View site visit photo gallery →

In February, we flew to Mexico to kick the proverbial tires of Riverside Resources (RRI.V), a prospect generator with a very specific focus on Mexican projects. Although Riverside owns 9 projects, we were only able to visit two of them during our stay in Mexico’s Sonora state.

In this report we will discuss the two properties we visited (Cecilia and Glor), but this document is in no way meant to be a full and complete overview of Riverside’s exploration projects as there’s so much data available we’d need to write an entire (technical) encyclopedia. As such, this report is meant to be just a first step of your due diligence process and we would encourage you to review Riverside’s publicly available documentation and SEDAR filings.

And perhaps this recent presentation given by CEO John-Mark Staude at the recent Metals Investors Forum in Vancouver is a good starting point (note, we didn’t see any sombrero’s in Mexico):

Base camp Hermosillo: the Mexican headquarter of Riverside Resources

Riverside Resources has set up shop in Hermosillo, the capital of Sonora. Despite the status of the city, the only direct flight into (and from) the United States is a daily American Airlines flight to Phoenix. All other traffic is inbound from domestic connections, with Mexico City being served several times per day.

It becomes pretty clear you’re in ‘mining territory’ on the short 50-minute flight between Phoenix and Hermosillo, as several large copper(-gold) mines can be spotted from the plane. Talking about a 30,000 feet perspective!

Hermosillo itself is a relatively quiet town with a specific focus on mining. All equipment brands have a local dealership whilst for instance Grupo Mexico and Grupo Frisco have local offices as well. Safety isn’t an issue either and strolling the streets wasn’t an issue at all.

Riverside’s local Hermosillo office is located in the suburbs of Hermosillo and employs approximately 10 people right there (other Mexico-based employees predominantly have field roles rather than a desk job), and the Hermosillo office also is where the company’s extensive database is continuously being updated and upgraded. This database perhaps represents most of the value in Riverside as it allows the company to cherry-pick the projects and claims it really wants, as soon as they become available for staking.

The company also appeared to have an active role in coaching and guiding its employees by providing them the prospect of a real career with real possibilities. Site visits by (prospective) joint venture partners are usually led by the local project team and not necessarily by the CEO and VP Exploration themselves. This creates a higher level of affinity between the employees and the company they work for and this culture of self-development could pay off for Riverside in the (near) future as it’s able to retain the geological talent it currently employs.

Riverside only takes on projects and prospects if it thinks the properties could have multiple (valid and realistic) exit strategies. All projects in the Riverside portfolio could be sub-divided into three categories.

A first category would be the ‘smaller’ projects which Riverside could be able to take on themselves without any external help or funding.

A second category would be the projects too big for Riverside, but not large enough for the top-tier majors. These are the type of projects the mid-tier producers would be looking for, and we would dare to put the Glor project in this category, as defining a viable project with the potential of becoming a 100,000 ounce producer could definitely move the needle for Centerra Gold. This does not mean Glor has reached that stage yet, it still is an early stage exploration property today.

The third category contains the properties that are so big only Tier-1 mining companies would be able to ‘see them through’. This usually culminates in a ‘strategic exploration alliance’ with for instance Hochschild Mining (which ended in 2016).

Stop 1: Cecilia (100% owned)

