In the second half of October, we flew to Argentina’s Salta province to kick the proverbial tires of Millennial Lithium’s (ML.V) Pastos Grandes lithium project. The company acquired the project during the summer, and has raised more cash in the third quarter to kick-start a drill program at the main project.

Pastos Grandes, the project that set everything in motion

The first stop of the visit was the Pastos Grandes lithium project, where Millennial’s journey into the lithium space started. The project is approximately 4.5 hours away from Salta, the capital of the Salta province in Northwestern Argentina. Approximately half of the journey was on paved roads with the remainder consisting of pretty well-maintained gravel roads.

As we mentioned before, Pastos Grandes is located right in the middle of the Lithium triangle, where any company with real ambitions in the lithium sector will want to be. Millennial Lithium has an option to earn a 100% stake in the property by paying a total of US$2.2M in cash as well as issuing US$1M worth of Millennial shares. As the final US$1M payment has to be made on the 1-year anniversary of the date the Stock Exchange approved the agreement, Millennial will own 100% of the property before the end of the third quarter next year. This will put the company in an enviable position as all other ‘competitors’ own just a part of their properties. Orocobre (ORL.TO, ASX:ORE) owns a 66.5% stake in Olaroz, Lithium Americas (LAC.TO) and SQM (SQM) are in a 50/50 joint venture whilst even Lithium X (LIX.V) owns just 80% of its lithium project in Argentina.

Owning 100% will be a major milestone for Millennial Lithium, as it will increase the company’s flexibility with regards to its plans to move forward. The attendees of the site visit also spent an entire afternoon with the Moreno-family, the vendors of the project, and it’s very clear all parties involved are getting along extremely well.

The property has previously been explored by Eramine, a subsidiary of Paris-listed Eramet (which currently has a market capitalization of approximately 1.15B EUR (C$1.7B)). Eramet drilled several holes and encountered lithium grades that were definitely economic, but the company limited the depth of the holes to just 120-140 meters, which is actually quite shallow, before deciding to move to another salar.

Millennial Lithium has decided to use another approach at Pastos Grandes, and as the heavier brine has a tendency to sink to the bottom, the company has now received a drill permit to drill 4 or more holes which will be drilled to a depth of 350 meters or more. That’s indeed 2-3 times as deep as the Eramet holes, and as the higher-grade lithium brine sinks to the bottom of the pool, this strategy makes a lot of sense as the chances to encounter higher lithium values at depth is actually pretty high.

Of course, the proof of the pudding is in the eating so we’re looking forward to see the assay results from this exploration program, and we anticipate seeing these results before the end of this year.

Cauchari East – working on a proof of concept

We have to admit that when we learned about the company’s option to acquire an unencumbered 100% ownership of the 3,000 hectares Cauchari East project we originally thought the project was optioned as some sort of ‘nearology’ play, to piggyback on Orocobre’s project and the Lithium Americas/SQM joint venture.

We were also surprised to learn the claims are located on land rather than in a salar, but after having discussed the project with VP Iain Scarr, we now have a better understanding of the rationale why Millennial Lithium entered into an option agreement to acquire Cauchari East.

