Like many other gold-focused juniors, Tocvan Ventures (TOC.C) has seen its share price slide throughout 2022. Fortunately, the company was able to remain busy and it completed its work programs on both the Pilar and El Picacho projects thanks to an equity distribution agreement with a US-based private equity partner which gave Tocvan access to approximately C$830,000 in cash so far, with the agreement continuing until June 2024. And last week, the company announced a private placement to raise C$325,000 priced at C$0.52 per unit with each unit consisting of one common share and ½ warrant allowing the warrant holder to acquire an additional share at C$0.62 per full warrant.

This helped to fund the recent drill program on the El Picacho property where ten holes were completed for a total of just over 1,000 meters. Drilling wasn’t easy, as the drill bit encountered several historical underground workings which complicated drilling the holes to the desired depth. That’s a pity, but on the other hand it is a testament of the high-grade nature of some of the mineralized areas and it lends more credibility to the company’s exploration theory that there must be lower grade zones around this high-grade mineralization.

We caught up with CEO Brodie Sutherland in Calgary to discuss the recent drill results from the El Picacho drill program.

The initial ten holes drilled at El Picacho are interesting

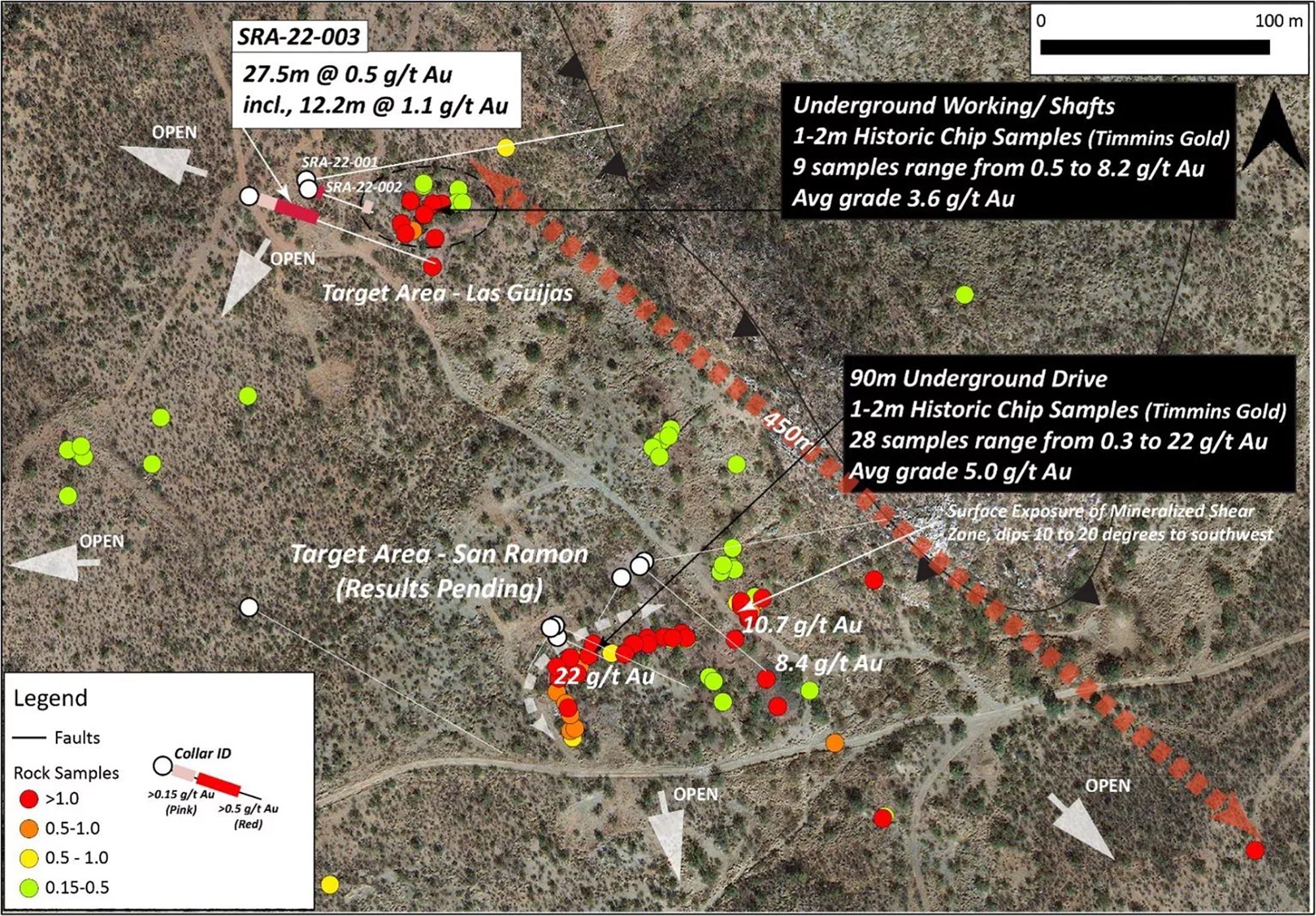

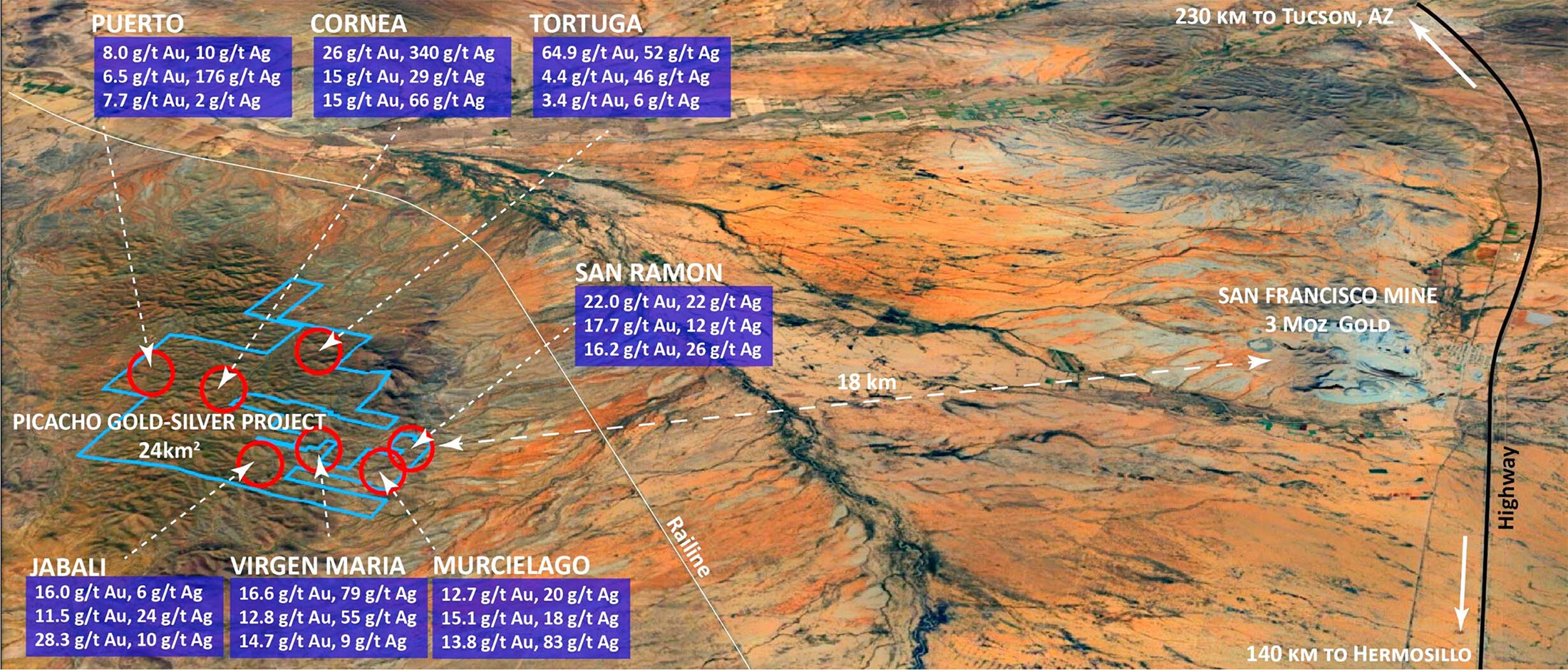

The company released the assay results in two separate batches: three holes were drilled on the Las Guijas zone, while the second batch of seven holes (focusing on the San Ramon zone) was released about a week later.

