Less than two years ago, Southern Silver (SSV.V) reached a low of just 2.5 cents per share giving it a market capitalization of less than C$1.5M. This gives you a good indication of how bad the markets were back then, and how the market didn’t even care about good properties.

Fast forward to now, the summer of 2017. Southern Silver’s joint venture partner, Electrum, has completed the initial earn-in phase on the property, and a maiden resource estimate at CLM unveiled a total silver-equivalent resource of almost 115 million silver-equivalent ounces, putting the company and project on the map.

In this initial report we will focus on the Cerro Las Minitas flagship project in Mexico. The company’s Oro project in New Mexico is also very intriguing, but we will discuss Oro in more detail in a next report.

Cerro Las Minitas, Southern Silver’s flagship project

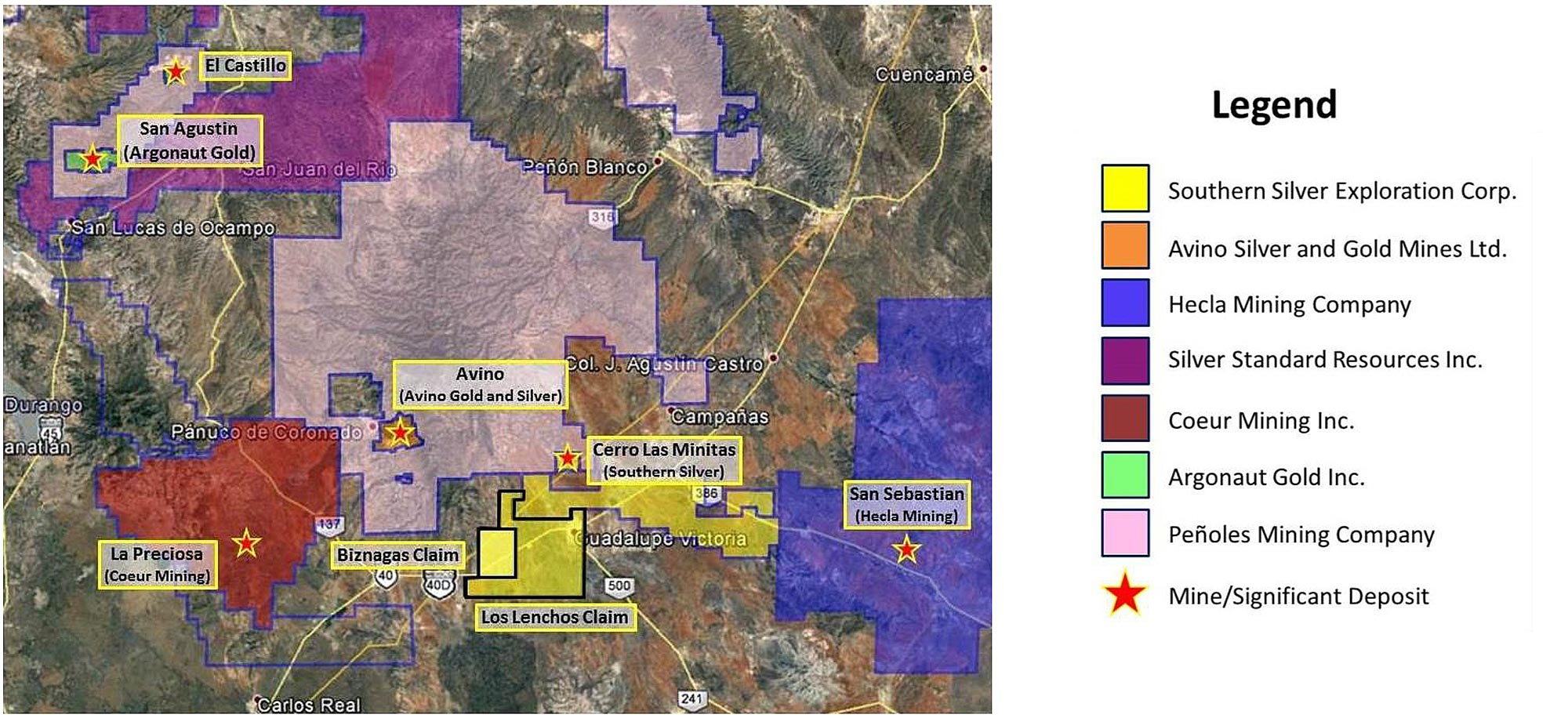

There’s very little doubt the Cerro Las Minitas project is Southern Silver’s main focus as it is continuing its exploration activities in an attempt to increase the currently known resources. Cerro Las Minitas (hereafter sometimes called ‘CLM’ for simplicity sake) is Southern Silver’s 23,240 hectare property located just 70 kilometers to northeast of the city of Durango, in Mexico’s Durango state.

