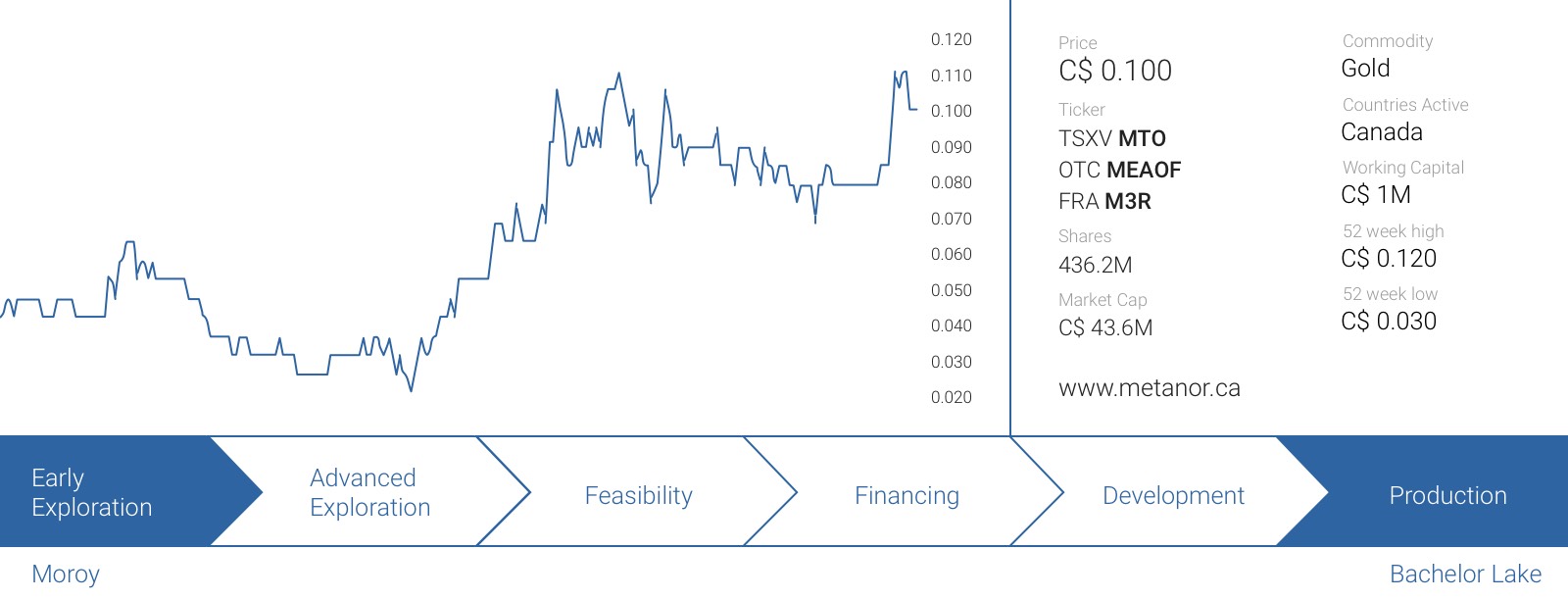

As the gold price has been on the move again, Metanor Resources (MTO.V) has been revisiting the potential development scenarios at the Barry open pit mine. As Barry is located within trucking distance from the existing processing plant at the Bachelor Lake mine, any development scenario at Barry would be an excavate-haul-process scenario. In this update report we will try to figure out if it makes economic sense to do so.