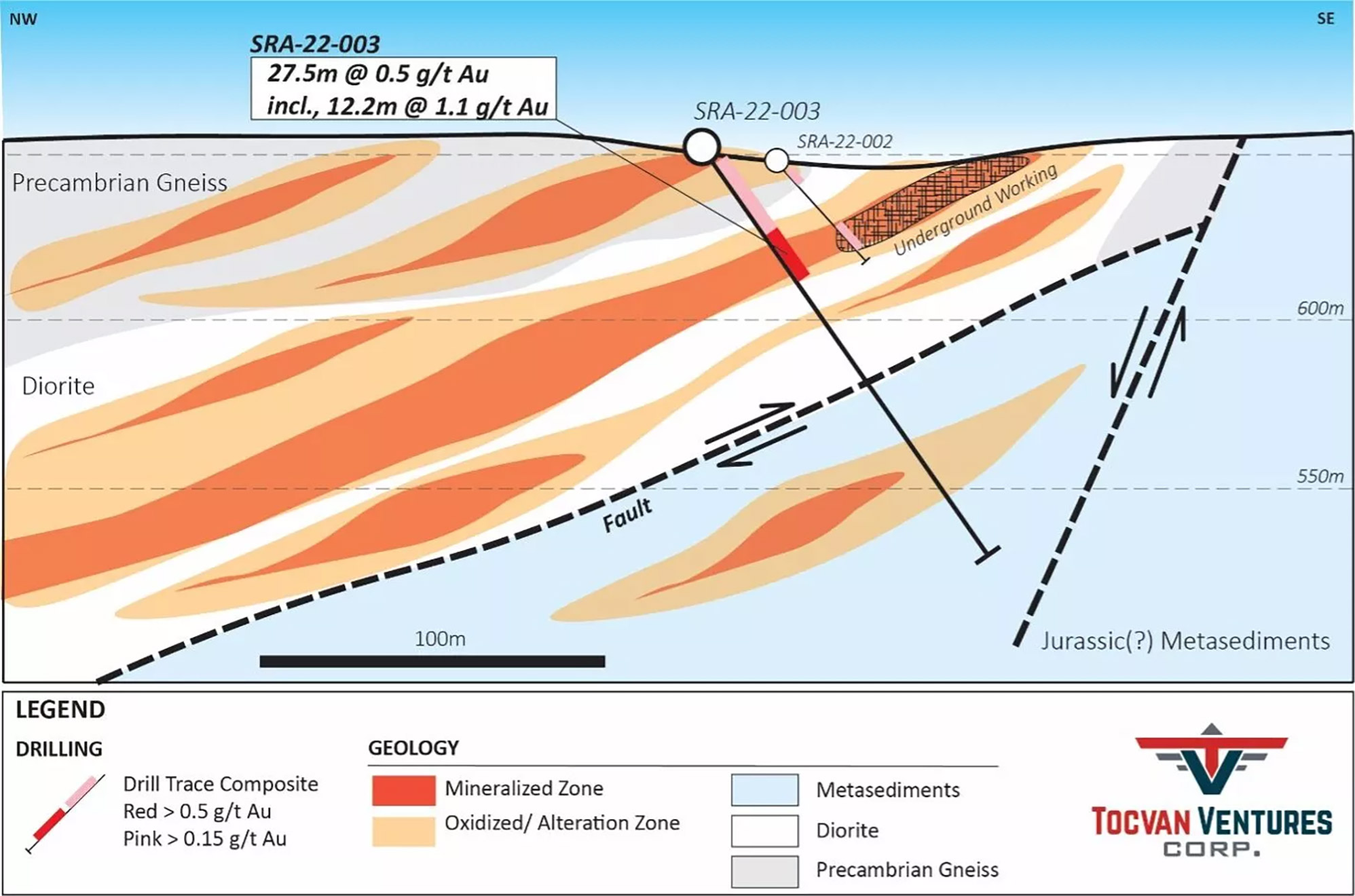

At Las Guijas, hole 3 was the best hole. Not for the 48.8 meters of 0.3 g/t gold but for the ‘higher grade’ zone of 27.5 meters of 0.51 g/g told starting at about 21.4 meters downhole. And due to the azimuth of that hole, this basically means the gold mineralization starts just about 10 meters below surface.

While the two other holes were less impressive, there are mitigating circumstances here. Hole SRA22-001 was drilled on the northern flank of the Las Guijas underground workings and although no significant mineralization was encountered in this hole, it did encounter a 9 meter wide quartz vein with anomalous values.

Hole SRA22-002 was targeting the down dip projection of the mineralisation at the underground workings on the Las Guijas zone and while anomalous gold values were detected (including 1.5 meters of 0.5 g/t gold), the hole was lost and had to be abandoned as it actually encountered the underground workings. That’s a pity as hole 3 actually picked up the mineralization of the Las Guijas zone just a dozen meters away and it looks like if hole two would have been drilled a few meters further to the northwest, it would have hit the same type of mineralization as hole 3 did.

