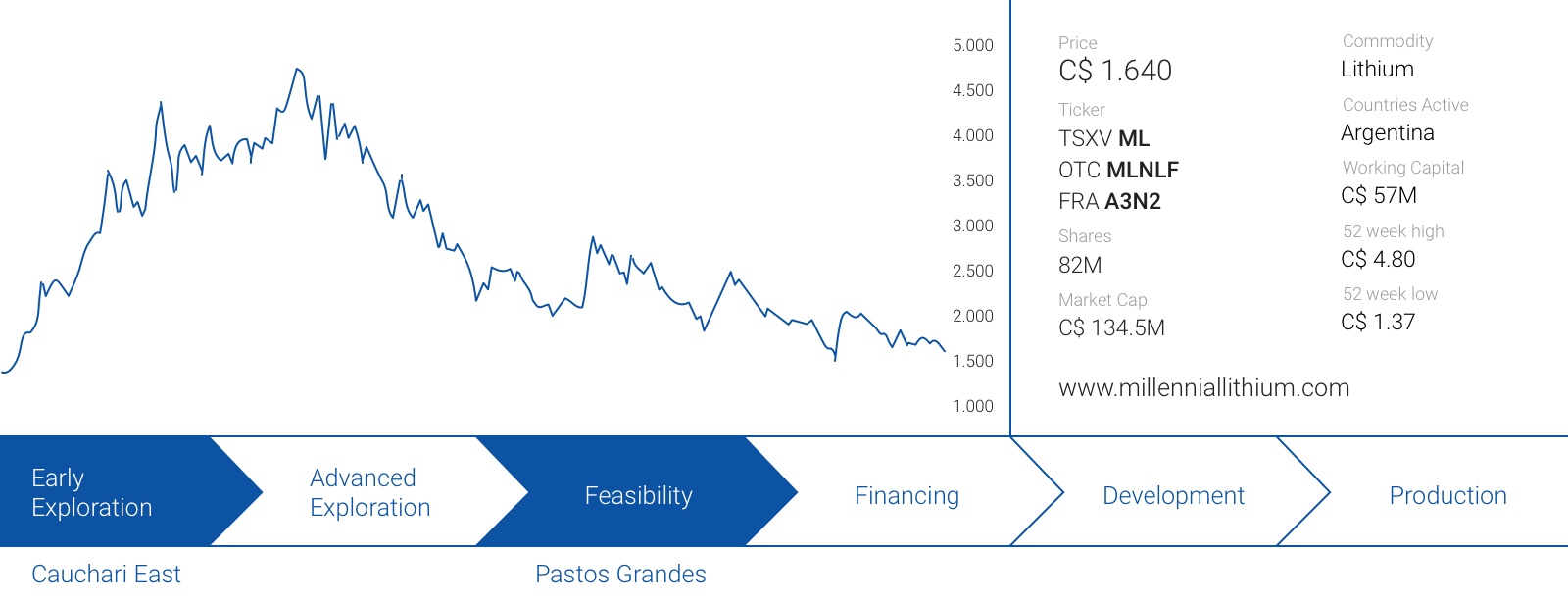

From the top of a hill to the bottom of a valley. That’s the best way to describe the trajectory completed by Millennial Lithium’s (ML.V) share price. Back in January the company was flirting with the C$5 level, but has recently touched a low of less than C$1.50. Completely undeserved, as Millennial Lithium is actually one of the few lithium companies with a promising project that would continue to generate a massive amount of cash flow, even when using a lithium price that’s 25% lower than the spot price and 40% lower than the base case price used in the PEA.

From the top of a hill to the bottom of a valley. That’s the best way to describe the trajectory completed by Millennial Lithium’s (ML.V) share price. Back in January the company was flirting with the C$5 level, but has recently touched a low of less than C$1.50. Completely undeserved, as Millennial Lithium is actually one of the few lithium companies with a promising project that would continue to generate a massive amount of cash flow, even when using a lithium price that’s 25% lower than the spot price and 40% lower than the base case price used in the PEA.