The new resource estimate at Barry looks promising

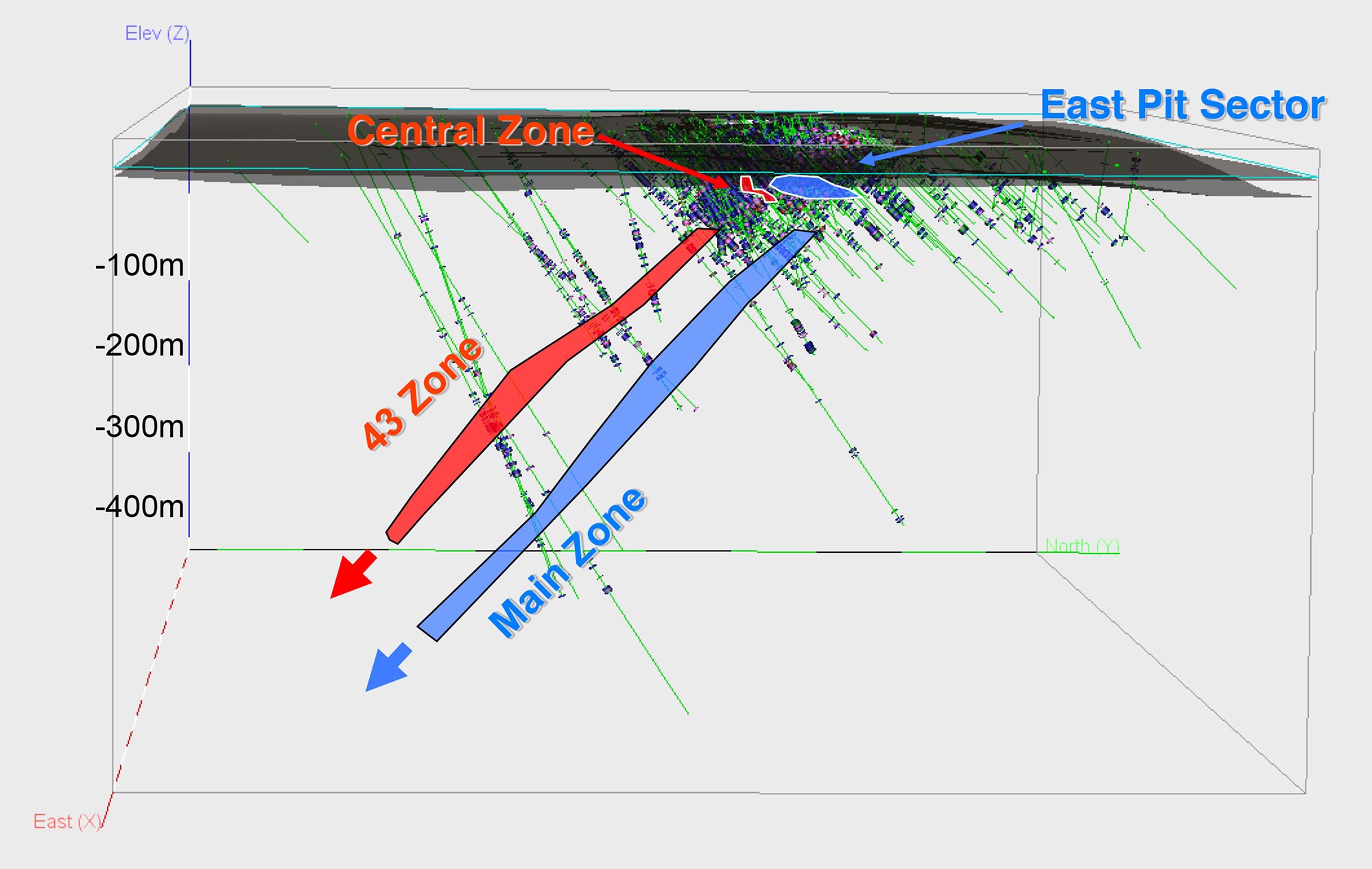

After having completed an additional drill program at the Barry project, Metanor considered it to be the right time to release an updated resource estimate at Barry. This new resource estimate is based on a total of approximately 1,100 drill holes and now contains a total of 1.4 million ounces of gold at an average grade of in excess of 1 g/t.

That’s not surprising considering the previous resource estimate contained a little bit less than 800,000 ounces of gold at an average grade that was quite a bit higher (which could indicate several lower-grade zones were now included in the current resource estimate as the higher gold price might make those ounces economical).

What’s more important is the fact this resource estimate now contains a higher-grade and in-pit resource as well, and that high-grade zone will be the focus of this update report. According to the NI43-101 compliant report, this high-grade zone consists of 5.24 million tonnes at an average grade of 2.07 g/t for a total in-pit resource of 347,350 ounces gold. That’s pretty good, and this will be the basis of a ‘reinvented’ excavating-hauling-processing plan. After all, at a production rate of 1,200 tonnes per day (the nameplate capacity of the Bachelor Lake mill, which could easily be expanded for a low single-digit dollar amount), these 5.24 million tonnes would underpin a mine life of approximately 13 years!

This doesn’t mean Barry has no additional potential, not at all. Keep in mind the total resource estimate contains 1.4 million ounces, and what’s even more impressive is the fact the deposit appears to be open in all directions. Even in our most conservative scenario’s we can’t see Barry containing less than 2 million ounces of gold, and it could very likely contain several more million ounces once the entire mineralized system will be drilled out.

What has changed since the previous attempt to process the Barry ore?

Well, first of all, the gold price is currently substantially higher. Whereas the Gold price was just C$1150-1250 when Metanor Resources ceased the hauling operations from the Barry open pit to the Bachelor Lake mill. With gold trading at in excess of C$1750 per ounce right now, the operating margins should definitely improve.

On top of that, due to the recent crisis in the mining sector, several inputs have now become cheaper. Contractors are working at lower rates whilst the transportation costs have also decreased. Cheaper labor and a higher availability of equipment pushes the operating expenses down, and this will reduce the operating cost per processed tonne of rock and produced ounce of gold.