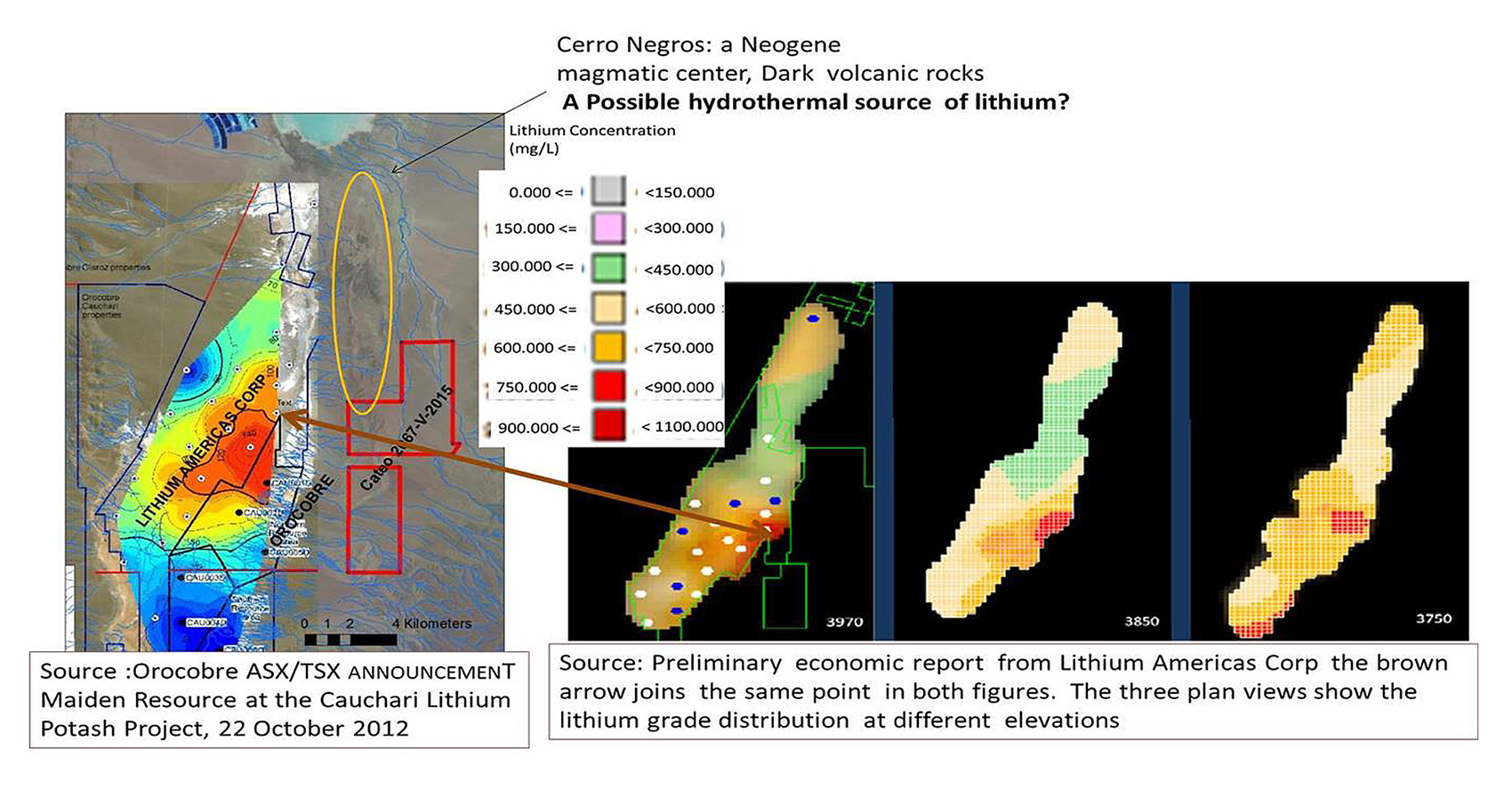

Lithium Americas, SQM and Orocobre have pretty much locked up the entire salar, but back in 2010 a technical report requested by Orocobre and completed by independent consultants confirmed the brine resource of the Cauchari salar seems to be extending towards the east, right onto the property Millennial Lithium has now optioned.

Scarr shared another interesting and perhaps even more important theoretical concept with us. Not only is the mineralization extending towards the east, the deepest part of the brine isn’t located in the salar, but under the overburden and potentially on the Cauchari East claims. This could have the advantage of encountering significant lithium grades in relation to the Olaroz-Cauchari resources. Of course, this is just a theoretical model, but the theory doesn’t just sound acceptable an image published by Orocobre is confirming the highest lithium grades are encountered at the east side of its Cauchari project (see the next image).

After hearing the more detailed explanation about Cauchari East, we are now fully convinced this exploration project has its merits, and drilling a few deep holes will be very helpful to determine the potential of this land package.

Iain Scarr probably is the company’s most valuable asset

One of the most noticeable things Millennial did last summer was appointing Iain Scarr as its Vice President Exploration and Development. Scarr has four decades of experience with mining mastodon Rio Tinto (RIO) and actually was involved early in the discovery and later in the commercial justification for development of the Jadar lithium-borate resource in Serbia.

