Reyna Silver (RSLV.V) has confirmed the company has now received the drill permits for the Guigui project in Chihuahua. The company has been trading for about half a year now, and with the drill permit now in hand, Reyna has hit the ground running and an initial 10,000-meter drill program at Guigui to drill-test the exploration theory on the asset was kicked off rightaway.

The upcoming drill program

Shortly after announcing the drill permits, Reyna Silver started its drill campaign as the company clearly wasn’t wasting any time. The current drill program will consist of 10,000 meters of drilling and Reyna Silver is earmarking C$1.8M for this drill program which will provide valuable information on the Guigui project.

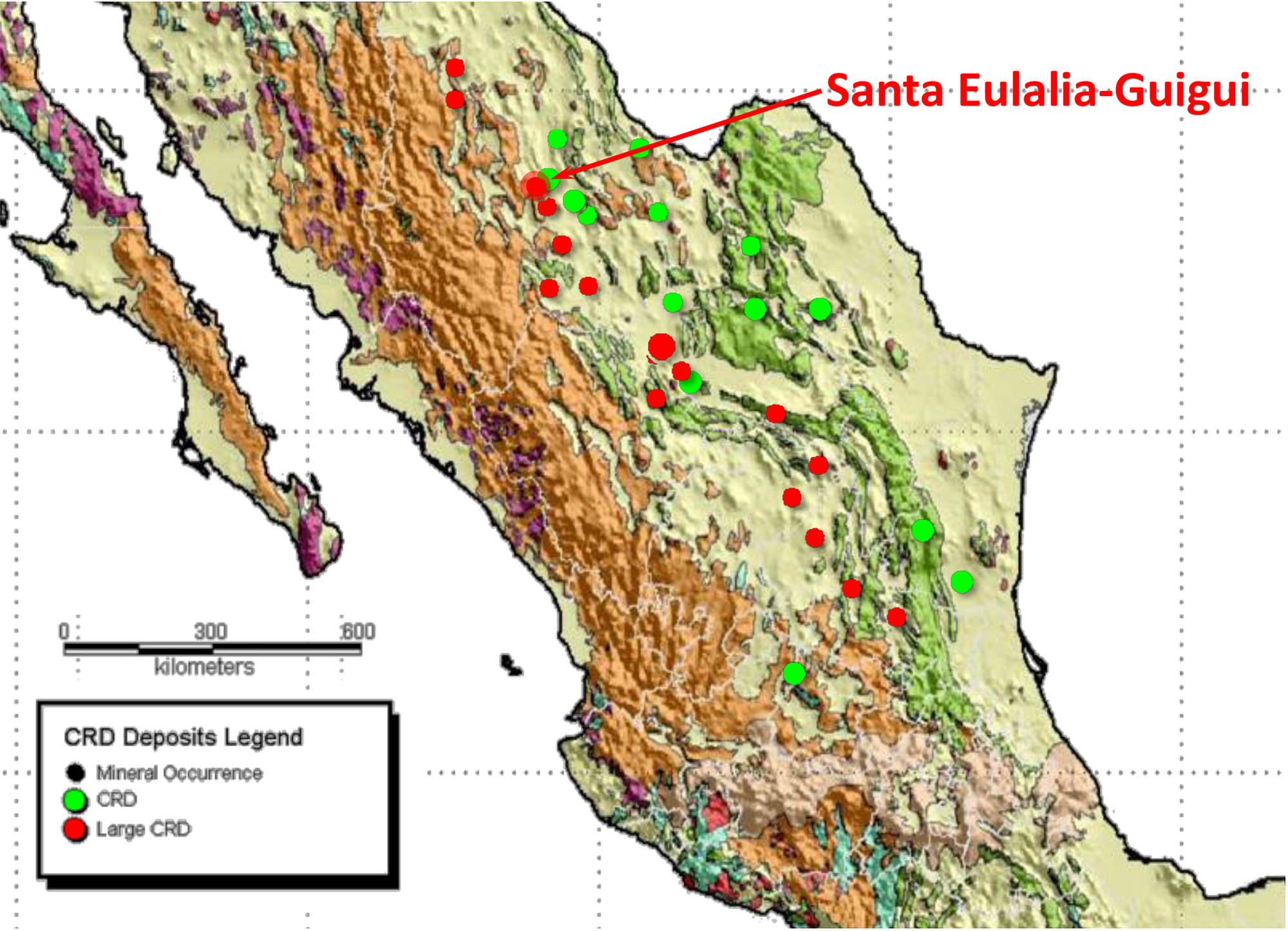

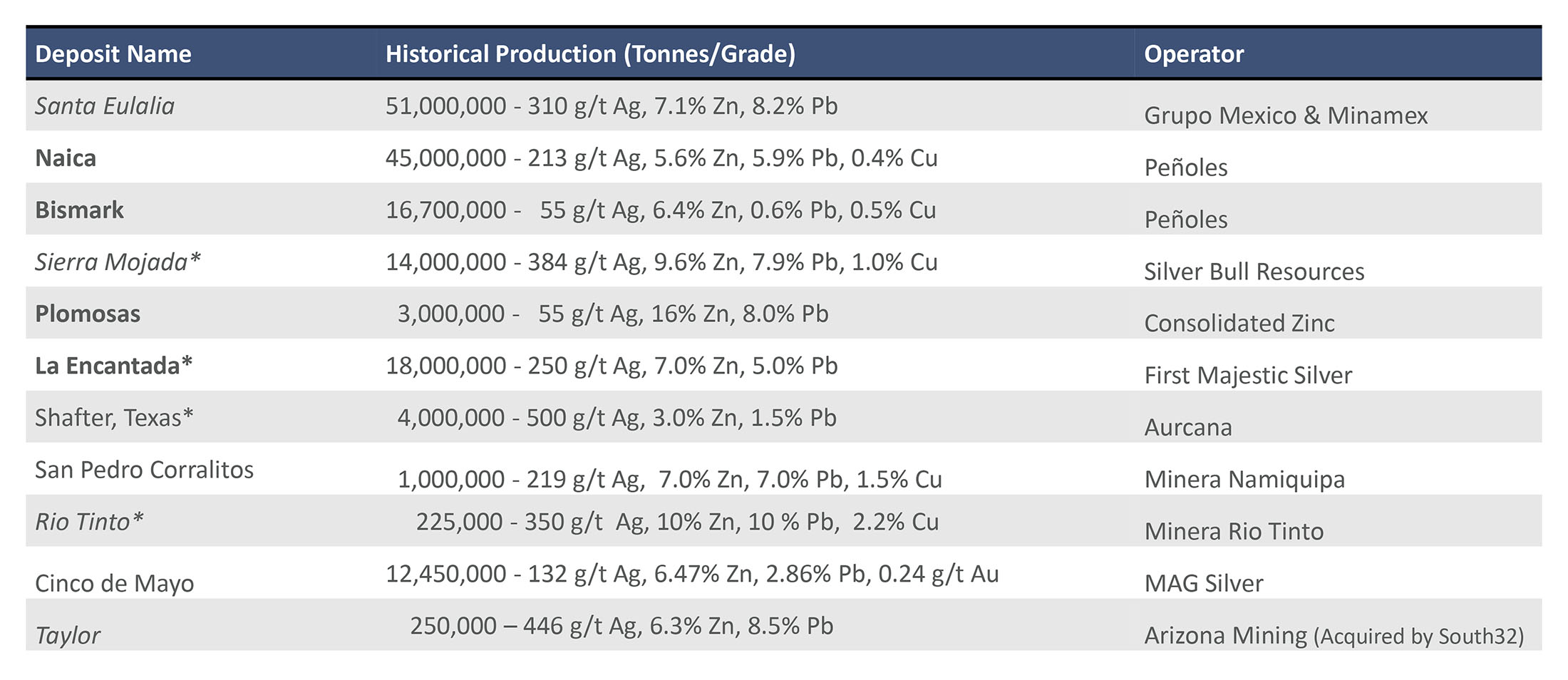

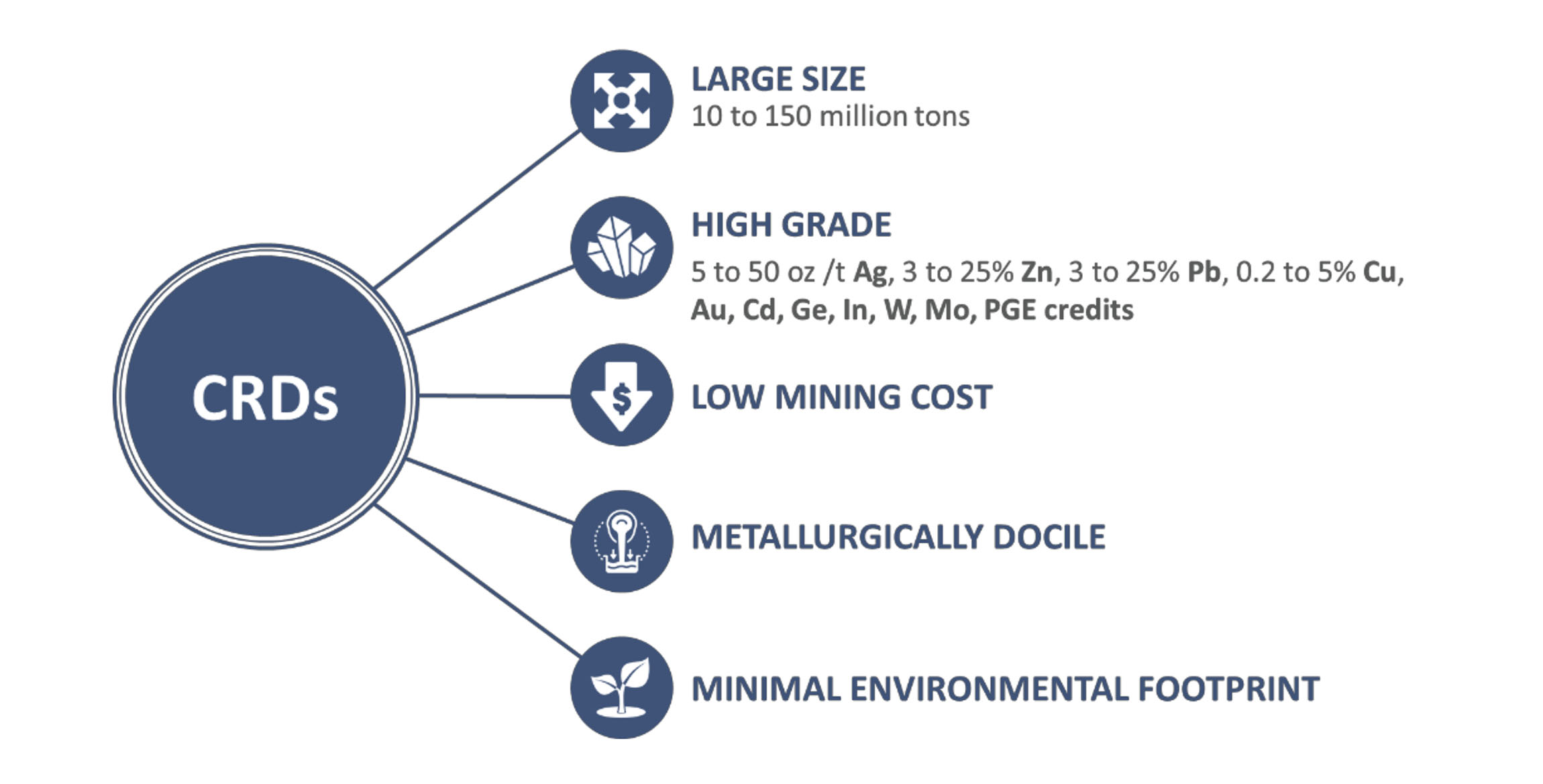

According to Peter Megaw, the Chief Technical Advisor to Reyna Silver, the initial holes will be targeting a series of geological targets and anomalies that coincide above the zone where his self-developed CRD (Carbonate Replacement Deposit) exploration model puts the hot spot of a mineralized system. The Guigui project (and by extension, the entire district) has been a very prolific producer, as shown in this overview of historical CRD deposits in the wider region (including some US based projects).

