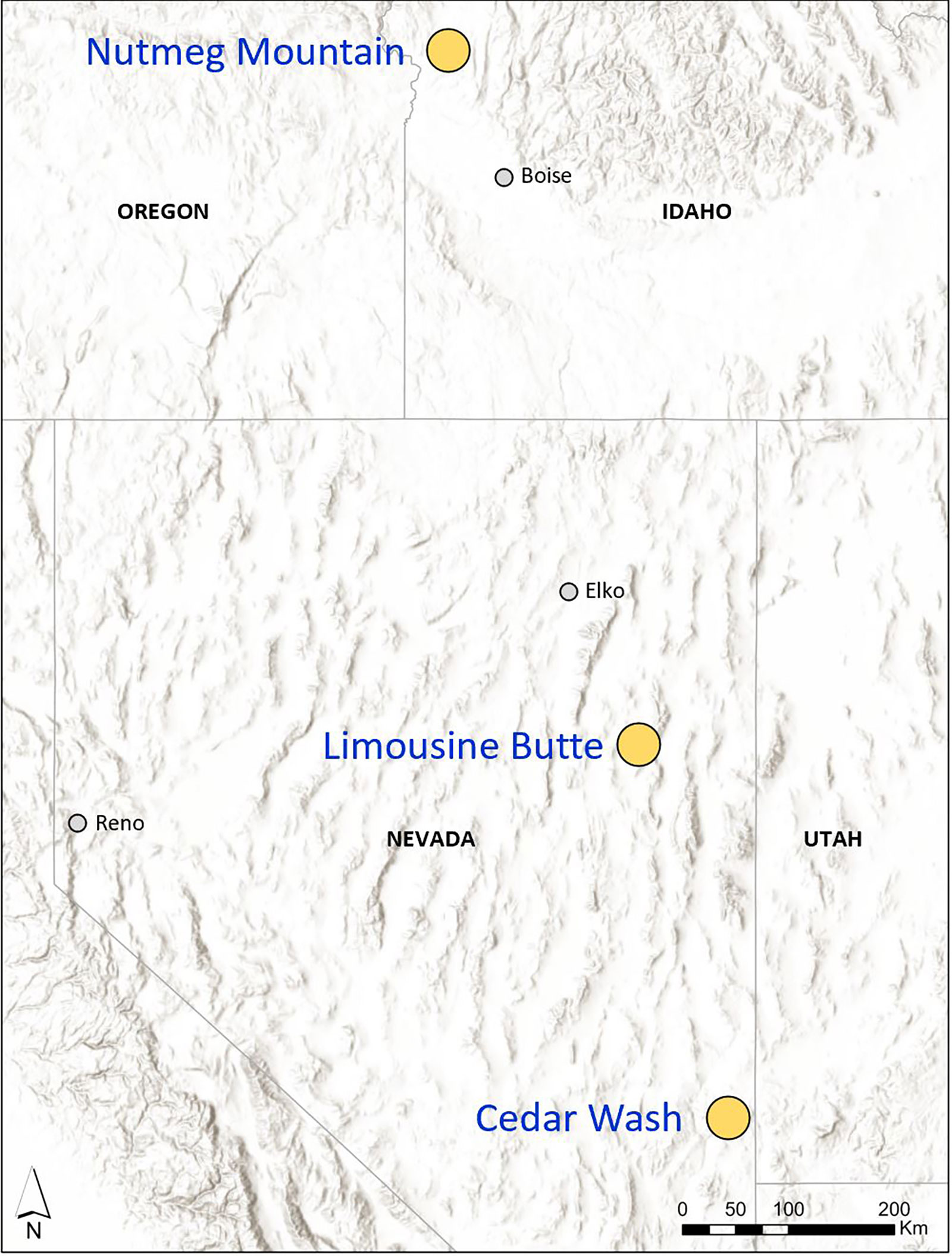

Last year, NevGold (NAU.V) entered into an option agreement to acquire full ownership of the Nutmeg Mountain project from GoldMining (GOLD.TO). This project is located in Idaho and came with a 2020 historical resource estimate with 910,000 ounces of gold in the indicated resource category and an additional 160,000 ounces in the inferred resource category (based on in excess of 900 holes drilled).