Southern Silver started the earn-in procedure to acquire a 100% ownership in these claims in 2010, and in 2014 it effectively completed the requirements of this earn-in agreement. Once it owned the entire project, SSV was able to attract the Electrum Group as a joint venture partner with Electrum earning up to a stake of 60% in the property (see later).

Electrum has now completed its earn-in for its 60% interest in the CLM by funding this year’s US$2.0M drill progam which has resulted in the company substantially increasing the mineralized zones after discovering the so-called ‘Blind Shoulder’ and a new target along strike SE of the known resource (see later). Subsequently, SSV and Electrum have now formed a 40/60 joint venture for further advancement of the CLM project.

The current resource estimate is just the start

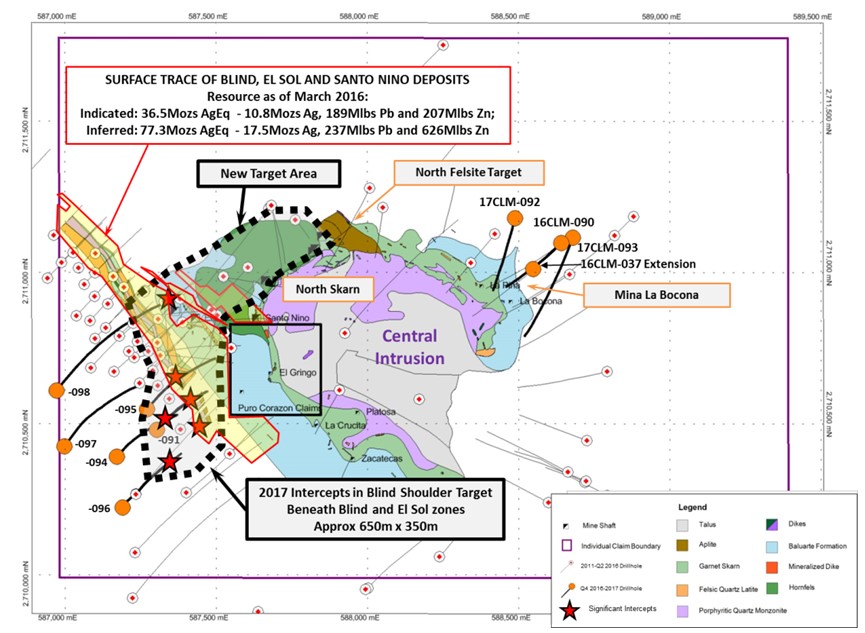

In the first five years of this decade, Southern Silver had completed in excess of 32,000 meters of drilling which resulted in the discovery and delineation of three mineralized zones called Blind, El Sol and Santo Nino. On these zones, Southern Silver initiated a maiden resource calculation to get a better understanding of what it was sitting on.

