The general perception in the mining sector still focuses on the tangible assets of a company. And of course, there’s absolutely no discussion possible on the fact that owning interesting projects is an important part of the attempts to create shareholder value. But the market doesn’t always realize some companies have intangible assets as well; and the most important intangible assets are ‘passion’ and a ‘will to push a project forward’.

Besides rocks and cacti, ‘passion’ was one of the most noticeable things during our site visit of Riverside Resources’ (RRI.V) Cecilia and Glor projects in Sonora, Mexico. In this report, we will provide an update on two of the projects, but more importantly, we sat down with President & CEO, John-Mark Staude to discuss why the PhD in economic geology is so keen on getting his hands dirty on grassroots exploration projects, trying to lead a project/prospect generator towards meaningful discoveries.

Two important updates since our site visit report

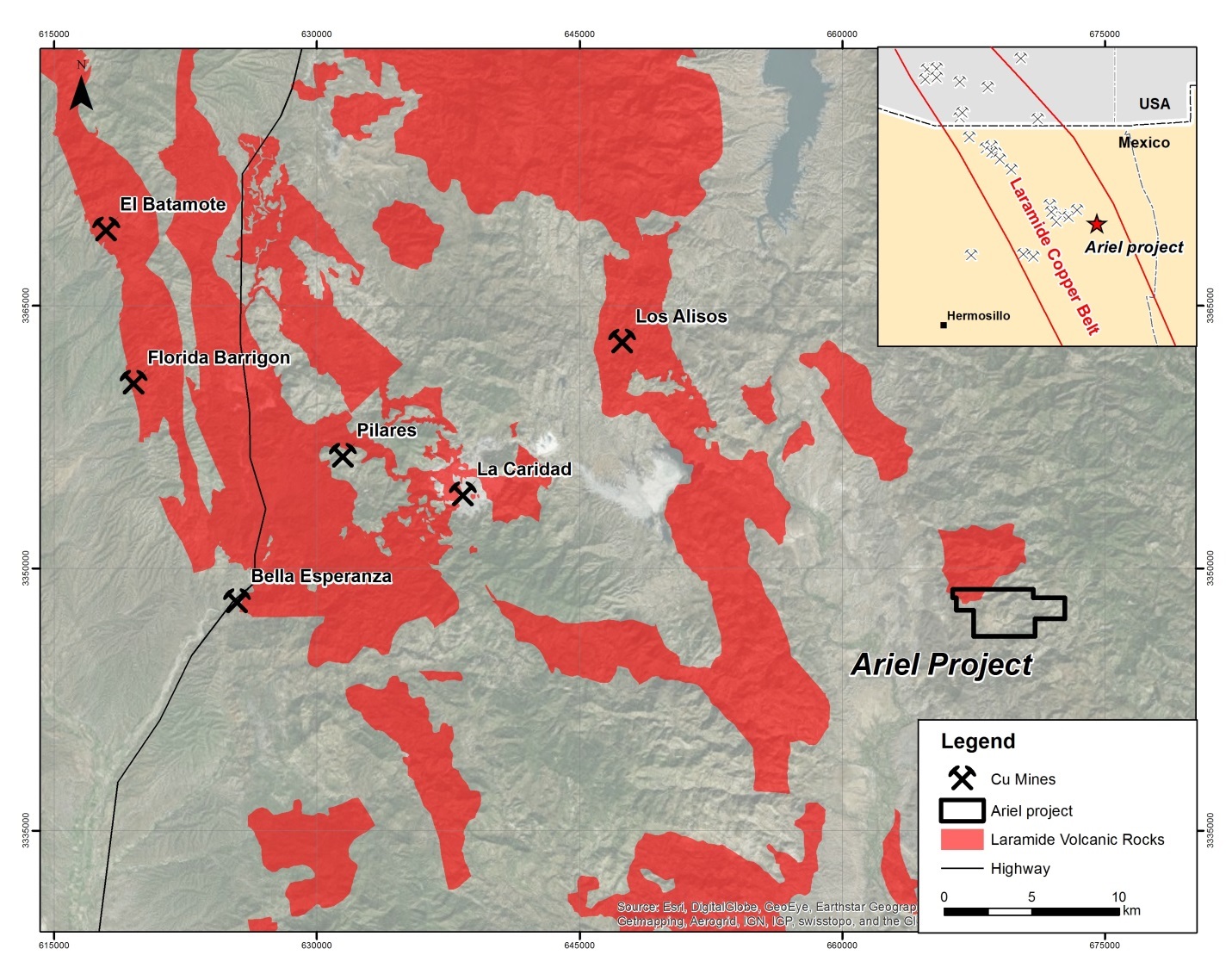

Most investors associate Riverside Resources with gold and silver exploration, but the company also owns some copper assets (we will also discuss the copper division in the Q&A later). One of those assets is the Ariel project, which was acquired as part of the strategic alliance with Antofagasta (ANTO.L). Riverside kept the concessions, which now have a total surface area of in excess of 1,200 hectares.

