NevGold Corp (NAU.V) released strong drill results on its flagship Limousine Butte oxide gold project in Nevada last year, but investors tend to forget the company owns an additional three projects. The recently acquired Nutmeg Mountain project in Idaho is being drilled right now but NevGold still has the Cedar Wash gold project in Nevada and the Ptarmigan silver project in British Columbia up its sleeve.

NevGold raised just over C$4M at the end of last year and is now well-funded to complete this year’s exploration programs on the two main projects.

The company has been pretty active in Nevada and Idaho

Limousine Butte

It has been relatively quiet around the Limousine Butte project, but we expect the company to hit the ground running this year as it has gained a much better understanding of the mineralization during the 2022 drill campaign. And of course the recent C$4M+ capital raise will be helpful as well.

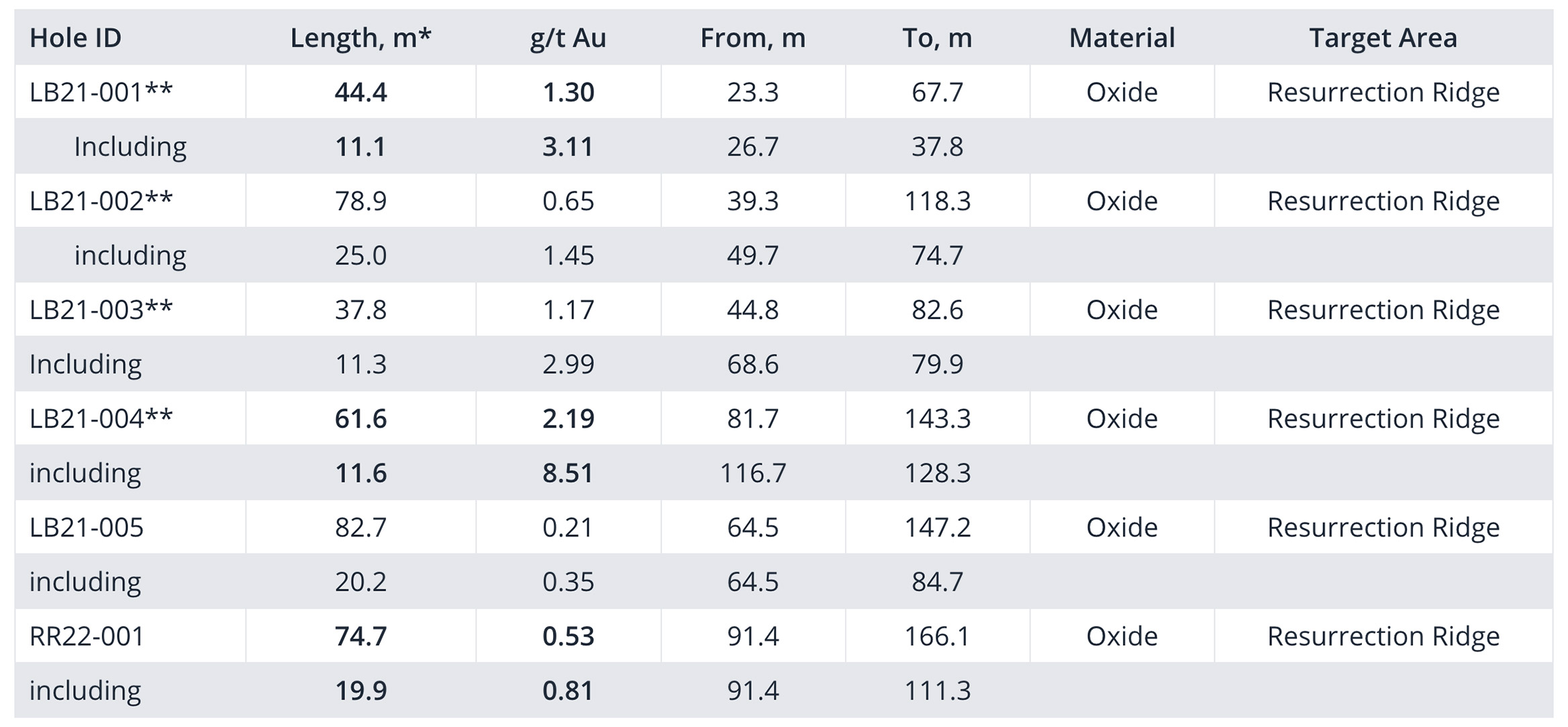

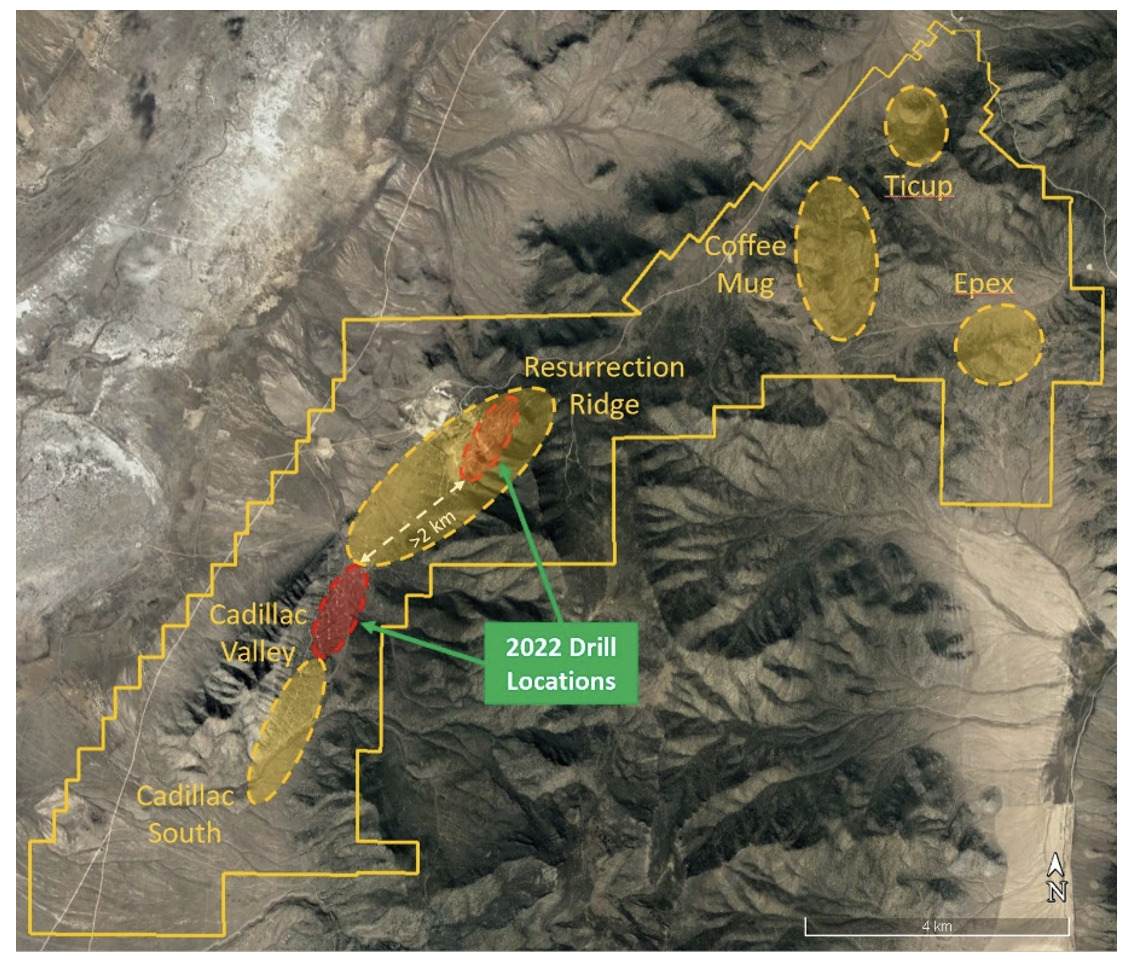

As it has been a while since NevGold released assay results, perhaps it could be useful to revisit the most recent drill results from Resurrection Ridge, where NAU released assay results in November last year. Resurrection Ridge is part of the Limousine Butte project in Nevada. These two holes are the first assay results from Resurrection disclosed by the company since February 2022.