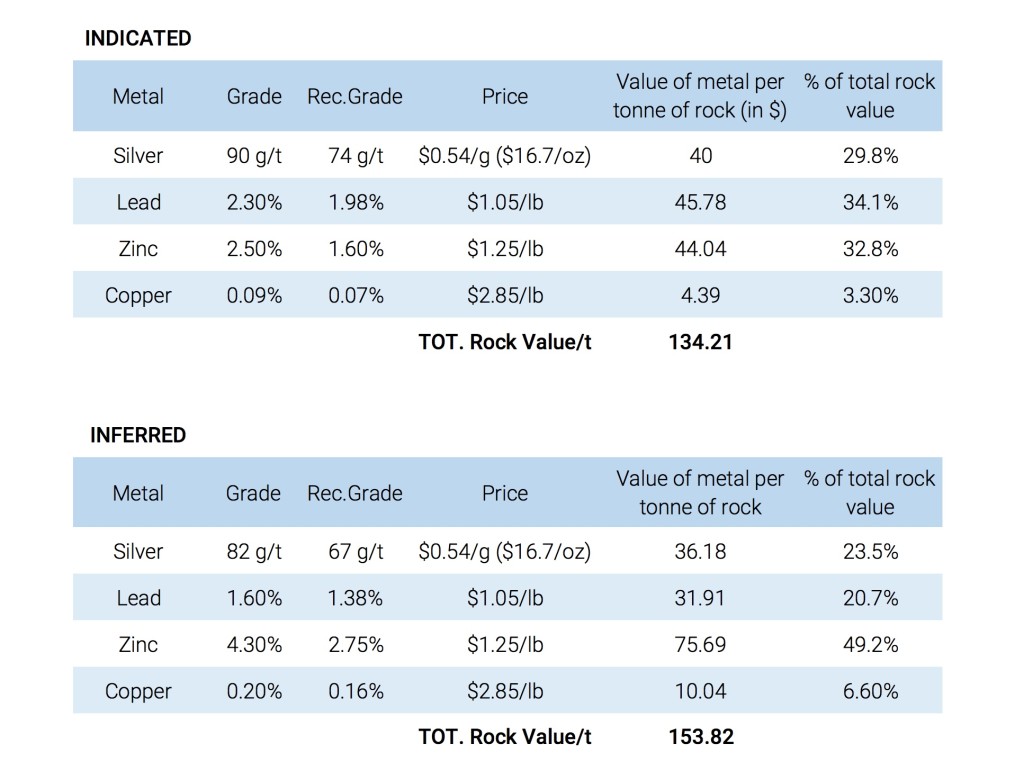

This initial resource estimate contained 3.7 million tonnes in the indicated resource estimate at an average silver-equivalent grade of 305 g/t, with an additional 6.6 million tonnes in the inferred resource category at an average grade of 363 g/t silver-equivalent.

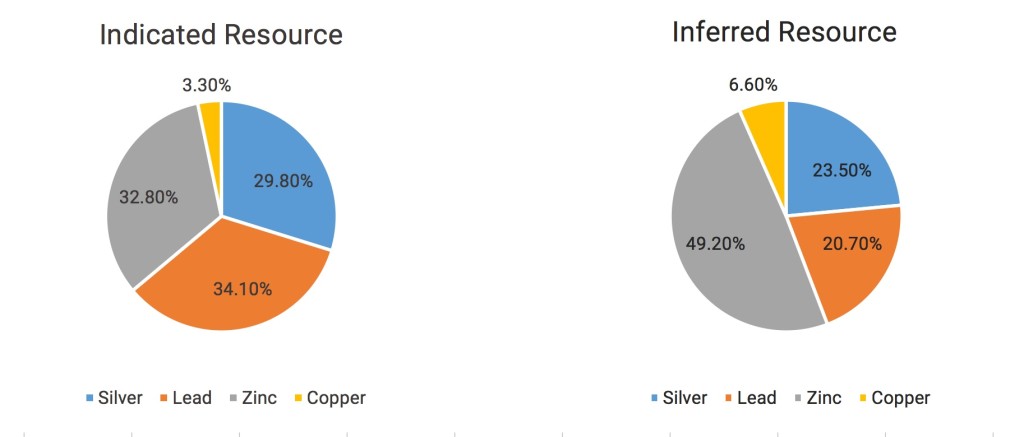

What’s also really interesting is the fact that due to the low silver price, it might make more sense to consider this to be a zinc project rather than a silver project. Have a look at how the relative weight of the minerals is in the indicated and inferred resource estimate (using a recovery rate of 82% silver, 86% lead, 80% copper and 64% zinc (0.88 X 0.73% recovery rate to get to a saleable concentrate – see later. No payability discounts have been applied), ignoring the (low) gold values (for now, as the gold-richer zones which have been discovered this year will increase the average gold grade at Cerro Las Minitas).

