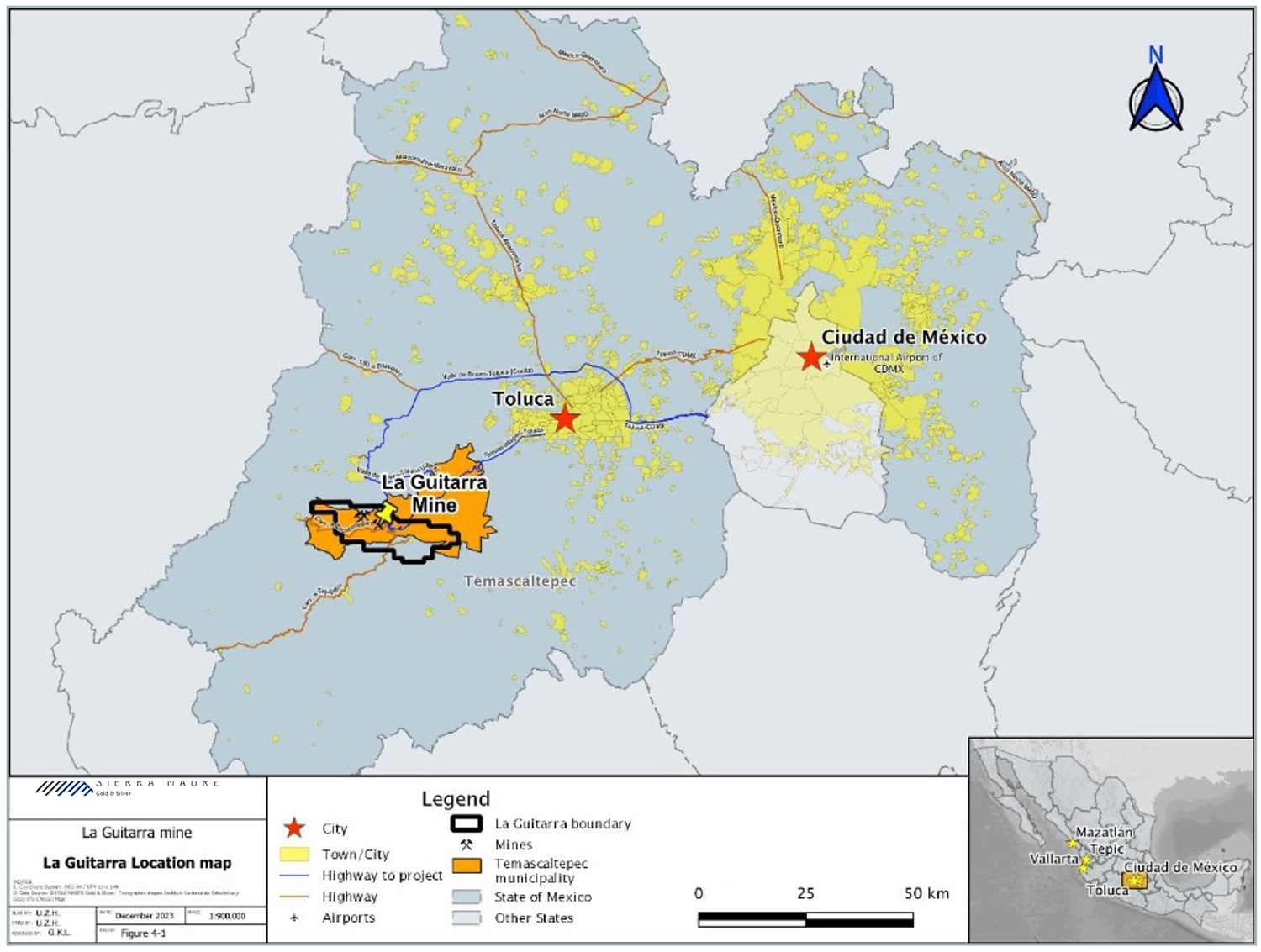

Sierra Madre Gold and Silver (SM.V) recently published the results of the second quarter of its financial year. While the company remained profitable and free cash flow positive, investors should see a profit and FCF acceleration in the second half of this year as Sierra Madre plans to boost the average grade of the processed material thanks to continued underground development work and the contribution of the Coloso mine, which has a higher average grade.

