When we wrote our initial report on Southern Silver Exploration Corp. (SSV.V) last year, we were confident the company would be able to increase the resource even further and in a follow-up report late last year we started to think SSV would get pretty close to its own exploration target of 200 million silver-equivalent ounces.

And Southern Silver indeed did better than expected, as its updated resource estimate contains approximately 209 million silver-equivalent ounces. That being said, at the current commodity prices, Cerro Las Minitas could increasingly be seen as a base metals project with a silver credit. In this update report, we’ll explain why.

A recap of the project and our expectations

Cerro Las Minitas clearly is Southern Silver’s flagship as it is continuing its exploration activities in an attempt to increase the currently known resource from the existing 209 million ounces silver-equivalent estimate. Cerro Las Minitas (hereafter sometimes called ‘CLM’ for simplicity sake) is Southern Silver’s 26,500 hectare property located towards the northeast of the city of Durango, in Mexico’s Durango state which is just a short drive away.

Southern Silver started the earn-in procedure to acquire a 100% ownership in these claims in 2010, and in 2014 it effectively completed the requirements of this earn-in agreement. Once it owned the entire project, SSV was able to attract the Electrum Group as a joint venture partner with Electrum earning up to a stake of 60% in the property through a US$5 million earn-in. The injection of cash was just what the project needed and resulted in 24,500m of additional core drilling, allowing Southern Silver to publish an initial mineral resource estimate in 2016.

Electrum has now completed its earn-in commitments and owns a direct stake of 60% in the project and a 36.2% stake in Southern Silver (for a total direct and indirect interest of almost 75% in Cerro Las Minitas). Needless to say Electrum has a lot of influence on the (exploration) decision making process and a vested interest in seeing the project develop into a world-class deposit. Being a major investor, Electrum’s interest is strongly aligned with other investors.

A few months before Southern Silver effectively released its resource update, we reported in a Flash Update we were getting increasingly confident in seeing a substantial resource increase as the total size of the mineralized envelope just continued to expand. We also argued using a higher zinc price would also help Southern Silver to increase the silver-equivalent ounces, but we were happy to see SSV continued to use relatively conservative commodity prices in its resource update.