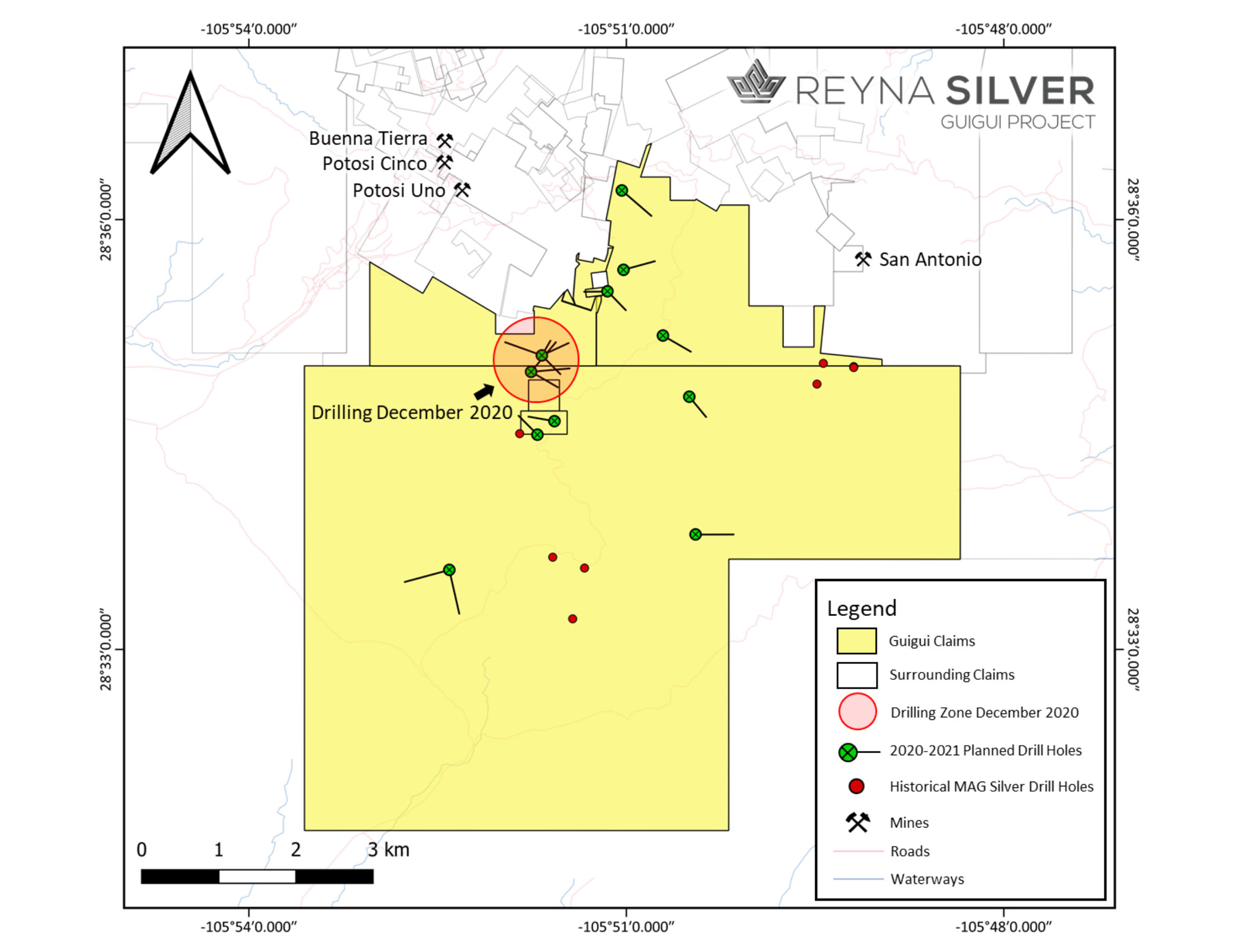

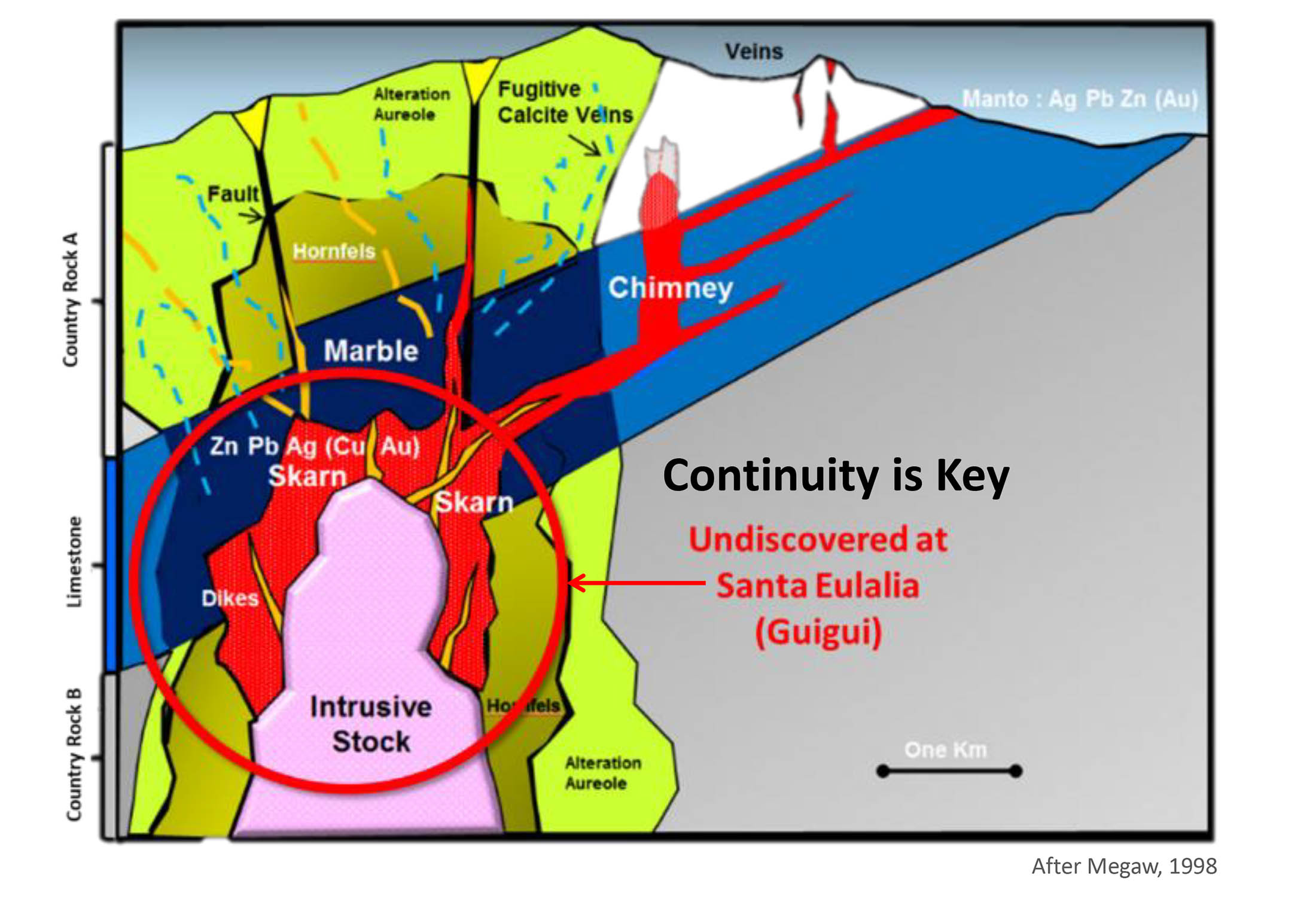

As you can see, the Santa Eulalia district had a cumulative production of 51 million tonnes of rock which resulted in the production of about 500 million ounces of silver, in excess of 6.5 billion pounds of lead and about 5 billion pounds of zinc. An extremely prolific district, but the source of this CRD system has never been found, and that’s exactly what Reyna Silver is going after. According to the image in the press release, the holes will predominantly be focusing on the northern portion of the project and considering the Chinche project will be subject to drilling right away, we understand this was a high-priority acquisition target for Reyna.