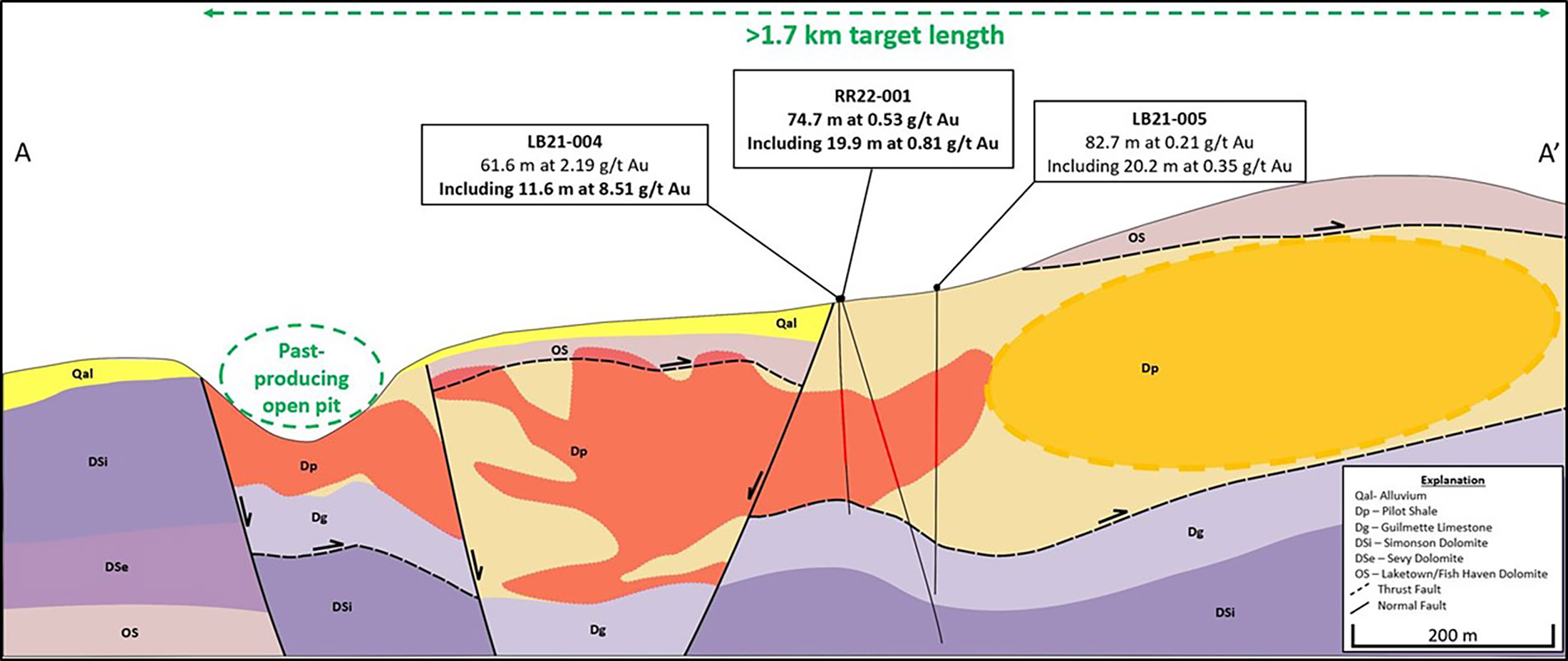

Hole LB21-005 and RR22-001 were drilled towards the northeast of the past producing pit and the known mineralization, and both holes intersected oxide-hosted gold mineralization. While hole 21-005 was relatively weak with 83 meters of 0.21 g/t gold, there was a higher grade interval of 20.2 meters containing 0.35 g/t gold starting at about 64.5 meters downhole. 0.35 g/t would definitely make the cutoff grade and even the 0.21 g/t zone, although low grade, would make it onto a leach pad as the traditional cutoff for oxide-hosted gold deposits in Nevada is usually around 0.14-0.17 g/t.

So, an okay hole, but nothing more than that. Hole RR22-001 is a different story. The drill bit intersected 74.7 meters of 0.53 g/t gold including a higher grade interval of 19.9 meters of 0.81 g/t starting at about 91.4 meters downhole. The true width for both holes is expected to be 70% to 90% of the reported width and this means the true width of the 0.53 meter interval is likely exceeding 50 meters. Finding a continuous interval of that size is a major accomplishment. Additionally, there doesn’t appear to be any ‘smearing’ (it was an RC hole anyway) as even if you would exclude the 19.9 meters of 0.81 g/t gold from the equation, the average gold grade in the residual 54.8 meters would be 0.43 g/t which is more than twice as high as the typical cutoff grade for an oxide deposit in Nevada.

Not is the grade in RR22-001 good and the thickness excellent, perhaps even more important is the location of the hole. Lower-grade hole LB21-004 expanded the mineralized footprint by in excess of 100 meters from previously reported hole LB21-004 (which contained 61.6 meters of 2.19 g/t gold), hole 22-001 confirms the potential to step out from the currently known mineralization. And just to give you an idea of how important these step-outs can be; they also validate the potential expansion of the mineralization by another kilometer to the northeast of the area that was just drilled.

