Riverside Resources (RRI.V) only acquired the Los Cuarentas project in September 2019 when it purchased the portfolio of Mexican assets from Millrock Resources (MRO.V). But after doing some initial groundwork, the company was in very short order able to attract one of the larger precious metals producers of the world as its joint venture partner. Hochschild Mining (HOC.L) produced almost 17 million ounces of silver and 270,000 ounces of gold in 2019 and provided an outlook to produce almost half a million gold-equivalent ounces in 2020 (before COVID-19 hit). Clearly a well-respected joint venture partner!

This is the second world-renowned company that has signed a joint venture deal with Riverside in the last couple of years, following in the footsteps of BHP last year. This success in attracting these highly credible majors appears to be validating Riverside’s long experience in and operating knowledge of Mexico’s Sonora province. Attracting Hochschild as a joint venture partner on a precious metals project also means this is the first multi-billion dollar joint venture partner Riverside has been able to attract on the precious metals front in several years.

That Riverside has been able to attract the attention and enter into these joint venture agreements with quality partners such as BHP and Hochschild means that the company is diligently following its tried and tested formula as a prospect generator. That formula calls for the use of a multitude of funding levers to help advance projects thereby precluding the need for regular financings, and the share dilution that results therefrom. As we will note in this article, these recent JV’s are in line with what Riverside has been able to accomplish in the past. The Penoles project, which was advanced in a similar diligent manner is now going to be part of a new spin-out company called Capitan Mining (which should start trading in August). And with the company’s flexibility in accepting stock as a medium of exchange in its JVs, Riverside continues to maintain a healthy financial position going forward. In this context, Riverside’s latest deal with Hochschild appears to be in line with what the company has always prided itself on – the ability to attracting funding from quality partners all while maintaining its tight share structure.

A brief recap of the Los Cuarentas project

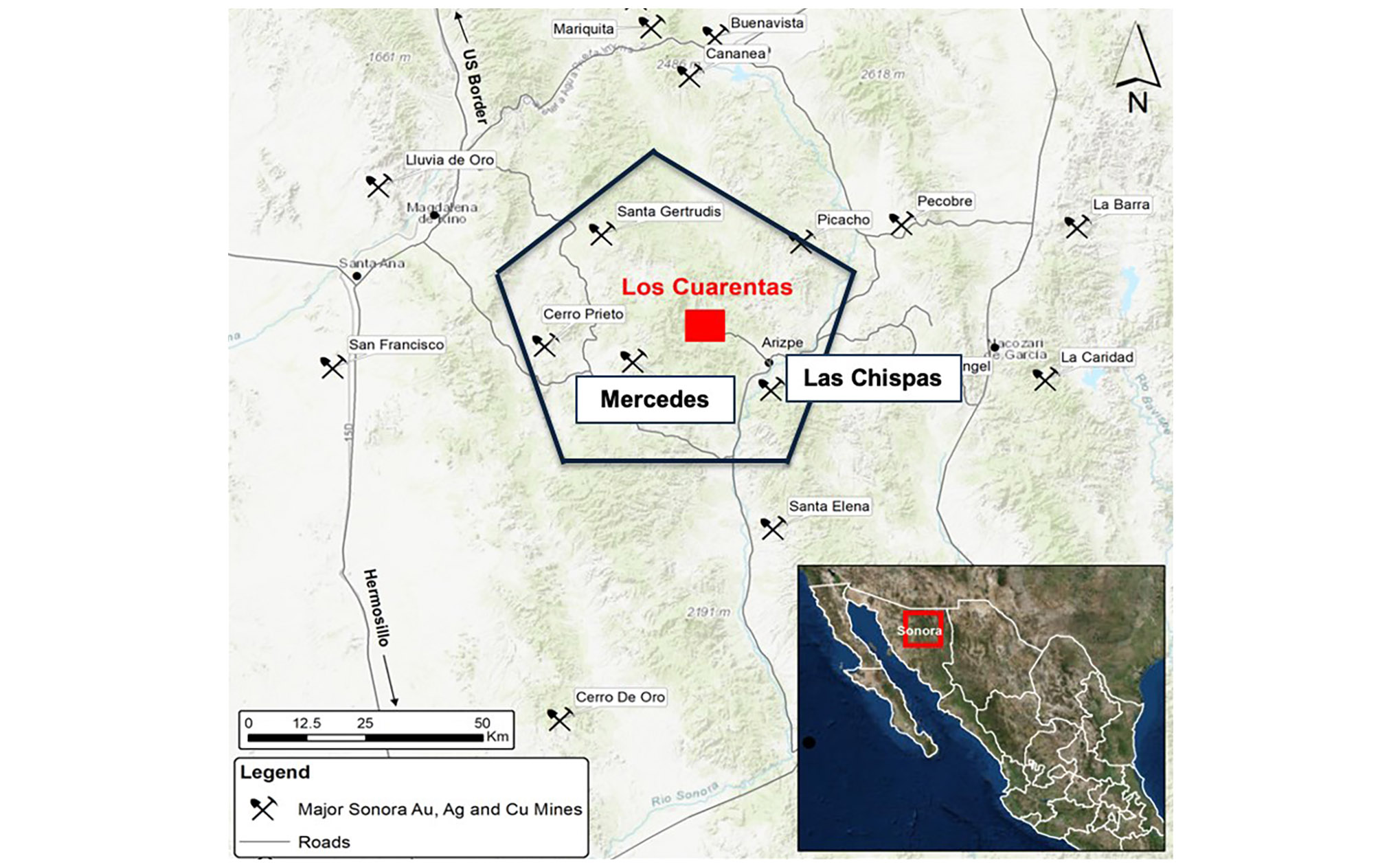

As Los Cuarentas Mining Area is located in the neighborhood of several other high-impact mines and projects with well-known properties like Silvercrest’s (SIL.V) Las Chispas project which contains over 100 million ounces silver-equivalent (predominantly in gold-silver mineralization) in the most recent resource estimate and the operating Mercedes mine owned by Premier Gold (PG.TO), it is an ideal spot to go look for additional mineralization at Los Cuarentas.