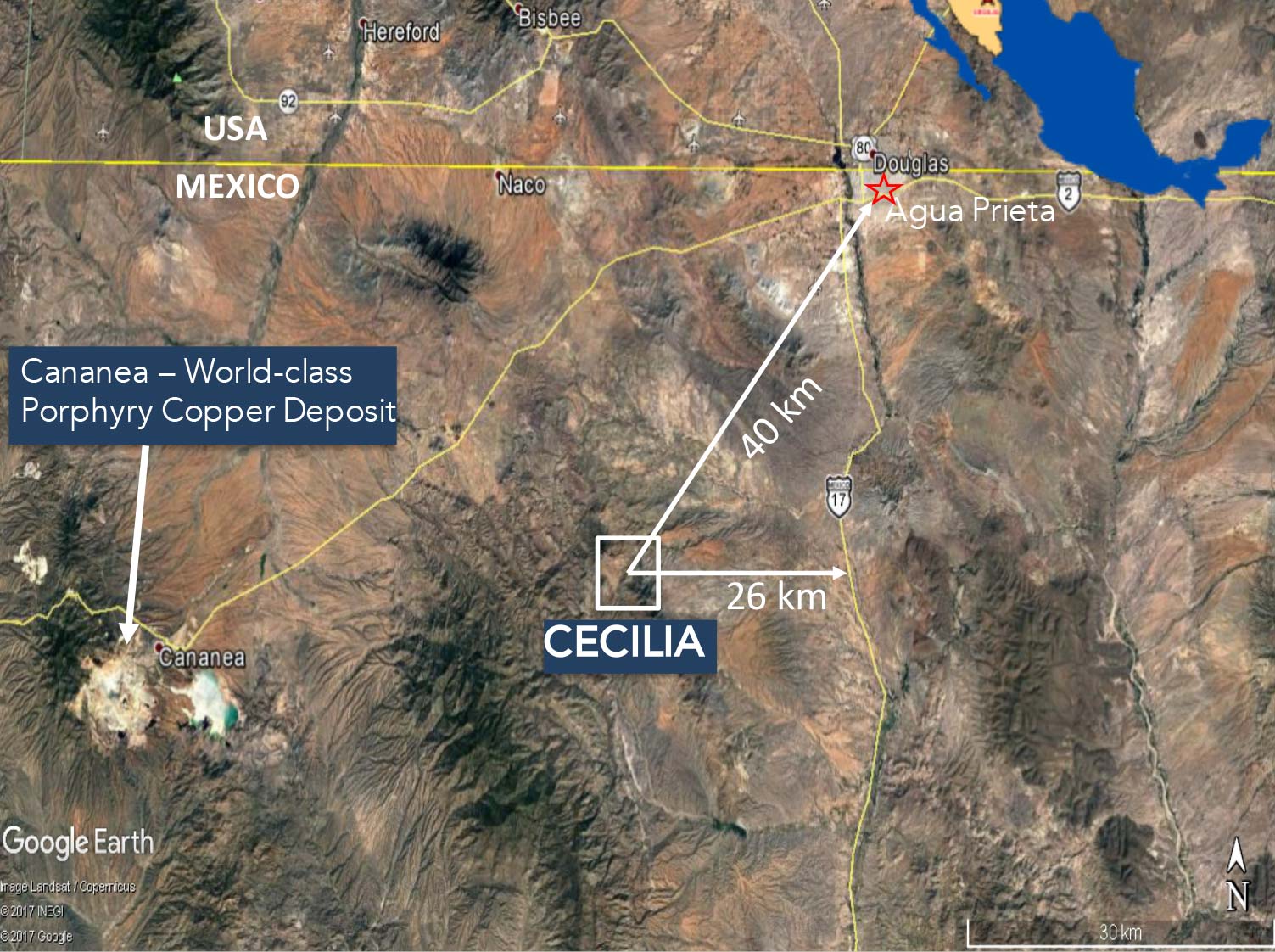

The Cecilia project is a six hour drive from Hermosillo and 90% of the distance is covered by paved roads with a nice two-lane highway between Hermosillo and Santa Ana. From there on, there’s a secondary road going straight through the mountains to the large Cananea copper mine (with several other large scale copper mines in the vicinity) and Agua Prieta, the border town with Douglas, AZ, on the other side of the border.

From Agua Prieta, it’s a 90 minute drive to the top of Cerro Magallanes, of which the first hour once again is on well-maintained paved roads followed by a dirt road which also is in a pretty good shape (you could easily reach speeds up to 50-70 km/h without your head hitting the roof of the car every few seconds).