Perhaps even more important is what Scarr did after his period with Rio Tinto. Not only did he assist Lithium One and Galaxy Resources (ASX:GXY) with the completion of an economic study on its Sal de Vida project, he was also one of the pinpoint people of the definitive feasibility study on the Rincon lithium project which is currently owned by the Enirgi group.

Scarr has plenty of experience with both lithium and the lithium triangle, and an additional advantage is the fact he’s based in Salta which gives Millennial Lithium direct access to someone who knows the ins and outs of the permitting system in the province.

According to Scarr, he originally just wanted to render his services in an advising capacity, but he was immediately on board after meeting the management team and seeing the historical results and data on the Pastos Grandes project. He was also very positive about the Cauchari East program, and we do expect more properties to be added to Millennial Lithium’s project portfolio.

As soon as project vendors in the greater Salta-Jujuy region realize Millennial Lithium is there to stay and has a lithium veteran running things on the ground, the more likely it is to negotiate new property deals to make Millennial Lithium one of the, if not THE, lithium exploration company in the Lithium Triangle.

The short ‘turnaround time’ on the recently-acquired Cruz property in the Pocitos Salar emphasizes this. Less than three weeks after Millennial had entered into an agreement to acquire the Cruz project from an unnamed vendor, it already signed a letter of intent to allow Southern Lithium (SNL.V) to earn a 70% or 80% stake in the property.

To earn the first 70% of Cruz, Southern Lithium needs to pay Millennial’s Argentinean operating subsidiary a total of US$2.2M over the next two years, as well as issuing US$100,000 worth of SNL stock and spend at least half a million US Dollar on exploration activities within the next 12 months.

As the original acquisition terms haven’t been disclosed, it’s unclear how good the joint venture deal is, but in any case, it does make sense to own a 20% or 30% stake in a property where someone else is spending its cash on to explore, whilst keeping its focus on the two main assets in Millennial’s project portfolio.

Where to go from here?

At Pastos Grandes, we’re obviously looking forward to see the results of the recently-started exploration program. Historical assay results (from the Eramet drill program) indicated an average grade of 400-600 mg/l but keep in mind these samples were taken at relatively shallow depths, and may not have selectively tested the target brines. Finding anything above 500 mg/l at depth would satisfy us as it will be very helpful to validate the past exploration program of Eramet, which spent in excess of C$5M on the project which included no less than six exploration wells.

Millennial thinks it will be able to bring the Pastos Grandes project into production before the end of this decade. That’s a very aggressive assumption, but it’s in the company’s best interest to secure a spot on the lithium market as fast as possible. As we explained before, even though the demand for lithium will very likely continue to increase, this doesn’t mean there will be an unlimited demand for new lithium projects.

We dare to say 90% of the lithium projects in more unconventional regions like Nevada will never be brought into production, and that’s what sets Millennial Lithium and other (soon-to-be) lithium brine producers in the lithium triangle apart from the rest. Grade is king, and the evaporation rate in the Puna region is extremely high as the sun (a free source of energy) is taking care of the evaporation of the water from the production ponds.

Millennial wants to have a NI43-101 compliant resource estimate by the summer of next year and even though it’s way too early to speculate about the size of the Pastos Grandes project, we would expect to see a resource estimate with a total Lithium Carbonate content of 1 million tonnes, at an average grade of in excess of 400 mg/l. It’s also not unlikely the company will simultaneously publish a Preliminary Economic Assessment, as we think Iain Scarr will be able to assist the independent consultants with a mine plan which should result in defining the potential economics of the project.

We expect the company to need approximately 18 months to move from a PEA to a Definitive Feasibility Study (as brines are usually straightforward with ‘metallurgy’ being one of the most important parts rather than resource definition), and Millennial could be skipping the pre-feasibility stage based on the results of the pilot plant.

We would also expect some more changes in the management team. As the company evolves from an exploration company to a developer and eventually a producer, it’s not unlikely additional expertise will be added to both the board of directors and management.