That was a great starting point and it is very impressive to see NevGold was able to already increase this resource with less than 12 months working on the project. We estimate the company has spent approximately C$1.65M on exploration (and C$2M in total qualifying expenditures) at Nutmeg since entering into the agreement.

The company has also been active on other fronts as it published an updated technical report on Limousine Butte, the Nevada gold oxide project, while it has been active on the corporate front by vending the Ptarmigan silver project into a newly created subsidiary company where Eagle Plains Resources (EPL.V) contributed other projects located in British Columbia.

While the Ptarmigan deal is very interesting as it frees up human resources and capital on the NevGold level, we will focus on the Nutmeg Mountain project in this update. We will circle back to the BC subsidiary and the Ptarmigan asset later on, when the news flow will start there.

A closer look at the updated resource

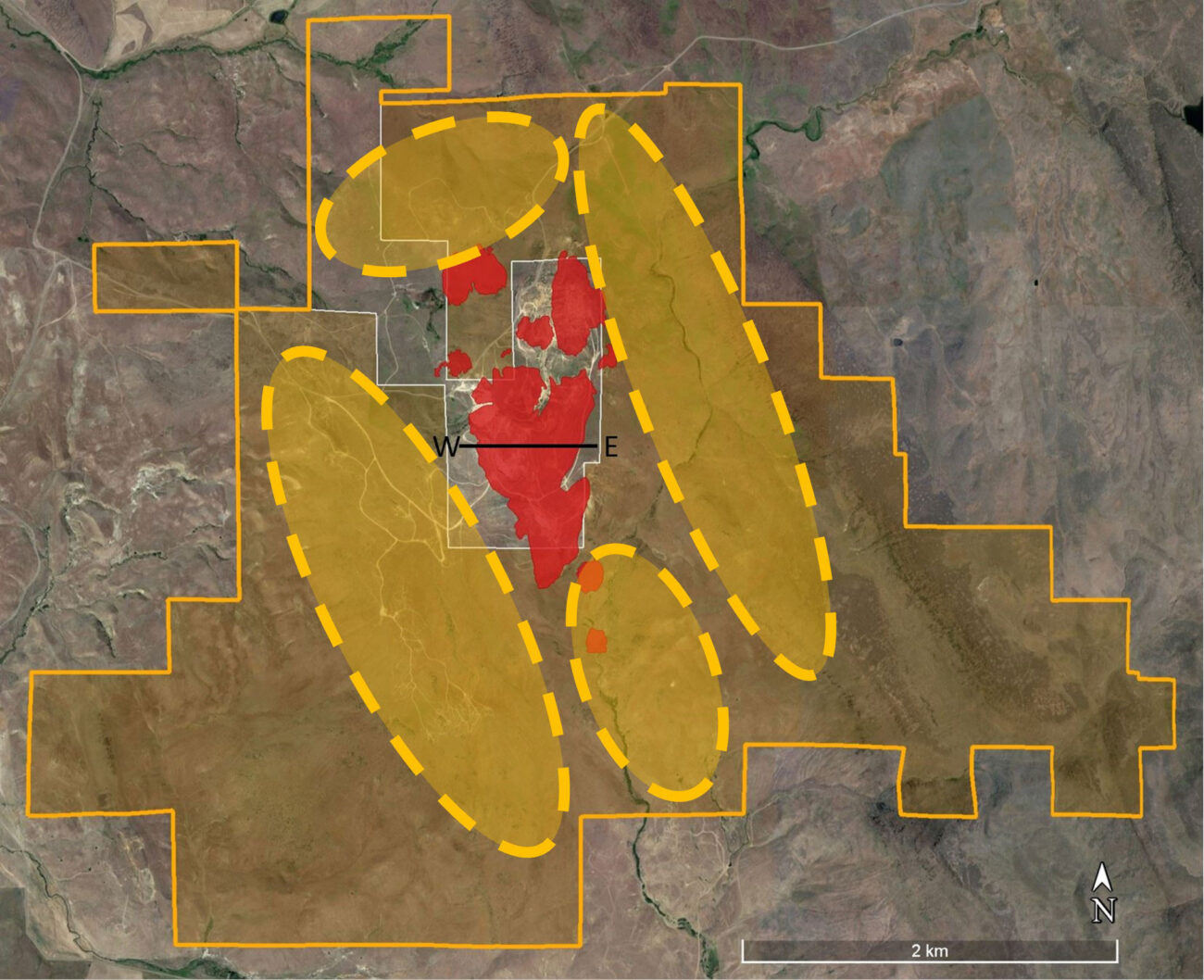

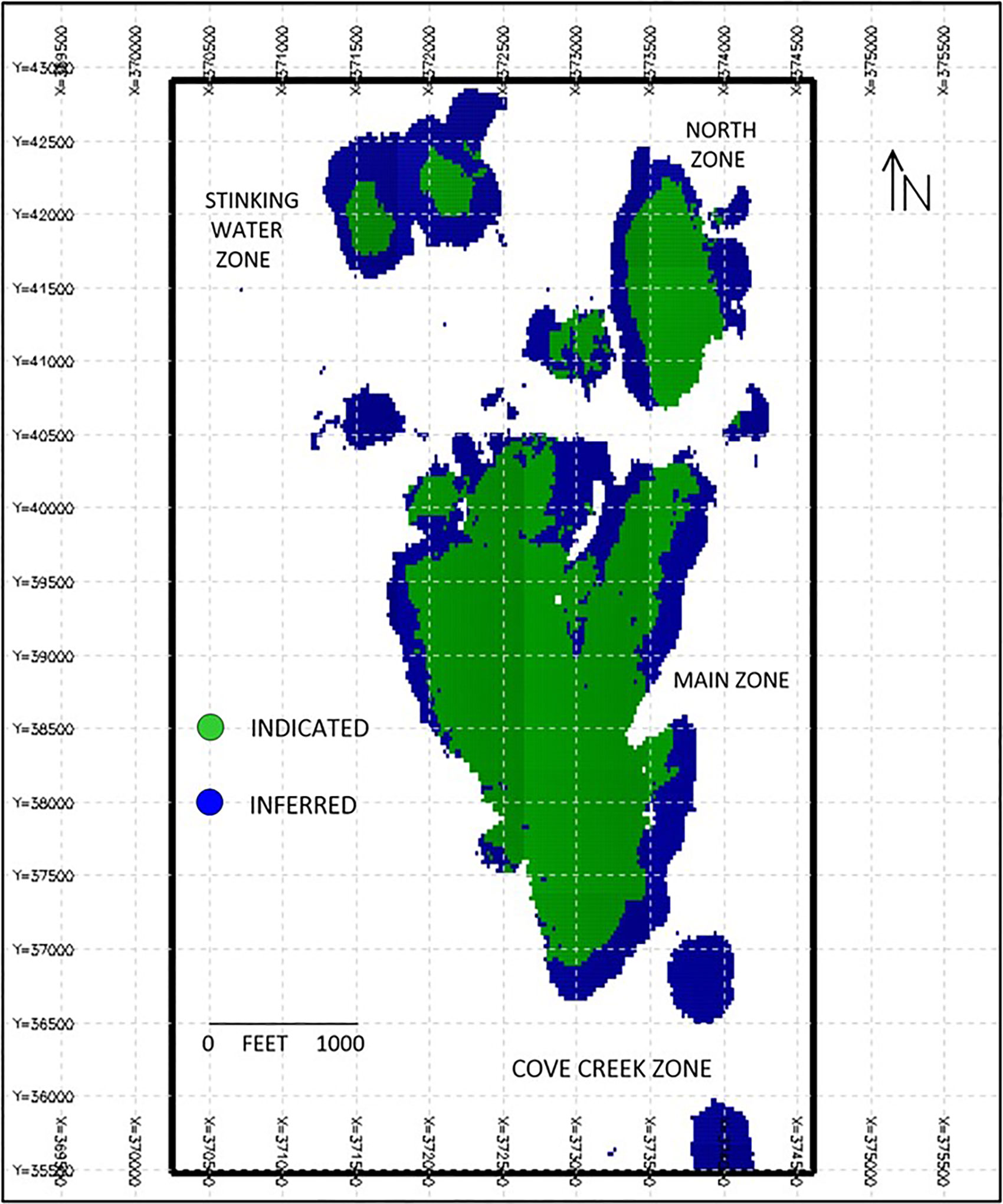

There’s no real need for a lengthy introduction to the Nutmeg Mountain property. We were initially not convinced acquiring an oxide gold project in Idaho was the best move forward for the company but over the past 15 months, NevGold has rapidly advanced Nutmeg while confirming its initial investment thesis. This has culminated in an initial resource estimateproviding a more up-to-date status of the project. The updated resource includes the assay results from just over 71,600 meters of drilling in 939 holes, of which only five holes were drilled by NevGold.