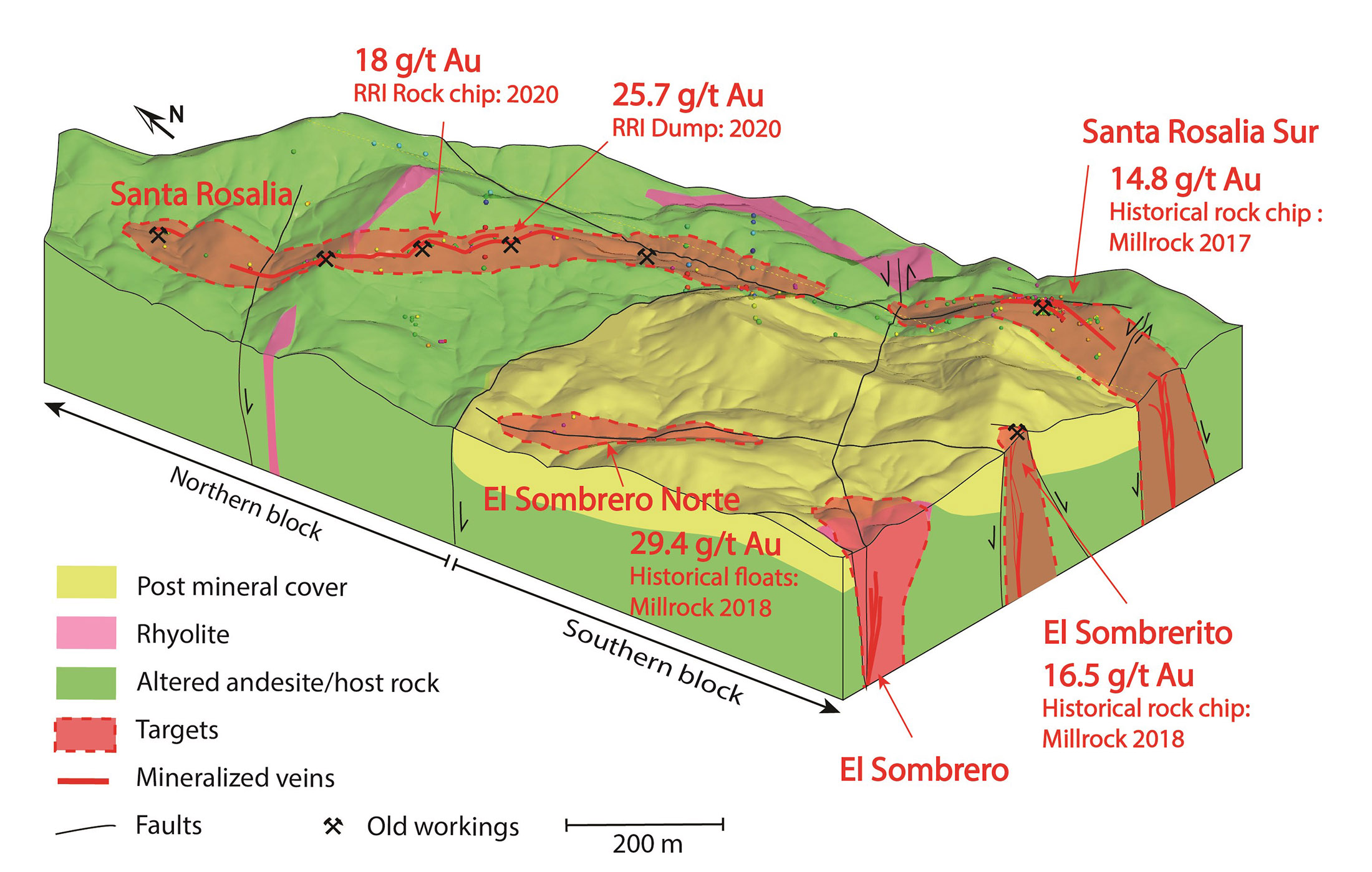

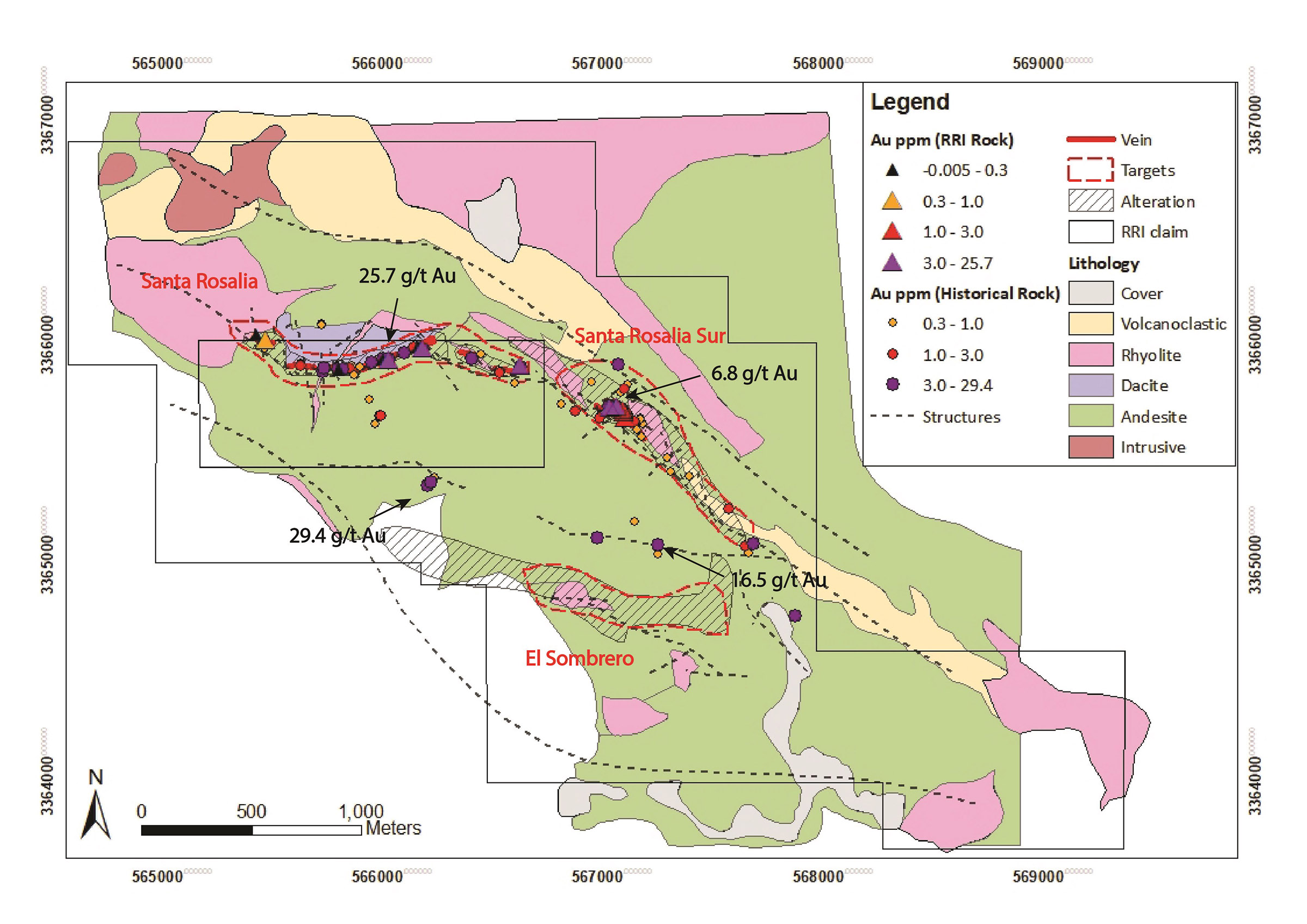

The mineralization at Los Cuarentas is similar to the other two projects as being epithermal of interpreted similar age and styles. New work at Los Cuarentas is being undertaken to study the relationship of some of the alterations to possible proximal heat and maybe interpreting a porphyry at depth which could make Los Cuarentas perhaps one the main centers in this large metal endowed region so geologists are excited but further work is first needed on this possibility. Los Cuarentas is definitely an epithermal vein system at the mine centers of Santa Rosalia and Santa Rosalia Sur. There are also large alteration zones that show possible zones of lithocap. And just a little bit to the south of Las Chispas which is a vein area north of the Santa Elena Mine which made Silvercrest 1.0 so successful that it was bought out by First Majestic Silver (AG, FR.TO). So far at Cuarentas the historic mining of the epithermal veins was largely for gold and upcoming drilling either by Riverside or a partner will further test the veins that Riverside now controls.

Another important aspect to Cuarentas is the infrastructure is already in place for the Arizpe district is well-endowed with well-maintained paved highways and an existing powerline could be accessed just a few kilometers away from the primary targets. Arizpe has been a mining center for over 200 years and previously was a mining capital city for Sonora State and had a mint where silver coins were made for the government of Mexico. Arizpe is along the river and had an old mission that Jesuit priests built with the local people as this was a mining center with the Spanish arrived to this region of Sonora.

Riverside acquired the property as part of its deal with Millrock Resources (MRO.V) which sold its project portfolio, and Riverside always seemed to have been quite charmed by the Los Cuarentas property. Millrock had done work at Cuarentas with Centerra Gold including soils, rocks, IP geophysics but did not at the time have signed an agreement with the key internal claim during the time with Centerra. Only after Centerra left was Millrock able to finalize all the paperwork and Riverside has taken over the option to control the internal claim and main Santa Rosalia mine area targets. This is a key element as to why Riverside’s exploration efforts with Hochschild could unlock more value than the Centerra/Millrock agreement.

