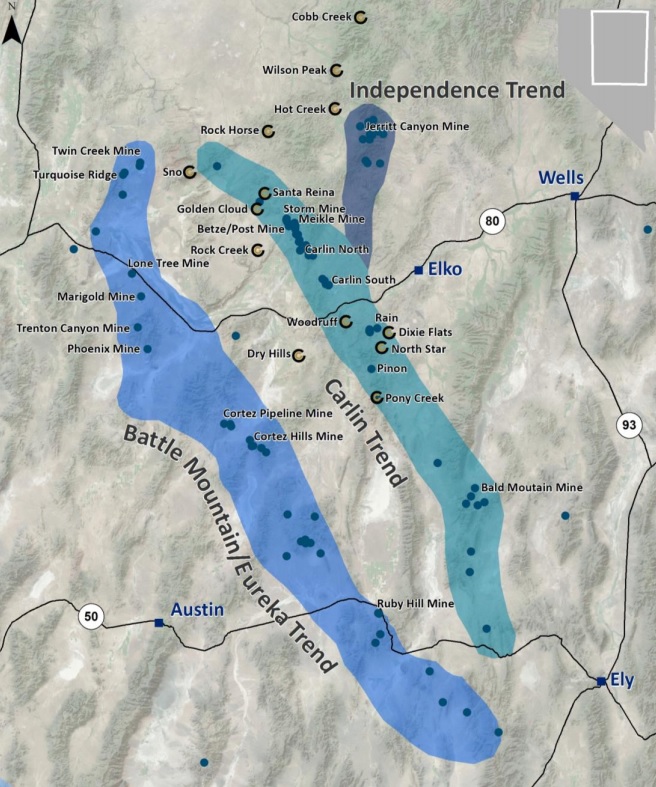

Sometimes the market needs some time to fully appreciate the true value of a company and its assets. Despite having attracted Goldcorp (GG, G.TO) as strategic investor, Contact Gold’s (C.V) Initial Public Offering seemed to have been flying under the radar. And that’s a pity as this fully cashed-up exploration company is already sitting on a historical resource estimate containing 1.5 million ounces at an average grade of 1.2 g/t (in oxide material).

This by itself should already justify an enterprise value of in excess of C$50M, but alas, after deducting the C$10M cash balance from the market cap, Contact Gold’s enterprise value is just C$24M.

An opportunity? Yes, we think so. So we sat down with CEO Matt Lennox-King to catch up on the ongoing 8,000 meter drill program on the company’s flagship Pony Creek project.

General

It doesn’t happen very often to see a new junior exploration company being able to pick up an entire portfolio of decent assets in Nevada. How were you able to get your hands on the asset portfolio?

Good question. On the back of a long standing relationship, we were approached by Waterton, the mining focused private equity group out of Toronto. They were looking for an experienced management team to partner with and drive value creation with a packed of their exploration stage projects. Waterton had been picking up assets during the downturn in the past several years and will now be able to leverage our expertise to advance these properties whilst it retains a strategic equity stake in Contact Gold.

You were also able to immediately build a strong technical team (Vance) whilst your board looks particularly strong as well with almost 100 years in combined mining experience. How did the team come together?

Most of the team has worked together in some capacity in the past, either through Fronteer Gold (Dorward, Vance and Lennox-King), Pilot Gold (Wenger, Dorward, Vance and Lennox-King) or Integra Gold (Salamis and Farncomb). In one way or another, we were all looking for new opportunities to partner up on…the fact that we cover all aspects of the business in our collective experience was a real key to building the team.

Pony Creek

We think it’s fair to assume Pony Creek is your flagship project, and deservedly so as there’s a historical resource estimate containing 1.5 million ounces of gold at an average grade of 1.2 g/t which is actually a really good grade for an oxide project in Nevada. We understand the resource was calculated based on drilling on just a fraction of your substantial land package?

That’s correct. At the time we closed the deal in June, only about ~30% of the property package at Pony Creek had even been sampled, with less having been drilled.

Since closing the deal, we’ve added over 30% more land to Pony Creek, which equates to approximately 300 claims. We’re in the process of completing a comprehensive soil sampling, geophysical and mapping program across the balance of Pony Creek. This will all be integrated into new drill targets which we anticipate to drill in 2018.

Also, drilling at Pony Creek was pretty shallow. Will you drill some deeper holes to test for the potential at depth? At what depth would you expect the oxide layer to transition into a sulphide zone?

With the drilling we’ve done so far at Pony Creek in 2017, we see oxidation as far down as 250m metres. Like most deposits or mineralized systems in Nevada, depth of oxidation is likely quite variable. We aim to have a much better model of this at the end of this year’s drill program.

