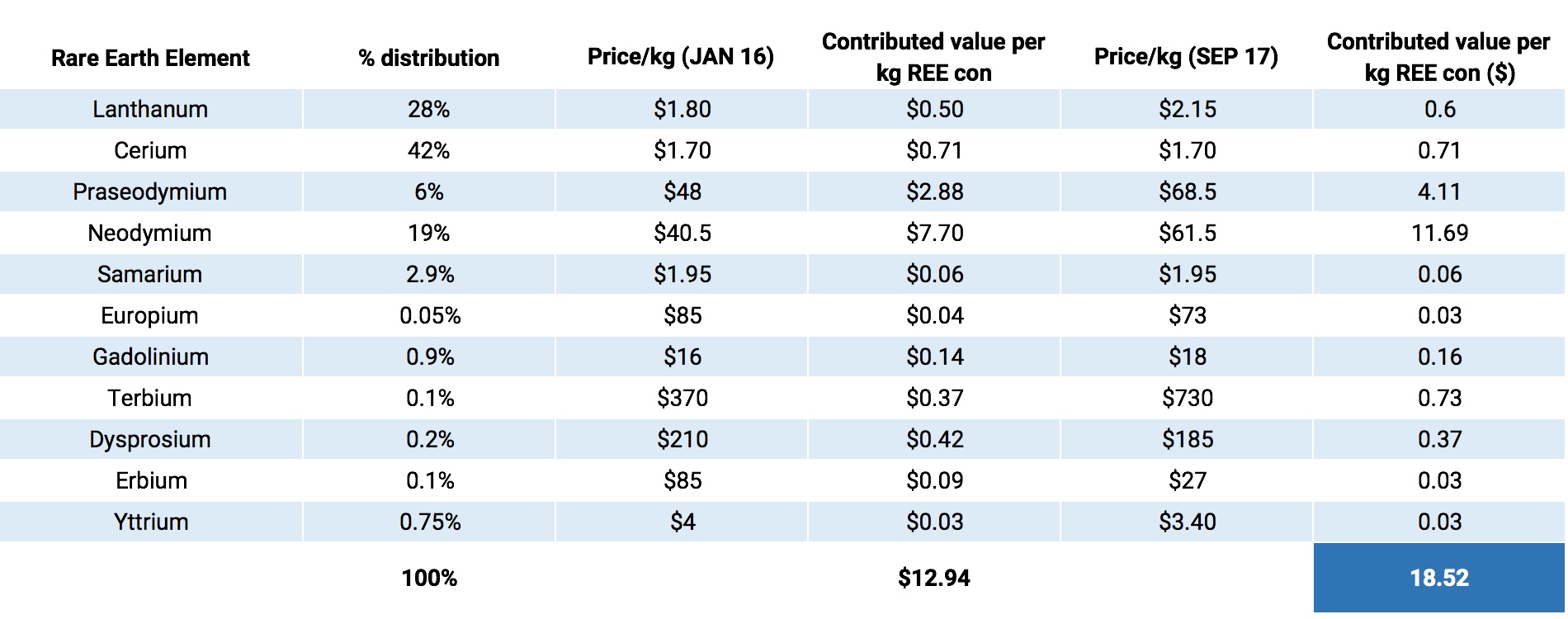

In the report we published last year, we used the REE prices of January 2016 to derive the value of the REE concentrate to be produced by Medallion Resources. Due to the relatively high weighing of two ‘cheap’ Rare Earth Elements (lanthanum and cerium), the value of the concentrate remained limited to just $12.94 per kilo, which wasn’t great at all.

Since January 2016, a lot has changed. The renewed focus on electrical vehicles (EVs) has driven certain REE prices up in the past few months as REE traders and buyers are realizing the supply might not be able to catch up with the anticipated demand. As REE prices were at multi-year lows in the past few quarters and years, none of the owners of REE projects were incentivized to develop a project into a mine and most companies actually dropped projects and switched focus to a different commodity or business.

One of the most important factors for the end users of REE’s is to secure a steady and reliable supply or Rare Earth Elements. As there simply are not a lot of decent projects (i.e., potential new production) on the way, some tightness of supplies in certain elements has formed and presto! – REE prices started to increase. What is very recent is that the mainstream financial media is just picking up on this change. Recently, The Economist, Financial Times, Bloomberg and Reuters have all recently reported on this issue. And we believe this is just the beginning.