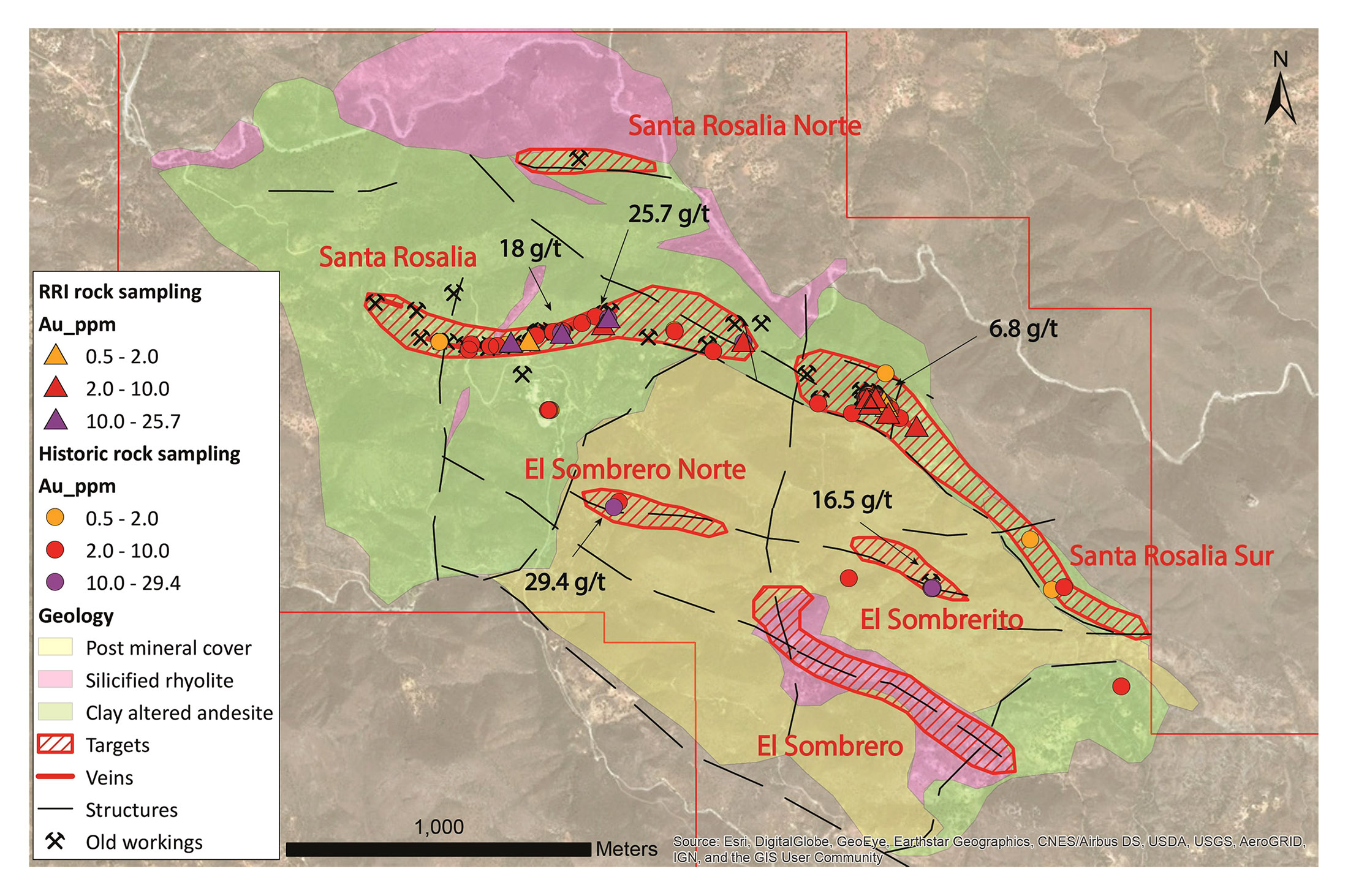

The interpretation of the magnetic survey and the mapping results has resulted in Riverside generating three primary targets: Santa Rosalia (where the sample grading 25.7 g/t gold was found at an old mine dump), Santa Rosalia Sur and El Sombrero. There are other target areas as well including parallel structures which will be further enhanced during the Q1 field program that is beginning this week. Riverside can focus its efforts on the main zones which contain a mixture of sheeted quartz veins, stockwork and breccia zones as is typical of high-level epithermal systems. Hochschild will visit the site in the coming weeks with Riverside and progress on targeting and planning drill holes.

The joint venture with Hochschild Mining on Los Cuarentas looks promising

Hochschild can earn an initial 51% interest in the project by spending US$8M on exploration expenditures during an initial 5 year period. If Hochschild completes this earn-in deal, a 51/49 joint venture could be formed or Hochschild can earn an additional 24% by spending US$3M on exploration and completing a feasibility study where after the Cuarentas ownership will revert to a 75/25 ratio at which point Hochschild can buy Riverside’s 25% stake for US$20M in cash and issuing a 1% NSR. If Hochschild only earns to 51%, Riverside has the option to buy out Hochschild’s interest for an NSR to Hochschild, so this is a very solid deal for Riverside.