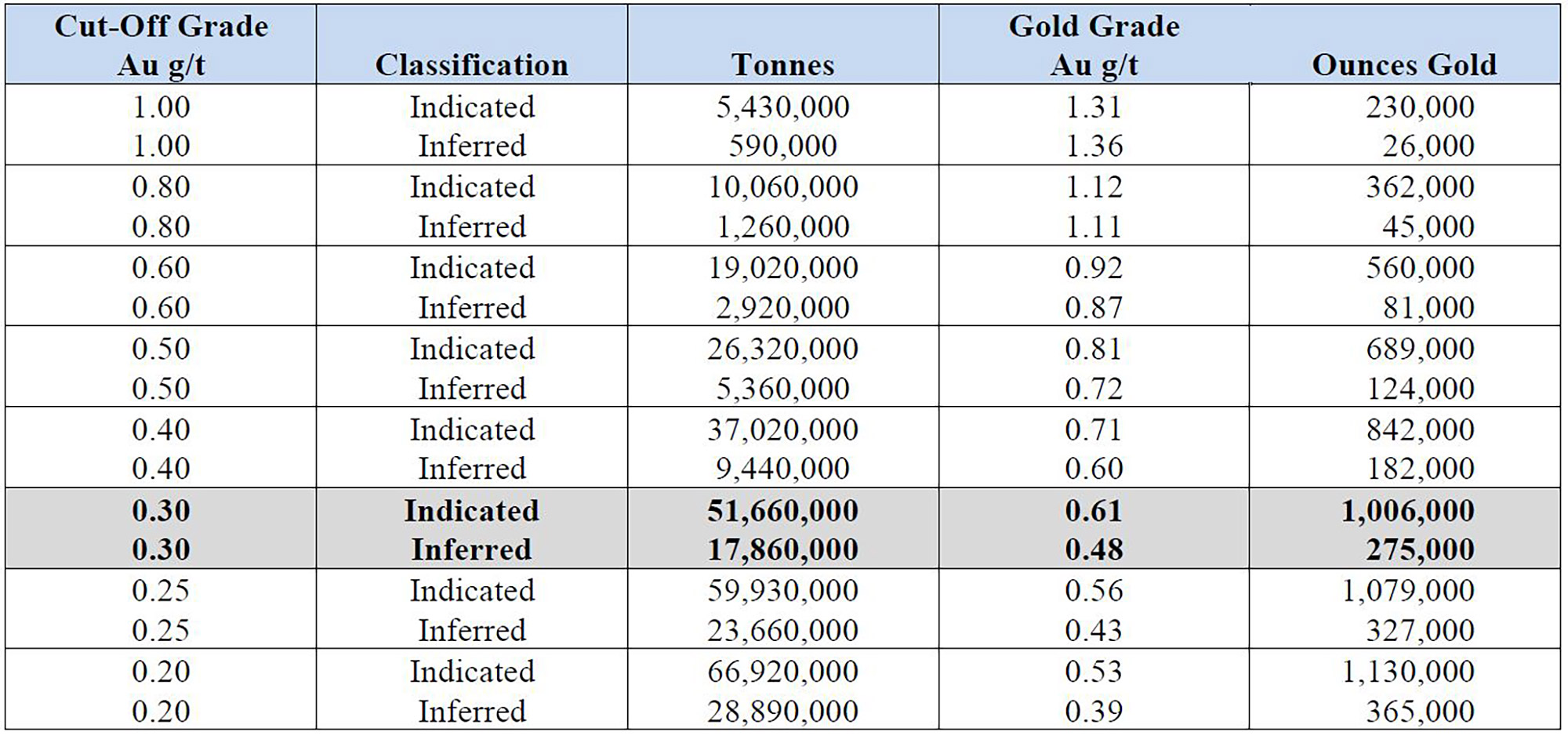

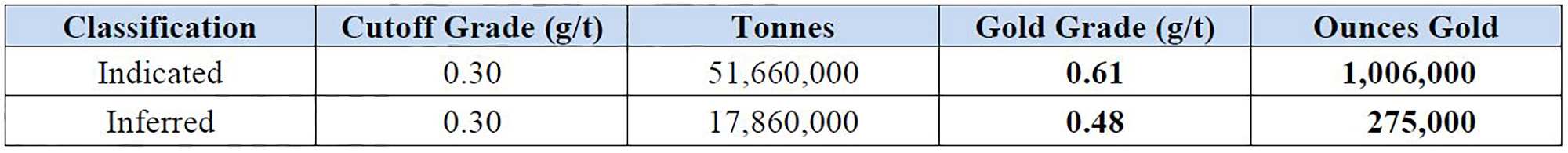

The updated resource now contains 1 million ounces in the indicated resource category where a total of 51.7 million tonnes has been outlined with an average grade of 0.61 g/t gold. An additional 17.9 million tonnes are part of the inferred resource category and applying the same cutoff grade of 0.30 g/t results in a total gold content of 275,000 ounces at an average grade of 0.48 g/t gold.

While this does sound like a low-grade project, the updated technical report confirms the oxide-hosted deposit should be amenable for heap leach processing. Considering the cutoff grade of the mineralization is 0.30 g/t gold and considering further south in Nevada, there are heap leach operations that are economic at an average grade of less than 0.30 g/t gold, we feel the title of NevGold’s announcement calling Nutmeg a ‘high-grade’ resource is not an exaggeration.

The sensitivity analysis included in the resource update also shows that no matter what direction you take the cutoff grade, there still is a robust mineralized body.

If you would apply a higher cutoff grade, the resource is still pretty robust. Applying a 0.50 g/t cutoff grade would result in 689,000 ounces of gold in the indicated resource category and 124,000 ounces of gold in the inferred category with an average grade of 0.81 g/t and 0.72 g/t respectively.