On the property, Riverside has now defined a wide zone of hydrothermal alteration with a total surface area of almost 5.5 square kilometers (2,800 meters by 1,900 meters).

The project is located in Mexico’s copper belt (yes, Mexico does have a copper belt, which is the extension of the copper-rich zones that host several huge mines in Arizona) and is pretty much surrounded by large copper mines (we saw several mines owned by for instance Grupo Frisco and Grupo Mexico when we visited the Cecilia project). Riverside is definitely looking in the right region. One of the biggest copper projects, La Caridad, a copper-molybdenum mine containing almost 20 billion pounds of copper, is just 30 kilometers away. We don’t have the impression this copper project is something Riverside would like to tackle on its own, and in its April press release, the company confirms it’s open for joint venture approaches on Ariel.

And although Riverside Resources is predominantly focusing on its Sonora projects, it also owns a few projects in other parts of Mexico. Riverside recently completed a channel and grab sampling program at the La Silla project in Sinaloa (which it acquired in 2015 through the traditional Mexican Lottery system), and the preliminary results appear to be very positive. Approximately 10% of the 52 samples returned gold grades of in excess of 1 g/t, which is really good for a surface sampling program.

Two vein zones have now been identified on the property, and the company was able to chase the Ciruelo vein for over 1.5 kilometers. It’s quite encouraging to be able to follow a vein on surface, and the average width of 1-3 meters make the vein ‘mineable’ as well. According to the exploration update, the veins ‘pinch and swell’, which is very common for an epithermal vein system, but Riverside is now zeroing in on the green quartz veins as those have the potential to carry high gold values.

The second vein detected on the property has been explored before and Meridian Gold completed a drill program on that specific vein about 15 years ago. With 15 meters containing 6.9 g/t gold and 33 g/t silver and 1.5 meters of 5.33 g/t gold and 26 g/t silver, it’s easy to spot the value of this vein, and we think Riverside Resources should be very happy it was able to pick up this property in 2015 when nobody really cared about precious metals anymore.

As Riverside confirmed it’s in discussions with prospective partners, we wouldn’t be surprised to see RRI announce an earn-in deal on this property sooner rather than later, as it checks a lot of boxes in terms of what junior exploration companies are looking for.

An extensive Q&A with John-Mark Staude, President and CEO

One of the exploration theses used at Riverside Resources is based around the Sonora-Mojave Megashear. Could you provide some background about this concept, and why this makes the surrounding areas so prolific?

“We like the state of Sonora, but we have and have had projects all over the country and continue our focus on the safe, best, and most readily profitable regions.

Mexico is an excellent place to generate new opportunities because of good access, ability to explore cost effectively year-round, and the rapid capability to progress from discovery to mining. Mexico has also been a world leader for silver and other metals for over 500 years, yet relatively underexplored under pediment cover. New discoveries (often around old mining camps) are being made annually in Mexico and those discoveries are being progressed rapidly toward new mines.

The Megashear is a concept of a possible ancient plate tectonic boundary that separates geology on either side and has a series of northwest fault shears. Some of these faults host gold mineralization somewhat like that found in central and eastern Canada where districts of well over 60M Oz of gold are found.

These shear zone gold deposits are highly profitable for mining and can be a key focus for even the largest gold miners. The northwestern part of Sonora State, Mexico has this type of deposit we call “Orogenic Gold Deposits” and the ongoing exploration and mining is proving very fruitful in Sonora so Riverside sees this as one exceptionally good gold deposit type to explore for.

Riverside’s experience and knowledge for operating in Mexico is first-class. Investing in junior exploration companies that are venturing into a new country to explore brings added risk, with investors often funding the learning curve for management teams as they learn how to navigate the landscape in terms of permitting, social and community challenges, advanced understanding of the claim-staking, tax, legal and other important aspects of running a business efficiently in a foreign country.

Riverside has all of this covered and runs a very efficient business of generating and acquiring prospective ground and advancing projects towards drilling. Riverside has developed this wealth of business and technical knowledge without taking on significant dilution by using a joint-venture, prospect generator business approach where Riverside provides the operational know-how.”