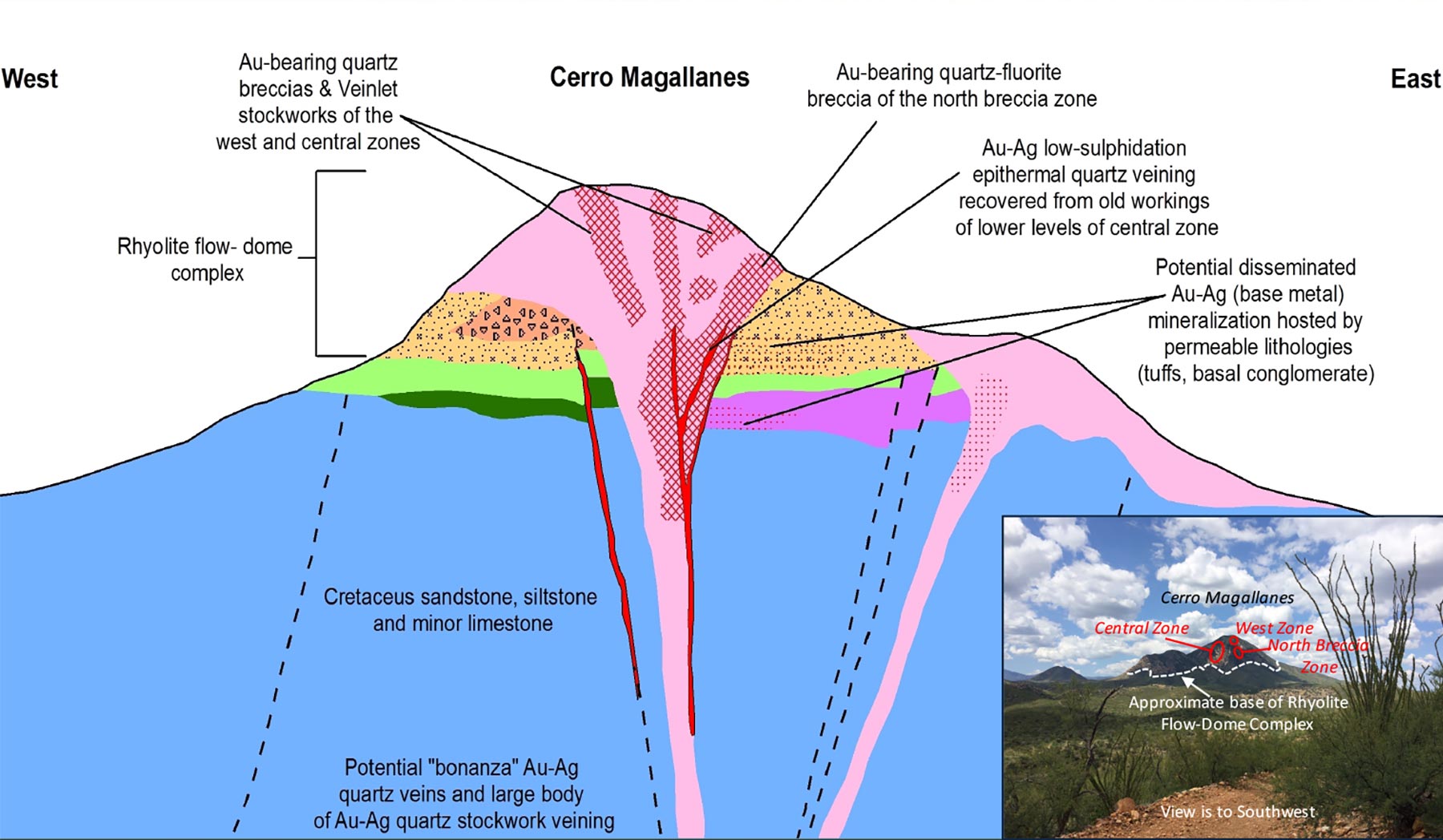

This project was previously owned by Cambior which completed 19 drill holes for a total of almost 4,000 meters. Unfortunately, Cambior didn’t quite seem to understand the at Cecilia and dropped the project approximately 20 years ago. The ownership of the project has changed several times since Cambior walked away in the mid-nineties before Riverside entered into an option agreement to acquire a 100% ownership from Millrock Resources (MRO.V) and Gunpoint Exploration (GUN.V). Riverside will have to pay an additional C$200,000 in cash and issue an additional 700,000 shares of Riverside Resources to complete the earn-in.