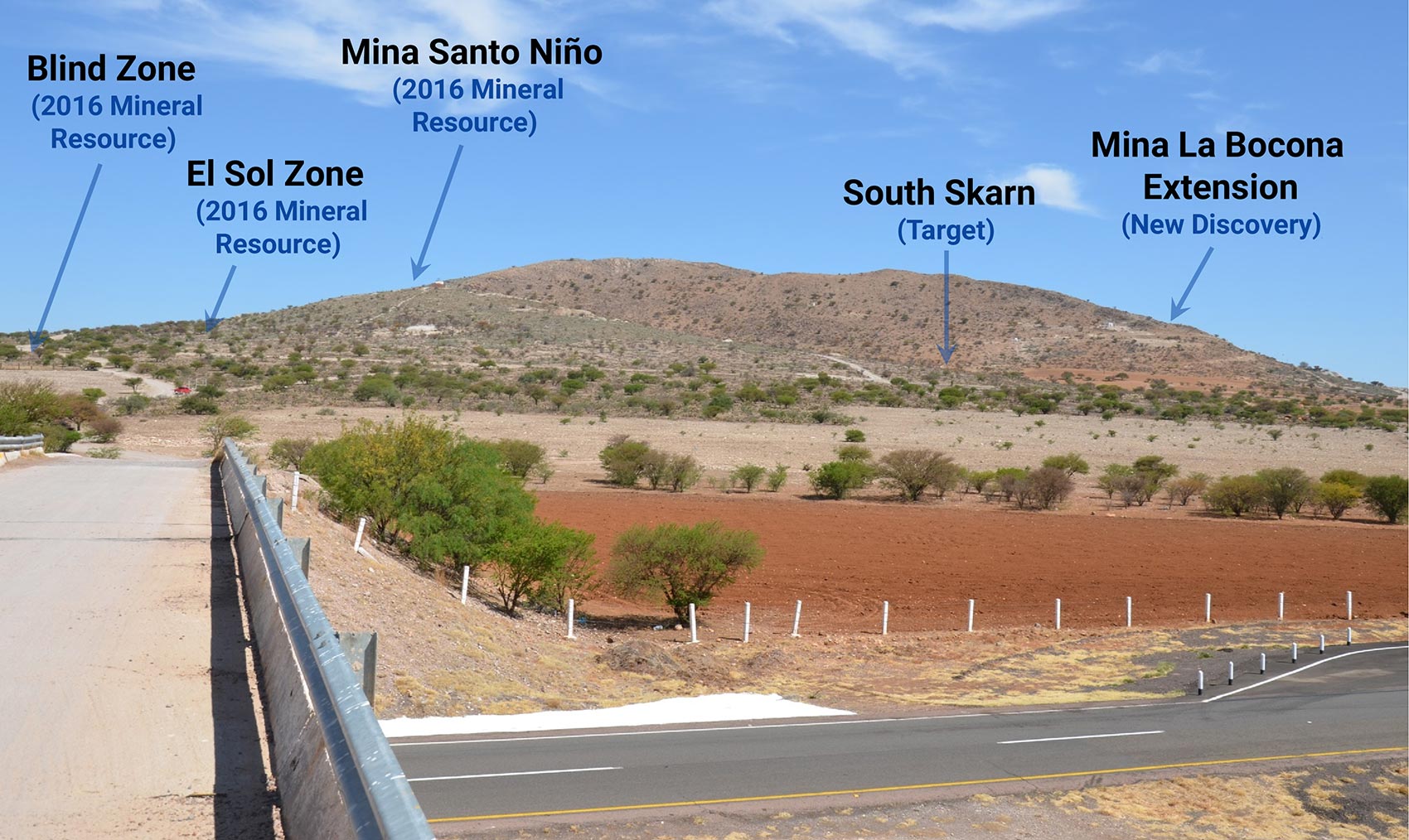

Cerro Las Minitas – Looking North from the Autopista (Highway)

Cerro Las Minitas – Looking North from the Autopista (Highway)

The updated resource definitely beat our expectations

Not only did Southern Silver meet its exploration target, its new silver-equivalent resource estimate came in higher than expected. The majority of the additional ounces were caused by the addition of approximately 9 million tonnes to the resource estimate but the higher lead and zinc prices also helped to increase the silver-equivalent resource. That being said, using a lead and zinc price of respectively $1/lbs and $1.1/lbs is still very reasonable, and it’s good to see Southern Silver didn’t exaggerate.

In the next table we are showing the increase in in-situ resources. We also provided a total based on the indicated and inferred resource categories (Southern Silver isn’t allowed to publish an indicated + inferred resource total, due to the strict NI43-101 regulations in Canada).

As you can see, just over 25% of the total amount of silver-equivalent ounces is effectively pure silver. This ratio increases once we apply the recovery rates and payability ratios for these commodities. For instance, of the total resource of 1.68 billion pounds of zinc, only 906 million pounds will be payable as 8-12% of the zinc will end up in the lead concentrate, whilst the current recovery rate for the zinc concentrate is around 74-78%. On top of that, the zinc contained in the zinc concentrate is only 85% payable (as determined by the smelters who purchase the concentrate. 85% is the standard percentage in the world).

As you can see, just over 25% of the total amount of silver-equivalent ounces is effectively pure silver. This ratio increases once we apply the recovery rates and payability ratios for these commodities. For instance, of the total resource of 1.68 billion pounds of zinc, only 906 million pounds will be payable as 8-12% of the zinc will end up in the lead concentrate, whilst the current recovery rate for the zinc concentrate is around 74-78%. On top of that, the zinc contained in the zinc concentrate is only 85% payable (as determined by the smelters who purchase the concentrate. 85% is the standard percentage in the world).

But despite this, using a zinc price of $1.15/lbs and a recovery rate of 82% and a payability ratio of 95% for the silver and a silver price of $17/oz, the sales revenue from the zinc will still outweigh the revenue generated by silver sales. And as the zinc price remains very strong, it looks like Southern Silver is now ready to look at Cerro Las Minitas as a zinc project with a silver credit. And that’s perhaps the main reason why the 2018 resource update now also contained a zinc-equivalent resource total – an interesting development.

And just for clarity sake; the recovery rates used in our examples will be subject to additional metallurgical testing which might (and very likely will) result in higher overall recovery rates as the flow sheet hasn’t been optimized yet. So there’s definitely room for improvement here.

Yes, an underground mine at these grades is viable. A comparison with First Majestic’s La Parrilla mine

So whilst the company has now confirmed there’s quite a bit of silver and base metals waiting to be mined, it makes sense for us to have a look at the (very preliminary) economics of a potential mining scenario at Cerro Las Minitas. Please note that all assumptions in this part of the report are our own expectations and assumptions (and not Southern Silver’s official guidances) based on publicly available data on other mining operations we consider to be similar.

Whilst the company’s resource estimate shows the ‘in situ’ resources, we will already apply the recovery rates and payability ratios. We summarize everything in the next table.