We think everybody knows what a prospect generator does, and how joint venture partners are funding a large part of the (early stage) exploration work to earn an interest in a property. But could you perhaps elaborate on what you, as Riverside CEO, tend to achieve during those earn-in negotiations? Do you have some policies or rules you abide to, to make sure a joint venture deal is in the best interests of the Riverside shareholders as well?

“Riverside is always focused on moving its projects forward and a main reason our shareholders invest in us is because they like that we advance multiple projects simultaneously, increasing the opportunity for a metal discovery.

What we want in a JV is a partner that’s going to be active with exploration/drilling in the near-term. We are glad to bring our field teams and operational skills to a joint venture where the partner can bring capital to de-risk the projects. It’s been great to have JV partnerships in the past where our team has had boots on the ground working on these assets. It has allowed Riverside to be involved and part of the decision making process, while providing the company with OPM (other people’s money) to further advance our projects, mitigate risk and conserving capital for Riverside to seek and acquire new, additional high quality assets.”

Some say a prospect generator is a very ‘romanticized’ idea of doing exploration work. It’s possible to make discoveries, but in the end, the joint venture partner ends up with the biggest slice of the pie. How would you react to such statements?

“Riverside will be an owner of discoveries and being a partial owner (later on) while carrying less of the costs due to using a partnership approach gives us faster and additional chances for our share price and value appreciation of discoveries.

Doing it all alone is indeed “romantic” but also often ends up going broke or so highly diluted that the investors do not end up with much of the discovery prize. Yes, our partners would get a bigger piece of the pie but would also carry the financial risks. We can always make the decision to participate or simply carry our royalty, so this gives us the leverage and exposure to the discovery without the financial burdens and share dilution that would come from having to finance in the earlier stage higher risk part of the discovery curve.

A good example would be how Reservoir Minerals owned the copper-gold exploration property in Serbia that had Freeport invest into. With discovery the stock of Reservoir had a great run from 30 cents to over $8.00 and eventually a full company take out by Nevsun. This is typical for the Prospect Generator success and having a minority interest in a great discovery still locks in a huge win for Riverside shareholders. Evrim Resources (EVM.V) is another example of what it looks like to be on the verge of a discovery as a Project Generator and we’ll see what moves they decide to make next. The stock has moved up highly on the results and having partners funding the work. Riverside’s business model is no different.

Making a company-making discovery is an incredible step for any exploration company and Riverside has developed the portfolio and knowledge over the past decade to increase the company’s odds of making a major discovery itself or through one of its partnerships.”

John-Mark, you have a PhD in economic geology. Could you elaborate a bit on your career, and why you decided to become the CEO of a prospect generator?

“After graduating from Harvard I went to work with the United States Geological Survey (‘USGS’) including a major research project on Mexico. I then worked for Kennecott Exploration (now a division of Rio Tinto (RIO)) where we were lucky to consolidate a key prospective project called Mulatos in Sonora which is now the central asset of Alamos Gold (AGI, AGI.TO). After the drilling discovery at Mulatos, I began studying for a PhD at the University of Arizona and complete a doctorate in Economic Geology focusing mineral deposits of Mexico.

As a graduate student at the University of Arizona I continued working for the USGS with a focus on the mineral wealth and distribution of deposits with a focus to estimate the potential for undiscovered deposits in Mexico. We completed various studies and have used these as part of the background to lead Riverside toward discoveries in diverse commodities in various parts of the country.”

Riverside usually gets cash payments, a commitment to spend money on exploration and a bunch of stock as part of the consideration for an earn-in deal. What is Riverside’s policy on keeping/holding the shares of joint venture partners?

“In detail each JV partnership is structured differently and depends on what each side wants/needs, but we have a theme of money in the ground, recovering our costs through payments, having carried interest of ownership and always an uncapped royalty.

This is a way Riverside reduces dilution (with cash and share payments) but we always remain fully exposed to an uncapped upside. We often also provide operational services with our technical people able to do the work efficiently. Sometime this is through spin-out deals, where a Junior or private company would earn-in to own an interest and we would have shares of the company. Throughout Riverside’s lifetime, the company has helped 7 private co’s spin out projects and complete IPOs. Now that’s pretty neat and quite an achievement!

Riverside has also been able to secure Strategic Exploration Alliance partnerships with major companies like Kinross Gold (KGC, K.TO), Cliffs Resources (CLF), Hochschild Mining (HOC.L) and Antofagasta (ANTO.L) to explore and work with them on new target generation in Mexico. This has brought our entire team’s knowledge base up tremendously.

