Money remains tight in the junior exploration business, meaning companies that are relatively low on the pyramid need to make choices. And the situation isn’t any different for Tocvan Ventures (TOC.C). The company owns two promising projects in Mexico’s Sonora state and while both assets deserve to be advanced, the tough reality right now is that every dollar counts and the company needs to focus on where it can get the biggest bang for its buck.

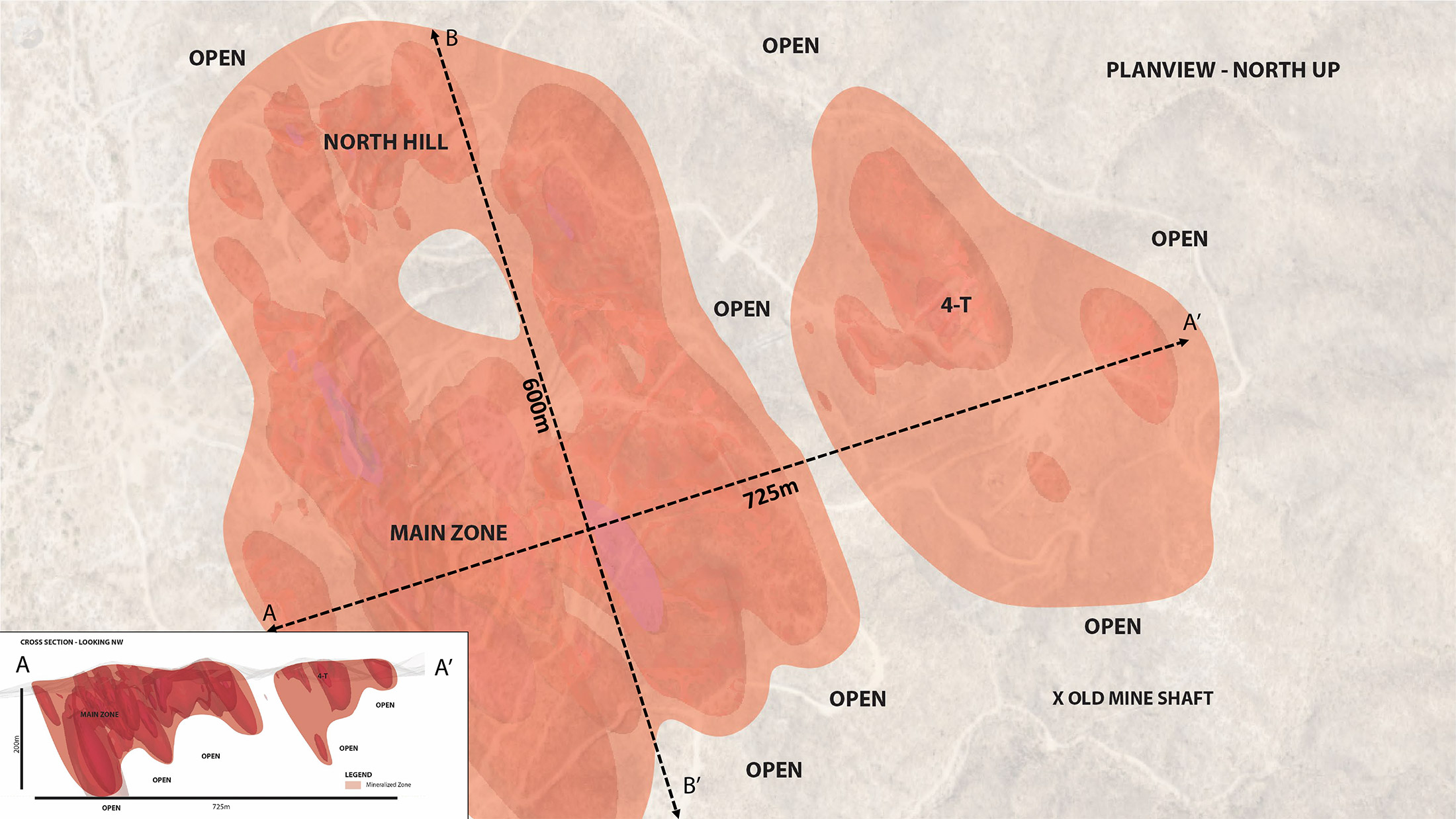

While the company completed a drill program at El Picacho last year (with results released earlier this year), the focus in 2023 appears to be on the Pilar gold oxide project in Sonora. The company recently substantially increased its land package and completed a deep dive into the metallurgical characteristics of the gold mineralization. Metallurgical testing took several quarters as the company understands it is a very important piece of the puzzle to de-risk the project, and the final results look promising.