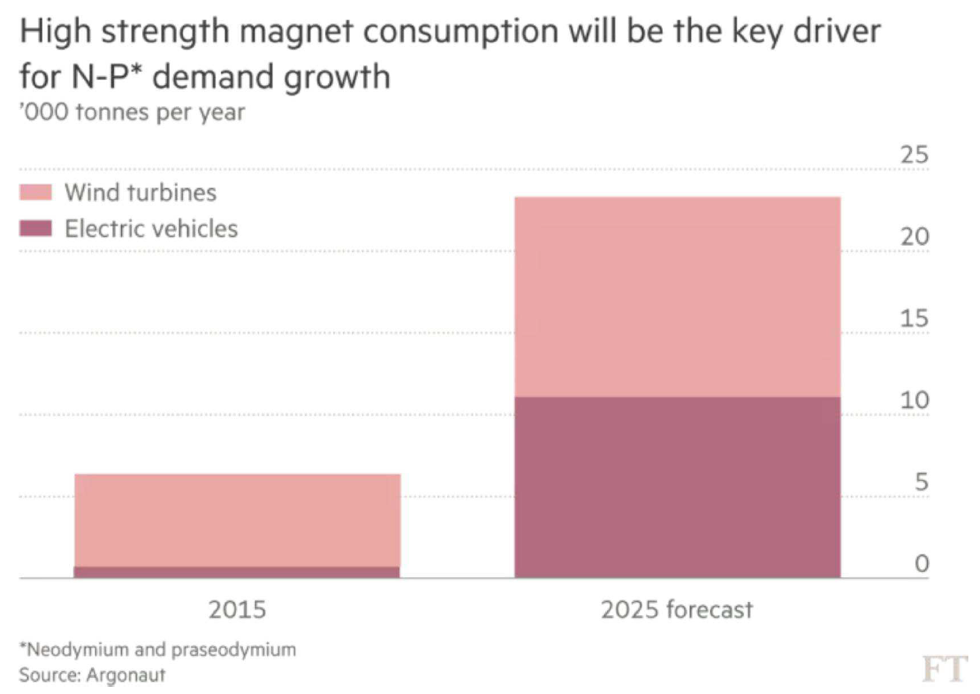

According to Argonaut Research, the use of magnets in both Electrical Vehicles and wind turbines will result in a demand increase of 250% for neodymium and praseodymium before 2030 and the main question now obviously is ‘where will these new supplies come from?’.

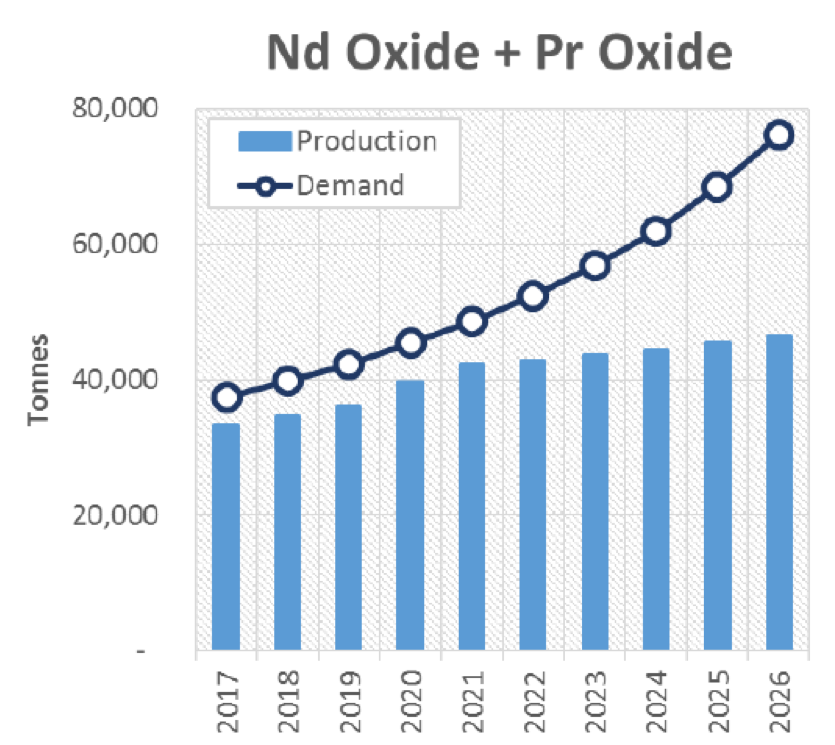

And if that chart isn’t sufficient, Adamas Intelligence, which specializes in Rare Earth Elements, has published several more interesting charts which allow you to visualize what’s about to happen. While the supply and demand side of neodymium and praseodymium was quite balanced in the past decade, this is about to change. The demand will continue to increase (it already increased from 24,000 tonnes in 2007 to approximately 35,000 tonnes in 2016, resulting in a supply deficit), and Adamas expects the demand for Nd and Pr to increase to almost 80,000 tonnes per year by 2026-2027.

And it all boils down to the same question: Where will the (new) supply come from?

There are indeed some projects which could step up the plate as there are 5-10 projects with a completed feasibility study but as those studies are very likely already outdated now, we would anticipate most companies to need an additional 6-24 months to update the studies. Even if those updated studies would confirm the economics, it is far from certain the owners will be able to secure funding due to sky-high capex’es, or for instance, the geopolitical risks associated with projects in second-tier and third-tier countries. And any of these project would be a minimum of 5 years to get to production.