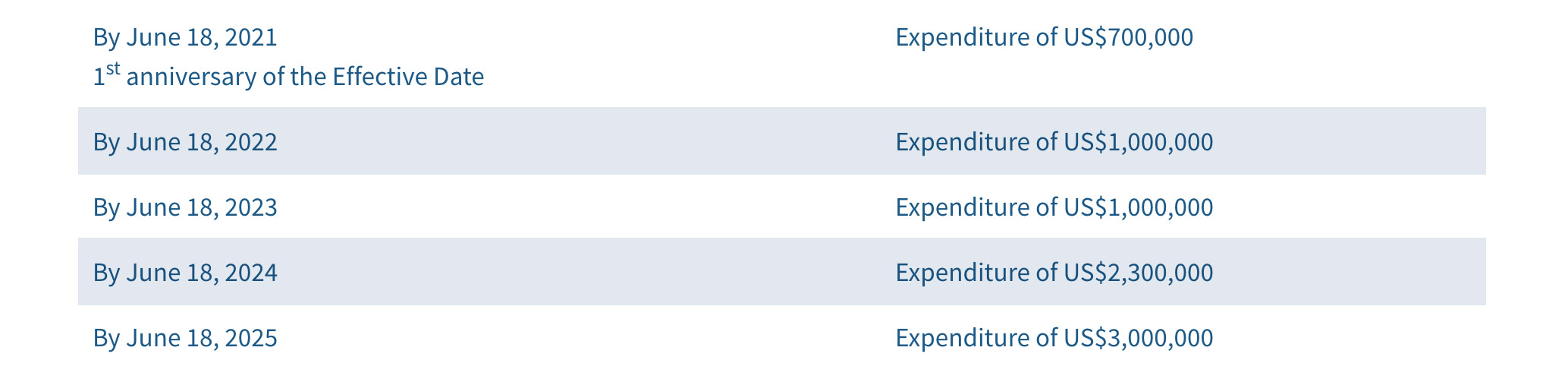

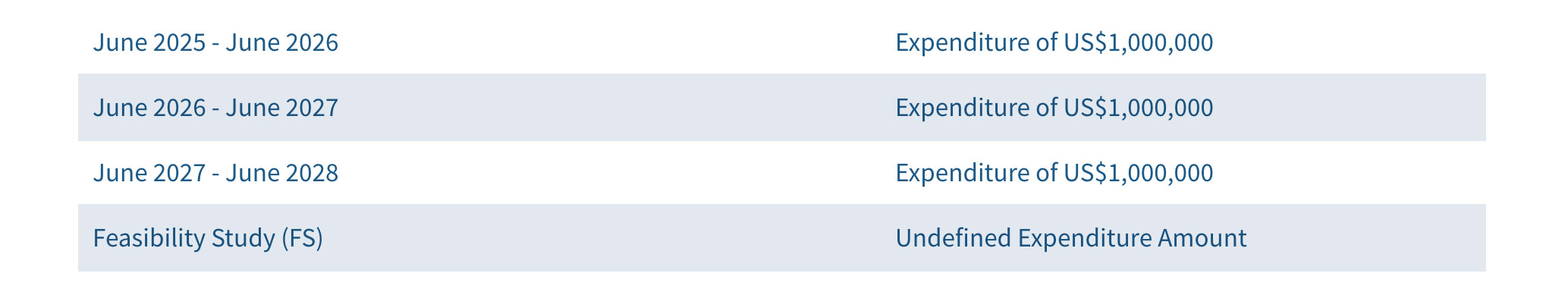

During the first phase of the earn-in agreement, Hochschild has to meet certain minimum exploration expenditures on an annual basis starting on the effective date.

As you can see in the table above, Hochschild’s commitments grow as the option time progresses and reaches the fifth year, the exploration commitments required to keep the earn-in agreement in good standing are becoming higher for Hochschild. We expect the company to complete some additional trenching and sampling programs in the Y1-2 in preparation of larger drill programs probably to start in Q4 this year. Seeing how the final two years of the joint venture require Hochschild to spend a cumulative US$5.3M, there will most certainly be some aggressive drilling involved in the future.

The interesting part of having US$8M in required cumulative exploration expenditures on Los Cuarentas is that even if Hochschild walks away after spending, say, C$5M, it won’t have earned a single percent ownership in Los Cuarentas. So Hochschild either spends the US$8M and earns a 51% stake, or walks away empty-handed. A well-negotiated deal from Riverside’s perspective. And even as stated above does not necessarily get Hochschild an interest unless they go to 75%. Additionally, conversations with Riverside’s management team indicate Riverside has the option to repurchase Hochschild’s 51% interest for a small NSR (less than 0.5%) and a low cash payment, so this protects Riverside in every possible way. Either Hochschild earns 75% (where after Riverside can sell its stake for in excess of C$25M) or it can regain full ownership on Los Cuarentas at a fraction of the expenses that will be incurred by Hochschild.

Once the initial 51% stake has been established, Hochschild can earn an additional 24% by spending an additional US$3M on exploration expenditures within a three year period and will have to complete a feasibility study (which will cost several millions of dollars) before it establishes a 75% ownership in the project. Whether the completion of a feasibility study will cost US$1M or US$10M, that’s irrelevant: the entire cost will be funded by Hochschild as part of its earn-in agreement to reach a 75% ownership status.

Once this step has been completed, Riverside and Hochschild will form a 25/75 joint venture whereby Riverside can elect to either continue to contribute 25% of the ongoing expenses (and potential capex should the feasibility study confirm the construction of a mining operation is warranted) or exercise a put option whereby it can sell its 25% stake to Hochschild for US$20M in cash and a 1% NSR.

