Cypress Development (CYP.V) has provided an update on its pilot plant operations where the pilot plant is processing material from the Clayton Valley Lithium project. The pilot plant has now been in operation for about two full quarters and has completed 11 complete runs whereby material was processed on a 24 hour per day basis over 3-14 day periods in an attempt to further improve its knowledge on how to operate the project and extract the lithium in the most economic way.

The most important takeaway at this point is that the pilot plant is confirming the recovery rate of the lithium from the claystone still ranges at 80-85% which is in line with expectations. As you may remember, the pre-feasibility study on the project used an average recovery rate of 83% and the pilot plant results now seem to be confirming that number is realistic.

You may also remember the company is now testing the possibility to use a chloride-based leaching process which would likely have environmental and economic benefits over the use of a sulphide-based process. The pilot plant has now produced about 4,000 liters of a lithium chloride solution as part of the test work and the samples have been shipped to two Canadian laboratories to work on recovering a lithium carbonate and a lithium hydroxide end product.

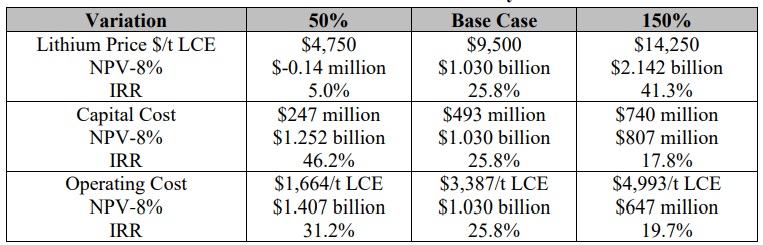

Meanwhile, the lithium market is on fire. Allkem (AKE.AX, AKE.TO) has confirmed it is anticipating an average sales price of US$40,000/t for its lithium carbonate in the current quarter and that price level is about four times higher than the $9,500/t used by Cypress Development in its pre-feasibility study. In the very same study, using a lithium carbonate price of US$14,250/t (which is still less than half the current lithium price), the after-tax NPV would increase to US$2.17B. And even if the capex would see a 60% increase due to inflation (this is just an arbitrary number, the real definitive capex number will be published in the feasibility study and will be the only number that counts), the after-tax NPV8% would be close to US$2B. We will find out soon enough as the company has confirmed the completion of the feasibility study remains on track for the end of this year.

Despite the lithium price trading at record levels and despite Cypress making good progress on derisking the project, the share price is almost trading at the lowest level in over a year.

Disclosure: The author has a long position in Cypress Development. Cypress is a sponsor of the website. Please read our disclaimer.