This is visualized in the next two pie charts:

As you can see, just 30% of the indicated resource and 23.5% of the inferred resource are ‘pure’ silver ounces (based on the currently known recovery rates), so Cerro Las Minitas should be seen as a polymetallic deposit with base metals representing the largest part of the in situ recoverable value per tonne of rock. This isn’t your average Mexican silver project but rather is a text book example of a silver-lead-zinc project. And that’s a good thing, as even when the precious metals prices are down the drain, Cerro Las Minitas’ base metal component could ‘save the day’.

The preliminary metallurgical test results are very encouraging

Defining a resource with an acceptable grade is one thing, but it doesn’t mean you’re sitting on a viable deposit before you know for sure you can recover the metals from the rock. Especially the zinc-rich deposits could be a bit tricky as the zinc concentrate will need to reach an average grade of 48-52% zinc to be accepted by the smelters.

When the company announced its preliminary metallurgical test work, it became clear Southern Silver will be aiming to produce both a lead concentrate and a zinc concentrate. In a first step, a lead zinc concentrate would be created which would see the company recover 82% of the silver and 86% of the lead. This resulted in a rougher lead concentrate with a lead grade of 61.5% Pb (which is below the needed 65-70%), and this was later upgraded to a clean & saleable concentrate with a lead grade of 71.1%, thus meeting the smelters’ requirements. Keep in mind 12% of the zinc also reported to the lead concentrate, which also has an average grade of 4.8% zinc and almost 4,000 ppm Arsenic which reports primarily to the iron (as arsenopyrite) which can be rejected.

The company also disclosed a subsequent zinc flotation circuit recovered 79% of the zinc in a rough concentrate with a zinc grade of 39.5%. As this is below the 48% benchmark, Southern Silver needed an additional two-step cleaning process to ‘upgrade’ the rougher concentrate to a clean concentrate with an average grade of 49.7%. Upon reviewing the documentation associated with these metallurgical tests, it looks like the total recovery of the zinc mineralization was approximately 73-74%, even àfter adding the two additional cleaning processes, and that’s a remarkably good result (as a comparison, Tinka Resources in Peru saw its recovery rate drop from 98% to just 60% in its attempts to create a saleable concentrate). Considering 12% of the zinc reports to the lead con, the ‘real’ net recovery rate of zinc to get to a clean concentrate will be approximately 64% (although we expect this number to increase).

These test results are obviously preliminary in nature, and we expect Southern Silver to focus on reducing the zinc grade in the lead concentrate and to reduce the Arsenic values in both concentrates. They should also try to increase the total % of the zinc immediately reporting to the rough zinc concentrate. The zinc in the lead con by itself won’t be penalized, but the smelters very likely just won’t pay (full value) for it.

The 2017 exploration program is in full swing

Thanks to the improved financial situation of the company and the strong backing of Electrum, assay results have been rolling in throughout the year so far, as Southern Silver is trying to define the edges of the Cerro Las Minitas deposit. Of specific interest were the company’s two most recent exploration updates, as these have completely changed the perspective of the asset.

On July 11th (press release), Southern Silver released the assay results from hole 98, where it intersected a thick layer of mineralization with 53.8 meters (almost 33 meters true width) containing almost 3.5 ounces of silver as well as 0.9% copper per tonne at a down-hole depth of 1086 meters.