Note, we used a recovery rate of 76% for zinc. Whilst the vast majority of the zinc content ends up in the zinc concentrate, some of the zinc will report to the lead concentrate. Just to err on the cautious side, we assume the zinc in the lead concentrate won’t be payable. We are also excluding the copper from the scenario for the time being and are using a recovery rate of 80% for the gold, but would hope to see more details in SSV’s next metallurgical update. After all, it could now make sense for Southern Silver to try to produce a copper-gold concentrate.

The next step is to apply the total percentage of recovered and payable metal to the average grade per tonne. Using the average grades provided in the official resource estimate, this is what we came up with:

Note: we used a silver price of $17.50/oz, a zinc price of $1.15/lbs, a lead price of $1/lbs and a gold price of $1250/oz.

So after applying the currently known (or anticipated) recovery rates and payability ratio, the net recoverable rock value per tonne in the indicated resource category is approximately $132/t. That wouldn’t be good enough if you’re mining a deep underground target in Québec, but fortunately the cost of doing business is substantially lower in Mexico.

The technical report on the La Parrilla silver mine (owned and operated by First Majestic Silver (FR.TO, AG)) might provide an excellent example to ‘borrow’ some of the operating costs from. The mine is located in the same state (Durango), and is an underground mine. On top of that, the technical report on this mine is relatively recent (2016), providing an excellent basis to compare. Let’s have a look at the breakdown of the operating expenses of the underground part of the La Parrilla mine:

Even if we would use a higher operating cost of $60/t, the operating margin would remain approximately $65/t (excluding royalties etc). Using the 19 million tonnes in the indicated and inferred resource estimate, this would point in the direction of an undiscounted pre-tax cumulative net cash flow of approximately $1.15B.

Depending on the size and the grade of Cerro Las Minitas, Southern Silver will have to decide on an optimal throughput to maximize the economics of the project. Sunshine Silver’s feasibility study (completed in January 2017) uses a base case production rate of 2,500 tonnes per day and an initial capex of US$316M. Southern Silver’s initial capex will very likely be a bit lower considering it has excellent access to existing infrastructure. So if we would use an initial capex of $280M and a throughput of 2,500 tonnes per day, this is what the economics would look like for Southern Silver’s Cerro Las Minitas project (using an average mill availability of 95%). Note, we have assumed a 15-year mine life with 11 years at $130/t and an additional 4 years at $120/t as net recoverable rock value per tonne.

On a pre-tax basis, our back of the envelope results indicate a potential NPV7% of US$229M. But there are two important remarks here.

On a pre-tax basis, our back of the envelope results indicate a potential NPV7% of US$229M. But there are two important remarks here.

First of all, even a small increase of the recovery rates would add quite a bit of value. According to our calculations, a 2% increase of the recovery rates would result in a 5-7% increase of the NPV7%. And secondly, should Southern Silver indeed be able to boost the total resource to 300 million silver-equivalent ounces, it would very likely be able to increase the annual throughput from 2,500 tpd to 4,000 tpd. This will unlock additional synergy benefits and will reduce the operating expenses due to economies of scale.

And of course, a higher silver price would be a tremendous help for Cerro Las Minitas’ economics. Using a silver price of $20/oz would increase the annual net cash flows by in excess of 10%. So although zinc is the dominating metal in the ultimate product mix, Cerro Las Minitas could be seen as a call option on the silver price as well.

Again, please keep in mind these are very preliminary back-of-the-envelope calculations and these are just meant to give you a very rough idea of the potential economics of Cerro Las Minitas (the final economics will depend on mining sequence, grade variations, different recovery rates for the sulphide and skarn mineralization). Now it’s up to Southern Silver to add more (economic) tonnes to the resources and design an optimal mining and milling scenario. And, granted, a 7% discount rate is a bit on the light side for a Mexico-based operation. Although we were relatively conservative with our metal prices input, we will very likely use a discount rate of 8% in our next calculations.

In the next table we are summarizing 4 different production scenario’s and our pre-tax and post-tax calculations. Again, take these with a pinch of salt as there still are a lot of moving parts at Cerro Las Minitas.

And of course, Southern Silver will have to increase its resources before even considering a 15-20 year mine life at a throughput of 4,000 tonnes per day. So for now, the 4,000 tpd scenario is purely theoretical and hypothetical.

What’s next?

Despite reaching the 200 million silver-equivalent ounce resource target, Southern Silver (and Electrum) have no intention to ‘throttle down’ on the exploration efforts. In fact, the company has published a brand-new exploration target of 300 million ounces silver-equivalent in a 30 million tonne deposit with an average grade of 80-120 g/t silver and 4-8% zinc-lead.

