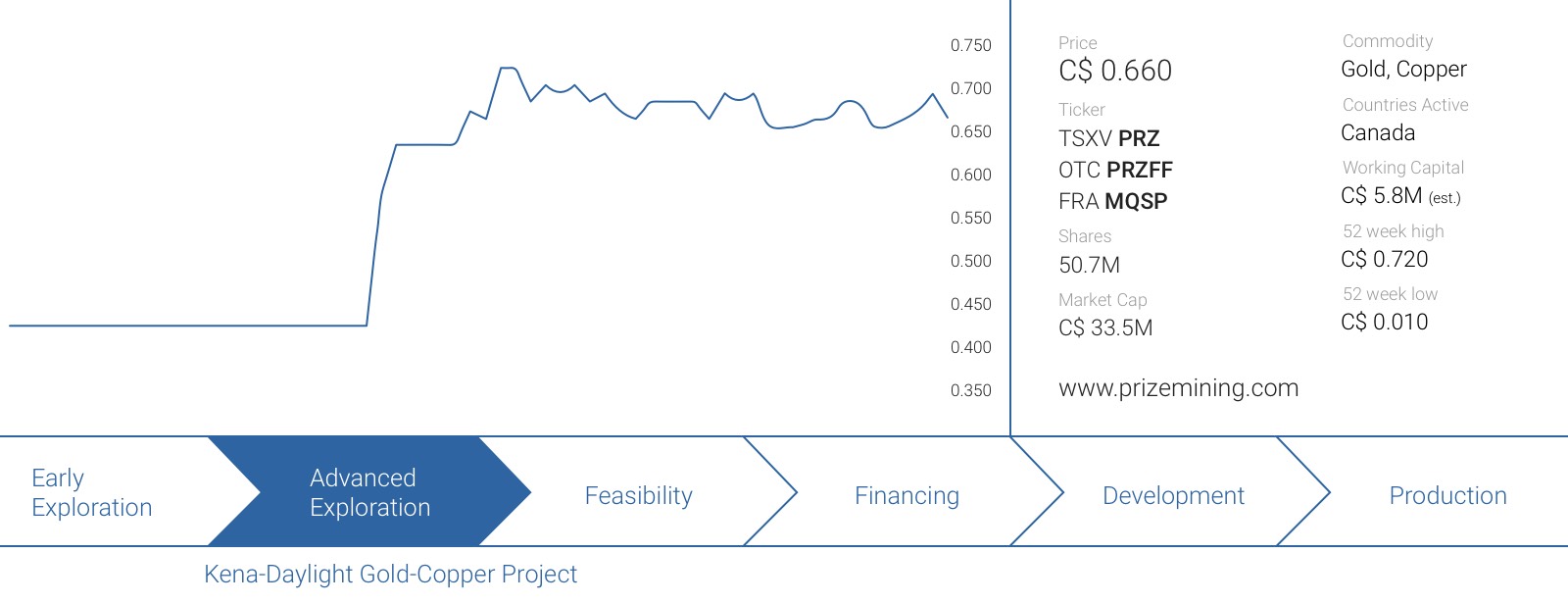

Prize Mining (PRZ.V) is the newest company trying to define a multi-million ounce gold deposit in British Columbia. Whilst the company is getting ready for a summer exploration and drill program, Prize has now announced it secured an option to acquire 100% of the adjoining Toughnut property which contains 3.5 kilometers of strike length of the Silver King shear zone.

Previous operators have identified high-grade gold and silver mineralization at two different showings and we have very little doubt Prize will follow up on this in an upcoming summer exploration program.