Not only is it encouraging to find a continuation of a thick layer of mineralization, the location of hole 98 is intriguing as well as this actually was a step-out hole from the currently known skarn mineralization at Cerro Las Minitas. Whereas the current resource could definitely be best described as ‘poly-metallic’, hole 98 seems to indicate there’s an additional copper-rich zone in this new target area. According to VP Exploration Robert MacDonald, this could indicate a transition into a ‘hotter’ endo-skarn part of the mineralized system.

But if there’s anything you need to remember, this hole validated the Blind Shoulder target which is a new target along the west-northwest-northern part of the currently known mineralization. This zone has now been modelled at approximately 800 meters down dip and in excess of 600 meters along strike.

This excellent update was followed up on with the results of hole 101, which actually further increased the size of the Blind Shoulder target. Whereas the company previously thought this zone was closed off towards the south-east, hole 101 intersected several mineralized layers with impressive average grades (for instance 12.5 meters true thickness containing 154 g/t silver, 2 g/t gold and 7.1% ZnPb). This assay result opens up an entirely new target area along strike of the current resource estimate, but much closer to surface (and with higher gold grades) than for instance the Blind Shoulder target.

Unfortunately the drill program will end soon as the remaining drill rig on site will very likely complete its activities within the next four weeks. Then it’s up to Southern Silver’s geologists to interpret the data and to design a new drill program to further increase and improve its understanding of the Cerro Las Minitas project.