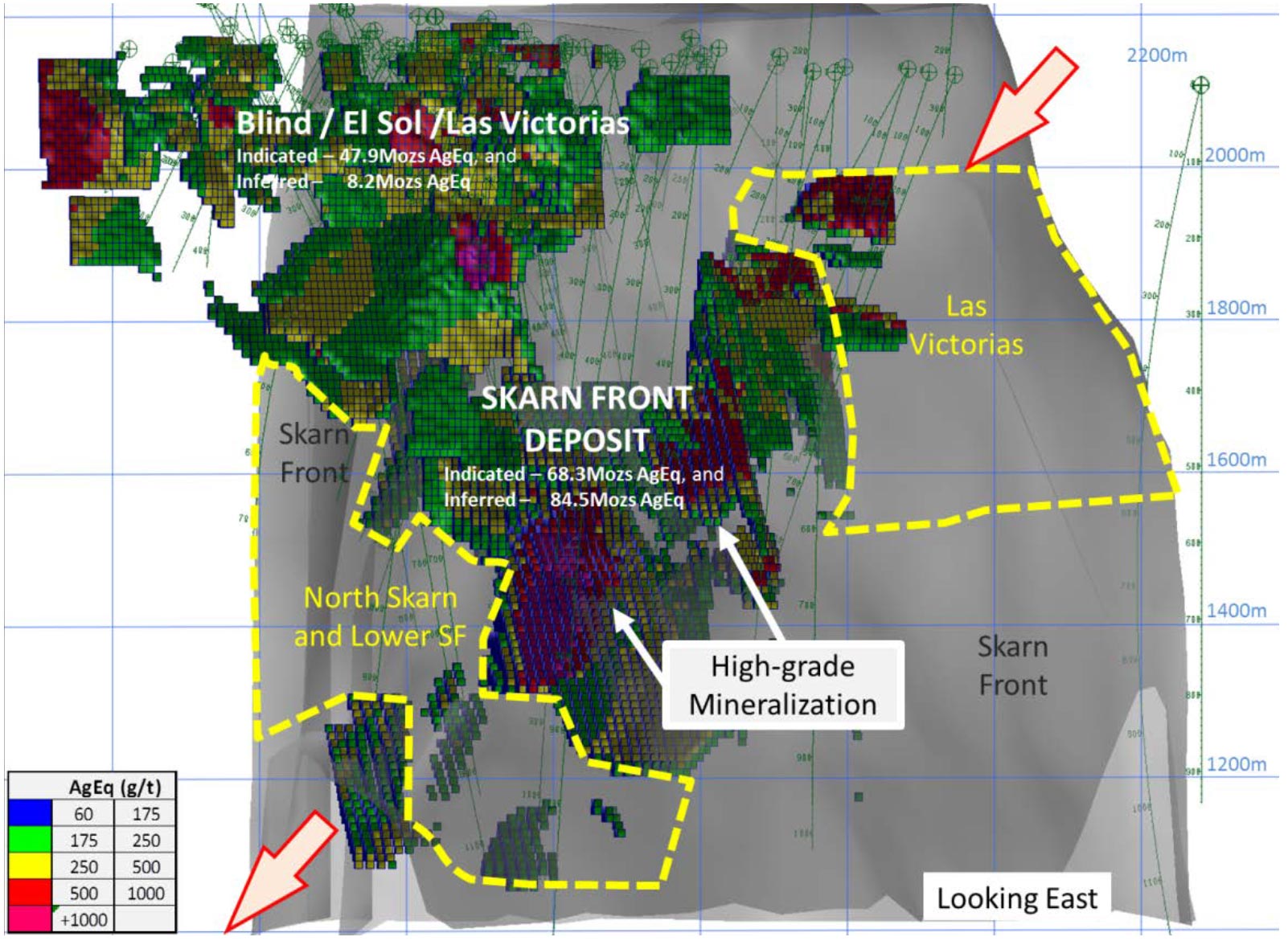

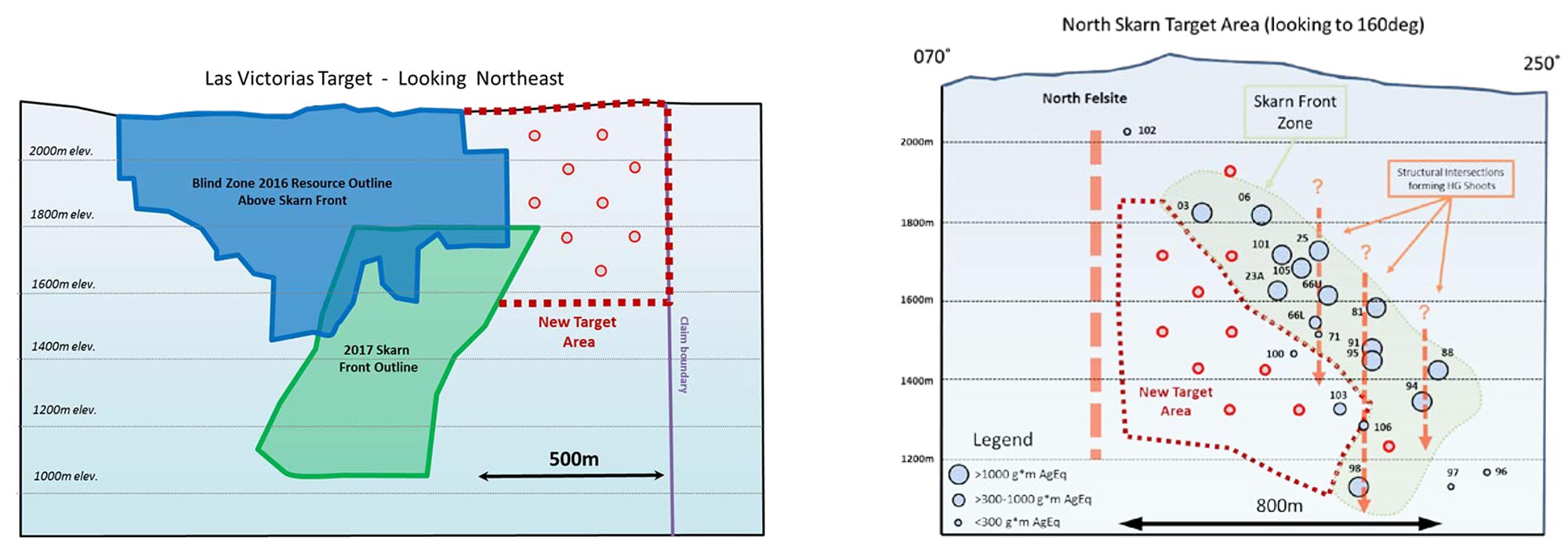

These additional tonnes will very likely come from testing the immediate offsets of the modelled mineral resource within area of the Skarn Front deposit. Off-set drilling in the Las Victorias and North Skarn extensions which will test high priority targets of 500m by 500m and 600m by 300m respectively, offer compelling targets for significant resource expansion in the coming year. The footprints of these two zones are pretty large, and if more economic-grade mineralization could be found, both Las Victorias and North Skarn have the potential to add a few million tonnes of additional mineralized rock to the resource.

But there is more! Exploration won’t remain limited to the two aforementioned zones, as Southern Silver will also try to identify new mineral deposits in close proximity to the Cerro Las Minitas project. Southern has been busy for the last several months developing drill targets on its newly acquired CLM West claim group. Here the company is focused on the development of precious-metal-enriched epithermal vein systems similar to those at Avino’s (ASM, ASM.TO) nearby gold-silver mine.

Drilling started on the Las Victorias zone in mid-May. A second drill will be mobilized to the CLM West Au-Ag epithermal vein target area upon completion of the current surface exploration and targeting program allowing the company to test both target areas simultaneously.

The overall objective of the 2018 exploration program is to continue to increase the existing resource base, refine the model for the ultimate development of the project and to identify and drill test new epithermal vein systems within the larger claim package.

Conclusion

Southern Silver is putting all pieces of the puzzle together and we’re confident Cerro Las Minitas has now reached the critical mass which would support a mine plan. This doesn’t mean SSV will stop exploring as it’s currently designing a new drill program to increase the silver-equivalent resource by an additional 50% to 300 million equivalent ounces.

We are also hoping to see more details on the planned metallurgical test work as even just a slight increase of the recovery rates will have a very positive impact on the economics of Cerro Las Minitas.

Purely looking at CLM, the project is being valued by the market at C$55M (US$43M) based on Southern Silver’s current market capitalization of C$22M and its 40% ownership in the project. Of course, you could argue the attributed value is even lower as SSV also owns 100% of the Oro property, but even if you’d exclude Oro from the equation, Southern Silver’s stake in Cerro Las Minitas is very likely worth more than the current market capitalization.

The author has a long position in Southern Silver Exploration. The company is a sponsor of the website. Please read the disclaimer