Tocvan Ventures (TOC.V) is an exploration company focusing on its portfolio of Mexican assets in the state of Sonora. The company isn’t new but we only really got interested when there was a management change. The previous CEO left the company in the capable hands of Brodie Sutherland, a geologist.

We first met Brodie Sutherland on a site visit in Nevada right before the COVID pandemic and reconnected after he took the reigns of Tocvan Ventures. As Sutherland is a geologist with plenty of field experience (including in harsh regions like Alaska), he seems to be the right person at the right time to help the company to move forward.

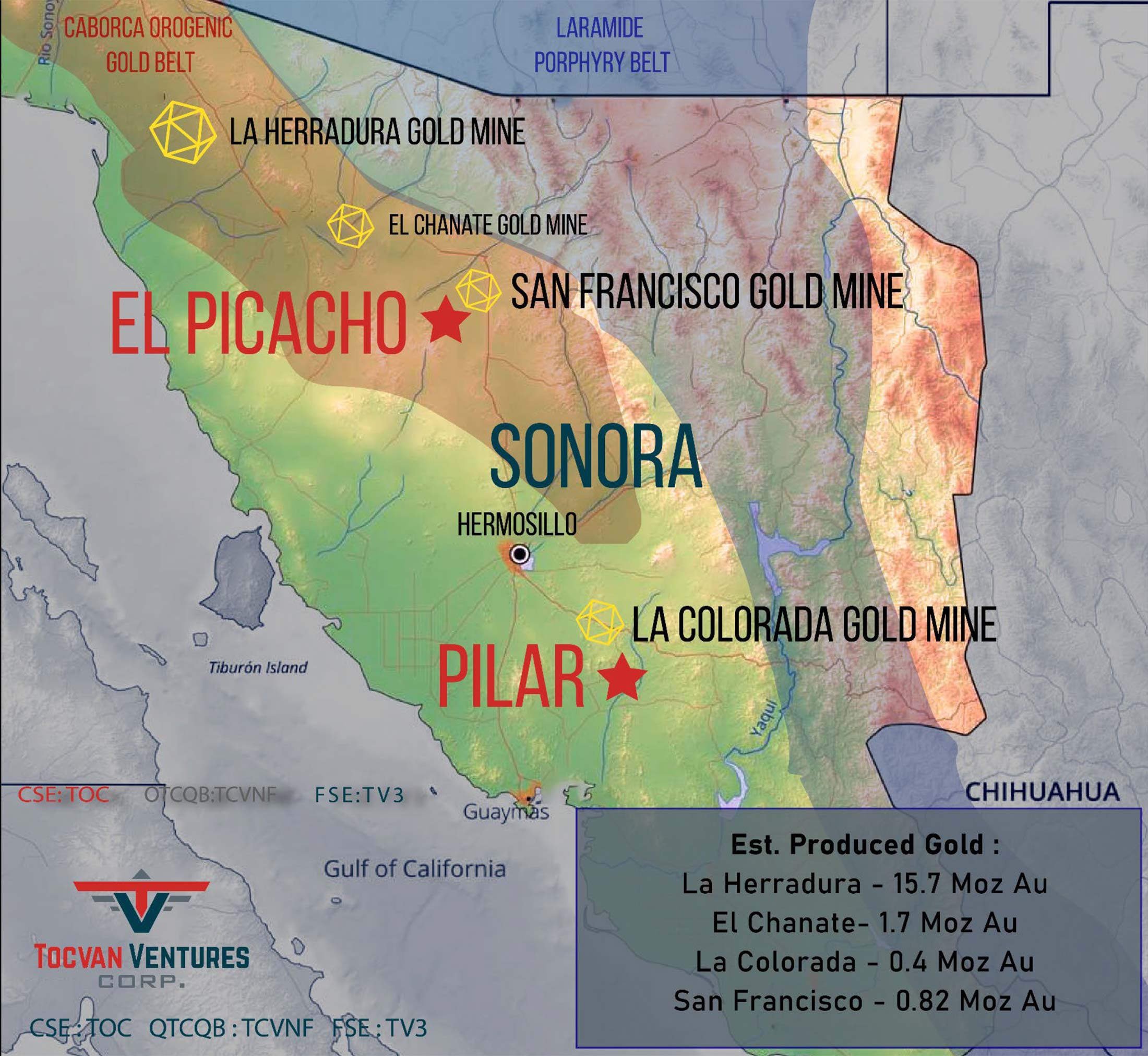

Tocvan has recently released several exploration updates with assay results on its Mexican assets where the flagship Pilar asset has been drilled. Tocvan also has a second horse in the stable as it acquired the El Picacho project in 2021 but limited financial resources likely mean the company will have to continue to focus on Pilar as that’s where Tocvan can get the biggest bang for its buck.

A two-pronged approach with the Pilar project as flagship asset

Tocvan’s flagship asset is the Pilar gold project in Sonora. This project is interpreted as a structurally controlled low-sulphidation epithermal project and the in excess of 20,000 meters of drilling (about 14,200 meters of drilling was completed by previous operators while Tocvan completed an additional 6,600 meters of drilling between December 2020 and March 2022) has outlined an interesting zone of oxide-hosted gold mineralization. This means the gold found at Pilar could be recovered through a heap leach operation. This should in theory result in a low capital intensity and a highly efficient gold production.