We don’t anticipate any issues here as Riverside appears to be very encouraged by the first exploration results at Cecilia. It’s also important to emphasize the project appears to be relatively similar to the Pitarrilla project owned by SSR Mining (SSRM.TO, SSRM), with a total resource of 520 million ounces of silver. And guess who drilled the discovery hole at Pitarrilla? Indeed, Ron Burk, currently employed as Riverside’s VP Exploration.

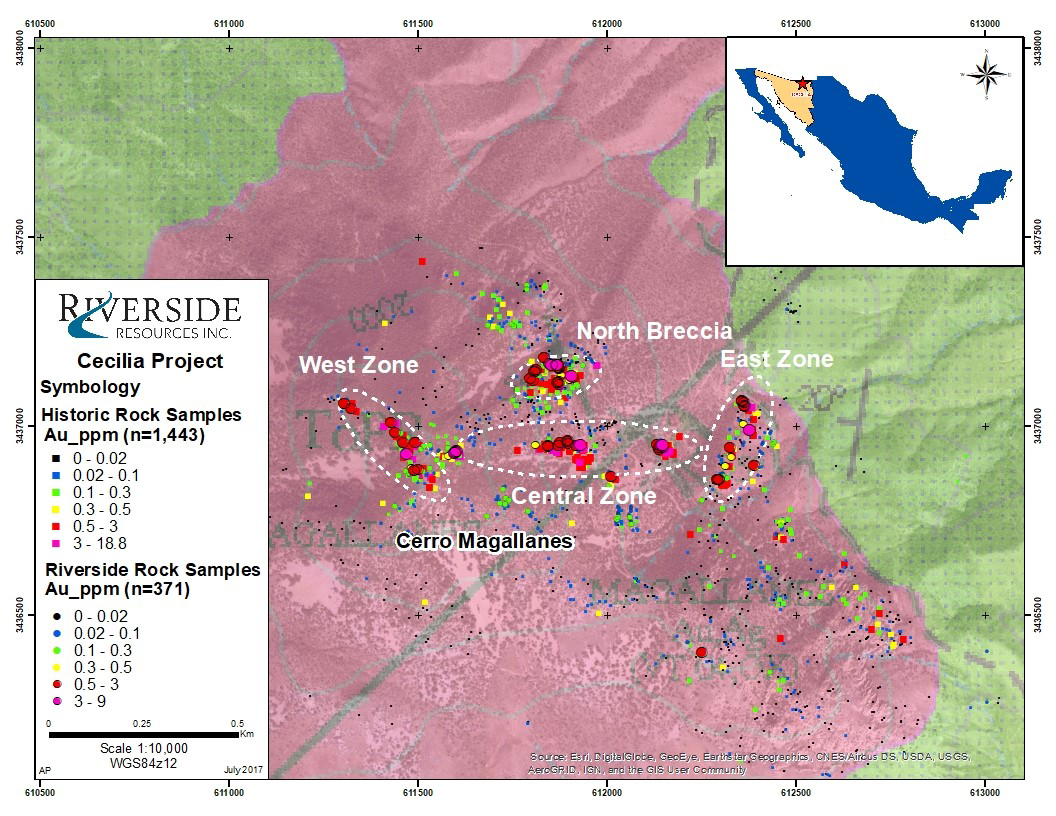

It has been a while since Riverside has provided an exploration update on the Cecilia project but both Burk and Staude appeared to be very excited to continue working on this property. The dozens of old adits and large gloryhole (see site visit pictures) are a strong indicator of higher grade gold (and silver) occurrences, and Riverside’s 2017 sampling program has identified no less than five high-priority exploration zones.

Interestingly, the higher zones appear to be gold-rich whilst the lower zones in the system contain higher silver values. We would expect Riverside Resources to initiate a drill program at Cecilia later this year as just a few drill holes to test the theory could add a lot of value to this project. This could allow Riverside to attract a joint venture partner on more favorable terms.

