Amur Minerals (AMC.L) has revisited the design and total price of its planned road construction activities to move concentrate from the Kun-Manie nickel project to the Baikal Amur Rail Line, and to haul mining supplies back to the site. In the original design, the company projected a 10.5 meter wide two lane road of crushed stone, but this design ‘significantly’ exceeded the hauling requirements of shipping 400,000 tonnes of concentrate from the mine and hauling 100,000 tonnes per year of supplies to the mine.

The original cost was expected to be around US$0.5-1M per kilometer of two-lane road, and US$440,000 per kilometer of a one-lane road but as the Russian Rubel has lost quite a bit of its value versus the dollar in the past few years, the updated cost estimates for the one-lane road have now decreased to US$382,000 per kilometer, for a total cost of US$129M for the 338 kilometer long road.

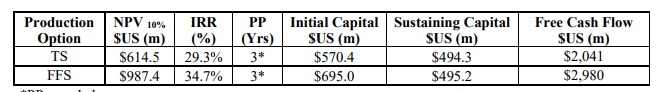

This will save the company quite a bit of money and as the construction of the access road was expected very early in the construction phase, every million Amur can save on the construction of this road will very likely be immediately added to the Net Present Value of the project. According to the most recent pre-feasibility study on Kun-Manie which was released last week, the project currently has an after-tax NPV10% of US$615M in the toll-smelt option (producing and selling a concentrate) and $987M in the electric furnace/flash smelter option, wherein Amur would built its own smelter.

Although we are charmed by Amur’s use of a 10% discount rate as base case scenario, it’s perhaps still a stretch to use a long-term nickel price of US$8/pound. Sure, on a longer-term basis this nickel price could be seen as ‘acceptable’, but we would also be curious to see the economics using the spot price of the project.

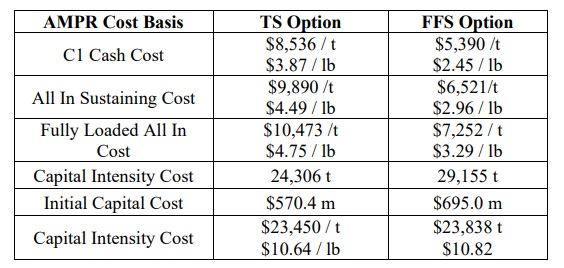

If we would have to choose between both scenarios, we would prefer Amur to build its own smelter as the additional $372M in after-tax NPV would cost just US$125M in additional capex (so basically for spending US$125M, Amur would generate an additional US$500M in discounted cash flows) as the AISC per produced pound of nickel would decrease from $4.49 to $2.96 as the construction of its own smelter would allow Amur to unlock the value of by-product credits which wouldn’t be (or barely) payable if it would sell a nickel concentrate.

Amur Minerals still has plenty of options to further improve the economics of the project as it could further extend the mine life of the project by incorporating the 2018 drill results into the NPV calculation (although these additional years will be heavily discounted and will barely contribute to the NPV), while additional met work could result in lower MgOx levels and perhaps the production of a separate copper production on the property.

Despite the project being based in Russia, it does look like Amur’s Kun-Manie project, as well as FPX Nickel’s (FPX.V) Decar project could provide feasible options to boost the nickel supply to meet the increasing demand.

Go to Amur’s website

The author has no position in either Amur or FPX. Please read the disclaimer