Additionally, the proceeds of the recently closed C$19.5M financing have put the company on solid financial footing and will accelerate the expansion plans at La Guitarra. We will catch up with CEO Alexander Langer after the summer, but we already wanted to provide a first look at the Q2 results as these will set the scene for what appears to be a busy second semester.

The production numbers and cash flows were encouraging in Q2 2025

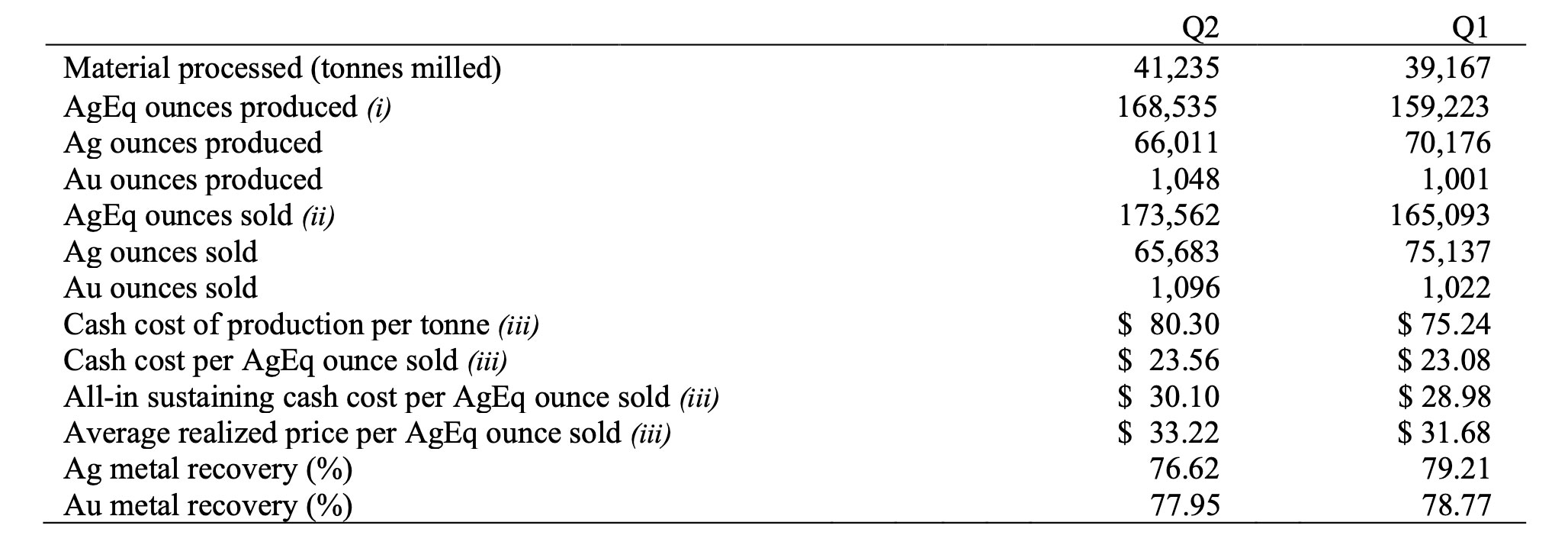

In the second quarter of this year, the company produced just over 1,000 ounces of gold as well as approximately 66,000 ounces of silver. This represents a total production of approximately 168,000 ounces of silver equivalent and the company sold just over 173,000 ounces of silver-equivalent at an average realized price of just over $33 per ounce. Considering the all in sustaining cost per silver equivalent oz that has been sold was just over $30, the company was slightly free cash flow positive on the mining level.

The mill processed just over 41,000 tons of material with recovery rates of almost 78% for the gold and 77% for the silver, and that’s in line with the recovery rates we have seen so far.