All these aforementioned thoughts are the main reason why we expect Medallion to be able to fill a part of the gap by processing monazite into REE concentrate.

Updating our calculations based on the current REE prices

In the next table, we have updated that table using more recent prices valid as of at the end of August. We applied an USD/CNY exchange rate of 6.60 for the September 2017 REE prices.

This is based on an average distribution from a variety of by-product monazite sands, so keep in mind the distribution of the REE’s in the monazite delivered to Medallion Resources might be (slightly) different and our model should be seen as a back-of-the-envelope calculation. Additionally, we were unable to find a decent recent price point for samarium, so we used the January price in our calculations.

As you can see, the REE prices indeed remain weak, and the value of a kilo of REE concentrate produced by Medallion Resources has now increased sharply. Whereas the value per kilo was $12.94 in January 2016, the current REE prices would allow Medallion Resources to sell its concentrate based on the $18.52 per kilo, an increase of 43%.

Potential icing on the cake: removing the cerium from the REE concentrate?

Last year, we already discussed how the company plans to extract the rare earth elements from the monazite sand delivered by the mineral sands producers. The technology has been around for several decades and is actually relatively simple compared to rare-earth metallurgical processes required for hard-rock deposits, especially those with multiple mineral types. Monazite will be dissolved in sodium hydroxide at a relatively high temperature (125-150°C) to separate the REE and thorium from the sodium phosphate (which will be recovered through precipitation).

That’s really pretty standard, and the main reason why there are just a few companies processing monazite to recover the REE’s is the fact that monazite contains ~5-8% of the slightly radioactive thorium (and also a small amount of uranium). This need to manage and disposed of properly to avoid both environmental damage and for health and safety concerns. As Medallion seems to be leaning towards building a processing plant in Canada close to the existing facilities where thorium and uranium are handled, we can be sure these elements will be dealt with appropriately. It should be noted that there are a number of US states that could host such a plant as well.

So once the company has extracted a REE concentrate, and producing a phosphate by-product, the obvious process next step would be to just market this chemical concentrate. However, in today’s world, the price for cerium is so low it actually drags the value of the entire concentrate down by quite a lot, as the purchaser of the REE concentrate will reduce the purchase price of the REE concentrate by its own costs to separate the different elements. In last year’s update, the technical value of the REE concentrate produced by Medallion Resources was US$12.94, and we applied a 35% discount (which was quite conservative) resulting in a price Medallion would receive for the concentrate of $8.41/kg.