In this update report, we will have a look at the recent developments at Pilar and discuss these developments with CEO Brodie Sutherland.

The recent metallurgical test results

Metallurgical test results are – without any exaggeration – a critical element in determining the potential viability of a project. While readers are cautioned Tocvan does not have a resource estimate on Pilar (and therefore all assumptions and interpretations set forth in this article are our own and do not reflect the company’s expectations and do not provide any official guidance), the company’s principal was smart enough to immediately kick off a substantial metallurgical test program to gain as much intel on the Pilar rock as possible.

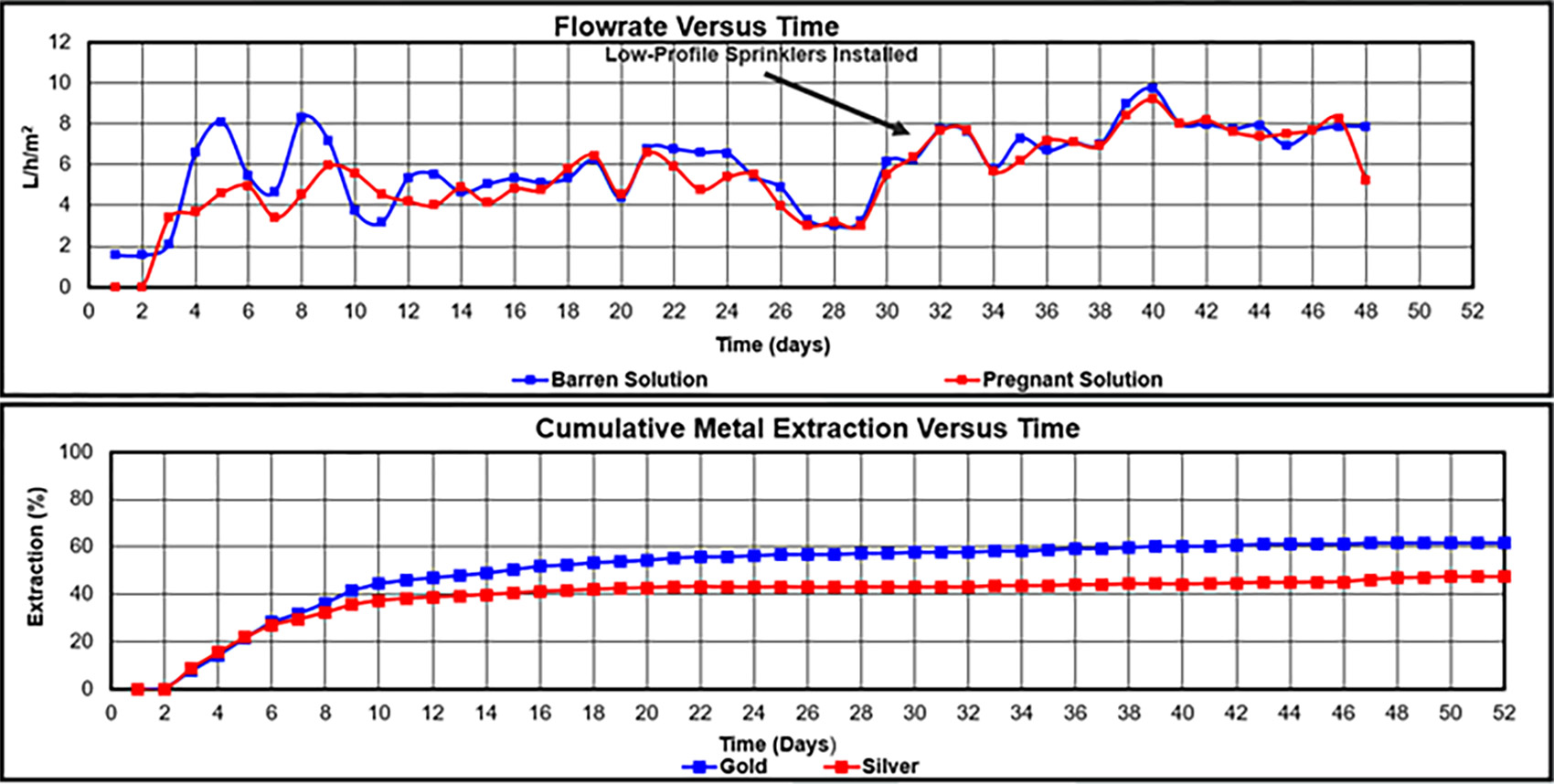

We already provided an update on the results of the agitated bottle roll test results and the metallurgical test work involving a gravity recovery circuit followed by agitated leaching, and the company has now released the results from the heap leach test program.

Initial loading of carbon in leaching tanks (left). Testing solution during leaching (right).

The recovery rate after a 46 day leaching process came in at 62% for the gold and 47% for the silver using a head grade of 1.9 g/t gold and 7 g/t silver. This means the gold recovery results are on the lower end of the spectrum while the silver recoveries are substantially higher than what most heap leach operations are reporting. According to Tocvan, only coarse material was used for this test program while the initial irrigation flow rate was too low during the first 30 days. This problem was rectified after 30 days and according to the consultants used by Tocvan, the total recovery rate would likely have been higher if the correct flow rate would have been applied from day one.

