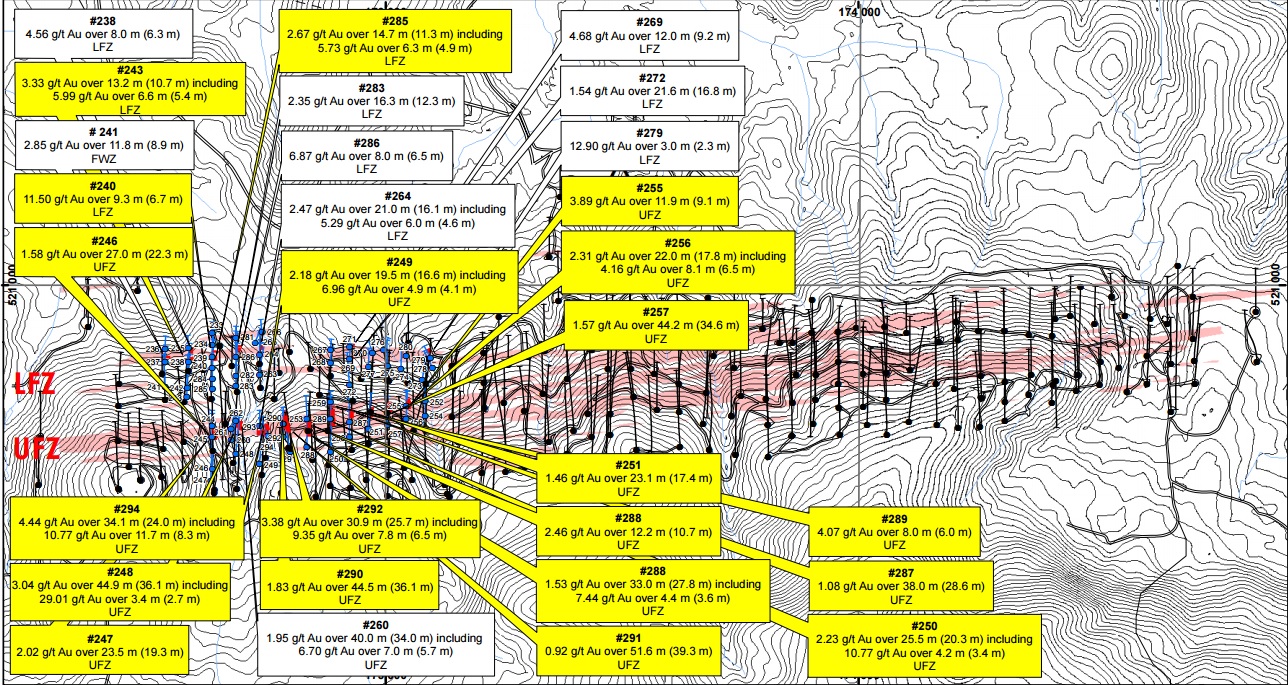

Columbus Gold (CGT.V) has now completed its infill drill program at the Montagne D’Or gold project in French Guiana and the new assay results contain some very valuable information as the company pulled some phenomenal intercepts out of the ground. Intervals of 6.7 meters true width containing 11.5 g/t gold and 36.1 meters containing 3.04 g/t are excellent and will increase the level of confidence in the geological model at Paul Isnard.

All results will now be incorporated in a new resource estimate which should increase the total amount of ounces in the measured resource category. This upgrade will be necessary to make sure the mine plan in the upcoming feasibility study is robust. We continue to expect Nordgold (LON:NORD) buying Columbus’ stake in the Paul Isnard project upon completion of the feasibility study (which is expected by the end of this year).

Considering Nordgold recently paid US$5M for a 5% stake, the remaining 45% of the Paul Isnard project is valued at US$45M on a pre-feasibility basis. Once the feasibility study will be completed, the valuation of the project should increase and we would disappointed if Nordgold would acquire the remaining 44.99% interest of the project for anything less than US$65-70M, which would work out to be C$0.62 per share.

Go to Columbus’ website

The author has a long position in Columbus Gold. Please read the disclaimer