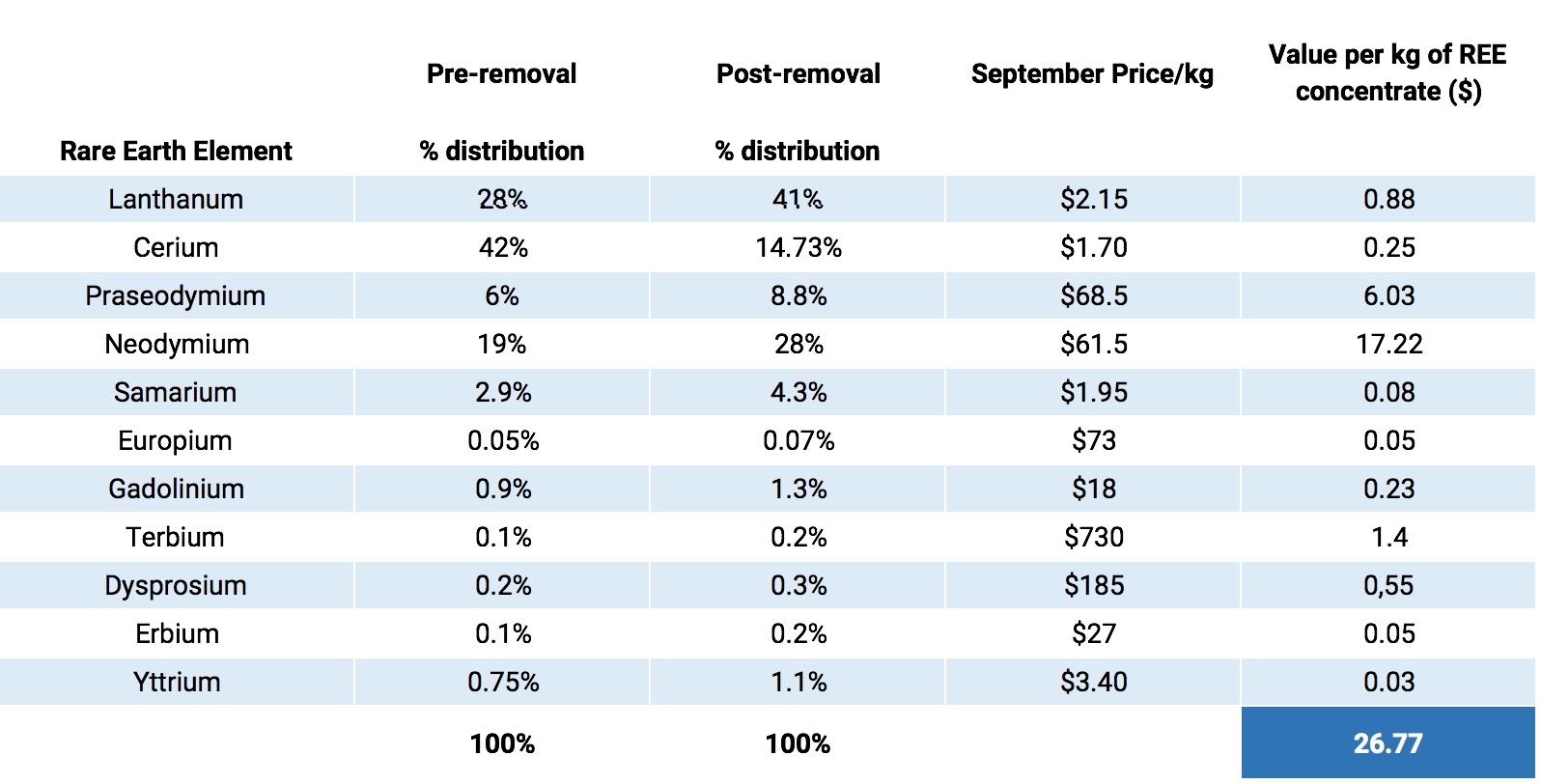

Using the updated REE prices, the value of the REE concentrate has increased to $21.83/kg (and applying a 30% discount for separation (the exact discount to the theoretical value will have to be negotiated as part of an offtake agreement) would result in an effective sale price of $15.28/kg), but CEO Don Lay thinks the company will be able to remove approximately 80% of the cerium content from the concentrate.

This could actually happen at a relatively low cost – as selective precipitation method, which will very likely be used by Medallion, will be cheaper than the separation techniques used to separate all other REE’s from each other. CEO Lay thinks it should be possible to remove the cerium at a cost of $0.50/kg, where after the cerium could be sold. For simplicity sake, we will assume the cerium will be sold at the same price it is costing the company to remove it from the REE concentrate. This allows us an increased margin of safety, as cerium is currently now being sold at $2.35/kg, or 4 times higher than the anticipated cost to recover it. Any additional value created by selling the cerium will be a major bonus.

Keep in mind the company is just exploring this option, and removing the cerium might not even be necessary now the REE prices are picking up again. It might be more straightforward to just keep the cerium in the REE concentrate (see the previous table) rather than producing a separate cerium oxide product. The next calculation is for illustration purposes only.

As said, the company aims to be able to remove 80% of the cerium, but we will be more conservative and use a removal factor of 76% which results in a residual value of 10% (of the original 100%). However, as 76% of the cerium will be removed, the entire weighing of the REE’s will change dramatically, and we have re-calculated the respective weight of the elements in the next table.

Keep in mind that of the original REE concentrate of 3,000 tonnes, only 2,040 tonnes of ‘improved concentrate’ would be produced, so Medallion would always have to make the trade-off between producing less REE concentrate at a higher value, or the intended concentrate at a lower value per tonne (and fewer headaches related to the removal and marketing of the separate cerium product).

Large dune system typical of heavy mineral sands deposits (left). Exploring and evaluating sources of heavy mineral sands (right).

Conclusion

The recent increase of the Rare Earth Element prices has an enormous impact on the value of Medallion’s expected REE concentrate. The market suddenly seems to have realized there’s simply not enough supply to meet the demand for neodymium and praseodymium in the near term and longer term future. This pushed the prices much higher and the theoretical value of Medallion’s REE concentrate recovered from monazite has increased by in excess of 40% compared to January last year.

As we expect Medallion’s operating expenses to be approximately $7/kg, the operating margin would now increase from less than $2/kg in January 2016 to almost $6/kg, an increase of approximately 200%. This excludes any potential quality improvement caused by removing the cerium (as it looks like the company will first focus on the ‘normal’ concentrate) and actually takes a generous discount for the purchaser on the theoretical value of the concentrate into account.

The pilot plant stage will be very important for Medallion Resources, as it’s in the pole position to take advantage of the current REE price strength. The momentum in the REE prices will also be a huge help as the leverage on the operating margin is gigantic. As we explained in this article, a 43% increase of the basket price results in a 200% increase of the operating margin…

Disclosure: Medallion Resources is a sponsoring company, we hold a long position.