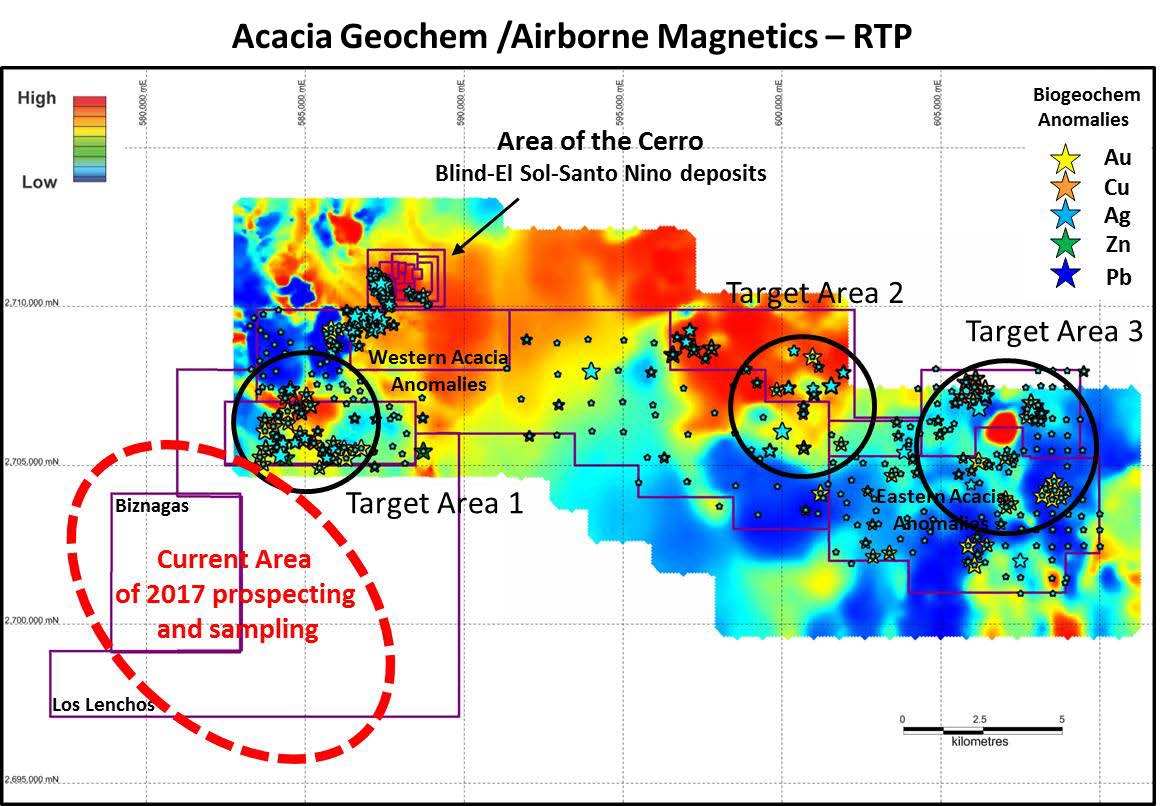

Biznagas and Los Lenchos: New discoveries, but another system

Southern Silver is also exploring on the newly acquired Biznagas and Los Lenchos claims which are located right next to Cerro Las Minitas. Even though these claims are contiguous to CLM, the mineralization is different and Southern Silver planned to search for epithermal gold-silver veins (rather than the skarn and CRD mineralization at CLM).

This also means that should Biznagas and/or Los Lencho host economic gold-silver deposits, Southern Silver will have to process the rock using a different process than the CLM ore. This means it could make sense to explore ‘strategic alternatives’, as the rock will be pretty similar to for instance the mineralization encountered at the Avino silver-gold mine, operated by Avino Silver & Gold Mines (ASM.V, ASM).

Of course, it’s still very early days at Biznagas and Los Lenchos, but it’s interesting to see Southern Silver was able to pick up large parts of what seems to be an entire precious metals district as Hecla Mining’s (HL) San Sebastian project, Coeur Mining’s (CDE) La Preciosa silver project and Argonaut Gold’s (AR.TO) El Castillo and San Agustin projects are all located within walking distance from Cerro Las Minitas, Los Lenchos and Biznagas. Plenty of options, but let’s first see what the drill bit will pull out of the ground on these two claims.

Southern Silver currently owns 40% of CLM

Despite having completed the earn-in requirements resulting in Southern Silver owning 100% of Cerro Las Minitas before the end of 2014, the capital markets remained closed for exploration stage companies.

That’s why Southern Silver was approached by the Electrum Group to create a joint venture to jointly advance (and develop Cerro Las Minitas). As part of the deal, Electrum had to complete US$2M of exploration expenditures in the first 18 months after signing the deal to earn an initial 30% stake followed by two additional US$1.5M commitments to earn a definitive 60% stake in Cerro Las Minitas. This process was completed in December of last year, and Southern Silver and Electrum are now officially in a 40/60 joint venture.

Cerro Las Minitas property with drill rig in 2015

The company’s share structure, cash position and management team

As of at the end of May, Southern Silver had a total share count of 87.2M shares, but the company was also in the process of raising C$5M in a non-brokered private placement, priced at C$0.40 per unit (with each unit consisting of one common share and a full warrant, allowing a warrant holder to acquire an additional share of Southern Silver at C$0.55 for a period of three years).

A first tranche (C$2.55M) was already closed in June which resulted in the addition of 6.37 million new shares to the share count (bringing the current pro-forma share count to 93.6M shares). That’s the current situation, but we expect Southern Silver to close a second (and final) tranche of the financing within the next few weeks as the company received approval from the Exchange to extend the closing date until August 16th. It’s possible the company won’t raise the entire C$5M but as its share price is now trading above the placement price and as the base metal prices are gaining momentum again, we are quite optimistic Southern Silver will be able to raise a decent amount in the second tranche, allowing it to continue to contribute its 40% of the total exploration expenditures.

Management Team

Lawrence Page – President & Director

Lawrence Page obtained his law degree from the University of British Columbia in 1964 and was called to the Bar of British Columbia in 1965 where he has practiced in the areas of natural resource law and corporate and securities law to the present date. Through his experience with natural resource companies and, in particular, precious metals development, Mr. Page has established a unique relationship with financiers, geologists and consultants and has been counsel for public Companies which have discovered and developed producing mines in North America. Specifically, he has been a Director and Officer of Companies which have discovered and brought into production the David Bell and Page Williams mines in Ontario, the Snip, Calpine/Eskay Creek and Mascot Gold Mines in British Columbia, as well as the discovery of the Penasquito Mine in Mexico.