The joint venture with BHP is entering its second year

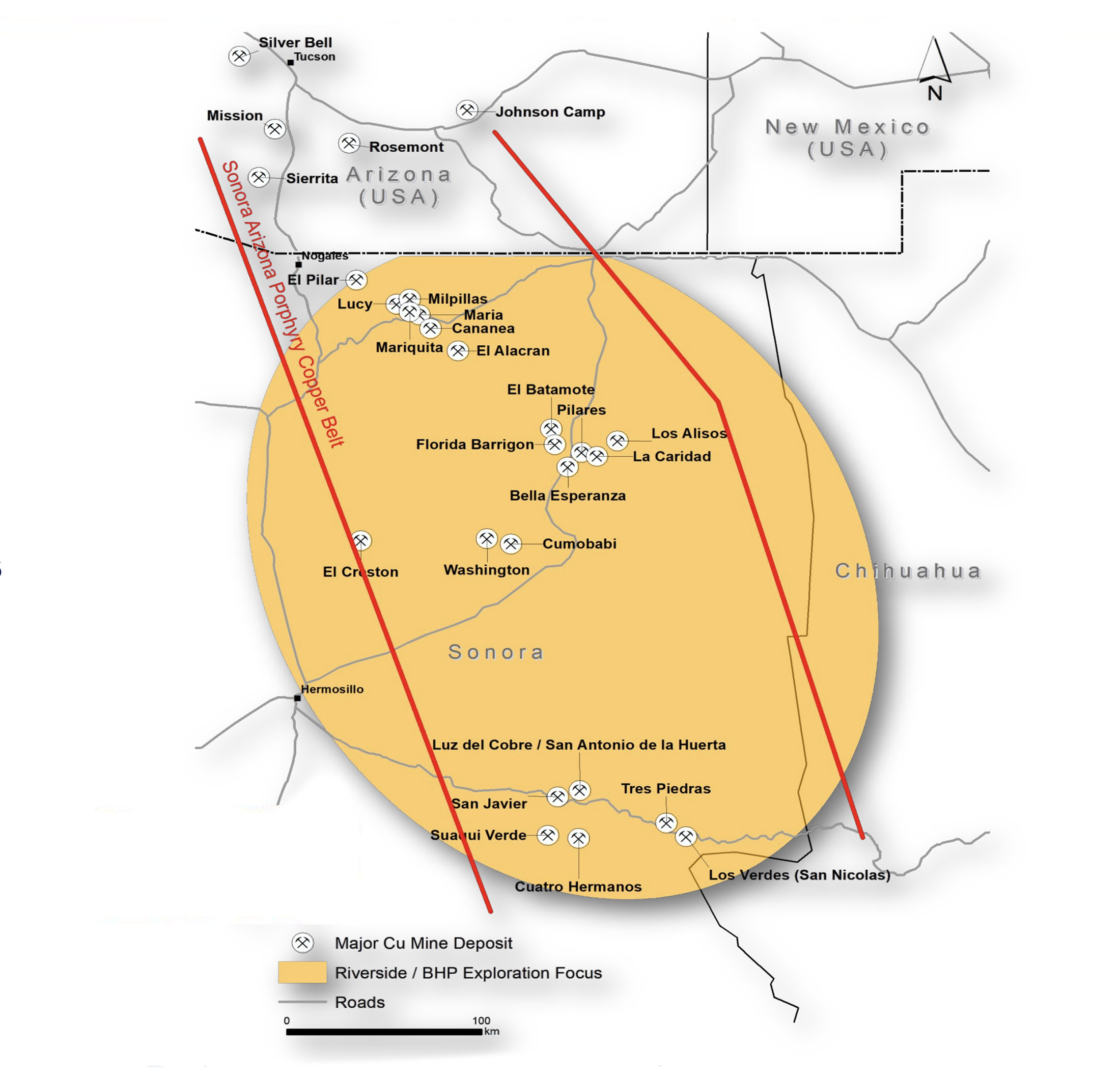

About a year ago, Riverside signed an agreement with commodity giant BHP (BHP) to jointly explore for large copper porphyry systems in Mexico’s Sonora state. The theory behind this was pretty simple: given the dozens of large footprints copper projects (and mines), it made sense to start looking right across the border in Sonora to find similar large copper deposits. This isn’t a brand-new idea as several large copper mines are already in operation in Sonora, but the area remains underexplored and BHP had used Staude, Herrera, and others from the Riverside team to do this work but that was cut short due to fall in metals and market cycle in the past, so this alliance really gives both companies good upside.

We haven’t heard a lot of details about the BHP-Riverside joint venture over the past year, and that hardly is a surprise. BHP has major operating mines all over the world, so grassroots exploration programs in Mexico hardly are an ‘announceable’ event for them. The same can be said about Riverside Resources: unless a large discovery has been made which would be considered a ‘material change’ for a small company like Riverside, there’s no real reason to provide too many details on early-stage grassroots exploration projects.

It was good to see both companies have now entered the second year of the joint venture agreement. That’s encouraging as it means BHP is still sufficiently interested to continue funding work programs looking for the next multi-billion pound copper porphyry project.

Right now, there are already five projects that have been acquired by the Riverside/BHP joint program during the generative stage and after agreeing on a budget increase for the first year, BHP is now once again boosting the budget for the second year of the exploration joint venture. Whereas the parties originally agreed to spend US$500,000 this year, the total budget has been hiked to US$720,000, a 44% increase for each 6 months or overall now C$2,000,000 annually.

The BHP / Riverside program is now still in the Project Generation Phase where projects are being evaluated and then either progressed toward drill decisions or being dropped but Riverside gets to keep these at no cost if they have already been acquired so we see Riverside is doing as it said in building a copper portfolio at a zero-cost basis. This is positive for shareholders and provides Riverside with data-rich, interesting copper districts which it can progress after the completion of the BHP program or BHP decides to release its focus on properties. After all, there are interesting copper projects that may not meet the minimum requirements of BHP, but could be very interesting to smaller copper companies with a lower cutoff threshold.

All five aforementioned projects in the Riverside/BHP agreement are still in Phase I, and this means Riverside will remain the operator and receive operatorship fees for doing so as geophysics, geochemistry, and other work is full funded by BHP with RRI retaining the 100% property control.

It will now be important to advance the projects in order to get them across the finish line to be defined as a Project Operation Phase. That’s important for Riverside Resources as this is where the cash success fees are coming in: Riverside will receive US$200,000 in cash for every project that makes the move from Project Generation to Project Operation while BHP also commits to spend US$5M on exploration per project reaching this stage.

There still is a general lack of details on these copper projects but as work progresses, we’ll probably see more data on the five projects as these large corporations often provide limited updates but definitely are looking for giant game-changer discoveries.

Riverside is now weeks away from spinning of its shares in Capitan Mining

As has been widely communicated that once Riverside obtains exchange approval it can then look to close the financing at the same time as it completes the share spin out and thus all shareholders will be treated with the same investor rights. Riverside Resources is only a few weeks away and in the final stages of the spinning off stock of Capitan Mining to its shareholders. Capitan Mining is a new company that will acquire the Peñoles gold-silver project from Riverside in an all-share deal, where after Riverside’s plan of arrangement will become effective and every Riverside shareholder will receive 0.2767 shares of Capitan Mining.