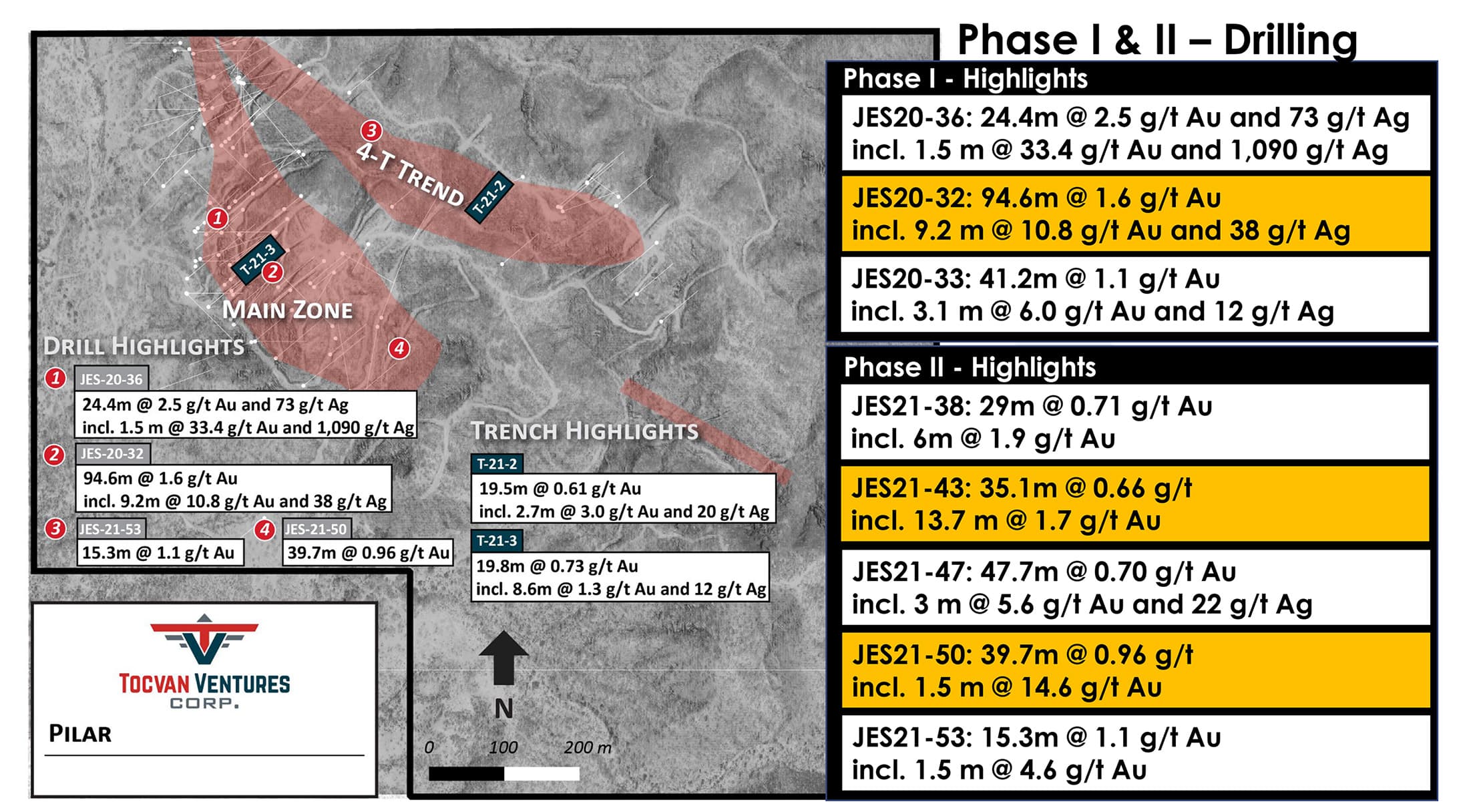

Tocvan’s drill history at Pilar consisted of three separate phases. The very first phase was completed in December 2020 and the company hit the ground running with some remarkable intercepts right off the bat. With for instance 41 meters containing 1.1 g/t gold and almost 95 meters of 1.6 g/t gold (including 9.2 meters containing 10.8 g/t gold and 38 g/t silver), the company’s exploration efforts immediately seem to have hit the sweet spot.

These results were obviously sufficiently encouraging to kick off a Phase 2 drill program right away in the second quarter of 2021. That program also encountered relatively thick intervals of gold mineralization with an average grade that should handsomely meet the cutoff requirements for heap leach projects as the drill bit intersected for instance 29 meters at 0.71 g/t starting at surface, while other holes encountered 35 meters containing 0.66 g/t gold and almost 48 meters at 0.7 g/t gold.

These grades are exceeding the traditional grades we see in these types of oxide and heap leachable deposits. Throw in the fact that a bottle roll test indicated recovery rates of up to 92% and Tocvan’s Pilar project looks very promising. Surprisingly, the metallurgical test work also indicated about 84% of the silver could be recovered. That would be phenomenally high for a heap leach operation so we are waiting for additional metallurgical tests before using an 80%+ recovery rate for silver in a heap leach scenario as the bottle roll test may be too optimistic. The company also completed metallurgical test work on low-grade material resulting in a 91% gold recovery and a 70% recovery rate for the silver.