A recap of the Guigui project and why we are excited about the drill program

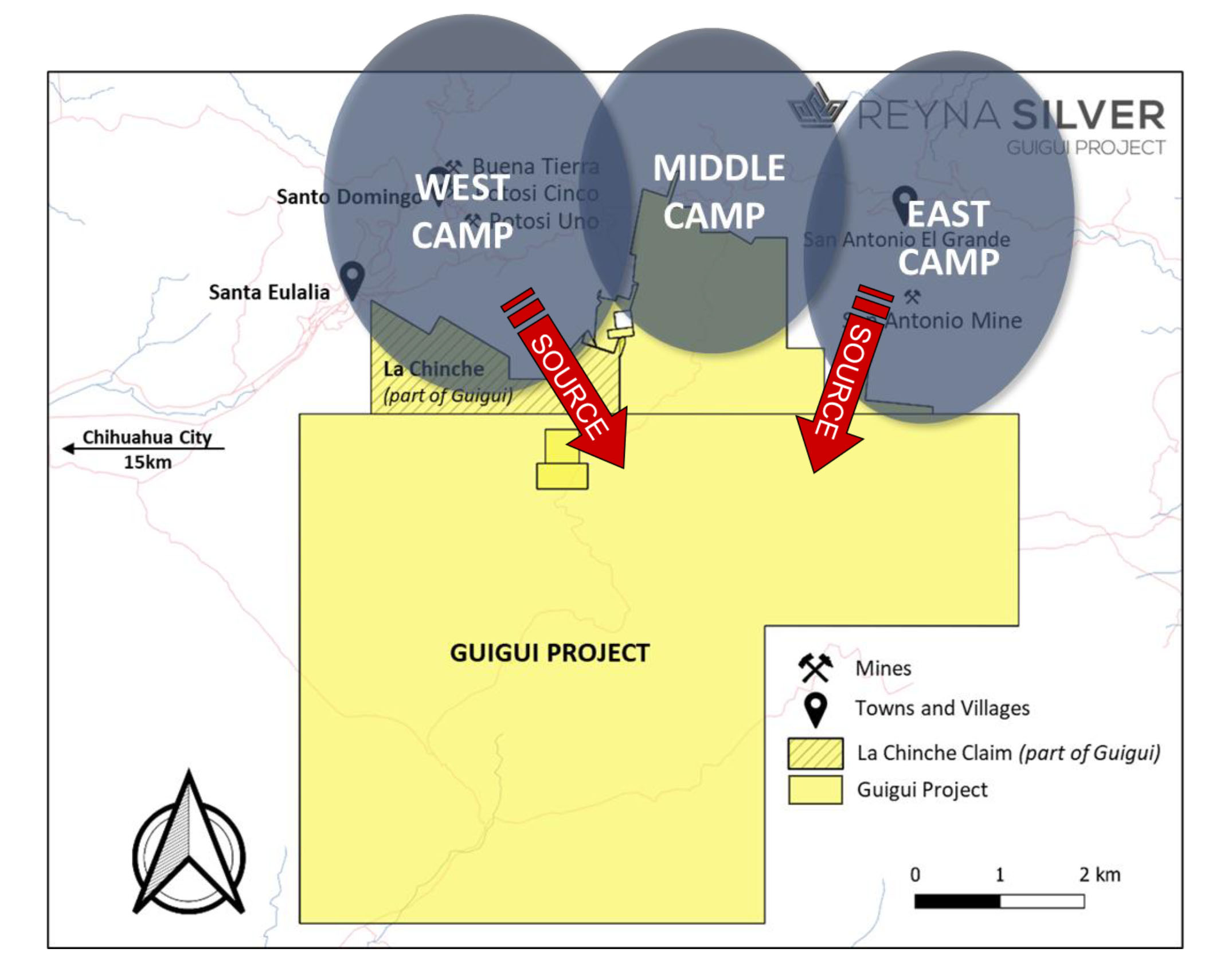

The Guigui property is Reyna Silver’s flagship project and originally consisted of just over 4,500 hectares of land (the property has since been expanded to include the La Chinche area). The location couldn’t have been more convenient: in the middle of the Santa Eulalia Mining district, the project is surrounded by known mineral occurrences and mines and having the city of Chihuahua in close proximity will keep exploration expenses down as it will be easy enough to attract local labor while the mobilization cost will remain low as well.

The location in the Santa Eulalia district is important, as this is one of the premier CRD (Carbonate Replacement Deposit) structures in the world that traditionally contain very high-grade mineralization. Peter Megaw, co-founder of MAG Silver (MAG.TO, MAG) is one of the world’s most renowned specialists on these types of deposits and Reyna Silver will be happy to rely on his technical expertise further down the road as Megaw accepted a position as Chief Technical Advisor at Reyna, determined to put his mark on this district.

The first occurrences of mineralization in the region were confirmed in the first few years of the 1900s and the area, including zones on the Guigui licenses, have been subject to limited exploration to test some theses. However, this is the first time a company will apply a dedicated exploration approach as Reyna has signed an agreement to acquire 100% of the Guigui project.

So why is Reyna (and by extension, MAG Silver as it still owns a 19.9% stake in Reyna) so interested in Guigui? After all, the district has seen 51 million tonnes being pulled out of the ground for close to half a billion ounces of silver, wouldn’t the hills be mined out by now?