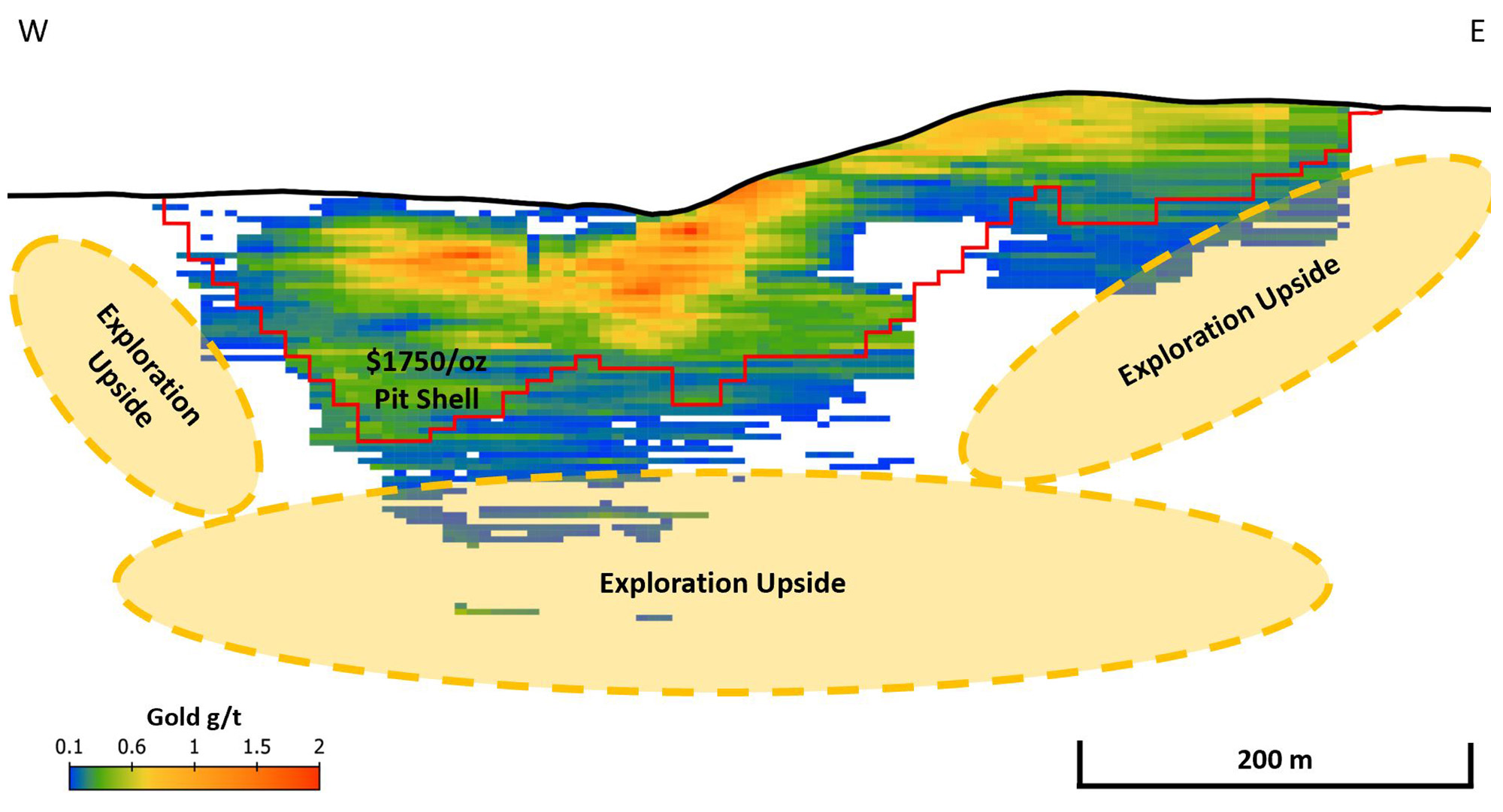

Interestingly, the parameters used for the open pit are somewhat optimistic for the mining cost (US$2/t which is lower than in the Revival Gold PEA but higher than in the Integra Resources pre-feasibility study) but then rather pessimistic for the processing cost (estimated at US$8/t). The former does not matter very much. And it looks like the strip ratio will be low: the company is guiding for ‘less than 1:1’ but our interpretation of the cross section below indicates it could be even lower than that as the gold-bearing mineralization comes close to surface. Of course, our opinion does not really matter, so let’s just use a strip ratio of 1:1 which is even more conservative than the company’s own estimate.

This means that even if the mining cost would be US$2.50 per tonne, the strip ratio is sufficiently low that this would not be a prohibiting factor: the US$0.50/t cost increase would result in a total increase of just US$1/t.

Meanwhile, the processing cost of US$8/t appears to be quite conservative. Not just compared to heap leach assets in Nevada (understandably, the operating costs will be higher in Idaho than in Nevada) but also compared to the economic studies of other companies working on heap leach gold assets in Idaho. Integra Resources (ITR.V, ITRG) has a pre-feasibility study with a processing cost of US$3.80/t while Revival Gold (RVG.V) used a processing cost of US$6.18/t in their economic study.

The resource calculation is based on a recovery rate of 80% for the rock but more metallurgical test work needs to be done to figure out the recovery rate on a more detailed basis. Additional metallurgical test work is included in the activities to further optimize the project that is recommended by the authors of the technical report (see later).