Similar projects in Nevada and elsewhere in the USA report recovery rates typically around 15-35%. So if even just half of the silver could be recovered, that would be great. Anything higher than that would be phenomenal. And keep in mind that gold is obviously more important than silver and the latter will be just a small by-product credit. But every dollar counts!

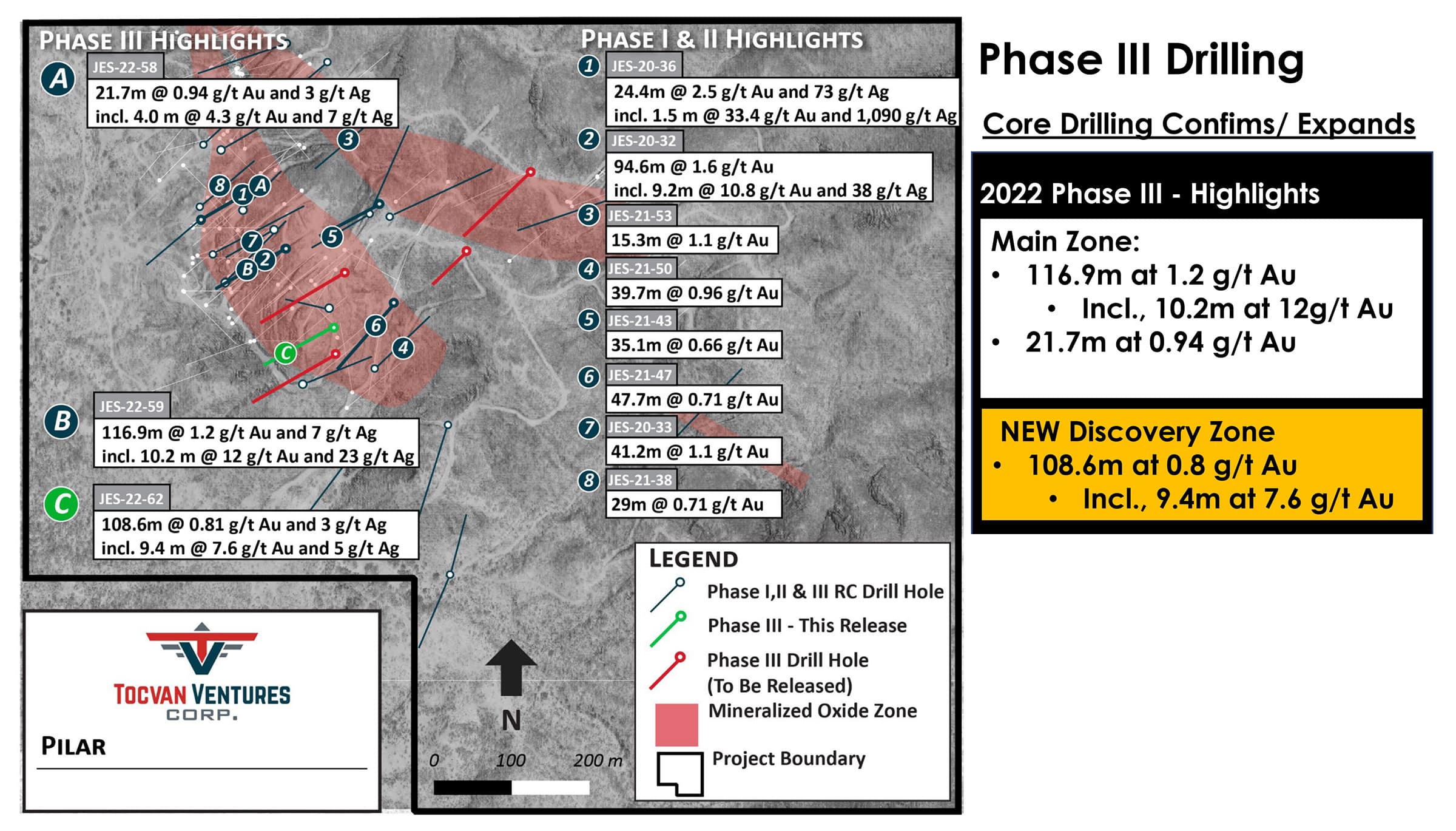

After completing the successful Phase 1 and Phase 2 drill programs, Tocvan Ventures kicked off its Phase 3 drill program in December 2021 and has been reporting assay results from that drill program over the past few weeks.