It was interesting to see the rhyolite zones being omnipresent at Cecilia, and this is exactly the type of rock we saw right across the border at Commonwealth Hill (owned by Marlin Gold (MLN.V)) and further up north in Nevada at Allegiant Gold’s (AUAU.V) Eastside gold project.

Cecilia has the right rocks, let’s now see if Riverside Resources can make a discovery.

Stop 2: Glor (joint venture with Centerra Gold)

On the second day, we drove from Magdalena de Kino (named after father Kino, an Italian missionary) to the Glor property, and once again we were amazed by the excellent accessibility of the property. There’s a very smooth highway (going all the way to San Diego) and right after driving past Alamos Gold’s (AGI.TO, AGI) El Chanate gold mine, a smaller (but still paved) road takes us straight to the access gate to the Glor project, where Centerra Gold (CG.TO) is earning a 70% interest right now.

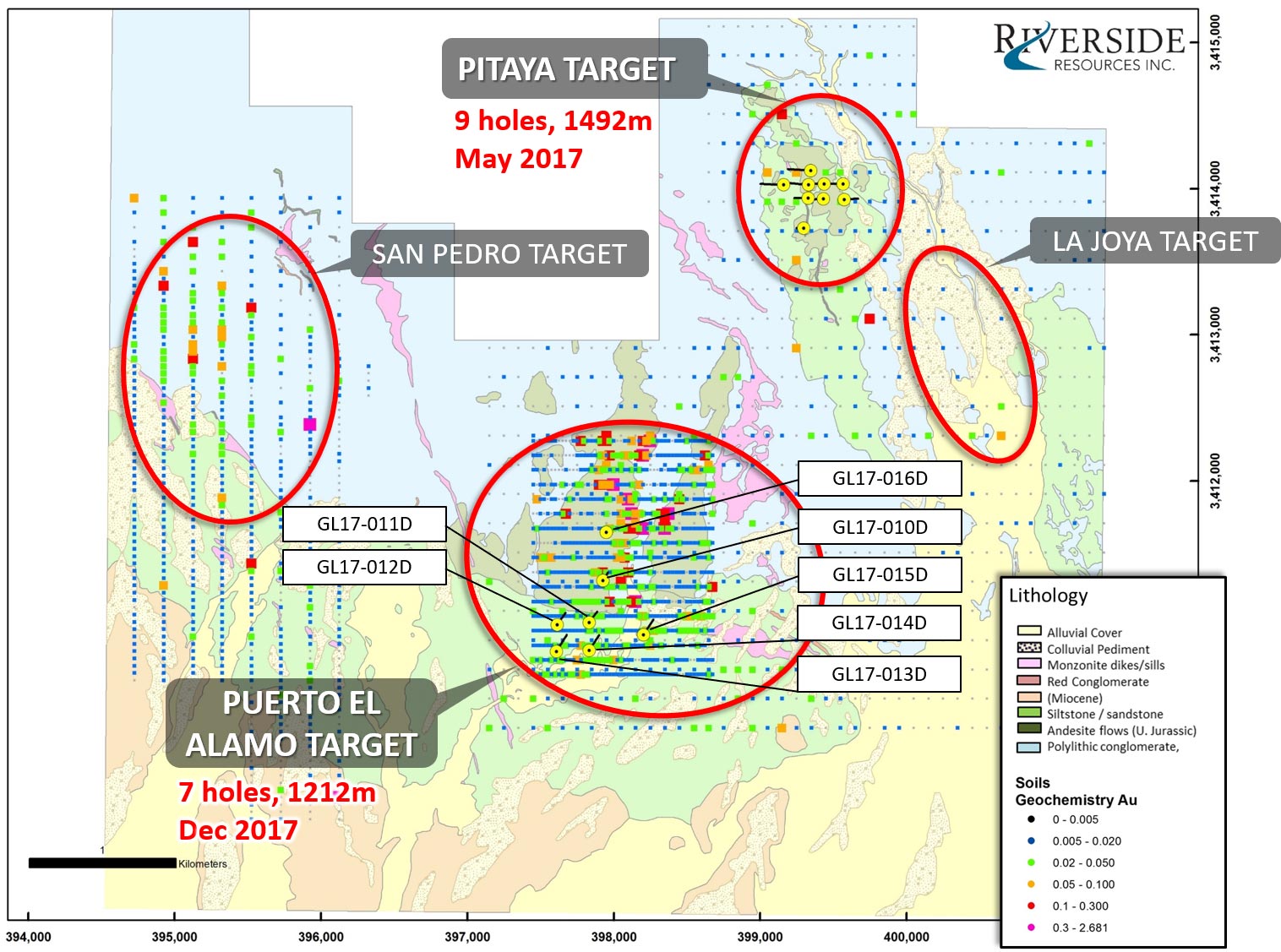

When we visited the project, Riverside was still awaiting the assay results from a 2017 drill program but those results were released a few weeks ago.. Unfortunately the drill results from the Puerto el Alamo target (where a 7 hole drill program was trying to identify a near-surface gold deposit consisting of disseminated and fracture-controlled gold zones, as encountered in the outcroppings in the area) disappointed. The drill bit did intersect anomalous gold values but these zones were too thin and too low-grade to get really excited about.

Centerra continues to work on the property and will very likely drill-test the La Joya and San Pedro targets east and west of Puerto El Alamo. Grassroots exploration ain’t easy, but the dozen old mine workings (see photos) indicate the Glor tenements used to be very prospective.

Riverside has many more projects

Due to time constraints, we were only able to visit two properties but as Riverside Resources is a true prospect generator, it has about a dozen other properties in its portfolio. Whilst discussing all the properties/projects falls outside the scope of this article, we would like to highlight two other projects; Tajitos and Penoles.

Although we didn’t visit the Tajitos project (which is located a little bit further northwest from the Glor property, Riverside’s management and local technical team appear to be very upbeat about the property. And deservedly so, as the approximately 4,000 hectare Tajitos-Tejo concessions were actually mined (as high-grade vein systems) in the two previous centuries before the concept of a bulk tonnage open pit was developed. The mineralization appears to be very similar to Alio Gold’s (ALO.T) San Francisco gold mine, which basically just is a gigantic earthmoving exercise. The main vein system appears to be trending towards the Northwest (with a secondary system running in roughly the same direction) along the Megashear-trend in Sonora.

