Canterra Minerals (CTM.V) announced earlier this week it has entered into a share exchange agreement with Teton Opportunities (private) whereby Canterra will acquire all of Teton’s outstanding shares in an all-share deal.

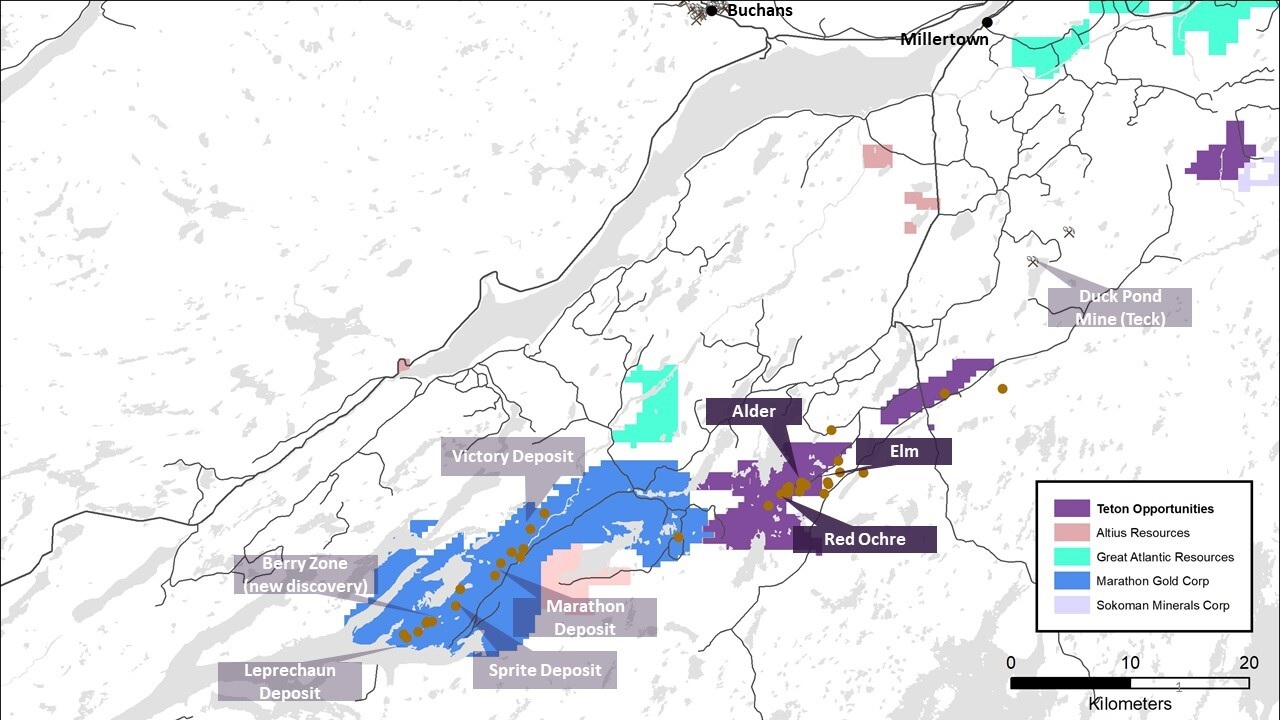

Teton’s assets consist of the 104 square kilometers split into 3 project blocks with the main project being Wilding. Combined, the projects cover 30 kilometers strike length of the Rogerson Lake structural corridor in central Newfoundland, one of the new hotspots for gold exploration in Canada. The Wilding land package also is on strike with the Valentine Lake project owned by Marathon Gold (MOZ.TO) which currently contains in excess of 4 million ounces of gold with a positive pre-feasibility study outlining a 12 year mine life. Needless to say Teton’s Wilding project is in the right location.

And this isn’t just ‘virgin ground’. The project was subject of a 30 hole drill campaign in 2017 (way before Newfoundland was a ‘hot’ area for gold exploration) and some of the intercepts highlighted in the press release are 5.3 meters of 10 g/t gold, 5.1 meters of 1.44 g/t gold and a thicker interval of 17 meters containing 0.98 g/t gold. We will be following up on this deal with Chris Pennimpede, Teton’s founder and incoming President and CEO of Canterra.

Canterra intends to acquire all outstanding shares of Teton by issuing 0.3519 of its own shares per share of Teton and the total of 27.5M Teton shares (including the 12.5M share payment to Altius Minerals) will be converted in approximately 9.7 million new shares of Canterra. As Canterra was halted at C$0.15 right before the transaction was announced, the ratio implies a C$0.052 consideration per share of Teton for a total deal value of approximately C$1.5M. However, applying the C$0.12 price used for the hard dollar raise, the deal is valued at C$1.2M and the total market cap of Canterra post-deal (but pre-raise) will be around C$2.25M using C$0.12 as price point.

Indeed, Canterra is also immediately launching a C$3.25 capital raise consisting of a flow-through component at C$0.13/share and a hard dollar component at C$0.12 per unit with each unit consisting of one common share and ½ warrant with a strike price of C$0.24 allowing the warrant holder to acquire an additional share during a period of two years.

Disclosure: The author has a long position in Teton Resources after participating in a private round.