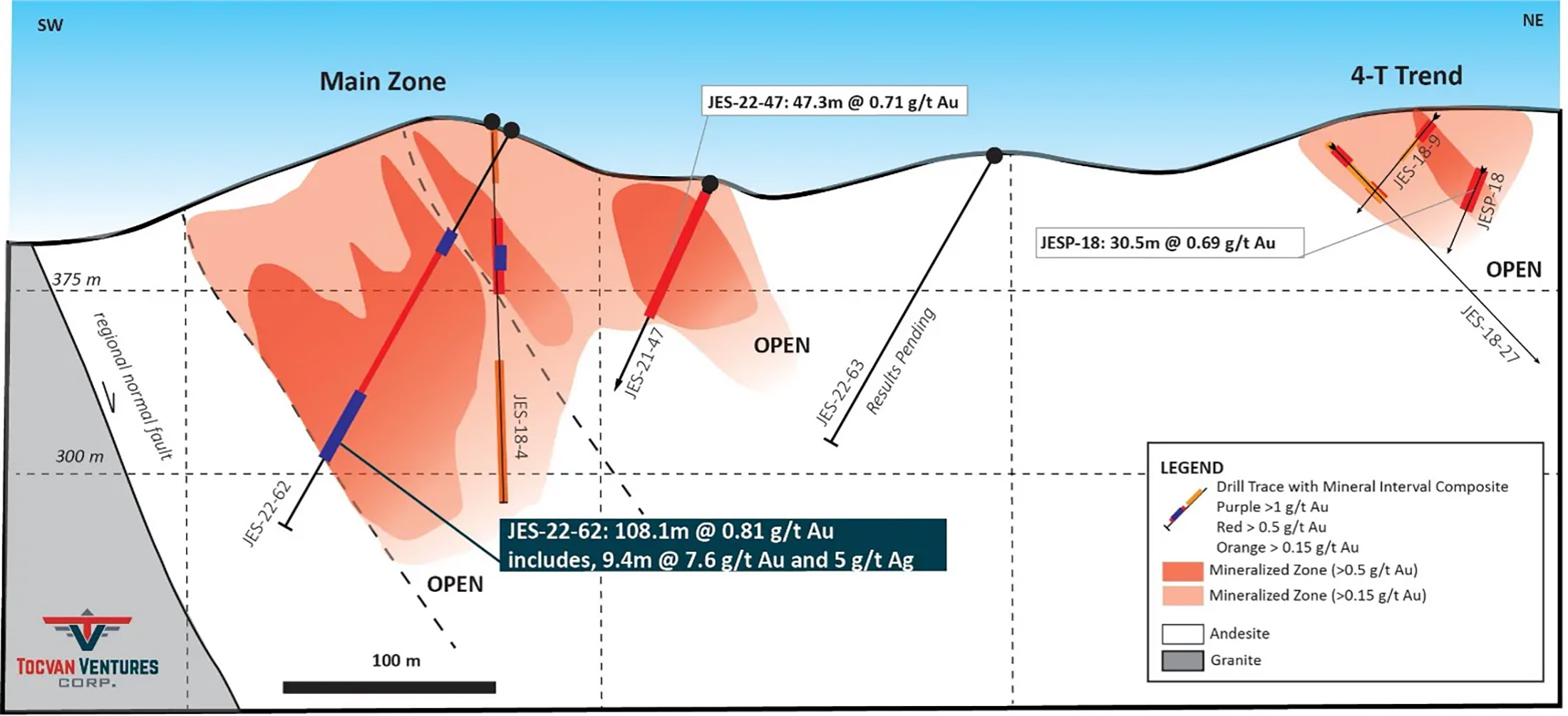

In the most recent exploration update issued last week, Tocvan encountered a thick layer of high-grade gold mineralization (relatively speaking, 0.8 g/t gold is relatively high for a heap leach project). More important than the grade is the location of the interval. Hole JES-22-62 was drilled as a step-out hole approximately 125 meters from hole 22-59 and was designed as an infill hole 100 meters west of hole JES-21-47 which returned 47 meters of 0.7 g/t gold.

On top of the 0.8 g/t gold over the entire almost 109 meter interval, the assay results also returned about 3 g/t of silver while the presence of a higher grade gold zone within this thicker interval was also confirmed as Tocvan intersected almost 32 meters at 2.4 g/t gold and 2 g/t silver including 9.3 meters of 7.6 g/t gold and 5 g/t silver.

This interval represents a new discovery at Pilar where the exploration model has now been confirmed and this infill hole suddenly adds quite a bit of tonnage (a block of 100 meters by 100 meters by 100 meters represents about 2-2.5 million tonnes of rock as the density of oxide mineralization is lower than average). And as you can see in the image above, the assay results from two holes drilled on each side of hole JES-22-62 still have to be released. It will be interesting to see if Tocvan was able to replicate the grade and thickness encountered in hole 62. We are predominantly looking forward to the assay results of hole 63 which will be drilled in ‘virgin’ territory in between two known zones of mineralization.