Riverside leverages off of significant ‘generative’ exploration funding from majors that allows the company to add quality properties to the portfolio that are or can become owned 100% if the partner decides to not keep funding. Perhaps more importantly these Alliances allow the company to review and evaluate hundreds of opportunities and lay the foundation for future deal flow and transactions in Mexico.

On top of all of the partner-funded work and potential value creation that already exists, Riverside will continue leveraging all of the previously funded knowledge gained to acquire more and more of the high quality targets it has identified in Mexico.”

Project Specific questions

Last quarter (May), you announced an update on the Glor gold project, which is a project where Centerra Gold (CG.TO) is earning an interest in. Although the 2017 drill results weren’t delivering the goods, it looks like Centerra shares your view on the Canasta target, which was recently added to your portfolio. A 3.5 kilometer long structure was identified through an extensive soil sampling program. What excited you about the sampling results, and what are the next steps?

“Yes, the actual main Glor concession has been tested and we will return that project to Argonaut Gold (AR.TO), but we can keep our tenure on the concessions we staked. We are pleased to have run a quality exploration and great example how we are exposed to the upside with limited downside. Riverside is a great investment because we leverage our ideas and partner with quality funded miner producers to de-risk assets. In the case of Glor the exploration so far has not panned out.”

Does this mean the Canasta zone will be your primary focus at Glor, going forward?

“The Canasta zone is our best part now and the focus, but overall we like our other targets more as recent results at La Silla and Cecilia are showing high promise for expanded discoveries.”

During our visit in February, we spent an entire day kicking (and smashing) rocks at Cecilia with Ron Burk, your Vice-President Exploration. He had a very plausible exploration theory, so we are keen to see some action at Cecilia. Are you still negotiating with potential partners on this project? Is a drill program this year likely?

“Yes, we are negotiating with prospective partners at Cecilia. It’s our lead asset and we’re keen on getting good workable deal terms finalized to advance Cecilia with further exploration. Riverside has worked hard on this asset sampling high-grade mineralization, identifying drill targets, completing drill permitting and acquired 7 times of additional ground at the asset. Cecilia is a turn-key asset for a JV partner to step into and advance with continued exploration and future drilling.”

Two other projects where very little work has been done in 2017, but that could be ‘company makers’ are the Peñoles and Tajitos projects. Could you elaborate a bit on the background of both projects, and what you are looking to achieve there?

“Riverside has two key advanced precious metal assets in Mexico with the Peñoles project which has a resource estimate on the project and identified high-grade silver at the Jesus Maria target. Bringing on a partner on Peñoles is something we are working on as well as our own focusing on the high grade, near surface, as there is an excellent target there.

The Tajitos gold project is a high grade and prime spot next to Fresnillo’s (FRES.L) gold resource of the same project name. We just completed funding a Master’s Thesis on the structural control of gold mineralization on Tajitos and are pleased to see the fine outcomes continue to improve our understanding of this gold system. Tajitos could be a future mine with presence of gold, excellent leach qualities as shown by studies done by Fresnillo and good location with infrastructure, but it is a matter of time and at the point of mining who will be the owner.”

Riverside Copper

Now the copper price seems to be consistently trading around $3 per pound (it’s a little bit weaker right now), there seems to be a renewed interest in copper projects and copper exploration. Do you also notice that at Riverside Resources?