Additionally, the heap leach test work used coarse material and a different grind size could have an additional impact on the recovery rates. That’s why we aren’t too disappointed with the 62% recovery rate for the gold as it sounds like there is some low-hanging fruit that could improve the recovery rates.

While the recent test work has provided the company with a lot of useful information, the recently completed activities were just the starting point to figure out the right approach for Pilar. The consultants that completed the study made three specific recommendations to narrow down the range of possibilities.

LTM Conclusions and Recommendations – Press Release August 22, 2023

- Two cyanide locked cycle column tests (1 Test with Agglomeration with Portland Cement & 1 Test Without Agglomeration) to evaluate if it is feasible to leach the fine fraction (100% -1/8”) of the Bulk Composite Sample without presenting percolation problems.

- Gravity Concentration at a grind of 80% minus 150 µm using a Knelson Laboratory Concentrator. The objective of the test will be to evaluate the amenability of recovery the free gold contained in the fine fraction of the Bulk Composite Sample.

- Gravity Concentration at a grind of 80% minus 150 µm using a Wilfley Concentrator Table. The objective will be to evaluate the amenability of recovery potential free gold contained in the fine fraction of the Bulk Composite Sample using the Wilfley Concentrator Table.

Long story short, more test work will be needed but at least the company now has a good idea of what areas it needs to focus on.