The current mineralized footprint now extends over 700 meters along strike and about 350 meters laterally. Applying an average thickness of the mineralization of 60 meters results in almost 40 million tonnes of rock. Applying an average grade of 0.50 g/t (it could and should be higher given the previously disclosed intervals as every single hole but LB21-005 encountered a grade exceeding 0.5 g/t gold) yields 600,000 ounces of gold. A grade of 0.7 g/t could add another quarter of a million ounces. Needless to say the Resurrection Ridge target is now shaping up like it could host a million ounces by itself and this could push the greater Limousine Butte project closer to becoming a 2 million ounce deposit once you add in Cadillac Valley and the low-hanging fruit there.

Of course more drilling will be required, but 1 million ounces at Limousine Butte now appears to be a conservative scenario and we can’t rule out seeing a number of twice that.

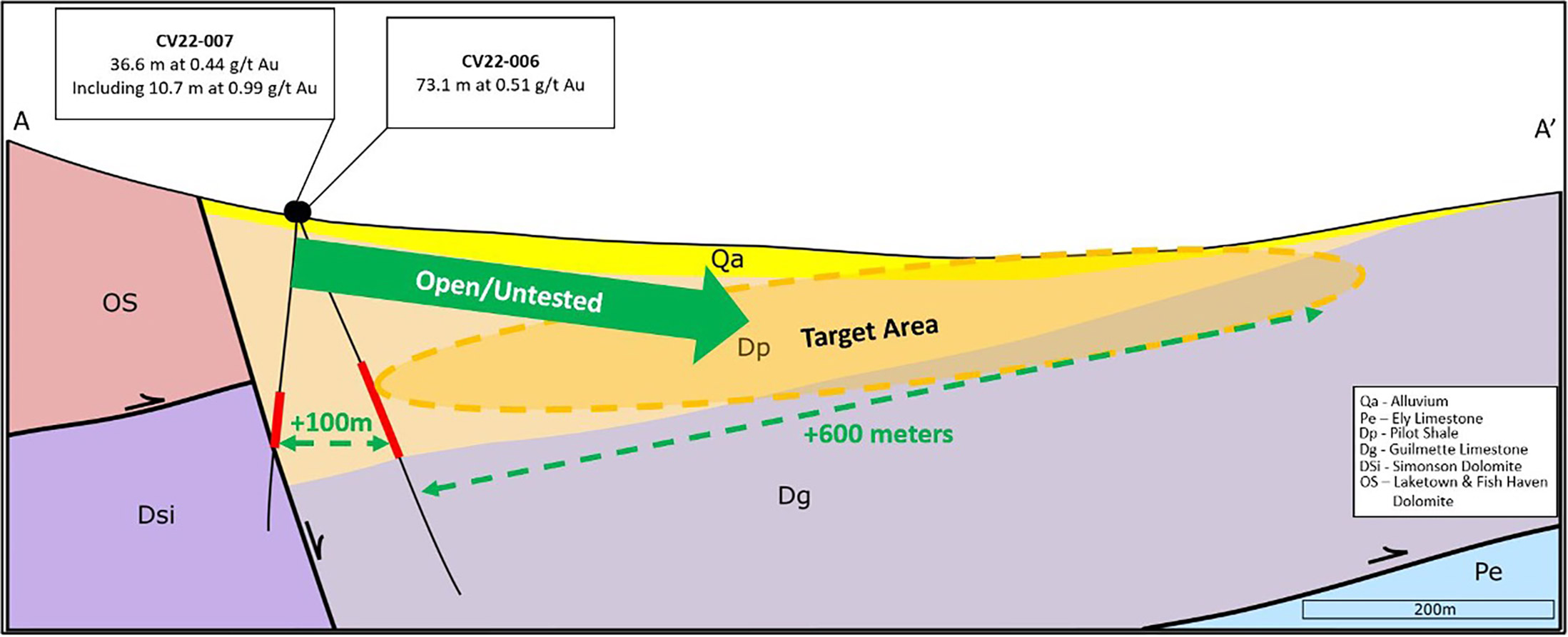

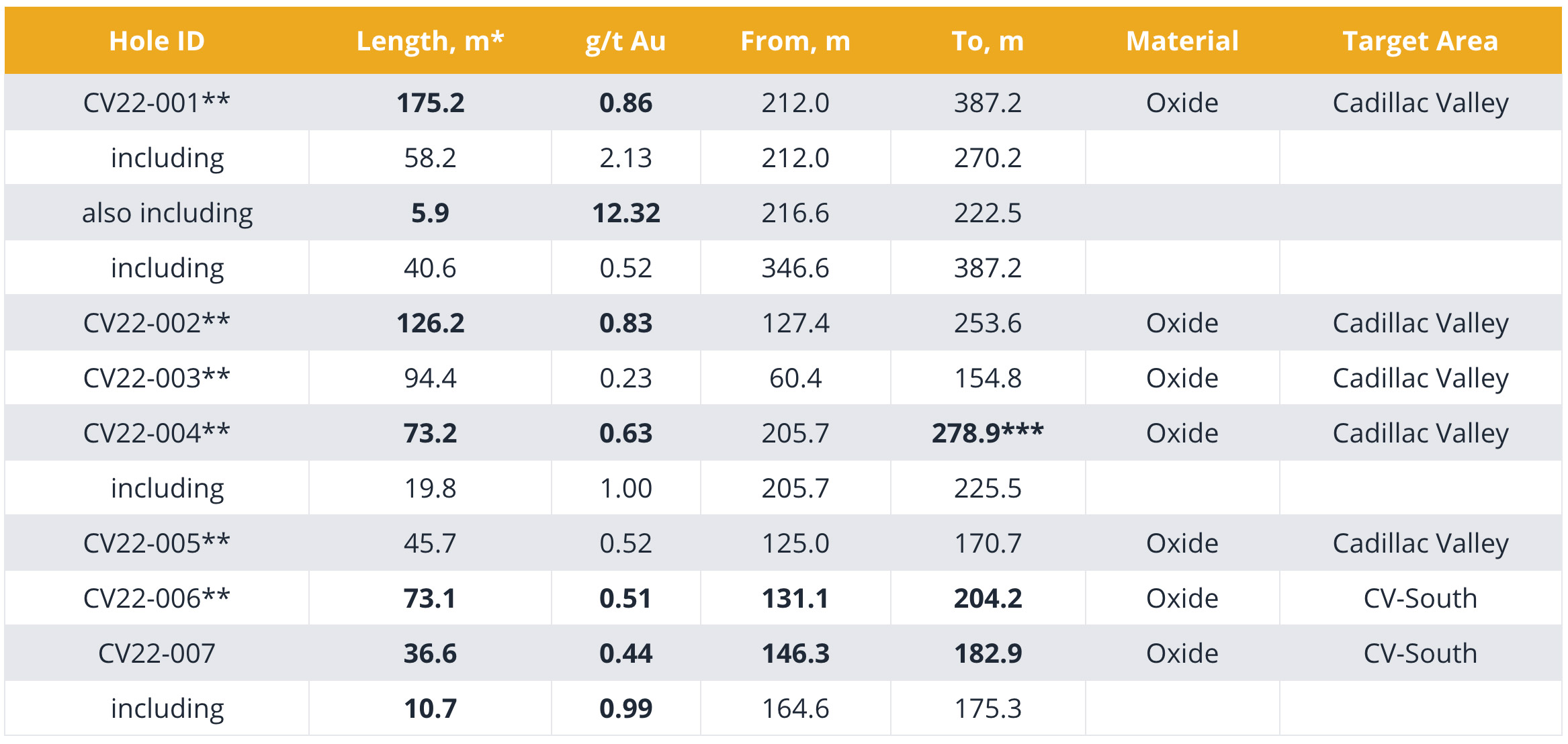

The Resurrection Ridge assay results came a few weeks after NevGold disclosed the assay results from CV22-007 from the Cadillac Valley area, which is a new area at Limousine Butte project. There certainly were some expectations for this hole drilled at the Cadillac Valley prospect as hole CV22-006, which was drilled nearby, encountered just over 73 meters of 0.51 g/t gold.

Hole CV22-007 didn’t disappoint either as the drill bit intersected 36.6 meters containing 0.44 g/t gold starting at about 146 meters down-hole. That’s roughly the same vertical depth as the level where the mineralization was encountered in hole CV22-006.

The direction of the new hole was also interesting as it confirms the presence of gold-bearing oxide mineralization towards the west-northwest from the previously interpreted mineralized zone and the image above clearly shows that a mineralized ‘lobe’ is developing on the southern portion of the Cadillac Valley area. And as VP Exploration Derick Unger explains, although the drill bit encountered the major northeast striking fault, it does confirm the fault was an important conduit for the gold-bearing fluids and the CSAMT geophysical surveys can identify the conductive zones associated with the faults and the resistive zones associated with the mineralization.