The interesting first three holes at Las Guijas were followed up on with the assay results from the seven holes drilled at the ‘main’ San Ramon zone.

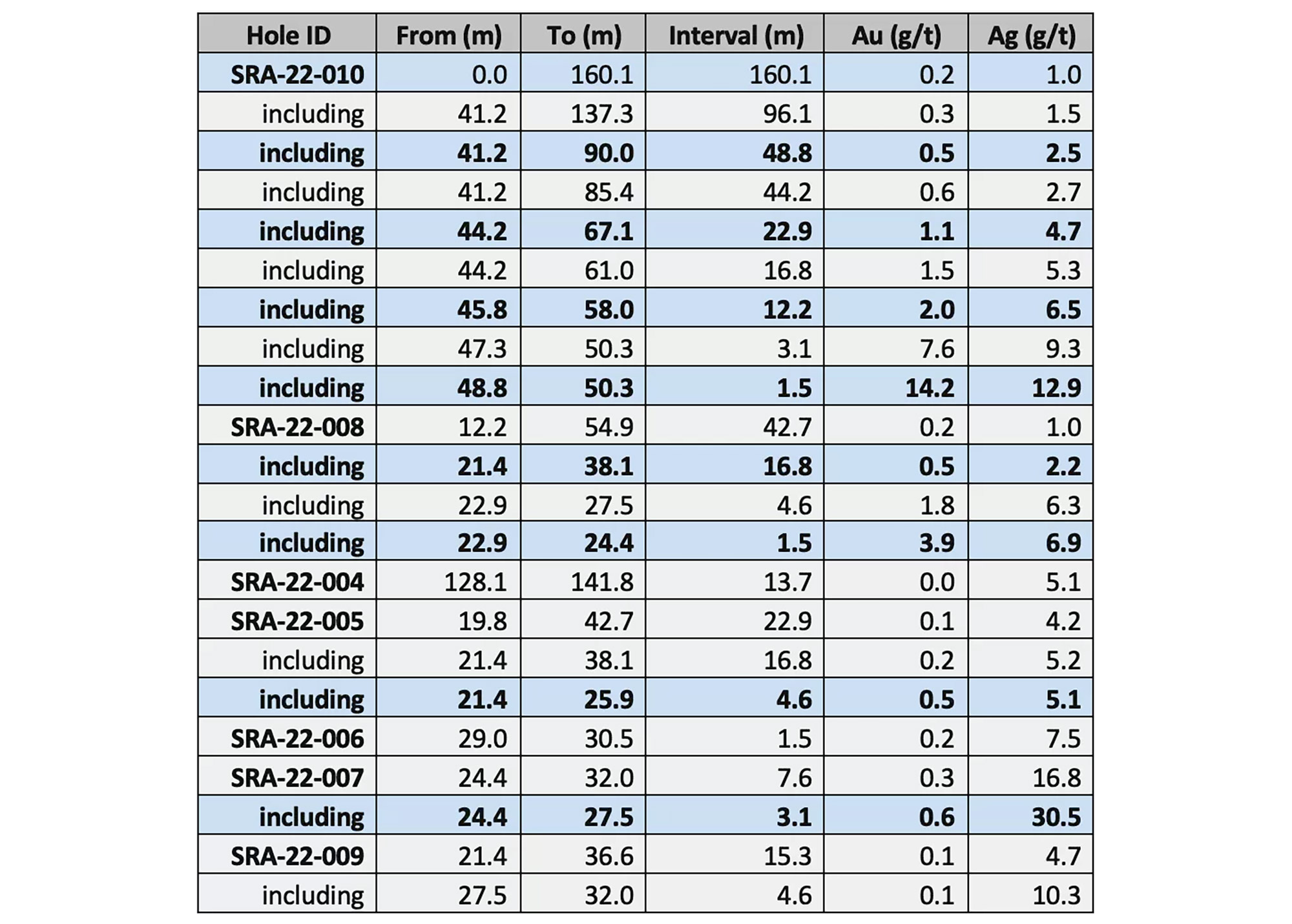

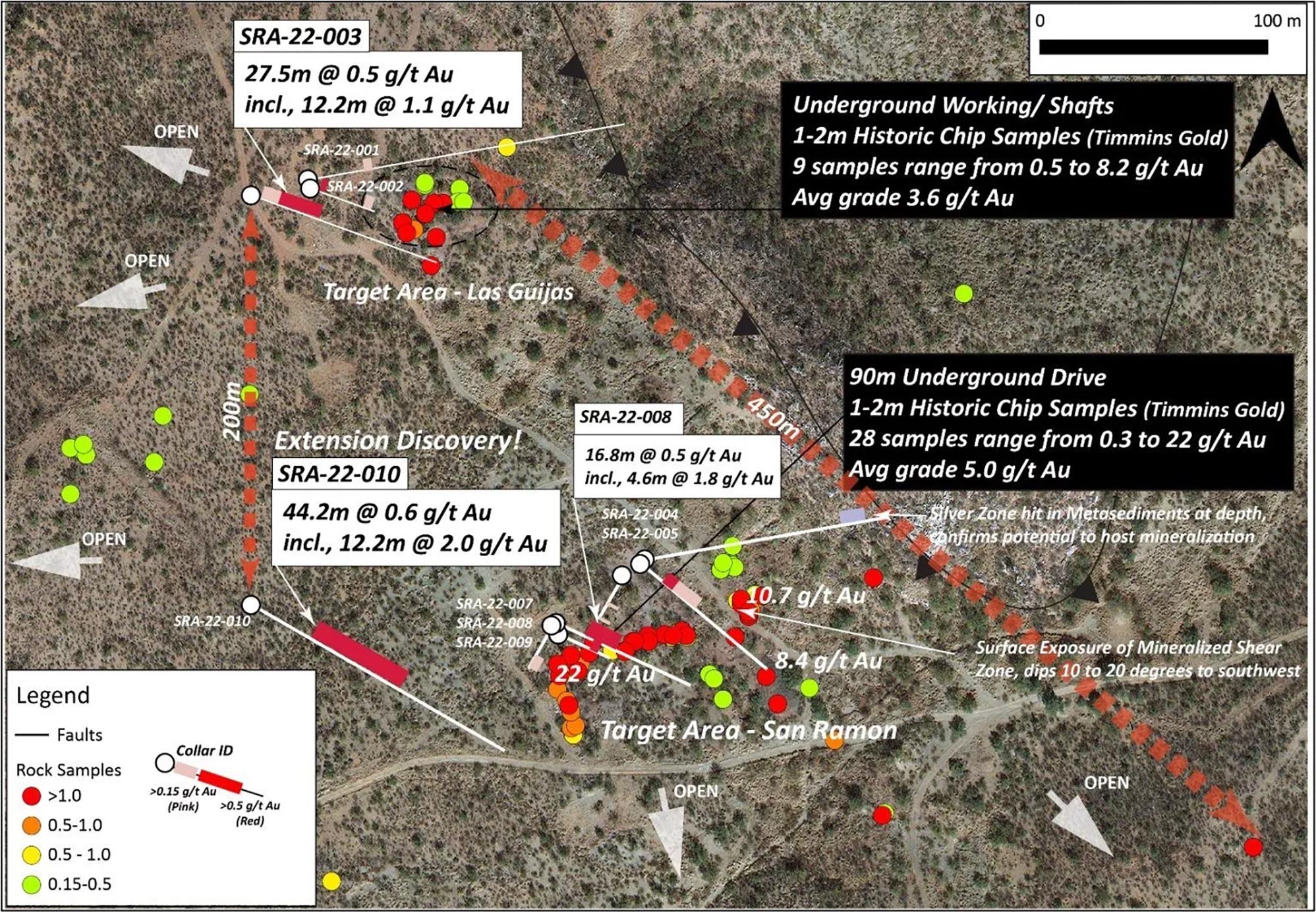

From that batch, the assay results from hole SRA-22-010 were clearly the best. While the entire 160 meter interval was mineralized with an average grade of 0.2 g/t gold, that interval was boosted by a series of higher grade but narrower intervals like 12.2 meters containing 2.0 g/t gold and 6.5 g/t silver which included 1.5 meters of 14.2 g/t gold with a silver content of about 12.9 g/t.

As you can see in the image above, most of the other holes were also mineralized. The 16.8 meters of 0.5 g/t gold in hole 8 would also be economical and while some of the other holes look weak with either low grade and/or narrow intervals, all seven holes drilled at San Ramon contained gold and silver. The image below shows the location and main results from the seven holes.

With eight of the ten holes returning gold values exceeding 0.2 g/t and scoring a 7/7 at the main zone at San Ramon, we wanted to catch up with CEO Brodie Sutherland to discuss these holes and his future plans at both San Ramon and Pilar.