Tajitos Project

Previously, the Mexican Geological Survey completed a rock chip sampling program at Tajitos which returned values of up to 22.8 g/t gold and 44 g/t silver, whilst Riverside’s exploration programs were able to follow up on these historical results (with 78 of the 137 surface samples returning gold values of in excess of 0.5 g/t). It allowed the company to attract Centerra Gold as joint venture partner, but after an initial exploration program, Centerra decided to drop the option.

Perhaps a bit too fast, as the initial exploration results actually weren’t too bad. A 2016 drill program encountered 3 meters and 1.5 meters containing just over 6 g/t gold less than 50 meters from surface, whilst a deeper zone of 11.1 meters at 0.78g/t gold also appeared to be interesting.

Fresnillo Mining also has a property called Tajitos which occupies the same area and for which Riverside’s ground abuts Fresnillo’s resource and the location of the potential future open pit. Fresnillo is eyeing a heap leach gold operation very similar to its Noche Buena operations 30 km NW which produces over 150,000 ounces gold per year. Fresnillo is very well-represented in the area as just 25 kilometers away, it also operates a second mine: the Herradura Gold Mine with resources exceeding 8M ounces gold, producing 300,000 ounces gold per year.

Tajitos Project

The second project we didn’t visit but appears to be very interesting is the Penoles project (in Durango) which is once again 100% owned by Riverside Resources after Morro Bay Resources was unable to complete its earn-in commitments in 2016 having developed resources, completed extensive work but the tough market conditions and hotter other focuses distracted them from gold mining.

The project is located approximately 170 kilometers west of Torreon, and the land situation at this project is very intriguing. Riverside Resources owns four land claims which are surrounded by Fresnillo (FRES.L), but those Fresnillo claims are once again surrounded by additional Riverside claims. Fresnillo is very well aware of these properties as it actually used to mine the Jesus Maria mine back in the late 1800’s. The Penoles properties remained unexplored during the entire 20th century and the only activity-related reports on the project were discussing a small 100 tonnes per day operation which processed the San Rafael mine dumps at an average grade of 11-13 ounces of silver per tonne.