The earn-in terms for Nutmeg

And just a quick recap of the earn-in structure. As the project needed a lot more work to be done, NevGold was able to acquire it on the cheap. It initially issued 4.44 million shares as consideration for the option. This represents a pro forma value of C$3M using a share price of C$0.675 at the time of the acquisition and vendor GoldMining is also participated in a private placement at that price investing an additional C$1M in cash with a firm commitment to be the lead order of a subsequent financing.

As per the terms of the agreement, NevGold issued 3.66 million shares to GoldMining in January to settle the C$1.5M cash or stock payment while the second semi-annual payment in July was settled by the issuance of 4.1 million shares. This means the sole remaining payment will be C$3M payable in January in cash or stock at the discretion of Nevgold.

The company was also required to spend C$2.25M on exploration by the end of this year, and C$2.0M in total project expenditures has been met so far, of which C$1.65M was spent purely on exploration.

There are some additional cash or stock payments upon reaching certain milestones (C$0.5M for the completion of a PEA, C$2.5M upon the completion of a pre-feasibility study and C$4.5M upon the completion of a Feasibility Study on the project) but those milestone payments are not part of the requirements to earn full ownership of Nutmeg. The 100% ownership will be achieved upon making the final January payment.

As NevGold is required to complete the exploration expenditures of C$2.25M by the end of this year, it appears to be quite clear the company will be the sole owner of the project in January 2024 when it makes the final C$3M payment (in cash or shares).

