Cancana Resources (CNY.V) has told the market it won’t exercise the catch up option to acquire a 40% stake in the Brazil Manganese joint venture. Cancana had the possibility to match a certain amount of expenditures incurred by JV partner Ferrometals. As Ferrometals has spent almost US$22M on the property (versus Cancana’s $7.5M), Cancana would have had to cough up almost US$7M (C$9.1M) to exercise the option to earn a 40% stake in the property.

At first, we were disappointed Cancana didn’t seem to be interested in exercising the option, but after doing the math it’s in the shareholders’ best interest not to exercise the option. Raising C$9.1M would not only have been extremely difficult, it would also have increased the share count by 60-75%. Cancana now owns 26% of the property and will do its best to keep its interest at that percentage. One small advantage is the fact it will also have to contribute ‘just’ 26% of the capital expenditures to increase the throughput of the Jaburi plant to 50,000 tonnes per day.

Cancana also confirmed it has entered into an agreement with Ferrometals whereby the latter has provided Cancana with a US$2M loan which will have to be repaid within 8 months. This should provide Cancana with some more time to raise cash at a higher share price instead of diluting the current shareholders.

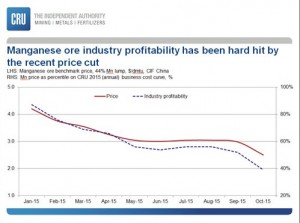

Meanwhile, the production rate at the BMC joint venture is still increasing and a record 2,489 tonnes of Manganese were produced in August. The production rate was a bit lower in July and September, but the total production in the third quarter was almost 7,000 tonnes at an average grade which will likely be in excess of 50% Mn (the final assays are still pending). The BMC JV has now increased its stockpile to 13,563 tonnes as it sold just 469 tonnes in the quarter. Based on the current manganese price, an anticipated grade of 51% Mn and the expected premiums on top of the benchmark price (which has fallen to $2.5/dmtu, 10% below the October 1 level used in the press release), this stock pile currently has a total value of US$2.25M.

> Click here to go to Cancana’s website

Disclosure: The author holds a long position in Cancana Resources. Cancana is a sponsor of the website. Please see our disclaimer for current positions.