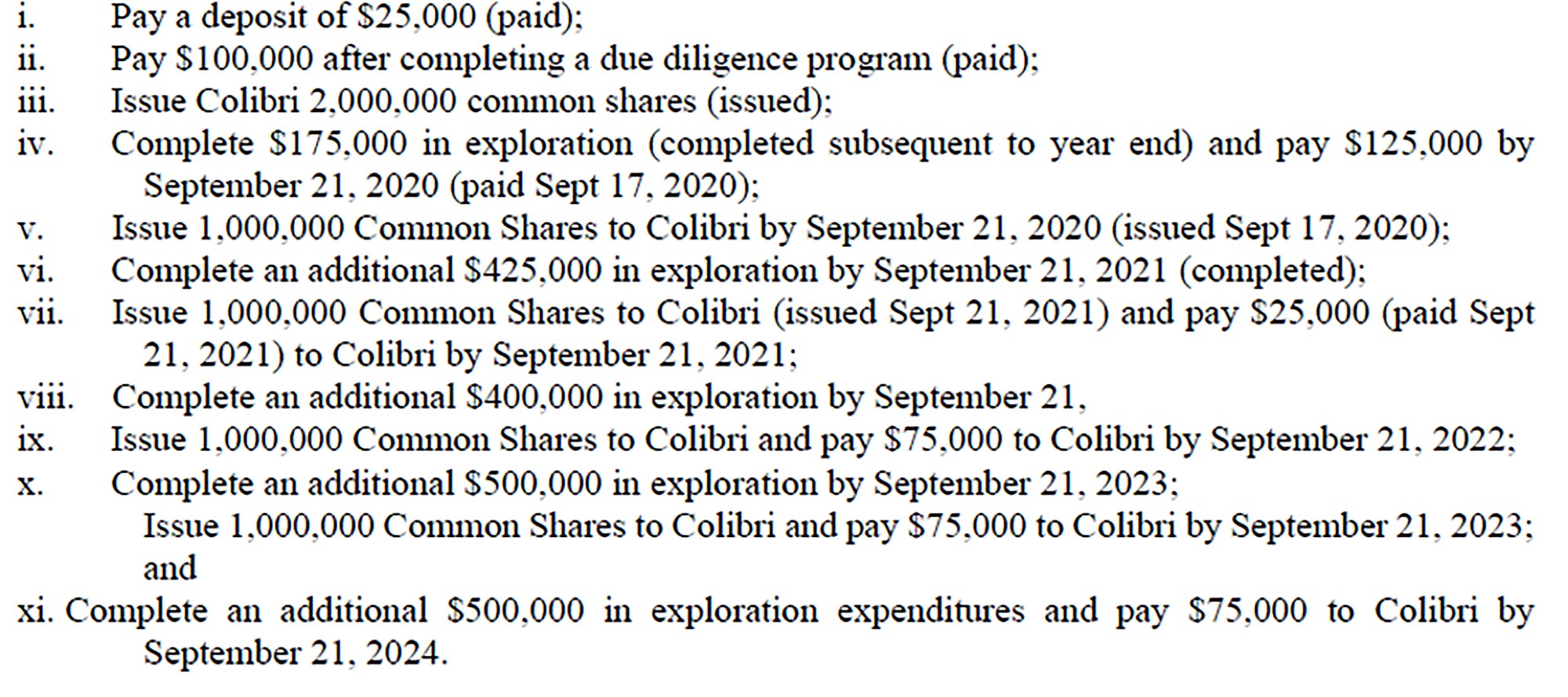

Tocvan is still earning a 100% stake in the Pilar gold project from Colibri Ventures (CBI.V) and is getting close to completing the establishment of an initial 51% stake in the project. All it needs to do is completing an additional C$1M exploration expenditure on the property, pay C$225,000 in cash and issue 2 million additional shares to Colibri within the next 2.5 years.

Once Tocvan has established a 51% stake in the project it can elect to either form a 51/49 joint venture with Colibri Resources (not likely) or elect to acquire the remaining 49% of the project (we think this is the most likely outcome). That 49% stake can be acquired by making a C$2M cash payment and granting Colibri a 2% Net Smelter Royalty on the Pilar project. Half of that NSR could be repurchased by Tocvan for C$1M.

Let’s not forget about the recently-acquired El Picacho property

It’s never good to be a one-trick pony and fortunately Tocvan realized that as well. In June last year, the company entered into an agreement with Millrock Resources (MRO.V) to acquire the option agreement on the El Picacho gold project in Sonora. The project s located about 1.5 hours north of Sonora’s capital, Hermosillo, and is quite close to the San Francisco gold mine currently operated by Magna Gold (MGR.V) although investors may remember San Francisco as the flagship asset once owned by Timmins Gold.