And more recently, Nevgold has submitted an Exploration Plan of Operations to the Bureau of Land Management or its Limousine Butte project. Once approved, this will allow the company to increase the disturbance area to up to 200 acres which almost 15 times the current allowance of just 15 acres.

Having more flexibility will help to optimize drill programs and will put NevGold in a better position to complete infill and expansion drill programs as some of the high priority drill targets were not accessible under the current Exploration Notice permits. The approval of the Exploration Notice is expected by end of Q3 2023 which would expand the allowable area of the disturbance in the 2023 drill program.

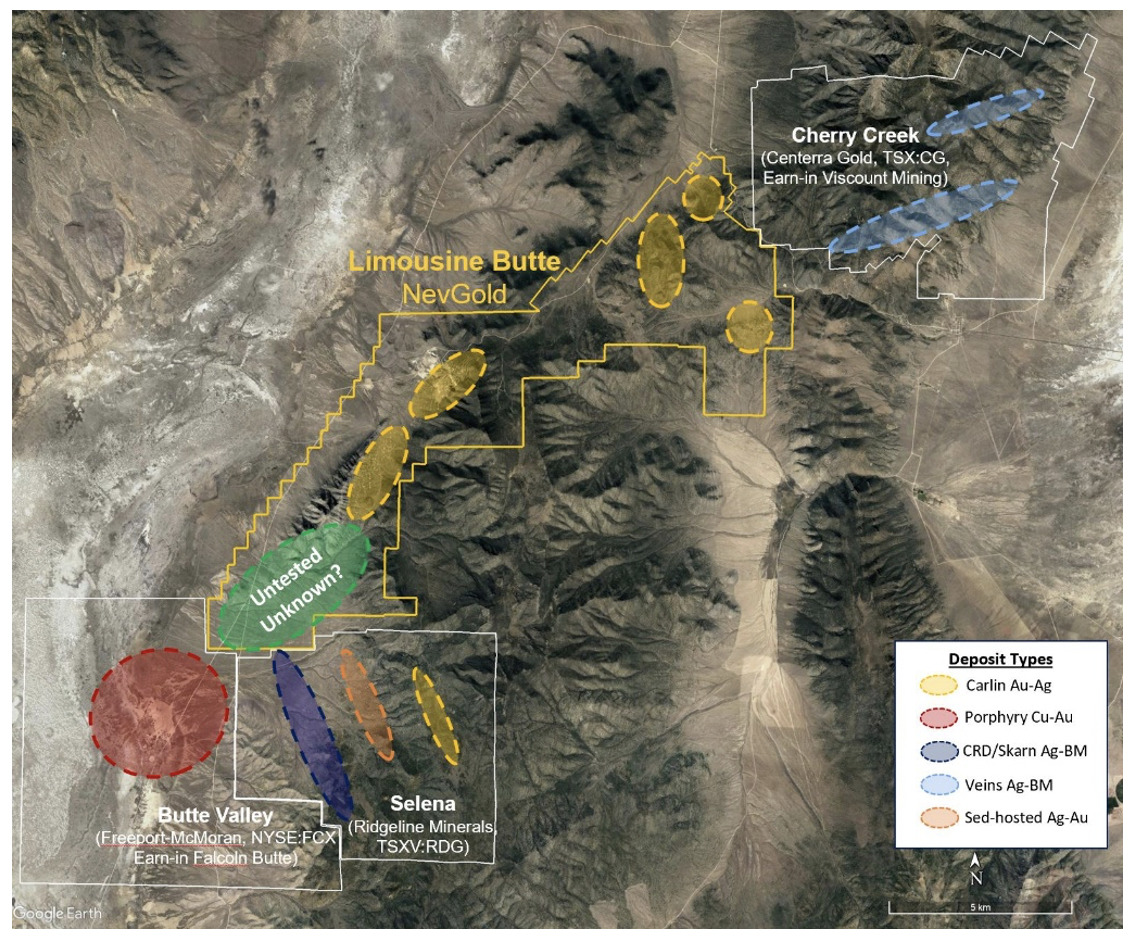

NevGold also highlighted the increased activity on both sides of its asset. Centerra Gold (CG.TO, CGAU) is still working on Cherry Creek while apparently towards the southwest copper giant Freeport McMoRan (FCX) is earning into a project as well.

