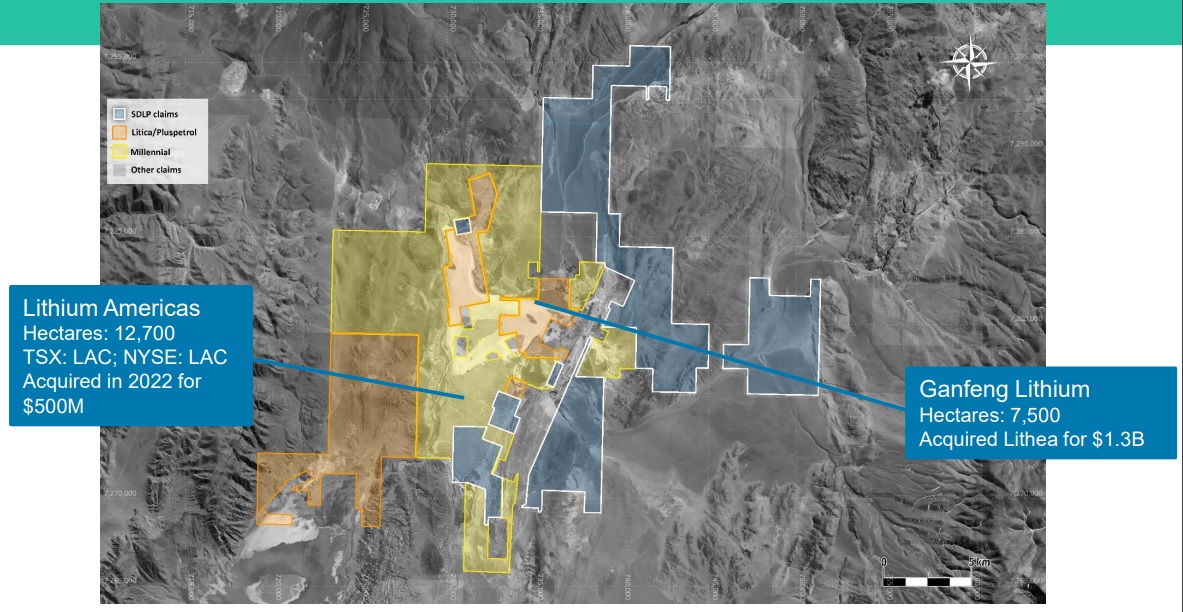

Arena Minerals (AN.V) has disclosed it has completed the first exploratory hole on the Fortuna II claim block, a portion of the 65% owned Sal de la Puna lithium project in Argentina’s Salta province. The Sal de la Puna block is located in the Pastos Grandes lithium district which you may remember from our updates on Millennial Lithium which was acquired by Lithium Americas (LAC, LAC.TO).

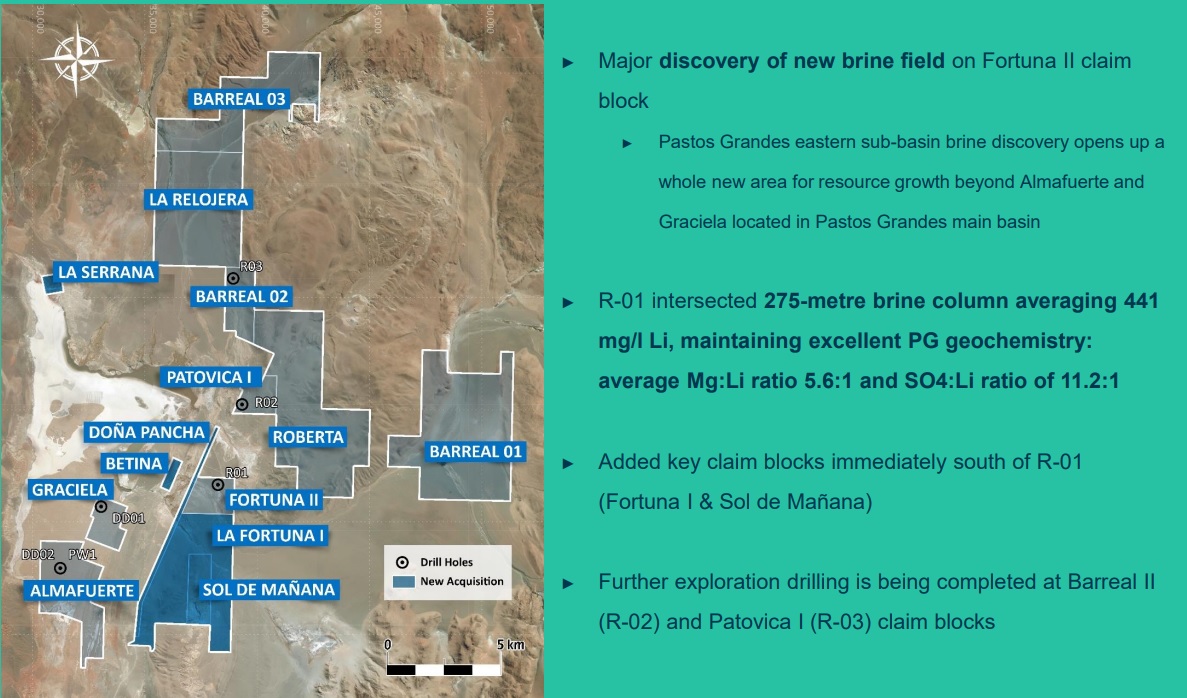

The hole intersected a thick continuous brine column of approximately 275 meter thick starting at about 240 meters downhole. The average grade of the 275 meter interval was approximately 441 mg/l Lithium. The magnesium level of 5.6:1 is relatively low and that makes this interval comparable to other projects in the Pastos Grandes basin. As this is just the first hole that was drilled by Arena in this specific area, the company is off to an excellent start and the drill rig has now moved to other locations in the basin.

Based on the Q2 financials, Arena Minerals had a working capital position of almost C$6.5M as of the end of June and with approximately 15 million options outstanding at an average exercise price of C$0.24. Meanwhile, there are about 62 million warrants outstanding with an average exercise price of C$0.20 and the if all options and warrants would be exercised, Arena’s treasury will receive in excess of C$15M in proceeds. That obviously was the situation as of the end of June and the ‘subsequent events’ note to the financial statements confirmed almost 37 million warrants were exercised subsequent to the end of the quarter, and this brought in almost C$7.4M in cash. This has boosted the current share count to in excess of 425 million shares but likely also means the company has north of C$10M in cash right now.

Subsequent to making this discovery, the company acquired five additional claims for a total of 2,200 hectares in the Pastos Grandes Basin. About 90% of these newly acquired claims are directly adjacent to the discovery zone. Total consideration for the acquisition of the title of three claims (Arena is only acquiring the lithium brine rights over the other two smaller claims) is US$3.825M payable in four tranches. The two final installments (on the 12 month and 24 month anniversary of signing the agreement) are the highest as Arena will be required to pay US$1.35M in cash on both dates.

Disclosure: The author has no position in Arena Minerals. Please read our disclaimer.