A Q&A with CEO Brodie Sutherland

El Picacho

You completed 10 holes at El Picacho. The first batch of three holes was interesting with one good hole, one bad hole, and one hole that was cut short prematurely as you encountered historical workings. How do you look back on the three holes drilled at Las Guijas? Does the lack of any noticeable mineralization in hole SRA-22-001 close off the mineralization in that direction?

The short answer is no, it still remains open towards SRA-22-001. This is because our geos logged a quartz vein, in oxidized pyrite bearing host rock over a 9-meter zone that correlates with where we thought the target would be. Sadly gold and silver were just elevated (so the hole wasn’t barren) but we are seeing Arsenic, Antimony and Tungsten (important pathfinder elements) all elevated across that zone as well which suggests it’s just off of something that could have more significant grade. There is nothing on surface that indicates mineralization would be truncated or cut off to the north. Hole 2 really showcased the potential intersecting 12.2 m of 1.1 g/t gold, close to surface and adjacent to the old workings.

You are still in the first stage of the 5 year option agreement with Millrock Resources (MRO.V) to acquire El Picacho from the Suarez brothers. Is it correct to assume there is no real time pressure to ‘get things done’ this year and additional Picacho drilling activities will depend on your ability to raise funds?

Exactly, there is no immediate rush. I do want to see our highest priority targets tested with drilling before the anniversary date in June of 2024. So, we can make a call if we want to hold onto the property. These first hits at San Ramon are very encouraging and already pushing me to believe we will follow through with the full option agreement. If the funds are available, we will drill as much as possible over the next year.

Let’s move over to the ‘main’ San Ramon zone where you completed seven holes. Could you elaborate on how you chose the drill locations and azimuth for those holes? Holes 7-8-9 for instance were drilled very close to each other while holes 4, 5 and 6 have completely different angles and directions. How did you design this drill program?

Drilling at San Ramon ‘main’ didn’t really go exactly to plan due to the sporadic location of historic workings. We really found out it’s Swiss cheese underground there. Originally, we wanted to test 3 different orientations across the area. 080 as an azimuth to test the westerly dipping broader mineralized system; 120ish to test across what we think could be higher-grade veins at a slightly different orientation to that main system trend; 210ish to test that same theory but in the other direction to see if we hit those veins which we think are near vertical. Hole 4 and 5 went to plan.

We hit some shallow mineralization in Hole 5 (azi 130). Hole 4 (azi 080) was interesting as we saw elevated silver values over a broad zone in the metasediments, La Herradura sees an average of 1.7 g/t Ag, we are seeing 2 g/t Ag over 100m…so it’s intriguing and means the meta sediments can be a potential host. Hole 6 (azi 210) hit a working so we stopped it. We then moved the drill to get a better angle under the historic drive. Hole 7 (azi 115) also hit a working (hence my Swiss cheese reference) but not before hitting a vein zone with up to 1 g/t Au and up to 54 g/t Ag, so that was pretty encouraging.We then repositioned and steepened the hole to try again. Hole 8 was successful in hitting some decent mineralization, but as you can see, nothing crazy high-grade. We then spun to test the 210 azimuth again with hole 9. We called the hole at 36-meters due to hitting another underground working…but not before hitting a vein zone from 13.7m to end of hole with gold values up to 0.3 g/t Au and Ag up to 14 g/t gold over 1.5m intervals. Looking at the hole 9 drill trace there is a chance we could have come across more if we were able to keep pushing it. At that point we decided to step away from the workings and test the bigger model. The 120 azimuth seemed to be getting the most consistent results so we stuck with that.

You used the assay results from hole 10 as your headline results. Deservedly so as the approximately 12.2 meters of 2 g/t gold are an interesting result. The majority of the gold was found in a 1.5 meter interval grading 14.2 g/t gold, indicating the residual value in the remaining 10.7 meters was just under 0.3 g/t gold. What does that narrow but high-grade interval tell you? Does this indicate there potentially is some ‘nugget effect’, or is it really a zone of high-grade oxide-hosted gold?

