Minera Alamos (MAI.V) has published a second set of drill results on its Santana gold oxide property in Mexico’s Sonora state. As we explained in our previous blurb on Minera Alamos (which you can re-read here), the company continues to drill-test the southwest extension of the Nicho main zone at the Santana project, and this second set of drill results once again confirms the potential to expand the resources at Santana as after finding 93.5 meters containing 0.65 g/t gold, Minera Alamos’ newest hole is even better.

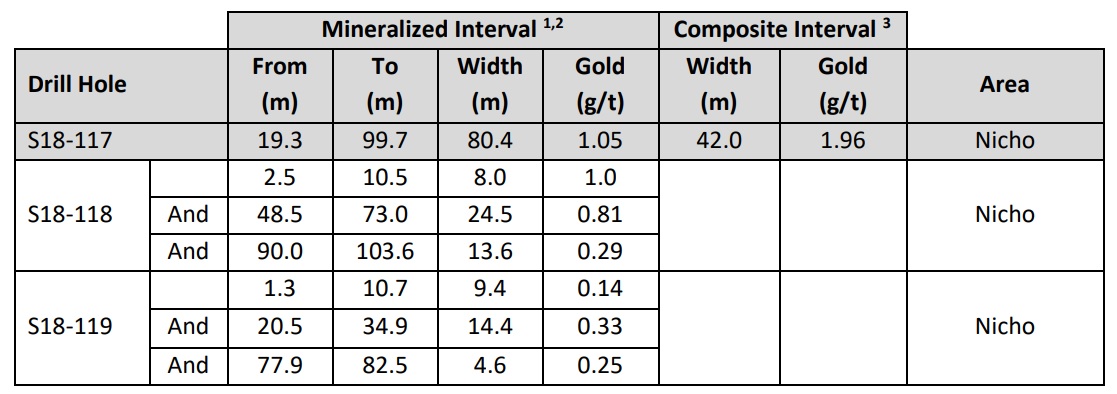

The drill bit intersected 80.4 meters of 1.05 g/t gold, and when expressing this drill result in gram-meters, it’s even better than the previous holes. An oxide deposit with gold mineralization at an average grade of 1.05 g/t is phenomenal (especially when you see the gold mineralization starts at less than 20 meters down hole), and if this would have been one of the Nevada oxide projects, the share price would most definitely have jumped overnight. Unfortunately the market reacts lukewarm on Minera’s exploration results, and that’s probably because it does look at Minera as a near-term production story where ‘poured ounces’ will be a more important metric than the pure drill results a ‘normal’ exploration company is being judged on.

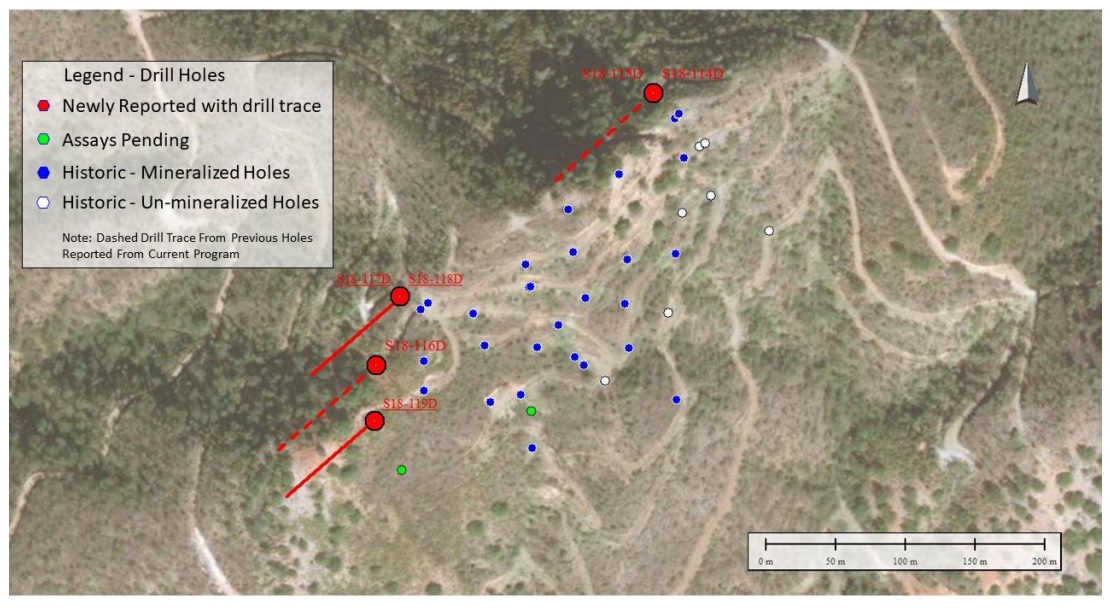

That didn’t happen at Minera Alamos, but it’s clear that holes like this will add a lot of value to the company’s Santana project as finding more gold-bearing rock containing a high average grade of gold will most definitely have an impact on the final pit outline, as Minera Alamos can now focus on designing the most efficient and optimized pit shell. The mineralization is now still open towards the southwest of the Nicho zone, but we are also expecting the company to release assay results from drill holes that are testing the potential northern extensions of the Nicho zone.

The first drill program at Santana in 7 years is paying off, and Minera shareholders are now starting to understand why MAI was so keen on merging with Corex Gold. The Santana project is improving on a weekly basis and will provide an early source of cash flow which could then be used to develop the other properties in the portfolio. The company’s current market capitalization of C$36M doesn’t appear to reflect the true value of the properties.

Go to Minera’s website

The author has a long position in Minera Alamos. Please read the disclaimer