Conclusion

The authors’ recommendations of the technical report on Nutmeg Mountain are very clear. It is recommended to kick off a Phase 1 and Phase 2 exploration program with the latter consisting of 6,500 meters of Reverse Circulation drilling to target the near-surface extensions of the known mineralization defined in the 2020 historical resource calculation and potentially chase the feeder structures and high-grade veins at depth. For now, we are solely focusing on the oxide-hosted gold and the potential heap leach scenario to determine the economic viability of the project, but as disclosed in the technical report, the potential for higher grade structures at depth is realistic.

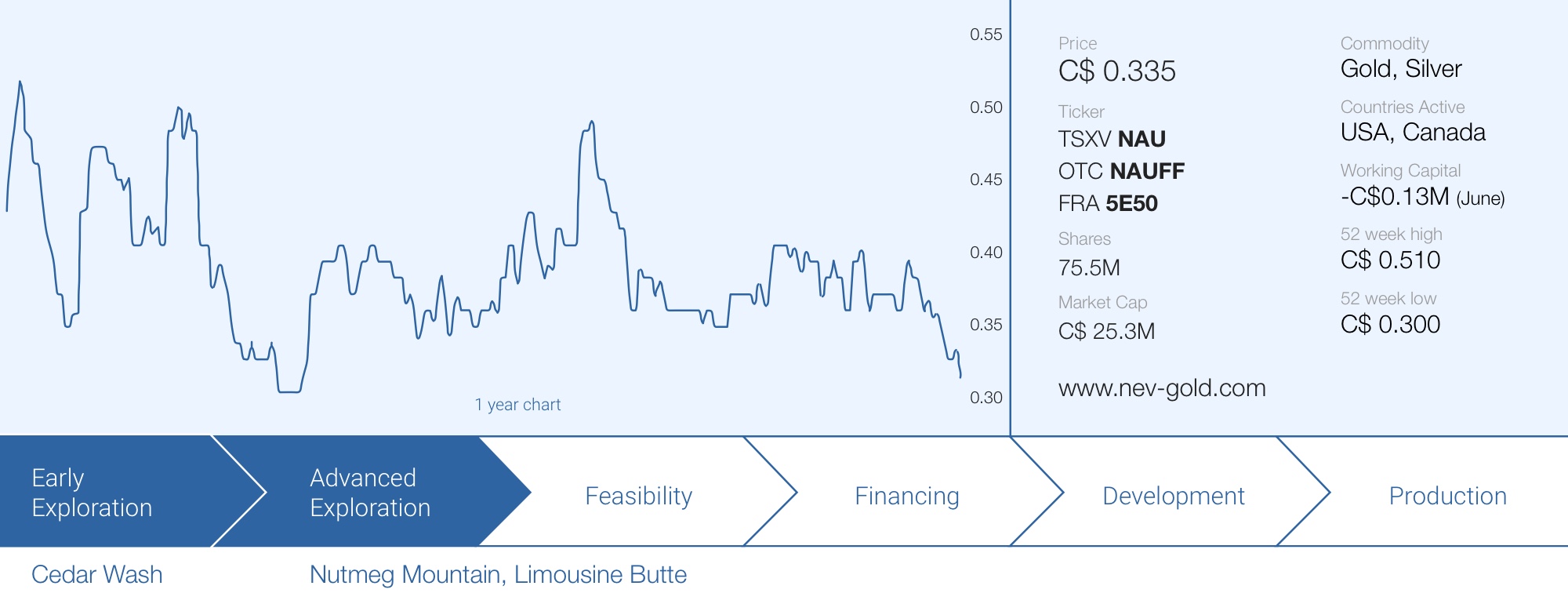

As the stock is currently trading at C$0.335 for a market capitalization of C$25.3M, it looks like NevGold is trading based on the valuation of just one of its projects. While we focused on Nutmeg Mountain in this report as that project seems to have overtaken Limousine Butte in the pecking order, let’s not forget the Limousine Butte gold project definitely still has its merits. But as cash still is tough to get by for non-revenue exploration stage companies, it is perfectly understandable to see NevGold is prioritizing the exploration plans where it expects to get the biggest bang for its buck.

Disclosure: The author has a long position in NevGold. NevGold is a sponsor of the website. Please read our disclaimer.