I think nugget effect is a factor here. We came across an intensely altered and oxidized quartz vein zone over that same interval and seeing oxidation and veining both above and below. That 12-meters shows up very strongly in the geochemistry (Ag, As, Sb) suggesting you could have decent gold grades anywhere within. If you look at the past sampling with the higher gold grades in the workings and at San Francisco where there are very high-grade intervals related to smaller veins, I think we should be looking at how to factor in a nugget effect with big diameter drilling and duplicate samples. Looking at the data I see this as oxide gold, we don’t see a lot of sulphur or base metals that would be related to sulphides in the assays. Again I think you can look at San Francisco as a comparable of what they are able to recover there with heap-leach, even though they are now 350-meters deep in the main pit. All that considered, I think we need to be optimistic when we are seeing the alteration and geochemistry elevate, if there is a nugget effect it might take added drill density to truly evaluate the full potential.

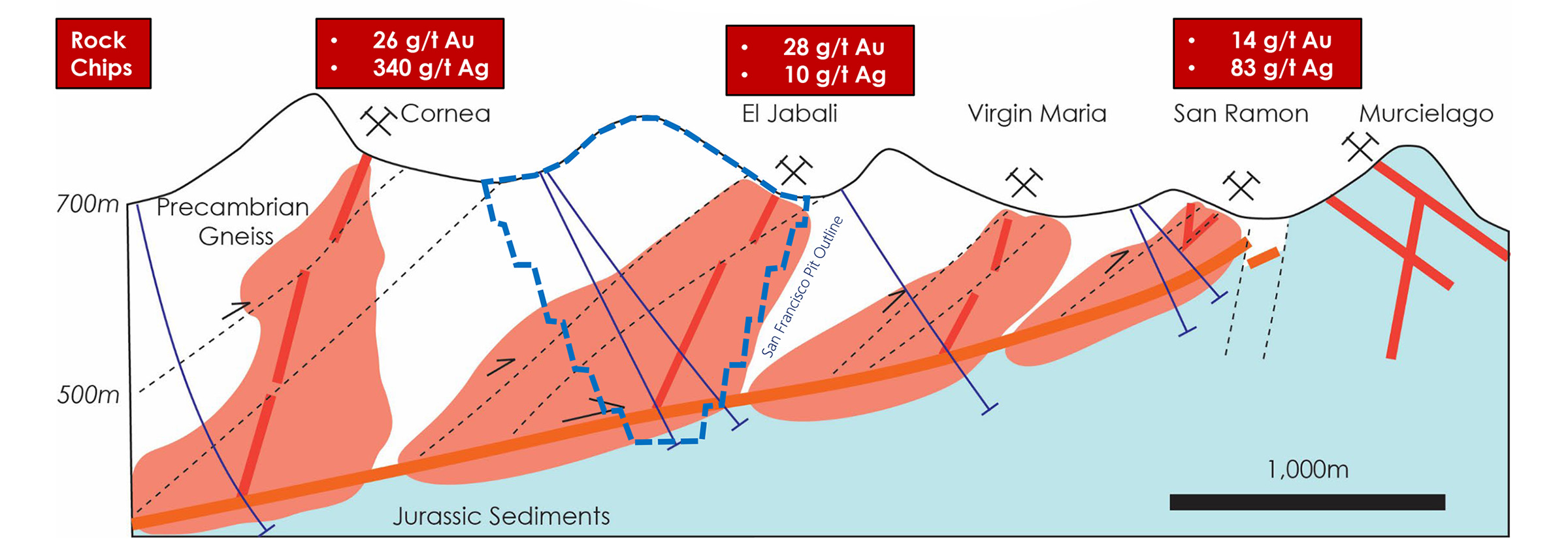

As you stepped out towards the west from the known gold zones at San Ramon, you confirmed the gold mineralization further extends to the west and at depth. This basically validates your exploration theory, but based on that theory, how much further to the west and how much deeper to you expect/anticipate to find gold mineralization? The cross-section in Figure 2 is just a theoretical outline and the further you go to the west, the less actual data you have?

There are veins mapped at surface further west and it’s part of our next steps to map more at surface to evaluate that and how it relates to what we see in hole 10 and 3. Virgen Maria is another target further west where we see high-grade at surface again. There is nothing geologically that suggests it stops. It really is just a question of ‘is there enough grade or parallel zones of mineralization that make it an attractive target at depth?’.

The location of hole 10 is also interesting. Although there is a gap of about 200 meters in between holes 10 and 3, do you expect this could potentially be part of the same mineralized trend? If so, does that mean you would like to drill a few holes in between holes 3 and 10 to see if they link up?

We do think they are related. They appear to be parallel zones of increasing alteration and oxidation where we see veining. As the schematic cross-section shows these are dipping to the west and vary in width and we think within these zones there are sub-vertical veinlets that can host gold as well (and possibly the higher grade mineralization, that’s what they see at San Francisco). So I think it’s very likely they are related. We will definitely test in between at some point.