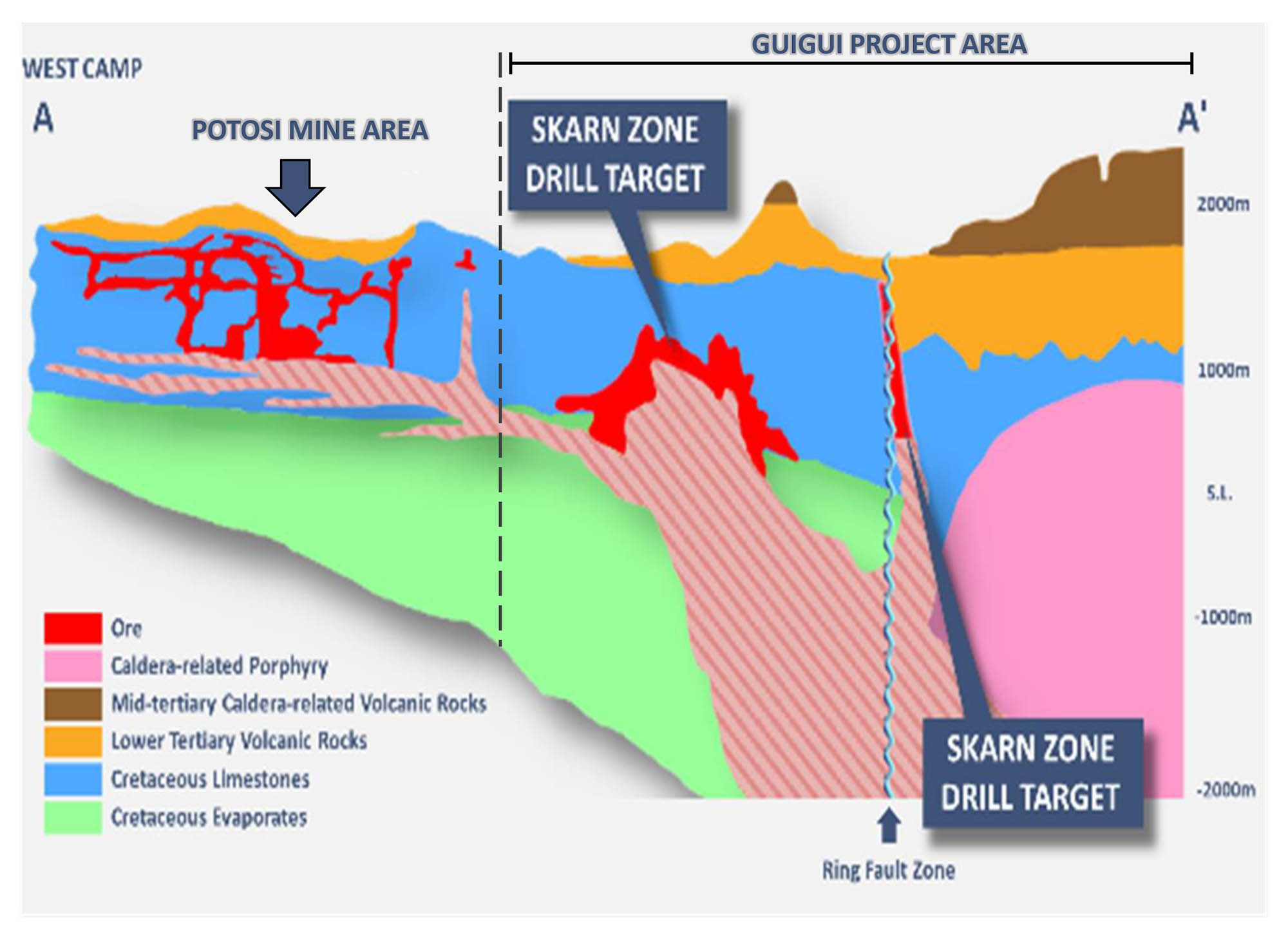

No. As you can see in one of the previous images, the source of the hydrothermal system that mineralized the areas that have been mined now remains undiscovered and it is Reyna’s belief the source of this system may actually be hiding underneath the Guigui land package. And that’s not just Reyna’s interpretation of the system, Megaw has been studying these CRD systems for the better part of the last half-century and all data appears to be pointing to the Guigui area as host of the source.

The prolific areas for historical production were the West Cap, Middle Camp and East Camp zones, and according to the geological interpretation of Megaw & team, the logical location of the source would be on the Guigui land package.

And Reyna isn’t just going on a wild goose chase. The project has been subject to a few drill programs and MAG Silver encountered the typical silver-lead-zinc mineralization on the northern edge of the license boundaries. These intervals were quite narrow but did encounter the right grades, so if anything, it does improve the odds of finding the source. The historical drill holes also helped to narrow down the specific areas that need to be drill-tested.

As Reyna will zoom in on the northern portion of the license, it also entered into an agreement to acquire the La Chinche project directly bordering the Guigui license to cover even more bases.