A recap of the Pastos Grandes project

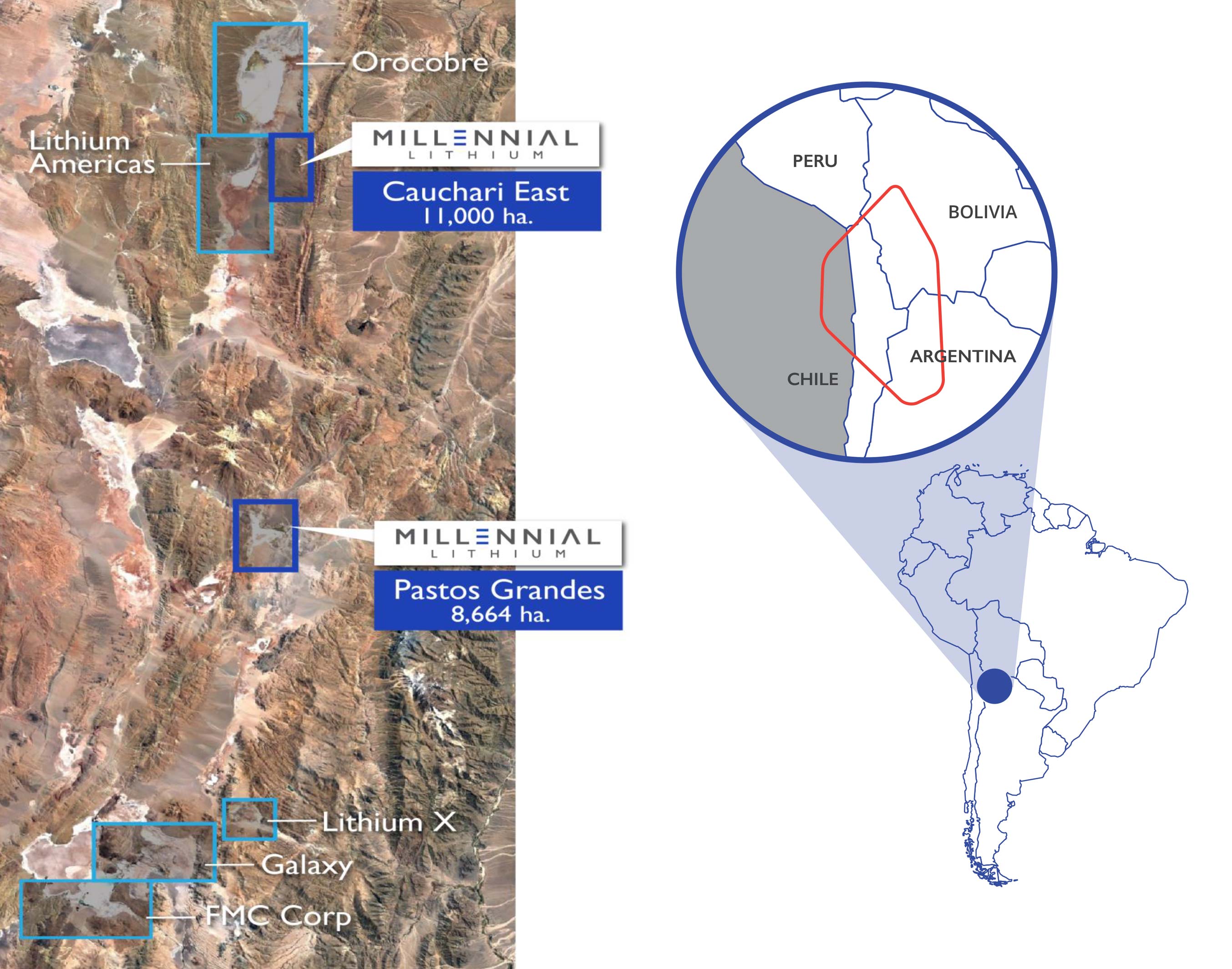

Without any doubt, the Pastos Grandes lithium project, just a 3-hour ride away from Salta, is Millennial Lithium’s flagship project. Pastos Grandes is located right in the middle of the Lithium triangle, where any company with real ambitions in the lithium sector will want to be. And even though there never is a guaranteed outcome when you’re exploring, Millennial’s team immediately discovered lithium-bearing brines at Pastos Grandes.

This eventually culminated in the company reporting its maiden resource estimate at Pastos Grandes, and this completely blew our expectations away. We were aiming for a total resource estimate containing 1-1.5 million tonnes of lithium carbonate equivalent, but with a maiden resource estimate containing in excess of 3 million tonnes (!), even we were surprised.

This resource estimate was based on a total of 4,000 meters of drilling at 11 locations of which one hole was expanded into a pumping test well. This resulted in a measured and indicated resource of 2.13 million tonnes of lithium carbonate equivalent, whilst an additional 878,000 tonnes are part of the inferred resource estimate. Millennial recently acquired more land from the government adjacent to the southern portion of the Pastos Grandes project, and their recent drill results confirm the existence of further lithium bearing brine. In actuality, the results on this newly acquired land are phenomenal, and the best results on the project to date. This should have a positive impact on the current resources on the project, potentially making Pastos Grandes one of the largest lithium deposits in the world.