A brief recap of the Kena-Daylight property

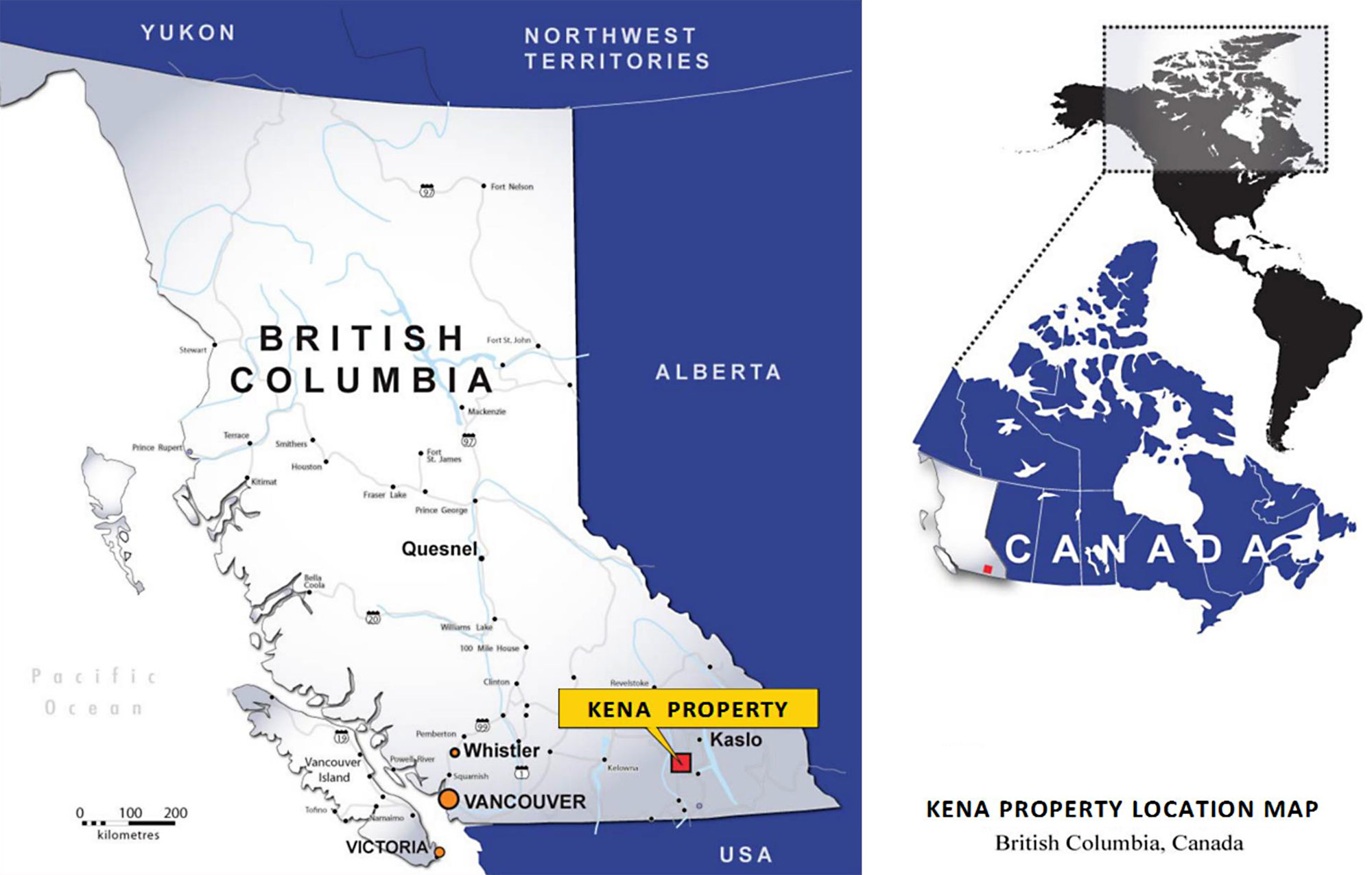

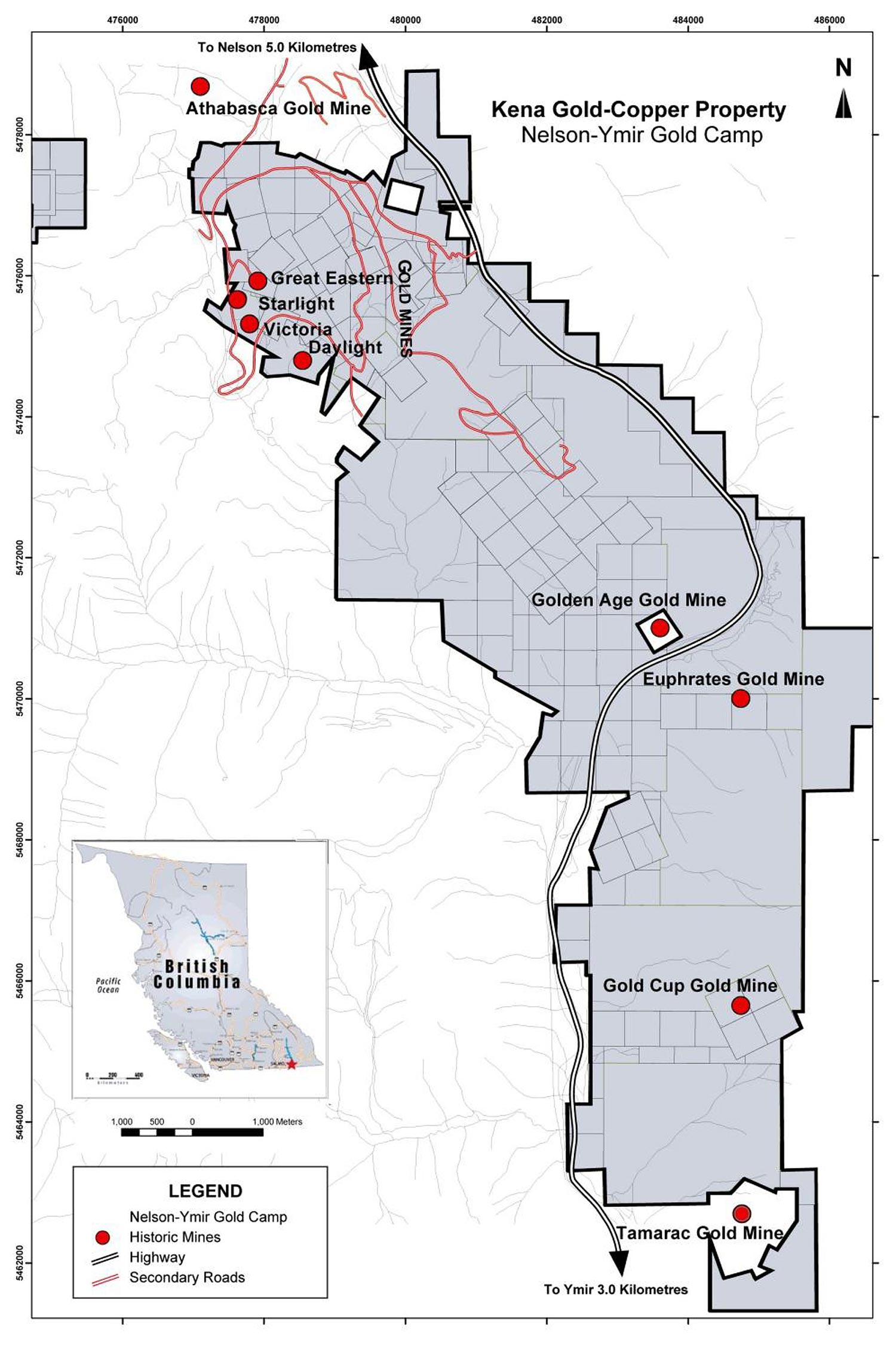

Earlier this year, Prize Mining acquired the Kena Daylight project which consists of 8,000 hectares in British Columbia’s Nelson region. When we met CEO Feisal Somji in Toronto earlier this year, we were impressed with the existing infrastructure at and around the project site.

As you can see on the previous image, the Kena claims are located just a few kilometers (seven, to be exact) South from Nelson along Highway 6 before turning onto forest service roads to get to the property and the past-producing mines on the property.

Not only does Nelson have 10,000 inhabitants (providing an easily accessible labor pool), there are several additional advantages, such as having a power line which is running along Highway 6, and the proximity of the Trail smelter, owned and operated by Teck Resources (TECK.B.TO, TECK), less than an hour away.

Whilst the smelter itself is focusing on lead and zinc concentrate (and thus not important for Prize’s plans), it’s important to note Teck has a majority stake in the Waneta dam (which is currently being sold to Fortis), which provides low-cost electrical power. The dam is producing more energy than Teck needs, so the excess power is put on the power grid, and this could be an important advantage for Prize if/when it develops a mine plan in the future.