And finally, grade has always been and still is king. The previous hauling operation wasn’t really based on a mine plan prioritizing the higher grade ore. Back in those days, Metanor was trucking ore with an average grade of just 1-1.5 g/t to the mill. If we would now use the higher grade resource estimate within the greater Barry pit, the grade will increase by 30-100% and it’s needless to say this obviously also contributes to a higher operating margin.

Our back of the envelope calculations

The theory sounds very nice, but let’s try to figure out if (A) trucking the Barry ore is a viable business proposal and (B) what the total value of an excavate-haul-process scenario at Barry could be. Every mine plan consists of several parts, and we will discuss them one by one:

A. The mining expenses

As mining ore out of Barry will be an open-pit operation, Metanor Resources should be able to keep its operating costs per mined tonne of ore relatively limited. Whereas the mining cost at the Bachelor lake mine was estimated to be C$55.39 per tonne of ore, mining the Barry pit should be substantially cheaper.

In our model, we will use a mining cost of C$5.5 per tonne, and assume a 3:1 strip ratio (please note, Metanor hasn’t published a NI43-101 compliant mine plan for Barry yet, so the strip ratio used in this calculation should be seen as a ‘guesstimate’ from our side. The strip ratio might be 2, but also 4, and we will only be able to fine-tune our expectations after an official mine plan has been released).

Using these parameters, the average cost per mined tonne of ore will be approximately C$22/t.

B. The transportation expense

This is another operating expense where we will have to rely on our own guesstimates. We will use a transportation cost of C$12.5/t to haul the ore from the Barry open pit to the Bachelor Lake mill. Again, this amount will have to be updated once Metanor publishes its official mine plan and economics, based on the received quotes. We think the transportation expenses will be relatively limited as Metanor is mulling over the possibility to use ‘road trains’ to haul the ore to the mill.

C. The processing cost and recovery rate

As the economic study to determine the viability of the Bachelor Lake underground mine estimated the processing cost to be approximately C$22.89/t, we will be using a processing expense of C$25/t. This brings the total expense per tonne of treated ore to C$59.5/t.

D. Putting all parameters into one model

If we would now assume an average grade of 2 grammes of gold per tonne of rock that will be shipped to the Bachelor Lake mill, and insert a 90% recovery rate, every trucked tonne would yield 1.8 grammes of recoverable gold. This means one would need 17.3 tonnes of Barry ore to produce one ounce of gold, but we will be rounding this to 18 as an additional layer of safety.

The calculation is then pretty simple. To produce one ounce of gold, Metanor will have to process 18 tonnes of ore at a cost of, say, C$59.5/tonne. If you would then multiply 18 by C$59.5, the total production cost per ounce of gold could be estimated at C$1070/oz (or just US$805/oz), resulting in an operating margin of in excess of C$650/oz. Again, that’s based on our parameters and for every Dollar per tonne of rock Metanor comes in below our expectations, the production cost decreases by C$18 per ounce. So if Metanor would be able to reduce the mining cost by C$0.5/t and the trucking cost by an additional C$1.5/t, the production cost could fall below C$1000/oz.

But what does this mean for the total value of the project? If we would assume a mine life of 10 years, a throughput of 1,200 tonnes per day and an annual production rate of 25,000 ounces (which is our conservative scenario using an average grade of 2 g/t, but it’s not unlikely the high grade zone could also be ‘high-graded’, resulting in a production rate of 30,000+ ounces per year in the first few years); we end up with an after-tax NPV10% of C$85M based on an initial capex of C$5M and a gold price of C$1725/oz. We don’t anticipate the company having to pay any taxes in the first 6 years of the mine life due to the forward carried operating losses, but we have applied a total tax rate of 40% in the final 4 years of the 10 year mine life. Using a discount rate of 6% would increase the after-tax NPV to $96.5M, whilst the undiscounted NPV is approximately C$121M. Keep in mind the streaming deal with Sandstorm Gold (SAND, SSL.TO) is only valid for the Bachelor Lake mine and surrounding area, and the gold production from the Barry pit will NOT be subject to the streaming agreement.

Bachelor Mine and Moroy

Conclusion

Keep in mind we only have a limited amount of data available, and we preferred to use relatively conservative inputs. Should Metanor be able to mine the rock at just C$5/t, it would save C$2/t and approximately C$35 per ounce, resulting in the annual cash flow increasing by almost C$1M per year. Our assumptions and guesstimates are based on similar cases, but we will definitely have to finetune our model once Metanor Resources releases its official economics and mine plan.

Reviewing Barry doesn’t mean Metanor won’t do any additional work at the greater Bachelor Lake region. The Moroy zone still is a very interesting discovery, and we expect Metanor Resources to drill more holes, and these future drill programs (at both Moroy and Barry) could be funded with the cash flow generated by the Barry excavate-haul-process plan, estimated at C$15M per year using the parameters in our base case scenario.

The author has a long position in Metanor Resources. The company isa sponsor of the website. Please read the disclaimer