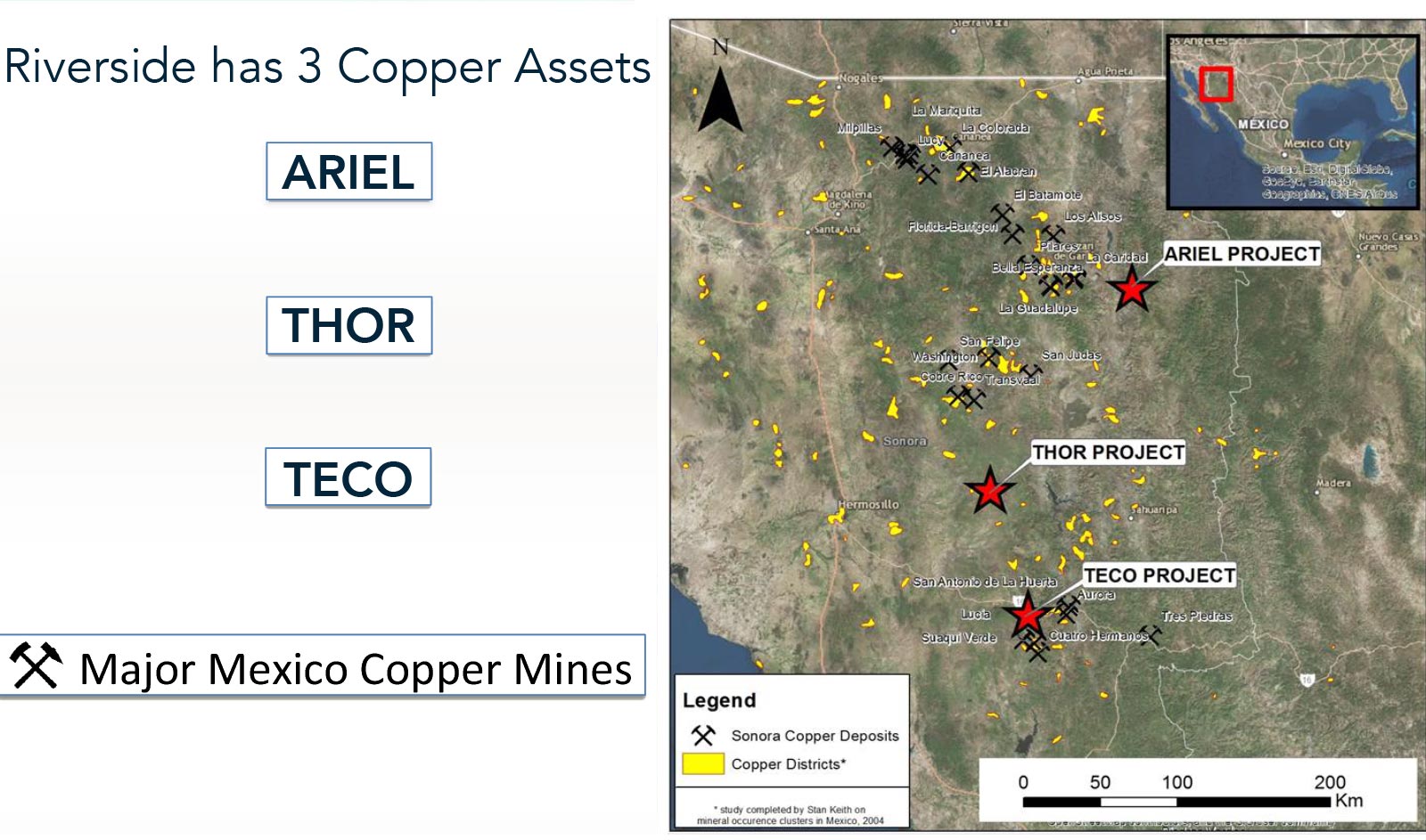

“Yes, there is a lot of interest in copper. Copper has done very well over the last year and we have a portfolio of early stage copper assets. At Thor we hit porphyry copper in ¾ holes drilled. We have had interest in our Copper assets and have been busy showing these assets to majors and juniors. We like copper fundamentals and Mexico has a good history as a copper producer. There are operators in country and an ability to partner our copper assets with a good range of companies.”

When we visited some of your projects, back in February, we encountered several huge copper mines, where Mexican groups (Grupo Frisco, Grupo Mexico, Penoles) were mining large porphyry systems, similar to the huge Arizona copper mines. Do you think there’s potential to discover more of those super-large porphyry deposits?

“Yes, there is amazing potential and some new discoveries were found just last year near our projects. The discoveries are able to be made cost effectively and progressed rapidly as we see with Rio Tinto, Teck, Freeport all interested in being part of Mexico copper discoveries. There is very good potential and the coming 24 months is an ideal time with copper prices moving favorable and Mexico having extensive undrilled target areas.”

Let’s stick to the copper side for a second. Are those large operators also actively exploring for additional orebodies? Or are they purely focusing on their existing operations? Do companies like Frisco/Mexico have exploration teams? Or do they prefer to let smaller companies do the hard work, and move in once a mineable and economic resource has been found?

“Although the operators have small exploration groups they need and look to juniors like Riverside to work up and make discoveries. The operators are so focused on their existing operations that it is hard to take the time for new discoveries. This makes a perfect fit for Riverside to bring drill ready good assets like at Thor, Ariel and Teco to name a few to existing producer copper companies.”

Conclusion

Riverside appears to be gearing up for a busy summer period, as it’s advancing its projects in order to find a suitable partner. Reading between the lines, it sounds like Riverside is expecting to announce a few new joint venture agreements later this year, and we would be very excited should a deal be made on the Cecilia project (which is our favorite!).

CEO John-Mark Staude has the passion and the drive to see everything through, and with Riverside advancing on different fronts, the news flow should pick up in the second half of the year.

Disclosure: Riverside Resources is a sponsor of the website. The author currently has a small position in Riverside Resources but could increase this at any moment. Please read the disclaimer