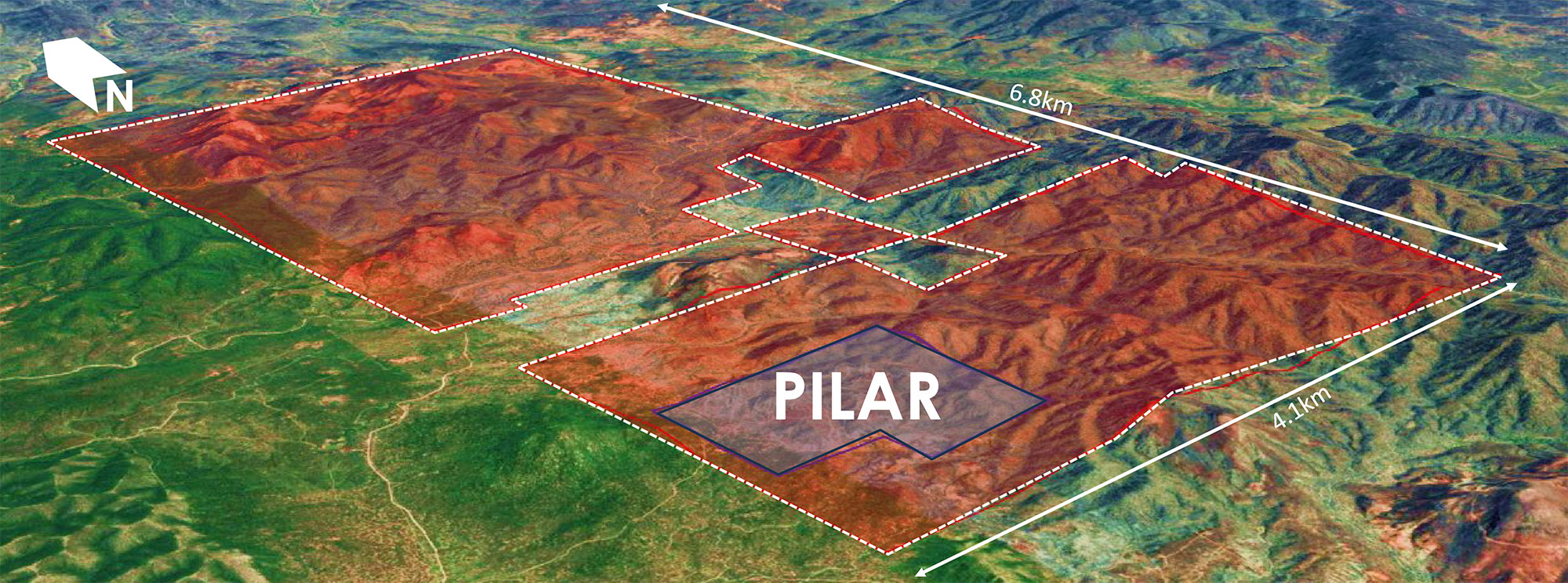

Expanding the Pilar project

In July, Tocvan announced it has signed an agreement with a private title owner for the acquisition of in excess of 2,000 hectares of land directly adjoining the Pilar project where Tocvan is earning in full ownership from Colibri Resources (CBI.V). This appears to be a strong vote of confidence from Tocvan for the project.

According to Tocvan, the 2,123 additional hectares have only seen very limited exploration activities but the existing and recent placer mining site suggest there may be untested gold and silver potential. CEO Brodie Sutherland commented:

Applying the knowledge we have gained from evaluating Pilar over the last few years gives us a huge advantage in quickly defining new areas of mineralization […]

We feel this acquisition will make Pilar standout as an emerging exploration district and recent placer mining in the area suggests there is much more to be discovered

Brodie Sutherland

The acquisition isn’t cheap for a small company like Tocvan, but fortunately the earn-in requirements are spread over a 5 year period. According to the press release, the company needs to complete US$4M in cash payments and issue 2.5M shares (with a pro forma value of just under C$1.25M based on the share price at the announcement date) on top of a US$1M work commitment. The title owner will retain a 2% NSR on the property while an additional US$0.5M cash payment subsequent to completing the 5 year earn-in agreement will be required to purchase full title ownership.

Sitting down with CEO Brodie Sutherland

Let’s talk about the metallurgical test results first.

In your first bullet point of the press release, you mention that a higher recovery rate can be reached using a higher flow rate. However, the cumulative metal extraction barely increases from day 30 on (based on the chart we’d estimate you were at 58-59% before the flow rate increased). How do you know the incremental recovery rates after day 30 are specifically related to the higher flow rate?

Although difficult to see in the data there is a slight trajectory change that indicated a recovery improvement. That coupled with the fact the first two weeks are the most critical to getting metal recovery up on step, we along with the independent metallurgical group who managed the sample believe that higher recovery can be achieved through consistent and increased flowrate. Of course we look to validate this with a follow-on study taking duplicate bulk material that we have stockpiled and processing it through column leach to replicate the setup.

