Base Resources (BSE.AX) continues to advance its Toliara heavy mineral sands project in Madagascar, as its existing operations are running out of steam. The Ranobe area, which is a part of Toliara, currently has a total resource estimate of 2.6 billion tonnes (!) at an average heavy minerals grade of 4.3%. Of the 2.6 billion tonnes, about 904 million tonnes made it into the reserves category, with an average grade of 6.1% heavy minerals. Those 904 million tonnes are already sufficient to underpin a mine life of almost 40 years.

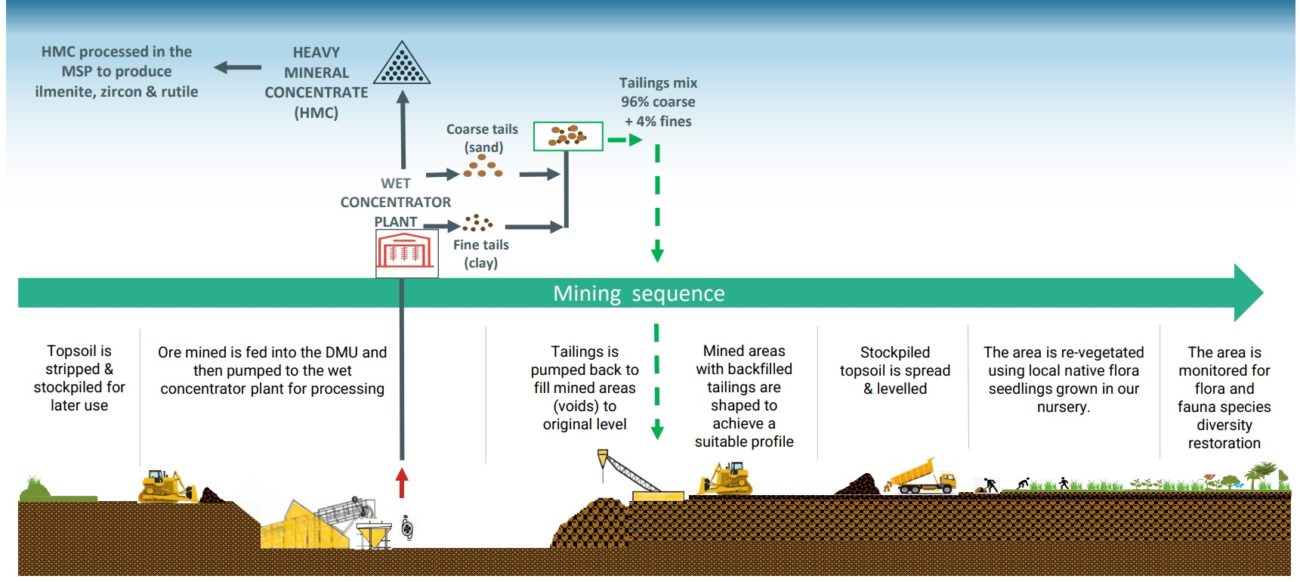

Base Resources plans to start with a 13 million tonnes per year operation which is estimated to cost about US$520M. The initial capex increased by almost 20% and Base is blaming inflation for the higher initial capex. The second phase of the Toliara production plan will boost the throughput to 25 million tonnes per year for an additional capex of $137M.

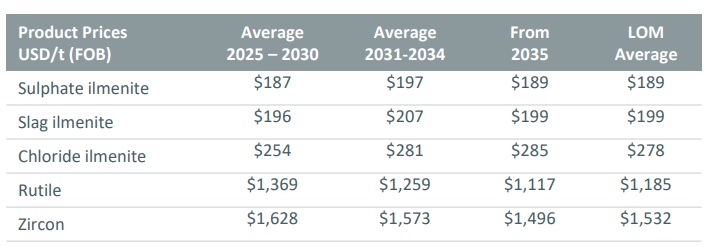

The average output is estimated at 960,000 tonnes of ilmenite per year, 66,000 zircon and 8,000 tonnes of rutile. This means the ilmenite portion of the output will be very important as it represents about 65% of the anticipated revenue. The economics are pretty good as the official feasibility study estimates the EBITDA to come in at around $219M resulting in a net income of $152M and an annual average free cash flow of US$174M. On an after-tax basis, the NPV10% is now estimated at US$996M while the internal rate of return increases to 23.8%.

Disclosure: The author has no position in Base Resources. Please read our disclaimer.