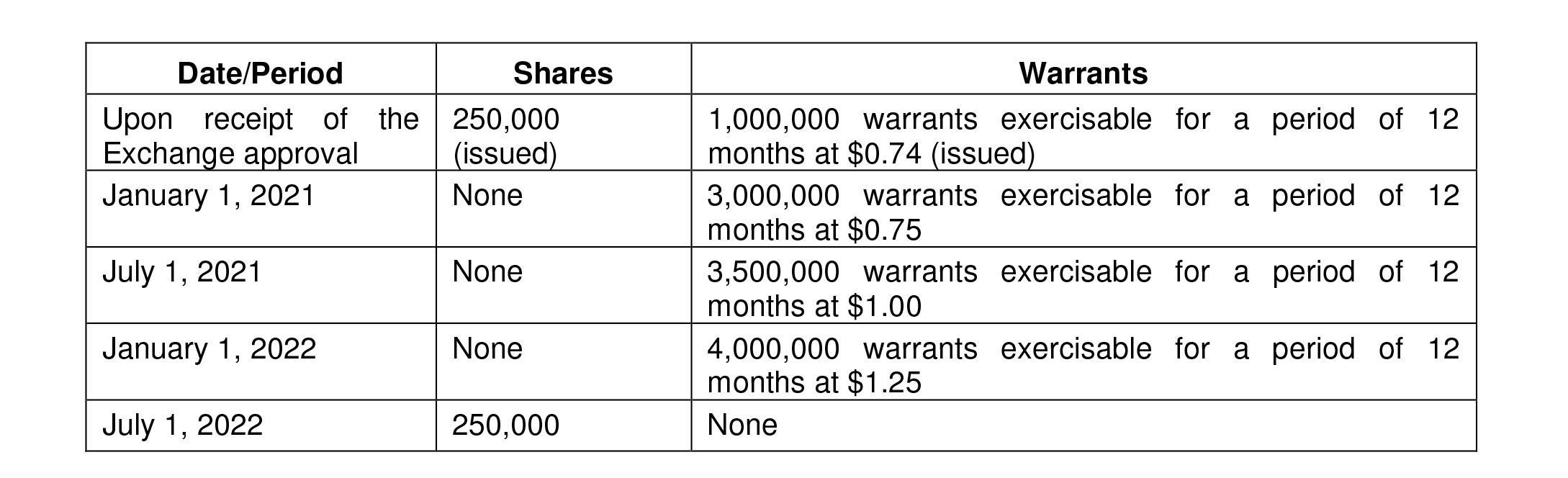

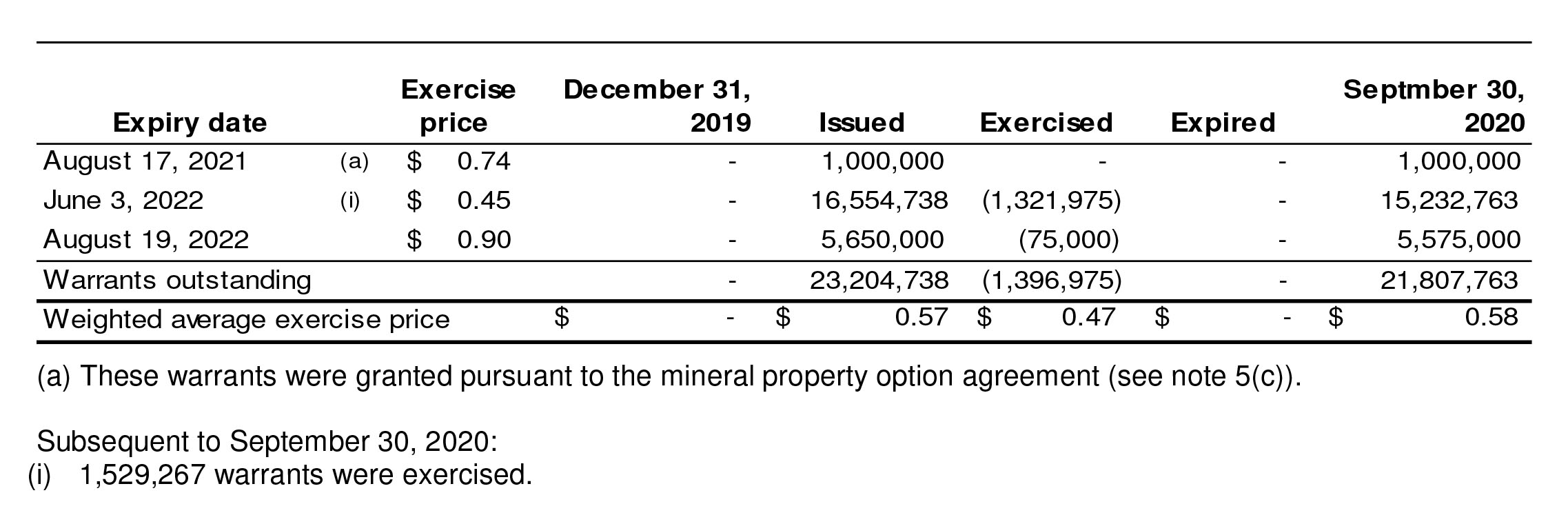

La Chinche is being purchased from two separate groups. Reyna has committed to making a combination of cash and warrant payments as well as making certain exploration commitments. Reyna will have to make a US$42,000 cash payment, issue 500,000 shares and 11.5 million warrants which will have to be issued every six months at exercise prices of C$0.74 (1M warrants), C$0.75 (3M warrants), C$1.00 (3.5M warrants) and 4M warrants at C$1.25.

This actually is a brilliant structure; it limits the cash outflow upfront and technically the vendors of the property will be making cash payments to Reyna Silver if the company is successful. All four warrant tranches would be in the money (assuming the share price remains above C$1.25 during the next two years) and if all warrants would be exercised, Reyna Silver will receive approximately C$11.5M from the vendors, which will actually make their money on share price appreciation rather than being paid upfront. Simple, but efficient!

Reyna Silver still has plenty of cash

Although the silver hype (when every company saw its share price appreciate just because it had the word ‘silver’ in its company name) appears to be over and gold is once again the precious metal most investors are focusing on, the silver price remains strong. At the current price of almost $25/oz, the silver price is trading about 50% higher than the $15-17 range it had been trading in before.