Figure 1 in your press release (see below) contains some other interesting data points. It looks like you will have to make a decision based on a trade-off between time and recovery. The majority of the gold gets recovered in the first two weeks and you are reaching the 58-59% recovery rate mark by day 28-30. Considering the ultimate recovery rate is just a few percent higher for twice the time, would it make sense to keep the rock on the ore pad for a shorter period of time to maximize production versus time?

As indicated above the first two weeks are critical. If we can display that an even higher recovery can be achieved through optimal flowrate, then yes, keeping that processing time down would have an advantage. That quick recovery is really highlighting the fact that the material is amenable to the heap leach process. This also leads us down the path of comparing other recovery methods versus time, which the data from Pilar suggest there are other processing options available.

The press release mentions only coarse fractions were used in the test program. Why is that? And wouldn’t smaller fractions have a bigger impact on ultimate recoveries versus increasing the flow rate of the irrigation?

We wanted to ensure optimal permeability through the heap leach pile by stacking homogenous crush sized material. Mixing the fines can create impermeable layers that slow down or inhibit the flow of solution creating unpredictable variation in the data. The fines we can study separately, and plan to look at static leach versus dynamic leach and agglomeration methods as a comparison. I think higher recovery by simply adding the fines to the pile is likely, and we have past column leach studies that suggest just that.

Heap leach recovery rates were relatively low at just 62% for the gold and around 47% for the silver (the latter is very decent for oxide-hosted silver). Meanwhile, gravity recovery test work followed by agitated leach returned recovery rates in the high 90% range for gold. And simple agitated bottle roll tests also indicated a recovery rate of 80% for the gold and 94% for silver. What is your main takeaway after this metallurgical test program?

The main takeaway is simple, at Pilar we have optionality, the metals are easily liberated and that allows for us to recover them in range of ways. Gravity, agitated leach and heap leach all work. It just comes down to taking that data and running through a cost analysis to determine what will yield the highest return. We can make assumptions now on what that will be, the higher recovery options look attractive at the moment.

The cyanide consumption level in the heap leach test was relatively low (0.19 kg/t). How were consumption levels observed testing the other processes?

Also relatively low to moderate. For agitated leach we were seeing 0.47 kg/t after a 72-hour retention time.

There were also some positive takeaways. The calculated head grade was 1.9 g/t gold and silver grades came in at 7 g/t gold. That’s substantially higher than what we had expected and what your drill results have indicated so far. Do you have a logical explanation as to why the calculated head grade now appears to be substantially higher? Can we assume the ‘real’ grade will be higher throughout the mineralized zones?

First, what an excellent problem to have, our grade is higher than expected. It is important to note that the material for the bulk sample came from five different locations across Pilar looking to get a representative blend of ‘high’ and ‘low’ grade material. The fact we are seeing a boost in that overall grade is excellent evidence of the true high-grade nature of certain structures at Pilar. We have drilled ‘high-grade’ along structures in multiple drill holes. Historically there are drill holes at Pilar that intersected up to 21-meters of 38.3 g/t Au. Having the adjacent low-grade mineralization around these zones allows us to tie a bigger bulk tonnage target together. I would expect in a mining scenario lower grade than the 1.9 g/t Au from the bulk sample (of course we will have to wait for a resource estimate to confirm my expectation), but even with a significant reduction the grade would still be on par or above the head grades seen in operating mines around us.

Placer Activity in the Pilar Expansion Area

It looks like a gravity & CIL process would have superior recovery rates, but it will be a trade-off between capex and recovery rates. Are we to assume that the smaller the resource at Pilar will be, the more likely a heap leach scenario is?

I think that is fair assumption for now, the bigger we can grow Pilar and identify new resources in the district the more likely the cost of superior recovery will make sense. Our goal is to now target drilling to grow a maiden resource estimate at Pilar as much as possible and to drill previously unknown areas to add expansion potential and satellite deposit potential. With the acquisition of the land around Pilar, we now can expand significantly in an area that has great indications of gold-silver mineralization, but no previous exploration for those metals. The upside could be big for us, making mine life and resource size big driving points for the process facility required.