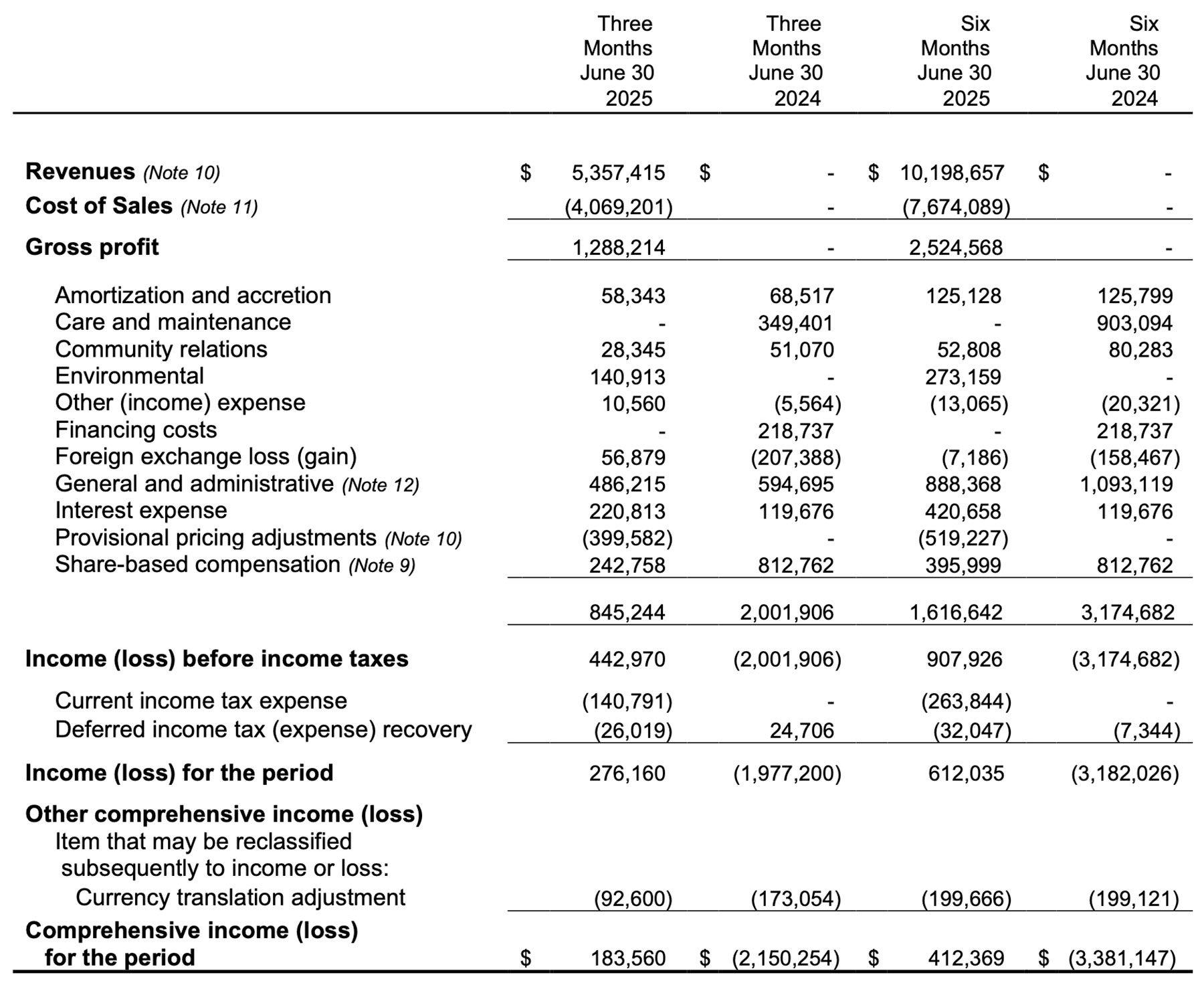

This resulted in a total reported revenue of approximately 5.36 million USD resulting in a gross profit of almost 1.3 million USD. Sierra Madre was profitable as the bottom line once again indicated a net income, this time to the tune of approximately 276,000 USD. But as the weighted average share count was approximately 154M shares, the reported EPS was still $0.00.