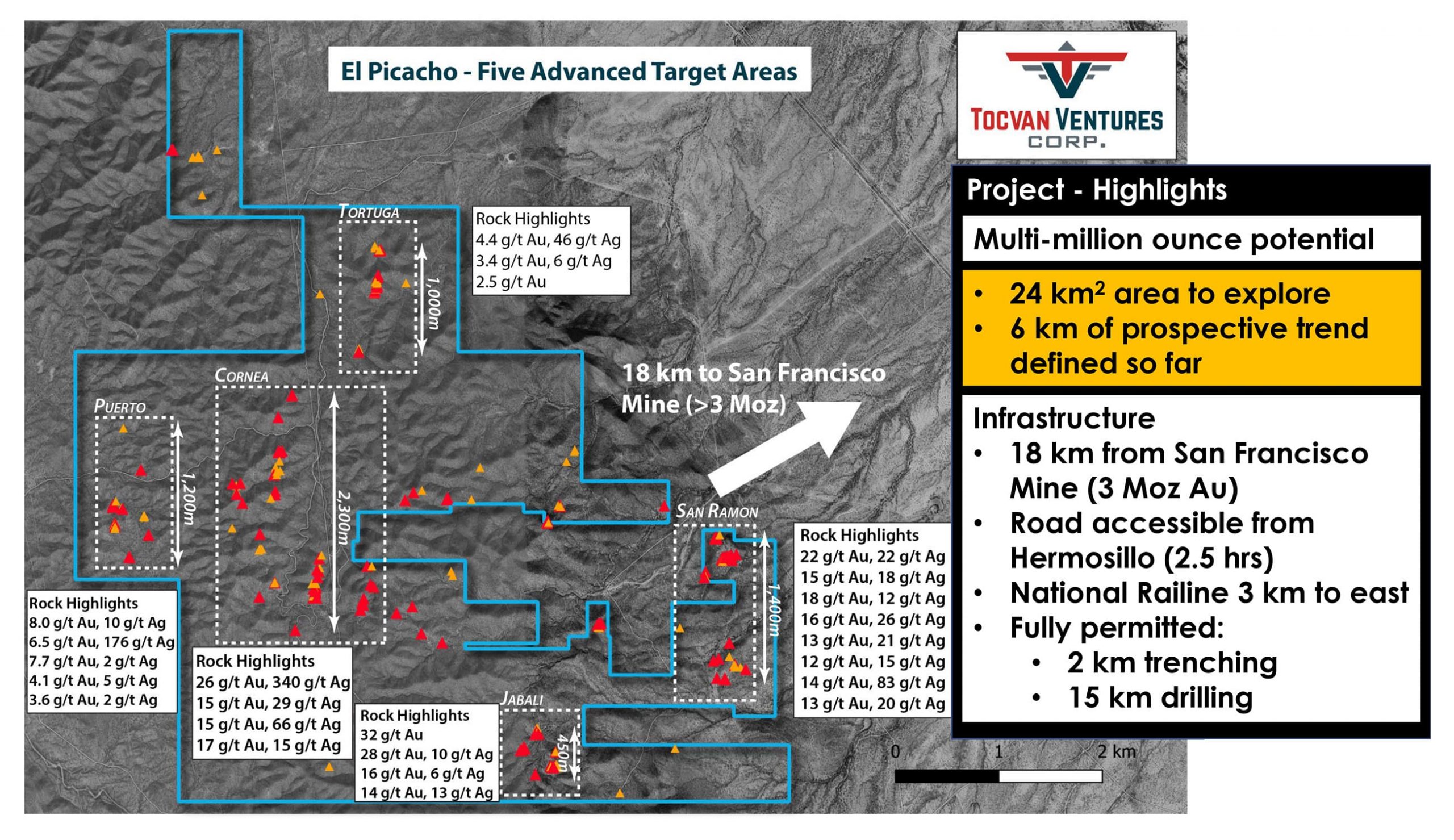

While the San Francisco mine is a large heap leach project with an average gold grade of just over half a gram per tonne of rock, the El Picacho project is dominated by orogenic gold occurrences. Previous operators have taken and analyzed in excess of 2,500 samples with almost 200 of these samples returning an average gold grade of in excess of 1 g/t and 32 samples returning grades exceeding 10 g/t gold. El Picacho currently consists of twelve mining concessions for a total area of just over 2,414 hectares

Both companies entered into a definitive agreement in September of last year and the agreement will allow Tocvan to earn a 100% stake in the project by making almost US$2M in cash payments. Meanwhile, Millrock Resources will retain a 2% Net Smelter Royalty with the standard buyback clause allowing Tocvan to repurchase half of that NSR for US$1M in cash. As part of the option agreement, Tocvan will also have to make advanced minimum royalty payments to Millrock. These payments start at US$25,000 in the first year but will double every year. This means that for instance in Y4 of the agreement the annual advance royalty payment will already increase to US$200,000 so it will be up to Tocvan to make sure it has enough cash to meet the spending requirements to keep the acquisition option in good standing.