A basic back of the envelope calculation (readers are cautioned this is just our own impression and the following calculation does not represent the company’s guidance or expectations) indicates a recoverable grade of 1.2 g/t gold in the heap leach scenario and 1.8 g/t in the gravity & agitated leach process. This difference of 0.6 g/t gold represents $36/t in additional recoverable value per tonne based on a gold price of $1900/t. Even if you’d only have 10 million tonnes of rock that could be processed, this delta would result in an additional US$360M in recoverable rock value, which should compensate for the additional cost of a processing plant. Is that a fair assumption? Of course this assumption changes dramatically depending on the ‘real’ head grade of the rock that will be processed, so in a way, this question is a bit premature, but we want to make sure we understand the implications of the different processing methods.

It is early and we do plan to continue towards resource estimation and PEA for Pilar that will confirm. However, I do see a similar outcome when I look at the data available today. The recoveries through gravity and agitated leach are much higher at this stage, it looks like a solid path forward for processing. We will continue to evaluate that, we have plenty of bulk sample material available to test these methods fully and we plan to do so.

Your metallurgical consultants made three recommendations for Tocvan to follow up on. What budget do you reckon you’ll need to complete those recommendations?

What they have highlighted for follow-on testing is budgeted at approximately US$80,000. So relatively low cost for some key information to move forward with. This is scheduled for later this year.

You recently expanded the size of the Pilar project, could you elaborate on your reasons for doing so? And how does this impact your annual holding costs?

Simple, the geology doesn’t stop at the previous Pilar boundary. We think there is a lot of prospective ground around us. This is an area that has seen no previous gold and silver exploration however is riddled with old mine workings plus has recent placer activity covering significant areas that can only be sourced from the surrounding hills. We have a model at Pilar that suggests mineralization continues and with this acquisition we can now test that. Expansion potential and discovery of new satellite deposits are high on the priority list for us.

Do you have any plans for El Picacho this year?

Yes, we will be back on the ground shortly. Obviously, the successful drilling at our San Ramon target was a great start and we want to follow up on that. There are also 6-kilometers of additional trend to evaluate, so we will be prioritizing those. How hard we push drilling at El Picacho will depend on what we are seeing at Pilar and the new expansion area around it.

El Picacho

Can you provide an update on your current financial situation and the agreement with Sorbie? How many shares can you still issue in total? And what would be the net proceeds based on a share price of C$0.55 per share?

At C$0.55 per share we are looking at approximately $1.5M CAD of net proceeds from now until June of 2024. Since the shares are in escrow they are already accounted for so our share count stays unchanged sitting at 40M shares outstanding today.

Do you have any (mining-related) comments on the actions of the Mexican government this year, and the upcoming elections in 2024?

Great question to leave things on. In short, over the next year, we expect continued rhetoric that makes it appear the mining regulations are changing or becoming more complicated however we have confidence that things will stabilize. There are murmurs the proposed mine regulation changes will not pass supreme court approval, so that needs to be considered. We have looked at the proposed changes and have determined they will have no material impact on our projects. Major producers like Fresnillo have stated the same. No one likes change, but we have to look at the reality, Mexico is one of the most cost effective places to discover, develop, permit and mine in the world. Right now the permitting process for mine development is taking 12-18 months…now compare that to Canada where it takes decades with much higher costs. I know where I want to see our funds deployed to maximize value for our shareholders.

Conclusion

Tocvan Ventures is diligently ticking all the boxes to de-risk the Pilar gold project. Although there is no resource estimate on the property just yet, Tocvan is already taking the necessary steps to put a preliminary economic assessment together on the back of a future resource estimate (of course on the condition that resource warrants a study).

The metallurgical test results are encouraging and although the head grade of the rock used in the met work was quite a bit higher than we had anticipated, we remain cautious until we see the actual average gold and silver grade in an official resource calculation.

In any case, Tocvan is taking all the right steps and we hope to see the company in a position to calculate a maiden resource at Pilar in 2024. That should help underpin the value of Tocvan Ventures and at the current fully diluted market cap of around C$23M (including the escrowed shares that still have to be issued to Sorbie-Bornholm) is still appealing.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website. Please read our full disclosure.