Mr. Page is the principal of the Manex Resource Group of Vancouver which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. He currently serves as a director of six public companies, including Homestake Resource Corporation, Bravada Gold Corporation, Quaterra Resources Inc., Southern Silver Exploration Corp. and Valterra Resource Corporation.

Robert W.J. Macdonald – VP of Exploration

Mr. Macdonald is the Vice President of Geological Services for the Manex Resource Group of Companies and in such capacity has been the Exploration Manager for several publicly listed companies including Homestake Resource Corporation (formerly Bravo Gold Corp.), Southern Silver Exploration Corp., Valterra Resource Corporation, Duncastle Gold Corp. and Fortune River Resource Corp. Mr. Macdonald has overseen the exploration of many projects throughout North America including the discovery and delineation of the high-grade 1.2 million ounce Homestake Ridge Au-Ag deposit in northern British Columbia and is currently advancing Southern Silver’s 10 million tonne Cerro Las Minitas Ag-Pb-Zn project, Durango State, Mexico. Mr. Macdonald graduated with a B.Sc. (Hons) from Memorial University of Newfoundland in 1990 and earned a MSc. from the University of British Columbia in 1999. Over his career in the geosciences Mr. Macdonald’s work has focused on vein and intrusion-related gold systems and VMS environments. Prior to joining Manex, Mr. Macdonald worked as a geologist with the British Columbia Geological Survey and Teck Exploration on projects in Alaska, Peru and British Columbia.

Graham Thatcher – CFO

Mr. Thatcher moved from London, England to Vancouver, British Columbia in 2006. Specializing in financial reporting and auditing across a breadth of business sectors in both the UK and Canada, he brings extensive experience of operating with International Financial Reporting Standards and paperless systems. He is also senior accountant at Manex Resource Group which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. Prior to this, he worked in public practice at Smythe Ratcliffe LLP with companies in the mining and exploration sector. Mr. Thatcher obtained a Bachelor of Arts degree with Honours in Economics from Lancaster University in 1995, which included a one year program at the University of British Columbia. He is also a finalist of global accounting designation, the Association of Chartered Certified Accountants (ACCA). Mr. Thatcher is also volunteer board member and treasurer at Heritage Hall Preservation Society, a non-profit charitable organization whose mandate is to restore and manage Heritage Hall, a landmark building located in Vancouver.

The Oro property

Although we fully focused on the Cerro Las Minitas flagship project, you shouldn’t discount the company’s 100%-owned Oro property in New Mexico at all. Most attention will indeed be aiming at CLM but Southern Silver is doing some work on its 100% owned Oro project as well.

Earlier this year, SSV has completed a 300-kilometer airborne survey over the 1600-hectare property and the results of this survey have identified numerous potential target areas.

At the end of last year, Southern Silver announced the assay results of its 2016 RC drill program, where the drill bit intersected a thick zone of anomalous (oxide) gold mineralization, with an interval of 41 meters containing 0.42 g/t gold and 12.2 meters at 0.23 g/t gold.

Needless to say Southern Silver’s plans to follow up on these intriguing drill results are 100% justified and even though most attention will be directed towards Cerro Las Minitas, just realize the Oro property has its merits as well.

Conclusion

The current $2M exploration program at Cerro Las Minitas has resulted in a massive amount of new data and information which will now have to be carefully digested by the company’s technical team. Not only was the new Blind Shoulder discovered earlier this year, the mineralization of the known resource also seems to be extending towards the south east. Simply chasing this structure could immediately add a lot of tonnes to the existing resource.

After releasing the previous resource estimate, Southern Silver guided for an exploration target of 20 million tonnes at 80-120 g/t silver and 4-8% lead-zinc for a silver-equivalent resource of in excess of 200 million ounces. With Blind Shoulder and the SE target now paving the way to add more tonnes to the resource, we would expect Southern Silver to increase its exploration target after the next resource update.

The author has a long position in Southern Silver Exploration. The company will become a sponsor of the website. Please read the disclaimer