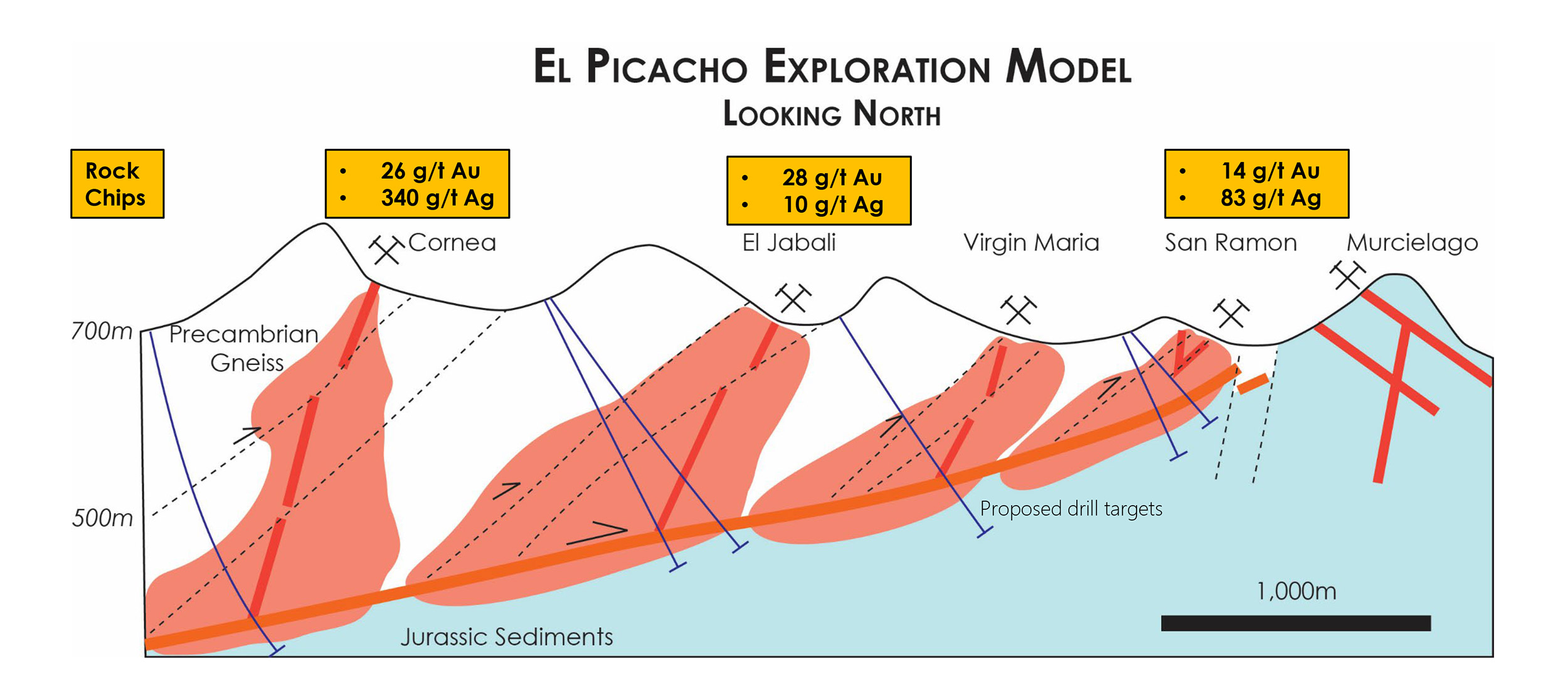

El Picacho is quite different from Pilar as the orogenic nature of the project doesn’t make it easily amenable for heap leach operations. This means Tocvan will have to apply a methodological approach to figure out where the high-grade gold mineralization is and how it is controlled. We can’t exclude heap leaching the mineralization just yet as the nearby San Francisco mine (which has the same host rock) has the same style of mineralization but is successfully able to use the heap leach process to recover the gold.

Fortunately the company does not have to start from scratch as Tocvan has access to historical exploration results (including in excess of 6,000 samples divided in 60% soil samples and 40% rock samples) and the assay results from those historical sampling programs (which include an underground drift) will be a tremendous help to define and refine drill targets on the land package. El Picacho is fully permitted for drilling and trenching so the company can get to work whenever it wants to.

There are several distinct areas of interest at El Picacho with San Ramon, Cornea, Jabali, El Puerto and Tortuga being the main ones.

At San Ramon, previous exploration efforts have confirmed the existence of a 1.4 kilometer long prospective trend with several historical workings. A previous operator drilled two holes in the San Ramon zone, both encountering gold with for instance 7.6 meters of 0.73 g/t gold and 10.7 meters containing 0.67 g/t gold. These holes were never followed up on and it could be interesting for Tocvan to get into the field and follow up on these holes.

At the Cornea zone, the company has identified several historical mine workings reaching depths of up to 30 meters along the 2.3 kilometer long prospective trend and finding these historical mine workings all over the place (all five high-priority areas of the project are hosting historical workings to some extent) clearly indicate Tocvan is looking for gold in the right place. It will now be up to the company’s geologists to further work on a ‘plan of action’ by connecting the dots and to drill-test some of the high-confidence targets.

Tocvan also has a third asset with the Rogers Creek project in British Columbia, but that project falls outside the scope of this article as it is clear the company is fully focusing on its Mexican assets.

Tocvan just raised money

Exploration requires cash and to make sure its activities can continue on an uninterrupted basis, Tocvan recently closed a small private placement.