The PEA was great, so we hope the economics get confirmed in the feasibility study

Thanks to a very capable technical team, Millennial Lithium was able to move really fast on advancing the property towards an economic study. In just 18 months, Millennial Lithium moved from the project acquisition stage to completing a PEA and starting to work on a feasibility study.

The results of the PEA looked very promising as a 25,000 tonnes per year production scenario would cost the company just US$410M in initial capital expenditures. Thanks to the good average grade of the Pastos Grandes project and the excellent evaporation conditions, the operating costs of the lithium project are estimated at just over $3200/t LCE. Several lithium mines have been over-promising on their expected production costs, but we remember from our site visit in 2016 how VP Iain Scarr was constantly reminding us that ‘any economic study Millennial Lithium would complete, would be a credible and reliable study’. So we do believe the real opex won’t be too far off from the quoted $3,200/t.

The NPV (US$824M after-tax using an 8% discount rate) and IRR (23.4%) appear to be low given the relatively low capital intensity of the project as well as the high operating margins of in excess of $10,000/t based on the lithium price used by Millennial’s consultants, but the explanation is pretty straightforward.

The NPV calculation starts from the moment the first dollar of the US$410M is being spent, but that also means that the first cash flow (occurring in year 4) is already discounted by a factor of 1.36. This has a serious impact on the total NPV calculation as for instance the US$159M in net cash flow in year 10 only counts for $76M in the NPV calculation due to this discounting factor. This isn’t a project-specific or company-specific issue: every lithium brine project using evaporation techniques will have a relatively long period in between building the project and generating cash flow. Evaporation doesn’t happen overnight.

And we’d like to end with this: although mining projects are traditionally valued based on a finite mine life. In Millennial Lithium’s case, WorleyParsons used a 24 year mine life, which starts at the commencement of the construction, and thus includes just 21 years of full production. That makes total sense for normal projects, but a case could be made to apply a ‘perpetual NPV model’ on Millennial Lithium. The company is (currently) sitting on 3 million tonnes of lithium carbonate in the ground and even if only 40% of that would be recovered, we are talking about a 50 year mine life at a production rate of 25,000 tonnes per year. Sure, 50 years still contradicts the case to look at this as a perpetual operation, but it should be clear the 21 year of full production used by the PEA consultant will very likely be a gross underestimate.

You should keep this in mind: even in the last year of the mine life (2042), the project will generate US$150M in operating cash flow. Granted, this calculation uses a relatively high lithium price, but even at a lower cash flow, the cash flow in that year remains very substantial. Due to the compounding discount rate of 8%, this US$150M only adds $20M to the NPV. According to our calculations, Millennial Lithium could see the after-tax NPV8% increase by US$95M by extending the mine life by just 5 more years (keeping all other parameters like production rate and lithium prices stable).

We are very comfortable with the PEA, and we hope the feasibility study will be based on a longer mine life. The NPV8% in the PEA wasn’t limited by resource constraints, but just by practical reasons. A 30 year mine life in full production will add US$136M to the after-tax NPV8% using the same commodity prices. And keep in mind the recent exploration success on the adjacent REMSA license further confirms the additional exploration potential at Pastos Grandes. All four holes on the REMSA claims encountered lithium brines with average grades that are actually higher than the average grade of the resource at Pastos Grandes. You can re-read our update on this positive development here.

Nervousness in lithium-land? Much ado about nothing

Whereas investors were scrambling to get their hands on lithium companies just one year ago, the lithium hype appears to be over, as resource investors moved on to the next shiny thing.

This is actually an advantage in disguise. First of all, it means the less serious lithium companies will slowly and quietly disappear as well, while investors will shrug off marginal lithium assets. This means the remaining lithium companies with a good (read: viable) project will have to compete with fewer other companies for the same cash and investor attention.

Secondly, we aren’t even sure where the bear market feeling in the lithium sector is coming from. The demand is still increasing and while the lithium prices aren’t as sky-high as last year, the producers are still reporting very high sales prices. Orocobre (ORL.TO, ORE.AX) for instance, has confirmed it received in excess of $12,000 per tonne of lithium carbonate. Well, if you’re a lithium company that can’t make money at $12,000 lithium, you better find yourself another project.

Because even at a 25% discount to the current lithium spot price (which takes into account that additional supply will be coming online), Millennial Lithium’s operating margin would still be approximately $5,500/tonne. Plenty of cash to service the debt part of the construction financing and then some.