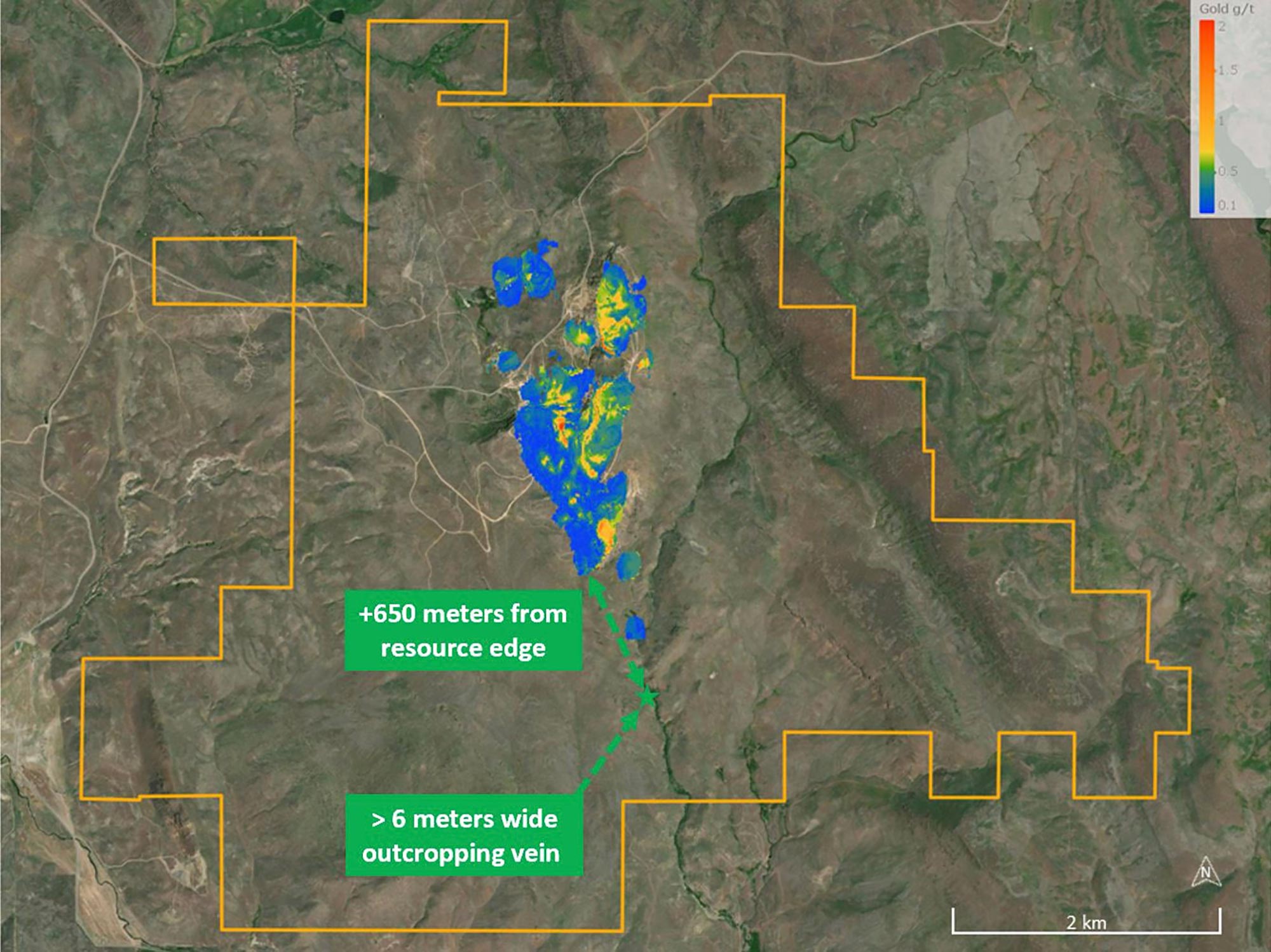

Nutmeg Mountain

The pieces of the puzzle are falling into place at the recently acquired Nutmeg Mountain project in Idaho. NevGold has received the approval of the Exploration Notice permit by the Bureau of Land Management for its Nutmeg Mountain gold project in Idaho. While 85% of the currently known resource (1.07 million ounces in total of which 910,000 ounces are in the indicated category and 160,000 ounces of gold are in the inferred resource category) is on patented mining claims, there are some high-priority targets on the unpatented land. The recently received permit will allow NevGold to complete work on those federal unpatented claims (the green area in the image below), where historically very little drilling has taken place.