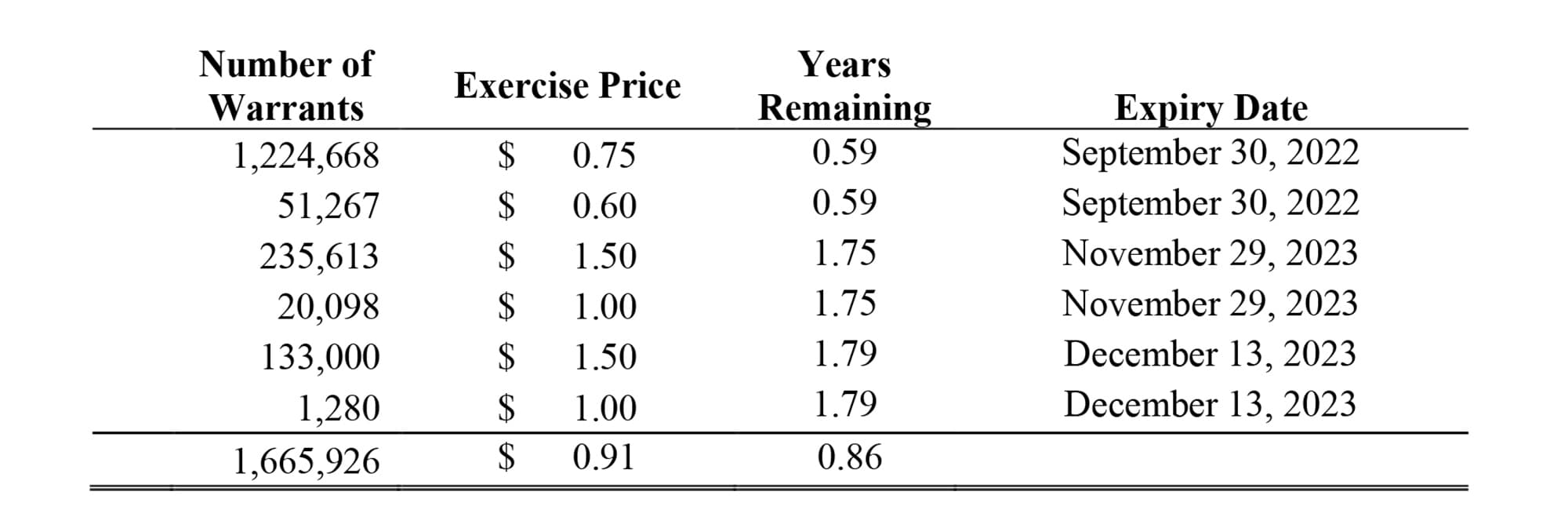

The company issued 481,000 units at C$0.75 per unit raising a total of just over C$360,000 in cash, with approximately C$345,000 hitting its bank account after taking the finders fees into consideration. Each 75 cent unit consisted of one common share and a full warrant allowing the warrant holder to purchase an additional share of Tocvan at C$1.35 within 18 months after closing the financing (the expiry date of the warrants will be in December 2023).

This was a very small placement as Tocvan didn’t want to issue more shares than strictly necessary at the C$0.75 share price considering this represented the one-year low. That being said, Tocvan originally wanted to raise C$600,000 so seeing the company raise just C$360,000 is perhaps a bit disappointing.

While ‘hope’ never is a good basis to run a company, Tocvan is hoping for the existing warrants to be exercised as this will bring in quite a bit more cash. There are about 1.3 million warrants expiring in September of this year and 1.22 million warrants have an exercise price of C$0.75 with an additional 51,000 warrants allowing the warrant holder to purchase additional shares at C$0.60. Should all these warrants be exercised, Tocvan can look forward to in excess of C$900,000 in proceeds.

This obviously means the share price will have to cooperate as the warrant holders need to be sufficiently incentivized to actually exercise these warrants. Should the share price be trading at 70 cents, not a whole lot of those 75 cent warrants will be exercised as it would make more sense to just buy the shares on the open market.

The current working capital position of approximately C$300,000 means CEO Brodie Sutherland will continue to have to run a tight ship as the company simply cannot afford any extravagant expenses. Fortunately Tocan is indeed run in a conservative way. During the first six months of the financial year, the total amount of operating expenses was just C$655,000, and almost 60% of this budget was invested in ‘advertising and promotion’. It doesn’t look like this really helped the share price but Tocvan just had to get the word out and try to build up awareness of the company.

This also means that if we would exclude the advertising expenses and the (non-cash) stock compensation, the cash burn in the first six months of the financial year was just C$250,000. Sutherland is indeed making sure every penny counts.

The management team

Brodie Sutehrland, President & CEO

Mineral exploration geologist, based in Calgary, with over fifteen years experience in over eighteen countries. Focused on economic geology and the development of grass roots mineral exploration projects.

Significant mineral exploration experience including: advanced geological mapping, reconnaissance and geochemical sampling, area selection and prospect generation and the implementation and management of diamond drilling programs. Strong understanding of QA/QC procedures, Best Practice and GIS in relation to grass roots exploration through to pre-feasibility. Experience with project review for acquisition.

Previous experience in advisory and board positions for publicly traded companies.

Rodrigo Calles-Montijo, Chief Geologist

Mr. Calles-Montijo has been an integral part to the success of operations at the Pilar Gold-Silver Project and compliments the Board and management team with his experience and knowledge related to project development in Mexico. Mr. Calles has over 30 years of global mineral exploration experience, working with groups that include Rio Tinto, Kennecott, SRK Consulting and as an independent consultant. Rodrigo holds a MSc. in Geology from the University of Sonora and is a registered Certified Professional Geologist. Mr. Calles-Montijo is fluent in both Spanish and English.

Issac Ortega, Project Manager

Geologist with 20 years of experience in exploration of base, precious and non-metallic deposits. Wide experience regional and detailed geological mapping, geochemical sampling and supervision and control of drill programs.

Conclusion

Perhaps we should look at Tocvan Ventures as a ‘mini-Minera Alamos’. After talking to CEO Sutherland it became clear he has a lot of respect for Minera Alamos and reading between his lines, the same ‘small-scale’ approach may be applicable at Pilar as focusing on a small heap leach operation makes sense. We also recognize the ‘bootstrap’ approach used by Tocvan Ventures although that’s mainly out of necessity than anything else.

Of course, Tocvan isn’t anywhere close to where Minera Alamos is right now and the company will have to complete more drilling to define a compliant resource estimate which would underpin the value of the company. It is quite unfortunate Tocvan was only able to raise C$345,000 in net proceeds in the recent financing as we are convinced a C$2-3M drill program at Pilar could really shift the project into fifth gear.

While Pilar most definitely is the flagship project, we shouldn’t forget about the El Picacho project where Tocvan is earning a 100% interest from Millrock Resources. While the cash payments are relatively low compared to the potential of the project, Tocvan will still have to meet those requirements so CEO Sutherland will have to keep an eye on its treasury to make sure the company can meet all cash calls (taxes, option payments and the advanced royalty payments on El Picacho).

The Phase 3 drill results at Pilar are very interesting and now it’s up to Tocvan’s technical team to connect the dots.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website.