Our own calculations

In fact, our own (back of the envelope) models confirm Pastos Grandes will still perform well using an average lithium price of $9,000/t, a production cost of $3,500/t and keeping all other parameters stable. For simplicity sake, we are using a production rate of 8,000 tonnes LCE in Y3 (at a cost of $5,000/t), 12,000 tonnes in Y4 (at a cost of $4,500/t) and a stable output of 25,000 tonnes per year from Y5 on at the aforementioned opex of $3,500/t. The average annual sustaining capex is $3M per year.

It looks like Millennial Lithium is using an aggressive depreciation rate in the PEA model, as the entire initial capex is written off by the time the project reaches full production. That’s why we applied zero income taxes in the first six years of the model, as the taxable income will be compensated by either depreciation charges or accrued net losses from the first few years. From year 7 on the taxes will kick in, at 20% in Y7, followed by the standard 35% from Y8 on. Please note: this does not take the recently introduced export tax into account as we expect the system to be overhauled before Millennial Lithium will be in full production.

So even at a more conservative lithium price, the after-tax NPV8% of Pastos Grandes (using the same 20 year full-production mine life as in the PEA) is approximately US$411M or C$530M.

But what if we would extend the mine life to 30 years in full production? The after-tax NPV would increase to US$511M, or C$670M. Remember, that’s using an average lithium price based on a 25% discount to the price currently received by producers. We ran a few additional scenario’s, including a received LCE price of $11,000/t from Y7 on (‘Lithium price 2’). We have summarized our findings in the following table:

So even in more adverse lithium pricing circumstances, Pastos Grandes remains viable. An IRR of 17% or 20% might appear to be low, but that’s good enough for an asset that will very likely produce lithium carbonate for several decades.

With C$56M in cash on the balance sheet, Millennial Lithium is in great shape

Millennial Lithium took advantage of the market’s interest in lithium and filled its treasury by issuing new shares at a premium to today’s share price.

In November 2017, Millennial raised C$30M at C$2.50 and more recently, in March, it issued 6.9 million units at C$3.5 in a brokered deal and an additional 2.2 million units in a non-brokered placement for a combined C$31.8M. This means Millennial Lithium raised in excess of C$60M in just 4 months’ time, and the most recent C$3.50 raise was perfectly timed as that almost was the tipping point where after the market started to lose interest in Lithium.

And the best thing? Throughout the past 2.5 years, the company has kept its share count incredibly tight. As Millennial has just 82 million shares outstanding, there’s approximately C$0.69 per share in cash on the bank.

This doesn’t mean we can just add this cash position to the previously calculated Net Present Value, as we expect Millennial Lithium to spend most of it on the upcoming studies and exploration programs. Keep in mind it was awarded the REMSA grounds last year, but these have a firm spending commitment of approximately C$20M on them. Millennial really doesn’t want to lose those claims, so we would expect the full C$20M to be spent.

Millennial plans to drill 13 exploration and production holes this year (the results of the first four holes have already been released), and 4 holes aiming to find fresh water to be used at the processing plant.

Millennial is also moving forward with a pilot plant. It will construct a 10,000 square meter containment pond and a 22,500 square meter pilot pond to be used as test case for a pilot plant with a capacity of 3 tonnes of LCE per month. This pilot plant (and trial ponds) will allow Millennial to fine-tune its evaporation expectations for the large-scale production plan.

Conclusion

Millennial Lithium raised money when it had to, and that’s why it still has approximately C$56M in cash on the balance sheet, allowing it to continue to aggressively advancing the Pastos Grandes lithium project. The recent addition of Jack Scott to the board of directors indicates Millennial is very serious about developing the project as Scott has plenty of experience on the capital markets given his recent executive roles at different companies.

Exploration is in full swing at the REMSA grounds (which could very well lead to another resource update and upgrade), whilst WorleyParsons is working on the final feasibility study which should be out in the first quarter of 2019. We don’t expect any major changes in the economics, but we will be looking forward to see if WorleyParsons A) changes the used lithium price to lower levels and B) extends the full-production mine life from the 21 years in the PEA to 25 or even 30 years.

Exploration never has a guaranteed outcome, but Millennial Lithium appears to be one of the companies joining the race to develop Argentina’s next large lithium project. As our calculations show, in a 25 and 30 year production scenario using a production cost of $3,500/t (+10% vs. PEA) and a sales price of $9000/t (-25% vs. spot, -35% vs. PEA), Pastos Grandes appears to be a money-maker. We would like to see our expectations being confirmed in the upcoming feasibility study where after it will be up to Millennial Lithium to advance the Pastos Grandes project towards construction and production.

The author has a long position in Millennial Lithium. Millennial Lithium is a sponsor of the website. Please read the disclaimer