The company didn’t wait for the approval to drill on unpatented land as it had already kicked off a maiden core drill program at Nutmeg Mountain. The company is attempting to achieve three things in this initial 2023 drill program. First of all, it wants to increase the resource to the north and the south with near-surface drilling while, secondly, it also wants to drill-test the potential for high-grade feeder structures at depth. The third priority is to identify parallel structures that host additional mineralization to the east and to the west of the 2020 resource calculation.

As drilling has started and the first samples have likely already been shipped to the lab, odds are we will see the initial batch of assay results later this month.

And just as a reminder why Nutmeg could potentially be very interesting for NevGold. This project is located in Idaho and already contains a NI43-101 compliant resource estimate with 910,000 ounces of gold in the indicated resource category and an additional 160,000 ounces in the inferred resource category (based on in excess of 900 holes drilled). The average grade is respectively 0.65 g/t and 0.56 g/t.

That sounds low but just like the Limousine Butte project, the gold is amenable to be recovered by using the heap leach or vat leach processing option. An additional bonus is the fact the mineralization starts right at surface and the strip ratio may even be less than 1.

Nutmeg Mountain, Idaho: inaugural drill program has officially started

According to the technical report completed for GoldMining, about 72% of the contained gold was recoverable by direct cyanidation while 21% was associated with silica encapsulation. The ounces are there, and the main issue NevGold will have to tackle will be metallurgy as that will obviously be key if one would like to develop a 0.65 g/t gold deposit, especially considering there’s a 5% NSR on most of the current resource. A 5% NSR could kill a project (or at least make it substantially less appealing) so it is good to see NevGold has already started to talk to the royalty owners in an attempt to reduce the royalty rate.

This year’s drill program will hopefully add ounces and beef up the grade as well to make Nutmeg Mountain a more robust project with a hopefully economic resource. We expect NevGold to work towards a PEA after this year’s drill results and a resource and met work update. That PEA – subject to satisfactory drill and met work results – will be the first time an NPV will be calculated at Nutmeg using the current NI43-101 standards and that will be an important study to ‘backstop’ the valuation of the entire company.

The recent capital raise

Nevgold was one of the first companies to take advantage of a recent change in the rules and regulations to raise cash as the company planned to raise C$3M in a brokered financing using the new Listed Issuer Financing Exemption (‘LIFE’). This makes it easier for companies to raise cash as the main benefit is that there no longer is a 4 month hold period required.

The demand for this financing was high and just a few weeks later, NevGold closed on an upsized placement, raising C$4.1M in total. The lead order came from GoldMining (GOLD.TO) which invested an additional C$1.25M in the company and now owns 12.6 million shares and 1.5M warrants. We were also pleased to see the insiders stepped up the plate again. According to the press release, officers and directors invested an additional C$150,000 in the company with CEO Brandon Bonifacio subscribing for 150,000 units (C$63,000). While the newly issued shares are not subject to a four month hold period for ‘normal’ investors, insiders are subject to a four month hold period. And just last week, CEO Bonifacio bought an additional 50,000 shares at C$0.355 per share on the open market. This brings his total position to almost 3 million shares.

Conclusion

It looks like NevGold will hit the ground running this year. A rig is currently working on the Nutmeg Mountain project and we should see assay results later this month. We also expect to see more details on the 2023 exploration plans for Limousine Butte which will undoubtedly be drilled again this summer but the company is awaiting better weather (winters in Nevada can be tough).

NevGold originally also planned to drill Cedar Wash but that won’t happen in the next twelve months. Understandable as the company will likely get a bigger bang for its buck at the more advanced Limousine Butte and Nutmeg Mountain projects so it makes sense to be selective with the cash and advance those two projects.

NevGold currently has just under 71.5M shares outstanding. At the current share price of C$0.35, this represents a market capitalization of C$25M. Considering NevGold has two resource-stage assets, one with in excess of 1 million ounces of gold in Idaho and one with a few hundred thousand ounces (which will likely grow to close to a million ounces as well in the next resource compilation) in Nevada, NevGold isn’t expensive at all. The company is still scratching the surface at both Nutmeg and Limousine Butte and there is a lot of resource growth potential after the fully funded 2023 drill programs.

Disclosure: The author has a long position in NevGold. NevGold is a sponsor of the website. Please read our disclaimer.