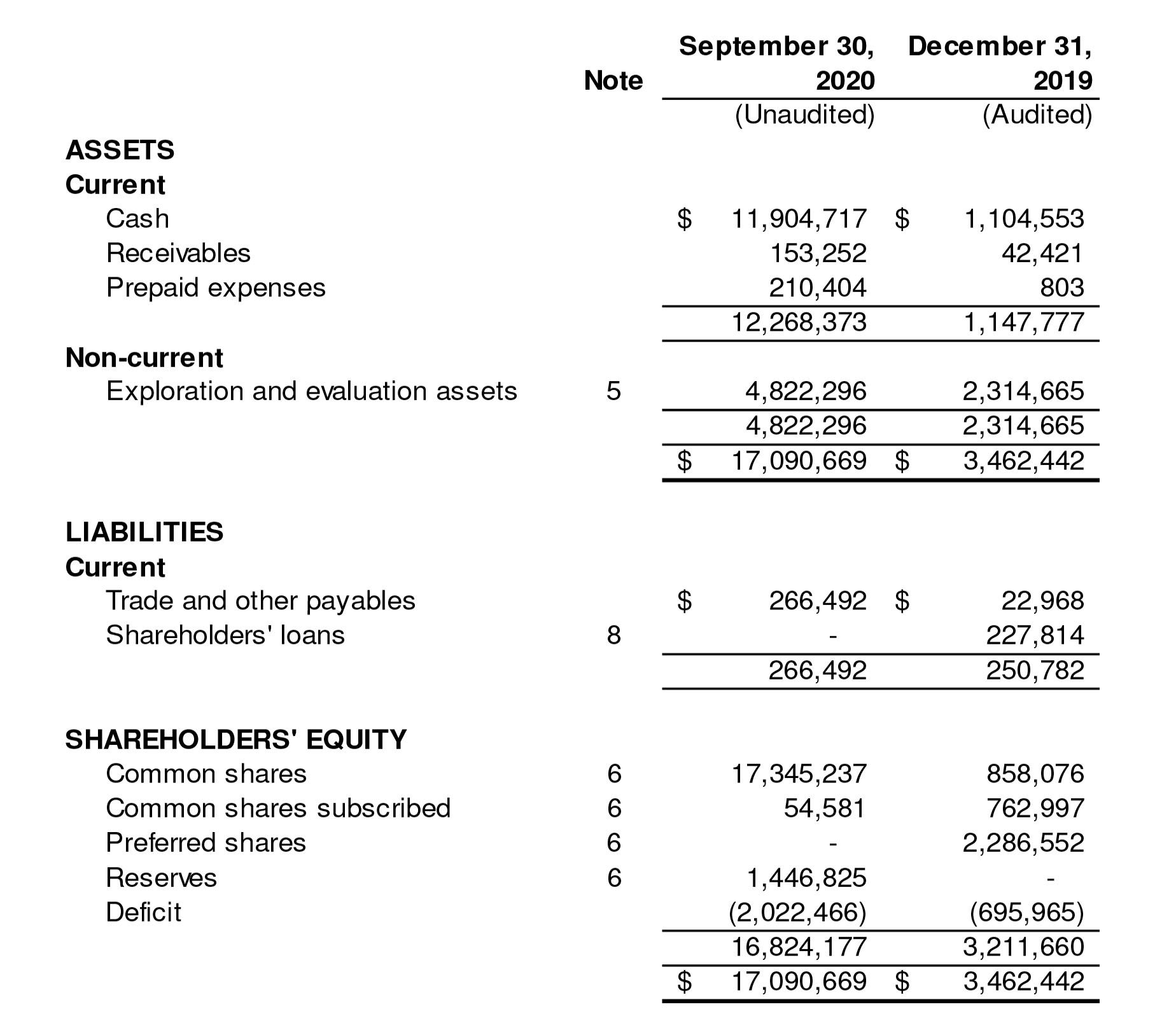

At the end of September, Reyna Silver had a positive working capital position of around C$10M, including C$11.9M in cash. And that obviously is a very comfortable position to be in.

And considering all of the warrants are currently in the money, we can reasonably expect Reyna Silver to continue to see a cash inflow as investors start exercising warrants. As of the end of September, Reyna had 15.2 million warrants at C$0.45 left as 1.32 million of those were already exercised), and subsequent to the end of September, an additional 1.53 million warrants were exercised, according to the financial statements. This means that since the end of September, Reyna Silver has received at least an additional C$700,000 (and likely even more) from warrant exercises, which keeps the treasury at a healthy level.

Considering even the C$0.90 warrants are in the money, the total cash inflow related to the warrant inflow (using 13.7M warrants at C$0.45) would be C$11.9M. This does NOT include the warrants that will be issued to the vendors of the La Chinche property. So although Reyna Silver undoubtedly easily can access the equity markets, we are expecting warrant exercises to continue to replenish the Reyna Silver bank account. There are also approximately 1.7M finders warrants outstanding which could bring in an additional C$800,000.

Conclusion

After preparing the Guigui project for drilling and consolidating additional claims bordering the existing Guigui land package, Reyna Silver is finally getting ready for the exciting stuff. A drill program has now kicked off and we hope the company is able to get a few thousand meters in before drilling will be suspended for the Christmas period. The start of the drill program in December means we will probably see the first assay results towards the end of January. Keep in mind this is just a first pass drill program and we should have realistic expectations, but the data from the 10,000 meter drill program should tell Megaw and his team a lot about what’s hiding beneath the surface.

Disclosure: The author has a long position in Reyna Silver. Reyna Silver is a sponsor of the website. Please read our disclaimer.