Pilar

The focus was recently on the El Picacho project where your initial drill program yielded some interesting results. Do the Picacho drill results ‘threaten’ the position of Pilar as your flagship project?

It for sure is a nice problem to have. I don’t think it threatens it, but Picacho really is a nice compliment to a more established Pilar project that we will switch focus back to for early 2023. Picacho has lots of interesting targets, so it gives us the ability to drill test those when the capital is available.

You announced in December you were planning a bulk sampling program at Pilar, which should start shortly. Could you perhaps provide a quick update on what you are trying to achieve with the bulk sampling program?

The aim of the bulk sample is to produce a head grade and recovery percentage that is more representative of what we could expect from a future development. In addition, we are looking to complete some other gold characteristic studies to determine: the size and shape of gold, is there course gold that is gravity recoverable, what percentage is amenable to standard leaching, what percentage is tied up with sulphides? This will ultimately help guide what a future production circuit could look like and if any additional processing techniques would be of value. The bulk sample will also give our shareholders/ investors confidence in taking Pilar to the next stage of development and should make it easier to raise capital to continue to advance it.

A company like Minera Alamos felt sufficiently confident in developing their own Santana gold mine in Sonora after gathering information in a bulk sample test. Do you feel this is also possible for Tocvan or would it just be too difficult to secure funding without completing the proper steps towards a production decision?

Santana is a great analog that shows this type of deposit doesn’t have to be large to make it work. Internally we will know what we have. From what I am hearing, there is a renewed sentiment growing towards gold. If that persists I think we can raise the capital needed without a resource or pre-feasibility study. I do want to evaluate where we are at by the end of this year and decide if a published resource at Pilar makes sense for us or if there is still room to expand it before we do that.

At Pilar, you need to spend C$500,000 on exploration by September 21st of this year. May we assume the bulk sample program will contribute towards that C$0.5M requirement, or would you effectively have to spend that amount on drilling?

We are actually over the total C$2M million required spend at Pilar for the 5 year option agreement so we could do no work this year and still honor the agreement as it does have a clause about carry over of previous years exploration cost that surpass the C$0.5M marker.

But none the less, the bulk sample would cover a good portion. Drilling will fill in the rest of the exploration cost. 1,500-meters would probably get us in that spend range with the bulk sample and we will look to do as much drilling as we can.

Corporate

It has now been over six months since you initiated the financing agreement with Sorbie Bornholm. Can you provide a quick update on how many shares you have issued to them and what the average price was?

To date, we have received $830k cash in 6 tranches, translating to 1.37MM shares, if you use that as a parameter for share price then looking at an average $0.61 price per share, which is probably pretty close to our average share price over that term.

About a year ago, you sold the Rogers Creek project to Cascade Copper, and were planning to distribute the Cascade shares to the Tocvan shareholders upon completion of the transaction. Do you have any update on when Cascade Copper will start trading? And just to be clear, the record date for Tocvan shareholders to qualify for the spinout was in May last year, right? So this means the shares that have been issued since May do not qualify?

This process has indeed been a drag. Cascade is run by different management who have diligently been going through the IPO process. Their team suggests it should be trading by end of the first quarter as it sounds like the prospectus has been approved they just need to raise cash. Hopefully they can deliver on that and perhaps the recently filed NI43-101 report -which you can find on SEDAR -will help. The price of copper should assist as well. The qualifying date for the Cascade shares was indeed in May, so yes, any shares issued or purchased after that won’t receive the Cascade Copper shares. Once Cascade goes public or perhaps even shortly before we will be issuing the shares to shareholders who qualify. It sure will be nice to have that completed and hopefully the shares can unlock new value for shareholders.

Conclusion

We think it’s fair to say Tocvan’s initial drill program on the El Picacho project was successful. Although not every hole has hit the desired targets due to the unknown extent of the historical underground workings, there’s plenty of evidence El Picacho deserves more attention going forward.

The immediate focus this year will be on the Pilar flagship project where Tocvan Ventures is working towards reaching the critical mass required to start thinking about developing the resource. 2023 could be a pivotal year for Tocvan Ventures as the higher gold prices increases the inbound interest in gold exploration. And hopefully the company can capitalize on this with its two promising exploration projects in Mexico’s Sonora state.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan Ventures is a sponsor of the website. Please read our full disclosure.