Capitan Mining is currently raising money at C$0.20 per share which basically means that if Capitan starts trading at that level, the shares that will be spun off from Riverside represent a value of approximately C$0.055 per share of Riverside.

Capitan Mining will have a dedicated management team and a pure focus on the Peñoles project and once there are more details about the going-public transaction (which should be completed in early August) and the exploration plans, we will provide a separate update.

Riverside’s balance sheet: healthy thanks to an excellent strategy of monetizing shares of investees

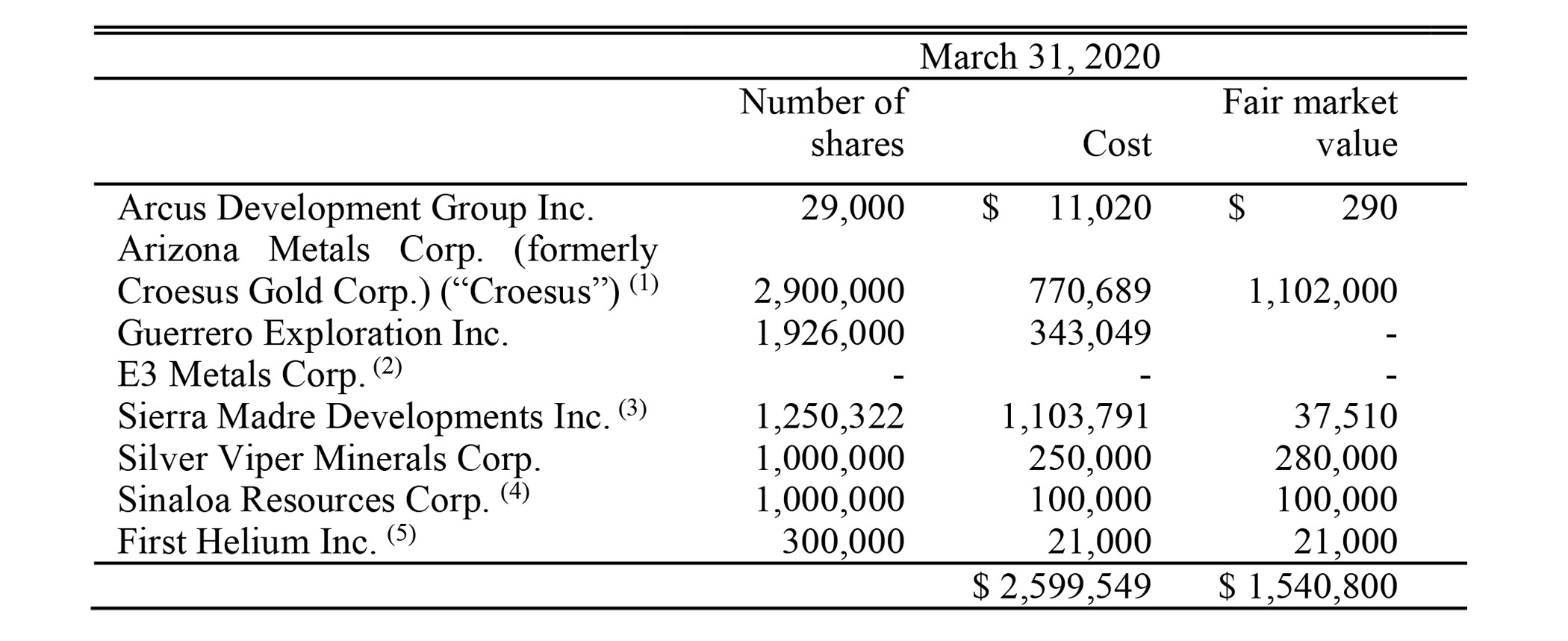

As you may remember, Riverside usually also accepts stock as consideration for joint venture agreements with smaller companies, and one of those companies has been doing well lately. Riverside Resources initially sold 4.4M shares of Arizona Metals (AMC.V) in November 2019 for just over C$784,000 indicating an average price of C$0.18, but it retained 2.9 million shares in the company. According to the Q2 2020 financial statements, Riverside still owned 2.9 million shares at the end of March, and has sold 900,000 shares in May at C$0.50 per share, further boosting the cash position of Riverside. Based on the current share price of C$0.32, the remaining 2 million shares of Arizona Metals have a market value of C$1.4M and as the trading volumes in the junior have picked up, we would expect Riverside to monetize its remaining shares along the way.