We have drilled three holes to a depth of greater than 600 m to test for deeper mineralization. Results are currently pending for these deeper holes.

You have already started a drill program at Pony Creek. Could you elaborate about the size of this drill program and the anticipated drill budget?

We have already drilled in excess of 6,000 metres so far in 2017, and are targeting to complete 8,000 metres for a total of approximately 40 drill holes. Total program cost, including all the assaying, geophysics etc. will be on the order of C$ 4 Million.

Of course, the Pony Creek land package is much larger than the zone where your historical resource is located. As you indicated in our previous talks, approximately 70% of the property has never been thoroughly explored. What’s your strategic plan (and budget + timeline) to complete a comprehensive review of the entire property?

As mentioned above, we’re in the process of completing a comprehensive soil sampling, geophysical (Gravity and CSAMT) and geological mapping program across the balance of Pony Creek. This will all be integrated into generating new drill targets.

The balance of Pony Creek is underlain by prospective stratigraphy, such as the Penn-Perm Moleen Formation, the Webb/Devil’s gate contact, and the Chainman shale. This work will be completed in 2017.

According to the technical report, there isn’t any information available on the metallurgical recovery rates of the gold. In a previous blog post we have just referred to the recovery rates released by Gold Standard Ventures (GSV, GSV.V) which are in the high 80’s. Can we assume you will immediately start with a metallurgical test program?

There is a lack of historical metallurgical test work on Pony Creek. We will start this process later this year through cyanide assays as part of our geochem analysis at ALS Chemex. This will give us a basic level of data on which to plan more robust future metallurgical programs.

Other projects

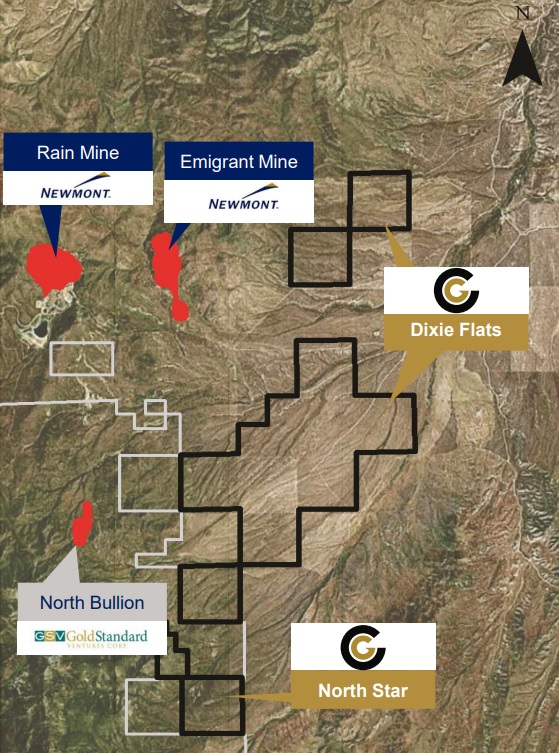

Pony Creek is just one of the thirteen projects of the portfolio. What would be your number 2 pick behind Pony Creek in terms of exploration potential?

Our number two is North Star. North Star sits immediately to the North of Gold Standard Ventures high grade oxide deposit, North Dark Star, and south of Newmont Mining’s (NEM.TO, NEM) Emigrant Mine. Our North Star sits on the same structure that is interpreted to control mineralization at both North Dark Star and Emigrant. This is clearly visible in our new gravity data, as well as public domain geophysical data from GSV.

Do you anticipate to do any work on any of the other properties? If so, could you elaborate on the exploration plans for the next 6-18 months?

We anticipate completing significant geophysical work (gravity and CSAMT) at both North Star and Dixie Flats in 2017, while getting ready for initial drilling in 2018.

Corporate

You probably still have C$10M in the treasury, how long do you expect your current cash position to last?

Correct on the projected cash balance. We anticipate our treasury, as is, to last us well into the end of 2018.

The preferred shares are costing you in excess of C$1M per year in dividend payments. Do you have the option to ‘call’ those preferred shares anytime you want? Does Waterton have the right to convert the stock at any given time during the 5 year term?

There are early redemption provisions at Contact Gold’s option. If they are converted into stock, Waterton’s interest would increase to 45.04% of issued and outstanding.

And finally, are you sellers or builders?

At this point in time, its far too early to contemplate which is the best outcome for our shareholders. That said, I believe no matter your goal (buy or sell), you need to advance a project as if you are going to build it…you don’t cut corners and you ensure that you are putting the best product forward for your shareholders.

Go to Contact Gold’s website

The author has a long position in Contact Gold. Please read the disclaimer