Conclusion

Even though Millennial Lithium was one of the last companies to join the lithium-race, it has been able to execute options to acquire some very promising lithium projects smack in the middle of the lithium triangle in Argentina. Drilling has started at Pastos Grandes, and we have a pretty good idea of what we can expect there as this isn’t really greenfields exploration given the fact Eramine has completed an extensive exploration program just a few years ago.

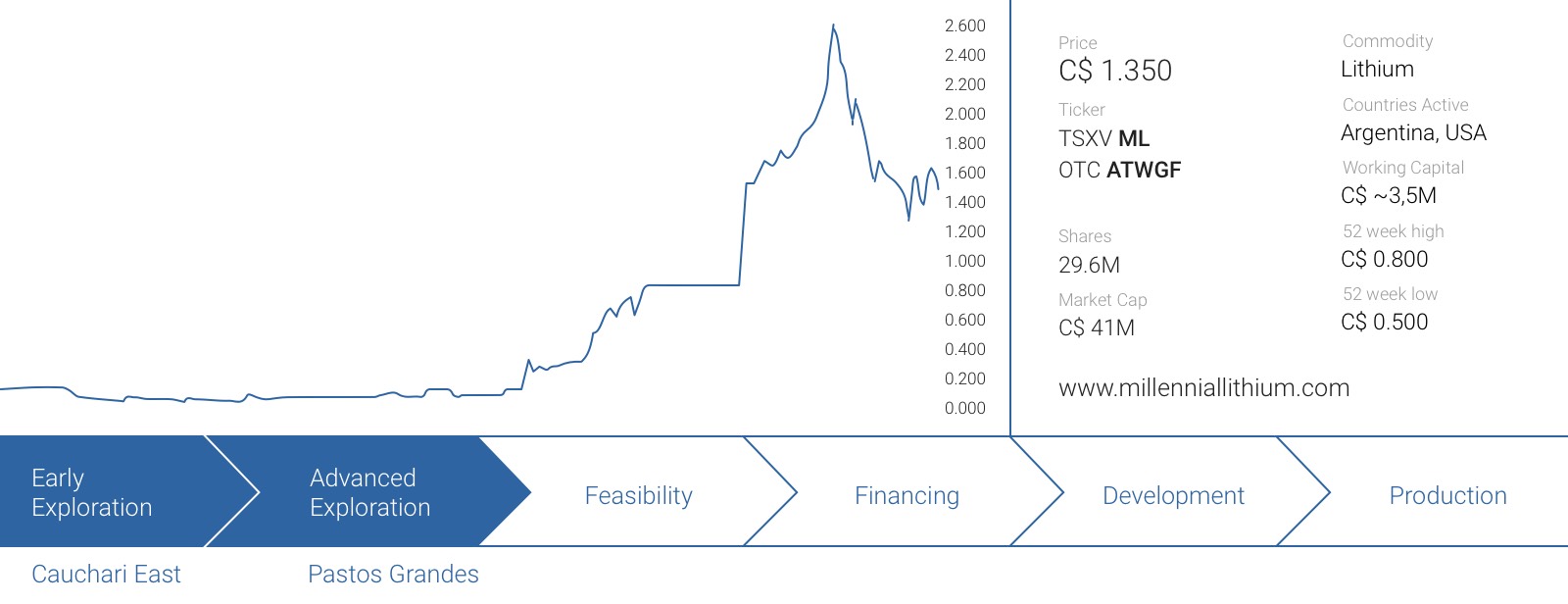

This doesn’t mean you should chase a share price. Even though Millennial’s share price has increased by 27% (after more than doubling) since the opening bell after our first report, today could be a good day to pick up some shares as one of the previous private placements exits the 4 month hold period. This might cause some pressure on the share price, and well-placed and well-timed limit orders could allow you to pick up some shares at a lower price, so keep an eye on today’s trading pattern.

In any case, after having travelled to Salta, visited the projects and talked with Iain Scarr, we think Millennial Lithium’s projects are better than the company initially thought, and we’re looking forward to see the initial drill results before the end of this year.

The author has a long position in Millennial Lithium. Millennial Lithium is a sponsor of the website. We will be reimbursed for our site visit-related expenses. Please read the disclaimer