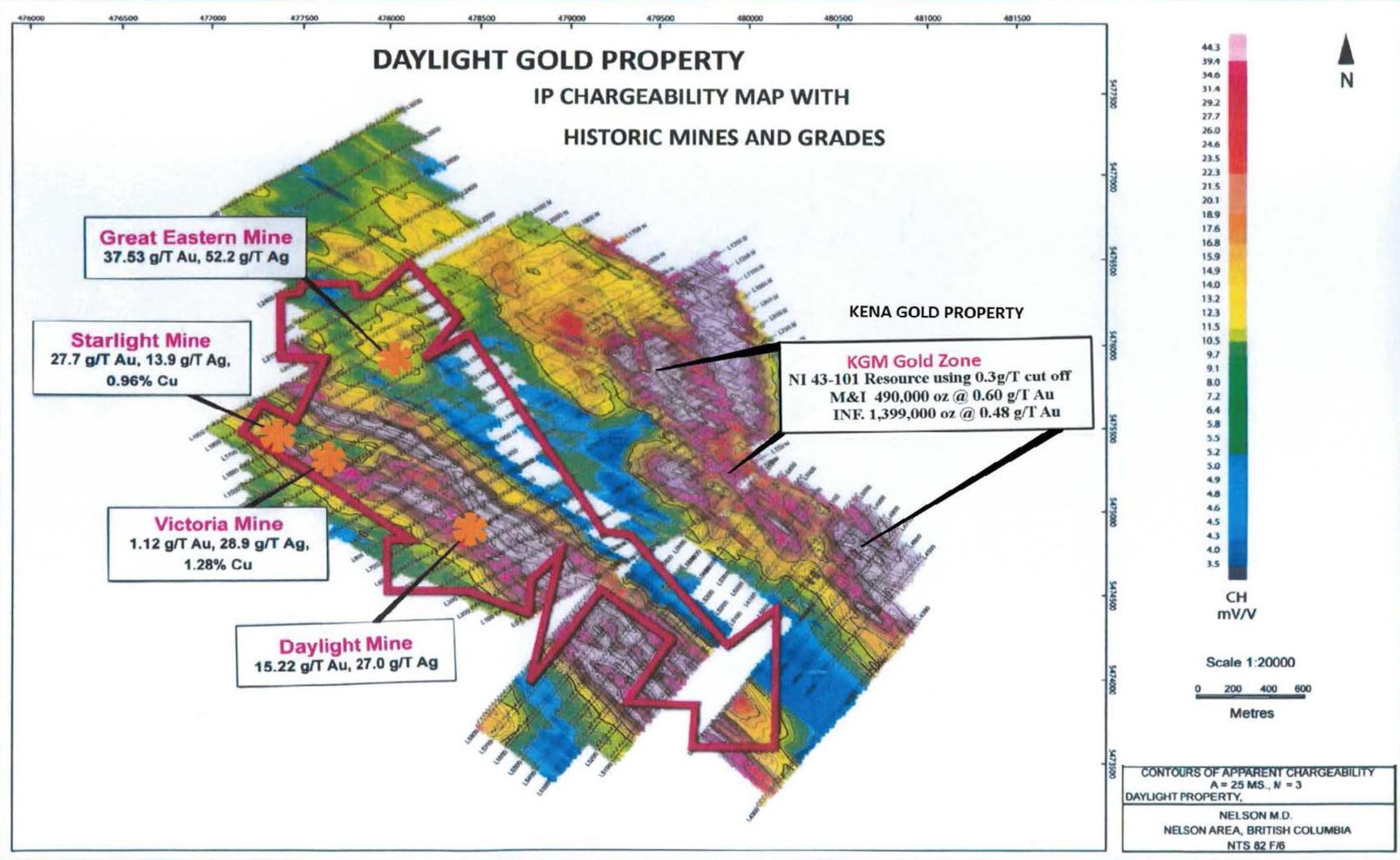

But let’s get back to the merits of the property itself. The Kena Daylight property currently hosts a resource estimate containing 1.8 million ounces of gold at an average grade of just over 0.5 g/t which is a great starting point. It will indeed be very difficult, if not impossible, to bring a low-grade deposit into production, but there’s plenty of potential to increase the average grade. First of all, the previous owners and explorers only completed a ‘first pass’ drill program, with Sultan Minerals completing 30,000 meters of drilling. A nice effort, but this doesn’t really mean much, as none of the high-grade past producing zones were thoroughly drilled.