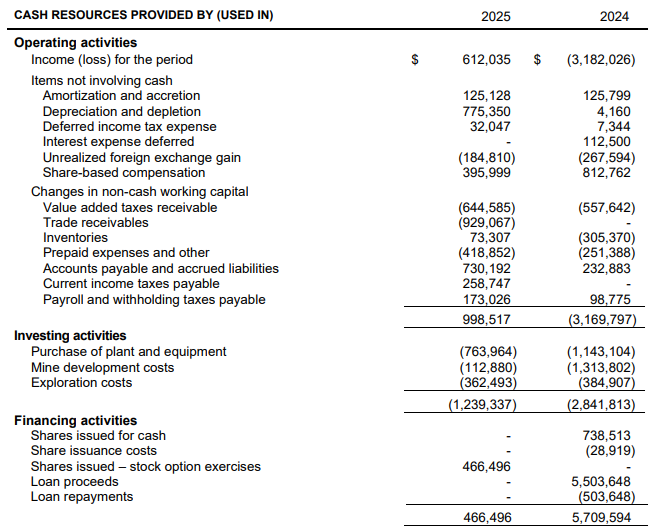

The cash flow statement for the first six months of the year indicates an operating cash flow of US$1M, but this includes approximately US$0.75M in working capital changes which means the underlying operating cash flow was approximately US$1.75M. As you can see below, the total amount of capex incurred in the first semester was approximately US$1.24M which means the company was free cash flow positive to the tune of US$0.5M in the first semester. While being cash flow positive is great, no one really gets very excited about an annualized free cash flow result of US$1M.

But instead of looking at the past, investors should look towards the future. The situation should continue to improve in the second half of the current financial year considering the company had to deal with an earlier than usual rainy season in Mexico and the Coloso ramp-up during the second quarter. Additionally, Sierra Madre is anticipating the head grade of the processed material to increase in the second half of the year and this should result in an excellent combination of a higher production and lower mining costs.

As you may remember from a few months ago, the company has announced that it is working to restart production at the Coloso mine about half a year ahead of schedule. As per the company’s guidance, the average grade at Coloso is quite a bit higher with an indicated resource of 432,000 tons and an average grade of 221g/t silver and 1.67 g/t gold. On average, the grades of Coloso are 70% higher in silver content and approximately 20% higher in gold content compared to the general grades that have been mined recently. During the second quarter, Sierra Madre mined approximately 649 tons of mineralized material at Coloso, followed by almost 600 tons in July after the company opened up additional stopes to maximize the production efficiency.

The recently completed capital raise will allow the company to expand

At the end of June, Sierra Madre still had a positive working capital position of approximately US$3.3M, but in order to accelerate the production expansion, Sierra Madre Gold and Silver tapped the equity markets. Originally announced as a C$10M placement, the company upsized it twice and ended up raising C$19.5M in additional capital.

A total of 27.86M units were sold at a price of C$0.70 per unit. Each unit consisted of one common share of Sierra Madre as well as a half warrant with each full warrant allowing the warrant holder to purchase an additional share at C$0.85 during a 12 month period (until July 2026).

The net proceeds of the financing will be used to increase the throughput at the La Guitarra mining and processing facility to unlock additional economies of scale. And as the company raised almost twice the amount it was originally eyeing, we anticipate Sierra Madre to also accelerate additional mine development activities as well as kicking off a comprehensive exploration plan to increase the current resource base at La Guitarra.

Conclusion

Sierra Madre brought the La Guitarra silver-gold mine back into production in a pretty short time frame, but as the milling capacity of the processing plant is relatively limited and as the company is still investing in mine development and acquiring new equipment or refurbishing old equipment, the reported free cash flows remain relatively weak.

The C$19.5M cash injection will help. Increasing the throughput of the processing plant should unlock additional economies of scale (reducing the operating cost on a per tonne basis). On top of that, we expect to see an improvement on the head grade and AISC per ounce in H2 as the mill will process more rock from the Coloso mine, which has a higher average grade.

It feels like the company is at a turning point. And the US$16M+ working capital position will definitely be helpful for Sierra Madre to achieve its objectives.

Disclosure: The author has a long position in Sierra Madre Gold & Silver. Sierra Madre is a sponsor of the website. This report is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our disclaimer.