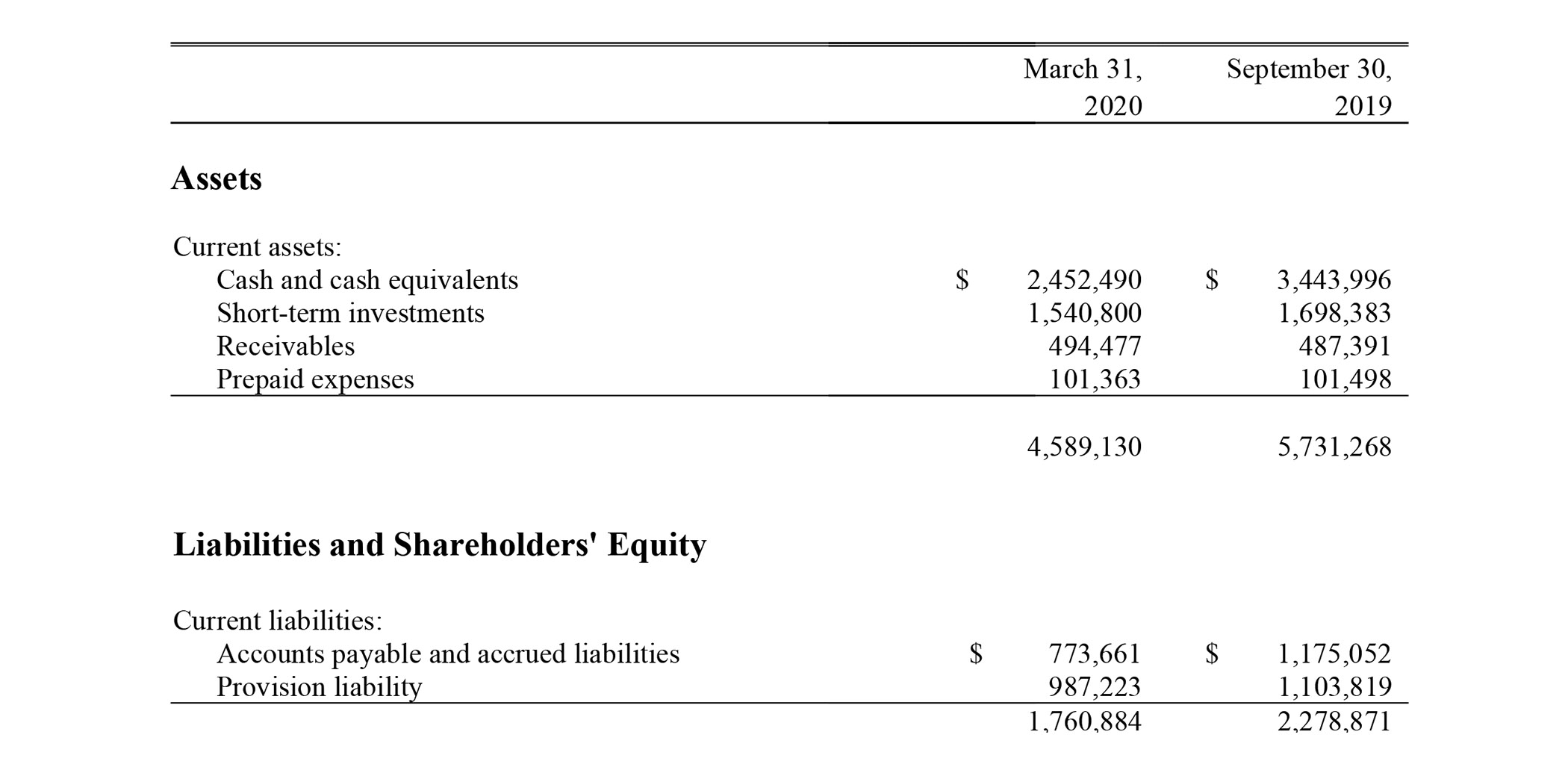

The sale of Arizona Metals stock in November has helped to keep Riverside’s working capital position in good shape. At the end of March, the balance sheet contained C$4.6M in current assets and C$1.8M in current liabilities for a positive working capital of around C$2.8M.

Keep in mind the market value of the short-term investments was based on the March 31 share price and as you may remember, the mining stocks were dragged down along with the main markets during the initial COVID-19 panic. Both Arizona Metals and Silver Viper are currently trading approximately 50% higher than where they were trading in March and we expect Riverside to report a virtually unchanged working capital position as the higher value of the investees on the balance sheet should offset the cash burn. Additionally, Riverside receiving nearly C$2M over the coming year for the BHP program definitely helps lower any burn rate as teams provide work on the BHP program.

Also keep in mind Riverside issued 17.5M warrants exercisable at C$0.22 as part of its March 2019 placement. These warrants expire in March 2021 and it’s not unlikely we will see some of the warrants being exercised (we participated in that financing, and have recently exercised some warrants) now the share price seems to have found some momentum. Should all warrants be exercised, Riverside can look forward to receiving an additional C$3.85M in cash which should secure its funding until well into 2022. This will of course depend on the number of warrants being exercised, so let’s keep an eye on that in the next few months and quarters but the combination of warrant proceeds and sales proceeds from selling Arizona Metals shares should keep Riverside’s balance sheet healthy.

Conclusion

The joint venture agreement with Hochschild is very promising as the South American company has to spend quite a bit of money to establish an initial ownership in the project. Additionally, with the commitment to repay US$90,000 in fees to Riverside as well as paying Riverside a 5-10% operator fee during the first two years of the agreement (wherein Riverside will be operator of the exploration programs), the incoming cash will help keeping the Riverside balance sheet in an acceptable state.

Right now, Los Cuarentas is an interesting exploration project and former gold vein mining operation, but needs drilling to block out a potential discovery and then resource. The millions from Hochschild will help to refine the exploration targets in an attempt to figure out some of the favorable areas for drill testing. Riverside’s share price was trading at C$0.20 for a market cap of just over C$12M when it announced the Hochschild deal but then got good momentum trading up to C$0.38 before settling down in the mid-thirties. Hochschild will have to spend just a little bit less than Riverside’s market cap on announcement to earn its initial 51% stake and this is one of more than 10 projects in Riverside’s asset portfolio so we see good value and upside in Riverside. The deal on Los Cuarentas looks very accretive to Riverside shareholders.

The fieldwork with BHP on the copper prospects is advancing, five properties have already been acquired and are progressing toward drill decisions. We look forward to seeing a more detailed update on the BHP program, it’s very likely the Los Cuarentas option and spinning out the Capitan Mining shares (slated for early August) that will be the main drivers for Riverside’s share price in the coming 6-12 months.

Disclosure: The author has a long position in Riverside Resources Inc. Riverside Resources Inc. is a sponsor of the website.

May I compliment you and your team on this very good and transparent update.

Regards,

Carl Hoekstra, Groningen, The Netherlands