The available historical records indicate the Starlight, Daylight and Great Eastern mines were mining ore with an average grade of 0.85-1.2 ounces of gold per tonne of rock. Granted, the production volumes from these zones were very low, but the gold grades were/are excellent and Prize Mining will very likely follow up on this.

As a reminder: to earn an initial 80% stake in the Kena property, Prize Mining will have to pay an additional C$750,000 in cash to Apex Resources in the next 2.5 years, whilst an additional 1.125 million shares will have to be issued in the same time frame (September 2020).

Prize is also required to spend a minimum amount on exploration on the property on an annual basis. For the first year, the company will have to spend C$100,000 on exploration (we think Prize has to incur the total C$100,000 as it looks like 1994854 didn’t spend any cash on exploration). In the second year, Prize will have to spend C$400,000, increasing to C$1M in the third year and C$1.5M in the fourth year of the option agreement.

If Prize meets all these requirements, it will earn an initial stake of 80% in the property, which could be boosted to 100%.

In order to acquire the final 20% stake in Kena, Prize will have to make a C$2M cash payment to Apex, whilst also granting it a 1% Net Smelter Royalty. Half of this NSR can be repurchased for C$5M (which isn’t cheap but would make sense if in excess of 1 million ounces could be recovered at Kena. If that’s not the case, it would be better to not repurchase the NSR, or negotiate a lower buyback price).

Toughnut – a logical addition to the land package

Today, Prize Mining announced it has entered into an option to acquire 100% ownership of the Toughnut property. What’s really important about Toughnut is its exact location. Not only is it located contiguous to the western border of Prize’s daylight property, the 1,010 hectare land package covers 3.5 kilometers of the Silver King shear strike length, connecting Prize Mining’s Starlight-Daylight block (on the northwest side of the land package) and its Sand block.

The importance of this shear zone should not be underestimated. Toughnut contains old pits and shafts as it has been subject to small-scale production, very likely around the same time the Daylight, Starlight and Great Eastern mine were in production, and you might perhaps remember what we wrote about the Silver King shear zone in our first report:

“[…]the Silver King gold corridor might play a really important role in the potential development of Kena, as this zone hosts veins with an average grade of 5-80 g/t. Needless to say finding more high-grade zones could provide a real boost to the average grade.”

The Toughnut property contains several high-grade showings, with the Toughnut showing returning assay results of 6.6-32.8 g/t gold (with 1-5.5 ounces per tonne silver) from a small grab sample program. These were indeed very encouraging assay results, and they were followed up on in 2010 with a small drill program which intersected 2 meters of 6.9 g/t gold and 143 g/t silver, as well as 8 meters of 4.05 g/t gold.

The second showing on the Toughnut property, Gold Eagle, has also been drilled and the most noticeable intercept was a 1.5 meter interval containing approximately 90 g/t gold whilst another drill hole encountered 14.47 g/t gold over 4 meters as part of a longer interval of 24.3 meters containing 4 g/t gold. The Gold Eagle zone remains open along strike and that’s very likely where Prize Mining will focus its exploration efforts on.

The acquisition of Toughnut is an important piece of the Kena-Daylight puzzle, and the acquisition terms seem to be very favorable. Prize Mining will pay C$150,000 in cash, issue 250,000 shares and complete C$750,000 in exploration expenditures over the next five years. The cash and stock payments are low, and the C$750,000 exploration commitment is also relatively low as it’s the equivalent of just 5,000 meters of diamond drilling – a task which could easily be completed in the next five years.

Conclusion

Our main concern about Prize Mining in our first report was the average grade of the existing resource. However, as none of the previous operators have tested the higher grade zones and areas, there’s a lot of potential to increase the average grade as Prize will be the first exploration company ‘drilling for grade’.

And whilst the 1,000 hectares of the Toughnut are increasing the land position at Kena-Daylight by just over 10%, it’s the location that really matters, as Prize now controls the Silver King shear zone where it expects to find more higher-grade mineralization.

Disclosure: Prize Mining is a sponsor of this website, we have a long position. Please read the disclaimer