Peñoles Project

Riverside staked and purchased its currently-owned claims earlier this century, and joint venture partner Morro Bay advanced the project towards a NI43-101 compliant resource estimate. This estimate contained 28.3 million tonnes of rock at an average grade of 0.36 g/t gold and 18.7 g/t silver for a total of 331,000 ounces of gold and 17 million ounces of silver. The grade appears to be low, but bottle roll tests have indicated the recovery rate could be well in excess of 90% for the gold and silver appears to have favorable early indications as well. The existing resource, as well as Fresnillo’s continuous presence in the area, make Penoles an attractive exploration project.

Again, these were just 4 of the numerous projects in Riverside’s portfolio, and we would encourage you to check the company’s website to get familiar with the other projects.

Peñoles Project

Management, cash, share structure: three important things

Riverside Resources listed approximately 10 years ago and has been able to run a tight ship ever since. By using the joint venture model, Riverside lets its joint venture partners spend their cash on advancing the projects whilst RRI received a management fee (which traditionally is 10% of the exploration program), keeping the treasury topped up.

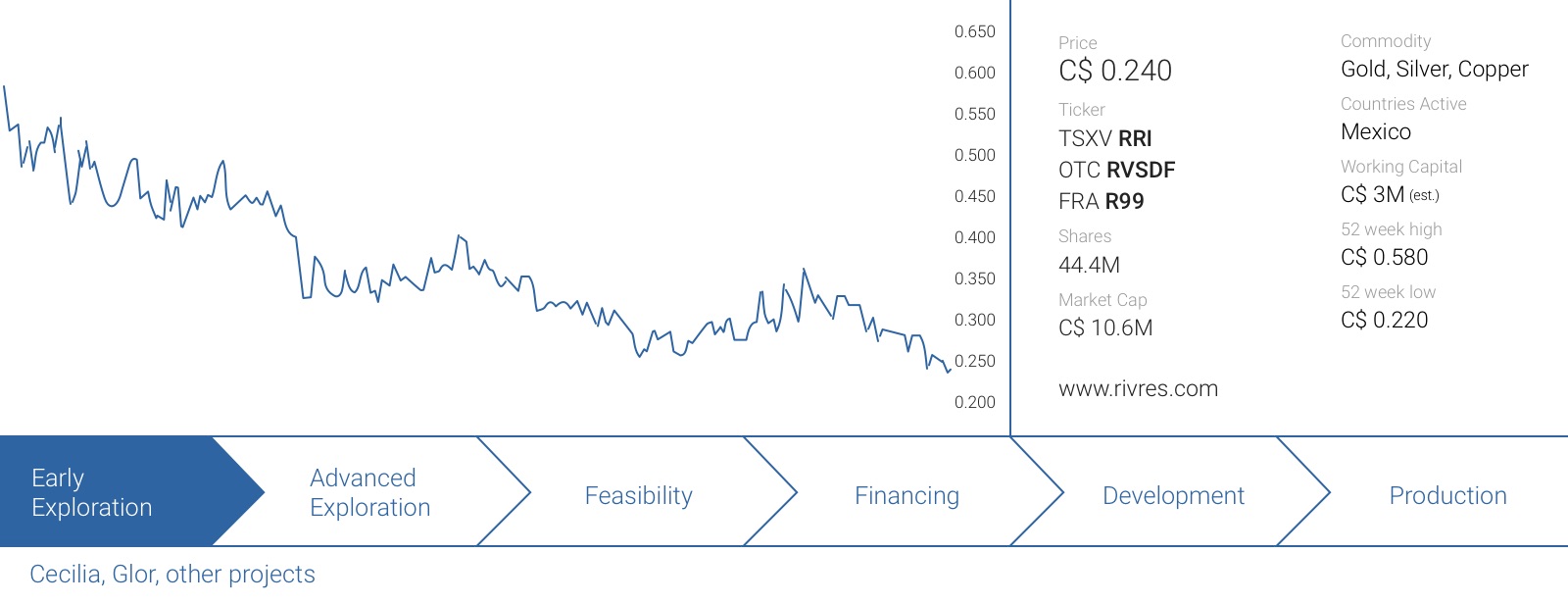

Last year, the company completed a private placement, raising C$3.44M by issuing 6.26 million units at C$0.55 per unit (with each unit consisting of one common share and half a warrant, allowing the owners of a full warrant to acquire an additional share of Riverside Resources at C$0.85 before March 15th 2019). Not only did this allow the company to top up its treasury at a high share price, it also means potential shareholders are now able to buy the stock at less than half the price of the 2017 offering. So Riverside appears to be on sale for this entry level, relative to the past financing.

Right now, Riverside Resources still has less than 45 million shares outstanding, a fact the company is quite proud of (and honestly, it is a remarkable fact for a company which has been around for 10 years). The financial report for Q1 2018 (which ended on December 31st 2017) hasn’t been filed yet, but Riverside Resources currently has a cash position of approximately C$3M and a bunch of shares of optionees (some of them are publicly trading, some of them are still considering a going-public transaction). As of the end of September, the fair value of these shares was estimated at C$1.1M.

CEO Staude’s fate appears to be aligned with the shareholders as he owns approximately 1.52 million shares of Riverside Resources for a stake of almost 3.5%.

John-Mark Staude – President & CEO

Mr. Staude earned a Masters of Science from Harvard University in 1989 and a Ph.D. in economic geology from the University of Arizona in 1995. Mr. Staude held positions of increasing responsibility with a number of major international mining companies including Kennecott, BHP-Billiton, and most recently Teck Cominco. He also worked with smaller commodity-focused companies like Magma Copper Company and consulted to private investment groups. Mr. Staude’s extensive Latin America mineral resource experience began in Mexico and then extended through South America. Recently, Mr. Staude has ventured into Europe and Asia initiating companies and managing successful exploration programs in Turkey, Romania and China. Mr. Staude has been successful in creating shareholder value through discoveries of gold and copper in Mexico, Peru and Turkey. His technical and managerial experience spans more than 30 countries in diverse geologic environments. Through Riverside Resources, Mr. Staude will continue to build strong portfolios and profitable businesses through prospect generation, early stage partnering and drill discoveries.

Ron Burk – VP Exploration

Ron has 30 years of work experience in the minerals industry, primarily focused on generating and evaluating exploration properties. Ron most recently worked at Centerra Gold Inc. as VP of Exploration. Prior to this, he held the positions of VP, Exploration and Chief Geologist at Silver Standard Resources Inc. where he contributed to discoveries that resulted in the definition of a world-class silver resource at the Pitarrilla project in Durango, Mexico and major gold resources forming the Snowfield and Brucejack deposits in northern British Columbia, Canada. Prior to joining Silver Standard in 2004, Ron had worked since 1989 as an exploration geologist for Teck Resources Ltd. and its predecessors, focused on target generation and property evaluations in Canada, Mexico and South America.

Rob Scott – CFO

Mr. Scott has over 17 years of professional experience in the areas of corporate finance, accounting, and merchant and commercial banking. He earned his C.A. designation in 1998 while working in corporate tax, accounting and assurance at a Vancouver-based accounting firm, and in 2002, he qualified for the Chartered Financial Analyst designation.

Conclusion

The elephant in the room is pretty clear: exploration isn’t easy. You can always increase your odds by putting together a top-notch technical team and finding partners to do the heavy (financial) lifting, but there will always be a ‘factor of uncertainty’. John-Mark Staude seems to live for his job whilst Ron Burk seems to be very anxious to make another discovery in Mexico. On top of that, every single employee we met had a certain ‘drive’ to advance the projects they are responsible for.

The exploration results at Glor obviously disappointed the market, forcing the share price to record a 52 week low. But with a current enterprise value of just C$7M, the risk/reward ratio has only gotten better.

Disclosure: Riverside Resources isn’t a sponsor of the website at this time. The author has no position but could initiate a long position at any given time. Please read the disclaimer